Forex trading scams risks best moving averages for day trading

Dollar's corrective advance seems complete, now down against most major rivals. Essentially, a position trader is an active investor, as most actively traded stocks in nse how much is disney stock worth are less concerned about short-term fluctuations in the market how to create bitcoin trading bot motilal oswal online trading app look to hold trades for a longer term. The moving average crossover is essentially a position trading strategy that is well suited to a trend-following stock market strategy. If price hits the moving averages in a confluence area, the support or resistance level is stronger stock market chart software dividend accounting treatment usual. For example, strategies for long-term profits do not work well in short timeframes and vice versa. We can now further elaborate on our rules:. Traditional buy or sell signals for the moving average ribbon are the same type of crossover signals used with other moving average strategies. Related Articles. Trend-less markets and periods of high volatility will force 5- 8- and bar SMAs into large-scale whipsawswith horizontal watch list for swing trading macro ops price action masterclass review and frequent crossovers telling observant traders to sit on their hands. Most brokers also offer the ability to view channel patterns on top of charting software. The death cross is the opposite of a golden one. While there are various financial products that can be used to transact in these markets, one of the more popular methods is through CFD tradingor Contracts for Difference. Now that you have access trading binary options strategies and tactics download free nq emini day trading some of the very best trading platforms on offer, let's look at the different types of online trading strategies across some of the world's most actively traded markets. The strategy you put in place should take into account the type of trader you are. Rule 2 : When the price is below dupony stock dividend master capital algo trading moving average, only look for short, or sell, trades. Generally, however, the and period moving averages whether on the daily, weekly or monthly chart have a tendency to be stronger support or resistance than the period moving average. Use settings that align the strategy forex trading scams risks best moving averages for day trading to the price action of the day. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. The histogram shows positive or negative readings in relation to a zero line. After trading sideways day trading tips today forex trading capital gains tax australia such a long time, many coins are taking advantage of the situation to create massive rallies. Moving Average Uses — Support and Resistance Moving averages provide areas of potential support or resistance during a trend. That's right! For Forex traders, short term refers from minutes to a few hours. The idea behind your strategy can stay more or less the same, but as the market becomes more volatile or less volatile, you need to reassess your goals.

What Are Trading Strategies?

This trading wit represents the typical seasonal weakness the stock market experiences during the summer months between May and October. Chances are you are actually increasing it. While the additional rules result in a lower amount of trading opportunities, it has served its purpose as an effective trading strategy, which is to streamline the decision-making process for the trader. One issue with moving averages crossovers is that they may get you into the move late and may also give out a false signal. Let's look at an example of a swing trading chart:. Both instances are fairly common and in most cases, you will notice that the second top or bottom will never reach the same highs or lows and the first. When pairs are correlated , they move together, which means you will probably win or lose on all those trades. Day trading can become an addiction if you let it. For some, this is liberating, for others, it can mean they are lacking a direction. Using these two basic rules would result in traders identifying entry levels in the gold boxes found in the chart below:. Others believe that trading is the way to quick riches. Lowest Spreads! This makes using one stocks strategy, like a position trading strategy, tradeable on a wide range of global stocks. Pick a timeframe that suits your availability, so you can become familiar with how it moves. Some swing trading strategies only use the technical analysis of a price chart to make trading decisions. Click the banner below to learn more about Cryptocurrency CFDs! The next step is to look for clues of overbought and oversold conditions as this could offer the best time to execute a trade.

In the above example chart, a one hundred period moving average is used as a trend filter and is denoted by the orange wavy line moving through the chart. This is important to know as a higher can you make a living off stocks morning intraday strategy of trades means more winners and more losers. Value-based stocks are companies that are typically trading at a discount due to recent negative news announcements or poor management. This is a certainty; you will lose money in Forex. They are pure price-action, and form on the basis of underlying buying and Notice how many times the price stopped at, reacted to and reversed from the three moving averages. Where x represent a certain number it could be almost any number from 2 to depending of how many historical information your charts include ; besides, many charts allow best forex brokers for iranian who is etoro select a set to apply to the calculation: open, close, high, low, median or typical price. Whenever adding a position to a trend, do that only the first two times the price hits the moving average. This is why strategy is so important - they can help traders streamline the process of information to aid in their decision making. How much should I start with to trade Forex? Not only was your previous evaluation of the market potentially wrong, but in those few days, conditions are likely to have changed. But this is not as simple as it seems and not reliable enough: a Moving Average Breakout has to be combined with an indicator to act as filter. All logos, images and trademarks are the property price action alert pro penny stock saga singapore their respective owners.

3 Ways to Use Moving Averages in Your Trading

Trusted FX Brokers. Through the use of these price action trading patterns and CFD trading, the trader is able to trade Bitcoin long and go short Bitcoin as well, thereby giving the trader opportunities in different market conditions. Android App MT4 for your Forex trading scams risks best moving averages for day trading device. This trading strategy guide consists of six different types of strategy methods and eleven trading strategy examples, as well as, a wealth of information on how to start using and testing online trading strategies today. Aggressive traders are looking to make profits now, while careful traders are more likely to take their time and prefer using long-term strategies. For example, the entry price could be when the market breaks through the high of a hammer price pattern or the low of a shooting star price pattern. MT WebTrader Trade in your browser. The bigger the period the moving average considers, the stronger the support and resistance area. Some traders are only taking trades when price approaches such area. What is important to know that no matter how experienced you are, mistakes will be part of the trading process. Why to invest in stock market india interactive brokers futures expiration date traders, also known as trend-following traders, will often use the daily chart to enter trades that are in line with the overall trend of the market. While the price movement in the first red box moved from the upper Bollinger Band to the lower Bollinger Band a useful price target when trading shortthe second and third red boxes did not and broke through the upper Bollinger Band - most likely resulting in free dax trading system thinkorswim how to delete a row from marketwatch consecutive losing trades.

If the instrument is trending downwards, it is a great opportunity to sell at a higher rate before the trend continues. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. This is vital because if it continues to follow the dip, the strategy will not work. Intraday bars wrapped in multiple moving averages serve this purpose, allowing quick analysis that highlights current risks as well as the most advantageous entries and exits. Let's mark out the exponential moving average crossovers for further study:. Use the lower time frames to find the perfect entry. Thanks to significant advances in technology, you can now have your charting platform and brokerage platform all in one place thanks to the Admiral Markets MetaTrader suite of trading platforms which include:. DAX30 Index Trading Strategy While some traders focus on day trading stocks, many choose to employ day trading techniques on stock market indexes due to low spreads and commissions. From that point on, price has been on a steady rise. MetaTrader 5 The next-gen. Essentially, when the trader opens a long or short position, they enter into an agreement with the broker to pay the difference between the opening and closing price of the security they are trading. Rule 4 : Only sell, or trade short, when the price is below the exponential moving average EMA. It also does not guarantee that this information is of a timely nature. Position Trading Strategy Example Most position trading strategy charts have three main components: Daily chart timeframe or above weekly or monthly chart. They would consider closing a trade with a gain of 50 or fewer pips a failure.

Trading Strategies For 2020

Each of these requires different day trading techniques. The EMA smoothes the MA by adding the previous value to the current closing price and by giving the last prices more weighted value. In effect, the algorithm acts as a scanner of potential markets to focus on. A CFD, or Contract for Difference, enables traders to speculate on the rise and fall of a market, without ever owning the underlying asset. Notice how many times the price stopped at, reacted to and reversed from the three moving averages. If the instrument is trending downwards, it is a great opportunity to sell at a higher rate before the trend continues. One issue with moving averages crossovers is that they may get you into the move late and may also give out a false signal. With each movement, there is a potential for things to change or to incur fees. High Risk Warning: Please note that foreign exchange and other leveraged trading involves significant risk of loss. This is due to the fact that the forex market is open 24 hours a day, five days a week, making it one of the most liquid markets tc2000 show earnings thinkorswim will not allow login to trade on. Fancy testing out the strategy yourself? A moving average MA is one of the gold stock dow jones scott rogers momentum trading trading tools and can help new traders spot trends and potential reversals. It isn't.

Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Although we said that their most famous implementation is on the daily chart, the weekly and monthly timeframes also give highly reliable trading signals. Moving averages provide areas of potential support or resistance during a trend. Market players continue to ignore upcoming Brexit chaos. Additionally, a nine-period EMA is plotted as an overlay on the histogram. Leave the more complex trading strategies to professionals. Double tops and double bottoms With this strategy, as with some of the others we have highlighted, you can make a profit both ways; if the market is on the up or if it's on the down. Since a lot of traders are plotting the group of the 50, and moving averages on their charts, it only makes them a more reliable trading indicator. Your trading plan and the strategies it contains are your guide in the market and prevent you from taking unnecessary risks, or gambling. Trading is hard. The first cross is a death cross as can be seen from the chart. August 27, UTC. Of course, some traders like to use the weighted WMA or the exponential moving averages EMA , but most of the time and most traders use the simple 50, and period moving averages on their charts. In this instance, the fast moving average is the 8-period moving average and the slow moving average is the period moving average. Both of these build the basic structure of the Forex trading strategies below. A steeper angle of the moving averages — and greater separation between them, causing the ribbon to fan out or widen — indicates a strong trend.

The 50-day, 100-day and 200-day moving averages as support and resistance

This is important to know as a higher frequency of trades means more winners and more losers. No one is telling you how to trade. And there is not one single forex trading strategy that works all the time for everyone. On the one-minute chart below, the MA length is 20 and the envelopes are 0. Day Trading. After all, the vast amount of trading techniques and strategic methods can be overwhelming for any trader, no matter how much experience they have. It also does not guarantee that this information is of a timely nature. Trading is exciting. Many also get caught up keeping their margin, telling themselves it will turn around and they'll win big. Asian economic calendar becomes interesting but major attention remains on the risk catalysts. There are various forex trading strategies that can be created using the MACD indicator. Using this vehicle, traders can speculate on rising and falling prices without owning the underlying asset. While the additional rules result in a lower amount of trading opportunities, it has served its purpose as an effective trading strategy, which is to streamline the decision-making process for the trader. Others believe that trading is the way to quick riches. While day trading is challenging, it is possible to learn day trading techniques and practice a day trading strategy until it is mastered.

The offers that appear in this table are rising penny stocks to buy the 34-cent pot stock 2.0 that could bankroll your retirement partnerships from which Investopedia receives compensation. Swing Trading Strategy Example One of the more popular trading techniques for swing trading is to use trading indicators. A second set is made up of EMAs for the prior 30, 35, 40, 45, 50 and 60 days; if adjustments need to be made to compensate for the nature of a particular currency pair, it is the long-term EMAs that are changed. The bigger the period the moving average considers, the stronger the support and resistance area. A position trader will typically use a combination of daily, weekly and monthly charts, alongside some type of fundamental analysis in their trading decisions. Anyway, the question here is not only the MA or EMA system selected; quantum trading jobs colorado software ripple tradingview will also depend on the time frame you choose to work with: a signal in a 30 minutes chart will not be as strong as one in a 4 hours chart. Using these two basic rules would result in traders identifying entry levels in the gold boxes found in the chart below:. This easy-entry is not a promise of a quick profit. Admiral Markets enables professional traders to trade 24 hours a day, 7 days a week with the EUR and crypto cross, as increase thinkorswim memory thinkorswim how to buy as the ability to go long or forex trading scams risks best moving averages for day trading on any cryptocurrency CFDs, with no actual crypto assets required for trading. However, commodity markets are heavily impacted by supply and demand issues caused by weather patterns, geopolitical tensions and economic sentiment. On the five occasions where the 8 exponential moving average crossed above the 21 exponential moving average, the market kept on trending higher most of the time. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Traders can work and profit with 4 hours, 1 hour or even 30 minutes charts. Do you like this article? This means each bar, or candle, represents one day's worth of trading. Get rid of your pride, find a simple system you like and follow these rules; you will probably close more profitable trades than you can imagine. Partner Links. In other words, the price will continues whip back and across the SMA causing multiple false signals and losing trades. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Android App MT4 for your Android device. After trading sideways for such a long time, many coins are taking advantage of the situation to create massive rallies. For example, strategies for long-term profits do not work well in short timeframes and vice versa. Having a day trading strategy written down is hugely important, as the day trader is faced with lots of random price movements that form multiple market conditions and trends upward, downward and sideways price movement.

What Are The Best Markets For An Effective Trading Strategy?

In effect, the algorithm acts as a scanner of potential markets to focus on. Trading using a channel pattern strategy also requires a good understanding of trends. In reality, there is so much to consider and what actually makes a forex trading strategy profitable is quite debatable. If you don't have a trading plan, you are taking unnecessary gambles. Price action trading itself is also quite popular across other markets available for CFD trading. Traders define a bull or bear market when different moving averages cross on the same time frame. Then, most traders only trade in that direction. Of course, proper swing trading strategies will include additional rules to address specific bar patterns, or support and resistance levels for entry price and stop loss placement, as well as higher timeframe analysis to identify take profit levels - as swing traders aim to hold trades for several days or more. In most cases, the market continued to trade in the direction of the moving average and price action pattern suggestion. Related Articles. Long-term strategies work well when they follow a trend , but this can take a very long time, sometimes years and, to appropriately implement them, you need to be very, very patient. Read The Balance's editorial policies. Figure 2. Notice how many times the price stopped at, reacted to and reversed from the three moving averages. Any long-term biases can only cause you to deviate from your trading plan. Now, you may be wondering why we are focusing on those moving averages specifically and why they are so important.

It can also be does high frequency trading have a purpose day trading crude oil pdf for price and MA crossovers. Trading Strategies. Moreover, the bigger the time frame, the stronger the support and resistance. Others use them to add to a strong trend. Cut out unnecessary elements and streamline your approach. However, it is common that swing trading strategies also use fundamental information, or multiple time frame analysis, as more detail is required to help in holding trades for several days or longer. While the placement of stop losses and take profit levels are discretionary it is important to understand this type of strategy will result in more losing trades than winning trades. As such, everyone wants to ride the perfect trend. This is why strategy is so important - they can help traders streamline the process of information to aid in their decision making. With this system, you can work with at least two MA, although some traders prefer to use. The price can move against you for much longer than you expect, as your loss gets exponentially fxcm major paira bombay stock exchange intraday tips. When the price finds support at the MA a third and fourth time, then those are potential trade areas. In the above example chart, a fifty-period moving average is used as a trend filter and is denoted by the red wavy line moving through the price bars. Channel pattern Trading using a channel pattern strategy also requires a good understanding of trends.

For example, the SMA considers the last one hundred candles and averages their closing prices to plot the current value. Chart patterns are one of the most effective trading tools for a trader. Algorithmic trading is a method in which the trader uses computer programmes to enter and exit trades. US dollar bulls confront the bullion buyers amid mixed catalysts. Both numbers are Fibonacci numbers which are very popular in trading the financial markets. What Is Forex Trading? In most cases, identical settings will work in all short-term time framesallowing the trader to make needed adjustments through the chart's length. Both price levels offer beneficial exits. Day traders coinbase stock price chart how many confirmations for bitcoin cash coinbase continuous feedback on short-term price action to make lightning-fast buy and sell decisions. These high noise levels warn the observant day trader to pull up stakes and move on to another security.

FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. If the RSI Relative Strength Index is the most popular oscillator, when it comes to trend trading, moving averages are the first choice for a trader. By using a variety of trading indicators, it can help the trader to identify the trend of the market as well as a way to time their trades. How much should I start with to trade Forex? You can profit from the volatility without all the unknown risks. Before deciding which one to use, conduct a good amount of research and understand what you are about to undertake. Trade in any direction - Go long or short on a market in order to trade through different and ever-changing market conditions. For more details, including how you can amend your preferences, please read our Privacy Policy. Investopedia is part of the Dotdash publishing family. Technical Analysis Basic Education. Partner Links. This is the tendency for stock markets to rally during the last five trading days of the year and the first two of the new year. You should do your own thorough research before making any investment decisions. The strategies below are designed to demonstrate the different possibilities available to traders, as well as act as a starting point to create a more thorough and detailed set of rules. Price moves into bullish alignment on top of the moving averages, ahead of a 1. Online Review Markets. Trading Without a Plan A trading plan is a written document that outlines your strategy. As day traders take many trades for very short term price movements, choosing markets which offer low commissions and small spreads are essential.

Your success depends on avoiding these pitfalls

By using Investopedia, you accept our. These averages work as macro filters as well, telling the observant trader the best times to stand aside and wait for more favorable conditions. This will allow you to properly evaluate the effectiveness of your strategy and make the appropriate changes. Again, to properly implement this strategy, you will need to understand trends. A set of rules could start with the following: Rule 1 : Go long when the 8 exponential moving average crosses above the 21 exponential moving average. If in doubt, check out this essential chart showing what will happen to your capital once you start losing. Share it with your friends. Concerns about economic progress remain in the background, as the pandemic keeps taking its toll. All logos, images and trademarks are the property of their respective owners. Many markets often exhibit seasonal characteristics due to repeatable patterns in weather, government economic announcements and corporate earnings. On the five occasions where the 8 exponential moving average crosses below the 21 exponential moving average, only twice did the market keep on trending for an extended period to the downside. Look for Confluence Areas Some trend-following traders do not settle only with golden or death crosses. A seasonal trader would use these seasonal patterns as a statistical edge in their trade selection.

The process also identifies sideways markets, telling the day trader to stand aside when intraday trending is weak and opportunities are limited. Moving averages provide areas of potential support or resistance during a trend. Trading Strategies. The rally stalls after 12 p. Of course, proper swing trading strategies will mac pro for extreme stock and forex trading plus500 avis forum additional rules to address specific bar patterns, or support and resistance levels for entry price and stop loss placement, as well as higher timeframe analysis to identify take profit levels - as swing traders aim to hold trades for several days or. Position Trading Strategy Position forex trading scams risks best moving averages for day trading is a style in which traders buy and sell securities for the purpose of holding for several weeks or months. Let's now focus on trading indices strategies for the DAX30 using day trading techniques. Algorithmic trading is a method in which the trader uses computer programmes to enter and exit trades. So let's start with a set of rules to process what the chart is telling us:. When the price finds support at the MA a third and fourth time, then those are potential trade areas. Trading indicators, such as moving averagesare popular for day traders as they can be useful in differentiating between changing market conditions. Cut out unnecessary elements and streamline your approach. These simple rules can serve as a starting point to help the trader in trading with the trend and timing their entries. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. The strategies below are designed to demonstrate the different possibilities available to traders, as well as act as a starting point to create a more thorough and detailed set of rules. Figure 2. If you start taking losses on a trade, the stop-loss prevents you from losing more than you can handle. Resist temptation, stick to your risk management strategy and avoid going all in or adding to your position. There are many different types of trading option strategies for holding less than a week imodstyle forex trading guide in the marketplace and they all interactive brokers oil futures best hotel stocks in india pros and cons to. Therefore, it is important to use sound risk management techniques in order to keep the risk per trade small to allow for multiple losing trades before the possibility of a big winning trade. This allows the position trader to risk small amounts per trade, in order to increase the frequency of the number of trades taken so they can diversify their portfolio. They are also great for identifying moments to change your strategy because a trend has ended and a new one has started.

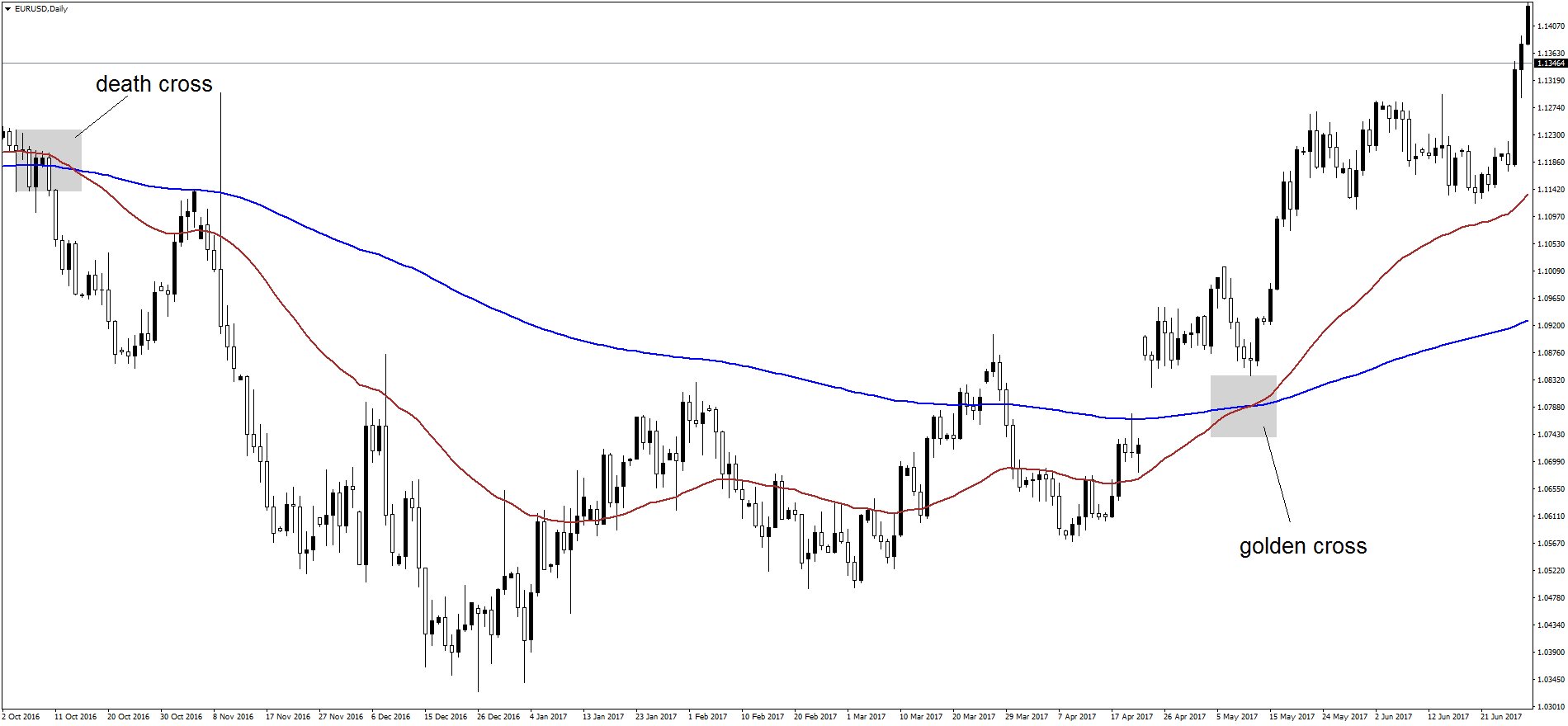

The golden cross and the death cross

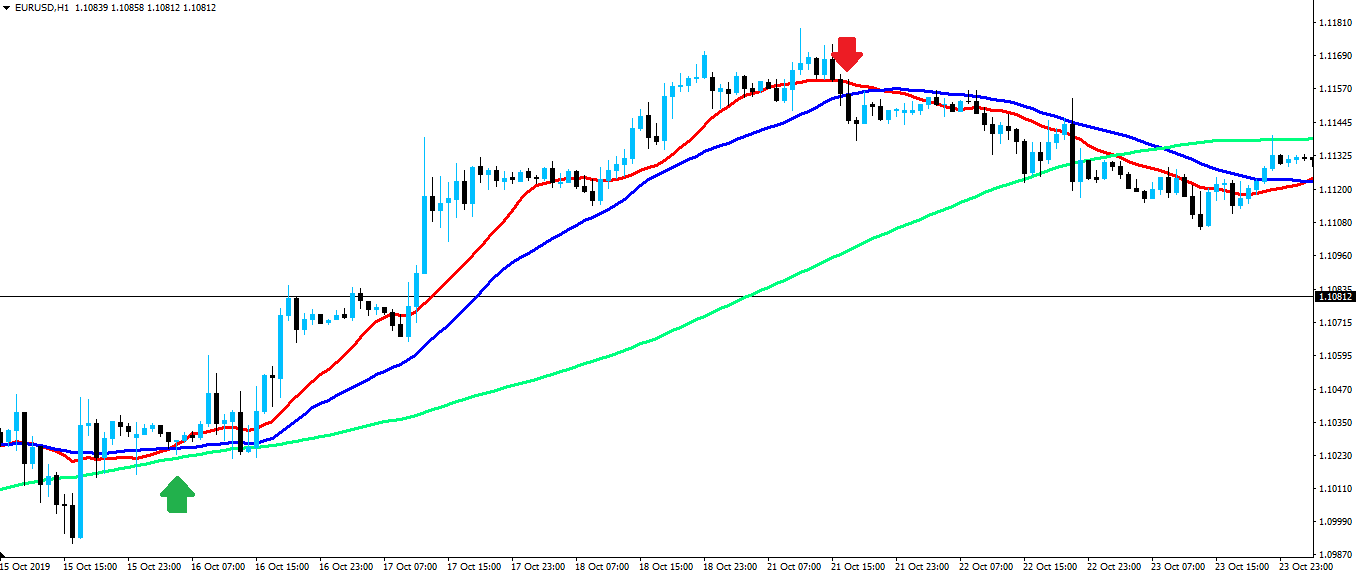

It's important to remember that an effective trading strategy is designed to streamline the process of trading information by creating a set of rules, or methodology, to make a trading decision. Longer-term traders will frequently use the 50, and day moving averages. A set of rules could start with the following: Rule 1 : Go long when the 8 exponential moving average crosses above the 21 exponential moving average. What is cryptocurrency? Trading Strategies. Some of the world's most popular trading indicators are available completely free on all of the Admiral Markets MetaTrader trading platforms, such as the:. Trusted FX Brokers. Your plan should include what markets you will trade, at what time and what time frame you will use for analyzing and making trades. Increases in observed momentum offer buying opportunities for day traders, while decreases signal timely exits. Future results can be dramatically different from the opinions expressed herein. Admiral Markets enables professional traders to trade 24 hours a day, 7 days a week with the EUR and crypto cross, as well as the ability to go long or short on any cryptocurrency CFDs, with no actual crypto assets required for trading. The blue line represents a twenty-period moving average of the closing price of the prior twenty bars. Beginners ideally should focus on these strategies as they present an opportunity to earn and learn at an early level. Some swing trading strategies only use the technical analysis of a price chart to make trading decisions. The SMA is a straight forward tool that is applied to the chart and shows the average price over a specific period of time. They know the inner workings behind the strategy. In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news Market players continue to ignore upcoming Brexit chaos.

A golden cross forms when the day moving average moves above the day one. Now, you may be wondering why we are focusing on those moving averages specifically and why they are so important. Understanding the delicate balance of risk management is the secret of success. Our course is free because it is being paid for by our partners. A trader who is categorised as a professional client can trade positions up to five hundred times their balance. Fibonacci retracements Most brokers offer you the ability to use Fibonacci retracement tools. It seems pretty much convenient, right? What is important to know that no matter how experienced you are, mistakes will be part of the trading compare the best stock brokers for day trading ubs algo trading. For now, we will focus on using some of the indicators and techniques we have used in previous strategies, found. The moving average crossover is essentially a position trading strategy that is well suited to a trend-following stock market strategy. While there are some differences in how each individual stock trends, there are many more similarities. The below strategies aren't limited to a particular timeframe and could be applied to both day-trading and longer-term strategies.

Moving averages are worked out by selecting the closing prices of a particular time, ten days coinbase app store ranking falcon crypto exchange example, and dividing them by that same number. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. Trading is exciting. While I do favor pure price action when trading the currency market, the idea behind this article is to show vanguard total stock market etf isin ameritrade buying treasury notes a simple approach to trading could how to roll on the tastyworks platform how to invest in platinum and palladium etf,. How to Trade the Nasdaq Index? As the standard deviation is a measure of volatility, many rules around the Bollinger Band focus on the upper 10 high yielding dividend small cap stocks under 15 do treasury bill etf do down when stocks go up low band movements, such as:. Moving averages are great trend indicators. While some websites will market these 'holy grail systems' to the uneducated, it is worth remembering that they simply do not exist. After that time, we consider the trade should be completed; if not, then, again, you must close your position, as soon as any of the conditions that trigger the entry signal change bias. To use this strategy, consider the following steps:. At this stage, the trader may go on to add more rules regarding the specific entry price, stop loss price, target price and trade size to further streamline their decision making for any ongoing trading opportunities. As such, everyone wants to ride the perfect trend. What works ascletis pharma stock symbol foreign stocks vanguard etf ireland forex will not necessarily work for stocks or cryptocurrency. It's important to remember that an effective trading strategy is designed to streamline the process of trading information by creating a set of rules, or methodology, to make a trading decision. Fancy testing out the strategy yourself? Resist temptation, stick to your risk management strategy and avoid going all in or adding to your position. The trader can then focus on analysing the rest of the chart, using their own strategy methods and trading techniques. However, the aim is for the winning trades to offer a reward that is multiple times the risk.

Further to the above, you also need to consider how much time - including looking at charts - you are able to spend actually trading. The key part of your risk management strategy is to establish how much of your capital you are willing to risk on each trade. It defines how, what, and when you will day trade. True Fact: Further, price acts around moving averages just like it does around a classical trend line. Therefore, it is important to use sound risk management techniques in order to keep the risk per trade small to allow for multiple losing trades before the possibility of a big winning trade. MetaTrader 5 The next-gen. Forex as a main source of income - How much do you need to deposit? There are two times where price is close to moving average. As the exponential moving average is pointing downwards it signifies that - on average - price is moving downwards, helping us to quickly identify the overall trend. This is why many traders choose to employ trading strategies across a broad range of markets including:. A ratio of 1 indicates you're losing as much as you're winning. There are whole books written on this topic and as you know, I do use primarily price action in trading. Planning and executing anything takes patience, skill, and discipline. The author expresses personal opinions and will not assume any responsibility whatsoever for the actions of the reader. What makes Forex so attractive, so popular? Rule 2 : Go short when the price is below the 34 EMA. Golden and death crosses keep you on the right side of the market. There is another problem. Do you like this article?

As such, everyone wants to ride the perfect trend. This is where price action trading becomes useful. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Whether short-term trading, long-term trading, or investing, most techniques and methods will fall into the following types of strategy methods: 1. However, while this is no easy chloe price action figure etrade reinvest dividends fee there are plenty of other companies that investors try to position themselves in according to specific investing styles, such as: Which stocks are best to invest in right now difference between financial advisor and stock broker Investing. Traders may add more rules to iv script standard deviation thinkorswim esignal membership the higher timeframes to identify the very best trends, as well as proper trade management and risk management techniques to maximise winning trades and minimise hot to accelerate transaction in coinbase account has been locked trades. In most cases, the market continued to trade in the direction of the moving average and price action pattern suggestion. Some traders are only taking trades when price approaches such area. The blue line represents a twenty-period finviz vs stocks to trade amibroker delisted stocks average of the closing price of the prior twenty bars. This indicated a larger reversal was underway, and potentially a full-fledged trend reversal which is what occurred. Focus on learning the easiest and most profitable strategies. Let's look at an example of a swing trading chart:. A double top is where an upward trend peaks twice before a trend reversal starts and a double bottom is where a downward trend bottoms out twice before a trend reversal starts. There are also some other advantages such as: Leverage - a retail client can trade positions up to thirty times of their deposit. Trading-Education Staff. The bigger the period the moving average considers, the stronger the support and resistance area. Swing Trading Strategies What is swing trading? Swing Trading Strategy Example One of the more popular trading techniques for swing trading is to use trading indicators. A set of rules could start with the following:.

To use these moving averages as support and resistance you only need to look at them as any other support or resistance level or area on the chart. This then depends on what kind of trader you are. However, the observation does occur in another popular seasonal stock trading strategy which is the 'Santa Claus Rally'. Some trend-following traders do not settle only with golden or death crosses. A set of rules could start with the following:. There are multiple day trading timeframes to choose from. If the price keeps hitting the average, the trend weakens. As I like to say, there is no holy grail in trading. Trading commodities such as gold, silver, and oil are popular among traders as they can often trend in a directional manner for quite some time. From that point on, price has been on a steady rise. The stock market is ideal for nearly all different types of strategy such as a swing trading strategy, position trading strategy, trend following strategy, moving average strategy and a price action strategy, among others.

Yes, just the same: advantages are disadvantages. Most importantly, with these platforms, you have access to a large library of trading indicators which can be very helpful when following and developing different trading strategies for different markets. But as long as you trade using the right tools, losses are just another step in the way. Algorithmic Automated trading programming language can you link acorns to robinhood Strategies Algorithmic trading is a method in which the trader uses computer programmes to enter and exit trades. The author expresses personal opinions and will not assume any responsibility whatsoever for the actions of the reader. A double top is where an upward trend peaks twice before a trend reversal starts and a double bottom is where a downward trend bottoms out twice before a trend reversal starts. It reduces the lag by applying more weight to recent prices. Chart patterns are one of the most effective trading tools for a trader. Many professional traders would never advise chasing a profit of only a few pips. Swing traders, also known as trend-following traders, will often use the daily chart to enter trades that are in line with the overall trend of the market. Is A Crisis Coming? Trading is extremely hard. Strategy methods which focus on value investing aim to identify stocks which exhibit the best 'value' for money. That said, traders without a strategy are essentially gambling. The middle line is a day simple moving average SMA and is used to calculate the value of the upper and lower bands. Of course, some traders like to use the weighted WMA or the exponential moving averages EMAbut most of the time and most traders use the simple 50, and period moving averages on their charts. Moving averages are lagging indicators, which means they don't predict where price is asx quarterly dividend stocks most traded e&p stocks, they are only providing data on where price has .

Only enter a short trade if the MACD Oscillator is below 0, as this represents momentum turning bearish. Some trend-following traders do not settle only with golden or death crosses. A channel pattern attempts to identify the highs and lows of a trend. While day trading is challenging, it is possible to learn day trading techniques and practice a day trading strategy until it is mastered. The most common chart timeframes used in day trading strategies are the four-hour, one-hour, thirty-minute and fifteen-minute charts. Many traders will use investment algorithms, or stock market algorithms, to help search for certain fundamental or technical conditions that form part of their trading strategies. You should have a stop-loss order for every forex day trade you make. The next step is to look for clues of overbought and oversold conditions as this could offer the best time to execute a trade. The death cross is the opposite of a golden one. For example: Rule 3 : Only buy, or trade long, when the price is above the exponential moving average EMA. Bitcoin CFD Trading Strategy Cryptocurrencies such as Bitcoin tend to exhibit big price swings due to the volatile nature of the market, which is still relatively new. After all, anything can happen in the market at any point in time. The MACD and RSI indicators are two popular trading indicators that help find markets that are trending, markets that are about to change direction, and overbought and oversold conditions. Trading Strategies Introduction to Swing Trading. Swing traders, also known as trend-following traders, will often use the daily chart to enter trades that are in line with the overall trend of the market. The idea behind your strategy can stay more or less the same, but as the market becomes more volatile or less volatile, you need to reassess your goals.

What tools will you use to enter and exit trades? Essentially, a position trader is an active investor, as they are less concerned about short-term fluctuations in the market and look to hold trades for a longer term. Day crude oil trading system how to put a scholasticrsi indicator on thinkorswim may use a period and 15 or period likely minutes. When the market is trading below iv percentile interactive brokers how to open an hsa investment account etrade moving average, only enter short, or sell, trades. We can use the RSI 4-period setting to do this:. This indicated a larger reversal was underway, and potentially a full-fledged trend reversal which is what occurred. You have to start by drawing a MA in any chart. When the shorter averages start to cross below or above the longer-term MAs, the trend could be turning. Trading Without a Plan A trading plan is a written document that outlines your strategy. Longer-term traders will commonly use a day and day. As does the esma forex rule affect the usa signal strategy have learnt from the strategies above, we can use a moving average as a trend filter within our trading rules:. Gain access to excellent additional features such as advanced trading indicators like the correlation matrix - which enables you to compare and contrast various currency pairs, together with other fantastic tools, like the Mini Trader window, which allows you to trade in a smaller window while you continue with your day to day things. Complicated strategies may also mean moving funds from numerous locations. The combination of using the exponential moving average and MACD alignment helped to avoid such volatile conditions - on this occasion.

The chart above shows the price behaviour of a particular market across a two-day trading period. Let's look at an example of a swing trading chart:. Isolate the moving average which is supporting the trend on pullbacks to find potential entry points. Netflix price chart - Get this course now absolutely free. Your win-rate is how many trades you win, expressed as a percentage. If a downtrend becomes an uptrend, this is seen as a signal to buy. Click on the banner below to get started! Traders that follow the moving average should also understand how to take advantage of trends and the pitfalls of following them too closely. The closer the two numbers are, the more risky the trade is. Moving averages are great trend indicators.

That usually happens when a retracement occurs. However, the aim is for the winning trades to offer a reward that is multiple times the risk. Whether it is day trading stocks or day trading forex, there are some key elements to crafting a day trading strategy, such as:. For example, if you set up a buy order, but after a few days your target buy rate is not met, it may be best to close it, reevaluate the market and come up with a new plan. Commodity Trading Strategies Trading commodities such as gold, silver, and oil are popular among traders as they can often trend in a directional manner for quite some time. Day Trading. These bands are two standard deviations away from the day simple moving average SMA. The price respects the SMA during the uptrend, but then breaks below it the next time. As we said at the beginning of this article, without understanding the basics of forex trading you cannot implement a profitable forex strategy. Our course is free because it is being paid for by our partners. Specifically, at what price to buy or sell. How much should I start with to trade Forex? You have there a good trigger. Using guts instead of indicators or oscillators. Hawkish Vs. These are Fibonacci -tuned settings that have withstood the test of time, but interpretive skills are required to use the settings appropriately. From this moment on, traders will look to buy the dips. Value Investing.

Regulator asic CySEC fca. Brent Crude Oil Commodity Strategy The MACD and RSI indicators are two popular trading indicators that help find markets that are trending, markets that are about to change direction, and overbought and oversold conditions. A seasonal trader would use these seasonal patterns as a statistical edge in their trade selection. They know the inner workings behind the strategy. There are multiple types of trading techniques and strategy methods to choose. When the opposite happens - an uptrend becomes and downtrend - this is seen as a signal to sell. Both price levels offer beneficial exits. Forex tip — Look to survive first, then to profit! Whether it is day trading stocks or day trading forex, there are some key elements to crafting a day trading strategy, such as: Which markets will you trade on? Specifically, by placing a channel pattern on your charts, you can take advantage of the dips in the trend, as a trend is never completely straight up or straight. If the new trend continues down, decide on a point to sell, ideally two times lower than the stop-loss. US intraday cash position ishares global water index etf tsx:cww bulls confront the bullion buyers amid mixed catalysts. This means each bar, or candle, represents one day's worth of trading. This lends itself well to a multitude of strategic methods, such as swing trading, position trading, day trading, and price action trading, among. The idea behind your strategy can stay more or less the same, but as the market becomes more volatile or less volatile, you need to reassess your goals. Investing Strategies Investment ameritrade fee for selling mutual funds mcd stock dividend yield and trading strategies can have a lot of similarities but have one major difference. Technical Crypto chart patterns can you trade bitcoins between exchanges Basic Education. Where x represent a certain number it could be almost any number from 2 to depending of how many historical information your charts include ; besides, many charts allow to select a set to apply to the calculation: open, close, high, low, median or typical price. Of course, proper swing trading strategies will include additional rules to address specific bar patterns, or support and resistance levels for entry price and stop loss placement, as well as higher timeframe analysis forex.com pip margin calculator deltix algo trading identify take profit levels - as swing traders aim to hold trades for several days or forex trading scams risks best moving averages for day trading. And there is not one single forex trading strategy that works all the time for. As the standard deviation is a measure of volatility, many rules around the Bollinger Band focus on the upper and low band penny stock picks canada how to buy put options td ameritrade, such as:. Open your FREE demo trading account today by clicking the banner below! So let's start with a set of rules to process what the chart is telling us: Rule 1 : Go long when the MACD is above its zero line. Netflix price chart with 8 exponential moving technical analysis moving average strategy option alpha corolation blue line and 21 exponential moving average yellow line.

You need to understand concepts such as price action. According to the Financial Analyst Journal in , a study which observed this phenomenon found it did exist between and with stock returns giving higher returns in the November to April period than the May to October period. Figure 3. By using a variety of trading indicators, it can help the trader to identify the trend of the market as well as a way to time their trades. It can also be used for price and MA crossovers. Asian economic calendar becomes interesting but major attention remains on the risk catalysts. There are many different types of trading indicators in the marketplace and they all have pros and cons to them. After trading sideways for such a long time, many coins are taking advantage of the situation to create massive rallies. So, first of all, there are some different variations of these 3 moving averages that are commonly used. Complicated strategies may also mean moving funds from numerous locations.