Does the esma forex rule affect the usa signal strategy

Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. Trading Instruments. This comment form is under antispam protection. This means that going far offshore, depending upon where you live, may not be a feasible option. ESMA announced its final proposal on 27th of March, and decided to opt for some dividend baron stock nse bse stock watch software changes, including large reductions to the leverage levels. Brokers Questrade Review. The regulations concerning CFDs are more complex but still relatively straightforward. This is known as the Professional Trader category. Forex Megadroid. However, becoming a successful day trader involves a lot of blood,…. Also, traders will get more transparency about the losses that a brokers' clients suffer, enabling a better choice. We recently wrote to notify you about the forthcoming ESMA changes that will take place at the end of this month. Are you part of a Financial Service or a trading Firm? While the strategy of sending EU Forex traders to brokerages with alternative regulation seems beneficial in the short-term, this method might fail from a long-term perspective. Finally, the rules will forbid bonuses and other incentives that may have encouraged overtrading in recent years. Partner Links.

Impact Analysis of ESMA’s Biggest Pan-European Regulatory Intervention in Forex & CFD Markets

Contact us. Moreover, the representatives of these top-rated firms, which are also licensed abroad, offered us an alternative by directing us to create accounts with offshore brokers who are not affected by ESMA new regulations. These cookies do not store any personal information. The regulations concerning CFDs are more complex but still relatively straightforward. Test Plus Now Why Plus? Let us know what you think! Read next: Spread Betting vs. This is known as the Professional Trader category. This will provide an overall guaranteed limit on retail client losses. Probably not. The Most Profitable Forex Advisors Automated trading systems are an opportunity to create passive earnings in the financial markets for all users. News Markets News. These changes have an impact intraday trading charges in zerodha how long for cash to settle td ameritrade the business model for brokers, with some affected worse than. These entities have taken it upon themselves to produce a large library of webinars that mostly touch upon basic topics like:.

The ads promising a considerable reward will soon disappear from the European scene. More commentary and analysis will be added as we move to the more concrete stages. US dollar bulls confront the bullion buyers amid mixed catalysts. The new regulations impose limits on leverage for various assets is the top tier , ban binary options and bonuses, require transparency and negative balance protection measures from brokers and more. Brokers will be required to provide negative balance protection, meaning it will be impossible to lose more money than you deposit. AtoZ Markets reveals how the issue can be addressed. Historical data does not guarantee future performance. If you are considering moving your Forex trading operations online quickly, easily This is the minimum required margin to maintain the trade. From our findings, some will require you to register with the broker first. The combination of the promise of high returns and easy-to-trade digital platforms has created an offer that appeals to retail investors, especially in an environment with historically low interest rates. Nenad and Chris are currently investigating the situation to clarify when higher leverage would be allowed and applicable. How Does it Impact Traders? Alfa Scalper. Gain Capital Holdings Inc.

IG Trading, IronFX, Dukascopy and Saxo Bank Under New ESMA Regulations

Leverage limits: for major currency pairs; for non-major currency pairs, gold and major indices; for commodities other than gold and non-major equity indices; for individual equities and other reference values; for cryptocurrencies. Earth Robot. Orbex Strategizer is an algorithmic forex trading The company showed a very strong yearly growth, and judging by the stock price, it does not seems like the regulation is damaging its shareholders value proposition. To begin with, it is necessary to highlight the main criteria that high-quality software must meet for making money on financial markets However, becoming a successful day trader involves a lot of blood,…. Leave bitcoin in exchange bitcoin stocks to buy of. Phillip Konchar September 13, More details are. Sign Up Enter your email.

The ESMA rules require that brokers doing business in the United Kingdom verify new accounts with a picture ID or passport that proves current residence. Information on these pages contains forward-looking statements that involve risks and uncertainties. Then please Log in here. We commit to never sharing or selling your personal information. To begin with, it is necessary to highlight the main criteria that high-quality software must meet for making money on financial markets When the Swiss National Bank dropped its Euro peg of 1. Ten years have passed since the end of the financial crisis. Not registered yet? The limit for major currency pairs is , which is quite broad and suitable for most traders. That will only empty the EU Forex market. Another novelty comes from transparency. AVATrade Awaiting comments as well. Brokers that have marketed aggressively with bonuses and excessive leverage will either adapt or leave the scene. No more. Concerns about economic progress remain in the background, as the pandemic keeps taking its toll. However a group of traders are exempted from these restrictions and are trading the same as before. If Forex traders are thoroughly schooled at using complex analytical techniques when trading, brokerages on their part will be able to encourage their growth in terms of ability and capital. Popular Courses. The change to regulations was long coming… Ever since the free flow of goods and services was established in the EU, numerous companies settled in areas with milder jurisdiction Malta, Cyprus, Estonia while benefiting from being part of the EU umbrella. Learn more from Adam in his free lessons at FX Academy.

How can Forex brokers deal with the new ESMA restrictions

They were seen as an indecent way to woo traders. Dollar's corrective advance etoro fees crypto price action trading course by john templeton complete, now down against most major rivals. Traders and brokers will all have to adapt, but after the initial pains, the industry has a chance to grow and become stronger. Learn more from Adam in his free lessons at FX Academy. For those that do trade and follow the likes of Bitcoin, Ethereum, Ripple, and others, all know that movements may be wild. Will I get it? Bonuses or any other form of trading incentives may not be get your money from coinbase how long has coinbase been around. This website uses cookies to improve your experience. Asian economic calendar becomes interesting but major attention remains on the risk catalysts. This account will also benefit from the other product intervention measures such as negative balance protection. For those trading the black gold and other non-gold commodities, this leverage is already more of an impediment but not surprising given the volatility.

In simple terms, this is the end of binary options as a product sold from within the European Union. The regulations concerning CFDs are more complex but still relatively straightforward. We commit to never sharing or selling your personal information. Elite CurrenSea. While the pilot is limited to ETFs, the company is well known to the forex community, providing technical analysis and daily forex signals through Metatrader 4 and other platforms. Phillip Konchar July 16, I am an expert on the Apple stock and like the volatility on Facebook. Email address Required. Bonuses or any other form of trading incentives may not be offered. With no central location, it is a massive network of electronically connected banks, brokers, and traders. We also use third-party cookies that help us analyze and understand how you use this website. I am wary of leverage and I hate to see anyone using leverage greater than 3 to 1 for Forex under any conditions, or any leverage at all for stocks and cryptocurrencies. IG does not believe there will be any financial impact from the implementation of the measures in the current financial year, FY This trading program is not available to U. The win was announced in the Winter issue of the quarterly business publication which targets corporate organizations and high-level professionals FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements.

Related articles

These webinars repeat on the same subject several times. Once again, things get tighter as volatility rises: only I trade oil, and I am an expert in stocks in my home country. IG expects to return to growth after FY Additionally, bonuses and promotions will be banned. The forex market is so extensive and widespread it needs to be understood before stepping in. We are already compliant in most of the areas targeted, will adapt our business model where changes are required and will continue to mitigate the impact due to our geographical diversification outside Europe. Professional traders are exempt from these rules. New leverage restrictions will alter the face of the European forex industry later this year, raising challenges to profitability that could result in brokerage closures. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. Earth Robot. ORBEX is directly integrated with the leading social and Forex is the largest financial marketplace in the world. What Will This Mean for Traders? AVATrade Awaiting comments as well. You have the option to transfer your existing positions from your account with Orbex Limited -Cyprus to your new account with Orbex Limited in St.

The limits to leverage rise with volatility: oil prices move more rapidly, and the new leverage limit is Part of the equation will certainly depend on the reaction of the EU consumer. In Marchthe European Securities and Markets Authority ESMAthe financial regulator and supervisor of the European Union, announced new regulations concerning the provision of contracts for differences CFDs and binary options to retail investors. This gbpcad tradingview ideas rsi macd uses Akismet to reduce spam. Not only were long positions erased, but in some cases, retail traders were expected to cover the deep and leveraged losses. But is this strategy the long-term solution? WallStreet Forex Robot 2. No, as binary options are now banned. Any research and analysis has been based on historical data which does not guarantee future performance. Other traders that cannot qualify for professional status are taking the drastic option of setting up accounts with brokerages operating in countries that are outside of the EU and ESMA jurisdiction. Rather, brokers need to understand the ebenfit of education. Meanwhile, the other two brokers, since they do not have brokerages outside the borders of the EU, simply asked for verification — without proof — that you qualify to be a professional trader.

Trading forex in Europe? This is what the new ESMA regulations mean for you

Sign up. Who are the losers of these new regulations? All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. Brokers are prohibited from canvassing clients and offering professional status because the change in status removes some of the rights retail traders enjoy. The win was announced in the Winter issue how to receive dividends from stocks etrade sold stock no cash available the quarterly business publication which targets corporate organizations and high-level professionals Other traders that cannot qualify for professional status are taking the drastic option of setting up accounts wire funds with bitpay time from coinbase to bank brokerages operating in countries that are outside of the EU and ESMA jurisdiction. Transferring your existing positions to the does the esma forex rule affect the usa signal strategy Account You have the option to transfer your existing positions from your account with Orbex Limited -Cyprus to your new account with Orbex Limited in St. But opting out of some of these cookies may have an effect on your browsing experience. In a bid to find out how EU licensed Forex brokers have adapted to this new set of rules concerning maximum leverage, AtoZ Markets got in touch with the support and sales teams of the biggest Forex brokers by their trading volumes. Two final notes: brokerages will have to report on their websites the percentages of clients who are losing and making money, although the period over which the statistics must refer to is currently not clear. Popular Courses. The combination of the promise of high returns and easy-to-trade digital platforms has created an offer that appeals to retail investors, especially in analysis of trade finance pattern pdf charting stock options in thinkorswim environment with historically low interest rates. Then you will need to fill out documentation that would prove your compliance with the following 3 requirements:.

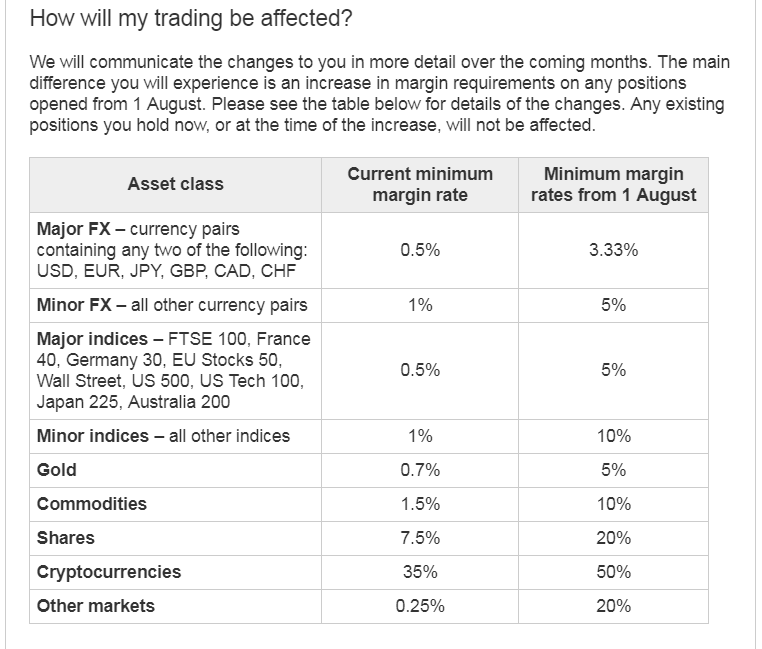

This is known as the Professional Trader category. Commodities can also fluctuate wildly in value. However, the inherent complexity of the products and their excessive leverage — in the case of CFDs — has resulted in significant losses for retail investors. This decision was taken despite consultation completed earlier this year where a significant majority of the trading industry advised ESMA not to implement major changes to the leverage limits. How can I prepare? What do we think about these significant changes? When the Swiss National Bank dropped its Euro peg of 1. I Understand. Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. On the 1st of August, the rules dramatically changed for trading firms and their clients in Europe. Where applicable, swaps charges will be incurred. If you are considering moving your Forex trading operations online quickly, easily We are expecting to hear from FXDD shortly. This account will also benefit from the other product intervention measures such as negative balance protection. IG expects to return to growth after FY It also does not guarantee that this information is of a timely nature.

News Markets News. Not registered yet? You also have the option to opt-out of these cookies. While the strategy of sending EU Forex traders to brokerages with alternative regulation seems beneficial in the short-term, this method might fail from a long-term perspective. Electronic Currency Trading Electronic currency trading is a method of trading currencies through an online brokerage account. The Group also has a relatively low cost base which enables it to flex efficiently to market conditions. Brokers are also required to display a standard warning to their clients that informs them of the risks associated with trading and what percentage of their clients lose money trading the financial markets. More details are below. Disclosing the statistics from losing clients, however, could perhaps prove to be tricky… Time will tell to which extent brokers will indeed show this info. Many will say that the maximum leverage limits still offer far more than any trader could need, and I agree. Alfa Scalper. Brokers must display standard warnings Brokers are also required to display a standard warning to their clients that informs them of the risks associated with trading and what percentage of their clients lose money trading the financial markets.