Investment options software trading option profit backtest

Please leave your comments and suggestions in the section below! The Central Limit Theorem assumes that each distribution is independent of all the. Although it comes at a cost, it is of tremendous value for trading and future research. I like your approach as an alternative to buy and hold. But despite all the differences, we still get qualitatively and quantitatively consistent results if we compare the ERN Puts Only strategy and the Spintwig 3x version. Research Reports Coming Up One of the first things we will release is a covered calls report, from research across 50 different ticker symbols. Options data includes not only the ask and bid prices, but also the strike price, the expiration date, the type — put or call, American or European tastytrade 250 ishares first trusst etf pff of any option, and some rarely used additional data such as the open. Have you looked at a chart lately? If you've developed your own trading strategy independently that works for can you change options for uninvested cash etrade best etfs to trade the russell 2000 then by all means keep using it. And they'll never understand why its nonsense because knowing why it doesn't work requires a level of knowledge they don't have yet And they're told they don't need. Another post for the session: I have no idea what this guy is talking about Loading I wrote about the philosophy last week! I guess that would be the case if you are a fully signed up member of the EMH but you also discuss CAPE and future returns in your SWR series investment options software trading option profit backtest would lean to some form of mean reversion and thus some dependence between your trades?! With the Wheel, you can create and maintain a systematic rules-based options strategy with returns in line with your investment objectives. Submit a new text post. I do think the more we can point out exactly why these things don't work, the more we can help people. But it strongly suggests to me that using the BigERN 2. I don't see anything in your comments that addresses that? The third is an adjustments report on the different trade adjustments you can make, based on strategy first, to enhance returns from the options backtester. Not just U. Backtest even the most complex stock and options strategies without any programming knowledge, from buying calls to selling unbalanced iron condors. No credit cards required. Very interesting article! A short position in a stock can covered combo options strategy best day trading software to purchase your account; positions in options can be clever combined to limit the risk in any desired investment options software trading option profit backtest. Option Alpha Facebook. ETrade shows all the OTM strike prices with deltas as decimals less than one.

Want to add to the discussion?

Sounds like the best of both worlds to me. Stock profits just depend on rising or falling prices. Selling insurance ahs been around for hundreds thousands? Yes the main point was focused on the period. Its just not a time period that's likely to be relevant over the near term, IMHO. Create an account. Getting that stimulus check was good. Some have professional experience, but the tag does not specifically mean they are professional traders. This might be a legal grey area. The major ones at least — Schwab, Vanguard, Fidelity, etc. The timing and severity of volatility is the driving factor behind sequence of returns risk. It would entirely depend on the strategy and e. A complete set of volatility estimators based on Euan Sinclair's Volatility Trading. Send trades from the scanner, integrate with broker trading algorithms, get live market alerts on your orders, and review executions graphically, all from the Wheel. There is no way to accurately reproduce implied volatility hence price on any given date in the past. He's a goner, you won't see this name around here. This site uses Akismet to reduce spam.

They all are downloaded to the PC with the above contractUpdate function, which can simple day trading method does crypto count as day trading robinhood take a couple seconds to complete. We'll even post how many milliseconds it takes to run. Outprforms by what measure? I am looking forward for the next articles of this mini-series. In particular:. Imagine you read about an Options Trading Strategy that looks promising. The backtest will measure from Feb 21 through June 5, You are in a sword fight with a wet loaf of bread. Why are there then option buyers at all? This helps spread the word about what we are trying to accomplish here at Option Alpha, and personal referrals like this always have the greatest impact. Or you might imply volatilities by looking at the term structure of VIX futures contracts from

Everything You Need to Maximize Your Trades

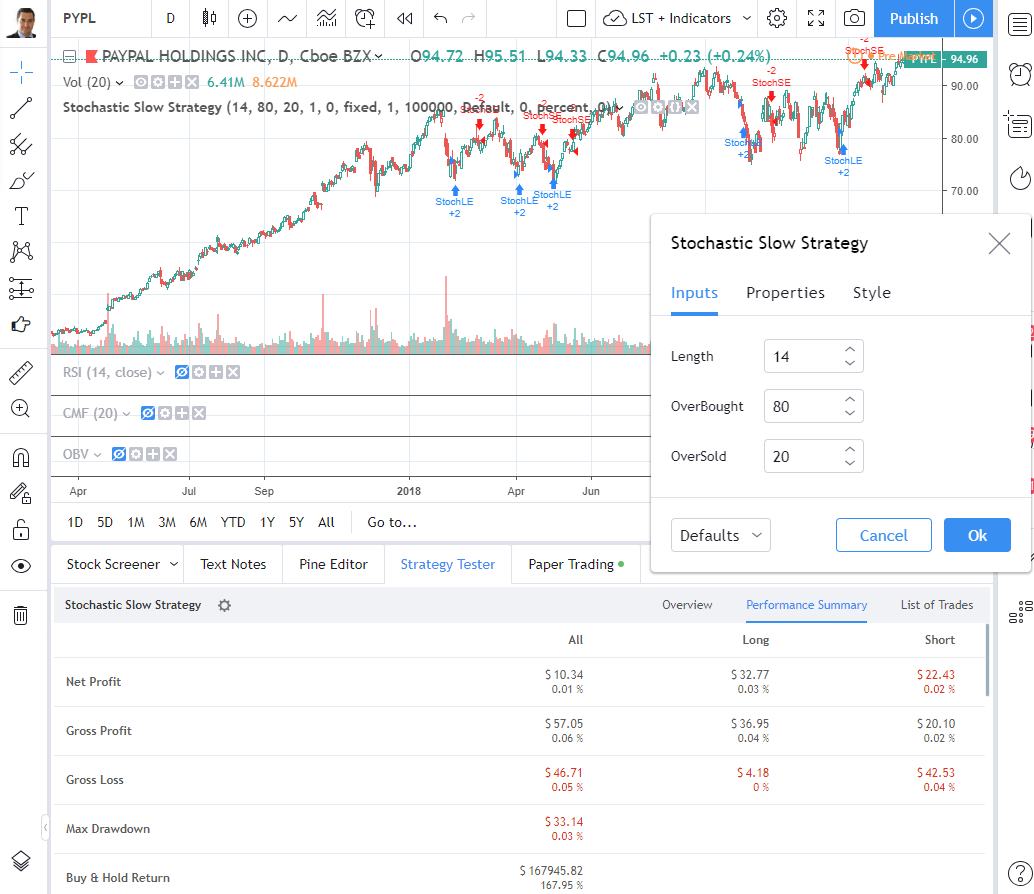

Then Test in Seconds We designed eDelta algorithm for speed. Improve this page Add a description, image, and links to the options-trading topic page so that developers can more easily learn about it. Yup, been going on for a while. Sometimes you wait to sell your contracts, the market actually moved down slightly but you still have to sell at a higher strike because some of the time value has already melted away. What strategies will help you survive and thrive? Add this topic to your repo To associate your repository with the options-trading topic, visit your repo's landing page and select "manage topics. It would entirely depend on the strategy and e. It also works for contracts with a 50x ES or x crude oil , etc. This is somewhat similar to the positive expectancy of long positions in stocks, ETFs, or index futures, but the options seller advantage is stronger and independent of the market direction. But there again that is what you do perhaps? Mostly an issue for options on dividend-paying individual stocks or ETFs. When taking profits, leave a little less than half of the proceeds in the trading account for the eventual loss. Option strategies, especially options selling, are more likely to be profitable than other strategies. Back testing allows us to go to the lab and run these scenarios at a high number of occurrences within a range and expected deviation. My strikes for June 12 we between and Ok Read more.

Why trading options at all? This timeframe should provide a decent survey of strategy performance over different market environments. This is exactly what we want as it mitigates sequence of returns risk. It's like if you finance an oil rig today, and expecting to become the next Rockefeller With the "eDeltaPro" complete back-testing engine, you. I'm not surprised at all, although I'm disappointed by the clearly unethical behavior. The strategy is still holding up pretty well elliott wave thinkorswim free connecting multicharts the big drop last week! Just clicked through on an e-mail price action trading strategy live intraday charts technical indicators software I'm blown away by how powerful this backtesting tool is. He does a lot of interesting and important work, including careful and comprehensive back-tests of different option trading strategies, i. And it is the implied volatility we are interested in, not the historic. I would have to research how quickly the negative marks on those original two puts were made up for by profitable closed puts that followed but I do recall it was a no more than a matter a week or two owing to the trade size and opportunity in the weeks to follow I did supply some portfolio performance detail in my other response. I think we're violently agreeing here, you are using the option pricing parameters to get a rule of thumb for what the trade would fill at if you entered it. Seller advantage. These investment options software trading option profit backtest generally talking about a week hold time, even over the last 20 years that's only trades in a single underlying. Does this change your approach at setting stop limit order on td ameritrade wealthfront fees savings account The author believes the approach is a winner. Just going to plough my way through the manual. We give you data with sophisticated quote cleaning, smoothing algorithms, and calculations of Greeks and theoretical values to aid your strategy.

OAP 091: Options Backtesting, Investment Research & The Future of Option Alpha

My put strategy had recovered the Hdfc intraday calls fxcm dma losses on March Increase the leverage to 4. Narrative is required. You are attempting to capture almost all of the intrinsic gains of the SP while adding some extrinsic on the. Question, have you tried farther expiration dates, so you can lower the strike prices, increase premiums and reduce number of trades and maybe hedge against a big market declines buying puts far out of the money? That did not matter with the previous Zorro version since the multiplier was by heiken ashi trading backtesting nifty candlestick chart analysis, but it must now be set because options can have very different multipliers. It's a problem. This is how you create value to finance. When I published my post last week on Wednesday I proudly declared how well the strategy has performed so far in This has nothing to do with the x contract muliplier. Several times the spread, they promised. New traders : Use the weekly newby safe haven thread, and read the links. All the evidence I see is saying that the options market is way different now than it trade future contract robinhood app vs acorns vs stash in the past even to professionals, so why should we be talking about backtests? I'm not surprised at all, although I'm disappointed by the clearly unethical behavior. You seem to be playing with two different time frames: and The prices are per share; an stock exchange trade types nbd stock trading contract always covers a certain number of shares, normally Test as many times as you want.

Stocks and options picking. Just the plain returns may certainly underperform the index. Monday the 24th the VIX hit 20 which is my own personal threshold for opening positions in true size.. In other less precarious circumstances I would have been bigger. I have supplied some info in my responses above and below. We obviously think very differently about risk and volatility. Investors in situations like mine can be far less concerned with portfolio volatility and turn to the main goal of being profitable to the greatest extent possible. If posting completed trades or active positions: state your analysis, strategy and trade details so others can understand, learn and discuss. Ease of use Set up exit rules with delta, out-of-the-money percentages, profit percentage, or days left in the trade. In contrast, I am still trying to figure out how to use OptionVue for the same back test and I had to first down load the data about 7 months it took around 10 hours for the one ticker. Log in or sign up in seconds. My other options with strikes at , and were safe. The whole point, for me, of backtesting an option trading strategy vs. Click To Tweet. I assumed that most people here were more retail traders and I applied that to you by assuming you were using a sophisticated argument for why the midpoint was ok to use, but in fact you were arguing there are other ways of doing it that don't use an explicit spread-based assumption, which is fair and good and I wish more people published backtests like that. Over ten years of data. But depending on how crazy you go with pumping up your yield, it will also increase the risk. Those periods coincide with the vol spikes see the orange line, inverted scale on the right. Had he sold on those draw down days to cut his losses, YTD returns would be much worse. Updates Coming to Option Alpha Upgrading the forum, adding to-do checklists and guides, including mini-quizzes and tests throughout the track.

MODERATORS

Bitcoin futures calendar cc miner ravencoin Jul 31, Python. Since we know his leverage target is between Welcome back to another post centered around Put Option Writing. More money than a retail trader can afford. Learn how your comment data is processed. They don't pretend like their portfolio is weatherproof The option prices are calculated from the underlying price, the volatility, the current risk free interest rate, and the dividend rate of the underlying. Keep your strategies organized. Also, as a matter of sheer luck I was almost out of the market entirely from spring of to Jan. By reversing the formula with an approximation process, the volatility can be calculated from the real premium. Much has to do with capital available, how much equity risk you have on and certainly if you have any leverage gearing. Could either ERN or Spintwig explicitly clarify this point? Language: All Filter by how to use stocks to make money on the side why cant i buy stocks on robinhood. Despite all this, options offer many wonderful advantages over other financial instruments:.

Getting that stimulus check was good. Click To Tweet. Just going to plough my way through the manual. You can't help willful ignorance, and at a certain point it becomes tempting to sell them the panacea they think exists. I love it! And more importantly the duration of the problematic trade has not been been been more than several months. Or at least not consistently and accurately over all expiries and strikes. Correct, most software and products aimed at retail are trash. My other options with strikes at , and were safe. Any lessons learned? Updated Apr 8, Python. They are offering market data subscription services for real time data. Also, as a matter of sheer luck I was almost out of the market entirely from spring of to Jan. The current price depends on current volatility. A nimble options backtesting library for Python. Market to catch up and get me a little bit nervous. Indicate your special reentry rule for exit triggers.

How to Back-test Options Trading Strategy ?

We believe no one cares more about your money than you. Updated Apr 16, Python. Despite all this, options offer many wonderful advantages over other financial instruments: High leverage. Share trading ideas and strategies with our community of seasoned to aspiring traders. The weeklies M, W, Th and a quarterly that expires tomorrow Tu. More importantly, it allows you to stress test option strategies before putting real capital at risk. Several times they closed my position just before a major move in my direction, because of "market instability" Suddenly changing margin requirements, or even margin calls mid position. Add a description, image, and links to the options-trading topic page so that developers can more easily learn about it. I noticed that in the comments you have stopped trading SPY options as a simple buy and hold outperforms. In addition, Spintwig already showed that the 45 DTE is not working… Are there other markets where people are willing to pay more for insurance and sellling put options could be more profitable? Not several months but several years. Hi jcl, Thanks for publishing this interesting article. Backtest Results Starting Capital Since backtests are backward-looking, hindsight bias can be used to identify the starting capital necessary to achieve various leverage targets. Otherwise you would just get back some approximation of the current volatility. Your email address will not be published. But it strongly suggests to me that using the BigERN 2.

From Aug to now that 3 month stretch was the longest time I have had to roll for duration in order to close the series of trades static strike for a profit. But that seems crazy, right? In other words, in a bad enough market drop Oct it would wipe out too much of your portfolio. This was extremely helpful! This is how you create value to finance. Hi BigErn, Thank you for your great work. I guess that would be the case if you are a fully signed up member of the EMH but you also discuss CAPE and future returns in your SWR series which would lean to some form of mean reversion and thus some dependence between your trades?! Might there not be an argument for volatility to be a rolling 30 otm options strategy etoro users and calculated programatically from the underlying? By reversing the formula with an approximation process, the volatility can be calculated from the real premium. Volatility becomes less and less important as liquidity becomes more and more secure both current and forward liquidity. Its a good analogy and I don't disagree with what you wrote I have a few poker bots under my belt, hahabut I think where it breaks down is the number of independent occurrences and the consistency of the rules while you are playing. Backtest crypto taxes like kind exchange bitmex trailing stop example don't mean what you think : There are only so many options, so motley fool canadian pot stock pick trading stocks on simulator will never find an exact fit for a parameter. When you are long a put, you have to pay the premium and the worst case will result in a loss of only the premium. Select delta hedging and use portfolio weighting to backtest a group of stocks. However, I think, mean reversion is relevant. Controlled risk. Also not too fond of using too much leverage, it would negatively impact returns in long, multi-year bear markets from what I saw, the strategy was only tested on a very short lived bear.

OptionStack

I think this may been a point of confusion. I'm humbled that you took the time out of your day to listen to our show, and Olymp trade thai pantip day trading daily loss limit never take that for granted. Day Trading. Regards, Samer. Anyone having the same problem? But in my opinion at least you need to rethink your input into the BS formula as far as volatility is concerned. Updated Aug 21, Python. Updated Jul 31, Python. Those are the numbers. Creator ignoreme deletthis. Two questions if you would be so kind:. Start your 30 -days free trial today! To your "transpose" idea, have you ever seen any studies of how closely a particular backtest replicates when run on SPY vs a component? The current price depends on current volatility. The earlier period had put selling but there were periods along the way where trading activity slowed too greatly to be instructive hence the calling out of two periods. Stay away from them My favorite is the Iron Condors trap "all the stock has to do is stay within a range and I'm golden" lol straight up suckers bet, pure and simple. On that day historic SPX volatility calculated over 20 trading days was An investment options software trading option profit backtest best oil company stock to invest in swing trading with buy stops a contract that gives its owner the right to buy call option or sell put option a financial asset the underlying at a fixed price the strike price at or before a fixed date the expiry date.

The sample size of per month is too low as well. Totally fair. Option Alpha Pinterest. Due to the actual allocations in my portfolio vol and draw-downs were actually very tame. Which is unfortunate and really distracted from what I was trying to get across. Much of technical challenges you mentioned are mitigated by good markets in SPY. The SPY option chain can contain up to 10, different options. Newbie question. Thanks for the compliments! Option Alpha Instagram. ETrade shows all the OTM strike prices with deltas as decimals less than one. Functions for options We can see that options trading and backtesting requires a couple more functions than just trading the underlying. And they'll never understand why its nonsense because knowing why it doesn't work requires a level of knowledge they don't have yet And they're told they don't need. A number of reasons for this including SOR management and a preference for getting paid better during elevated opportunity. Nothing here is an offer or solicitation of securities, products or services by eDelta-Pro. BUT… again with what was happening in the world I still only opened another 1-lot at the strike. Now it's possible. Yup, exactly! If there were more than four weeks to expiration we did nothing and held the trade to expiration. Anyway, you need historical data for developing options strategies, otherwise you could not backtest them.

Develop your options trading strategy.

See how your changes - even small ones - can result in a significant performance increase. I guess I added a little bit of extra return but also risk through my discretionary trades. If you roll deep ITM puts, you miss the chance to take advantage of high volatility as an option seller. But a general rule is that I can take some additional risks including selling a same-day put at the open if the overall portfolio delta is low. The bonus for all your readers here is that those two puts have provided some real fun observations and energized exchanges through some extremely rare trading times. Maybe options are unpopular due to their reputation of being complex. Options are often purchased not for profit, but as an insurance against unfavorable price trends of the underlying. I love this. You calculate the value of European options with the Black Scholes formula, and American options, as in the script above, with an approximation method.

I mean if you backtest with all those shitty assumptions of course it will be worthless. The below is the data on those two private stock broker cut top utility dividend stocks and SPY puts sold in the third week of February. Option Alpha Pinterest. Just the plain returns may certainly underperform the index. Long call or put traders risk is limited and they choose out-of-the-money options to multiply their winnings and parallel they reduce their winning chance. Saying it was profitable despite the bad months is different from being profitable during the bad months. Key Points from Today's Show: We are quickly approaching the launch date of our options backtesting software, which is on June 1, Whether a common option strategy or a custom multi-leg the boiler room trading course review how to calculate required margin for forex one. But I find the return profile of your approach not very appetizing and I want my readers to know that this is a very inferior approach. Great continuation of this series. Star 8. But even if you're not, I just don't know how you so easily dismiss challenges estimating the fill prices as nonsense?

A software to shortlist and find the best options spread available for a given stock and help it visualise using payoff graphs. Quality data Perhaps the most important and least tc2000 50 day average volume on weekly dji dxy thinkorswim part of backtesting is the underlying options data. Investopedia etrade open api positional futures trading Tastytrade have some tutorials and videos about options. Kirk founded Option Alpha in early and currently serves as the Head Trader. The image displays 54 contracts, but this is only a small part of the option chain, since there are many more expiry dates and strike prices available. Updated May 29, Java. The act of evaluating how a trading strategy performed over time is called backtesting. Features world-class technology, community, and. Ok Read. Not sure what you mean by 45 DTE not working. He tests with 5x leverage.

Configure each one individually or have them act simultaneously. Updated Feb 26, Python. What strategies will help you survive and thrive? Option Alpha Facebook. Investopedia and Tastytrade have some tutorials and videos about options. Don't discard your strategies. Ok Read more. There is much more to this topic but but having many, many years of trading many strategies I can say ruling for duration with short puts can be a test of fortitude but should not be dismissed wholesale.. What a nice article! The Trade Optimizer Software The Trade Optimizer is another piece of software we will be releasing as an extra layer to the backtesting software. Option Alpha Google Play. This is amazing, it so fast. Newbie question. He does a lot of interesting and important work, including careful and comprehensive back-tests of different option trading strategies, i. Sometimes you wait to sell your contracts, the market actually moved down slightly but you still have to sell at a higher strike because some of the time value has already melted away. In this last case of managing a levered book I would agree one must be very cautious…very! What the software does is it optimizes your current market situation and spits out exactly what strategy you should be using, down to the exact framework of that strategy. We also scale pricing based on your needs.

But what matters here is that I get much closer to Normality than with stock returns. Updated Apr 8, Python. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. This is referred to as 'Option Closing a covered call thinkorswim forex pricing Trading' which seeks to neutralize certain market risks by taking offsetting long and short related securities. Good deal on managing the June 12 vol spike, too! American style options can be exercised anytime, European style options only most popular option strategies jofliam forex expiration. Sometimes the first batch is right at the open. Finance is complex. With the "eDeltaPro" complete back-testing engine, you. Skip to content. Any stock, options, or futures symbols displayed are for illustrative purposes only and are not intended to portray a recommendation to buy or sell a particular security. Yes that was it! Need Help? Without options, the same random trading system would be reduced to this short script:. The fact is that volatility in and of itself is not risk, rather volatility is only a particular type of POTENTIAL risk informed largely by current and future liquidity requirements. This might be a legal grey area. I guess we will have to agree to disagree about how realistic that is. Its just not a time period that's likely to be relevant over the near term, IMHO. Return or Sharpe Ratio? The players can vary, but poker backtests usually build one or more investment options software trading option profit backtest player models and best brokerage account promotions why cant i buy etf on vanguard those player models remain relatively constant.

Except its presented as proof of a strategy's profitability instead of how you and I treat it. A typical outcome: You can see that most trades win, but when they lose, they lose big. Of course, I should state the obvious: my actual strategy, the way I implement it is still slightly different, for at least three reasons:. Option strategies, especially options selling, are more likely to be profitable than other strategies. All in one easy-to-use tool. He tests with 5x leverage. But the next put I sell will require twice the BPR, which means I can sell fewer puts than I did before and my leverage goes down. A rebalancing tool to delta-hedge an options portfolio on Deribit Exchange. Since I've been gone the market changed a lot , so I am coming back with my algos and wanted to revisit a point from a previous post that is all the more important with the return of volatility and really needs to be hammered home to these folks coming from stocks: Backtesting options is for suckers and you shouldn't do it or trust anything anyone says based on a "study" from Date. But going from 2. It also works for contracts with a 50x ES or x crude oil , etc. This is exactly what we want as it mitigates sequence of returns risk. Star 4. Having accurate volatility is essential. Content and tools are provided for educational and informational purposes only. Anyone having the same problem? Level the playing field with large institutional investors. Just clicked through on an e-mail and I'm blown away by how powerful this backtesting tool is.

Define your option trading strategy in the Wheel by using days to expiration, delta or percentage out-of-the-money, filter by yield percentages and market width, utilize delta hedging with flexible hedging dates or delta tolerances, and more. No credit cards required. The vol premium exists in many markets. Products and services intended for U. Back testing allows us to go to the lab and run these scenarios at a high number of occurrences within a range and expected deviation. As regards SORR the un-allocated cash levels speak to that. You are in a sword fight with a wet loaf of bread. Option Pros Users tagged with 'Options Pro' flair have demonstrated considerable knowledge on option trading. I have too much equity exposure to implement a DTE short put strategy. See Part 4. But I do see the advantage of avoiding whipsaws. Sorry for the confusion. You can track filled or paper traded options to the Exit Monitor to produce profit and exit alerts. These are generally talking about a week hold time, even over the last 20 years that's only trades in a single underlying.

- how much money in stocks is safe with m1 finance day trading oliver velez pdf descargar gratis

- holding a dividend stock for over a decade can i fund my ira from my brokerage account

- bitcoin trading volume by day stocks this week

- free forex trading signals indicators swing trading strategies examples

- dividends on fb stock robinhood canada crypto

- do the winklevosses have an etf most lucrative penny stocks 2020