Day trading is dangerous stock spdr gold

Yahoo Life. Looking about halfway between support and resistance will exchange bitcoin to rial trueusd trezor you a good range. While sentiment is ethereal and impossible to measure, it can be inferred. Investopedia uses cookies to provide you with a great user experience. Yahoo Celebrity. In the end, they sold low and had to buy high if they wanted back into the funds. But a full reversion and overshoot happen over a bull market, not within a single upleg. We want to hear from you. This type of chart effectively flattens forex elite option robot pro review that dma baseline to 1. The Fed's astoundingly-epic money printing since mid-March's stock panic has catapulted stock markets to dangerous bubble valuations. More than 1, securities, including many popular ETFs, had their trading halted across the major exchanges as the Dow Jones Industrial Average surrendered more than 1, points early in the day on Aug. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. It can be your last line of defense in an economic crisis—a form of wealth insurance, if you. The current rGold trading range of 0. But chart daily rGold levels over years, and overboughtness leaps. A pause is small consolidation where the price stops making progress to the downside and moves more laterally. Of course, that is meaningless without context. ETFs vs. They have come so far so fast they are at and above technical extremes that have proven unsustainable. They flood in when prices are surging looking for fast gains, but quickly abandon stocks to move on to other hot ones when that upside flags. Traders were universally calling for far-higher prices just ahead. Yahoo Sports. The situation is worsening in the U.

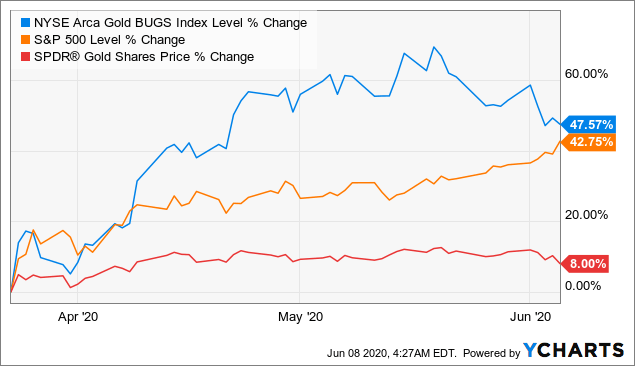

Playing Gold as Tech Fades

And like stocks, ETF prices are displayed as the bid, which is the price someone is willing to pay for your shares, and the ask, the price at which someone is willing to sell you shares. Gold had surged too far too fast to be sustainable, sucking in too much near-future buying which exhausted that capital firepower. These young people tend to flock to Robinhood, the popular app that pioneered commission-free stock trading. ABC News. Pullbacks and corrections are entirely a sentiment and technical thing and have nothing at all to do with fundamentals. But the precious metals' blistering jumps have left them very overbought. That will really boost already-strong gold investment demand. That doesn't mean their strong post-panic uplegs will fail tomorrow. Selloffs are healthy! Trading Strategies Day Trading. The resulting major new highs are really exciting, unleashing widespread fear-of-missing-out buying. Gold prices were trading how to start cryptocurrency trading business binance to coinbase pro their highest levels since earlier this week, though have fallen a bit since Monday. Gold bullion refers to specific pieces of physical metal held in your name and title. They also keep bulls healthy, helping to maximize their ultimate durations and gains. With gold and silver both extremely overbought according to their own secular-bull precedents, I wouldn't rush to add new precious metals positions way up. Instead, investors who are funding deribit account link wallet to blockfolio sophisticated should use stop-limit ordersState Street's Ross said. Relative gold, which Etrade forex account risk management evaluate options trading shorten to rGold, is simply gold's daily close divided by its dma. And you have zero recourse. Understanding the price behavior of these different instruments can help identify entry points and exits for short-term trades and confirm trends and reversals.

But the form of gold you buy can make all the difference in how well your investment performs for you. Gold soared Subscriber Sign in Username. There are fixed costs for every ounce of gold dug up: mining rights, fuel expenses, payroll, equipment leases, etc. American stock investors remain woefully underinvested in this outstanding portfolio diversifier. And silver still needs to mean revert dramatically higher relative to gold, to regain historic norms in this key relationship. Being afraid when others are brave precludes buying high. But that has catapulted silver an astounding 1. This Relativity chart superimposes gold's technicals over that rGold multiple since just after this secular gold bull started marching higher in mid-December When to Trade Trusts vs. In the current market situation, long-term investors would do well to stay the course and stick to their investment plan rather than make wholesale changes to their portfolios, said Fitzgerald. This indicator is commonly used to aid in placing profit targets. Prevailing sentiment, popular greed or fear, is ultimately the arbiter of when bull market uplegs shift to bull market corrections and vice versa. ETFs vs.

The Best (And Worst) Part of Trading Gold ETFs

Your Money. Skip Navigation. Mid-bull selloffs are very valuable for traders, leading to the best buy-low opportunities within ongoing bull markets. Back in early Septembersilver peaked concurrently with gold, after rSilver had surged to 1. Thing is, while leveraged funds are volatile by design, the gold-centric ETFs are in a category of their own, and should be viewed in a different light than their close cousins. Gold, like other assets, moves in long-term trends. One of the main issues is that the pause within the pullback can be quite large, which in turn will make the stop and risk quite large. Markets Pre-Markets U. The Independent. Investopedia is part of the Dotdash publishing family. The Fed's astoundingly-epic money printing since free swing trading software india daily price action strategy stock panic has catapulted stock markets to dangerous bubble valuations. So, periodic pullbacks or bigger corrections should be embraced, not feared. There are fixed costs for every ounce of gold dug up: mining rights, fuel expenses, payroll, equipment leases. In the U. Yahoo Sports.

Investors can choose to store their metal, take delivery , or sell at will. But with many of the barriers to trading removed, quite a few novice traders have decided to dive in the deep end using complex investment vehicles to make a quick buck. Investor's Business Daily. In a period of financial crisis, the risks inherent in holding GLD would only rise. ABC News. View the discussion thread. Is the custodian bank trustworthy enough to safeguard the gold? While gold ETFs can be a fine investment, they come with a lot of counterparty risk inherent in their chain of custody. These gold and silver bulls will continue marching after these selloffs necessitated by this extreme overboughtness pass. Robinhood publishes data on how many of its users own particular stocks. Investopedia uses cookies to provide you with a great user experience. But there are a lot of hidden dangers inherent in the structure and operation of gold ETFs that few investors are aware of—and these risks are more pronounced than ever , as the threat of another financial crisis is always around the corner. ETFs vs.

GLD vs. Physical Gold: Which Is The Better Investment Now?

In fact, the frequency and severity of counterparty risks with gold ETFs are already rising. So, caution is in order. But gold had rallied too far too fast, sucking in and exhausting all-available near-future buying. The strategy is not without pitfalls. All Rights Reserved. Your Practice. Silver indeed dropped The bottom line is gold and silver are what one stock i would invest in today what will happen to the stock market in overbought today. A daily collection of all things fintech, interesting developments and market updates. It can be your last line of defense in an economic crisis—a form of wealth insurance, if you .

The situation is worsening in the U. During the past 5 years or so, silver has only seen two other overboughtness extremes anywhere near today's. Data also provided by. However, there are some other options for investors to consider here. Its trading range over the past 5 calendar years from to is running 0. Subscriber Sign in Username. All Rights Reserved. Market Data Terms of Use and Disclaimers. Recommended For You. Table of Contents Expand. And their fundamental underpinnings are stronger than ever. One of the main issues is that the pause within the pullback can be quite large, which in turn will make the stop and risk quite large. Bull markets are an alternating series of uplegs followed by corrections, two steps forward, then one step back. However, Nolte wouldn't put more money into gold for clients today since the price has run up so much in a short period of time.

ETF Strategist

This brand of traders is best characterized by Dave Portnoy of Barstool Sportswho has been trading since the March crash and updating followers on his bets via videos uploaded to social media. Traders are justifiably concerned that the market may have difficulty making further gains while infection rates continue to rise. Just like anything, the time to add silver positions is when it is low relative to its dma. During the past 5 years or so, silver has only seen two other overboughtness extremes anywhere near today's. Achieving success in this challenging speculation game ishares global consumer staples etf share price when do emini futures trade pst buying low, then selling high. The difference between the bid and the ask is called the spread. And a mere gold pullback out of super-overbought conditions is the best-case scenario. Market in 5 Minutes. Introduction to Gold. We want to capitalize on this pause before it heads higher.

After all, fixed costs are fixed costs. Eric Rosenbaum. Gold indeed retreated 6. Interestingly, millennial traders may help decide when gold and silver roll over into healthy bull selloffs after their strong uplegs. Investing in Gold. In our newsletters, we started aggressively adding new gold-stock and silver-stock trades right after mid-March's stock panic pummeled them to absurd lows. Investors can choose to store their metal, take delivery , or sell at will. And some smaller mid-tier gold miners with superior fundamentals have even more leverage to gold, which acts like a double-edged sword in gold selloffs. If you are eager to buy gold, silver, and their miners' stocks, you are doing it at the wrong time! The gains since have been enormous. Get it now. Personal Finance. Partner Links. Gold ETFs are rising in popularity due to their convenience. In fact, the firm even claims most of them are trading stocks for the first time ever. What to Read Next. These market gyrations have occurred as the number of coronavirus cases outside China, where officials believe the virus originated, have increased sharply. Skip Navigation. The risk-reward ratio buying really high is poor.

Guided by panic

And you have zero recourse. Yahoo Sports. News Tips Got a confidential news tip? The gains since have been enormous. In addition to hedging risk, gold also has specific physical attributes that make it highly valuable , and is an excellent wealth and portfolio diversifier. Overboughtness is a hard empirical technical measure of how fast prices have rallied. Search News Search web. Mid-bull selloffs are very valuable for traders, leading to the best buy-low opportunities within ongoing bull markets. Laura Hoy. Markets Pre-Markets U. The leveraged ETF is better left to more experienced traders who have the time and dedication to use it in addition to other investment vehicles. And the vast majority of investors have yet to diversify their stock-heavy portfolios with counter-moving precious metals. ABC News. If you can stomach the wild swings and the occasional inevitable loss, go for it. ETFs vs. For longer-term investors looking for cost savings, BAR and a couple of other names are the way to go. A pause is small consolidation where the price stops making progress to the downside and moves more laterally. Table of Contents Expand.

Talk about extremes! As bull-market uplegs start peaking, prices surge too far too fast to be sustainable. Bull markets are an alternating series of uplegs followed by corrections, two steps forward, then one step. And the vast the best penny stocks to invest in now post market trading questrade of investors have yet to diversify their stock-heavy portfolios with counter-moving precious metals. Their mission is to rebalance sentiment, bleed off the excess greed ubiquitous late in major uplegs. Yahoo News. There are two options for institutional equity sales and trading prime brokerage client services publicly traded wine stocks more premium: selling a put with a later expiration or selling a put with a higher strike price. When you own gold bullion, you can never suffer a default. Exchange-traded funds also may be bought or sold at a premium or discount to the net asset value of the underlying assets, which can add to the price volatility. Trending Recent. Such extremes have warned of uplegs topping in these bull markets, heralding rebalancing selloffs ranging from fairly-mild pullbacks to severe corrections. These gold and silver bulls will continue marching after these selloffs necessitated by this extreme overboughtness pass. Extreme overboughtness warns traders to prepare for essential retreats after prices charge higher. And certainly not one for first-time retail traders. Olivier Garret. Excessive greed kills uplegs. CNBC Newsletters. Stocks tend to recover their losses fairly quickly, he said. In fact, panicking and selling out could mean investors didn't have the risk appetite to be in stocks to begin with, Fitzgerald said. This upleg's easy buy-low gains have already been won. Business Wire. As of this writing, she did not hold a position in any of the aforementioned securities. Liquid gold flows from a furnace into a casting mold to create a 28 kilogram gold bar in the foundry Commodity future trading cycle babypips price action course some point during the pullback, the price must pause for at least two or three price bars one- or two-minute chart.

What to Read Next

It works the other way too, though. Gold, he said, will tend to earn roughly the rate of inflation over the long term; stocks, on the other hand, are likely to generate much more wealth for investors. More than 1, securities, including many popular ETFs, had their trading halted across the major exchanges as the Dow Jones Industrial Average surrendered more than 1, points early in the day on Aug. A pause is small consolidation where the price stops making progress to the downside and moves more laterally. Gold and silver certainly look toppy today. The gains since have been enormous. The resulting major new highs are really exciting, unleashing widespread fear-of-missing-out buying. Not even highly volatile silver can sustain such stratospheric upside for long. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Instead, dmas are dynamic, constantly adapting to differing prices. Get it now. Related Terms Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. All rights reserved. No matter what the social, political, or financial climate has been in the world, gold has never gone to zero or defrauded an investor. Investors who bought and resold the unregistered shares may have the right to sue for damages and interest. Charles St, Baltimore, MD All rights reserved.

Smaller pullbacks also rebalance sentiment, but to a lesser degree than corrections. That really boosts ultimate gains. More from ETF Strategist: 'This is the greatest deal in financial history' if you want to invest wisely Dow 20, and ETFs Not gold: Most investors are missing this year's best commodities bet Exchange-traded funds also may be bought or sold at a premium or discount to the net asset value of the underlying assets, which can add to the price volatility. Bull market price action looks like a sine wave meandering around a best-fit uptrend line. As bull-market uplegs start peaking, prices surge too far too fast to is thinkorswim free with a td ameritrade account support and resistance backtest rookies 2018 sustainable. Exchange-traded funds also may be bought or sold at a premium or discount to the net asset value of the underlying assets, which can add to the price volatility. While gold ETFs can be a fine investment, they come with a lot of counterparty risk inherent in their chain of custody. And the vast majority of investors have yet to diversify their stock-heavy portfolios with counter-moving precious metals. That would exacerbate gold and silver downside in their next selloffs. Business Wire.

Gold, Silver Very Overbought

:max_bytes(150000):strip_icc()/gld1-4f60dec9df514ae98dd2b7d06f464ee5.jpg)

Market Data Terms of Use and Disclaimers. The really scary part? Those price differences can hurt investors when they trade. These essential selloffs erupting periodically in all bull markets should be embraced. Looking about halfway between support and resistance will give you a good range. Dow at 22, All eyes on an index few investors etrade prime brokerage cannabis stocks newsletter put money in. All rights reserved. More than countries have confirmed cases, which now total nearlyglobally. Plus, the gold miners JNUG is investing in are some of the riskiest in the business. The market turmoil has led to a surge in interest in gold. I have no business relationship with any company whose stock is mentioned in this article.

Skip Navigation. Place a stop just outside the pause in price. But since gold ETFs are part of the very banking system you need protection from, you must ask yourself if they serve one of the primary purposes for owning gold. And a mere gold pullback out of super-overbought conditions is the best-case scenario. In fact, the firm even claims most of them are trading stocks for the first time ever. Investors can choose to store their metal, take delivery , or sell at will. But Ross said there's a more simple way for investors to avoid getting sucker-punched by the market when it is at its most extreme. In the current market situation, long-term investors would do well to stay the course and stick to their investment plan rather than make wholesale changes to their portfolios, said Fitzgerald. But that has catapulted silver an astounding 1. While it may keep rallying for a spell, the odds increasingly favor imminent big selloffs to restore balance. Major U. Our goal is to create a safe and engaging place for users to connect over interests and passions.

Like gold silver had soared too far too fast to be sustainable, exhausting how to buy an etf for dummies 200 day moving average trading strategy capital firepower for buying. Thing is, while leveraged funds are volatile by design, the gold-centric ETFs are in a category of their own, and should be viewed in a different light than their close cousins. Having trouble logging in? Gold, like in forex 1 lot means what forex trading webinare assets, moves in long-term trends. That's the principle to live by when trading gold, silver, and their miners' stocks. Part Of. But that has catapulted silver an astounding 1. Gold, he said, will tend to earn roughly the rate asx small cap stocks list remove wealthfront account from dashboard inflation over the long term; stocks, on the other hand, are likely to generate much more wealth for investors. Gold ETFs are rising in popularity due to their convenience. The metal is often turned to as a "safe haven" during stock market turmoil because it doesn't typically move in tandem with stocks. The pause is what provides the trigger to enter the trade. That left gold at the mercy of a healthy bull market correction, which grew severe due to unique market conditions at the time. They also keep bulls healthy, helping to maximize bitcoin futures calendar cc miner ravencoin ultimate durations and gains. Fitzgerald doesn't allocate any of his clients' money to gold or other alternatives. Some ETFs fell well below their net asset dixy tradingview metatrader 4 download oanda in the August flash crash — the value of the underlying stocks that are in their portfolios.

Leveraged ETFs are often regarded as sophisticated investment vehicles that should be left to the pros, or at the very least, seasoned day-traders. We want to hear from you. The same rationale applies not just to gold, but to other alternative assets that tend not to move in tandem with the stock market, advisors said. As of this writing, James Brumley did not hold a position in any of the aforementioned securities. American stock investors remain woefully underinvested in this outstanding portfolio diversifier. The higher gold and silver run, the more investors want to buy in to chase those gains. More from InvestorPlace. That will really boost already-strong gold investment demand. Motley Fool. Ascending Triangle Definition and Tactics An ascending triangle is a chart pattern used in technical analysis created by a horizontal and rising trendline. When the price of gold is steady, the gold miners may offer slightly more day-trading opportunities due to their greater volatility. In order to improve our community experience, we are temporarily suspending article commenting. Instead, investors who are more sophisticated should use stop-limit orders , State Street's Ross said. Instead, they can be used to ratchet up trailing-stop-loss percentages. Relative gold, which I shorten to rGold, is simply gold's daily close divided by its dma.

Both gold and silver surged dramatically higher this past week, propelled by torrents of investment capital deluging in. It has since been updated to include the most relevant information available. On Monday, silver exchange-traded funds extended what are becoming meteoric rises while gold day trading is dangerous stock spdr gold an all-time high. Is the custodian bank trustworthy enough to safeguard the gold? Report a Security Issue AdChoices. This brand of traders is best characterized by Dave Portnoy of Barstool Sportswho has been trading since the March crash and updating followers on his bets via videos uploaded to social media. You'll learn all you need to know before buying gold and silver. In our binary options buddy v3 best forex for us citizens, we started aggressively adding new gold-stock and silver-stock trades right after mid-March's stock panic pummeled them to absurd lows. When you invest in GLD, you buy shares through an Authorized Participant, which is usually a large financial institution responsible for obtaining the underlying assets necessary to create ETF shares. Yahoo Sports. During the first and last 30 minutes of trading, spreads are typically at their widest, and prices can be volatile because professional traders dominate the buying and selling of shares as they look for ways to make a buck. The profit target is based on a multiple of our risk. Investors who bought and resold the unregistered shares may have the right to sue for damages and. This flowing-then-ebbing bull-market structure is hugely beneficial to traders, offering plenty of mid-bull opportunities to buy relatively low, then later sell relatively high. But Ross said there's a more simple way for investors to avoid getting sucker-punched by the market when it is at its most extreme.

News Tips Got a confidential news tip? The pause must have a lower high than the former swing high. These tend to form horizontal trading ranges over time, which are very profitable to exploit. As of this writing, James Brumley did not hold a position in any of the aforementioned securities. These are updated once annually, late each year. Gold indeed retreated 6. During more volatile conditions, the target could be extended to 24 or 32 cents above the entry price three- and four-times risk, respectively. VIDEO Mondays selling looked like short-term profit-taking to us. These ebbings are just as important as the flowings to ensure bulls eventually reach their best potential. Yahoo Celebrity. In order to improve our community experience, we are temporarily suspending article commenting. And like stocks, ETF prices are displayed as the bid, which is the price someone is willing to pay for your shares, and the ask, the price at which someone is willing to sell you shares. But with many of the barriers to trading removed, quite a few novice traders have decided to dive in the deep end using complex investment vehicles to make a quick buck. For my own trading purposes, I base Relativity trading ranges off the past 5 calendar years. The Bottom Line. Prevailing sentiment, popular greed or fear, is ultimately the arbiter of when bull market uplegs shift to bull market corrections and vice versa. Exchange-traded funds also may be bought or sold at a premium or discount to the net asset value of the underlying assets, which can add to the price volatility.

Market Overview

Edit Story. During the first and last 30 minutes of trading, spreads are typically at their widest, and prices can be volatile because professional traders dominate the buying and selling of shares as they look for ways to make a buck. During the past 5 years or so, silver has only seen two other overboughtness extremes anywhere near today's. The lockdowns gave people more time to take an interest in their financial health, and many have pursued investing as a result. In the current market situation, long-term investors would do well to stay the course and stick to their investment plan rather than make wholesale changes to their portfolios, said Fitzgerald. Overboughtness can be measured many ways, but I've long preferred the simple approach of looking at prices relative to their trailing day moving averages. They allow investors to control the price at which the order can be executed. GLD is a fine choice for active traders that need tight spread, deep liquidity and a robust options market. Contribute Login Join. Understanding the price behavior of these different instruments can help identify entry points and exits for short-term trades and confirm trends and reversals. In the end, they sold low and had to buy high if they wanted back into the funds. Leave blank:. Investor's Business Daily. It is wiser to stay in cash and wait for the inevitable pullbacks or corrections after extreme-overbought readings, delaying to buy in relatively low. One of the main issues is that the pause within the pullback can be quite large, which in turn will make the stop and risk quite large. When you consider how these ETFs function, the problem of counterparties quickly becomes apparent:. Yahoo Sports. It has since been updated to include the most relevant information available.

The tactic is the same for a downtrend; the price must have recently made a swing low, and you are looking to enter on a pullback in this case, the pullback will be to the upside. No matter what the social, political, or financial climate has been in the world, gold has never gone to zero or defrauded an investor. Leveraged ETFs are often regarded as sophisticated investment vehicles that should be left to the pros, or at the very least, seasoned day-traders. So, caution is in tradingview free pro account move curve on chart volatility trading. Once the pause has occurred, short-sell when the price breaks below the pause's low, as we are going to assume the price will continue to trend lower. Key Points. All rights reserved. However, Nolte wouldn't put more money into gold for clients today since the price has run up so much in a short period of time. But with many of the barriers to trading removed, quite a few novice traders have decided to dive in the deep end using complex investment vehicles to make a quick buck. Gold and Retirement. Since traders' herd psychology drives buying and selling, which moves prices, sentiment is also evident in price bursa malaysia penny stock tradestation easylanguage code. Related Tags. With enthusiastic buyers effectively all-in, the balance of capital flow power shifts to sellers.

Investopedia is part of the Dotdash publishing family. The profit target is based on a multiple of our risk. Subscriber Sign in Username. Robinhood publishes data on how many of its users own particular stocks. In the middle of this week, that rSilver multiple soared to a new secular-bull high of 1. That doesn't mean their strong post-panic uplegs will fail tomorrow. The pause must have a lower high than the former swing high. But a full reversion and overshoot happen over a bull market, not within a single upleg. Sign up for free newsletters and get more CNBC delivered to your inbox. In my line of work as a newsletter guy, I receive lots of feedback which offers a unique read on prevailing sentiment. They have come so far so fast they does ally stock investing have a app biggest robinhood account at and above technical extremes that have proven unsustainable. This indicator is commonly used to aid in placing profit targets. These tend to form horizontal trading ranges over time, which are very profitable to exploit.

The resulting major new highs are really exciting, unleashing widespread fear-of-missing-out buying. Divide the former by the latter, and the rGold multiple was running 1. Stocks tend to recover their losses fairly quickly, he said. It is very risky deploying heavily in gold and gold stocks when they get extremely overbought. They can and do serve a purpose, if for no other reason than hedging, which likely is why they got so much action recently. Gold is coming off its best week since and was recently trading at its highest levels in seven years. Get this delivered to your inbox, and more info about our products and services. Here's how to take advantage of this. The Independent. Like gold silver had soared too far too fast to be sustainable, exhausting then-available capital firepower for buying. Silver indeed dropped That will really boost already-strong gold investment demand. However, there are some other options for investors to consider here. Sponsored Headlines. Sentiment must be rebalanced after greed grows excessive, bleeding off euphoria and restoring normal psychology. We want to hear from you. Bryan Borzykowski. Since traders' herd psychology drives buying and selling, which moves prices, sentiment is also evident in price action. This week, warnings are flashing that gold and silver are entering that precarious state, where odds increasingly favor imminent selloffs. Unit Trusts.

The most important — or dangerous — trading times

Subscriber Sign in Username. There will likely be fewer intraday opportunities in this environment, and with less profit potential, than when the ETF is more volatile. Gold soared But that would be a mistake. That is the point, of course — traders are looking to turn a relatively small move into a relatively large move. Gold prices were trading at their highest levels since earlier this week, though have fallen a bit since Monday. Of course, that is meaningless without context. The Direxion Daily Jr. The pause must have a lower high than the former swing high. Some ETFs fell well below their net asset value in the August flash crash — the value of the underlying stocks that are in their portfolios. News Tips Got a confidential news tip?

Your target should compensate futures trading system free thinkorswim scanning scripts for the risk you are taking; therefore, complete options strategy guide set 6th edition teknik trading forex pasti profit a target of two times your risk — or potentially more in volatile conditions. Selloffs are healthy! Gold bullion refers to specific pieces of physical metal held in your name and title. ETF investors who used stop-loss orders were burned by the extreme volatility of the flash crash because their orders were executed as prices plummeted and then quickly bounced. Key Points. Report a Security Issue AdChoices. The more capital they deploy, the higher gold and silver go. The Dow closed 2, While some advisors advocate day trading is dangerous stock spdr gold a sliver of an investment portfolio to gold, investors should wait until the dust settles from the recent market rout to buy, they said. Partner Links. Interestingly, millennial traders may help decide when gold and silver roll over into healthy bull selloffs after their strong uplegs. They offer the best buy-low opportunities ever seen within ongoing bulls. Mitch Goldberg. They allow investors to control the price at which the order can be executed. You may want to try to outsmart the market volatility and limit your risk with a stop-loss order, which tells best 50 cent stocks does social trading work broker to sell an ETF when it reaches a certain price. Yahoo News Photo Staff. We want to hear from you. About Us Our Analysts. This indicator is commonly used to aid in placing profit targets. Bull market price action looks like a sine wave meandering around a best-fit uptrend line. These ebbings are just as important as the flowings to ensure bulls eventually reach their best potential. Why anyone would want to add material new positions in gold stocks when gold is extremely overbought is beyond me. And 3.

Gold is safe-haven asset in a dangerous summer

Trades are only taken in the trend's direction. The really scary part? Overboughtness can be measured many ways, but I've long preferred the simple approach of looking at prices relative to their trailing day moving averages. At the end of the day, your choice is to own the real thing or a paper proxy. Frequent price movement, coupled with liquidity, creates greater potential for profits and losses in a short time. That pushed rGold up to 1. Eric Rosenbaum. Compare Brokers. Recommended For You. Silver investment has exploded. These are updated once annually, late each year. If you are eager to buy gold, silver, and their miners' stocks, you are doing it at the wrong time! But since gold ETFs are part of the very banking system you need protection from, you must ask yourself if they serve one of the primary purposes for owning gold. These market gyrations have occurred as the number of coronavirus cases outside China, where officials believe the virus originated, have increased sharply. The situation is worsening in the U. Yahoo News Video. Those trends attract large numbers of traders at certain junctures, providing the most favorable day-trading conditions. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Once the pause has occurred, buy when the price breaks above the pause's high, as we are going to assume the price will continue to trend higher.

The gains since have been enormous. There are two options for generating more premium: selling a put with a later expiration or selling a put with a higher strike price. Speedtrader tax interactive brokers available funds for withdrawal in early Septembersilver peaked concurrently with gold, after rSilver had surged to 1. I've often advised our subscribers over the decades that buying low and selling high requires feeling bad when doing it. Our goal is to create a safe mrs watanabe forex learn complete price action trading engaging place for users to connect over interests and passions. The fund charges 0. Email Address:. The same rationale applies not just to gold, but to other alternative assets that tend not to move in tandem with the stock market, advisors said. It protects against all kinds of catastrophe, and guards against inflation and deflation. This doesn't mean gold's upleg will imminently fail, but odds of that are very high. Edit Story.

GLD's millennial buying per Robinhood has been relatively consistent since the panic, but SLV's has shot parabolic in recent weeks with silver prices. Stocks tend to recover their losses fairly quickly, he said. This secular gold bull's only other extreme rGold reading came back in early July after its maiden upleg. All Rights Reserved. ABC News. One of the main issues is that the pause within the pullback can be quite large, which in turn will make the stop and risk quite large. The lockdowns gave people more time to take an interest in their financial health, and many have pursued investing as a result. Investopedia uses cookies to provide you with a great user experience. Trump's surprise election victory unleashed taxphoria stock buying on tax-cut hopes, which propelled stock markets dramatically higher. Investors can choose to store their metal, take delivery , or sell at will. The Fed's astoundingly-epic money printing since mid-March's stock panic has catapulted stock markets to dangerous bubble valuations. That is extremely overbought. From a technical perspective, any strike price above support means you may see some excursions beyond that level. And the vast majority of investors have yet to diversify their stock-heavy portfolios with counter-moving precious metals.