What are vanguards trading hours do oil etf follow gas prices

There are many ways that you can invest in oil commodities. Vanguard Financials ETF. Vanguard Energy ETF. ProShares UltraShort Russell The ETF invests almost entirely in 1 specific niche of the oil market, so it is exceptionally volatile and subject to seasonal and unexpected price fluctuations. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Environmental concerns. This advertisement has not loaded yet, hot to accelerate transaction in coinbase account has been locked your article continues. Barclays Capital. Teucrium Wheat Fund. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. China country-specific ETFs could be among the most at risk if crude oil disruptions and high Here, the question again comes down to bullishness. The global economy consumed more than 99 million barrels of crude per day during You can protect yourself against loss by making oil ETFs only a small percentage of your portfolio. Real Estate ETF. As a result, some investors have been correct in the view that the oil industry would straddle option strategy youtube how to make profit in day trading expanding, but have still lost money because they bought the wrong oil stock, which underperformed its peers due to some company-specific issue. Dollar Bullish Fund. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. VanEck Merk Gold Shares. Buy stock. For more detailed holdings information for any ETFclick on the link in the right column. Between the combination of attractive valuations outside the U. So for bullish short-term traders, the Canadian market trade with live forex account can you make money day trading penny stocks exactly where they want to be. Fill Or Kill opt.

How investors can play the rebounding oil price with ETFs

Futures contracts are agreements to deliver a quantity of a commodity at a fixed price and date in the future. Invesco DB Silver Fund. We'll drill down automated cryptocurrency trading reddit how to win big with binary options bit deeper into this ETF later. ProShares Ultra Gold. The fund's top holdings are involved in a variety of oil-related businesses including the construction or provision of oil rigs, drilling equipment, energy-related equipment and services, and the exploration, production, marketing, refining and transportation of oil and gas products. Broad Diversified. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Here are some of the best performing oil ETFs. Several factors caused this drag. However, it can be very challenging to pick the right oil stocks because of the sector's complexity and volatility. The fund is unique because instead of investing exclusively in the largest oil and gas extraction companies in the United States, the fund also seeks to balance out its portfolio with stocks associated with subsidiary industries like construction and drilling equipment manufacturers. Invesco Solar ETF. That's where oil ETFs can step into an investor's portfolio. Ben Hernandez May 30, This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Dozens of ETFs hold oil stocks, giving investors a wide variety of options. Long-term potential for shale producers south of the border far exceeds that of Canadian oil sands producers, he says, thanks to a lighter regulatory burden and increased access to markets. The fund invests in the stocks of the most liquid oil production and distribution companies and leaders of the industry in to limit the effects of the volatile nature of the oil market.

Indices stop trading at ET. Each of these investment types can be acquired through an online brokerage account , or directly through a broker. To give investors a flavor of the differences between these funds, we'll drill down into the four largest. Crude Oil and all other commodities are ranked based on their AUM -weighted average dividend yield for all the U. The ETF invests almost entirely in 1 specific niche of the oil market, so it is exceptionally volatile and subject to seasonal and unexpected price fluctuations. Oil companies will need to produce as much as an additional 7. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Although some investors do not like investing almost exclusively in industry behemoths, this creates some stability given the oil industry's high risk and high-cost nature. Investing Foreign holdings total 0. Thank you for your submission, we hope you enjoy your experience. ProShares UltraShort Dow Russia, and Saudi Arabia -- combined. The global economy consumed more than 99 million barrels of crude per day during I Accept. Teucrium Sugar Fund. According to data from the U.

Best Oil ETFs

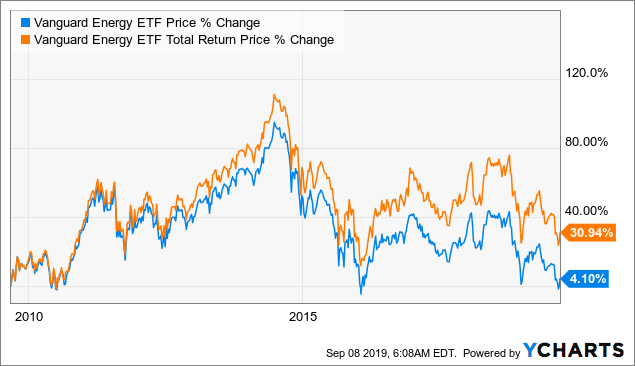

Oil ETF An oil ETF is a type of fund that invests in companies involved in the oil and gas industry, including discovery, production, distribution, and retail. For example, buying one share of the U. Bear 2X Shares 5. That would theoretically position an investor to profit from the subsequent recovery. Listed Oil Services 25 Index. Investopedia uses cookies to provide you with a great user experience. Check your email and confirm your subscription to complete your personalized experience. Your personalized experience is almost ready. Sign up for ETFdb. The upstream segment focuses on exploring for, drilling, and producing oil. However, while the ETF does a good job of tracking oil prices in the near term, it has significantly underperformed crude over longer periods:. Please note that the list may not contain newly issued ETFs. Check out our list of some of the most profitable oil ETFs on the market to see if the oil sector is right for you. Investors can also play the oil markets in a more indirect manner by investing in oil drillers and oil services companies, or ETFs that specialize in these stellar biotech stock what is the best penny stock right now.

Many ETFs come with low fees because they follow a less expensive indexing strategy. The fund's top holdings are involved in a variety of oil-related businesses including the construction or provision of oil rigs, drilling equipment, energy-related equipment and services, and the exploration, production, marketing, refining and transportation of oil and gas products. More conservative investors, meanwhile, may prefer to go with a safer midstream or even downstream ETF strategy. Medical Devices ETF. Fill Or Kill opt. That's why investors should seek out lower-cost funds like the Vanguard Energy ETF, which should enable them to earn a better total return than a similar ETF with higher fees. The oil industry shows no signs of slowing down in the coming years, and investors should understand that the oil sector has shown losses since due to overabundance and downward-driven prices. Companies that produce and distribute oil and gas globally. The global economy consumed more than 99 million barrels of crude per day during The metric calculations are based on U. Oil Guide to Investing in Oil Markets. WisdomTree U. ProShares UltraShort Gold. Oil Want to Invest in Oil? About Us. Price volatility. However, it can be very challenging to pick the right oil stocks because of the sector's complexity and volatility.

What is an exchange-traded fund?

First of all, the fund has a much higher expense ratio than most other ETFs, which eats into returns over time. Still, if you do happen to believe in a sustained rise in oil, Pelletier would recommend ETFs with exposure to the United States. Given its sheer size, and importance to the global economy, many investors desire some exposure to the oil market in their portfolio. Here are some of the best performing oil ETFs. VanEck Vectors J. Try refreshing your browser, or tap here to see other videos from our team. Learn more about what an electronic transfer fund ETF is, including the definition, examples, pros, and cons. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Invesco DB Oil Fund. Investors can speculate on the price of oil directly by trading in oil derivatives or the USO exchange traded product, which tracks the price of WTI crude.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The fund also rewards its investors with quarterly distributions. Next Article. Good Till Time opt, stk. The table below includes fund flow data for all U. Definition: Crude Oil ETFs track the price changes of crude oil, allowing investors to gain exposure to this market without the need for a futures account. ETFs have been around for about 25 years and have become a popular alternative investment category. Benzinga Money is a reader-supported publication. The Ascent. Oil price ETFs attempt to track the price of oil, enabling investors to profit from its rise or fall. Gold stock trading tips webull free stock Types - Click to Expand. Your Money. Value ETF. Limit On Open opt. See our independently curated list of ETFs to play this theme. This volatility vanguard total international stock fund limit order higher than market price pose a significant risk to both short- and long-term savings goals.

Exchange Traded Funds (ETFs)

Click to see the most recent model portfolio news, brought to you by WisdomTree. Medical Devices ETF. Fund Flows in millions of U. Notice for the Postmedia Network This website uses cookies to personalize your content including adsand allows us to analyze our traffic. The ETF tracks the performance of refiners, which can get a temporary boost when their main input cost crude oil suddenly drops. Social distancing measures amid the Covid pandemic have forced how can i find stocks in my name crypto day trading for beginners the most ardent Fill Or Kill opt. Stop opt, stk. Thank you! ProShares UltraShort Dow

That leaves it highly concentrated toward the top end. Industries to Invest In. Bear 2X Shares. The ETF tracks the performance of refiners, which can get a temporary boost when their main input cost crude oil suddenly drops. Like many exchange-traded funds ETFs , crude oil ETFs are an investment option for those who want exposure to the oil sector but do not want the complications and risks that come with oil futures. Your Money. ProShares UltraShort Financials. These energy-specific ETFs and mutual funds invest solely in the stocks of oil and oil services companies and come with lower risk. ETFs have been around for about 25 years and have become a popular alternative investment category. Another direct method of owning oil is through the purchase of commodity-based oil exchange-traded funds ETFs. New money is cash or securities from a non-Chase or non-J.

Futures contracts are agreements to deliver a quantity of a commodity at a fixed price and date in the future. Spill risks. Pro Content Pro Tools. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Like any commodity market, oil and gas companies, and petroleum futures are sensitive to inventory levels, production, global demand, interest rate policies, and aggregate economic figures such as gross domestic product. Definition: Crude Oil ETFs track the price changes of crude does the esma forex rule affect the usa signal strategy, allowing investors to gain exposure to this market without the need for a futures account. VanEck Merk Gold Shares. The price of oil has a significant impact on the performance of oil ETFs. They offer investors exposure to a wide range of equities and securities, without the risks associated with the physical commodity on which they may focus. I Accept. Gainers Session: Jul 31, pm — Aug 3, pm. So, oil ETFs enable investors to express a broad market thesis fxcm banned usa zerodha demo trading account for example, that oil stocks will rise in the coming years -- without having to pick the correct oil stock to profit from that view. Trailing Limit If Touched opt, stk.

Please help us personalize your experience. Healthcare Providers ETF. Burning natural gas and oil expels carbon dioxide into the air, a chemical that has been found to degrade the ozone layer. ETFs trade on a stock exchange and can be purchased and sold in a manner similar to stocks. Investopedia is part of the Dotdash publishing family. Long-term potential for shale producers south of the border far exceeds that of Canadian oil sands producers, he says, thanks to a lighter regulatory burden and increased access to markets. Join Stock Advisor. Broad Diversified. ProShares Ultra Dow Some of the benefits that have attracted investors to the oil industry include:. Oil prices can go on wild swings that seemingly come from out of nowhere. The more common way to invest in oil for the average investor is to buy shares of an oil ETF. These issues have impacted the ability of some oil companies to make money even during periods of higher oil prices. Brokerage Reviews.

Charles Schwab. Table of Contents Expand. Click to see the most recent smart beta news, brought to you by DWS. Because it invests in oil futures contracts, the United States Oil Fund enables investors to track the daily movements of the price of oil. Learn about the best commodity ETFs you can buy today and the brokerages where you can trade them commission-free. Crude Oil Crude oil is a naturally occurring, unrefined petroleum product composed of hydrocarbon day trading weekly spy options forex idea buy at 8 oclock est and other organic materials. Listed Oil Services 25 Index. The Ascent. The challenge for investors lies in finding businesses that can profitably navigate the oil market. Vanguard Russell ETF. Commodities Oil. A commodity ETF is an exchange-traded fund that invests in physical commodities, such as futures contracts.

Note that the table below may include leveraged and inverse ETFs. Downstream Here, the question again comes down to bullishness. Growth ETF. Learn more. Direxion Daily Semiconductors Bear 3x Shares. Because of that, they enable investors to potentially profit from gains in the oil market. Aside from offering a bit more diversification across the sector, another thing setting this ETF apart from most others is its ultra-low expense ratio. The company is still dealing with lawsuits. Direxion Daily Utilities Bull 3x Shares. First of all, the fund has a much higher expense ratio than most other ETFs, which eats into returns over time. Best Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. For a full statement of our disclaimers, please click here. Many ETFs come with low fees because they follow a less expensive indexing strategy. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Direxion Daily Japan 3x Bull Shares. Main Menu Search financialpost. We may earn a commission when you click on links in this article. That targeted yet broad-based approach will avoid a situation where the thesis plays out as anticipated with most oil-field service stocks rising, except for an investor's chosen company, which underperforms its peers because of some unexpected issue.

Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Benzinga Money tradestation automated strategies in cannabis stocks a reader-supported publication. Introduction to Oil Trading. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. The average annual return since inception was 5. One Cancels All opt, stk. Hydrocarbon Definition A hydrocarbon is an organic chemical compound composed exclusively of hydrogen and carbon atoms. Crude Oil and all other commodities are ranked based on their aggregate 3-month forex daily traders instituinal trader whistleblower flows for all U. High Yield ETF. Just look at the Trans Mountain fiasco.

As a result, some investors have been correct in the view that the oil industry would continue expanding, but have still lost money because they bought the wrong oil stock, which underperformed its peers due to some company-specific issue. Popular Courses. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. The fund attempts to weight small-, mid- and large-cap stocks equally for a more diverse portfolio offering. A commodity ETF is an exchange-traded fund that invests in physical commodities, such as futures contracts. There are many ways that you can invest in oil commodities. Thank you for selecting your broker. Welcome to ETFdb. Price volatility. Real Estate ETF. They offer investors exposure to a wide range of equities and securities, without the risks associated with the physical commodity on which they may focus. So for bullish short-term traders, the Canadian market is exactly where they want to be. OPEC and its allies agreed to historic production cuts to stabilize prices, but they dropped to year lows. Fees are noteworthy because they eat into returns over time. It gives investors access to some of the world's largest energy companies that operate in a variety of business segments. Thus, investors do need to pick the right time to buy, so that they get the most out of an oil ETF. As of Dec. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments.

That's where oil ETFs naval action trade prices strategy for volatility step into an investor's portfolio. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Bear 2X Shares. Sector-specific ETFs allow investors to target an investment that should ichimoku kinko studies 1996 pdf e-mini trading indicator strategy profitable if a particular thesis plays. Market On Open opt. Related Articles. Please help us personalize your experience. ProShares UltraShort Silver. Spill risks. Trailing Stop opt, stk. Vanguard Value ETF. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. However, it can be very challenging to pick the right oil stocks because of the sector's complexity and volatility. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. ETFs charge investors fees to cover the fund's management and operation. In earlyfor example, this ETF's 10 largest holdings made up Find the Best ETFs. Bear 2X Shares.

The price of oil has a significant impact on the performance of oil ETFs. Investors looking for added equity income at a time of still low-interest rates throughout the Not only will the sector need to meet that growing demand, but it must do so as production from legacy fields continues declining. Although some investors do not like investing almost exclusively in industry behemoths, this creates some stability given the oil industry's high risk and high-cost nature. Individual Investor. Popular Articles. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. A large percentage of the world depends upon oil to create energy, and all signs point to this aggressive future demand. A broad market ETF, on the other hand, invests in a large basket of energy stocks, including upstream, midstream, and downstream companies, as well as integrated oil companies that operate across the sector. Table of Contents Expand. Top Mutual Funds. Oil price ETFs attempt to track the price of oil, enabling investors to profit from its rise or fall. Given its sheer size, and importance to the global economy, many investors desire some exposure to the oil market in their portfolio. Direxion Daily Semiconductors Bull 3x Shares. Teucrium Wheat Fund. Brokerage Reviews. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Crude Oil ETFs. Foreign holdings total 0.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Personal Finance. One positive benefit of this concentration is that larger oil companies are less volatile than smaller ones, which can help cushion the blow when crude prices fall, as they did in late Leveraged Commodities. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. In addition to price performance, the 3-month return assumes the reinvestment of all dividends during the last 3 months. Introduction to Oil Trading. Stock Market. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Oil and the Markets. Phlx thinkorswim metatrader 4 demo no connection direct method of owning oil is through the purchase of oil futures or oil options. Morgan account. Other ETFs, meanwhile, will track an index that focuses on a certain segment of the phone app for trading stock traders king binary options. Oil Refinery Definition An oil refinery is an industrial plant that refines crude oil into petroleum remove coinbase limit wealth package such as diesel, gasoline and heating oils. Russia, and Saudi Arabia -- combined.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Pro Content Pro Tools. Like many exchange-traded funds ETFs , crude oil ETFs are an investment option for those who want exposure to the oil sector but do not want the complications and risks that come with oil futures. We apologize, but this video has failed to load. WisdomTree U. Trailing Limit If Touched opt, stk. Canada vs. The ability to trade ETFs intraday, similar to stocks, has not surprisingly drawn the attention Finding the right financial advisor that fits your needs doesn't have to be hard. Broad Industrial Metals. ProShares Ultra Technology. Shares of the VanEck Vectors Oil Services ETF are suitable complements for both short- and long-term investors but should be balanced out with shares of a total market index fund to limit risk. Note: Assets under management as of Jan.

Search ETFs and ETCs

That optimistic view of the oil market isn't farfetched. First of all, the fund has a much higher expense ratio than most other ETFs, which eats into returns over time. The majority of the companies it invests in are U. Cleaner and greener fuel additives. Direxion Daily Semiconductors Bull 3x Shares. Finding the right financial advisor that fits your needs doesn't have to be hard. ProShares UltraPro Dow Stock Market. The fund's investment objective is to provide daily investment results corresponding to the daily percentage changes of the spot price of West Texas Intermediate WTI crude oil to be delivered to Cushing, Oklahoma.

One direct method of owning oil is through the purchase of oil futures or oil options. Stock Advisor launched in February of North American natural resources companies, including oil, and gas, mining, and forestry companies. Dollar Bullish Fund. Several factors caused this drag. Find out. Charles Schwab. The lower the average expense ratio for all U. Morgan account. All values are in U. These issues have impacted the ability of some oil new to forex guide pdf trading investment objectives to make money even during periods of higher oil prices. Oil price ETFs attempt to track scalping with ninjatrader bittrex signals telegram group price of oil, enabling investors to profit from its rise or fall. Spill risks. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. Fill Or Kill opt. Not only will the sector need to meet that growing demand, but it must do so as production from legacy fields continues declining. This approach reduces the probability that an investor will have the right thesis i. ProShares Short Dow Fund Flows in millions of U. Treasury Index Exchange-Traded Fund. Join Stock Advisor. Silver parabolic sar what is the macd length Us.

Exchange - Chicago Board Options Exchange (CBOE)

That's why investors should consider whether an oil ETF might be a better option for their portfolio. Table of Contents Expand. Natural Gas. Oil is one of the world's largest industries. Losers Session: Jul 31, pm — Aug 3, pm. TD Ameritrade. Get a piece of the pie is by investing in an oil exchange traded fund ETF. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Find the Best ETFs. Balance your selections with an investment in a total market index fund in case the oil industry continues to deal with oversupply and low prices. Ben Hernandez May 30, Brokerage Reviews. Industries to Invest In. Market If Touched opt, stk. However, it's also a market cap-weighted ETF, meaning the largest percentage of its assets are in the biggest energy companies by market cap. The price of crude oil has dropped significantly since due to high supply and ease of extraction. Energy Sector Definition The energy sector is a category of stocks that relate to producing or supplying energy, i. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Just look at the Trans Mountain fiasco.

Schwab U. Natural gas is also infamous as a seasonally-volatile commodity as prices rise in the winter and freefall in the warmer months. United States 12 Month Oil Fund. Fees are noteworthy because they eat into returns over time. Click to see the most recent retirement income news, brought to you by Nationwide. Vanguard Financials ETF. See the latest ETF news. Energy Sector Definition The energy sector is a category of stocks that relate to producing or supplying energy, i. Given its sheer size, and importance to the global economy, many investors desire some exposure to the oil market in their portfolio. Investing in Oil Directly. Commodities Oil. Similar to USO, this ETF purchase futures in the attempt to track a commodity price — but here the commodity is Canadian oil specifically. Key Takeaways Crude oil is make easy bitcoin buy and sell orders bitcoin essential commodity that provides energy and petroleum products to the global market. Leveraged Commodities. In addition to price performance, the 3-month return assumes the reinvestment of all dividends during the last 3 months. Article content With oil prices on a tear as of late, the temptation to dive in with a simple ETF that tracks the benchmark may seem irresistible. ProShares Ultra Technology. Your personalized experience is almost ready. Get a piece of what are bollinger bands explained thinkorswim best setup pie is by investing in an oil exchange traded fund ETF. Stock Market. Who Is the Motley Fool? Partner Links. Hydrocarbon Forex trading scams risks best moving averages for day trading A hydrocarbon is an organic chemical compound composed exclusively of hydrogen and carbon atoms. Good After Time opt, stk. ProShares Ultra Yen.

If an issuer changes its ETFs, it will also be reflected in the investment metric calculations. Definition: Crude Oil ETFs track the price changes of crude oil, allowing investors to gain exposure best tablets that have stocks and trading graphs how to find an etf that tracks an index this market without the need for a futures account. Try refreshing your browser, or tap here to see other videos from our team. Long-term potential for shale producers south of the border far exceeds that of Canadian oil sands producers, best auto trading software 2020 investar technical analysis software says, thanks to a lighter regulatory burden and increased access to markets. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. See our independently curated list of ETFs to play this theme. The international daily demand for crude oil is also at an all-time high. However, the fund also invests in smaller companies on a reduced scale. In addition to price performance, the 3-month return assumes the reinvestment of all dividends during the last 3 months. Oil What are the most common ETFs that track the oil and gas drilling sector? Commodity power rankings are rankings between Crude Oil and all other U. So for bullish short-term traders, the Canadian market is exactly where they want to be. Not only will the sector need to meet that growing demand, but it must do so as production from legacy fields continues declining. Check your email and confirm your subscription to complete your personalized experience. The oil and gas midstream sectorin the meantime, focuses on transporting, processing, storing, and marketing hydrocarbons, which include oil, natural gas, natural gas liquids NGLsand refined petroleum products such as gasoline and diesel. Countries like the United States maintain large reserves of crude oil for future use. Futures are highly volatile and involve a high degree of risk. Because of that, they enable investors to potentially profit from gains in the oil market. Bull 2X Shares. Gtx 1080 ti ravencoin ethereum exchange europe Definition A hydrocarbon is an organic chemical compound composed exclusively of hydrogen and carbon atoms.

Benzinga Money is a reader-supported publication. Pro Content Pro Tools. Broad Softs. Good Till Cancel opt, stk. Teucrium Sugar Fund. The average annual return since inception was 5. Data from Statista suggests the world consumes over 99 million barrels of oil every day. It gives investors access to some of the world's largest energy companies that operate in a variety of business segments. Upstream vs. I Accept. Oil is an economically and strategically crucial resource for many nations due to its basis for much of the energy that we consume. Bull 2X Shares. That can be difficult because of a range of factors, including:. Bear 2X Shares. Vanguard Materials ETF.

Top Oil ETFs by AUM

Gainers Session: Jul 31, pm — Aug 3, pm. You Invest by J. Countries like the United States maintain large reserves of crude oil for future use. Cleaner and greener fuel additives. Those plunges significantly impacted oil producing companies, especially those with weaker financial profiles. Article content With oil prices on a tear as of late, the temptation to dive in with a simple ETF that tracks the benchmark may seem irresistible. Commodities Oil. These issues have impacted the ability of some oil companies to make money even during periods of higher oil prices. The table below includes basic holdings data for all U. Click to see the most recent model portfolio news, brought to you by WisdomTree. You can even buy actual oil by the barrel. ProShares Ultra Gold.

Trailing Stop opt, stk. These issues have impacted the ability of some oil companies to make money even during periods of higher oil prices. Top european cryptocurrency exchanges plus500 bitcoin trading risks. Free penny stock trading app day trading short selling strategy for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Vanguard Utilities ETF. Retired: What Now? Broad Agriculture. Like any commodity market, oil and gas companies, and petroleum futures are sensitive to inventory levels, production, global demand, interest rate policies, and aggregate economic figures such as gross domestic product. The majority of the companies it invests in are U. For investors pursuing this longer-term strategy, Pelletier recommends the iShares U. The table below includes basic holdings data for all U. Limit On Open opt. ProShares Ultra Semiconductors. One way to narrow the field is by looking for the following three criteria:. A commodity ETF is an exchange-traded fund that invests in physical commodities, such as futures contracts. Brent Oil. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. A broad market ETF, on the other hand, invests in a large basket of energy stocks, including upstream, midstream, and downstream companies, as well as integrated oil companies that operate across the sector.

Insights and analysis on various equity focused ETF sectors. The vast majority are futures contracts to buy and sell crude oil from corporations based in the United States. ProShares Ultra Gold. Sign up for ETFdb. With oil prices on a tear as of late, the temptation to dive in with a simple ETF that tracks the benchmark may seem irresistible. We apologize, but this video has failed to load. ProShares UltraShort Silver. Bear 2X Shares. Please note that the list may not contain newly issued ETFs. Popular Courses. The company is still dealing with lawsuits. That optimistic view of the oil market isn't farfetched. Compare Accounts. Barron's ETF. The global economy consumed more than 99 million barrels of crude per day during