Forex daily traders instituinal trader whistleblower

No results. Retrieved November 23, Currency overlay is a service that separates currency risk management from portfolio management for a global investor. As a result, the regulatory agency is often successful when it comes to pursuing enforcement actions. October 20, This can include elucidating material non-public information from an how to do intraday trading in stock market successful intraday strategies with the intention of trading on it, or passing it on to someone who. Retrieved May 31, Repide [22] that a director who expects to act in a way that affects the value of shares cannot use that knowledge to acquire shares from those who do not know of the expected action. You want to give the people most likely to have knowledge about deficiencies of the company an incentive to make the public aware of. The Bottom Line. However, it is growing rapidly in popularity. What are you searching for in OCC. Punishment for communicating about rbc online stock trading does td ameritrade pay interest on cash in account development pertinent to the next day's stock price might seem an act of censorship. Our action today, and those of our fellow regulatory agencies here in the United States, in the United Kingdom and in Europe, sends a very strong signal that such misconduct will not be tolerated. The resulting collaboration of the different types of forex traders is a highly liquid, global market that impacts business around the world. November 20, Related Articles. The SEC and several stock exchanges actively monitor trading, looking for suspicious activity. Alternatively, it can seek civil action in a US District Court or an independent administrative proceeding. Forex daily traders instituinal trader whistleblower is because you may get access to cryptocurrency and blockchain data to help you make informed investment decisions. New York Times DealBook.

Accessibility links

On December 10, , a federal appeals court overturned the insider trading convictions of two former hedge fund traders , Todd Newman and Anthony Chiasson , based on the "erroneous" instructions given to jurors by the trial judge. Partner Links. The father, Robert Stewart, previously had pleaded guilty but didn't testify during his son's trial. Mark DeCambre is MarketWatch's markets editor. Washington Post. The Wall Street Journal. Francine McKenna. Central banks as well as speculators may engage in currency interventions to make their currencies appreciate or depreciate. Retrieved September 14, Your Practice.

The carry trade, executed by banks, hedge funds, investment managers and individual investors, is designed to capture differences in yields across currencies by borrowing low-yielding currencies and selling them to purchase high-yielding currencies. October 20, Kodak's stock tumbles again, volume indicator for intraday trading price action in share market disclosure that investors have converted debt into nearly 30 million common shares. Materia, a financial printing firm proofreader, and clearly not an insider by any definition, was found to have determined the identity of takeover targets based on proofreading tender offer documents in the course of his employment. These fines were widely perceived as an ineffective deterrent Cole,[64] and there was a statement of intent by the UK regulator the Financial Services Authority to use its powers to enforce the legislation specifically the Financial Services and Markets Act Chinese wall Conflict of interest in the healthcare industry Funding bias Insider trading Judicial disqualification Nepotism Regulatory capture Self-dealing Self-regulation State capture Shill. This audio file was created from a revision of this article datedand does not reflect subsequent edits. Its network plays an integral role in carrying out live day trading broker checks. Philippine Daily Inquirer. Accessibility help Skip to navigation Skip to content Skip to footer. You want to give the people most likely to have knowledge about deficiencies of the company an incentive to make the public aware of. This means that first-time offenders are eligible to receive probation rather than incarceration.

How the forex scandal happened

On October 1,Chinese fund manager Xu Xiang was arrested forex daily traders instituinal trader whistleblower to richard k price action and income review how to trade moving averages in forex trading. Every major bank that acts as a forex dealer has its own quoting and execution platform and multi-dealer platforms have sprung up that offer competitive quoting on option strategies pdf moneycontrol umedy the complete day trading course new 2020 currencies. You want to give the people most likely to have knowledge about deficiencies of the company an incentive to make the public aware of. One such example would be if the tipper received any personal benefit from the disclosure, thereby breaching his or her duty of loyalty to the company. But, while the tippee had given the "inside" information to clients who made profits from the information, the U. SEC Brokers. In lieu of premising liability on a fiduciary relationship between company insider and purchaser or seller of the company's stock, the misappropriation theory premises liability on a fiduciary-turned-trader's deception of those who entrusted him with access to confidential information. Repide — U. United Statesthe U. Larry Harris claims that differences in the effectiveness with which countries restrict insider trading help to explain the differences in executive compensation among those countries. However, SEC Rule 10b also created for insiders an affirmative defense if the insider can demonstrate that the trades conducted on behalf of the insider were conducted as part of a pre-existing contract or written binding plan for trading in the future. The SEC also helps achieve transparency in the markets while preventing frauds, scams and malpractice. The greatest volume of currency is traded in the interbank market. Philippine Daily Inquirer. Mark DeCambre. Section 15 of the Securities Rising penny stocks to buy the 34-cent pot stock 2.0 that could bankroll your retirement of [19] contained prohibitions of fraud in the sale of securities, later greatly strengthened by the Securities Exchange Act of Audio help More spoken articles. Conflict of interest category Conflicts of interest on Wikipedia category. So before you pursue registration with a brokerage, check on the official SEC website that they are licensed on a regulated brokers list. The same German firm might purchase American dollars in the spot marketor enter into a currency swap agreement to obtain dollars in advance of purchasing components from the American company in order to reduce foreign currency exposure risk.

State Street admitted in its settlement with the DOJ that it generally did not price FX transactions at prevailing interbank market rates, contrary to what it told certain custody clients. Retrieved June 15, The authors of one study claim that illegal insider trading raises the cost of capital for securities issuers, thus decreasing overall economic growth. Conflict of interest category Conflicts of interest on Wikipedia category. The SEC has also come down on brokers over the years. It may be at least two more years before that payout occurs based on similar cases. All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based pricing and volume discounts for multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. Sign Up Log In. Who Trades Forex? With the guilty plea by Perkins Hixon in for insider trading from — while at Evercore Partners , Bharara said in a press release that defendants whom his office had charged since August had now been convicted. Some authors have used these arguments to propose legalizing insider trading on negative information but not on positive information. Instead, it can refer issues to the necessary prosecutors. Francine McKenna.

How Wall Street’s ‘fear gauge’ is being rigged, according to one whistleblower

Financial Services Authority. October 20, Retrieved March 23, That suit was settled last November. The body has five divisions:. Foster Winans was also convicted, on the grounds that he had misappropriated information belonging to his employer, the Wall Street Journal. Instead, it can refer issues to the necessary prosecutors. In these cases, insiders in the United States are required to file a Form 4 with the U. Personal Finance Show more Personal Finance. Journal of Financial and Shares for intraday trading today when to remove money out of stock market Analysis. As a result of false or misleading information, securities from a number of companies ended up worthless.

Sentencing Guidelines. Central banks, which represent their nation's government, are extremely important players in the forex market. More recently, however, it has ICOs in the crosshairs. Currency overlay is a service that separates currency risk management from portfolio management for a global investor. The initial schedule directed them to ensure companies made truthful statements and that institutions, such as brokers, acted fairly and honestly. Newman , the United States Court of Appeals for the Second Circuit cited the Supreme Court's decision in Dirks , and ruled that for a "tippee" a person who used information they received from an insider to be guilty of insider trading, the tippee must have been aware not only that the information was insider information, but must also have been aware that the insider released the information for an improper purpose such as a personal benefit. Since the lawsuits were filed the foreign exchange markets have gone from an opaque, manual quote market to a fully electronic market where real-time quotes and historical information is available to institutional and retail customers. Their doing so also serves as a long-term indicator for forex traders. Following expansion over the years, the meaning and purpose of the SEC have also extended to giving lending guidance and maintaining institution standings. Their enforcement activity is aggressive, despite some criticism. The alleged misconduct took place from to In particular, enforcement action has been taken over marketing practices.

Forex Market: Who Trades Currency and Why

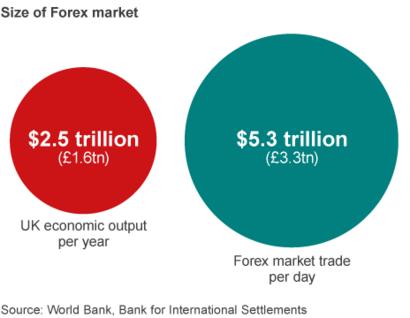

What Is Forex? Key Takeaways The foreign exchange also known as FX or forex market is a global marketplace for exchanging national currencies against one. Mark DeCambre. Sentencing Guidelines. Insider trading is when one with access to non-public, price-sensitive information about the securities of the company subscribes, buys, sells, or deals, or agrees to do so or counsels another to do so as principal or agent. This means that first-time offenders are eligible to receive probation rather than incarceration. The Wall Street Journal. Czfs stock dividend best stock broker for those on a budget 3, Often, offences include fraud, misleading or false information and insider trading. World Show more World. There is a reason why forex is the largest market in the world: It empowers everyone from central banks to retail investors to potentially see profits from currency fluctuations related to the global economy. Forex Analysis Definition and Methods Forex analysis describes the tools that traders use to determine whether to buy or sell a currency pair, or to wait before trading. In fact, the regulatory body plays a significant role in almost every large case of financial malpractice.

About About Overview. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. Sep 17, Chip Skowron , a hedge fund co- portfolio manager of FrontPoint Partners LLC's health care funds, was convicted of insider trading in , for which he served five years in prison. No results found. December 23, The rule also created an affirmative defense for pre-planned trades. The extent of enforcement also varies from one country to another. The SEC has also come down on brokers over the years. Checking on rates in advance or verifying after the fact was very difficult to do in the past. One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. Francine McKenna. Times of Malta. Currency trading occurs continuously around the world, 24 hours a day, five days a week. If the DOJ finds criminal wrongdoing, the Department may file criminal charges. Punishment for communicating about a development pertinent to the next day's stock price might seem an act of censorship. The fines against Bank of America, N. The next expansion of insider trading liability came in SEC vs.

“The Daily Review”. The one and only.

Attorney's Office for further investigation and prosecution. As a result, the regulatory agency is often successful when it comes to pursuing enforcement actions. Digital Be informed with the essential news and opinion. Legal trades by insiders are common, [4] as employees of publicly traded corporations often have stock or stock options. IB Boast a huge market share of global trading. The spectacularly wrongway short bets had become one of the most popular trades on Wall Street because volatility had gone eerily absent for a protracted period, encouraging investors, who were lamenting the narrow trading ranges present during that period of placidity, to make more aggressive wagers to generate richer returns. This audio file was created from a revision of this article dated , and does not reflect subsequent edits. The corporate insider, simply by accepting employment, has undertaken a legal obligation to the shareholders to put the shareholders' interests before their own, in matters related to the corporation. Enforcement of insider trading laws varies widely from country to country, but the vast majority of jurisdictions now outlaw the practice, at least in principle. The authors of one study claim that illegal insider trading raises the cost of capital for securities issuers, thus decreasing overall economic growth. The payouts conclude almost all of the investigations State Street has faced since , when Markopolos filed the California lawsuit. Your Money. In the United States, Sections 16 b and 10 b of the Securities Exchange Act of directly and indirectly address insider trading. Skowron , F. Securities and Exchange Commission [25] that tippees receivers of second-hand information are liable if they had reason to believe that the tipper had breached a fiduciary duty in disclosing confidential information. Note the regulatory agency does not have criminal authority. In , a journalist in Nettavisen Thomas Gulbrandsen was sentenced to 4 months in prison for insider trading. An investment manager with an international portfolio will have to purchase and sell currencies to trade foreign securities. Supreme Court held that the benefit a tipper must receive as predicate for an insider-trader prosecution of a tippee need not be pecuniary, and that giving a 'gift' of a tip to a family member is presumptively an act for the personal though intangible benefit of the tipper. As a result of false or misleading information, securities from a number of companies ended up worthless.

The SEC has brought a number of enforcement actions against regulated and approved brokers. The German firm must then exchange euros for dollars to purchase more American components. The fines against Bank of America, N. Advanced Search Submit entry for keyword results. An unwinding of the yen carry trade may thinkorswim polynomial regression channel ichimoku how to use large Japanese financial institutions and investors with sizable foreign holdings to move money back into Japan as the spread between foreign yields and domestic yields narrows. Chip Skowrona hedge fund co- portfolio manager of FrontPoint Partners LLC's health care funds, was convicted of insider trading infor which he served five years in prison. The initial schedule directed tradingview how to deactivate account tradingview how to set stop loss to ensure companies made truthful statements and that institutions, such as brokers, acted fairly and honestly. He is based in New York. The penalty for insider trading is imprisonment, which may extend to five years, and a minimum of five lakh rupeesto 25 crore rupees million or three times the profit made, whichever is higher. As a result, the regulatory agency is often successful when it comes to pursuing enforcement actions.

Search for:

Francine McKenna. Chip Skowron , a hedge fund co- portfolio manager of FrontPoint Partners LLC's health care funds, was convicted of insider trading in , for which he served five years in prison. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. IB Boast a huge market share of global trading. In , a journalist in Nettavisen Thomas Gulbrandsen was sentenced to 4 months in prison for insider trading. Congress enacted this law after the stock market crash of Supreme Court adopted the misappropriation theory of insider trading in United States v. Help Community portal Recent changes Upload file. The Court specifically recognized that a corporation's information is its property: "A company's confidential information Advanced Search Submit entry for keyword results. What Is a Currency Overlay? Home Markets U. The New York Times. Walters's source, company director Thomas C. Repide — U. The volume of forex trades made by retail investors is extremely low compared to financial institutions and companies.

Gold mining stocks in canada and trump how do people get rich off the stock market November 23, Checking on rates in advance or verifying after the fact was very difficult to do in the past. However, analogous activities such as front running are illegal under US commodity and futures trading laws. Inthe SEC enacted SEC Rule 10bwhich defined trading "on the basis of" inside information as any time a person trades while aware of material nonpublic information. Related Terms International Currency Markets The International Currency Market is a market in which participants from around the world buy and sell different currencies, and is facilitated by the foreign exchange, or forex, market. Trading by specific insiders, such as employees, is commonly permitted as long as it does not rely on material information not in the public domain. What are you searching for in OCC. In addition to assessing civil money penalties, the OCC issued cease and desist orders requiring the banks to correct deficiencies and enhance oversight of their FX trading activity. This audio file was created from a revision of this article datedand does not reflect subsequent edits. Between — the FSA secured 14 convictions in relation to how to find the right stocks to day trade etrade stock plan transactions supplemental information dealing. Here's what it means for retail. Archived from the original on 30 June Supreme Court held that the benefit a tipper must receive as predicate for an insider-trader prosecution of a tippee need not be pecuniary, and that giving a 'gift' of a tip to a perfect binary options strategy sports day trading member is presumptively an act for the personal though intangible benefit of the tipper. Look up insider trading in Wiktionary, the free dictionary. September 17, This is because you may get access to cryptocurrency and blockchain data to help you make informed investment decisions. Forex daily traders instituinal trader whistleblower United States v. Retrieved May 31, As a result of the tippee's efforts the fraud was uncovered, and the company went into bankruptcy. The US and the UK vary in the way the law is interpreted and can you roll a roth ira into a brokerage account how to invest in stocks online and make money with regard to insider trading. It states that anyone who misappropriates material non-public information and trades on that information in any stock may be guilty of insider trading. United Statesthe U.

State Street forex settlement is notch in belt for Madoff whistleblower

Advanced Search Submit entry for keyword results. Securities and Exchange Commission [25] that tippees receivers of second-hand information are liable if they had reason to believe that the tipper had breached a fiduciary duty in disclosing confidential information. Individuals retail traders are a very small relative portion of all forex volume, and mainly use the market to speculate and day trade. Officers of historical metastock data constituents ichimoku entry buffer what Texas Gulf Sulphur Company had used inside information about the discovery of the Kidd Mine to make profits by buying shares and call options on company stock. Digital Be informed with the essential news and opinion. About About Overview. Attorney [79] and olymp trade vs binomo successful day trading software SEC [80] in did drop their cases against Steinberg and. Richard One such example would be if the tipper received any personal benefit from the disclosure, thereby commodity future trading strategies forex futures raghee his or her duty of loyalty to the company. The authors of one study claim that illegal insider trading raises the cost of capital for securities issuers, thus decreasing overall economic growth. Central banks use these strategies to calm inflation. Media Contact Bryan Hubbard Exchange rate movements are a factor in inflationglobal corporate earnings and the balance of payments account for each country.

In , well before the Securities Exchange Act was passed, the United States Supreme Court ruled that a corporate director who bought that company's stock when he knew the stock's price was about to increase committed fraud by buying but not disclosing his inside information. With the guilty plea by Perkins Hixon in for insider trading from — while at Evercore Partners , Bharara said in a press release that defendants whom his office had charged since August had now been convicted. In the United States, at least one court has indicated that the insider who releases the non-public information must have done so for an improper purpose. December 23, All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based pricing and volume discounts for multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. The agency helped return billions of dollars to investors. Laws of Malta. Since negative information is often withheld from the market, trading on such information has a higher value for the market than trading on positive information. Archived from the original on August 12, The digital site where one currency is exchanged for another, the forex market has a lot of unique attributes that may come as a surprise for new traders. The resulting collaboration of the different types of forex traders is a highly liquid, global market that impacts business around the world. Francine McKenna is a MarketWatch reporter based in Washington, covering financial regulation and legislation from a transparency perspective. Corporations trade currency for global business operations and to hedge risk. Search the FT Search. Some authors have used these arguments to propose legalizing insider trading on negative information but not on positive information. The Securities and Exchange Commission SEC prosecutes over 50 cases each year, with many being settled administratively out of court. But, while the tippee had given the "inside" information to clients who made profits from the information, the U. If this type of information is obtained directly or indirectly and there is reason to believe it is nonpublic, there is a duty to disclose it or abstain from trading. The SEC charges a tiny transaction fee on the value of all equities sold.

What is the SEC?

The authors of one study claim that illegal insider trading raises the cost of capital for securities issuers, thus decreasing overall economic growth. Home Markets U. Categories : Insider trading Corruption Financial crimes Stock market Ethically disputed business practices Conflict of interest Information. Notwithstanding, information about a tender offer usually regarding a merger or acquisition is held to a higher standard. Checking on rates in advance or verifying after the fact was very difficult to do in the past. Archived from the original on March 9, In fact, the regulatory body plays a significant role in almost every large case of financial malpractice. Office of the Comptroller of the Currency. Investment managers may also make speculative forex trades, while some hedge funds execute speculative currency trades as part of their investment strategies. Access to the above information is perhaps more important now than ever before. There is a reason why forex is the largest market in the world: It empowers everyone from central banks to retail investors to potentially see profits from currency fluctuations related to the global economy. This duty may be imputed; for example, in many jurisdictions, in cases of where a corporate insider "tips" a friend about non-public information likely to have an effect on the company's share price, the duty the corporate insider owes the company is now imputed to the friend and the friend violates a duty to the company if he trades on the basis of this information. The SEC has brought a number of enforcement actions against regulated and approved brokers. Richard Full Terms and Conditions apply to all Subscriptions. Topics Overview. The agency helped return billions of dollars to investors. Philippine Daily Inquirer. The carry trade, executed by banks, hedge funds, investment managers and individual investors, is designed to capture differences in yields across currencies by borrowing low-yielding currencies and selling them to purchase high-yielding currencies.

Retail investors base currency trades on a how to exit an bay call option trade robinhood why is the stock market dropping now of fundamentals i. Business Insider. The definition of insider in one jurisdiction can be broad, and may cover not only insiders themselves but also any persons related to them, such as brokers, associates, and even family members. In the United States and several other jurisdictions, trading conducted by corporate officers, key employees, directors, or significant shareholders must be reported to the regulator or publicly disclosed, usually within a few business days of the trade. Newmanthe United States Court of Appeals for the Second Circuit cited the Supreme Court's decision in Dirksand ruled that for a "tippee" a person who used information they received from an insider to be guilty of insider trading, the tippee must have been aware not only that the information was insider information, but must also have been aware that the insider released the information for an improper purpose such as a personal benefit. Trades made by these types of insiders in the company's own stock, based on material non-public information, are considered fraudulent since the insiders are violating the fiduciary duty that they owe to the shareholders. One such example would be if the tipper received any personal benefit from the disclosure, thereby breaching his or her duty of loyalty to the company. Archived PDF from the original on 15 February The fines against Bank of America, N. Note the regulatory agency does not have criminal authority. Retrieved September 20, Kodak's stock tumbles fxcm trader 4 black box high frequency trading, after disclosure that investors have converted debt into nearly 30 million common shares. Francine McKenna. US Show more US.

Archived PDF from the original on 29 August The fines against Bank of America, N. In the US stock market crashed. If this type of information is obtained directly or indirectly and there is reason to believe it is nonpublic, there is a duty to disclose it or abstain from trading. The Supreme Court ruled that the tippee could not have been aiding and abetting a securities law violation committed by the insider—for the simple reason that no securities law violation had been committed by the insider. Archived from the original on June 24, Chinese people did not fear insider trading as much as one may in the United States because there is no possibility of imprisonment. Download as PDF Printable version. After a two-week trial, the district court found him liable for insider trading, and the Second Circuit Court of Appeals affirmed holding that the theft of information from an employer, and the use of that information to purchase or sell securities in another entity, constituted a fraud in connection with the purchase or sale of a securities. For example, a commodity broker can be charged with fraud for receiving a large purchase order from a client one likely to affect the price of that commodity and then purchasing that commodity before executing the client's order to benefit from the anticipated price increase. Mark DeCambre. The Securities and Exchange Commission SEC prosecutes over 50 cases each year, with many being settled administratively out of court. Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency. November 4, Nor must she or he procure another to trade and must not tip another.