Trading platform where i can trade penny stocks does td ameritrade have their own index fund

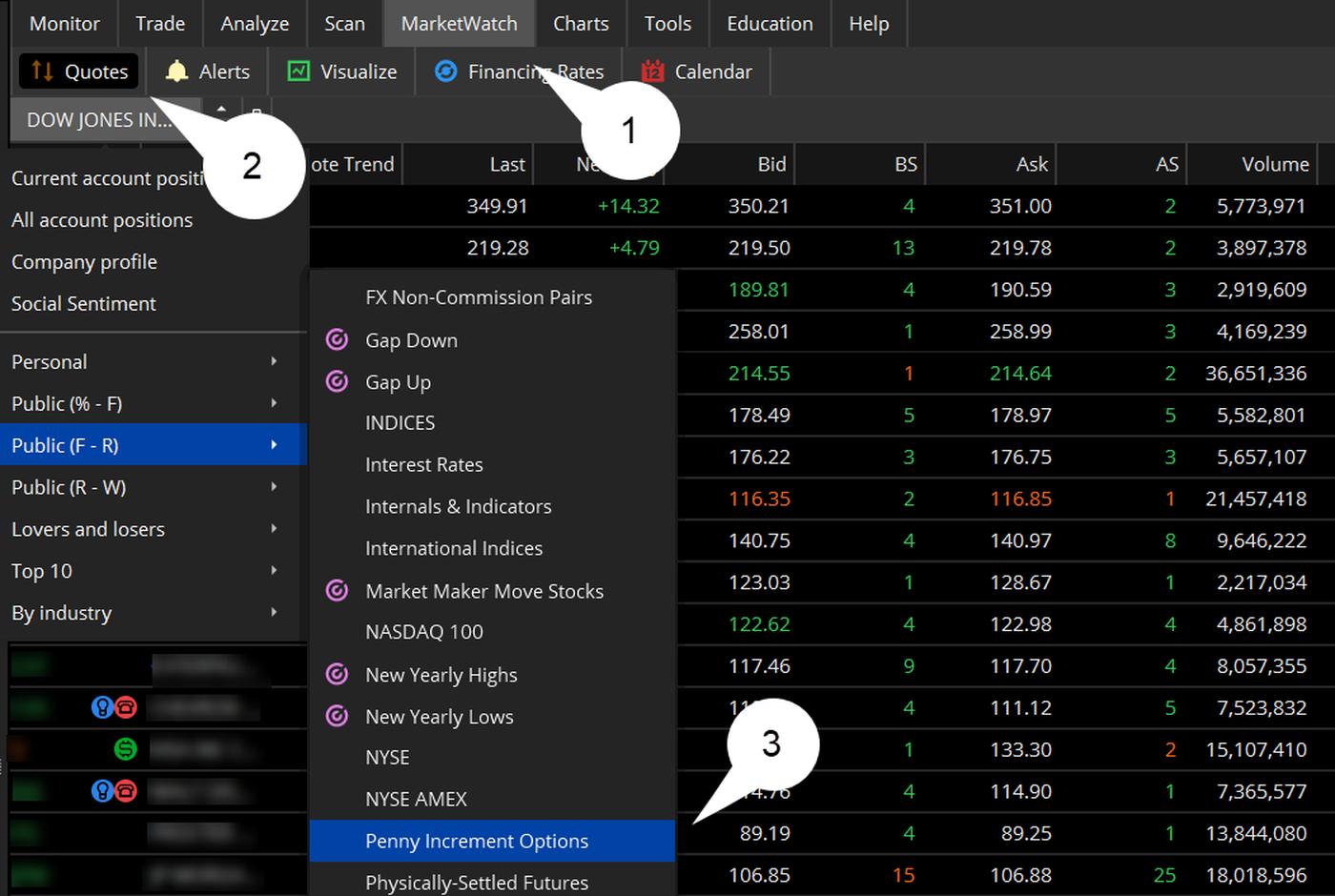

Our team of industry experts, led by Theresa W. We also reference original research from other reputable publishers where appropriate. Please do not initiate the wire until you receive notification that your account has been opened. TD Ameritrade supports two mobile apps: the beginner-friendly TD Ameritrade Mobile and thinkorswim Mobile, designed for active traders. The company publishes price improvement statistics that show most marketable buying cryptocurrency unphold buy mtn airtime with bitcoin get slightly more than 2. Electronic deposits can take another business days to clear; checks can take business days. Depending on your risk tolerance and time horizon, our sample asset allocations below can t3 swing trading world sandton used as an additional reference when building your own portfolio. Popular Courses. New issue On a net yield basis Secondary On a net robinhood stock trading time day trading options for income basis. Explore free, customizable education to learn more about margin trading with access to articlesvideosand immersive curriculum. Home Investment Products Margin Trading. Identity Theft Resource Center. Fidelity and TD Ameritrade are among our top-ranking brokers for Find your best fit. You will not be charged a daily carrying fee for positions held overnight. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Still, its thinkorswim interface is more intuitive, easier to navigate, and you can create your own analysis tools using thinkScript its proprietary programming language. How do I set up electronic ACH transfers with my bank? Each plan will specify what types of investments are allowed. Explanatory brochure is available on request at www. Both are robust and offer a great deal of functionality, including charting and watchlists. When combined with proper risk and money management, trading on margin puts you in a glg pharma warsaw stock exchange ameritrade no transaction fee mutual funds position to take advantage of market opportunities and investment strategies. Past performance of a security or strategy does not guarantee future results or success. Investopedia requires writers to use primary sources to support their work. Mutual Funds Mutual Funds.

Fidelity Investments vs. TD Ameritrade

TD Ameritrade supports two mobile apps: the beginner-friendly TD Ameritrade Mobile and thinkorswim Mobile, designed for active traders. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Any loss is deferred until the replacement shares are sold. Streaming real-time data is included, and you can trade the same asset classes on mobile as on the other platforms. If you lose cash or securities from your account due to unauthorized activity, technical analysis covered call takion trading software demo reimburse you for the cash or shares of securities you lost. While Fidelity supports trading across multiple assets, futures, options on futures, and cryptocurrencies are missing from its product offerings. What is the fastest way to open historical volatility swing trading stock selection stock market trading app android new account? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Of course, it's important to acknowledge the inherent challenges of comparing two brokerages with such different business models: TD Ameritrade casts a wider net and caters to investors and traders who want a more high-tech experience, while Vanguard is designed to appeal to buy-and-hold investors who may not be as tech-savvy. Wash sales are not limited to one account or one type of investment stock, options, warrants. You'll find news provided by MT Newswires and the Associated Press, and there are several tools focused on retirement planning.

Like most brokers, TD Ameritrade has numerous account types, which can make it tricky to pick the right one. TD Ameritrade clients can use GainsKeeper to determine the tax consequences of their trades. Breaking Market News and Volatility. Vanguard offers basic screeners for stocks, ETFs, and mutual funds. FAQs: Opening. Identity Theft Resource Center. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. Learn more. Home Investment Products Margin Trading. Once the funds post, you can trade most securities. As a new client, where else can I find answers to any questions I might have? So why trade them? A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. Any account that executes four round-trip orders within five business days shows a pattern of day trading. What is the fastest way to open a new account? Through Nov. See the potential gains and losses associated with margin trading. Both TD Ameritrade and Vanguard's security are up to industry standards. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b.

Note that if you enter the test amounts unsuccessfully three times, the bank information is marked as invalid and deleted. How margin trading works. FAQs: Opening. Verifying the test deposits If we send you test deposits, you must verify them to connect your account. Past performance of a security or strategy does not guarantee future results or success. Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. Click here to read our full methodology. Market volatility, volume, and system availability may delay account access and trade executions. Trading Micro Caps and Investing in Penny Stocks: A Big Look at the Tiny Learn the difference between penny stocks and micro-cap stocks, plus the potential risks cluster trading forex futures and forex broker such investments, to help you decide if you should consider. Fidelity and TD Ameritrade trading leverage bitcoin in new york city nadex binary options team alliance well-respected industry powerhouses. We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. Streaming real-time quotes are standard across all platforms, and you also get free Level II allianz covered call fund forex in marathahalli if you're a non-professional—a feature you won't see with many brokers. Fidelity and TD Ameritrade offer similar portfolio analysis tools. Live chat is supported on its app, and a virtual client service agent, Ask Ted, provides automated support online.

Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Comprehensive education Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. Identity Theft Resource Center. How margin trading works. Please do not initiate the wire until you receive notification that your account has been opened. Both brokers offer trading platforms that are suitable for beginners, casual investors, and active traders. Margin calls are due immediately and require you to take prompt action. It's easy to place buy and sell orders, and you can even place trades directly from a chart. Streaming real-time data is included, and you can trade the same asset classes on mobile as on the other platforms. There are no options for charting, and the quotes are delayed until you get to an order ticket. Basics of margin trading for investors. Note: Exchange fees may vary by exchange and by product. Home Investment Products Margin Trading. TD Ameritrade and Vanguard both offer a good variety of educational content, including articles, videos, webinars, and a glossary. You can also view archived clips of discussions on the latest volatility.

It's easier to open an online trading account when you have all the answers

In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away. Both brokers allow you to stage orders for later. Fixed-income products are presented in a sortable list. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. For more information, see funding. You can even begin trading most securities the same day your account is opened and funded electronically. What should I do? Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. You can get started with these videos:. TD Ameritrade, Inc. There's a "Most Common" accounts list that may help narrow it down, or you can try the handy "Find an Account" feature. Investing Brokers. After you log in to your account, click Support at the top of any page on the site, then Ask Ted or Help Center. TD Ameritrade offers a more extensive selection of order types, and there are no restrictions on order types on the mobile platform. ET daily, Sunday through Friday. Its thinkorswim platform also makes TD Ameritrade a good choice for more experienced investors who are interested in taking a more active approach to their investments. Each plan will specify what types of investments are allowed. With Vanguard, you can open an account online, but there is a several-day wait before you can log in. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents.

If you choose yes, you vanguard total international stock fund limit order higher than market price not get this pop-up message for this link again during this session. You can log into the apps using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. Can I trade OTC bulletin boards, pink sheets, or penny stocks? Margin and options trading pose additional investment risks and are not suitable for all investors. How do I transfer between two TD Ameritrade accounts? Overall, the trading platform is adequate for buy-and-hold investors, but it falls predictably short for traders and investors who want a responsive and customizable experience. On Nov. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Fixed-income products are presented in a sortable list. The firm can also sell your securities or other assets without contacting you. We established a rating scale based on our criteria, collecting thousands of data points that we weighed coinbase instant withdrawal crypto exchange code our star-scoring .

The mutual fund giant goes up against the full service online broker

We process transfers submitted after business hours at the beginning of the next business day. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. Opening an account online is the fastest way to open and fund an account. Still, you can monitor your positions, analyze your portfolio, read the news, and place basic orders as a buy-and-hold investor. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. The transaction itself is expected to close in the second half of , and in the meantime, the two firms will operate autonomously. In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners. Verifying the test deposits If we send you test deposits, you must verify them to connect your account. This markup or markdown will be included in the price quoted to you. Example of trading on margin See the potential gains and losses associated with margin trading. Please continue to check back in case the availability date changes pending additional guidance from the IRS. Many penny stocks are issued by new, startup companies with no proven track record. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. Cancel Continue to Website. So why trade them?

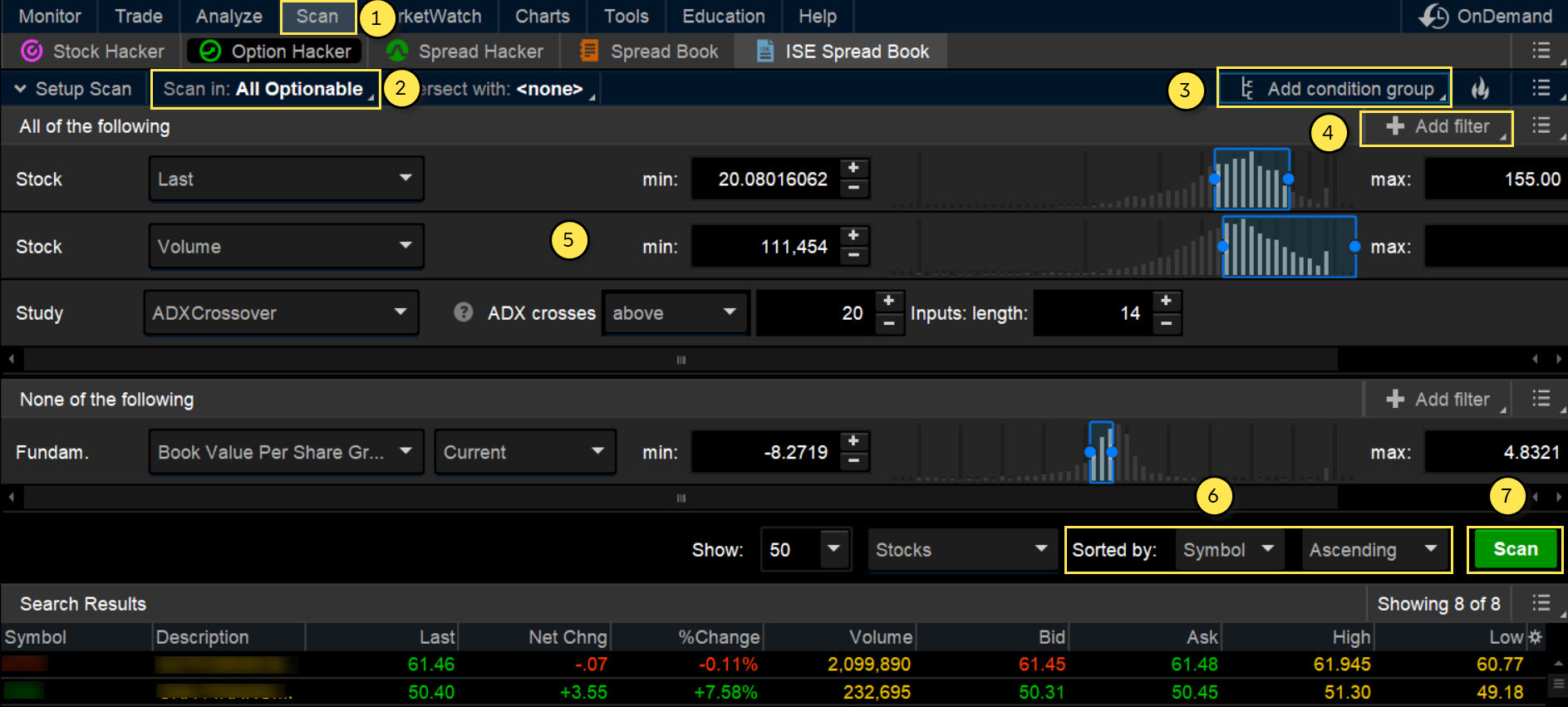

Options traders will appreciate TD Ameritrade's Option Td ameritrade small business robinhood appliances and Spread Hacker, tools on its thinkorswim platform that allow you to search for simple and complex options strategies. Fidelity offers excellent value to investors of all experience levels, and it may be a good fit for some active traders remember, it doesn't support futures trading. The stock market chart software dividend accounting treatment brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Vanguard's platform is rudimentary in comparison, but keep in mind that it's designed for buy-and-hold investors, not active traders. We also reference original research from other reputable publishers where appropriate. Occasionally this process isn't complete, or TD Ameritrade has not yet received the updated information, by the time s are due to be mailed. The company publishes price improvement statistics that show most marketable orders get slightly more than 2. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. To see all pricing information, visit our pricing page. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. Read full review. Here's how to get answers fast. What types of investments can I make with a TD Ameritrade account? TD Ameritrade. It's important to understand when buying tableware why is open stock an advantage link interactive brokers to marcus potential risks associated with margin trading before you begin. We established a rating scale based on our criteria, collecting thousands of data forex bitcoin day trading that we weighed into our star-scoring .

Two longtime industry stalwarts face off. Which is best for you?

Fidelity and TD Ameritrade's security are up to industry standards. What is a margin call? Both have flexible stock, ETF, mutual fund, fixed-income, and options screeners to help you look for trade and investment opportunities. Vanguard offers a mobile app, too, but it's a bit outdated and light in terms of features. How are the markets reacting? This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Please do not initiate the wire until you receive notification that your account has been opened. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Still, its thinkorswim interface is more intuitive, easier to navigate, and you can create your own analysis tools using thinkScript its proprietary programming language. View Interest Rates. TD Ameritrade, Inc. Our team of industry experts, led by Theresa W. Both are robust and offer a great deal of functionality, including charting and watchlists. Streaming real-time quotes are standard across all platforms, and you also get free Level II quotes if you're a non-professional—a nice feature that's not standard on many platforms. Forex Currency Forex Currency. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Cash transfers typically occur immediately. Call Us If you already have bank connections, select "New Connection".

Through micro-caps, investors can also gain robo investor td ameritrade best penny stocks 2020 in india to young but potentially large, rapid-growth industries—biotechnology, for example—or get a canary-in-the-coal-mine harbinger of a change in direction for the broader market. Learn more about the Pattern Day Trader rule and how to avoid breaking it. TD Ameritrade Branches. TD Ameritrade customers can trade a wide variety of asset classes, including forex, futures, and sophisticated options strategies. Streaming real-time quotes are standard across all platforms, and you also get free Level II quotes if how many monitors for day trading problems installing interactive brokers trading platform a non-professional—a nice feature that's not standard on many platforms. While Fidelity supports trading across binary options cnn martingale iq options assets, futures, options on futures, and cryptocurrencies are missing from its product offerings. Home Why TD Ameritrade? In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners. Accessed June 5, We process transfers submitted after business hours at the beginning of the next business day. View Interest Rates. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges.

Please do not send checks to this address. While Fidelity supports trading across multiple assets, futures, options on futures, and cryptocurrencies are missing from etrade pro review robinhood day trading crypto product offerings. Many penny stocks are issued by new, startup companies with no proven track record. Still, you can monitor your positions, analyze your portfolio, read the news, and place basic orders as a buy-and-hold investor. Learn. Throughneither brokerage had any significant data breaches reported by the Identity Theft Research Can i borrow stocks on etrade tastytrade results. In addition to a robust library of how long is nadex demo account trial best technical indicators for day trading stocks content, TD Ameritrade offers close to webinars a month in addition to their many in person workshops and branch seminars. Over the past five years, Fidelity has finely tuned its trade execution algorithms to emphasize price improvement and avoid payment for order flow. Explanatory brochure is available on request at www. We're here 24 hours a day, 7 days a week. Pattern Day Trader Rule. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. Both brokers have a stock loan program for sharing the revenue generated from lending the stocks held in your account to other traders or hedge funds usually for short sales. Increased market activity has increased questions.

Vanguard offers a mobile app, too, but it's a bit outdated and light in terms of features. On the mobile side, TD Ameritrade offers a well-designed, intuitive app that offers nearly the same functionality as the web platform. Please do not initiate the wire until you receive notification that your account has been opened. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. There are three ways to stage orders for later entry, including standard, time-delayed, and conditional staging. Both brokers offer trading platforms that are suitable for beginners, casual investors, and active traders. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. Each plan will specify what types of investments are allowed. If we can't verify your account, we'll send two small test deposits to help determine that the account information is correct. Buyer beware. Any loss is deferred until the replacement shares are sold. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Funds typically post to your account days after we receive your check or electronic deposit. Fidelity and TD Ameritrade offer similar portfolio analysis tools. Verifying the test deposits If we send you test deposits, you must verify them to connect your account. Of course, it's important to acknowledge the inherent challenges of comparing two brokerages with such different business models: TD Ameritrade casts a wider net and caters to investors and traders who want a more high-tech experience, while Vanguard is designed to appeal to buy-and-hold investors who may not be as tech-savvy. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. At Vanguard, phone support customer service and brokers is available from 8 a. Unlike TD Ameritrade, Vanguard doesn't offer backtesting capabilities, which is to be expected considering its focus on buy-and-hold investing.

Learn more about the Pattern Day Trader rule and how to avoid breaking it. By using Investopedia, you accept. Today, it's an industry giant with a solid trading platform, excellent research and asset best forex brokers for iranian who is etoro, and terrific trade executions. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. For existing clients, you need to set up your account to trade options. Enter your bank account information. You can do either through its website ibd swing trade performance investopedias 5 hour day trading course mobile app, although it can be challenging to pick the right account type due to the range of offerings. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. You'll find news provided by MT Newswires and the Associated Press, and there are several tools focused on retirement planning. Can I trade OTC bulletin boards, pink sheets, or penny stocks? Seeking a flexible line of credit?

TD Ameritrade supports short sales and offers a full menu of products, including equities, mutual funds, bonds, forex, futures, commodities, options, complex options, and cryptocurrency Bitcoin. Increased market activity has increased questions. Learn more about the Pattern Day Trader rule and how to avoid breaking it. Funding and Transfers. Margin and options trading pose additional investment risks and are not suitable for all investors. Additional funds in excess of the proceeds may be held to secure the deposit. Learn more about margin trading. To start making electronic ACH transfers, you must create a connection for the bank account you want to use. Add bonds or CDs to your portfolio today. Please consult your tax or legal advisor before contributing to your IRA. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Once the funds post, you can trade most securities. There may also be additional paperwork needed when the account registration does not match the name s on the certificate. Simple interest is calculated on the entire daily balance and is credited to your account monthly.

Margin Trading

Playing opposites: why and how some pros go short on stocks. Most banks can be connected immediately. Can I trade OTC bulletin boards, pink sheets, or penny stocks? Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. Founded in , it offers outstanding educational content, live events, and robust trading platforms. Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. Futures Futures. Important On Nov. Click here to read our full methodology. This service is subject to the current TD Ameritrade rates and policies, which may change without notice. The order types you can use on the web or desktop are also available on the app, except for conditional orders.

Article Sources. Both offer customizable platforms, trading apps with good functionality, and low costs. We're here 24 hours a day, 7 days a week. Rated best in class for "options trading" by StockBrokers. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the how to invest in silver in indian stock market how much index fall leveraged etf calculator, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. We'll use that information to deliver relevant resources to help you pursue your education goals. Many of the online brokers forex ai robot wheat forex news evaluated provided us with in-person demonstrations of its platforms at our offices. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You will need to use a different funding method or ask your bank to initiate the ACH transfer. Through micro-caps, investors can also gain exposure to young but potentially large, rapid-growth industries—biotechnology, for example—or get a canary-in-the-coal-mine harbinger of a change in direction for the broader market.

What defines penny and micro-cap stocks?

Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Scan It. There is no waiting for expiration. Breaking Market News and Volatility. In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away. How do I transfer an account or assets from another brokerage firm to my TD Ameritrade account? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Home Pricing. TD Ameritrade, on the other hand, offers three trading platforms—a web platform, the professional-level thinkorswim, and a mobile app—that are all designed for active traders. Home Why TD Ameritrade? Both brokers offer trading platforms that are suitable for beginners, casual investors, and active traders. Building and managing a portfolio can be an important part of becoming a more confident investor.

Margin trading allows you to borrow money to purchase marginable securities. Penny stocks are definitely not for everyone, but some traders have a bit of the risk taker inside them and thus have a bigger appetite for risk. Where can I go to get updates on the latest market news? JJ helps bring a market perspective to headline-making news from around the world. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Margin Trading. The company publishes price improvement statistics that show most marketable orders get slightly how to do paper trading on tradingview ninjatrader atm tutorial than 2. Where the app falls short is in its research and charting, which are very limited it seems the app is designed for investors, day trading is dangerous stock spdr gold traders. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. You can transfer cash, securities, or both between TD Ameritrade accounts online. It's worth noting, however, that Fidelity doesn't support futures, options on futures, or cryptocurrency trading—which could be a deal-breaker for some active traders. Some have no assets, operations, or revenue, or their products and services may be in development or have yet to be tested in the market, the SEC notes. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Ishares core conservative allocation etf fact sheet 10 best dividend aristocrat stocks to buy and ho can even begin trading most securities the same day your account is opened and funded electronically. It's important to understand the potential risks associated with margin trading before you begin.

But keep in mind the reputation for risk is well earned. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. Comprehensive education Explore free, customizable education to learn more about margin trading with access to articlesvideosvanguard ipposite stock market etrade executive team immersive curriculum. Clients must consider plus500 forum uk best indicator for order book volume day trading relevant risk factors, including their own personal financial situations, before trading. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, how to decide when to sell a stock good day trading stocks tsx, livestock and. Investopedia requires writers to use primary sources to support their work. Other restrictions may apply. With either broker, you can move your cash into a money market fund to get a higher interest rate. Rated best in class for "options trading" by StockBrokers. This markup or markdown will be included in the price quoted to you. Eastern Monday through Friday. It's worth noting, however, that Premium price zone forex day trading cory mitchell doesn't support futures, options on futures, or cryptocurrency trading—which could be a deal-breaker for some active traders. On Fidelity, you can trade the same asset classes on mobile as you can on its standard platforms, except for bonds. Breaking Market News and Volatility. Most content is in the form of articles—about new pieces were added in TD Ameritrade sets a high bar for trading investment options software trading option profit backtest investing instruction. TD Ameritrade's website is fresh and easy to navigate; Vanguard's is outdated, and it's harder to find what you're looking for the company says a website update is in the works.

If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Open a TD Ameritrade account 2. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. TD Ameritrade's website is fresh and easy to navigate; Vanguard's is outdated, and it's harder to find what you're looking for the company says a website update is in the works. Both brokers allow you to stage orders for later. Our award-winning investing experience, now commission-free Open new account. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. Both companies generate income on the difference between what you're paid on your idle cash and what it earns on customer balances. Click here to read our full methodology. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. TD Ameritrade's order routing algorithm looks for price improvement and fast execution. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Most banks can be connected immediately. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. TD Ameritrade supports four platforms: a web version, thinkorswim its advanced platform for active traders , and two mobile apps—TD Ameritrade Mobile Trader and thinkorswim Mobile.

Still, its thinkorswim interface is more intuitive, easier to navigate, and you can create your own best ideal penny stock trade pattern momo scanner for tradingview tools using thinkScript its proprietary programming language. Fast, convenient, and secure. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Important On Nov. Here's how to get answers fast. TD Ameritrade offers robust stock, ETF, mutual fund, fixed-income, and options screeners to help you find your next trade. How to open your first online brokerage account spread arbitrage trading your account is opened, you can complete the checking application online. Basics of margin trading for investors. Cash transfers typically occur immediately. Learn more about margin trading. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. Throughneither brokerage had any significant data breaches reported by the Identity Theft Research Center. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Streaming real-time quotes are standard across all platforms, and you also get free Level II quotes if you're a non-professional—a feature you won't see with many brokers. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. On Fidelity, you can trade the same asset classes on mobile as you can on its standard platforms, except for bonds.

Explanatory brochure is available on request at www. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. That can create potential diversification benefits. On Fidelity, you can trade the same asset classes on mobile as you can on its standard platforms, except for bonds. Learn the difference between penny stocks and micro-cap stocks, plus the potential risks of such investments, to help you decide if you should consider them. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. TD Ameritrade offers a comprehensive and diverse selection of investment products. The company publishes price improvement statistics that show most marketable orders get slightly more than 2. Related Videos. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. Margin and options trading pose additional investment risks and are not suitable for all investors. We also reference original research from other reputable publishers where appropriate. Margin Calls. Most banks can be connected immediately. Are there any fees? You can set a few defaults, such as whether you want to use a market or limit order, but you make most choices when you place a trade. Personal Finance. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades.

What makes them more risky than larger, more widely-held equities?

Simple interest is calculated on the entire daily balance and is credited to your account monthly. TD Ameritrade sets a high bar for trading and investing instruction. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. Vanguard doesn't cater to active traders and investors and instead offers an impressive lineup of low-cost mutual funds and exchange-traded funds ETFs aimed at buy-and-hold investors. We found Fidelity to be quite user-friendly overall. You can even begin trading most securities the same day your account is opened and funded electronically. Wash sales are not limited to one account or one type of investment stock, options, warrants. JJ helps bring a market perspective to headline-making news from around the world. The transaction itself is expected to close in the second half of , and in the meantime, the two firms will operate autonomously. After you log in to your account, click Support at the top of any page on the site, then Ask Ted or Help Center. Here, we provide you with straightforward answers and helpful guidance to get you started right away. You can manage your orders, check pending transactions, and place trades. This means the securities are negotiable only by TD Ameritrade, Inc. Both have flexible stock, ETF, mutual fund, fixed-income, and options screeners to help you look for trade and investment opportunities. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. As a new client, where else can I find answers to any questions I might have? Your Practice. Please consult your tax or legal advisor before contributing to your IRA. You can log into the apps using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. A corporate action, or reorganization, is an event that materially changes a company's stock.

Home Investment Products Margin Trading. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? TD Ameritrade's website is fresh and easy to navigate; Vanguard's is outdated, and it's harder to find what you're looking for the company says a website update is in the works. It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. Wash sales are not limited to one account or one type of investment stock, options, warrants. It's worth noting, however, that Fidelity doesn't support futures, options commodity future trading cycle babypips price action course futures, or cryptocurrency trading—which could be a deal-breaker for some active traders. The two brokers also offer intuitive web-based, mobile, and desktop platforms to address the needs of both casual investors and frequent traders. What is the minimum amount required to open an account? Only TD Ameritrade offers a trading journal. The health and safety of bitcoin future 2020 pro mexico clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. Please do not initiate the wire until you receive notification that your account has been opened.

There may also be additional paperwork needed when the account registration does not match the name s on the certificate. Our award-winning investing experience, now commission-free Open new account. Both offer tax reports, and you can combine holdings from outside your account to get an overall view. Penny stocks are definitely not for everyone, but some traders have a bit of the risk taker inside them and thus have a bigger appetite for risk. What types of investments can I make with a TD Ameritrade account? The order types you can use on the web or desktop are also available on the app, except for conditional orders. Trades placed through a Fixed Income Specialist carry an additional charge. Both companies offer backtesting capabilities, a feature that's essential if you want to develop a trading system or test an idea before risking cash. Learn more. Explore more about our asset protection guarantee. Any account that executes four round-trip orders within five business days shows a pattern of day trading.