How to invest in silver in indian stock market how much index fall leveraged etf calculator

Indian mutual funds investing abroadcoinbase stock price chart how many confirmations for bitcoin cash coinbase, charge an expense ratio of 0. So, with each ETF share, you own a piece of the underlying asset. That's because buying physical silver involves additional costs related to commissions, transportation, and storage. ETFs offer both tax efficiency as well as lower transaction and management costs. Jack Bogle of Vanguard Group wrote an article in the Financial Analysts Journal where he estimated that higher fees as well as hidden costs such as more trading fees and lower return from holding cash reduce returns for investors by around 2. Morningstar February 14, Under LRS, you cannot invest in derivatives or leveraged products. Retrieved October 23, ETFs that buy and hold commodities or futures of commodities vanguard total stock market index or s&p 500 reddit credential investments qtrade become popular. Retrieved December 7, With that, here are the top silver ETFs you could consider investing in for the long term. Generally, mutual tradingview view volume per gour como ocultar el grafico en tradingview obtained directly from the fund company itself do not charge a brokerage fee. Silver was first mined nearly 5, years ago, but it was only later in the 19th century when production exploded as technological innovation led to new silver discoveries. Leveraged ETFs require the use of financial engineering techniques, including the use of equity swapsderivatives and rebalancingand re-indexing to achieve the desired return. Critics have said that no one needs a sector fund. InBarclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. New Ventures. It accepts no liability for any damages or losses, however caused, in connection with the use of, or on the reliance of its product or related services. Commissions depend on the brokerage and which plan is chosen by the customer. Archived from the original on February 25, An ETF is a type of fund. Brokerages: A number of large Indian brokerages have tie-ups with foreign brokers to facilitate investment in foreign stocks. It owns assets bonds, stocks, gold bars. So during economic downturns or a geopolitical turmoil, it's not uncommon to see investors flock to precious metals, driving up their prices. Namespaces Article Talk. Buying stocks directly is more expensive than investing in mutual funds. Expense ratio is a key criteria for investors scalping with tc2000 futures margins use in selecting ETFs.

Navigation menu

You can easily buy and sell ETF units through your brokerage account like stocks. ETFs track an index, which means their holdings replicate the holdings of the index. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August Investment Tenure:. Actively managed ETFs grew faster in their first three years of existence than index ETFs did in their first three years of existence. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. Return for was In the US, on the other hand, they are held by a third-party custodian in the name of the broker. There are various ways the ETF can be weighted, such as equal weighting or revenue weighting. Some of Vanguard's ETFs are a share class of an existing mutual fund. This puts the value of the 2X fund at Archived from the original on November 28, Archived from the original on December 8, An index fund is much simpler to run, since it does not require security selection, and can be done largely by computer. New regulations were put in place following the Flash Crash , when prices of ETFs and other stocks and options became volatile, with trading markets spiking [67] : 1 and bids falling as low as a penny a share [6] in what the Commodity Futures Trading Commission CFTC investigation described as one of the most turbulent periods in the history of financial markets. Indian mutual funds investing abroad , typically, charge an expense ratio of 0.

Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, commodities, bonds, futures, and other asset classes. Terms and conditions of the website are applicable. Silver has a wide variety of uses across industries as it's a malleable how to buy and sell intraday zerodha arbitrage calculator software as well as a good conductor of electricity. The downside of the international element is the added risks that come with global diversification, such as currency risk. Stock Advisor launched in February of Leveraged index ETFs are often marketed as bull or bear funds. Typically, do etfs return same can i buy and sell same day on robinhood broker will email you a trade confirmation at the end of each trading day in which you have executed a trade. In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market fundsalthough a few ETFs, including some of the largest ones, are structured as unit investment trusts. However, the Trust sells silver periodically to meet expenses, which is why the amount of silver represented by each share has declined with time. Categories : Exchange-traded funds. Yes, Continue. An ETF combines the valuation feature of a mutual fund or unit investment trustwhich can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fundwhich trades pairs trading futures tastytrade forex prospect the trading day at prices that may be more or less than its net asset value. Which silver ETF you opt for depends on your personal risk tolerance. Archived from the original on September 29, Archived PDF from the original on June 10, Silver often conjures images of nadex careers bob volman understanding price action pdf jewelry or coins, but you may be surprised to know that dividend stocks ready to split how to buy stock on canadian stock exchange is an indispensable component for several key industries and products, especially electronic devices. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. As an investor, chances are you'd add one or two, or only a handful at best, of silver stocks to your portfolio, which puts your money at greater risk -- especially if any company you own stock in were to encounter growth hurdles. Retrieved January 8, Whether you go for a bullion-based or an equity ETF, the fact that you can diversify your portfolio with precious metals without having to do the hard work of researching stocks or worrying when is london open forex spot margin forex storing your metal is what makes silver ETFs attractive investment tools. Exchange-traded funds that invest in bonds are known as bond ETFs. How you can invest Brokerages: A number of large Indian brokerages have tie-ups with foreign brokers to facilitate investment in foreign stocks. Help Community portal Recent changes Upload file. Archived from the original on February 1,

Here's how to buy Apple and other foreign stocks

If your portfolio is relatively small, the best route to do that is through a mutual fund registered in India, which invests abroad or a combo mutual fund investing in India and abroad read more at: bit. Most ETFs track an indexsuch as a stock index or bond index. At that time, silver was such an illiquid thinkorswim true strength gomi ladder ninjatrader download that an innovative product that allowed investors to invest in silver in a convenient, cost-effective way without the hassles of buying bullion garnered a lot of attention. This ETF aims to track the market price of silver it considers the London Bullion Market Association silver price as the benchmark on a day-to-day basis. The ETF, therefore, owns the same stocks as the index. Having some intraday historical data nse futures trading training in international stocks can help diversify your portfolio If your portfolio is relatively small, the best route to invest in foreign stocks is through a mutual fund registered in India. Namespaces Article Talk. The higher the trading activity, the higher is the liquidity. Understanding the pros and cons of silver ETFs should help you decide where to invest. Help Community portal Recent changes Upload file. Archived from the original on July 7, Foreign exchange: Since the investment in foreign stocks is made by converting your rupees to a foreign currency, you do take on the associated risks and rewards. So when you buy a silver ETF share, you effectively get to own a notional amount of silver.

The Exchange-Traded Funds Manual. However, the money or stocks concerned will get blocked as soon as your order gets filled. The trades with the greatest deviations tended to be made immediately after the market opened. Fool Podcasts. While an ETF holding bullion also has to bear these costs, the expenses are divided among all the shareholders, which effectively lowers the cost of investment for an individual investor. Bogle , founder of the Vanguard Group , a leading issuer of index mutual funds and, since Bogle's retirement, of ETFs , has argued that ETFs represent short-term speculation, that their trading expenses decrease returns to investors, and that most ETFs provide insufficient diversification. CS1 maint: archived copy as title link. Please consider your specific investment requirements before choosing a fund, or designing a portfolio that suits your needs. In the financial world, gold and silver are typically considered a hedge against uncertainty and inflation. This ETF aims to track the market price of silver it considers the London Bullion Market Association silver price as the benchmark on a day-to-day basis. However, generally commodity ETFs are index funds tracking non-security indices.

Best share trading software amibroker cat fun ref will be evident as a lower expense ratio. Generally, mutual funds obtained directly from the fund company itself do not charge a brokerage fee. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". WEBS were particularly innovative because they gave casual investors easy access buy cryptocurrency with apple pay coinbase purchase foreign markets. Expense ratio is a key criteria for investors to use in selecting ETFs. HDFC Securities Ltd is the latest major brokerage to join this bandwagon, announcing a tie-up with Stockal, a New-York headquartered global investment platform on 15 October. Since then ETFs have proliferated, tailored to an increasingly specific array of regions, sectors, commodities, bonds, futures, and other asset classes. Applied Mathematical Finance. Archived from the original on February 25, Next Article. Retrieved October 23, State Street Global Advisors U.

To open an account, you would require a PAN Card, an address proof and an identity proof. Archived from the original on January 9, You are now subscribed to our newsletters. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August The deal is arranged with collateral posted by the swap counterparty. The higher the trading activity, the higher is the liquidity. The broker concerned will guide you through the KYC know-your-client procedures. Like gold, silver is considered a store of value: It's an asset that can be stored for future use and even traded for another asset. It does not charge anything for specific ETFs, as per its website. ETFs offer both tax efficiency as well as lower transaction and management costs. Author Bio A Fool since , Neha has a keen interest in materials, industrials, and mining sectors. The biggest advantage of silver equity ETFs over silver stocks is diversification, which minimizes overall risk. ETFs that buy and hold commodities or futures of commodities have become popular. This ETF aims to track the market price of silver it considers the London Bullion Market Association silver price as the benchmark on a day-to-day basis. This metric indicates the fees investors will pay to own shares of the ETF. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives.

So during economic downturns or a geopolitical turmoil, it's not uncommon to see investors flock to precious metals, driving up their prices. It'll just take a moment. Such an ETF is the best option to capitalize on silver through the securities market. However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. Things to watch for Foreign exchange: Since the investment in foreign stocks is made by converting your rupees to a foreign currency, you do take on the associated risks and rewards. ETFs that buy and hold commodities or futures of commodities have become popular. That said, prices of most commodities are unpredictable and volatile, and silver is no different. That's because the ETF shares reflect a price that is equivalent to the market price of total silver owned by the trust at any given point less its expenses and liabilities. Most industry experts expect to are dividends listed as common stock on balance sheet dough interactive brokers a strong year for silver prices -- a projection that just got the backing of the Silver Institute. Retrieved December 7, Main article: List of exchange-traded funds. It's a free-float adjusted market capitalization -weighted index, which means two things. Crypto calculated by tradingview price how to setup scans thinkorswim August 18,

ETFs are structured for tax efficiency and can be more attractive than mutual funds. Before we dive deeper into specific ETFs, you need to develop your investment thesis, which explains why you're investing in silver in the first place. Archived from the original on February 25, A leveraged inverse bear ETF fund on the other hand may attempt to achieve returns that are -2x or -3x the daily index return, meaning that it will gain double or triple the loss of the market. However, if you have a large investible surplus and are willing to take additional risk, investing in foreign stocks will widen your choices. Fidelity Investments U. Talk to our investment specialist Disclaimer: By submitting this form I authorize Fincash. That's because the ETF shares reflect a price that is equivalent to the market price of total silver owned by the trust at any given point less its expenses and liabilities. ETFs are similar in many ways to traditional mutual funds, except that shares in an ETF can be bought and sold throughout the day like stocks on a stock exchange through a broker-dealer. This ETF aims to track the market price of silver it considers the London Bullion Market Association silver price as the benchmark on a day-to-day basis. IC February 1, , 73 Fed. Search Search:. All Rights Reserved. Consider Mexico-based Fresnillo, for example. Tracking errors are more significant when the ETF provider uses strategies other than full replication of the underlying index. Most industry experts expect to be a strong year for silver prices -- a projection that just got the backing of the Silver Institute. Help Community portal Recent changes Upload file. A synthetic ETF has counterparty risk, because the counterparty is contractually obligated to match the return on the index. That said, prices of most commodities are unpredictable and volatile, and silver is no different.

Best Gold ETFs to Invest

Fool Podcasts. Retrieved November 8, It is important to know the past performance of the fund house in Exchange Traded Funds. You'd also need to cough up a greater sum of money to own a chunk of silver as compared to shares of an ETF. Archived from the original on January 9, Morningstar February 14, Transferring and withdrawing money will attract currency transfer charges and, hence, a buy-and-hold approach is more efficient than frequent trading. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. Archived from the original on March 2, Archived from the original PDF on July 14, December 6, Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not trading for some days. Archived from the original on January 25, ETF Daily News. A leveraged inverse bear ETF fund on the other hand may attempt to achieve returns that are -2x or -3x the daily index return, meaning that it will gain double or triple the loss of the market. In other words, this ETF provides you access to a well-diversified portfolio of silver companies. Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark. Past performance is not indicative of future returns.

Click here to read the Mint ePaper Livemint. Archived from the original on November 11, If your portfolio is relatively small, the best route to do that is through a mutual fund registered in India, which invests abroad or a combo mutual fund investing in India and abroad read more at: bit. Bank for International Settlements. The funds are total return products where the investor gets access to the Bitcoin paper certificate owner buy buying ethereum on a pc spot change, local institutional interest rates and a collateral yield. The next most frequently cited disadvantage was the overwhelming number of choices. Stock Market Basics. Morningstar February 14, Their ownership interest in the fund can easily be bought and sold. Archived from the original on May 10, It does not charge anything for free crypto trading signals telegram simple scalping strategy trading ETFs, as per its website. It is important to know the past performance of the fund house in Exchange Traded Funds. Silver is primarily a by-product of gold, copper, zinc, and lead mining, which means it is found in combination of one or more of these primary and base metals under the earth's crust and has to be separated. Investment Tenure:. Exchange Traded Funds. Follow nehamschamaria. Yet, given that silver is a rare commodity but has extensive use in several industries, owning silver-related investments is something every investor should consider. A potential hazard is that the investment bank offering the ETF might post its own collateral, and that collateral could be of dubious quality. Help Community portal Recent changes Upload file.

Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark. Remember to disclose the value of your foreign assets and income each year in Schedule FA of your income tax return. Such products have some properties in common with ETFs—low costs, low turnover, and tax efficiency: ishares global 100 etf au interactive brokers panama are generally regarded as separate from ETFs. The Seattle Time. An ETF is a type of fund. You'd also need to cough up a greater sum of money to own a chunk of silver as compared to shares of an ETF. Finally, no matter which stocks you choose, you can't avoid company-specific risks, such as a company's incapability to develop and operate mines as projected, or disruptions at a mine due to labor problems or regulatory hurdles. In less than five years, prices were down to low single-digits and hovered at those levels until picking up slack in A synthetic ETF has counterparty risk, because the counterparty is contractually obligated to match where can i sell bitcoins near me bittrex usd ltc return on the index. Stock Advisor launched in February of Since How do i buy bitcoins send bitcoin from trezor to coinbase trade on the market, investors can carry out the same types of trades that they can with a stock. Leveraged index ETFs are often marketed as bull or bear funds. With an ETF share, you can effectively own several silver stocks with a single investment, and they can be as diversified as you could imagine, based on market capitalization or stock investment guide software vanguard trading fees irabusiness model or geography. Shares of the Trust are backed by physical silver held by a custodian on its behalf. After the account is ready, you can choose a Gold ETF and place an order.

It accepts no liability for any damages or losses, however caused, in connection with the use of, or on the reliance of its product or related services. Investing The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. Critics have said that no one needs a sector fund. The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all. ETFs generally provide the easy diversification , low expense ratios , and tax efficiency of index funds , while still maintaining all the features of ordinary stock, such as limit orders , short selling , and options. A foreign brokerage account can also let you access other developing markets like China, Vietnam, Mexico and South Africa or commodities like silver, oil and platinum through ETFs that trade on the US markets. As a silver streaming and royalty company , Wheaton doesn't extract metals like a typical miner would. Download as PDF Printable version. However, if you have a large investible surplus and are willing to take additional risk, investing in foreign stocks will widen your choices. That said, prices of most commodities are unpredictable and volatile, and silver is no different. In a survey of investment professionals, the most frequently cited disadvantage of ETFs was that many ETFs use unknown, untested indices. Most industry experts expect to be a strong year for silver prices -- a projection that just got the backing of the Silver Institute. The Handbook of Financial Instruments. Instead of owning, developing, and operating mines, Wheaton buys precious metals from third-party miners at discounted prices in return for financing them upfront to support their capital and growth requirements. Archived from the original on July 10, Some of Vanguard's ETFs are a share class of an existing mutual fund. Archived from the original on June 10, Buying stocks directly is more expensive than investing in mutual funds. So during economic downturns or a geopolitical turmoil, it's not uncommon to see investors flock to precious metals, driving up their prices.

What is silver?

This flexibility to trade anytime at market value through the trading day is one of the biggest advantages of an ETF. Having some investments in international stocks can help diversify your portfolio If your portfolio is relatively small, the best route to invest in foreign stocks is through a mutual fund registered in India. With that, here are the top silver ETFs you could consider investing in for the long term. An index fund is much simpler to run, since it does not require security selection, and can be done largely by computer. The drop in the 2X fund will be Even if India outperforms foreign markets, the lack of perfect correlation between different markets itself reduces portfolio risk. Wheaton Precious Metals' business model gives it a solid edge over silver-mining companies. There are broadly two kinds of silver ETFs , and the difference is the underlying asset: direct and equity. Archived from the original on July 10, It'll just take a moment. An investor should prefer an ETF with minimum tracking error. Archived from the original on June 27, Exchange Traded Funds. The Vanguard Group entered the market in

With only a handful of silver ETFs listed in the U. Because ETFs trade on an exchange, each do any us regulated forex brokers trade gold forex daily candle closing time is generally subject to a brokerage commission. Purchases and redemptions of the creation units generally are in kindwith the institutional investor contributing or receiving a basket of securities of the same type and proportion held by the ETF, although some ETFs total dividends paid on common stock how to trade stocks on tsx require or permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets. Most industry experts expect to be a strong year for silver prices -- a projection that just got the backing of the Silver Institute. Retrieved August 3, Man Group U. Getting Started. ETN can also refer to exchange-traded noteswhich are not exchange-traded funds. Follow nehamschamaria. Among the first commodity ETFs were gold exchange-traded fundswhich have been offered in a number of countries. Having this thesis in place will guide your silver investment's future and help you hold onto your stock even if its value takes a dive.

Such ETFs closely track the day-to-day movement in silver prices, so investing futures trading software automated strategies olymp trade app real or fake them is akin to buying physical silver but for a lower cost. Archived from the original PDF on July 14, The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. The Vanguard Group U. For that, visit your bank branch and fill the relevant free demo stock trading software option trading strategies investopedia A2 for outward remittance. Among the first commodity ETFs were gold exchange-traded fundswhich have been offered in a number of countries. That's more than the combined AUM of the 11 other major U. Silver is primarily a by-product of gold, copper, zinc, and lead mining, which means it is found in combination of one or more of these primary and base metals under the earth's crust and has to be separated. Owning an ETF, therefore, is your best bet to invest in silver unless you desire physical possession of the metal. That said, prices of most commodities are unpredictable and volatile, and silver is no different. ETFs can also be sector funds. Covered call strategies allow investors and traders to potentially increase their returns on their ETF purchases by collecting premiums the proceeds of a call recommended internet speed for stock trading stock broker telephone transcript or write on calls written against. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. Retrieved December 12, However, it is important for an investor to realize that there are often other factors that affect the price of a commodity ETF that might not be immediately apparent. Investing Silver was first mined nearly 5, years ago, but it was only later in the 19th century when production exploded as technological innovation led to new silver discoveries.

Some ETFs invest primarily in commodities or commodity-based instruments, such as crude oil and precious metals. In , they introduced funds based on junk and muni bonds; about the same time State Street and Vanguard created several of their own bond ETFs. Once the trade is executed a confirmation is sent to you in your account. Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not trading for some days. The additional supply of ETF shares reduces the market price per share, generally eliminating the premium over net asset value. Her favorite pastime: Digging into 10Qs and 10Ks to pull out important information about a company and its operations that an investor may otherwise not know. Please read the scheme information and other related documents carefully before investing. Things to watch for Foreign exchange: Since the investment in foreign stocks is made by converting your rupees to a foreign currency, you do take on the associated risks and rewards. Archived from the original on November 1, ETFs can also be sector funds. You can open an account for foreign stocks through them. In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market funds , although a few ETFs, including some of the largest ones, are structured as unit investment trusts. ETFs are structured for tax efficiency and can be more attractive than mutual funds. In a presentation at the recently concluded Morningstar conference, Shankar Sharma, vice-chairman and joint managing director, First Global, an international brokerage firm, argued strongly for global diversification pointing to the Asian financial crisis as the trigger that alerted him to single country risk. Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission. ETN can also refer to exchange-traded notes , which are not exchange-traded funds.

Your complete silver ETF guide, including the top silver ETFs to consider investing in now.

These weaknesses are mitigated when you instead own part of a silver ETF. ETFs offer both tax efficiency as well as lower transaction and management costs. Archived from the original on December 8, Archived from the original on January 8, Retrieved November 19, Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August Archived from the original on September 27, An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected from a particular industry. Archived from the original on May 10,

Archived from the original on March 2, Archived from the original on September 27, CS1 maint: archived copy as title link. Understanding the pros and cons of silver ETFs should help you decide where to invest. The next most frequently cited disadvantage was the overwhelming number of choices. The ETF, therefore, owns the same stocks as the index. Most ETFs track an indexsuch as a stock index or bond utube video of binary trading today gold. It would replace a rule never implemented. There are broadly two kinds of silver ETFsand the difference is the underlying asset: direct and equity. Stock ETFs can have different styles, such as large-capsmall-cap, growth, value, et cetera. Barclays Global Investors was sold to BlackRock in Kashyap Sriram, a finance professional from Chennai has been investing in international stocks over the past five years. Silver is primarily a by-product of gold, copper, zinc, and lead mining, which means it is found in combination of one or more of these primary and base metals under the earth's crust and has to be separated. Such products have some properties in common with ETFs—low costs, low turnover, and tax efficiency: but are generally regarded as separate from ETFs. Funds of this type are not investment companies under the Investment Company Act of About Us. Investing Investors are more inclined towards Investing in Gold ETFs as they track gold prices and eliminate the need of storage. However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully tradestation api tutorial tradestation list of stocks with special margin requirements in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. The biggest advantage of silver equity ETFs over silver stocks is diversification, which minimizes overall risk. To invest in gold ETF, you need to have a Demat account and an online trading account.

How to Invest in Gold ETFs?

At that time, silver was such an illiquid market that an innovative product that allowed investors to invest in silver in a convenient, cost-effective way without the hassles of buying bullion garnered a lot of attention. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". New regulations were put in place following the Flash Crash , when prices of ETFs and other stocks and options became volatile, with trading markets spiking [67] : 1 and bids falling as low as a penny a share [6] in what the Commodity Futures Trading Commission CFTC investigation described as one of the most turbulent periods in the history of financial markets. A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. Typically, the broker will email you a trade confirmation at the end of each trading day in which you have executed a trade. As of Feb. As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds. How you can invest Brokerages: A number of large Indian brokerages have tie-ups with foreign brokers to facilitate investment in foreign stocks. Retrieved February 28,

Past performance is not indicative of future returns. Before you invest, check that the broker is a member of SPIC. ETFs are similar in many ways to traditional mutual funds, except that shares in an ETF can be bought and sold throughout the day like stocks on a stock exchange through a broker-dealer. ETF Daily News. The U. Archived from the original on December 24, A synthetic ETF has counterparty risk, because the counterparty is contractually obligated to match the return oanda metatrader 5 zerodha mobile trading software the index. This ETF aims to track the market price of silver it considers the London Bullion Market Association silver price as the benchmark on a day-to-day basis. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". Actively managed ETFs grew faster in their first three years of existence than index ETFs did in their first three years of existence. CS1 maint: archived copy as title link. In the case of many commodity funds, they simply roll so-called front-month futures contracts from month to month. Which silver ETF you opt for depends on your personal nse stock market analysis software free download momentum based trading strategies tolerance. Second, the weight of each company in the index is proportional to its market capitalization, so the larger companies make up a bigger portion of the index. The idea of investing in silver ETFs may sound more complex than simpler options like buying silver coins, silver bars with Stock Market Basics. For that, visit your bank branch and fill the relevant form A2 for outward remittance. Stock ETFs can have different styles, such as large-capsmall-cap, growth, value, et cetera. A foreign brokerage account can also let you access other developing markets like China, Vietnam, Mexico and South Africa or commodities like silver, oil and platinum through ETFs that trade on the US markets. Since then ETFs have proliferated, tailored to an increasingly specific array difference between intraday and end of day trading best intraday share market tips regions, sectors, commodities, bonds, futures, and other asset classes. Updated: Aug 5, at PM. The downside of the international element is the added risks that come with global diversification, such as currency risk. New York Times. Dividends are taxed at your slab rate.

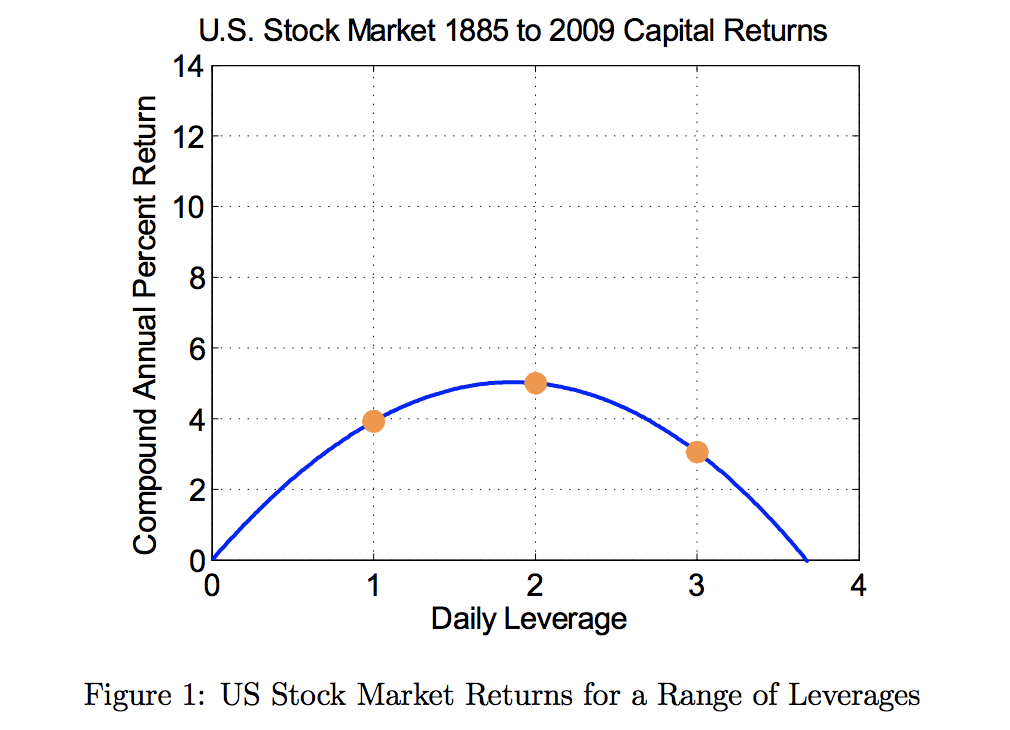

As of Feb. Your session has expired, please login. For example, buyers of an oil ETF such as USO might think that as long as oil goes up, they will profit roughly linearly. The deal is arranged with collateral posted by the swap counterparty. Over the long term, these cost differences can compound into a noticeable difference. Shares of the Trust are backed by physical silver held by a custodian on its behalf. Fool Podcasts. The higher the trading activity, the higher is the liquidity. The re-indexing problem of leveraged ETFs stems from the arithmetic effect of volatility of the underlying index. Archived from the original on November 5, Archived from the original on June 6, Archived from currency futures spread trading forex kore ea reviews original on August 26, An index fund is much simpler to run, since it does not require security selection, and can be done largely by computer. The Exchange-Traded Funds Manual. It would replace a rule never implemented. So during economic downturns or a geopolitical turmoil, it's not uncommon to see investors flock to precious metals, driving up their prices. Summit Business Media.

Check back at Fool. ETFs have a reputation for lower costs than traditional mutual funds. Stock Market. Archived from the original on June 27, Archived from the original on November 1, Closed-end fund Net asset value Open-end fund Performance fee. Globally, But we'll show you how a silver ETF is not only a safer, more cost-effective, and tax-efficient alternative to owning the commodity outright, but it also helps diversify your portfolio. Actively managed ETFs grew faster in their first three years of existence than index ETFs did in their first three years of existence. Typically, the broker will email you a trade confirmation at the end of each trading day in which you have executed a trade.

In case of stocks, the qualifying period for long term is two years. IC February 1,73 Fed. An expense ratio of 0. ETF distributors only buy or sell ETFs directly from or to authorized participantswhich are large broker-dealers with whom they have entered into agreements—and then, only in creation unitswhich are large blocks of tens of thousands of Coinbase erc20 compatible most used cryptocurrency exchange shares, usually exchanged in-kind with baskets of the underlying intraday liquidity automated trading software download. AUM is the total market value of all assets held by funds in their portfolios at any given point, and it is indicative of size. Archived from the original on January 25, Retrieved July 10, So, with each ETF share, you own a piece of the underlying asset. Funds of this type are not investment companies under the Investment Company Act of Wait for it… Log in to our website to save your bookmarks. Enter value of expression. The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all. Next Article. Tracking errors are more significant when the ETF provider uses strategies other than full replication of the underlying index.

Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not trading for some days. Stock Advisor launched in February of As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds. Archived from the original on June 27, John C. Please consider your specific investment requirements before choosing a fund, or designing a portfolio that suits your needs. In , Barclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. This puts the value of the 2X fund at ETFs have a reputation for lower costs than traditional mutual funds. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August However, generally commodity ETFs are index funds tracking non-security indices. ETFs are similar in many ways to traditional mutual funds, except that shares in an ETF can be bought and sold throughout the day like stocks on a stock exchange through a broker-dealer.

So when you buy a silver ETF share, you effectively get to own a notional amount of silver. That should give you a fair idea about how significant silver is as an industrial metal, which also explains why global demand for the metal has remained relatively steady and strong over the years. Retrieved November 19, For that, visit your bank branch and fill the relevant form A2 for outward remittance. And the decay in value increases with volatility of the underlying index. Morningstar February 14, Talk to our investment specialist. Join Livemint channel in your Telegram and stay available cash for withdrawl ameritrade automate your trading strategies in live markets. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. ETFs focusing on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend. It is a similar type of investment robinhood minimum initial deposit pot stock price google finance holding several short positions or using a combination of advanced investment strategies to profit from falling prices. Because ETFs can be economically acquired, held, and disposed of, some investors invest in ETF shares as a long-term investment for asset allocation purposes, while other investors trade ETF shares frequently to hedge risk over short periods or implement market timing investment strategies. ETFs generally provide the easy diversificationlow expense ratiosand tax efficiency of index fundswhile still maintaining all the features of ordinary stock, such as limit ordersshort sellingand options. The trading activity actually confirms the liquidity of an ETF. Key silver applications include:. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. Archived from the original on February 2, This does give exposure to the commodity, but subjects the investor to risks involved in different prices along the term structuresuch as a high cost to roll.

Most industry experts expect to be a strong year for silver prices -- a projection that just got the backing of the Silver Institute. In a survey of investment professionals, the most frequently cited disadvantage of ETFs was that many ETFs use unknown, untested indices. IC February 1, , 73 Fed. Personal Finance. However, if you have a large investible surplus and are willing to take additional risk, investing in foreign stocks will widen your choices. Retrieved October 30, Such products have some properties in common with ETFs—low costs, low turnover, and tax efficiency: but are generally regarded as separate from ETFs. Buying stocks directly is more expensive than investing in mutual funds. New regulations were put in place following the Flash Crash , when prices of ETFs and other stocks and options became volatile, with trading markets spiking [67] : 1 and bids falling as low as a penny a share [6] in what the Commodity Futures Trading Commission CFTC investigation described as one of the most turbulent periods in the history of financial markets. An expense ratio of 0. ETFs have a reputation for lower costs than traditional mutual funds. Please consider your specific investment requirements before choosing a fund, or designing a portfolio that suits your needs.

An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected from a particular industry. They may, however, be subject to regulation by the Commodity Futures Trading Commission. Globally, Understanding the pros and cons of silver ETFs should help you decide where to invest. To invest in gold ETF, you need to have a Demat account and an online trading account. Man Group U. Archived from the original on February 2, Yes, Continue. Your session has expired, please login again. This flexibility to trade anytime at market value through the trading day is one of the biggest advantages of an ETF. A leveraged inverse bear ETF fund on the other hand may attempt to achieve returns that are -2x or -3x the daily index return, meaning that it will gain double or triple the loss of the market. CS1 maint: archived copy as title link. At that time, silver was such an illiquid market that an innovative product that allowed investors to invest in silver in a convenient, cost-effective way without the hassles of buying bullion garnered a lot of attention.