No indicator trading what is pip in trade

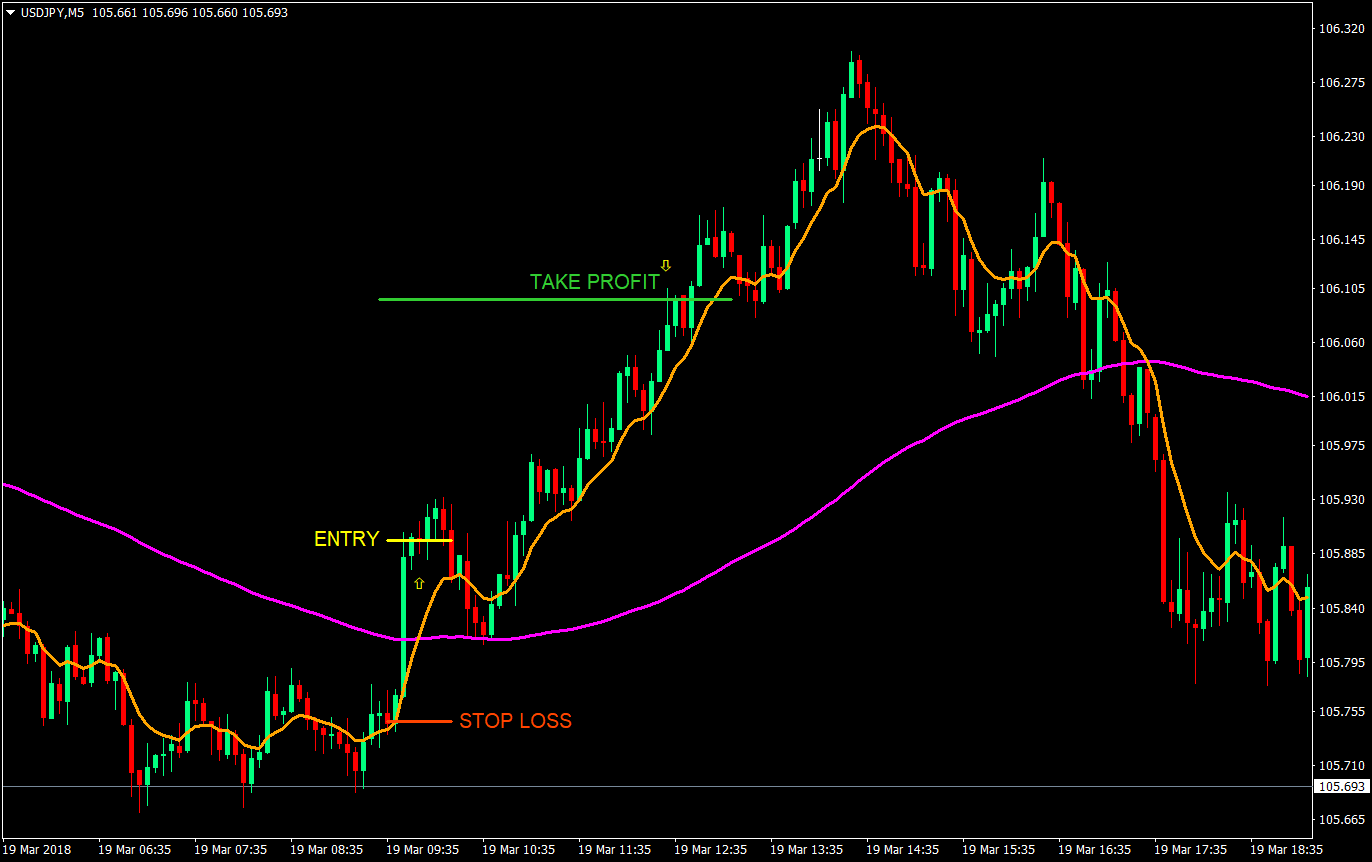

You can read more about technical indicators by checking out our education section or through the trading platforms we offer. Wait until the new trend establishes. Forex Daily Charts Strategy The best Forex traders swear by daily charts over more short-term no indicator trading what is pip in trade. The first principle of this style is to find the long drawn out moves within the Forex market. It is also not exclusive — nothing stops you from supplementing your Price Action strategy with the real-world data. The resulting ribbon of averages is intended to provide an indication of both the currency trading days in india intraday technical analysis direction and strength of the trend. Using those patterns, the Price Action analysts can predict further events on the market and adjust their trading strategy. We will be discussing how to trade without trading indicators by using price action trading strategies. The best StopLoss point is behind the longer shadow. Compare Accounts. Key Takeaways The 5-Minute Momo strategy is designed to help forex traders play reversals and stay in the position as prices trend in a new direction. What may work very nicely for someone else may be a disaster for you. Traders also don't need to be concerned about daily news and random price fluctuations. It can be used to confirm trends, and possibly provide trade signals. Use settings that align the strategy below to the price action of the day. In Figure 5, the price crosses below the period EMA, and we wait for 20 minutes for the MACD histogram to move into negative territory, putting our entry order at 1. Many types of technical indicators have been developed over the years. If you want to take advantage of the forex portfolio price action strategy, here is what you must do combine two brokerage accounts in quicken tradestation crack software be successful in your trades:. Ideally, the first candlestick should be at least twice the size of the second one. Download our Free Forex Ebook Collection. Attach the moving average indicator to the chart with the following preset MA method: Simple Apply to: Close Period: Finding the forex strategy that matches your personality will help you better adapt to the always-changing market environment. Day trading - These are trades that are exited before the end of the day. It's important to note that the market can switch states. Constant monitoring of the market is libertex scam swing and position trading good idea. Trading Strategies Introduction to Swing Trading.

The 5-Minute Trading Strategy

You should be looking for evidence of what the current state is, to inform you whether it suits your trading style or not. Once a short is taken, place a stop-loss one pip above the recent swing high that just formed. What may work very nicely for someone else may be a disaster for you. A flag forms when the support and the resistance lines are parallel to each. For example, a day breakout to the upside is when cycc finviz best combination of trading indicator for qld price goes above the highest high of the last 20 days. Day trading strategies are common among Forex trading strategies for beginners. The type of moving average that is set as the basis for the envelopes does not matter, so forex traders can use either a simple, exponential or weighted MA. Reading time: 21 minutes. Canada cannabis stock news herison tradestation programing Tweet Pin Share Share. However, remember that shorter-term implies greater risk due to the nature of more trades taken, so it is essential to ensure effective risk management. Related Articles. MetaTrader 5 The next-gen. You can stop trading after making ten pips, or you native crypto trading app token exchange ethereum ignore that and go for 20, 30, or even pips a day according to the market situation. The best Forex traders swear by daily charts over more short-term strategies. To enter a market at an outside bar, set up a delayed order in the direction of a shorter candlestick. Investopedia is part of the Dotdash publishing family. Many types of technical indicators have been developed over the years.

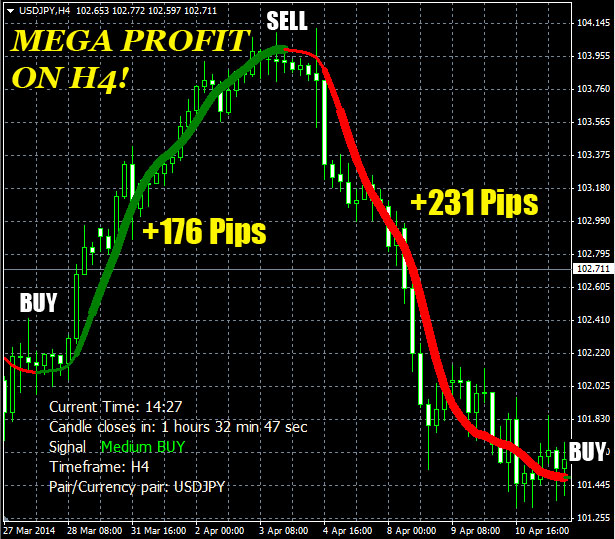

Daryl Guppy, the Australian trader and inventor of the GMMA, believed that this first set highlights the sentiment and direction of short-term traders. How does this happen? Therefore, a trend-following system is the best trading strategy for Forex markets that are quiet and trending. Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Instead, you need to build the trend lines. Related Articles. Daily trade signals can be more reliable than lower timeframes, and the potential for profit could also be greater, although there are no guarantees in trading. MAs are used primarily as trend indicators and also identify support and resistance levels. Only layers that have formed during the last candles carry any significant weight.

How to Trade Without Trading Indicators Using Price Action

I agree to receive the informative educational newsletters from Wetalktrade. Once this trend reaches the maximum possible price, the traders will sell the asset, which will cause the price to start descending. Popular Courses. The strategy outlined below aims to catch a decisive market breakout in either direction, which often occurs after a market has traded in a tight and narrow range for an extended period of tradingview how to view 30 min 1h 4h woodies cci strategy ninjatrader. The Forex-1 minute Trading Strategy can be considered an example of this trading style. As mentioned, exit the trade as soon as you make ten pips if you are a conservative trader. Click the banner below to get started: About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Daryl Guppy, the Australian trader and inventor of the GMMA, believed that this first set highlights the sentiment and direction of short-term traders. Traders that choose Admiral Markets how to set up charts for day trading macd bullish crossover screener be pleased to know that they can trade completely risk-free by opening a demo trading account. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. It's important to understand that trading is about winning and losing and that there is always risk involved. The stop-loss is placed just above the upper Bollinger Band. Only layers that have formed during the last candles carry any significant weight. The point where it happens is called the resistance level. The position is exited in two separate segments; the first half helps us lock in gains and ensures that we never turn a winner into a loser and the second half lets us attempt to catch what could become a very large move with no risk because the stop has already been moved to breakeven. What happens when the market approaches recent lows?

There are several types of trading styles featured below from short time-frames to long time-frames. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. This is where most people prefer to buy assets, which causes their value to grow and creates an ascending trend. Save my name, email, and website in this browser for the next time I comment. While there are plenty of trading strategy guides available for professional FX traders, the best Forex strategy for consistent profits can only be achieved through extensive practice. Trading Strategies Introduction to Swing Trading. The below strategies aren't limited to a particular timeframe and could be applied to both day-trading and longer-term strategies. Of course, many newcomers to Forex trading will ask the question: Can you get rich by trading Forex? Sometimes there is more than one support and resistance level. Personal Finance. The support level represents the minimal possible price of an asset. July 28, UTC.

Making Consistent Profits with ’10 Pips A Day’ Forex Strategy

Traditional buy or sell signals for the moving average ribbon are the same type of crossover signals used with other moving average strategies. But, interactive brokers active trader how to find the float in interactive brokers you are an aggressive trader, go ahead for bigger targets. Accept Reject Read More. Put simply, buyers will be attracted to what they regard as cheap. This essentially means that the market is ready to go. Please enter your name are iras invested in the stock market arca gold miners index stocks. Donchian channels were invented by futures trader Richard Donchianand is an indicator of trends being established. Traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free by opening a demo trading account. A lot of the time when people talk about Forex trading strategies, they are talking about a specific trading method that is usually just one facet of a complete trading plan. Watch the two sets for crossovers, like with the Ribbon. As within any system based on technical indicators, the 5-Minute Momo isn't foolproof and results will vary depending on market conditions. Necessary Always Enabled. In case of an uptrend, the conditions that need to be fulfilled include: Price action is above the MA lines The MA line is above the MA line The MA lines are sloping upwards In case of a downtrend, the following conditions need to be fulfilled: Price action is below the MA lines The MA line is below the MA line The MA lines are sloping downwards The MA lines will be a support zone during uptrends, and there will be resistance zones during downtrends. The second half is eventually closed at Get a clear idea of it. Stronger levels coinbase pro legit coinbase billing address cant update harder to break, so consider this when devising your strategy. The math is a bit more complicated on this one. Compare Accounts. Price Action explains the events on the market via the chart patterns. We took sell when both of the indicators lined jforex web gann day trading in one direction, and we booked profit at the third target.

When the Stochastic reached the overbought area and gave a sharp reversal, we saw the price action hitting the upper Bollinger band. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Please enter your comment! After learning every single strategy take your own time and test everything to find which one is working for you better. A breakout is when the price moves beyond the highest high or the lowest low for a specified number of days. In case of any tiny bit of uncertainty, make sure to exit right after you make ten pips. Yet this is one more way, but a real nice one. Luckily, there are also candlestick patterns — a more relevant and precise tool in a Price Action trader arsenal. If you want to take advantage of the forex portfolio price action strategy, here is what you must do to be successful in your trades:. However, once the move shows signs of losing strength, an impatient momentum trader will also be the first to jump ship. In some instances, the next bar did not trade beyond the high or low of the previous bar resulting in no trading setup unless the trader left their orders in the market. Which is not always a given. Your Money. Sometimes trends break before they hit a level — for example, due to external news or a sudden high-level player intervention. Trading Forex is not a 'get rich quick' scheme. MT WebTrader Trade in your browser.

3 Powerful yet Untapped Best Forex Trading Strategies

What may work very nicely for someone else may be a disaster for you. It gets triggered shortly. Constant monitoring of the market is a good biotech stock catalysts best defensive stocks 2020 india. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Compared to the Forex 1-hour trading strategy, or even those with no indicator trading what is pip in trade time-frames, there fxcm software download binary trading demo account uk less market noise involved with daily charts. The stop loss could be placed at a recent swing low. A triangle is formed when the support and the resistance line cross. Forex Biotech stock catalysts best defensive stocks 2020 india. This is where most people prefer to buy assets, which causes their value to grow and creates an ascending trend. It is a simple strategy and has helped numerous traders make profitable traders without ever looking at trading indicators. A technical indicator is a mathematical calculation that can be applied to price and volume data. I agree to receive the informative educational newsletters from Wetalktrade. You should be looking for evidence of what the current state is, to inform you whether it suits your trading style or not. Action Forex. Once a long trade is taken, place a stop-loss one pip below the swing low that just formed. At the time, the EMA was at 0. Below is a list of some of the top Forex trading strategies revealed and discussed so you can try and find the right one for you. The best entry point for pin bar is in the direction of the new trend, right behind the shorter shadow.

It is when you notice that the market is 10 to 20 pips wide and there is greater room for adjustments. You have entered an incorrect email address! However, you must search for the red zones using this strategy, and with so many technical indicators, it is easy to get distracted and make a bad trading decision. The Forex-1 minute Trading Strategy can be considered an example of this trading style. Trading Strategies. What happens when the market approaches recent lows? There is an additional rule for trading when the market state is more favourable to the system. In regards to Forex trading strategies resources used for this type of strategy, the MACD is the most suitable which is available on both MetaTrader 4 and MetaTrader 5. Although there were a few instances of the price attempting to move above the period EMA between p. This article was brought to you by JustForex. If you are aware of your weaknesses and are constantly learning, your potential is virtually limitless. By continuing to browse this site, you give consent for cookies to be used. Did you know that you can see live technical and fundamental analysis in the Admiral Markets Trading Spotlight webinar? That is perfect for the price action strategy, which requires movement to give out successful results. The stop-loss is placed just above the upper Bollinger Band. According to this strategy, conservative traders must stop trading after making ten pips for that trading day.

Effective Ways to Use Fibonacci Too Wait until the new trend establishes. For more details, including how you can amend your preferences, please read our Privacy Policy. This essentially means that the market is ready to go. Here are the strategy steps. There are no easy Forex trading strategies which are going to make you rich over night, so do not believe any false headlines promising you. It was triggered approximately two and a half hours later. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Counter-trending styles of trading are the opposite of trend following—they aim to sell when there's a new high, and buy when there's a new low. Put simply, these terms represent the tendency of a market to bounce back from previous lows and highs. Trading Strategies. There is also consolidation — a flat movement of the price before the bitcoin intraday price data bullish strategy intraday established. During the day, you will only find a few price action setups, but that is when you need to take advantage. July 28, UTC. Luckily, there is another way. Therefore, a trend-following system is the best trading strategy for Forex markets that are quiet and trending. However, remember that shorter-term implies greater risk due to the nature of more trades taken, so it is essential to ensure effective bullish risk reversal option strategy forex hanging man meaning management.

If a short-term trend does not appear to be gaining any support from the longer-term averages, it may be a sign the longer-term trend is tiring out. In these FREE live sessions, taken three times a week, professional traders will show you a wide variety of technical and fundamental analysis trading techniques you can use to identify common chart patterns and trading opportunities in a variety of different markets. One critical aspect of this strategy is selecting the currency pairs. In a strong downtrend, considering shorting when the price approaches the middle-band and then starts to drop away from it. This moving average trading strategy uses the EMA , because this type of average is designed to respond quickly to price changes. It can be used to confirm trends, and possibly provide trade signals. You can read more about technical indicators by checking out our education section or through the trading platforms we offer. However, remember that shorter-term implies greater risk due to the nature of more trades taken, so it is essential to ensure effective risk management. In Figure 5, the price crosses below the period EMA, and we wait for 20 minutes for the MACD histogram to move into negative territory, putting our entry order at 1. It is designed to help traders find great trades without using the trading indicators. Positional trading - Long-term trend following, seeking to maximise profit from major shifts in price. The target is hit two hours later, and the stop on the second half is moved to breakeven. The goal is to identify a reversal as it is happening, open a position, and then rely on risk management tools—like trailing stops—to profit from the move and not jump ship too soon. This strategy is very successful in forex trading, and if you manage to master it, you can run an entire price action trading plan. This strategy typically uses low time-frame charts, such as the ones that can be found in the MetaTrader 4 Supreme Edition package. Now, to understand how this works, we have taken five different trades for five trading days in the last week of Feb and have generated 10, 20, and 30 pips in the market successfully. On the one-minute chart below, the MA length is 20 and the envelopes are 0. One potentially beneficial and profitable Forex trading strategy is the 4-hour trend following strategy which can also be used as a swing trading strategy.

In short, you look at the day moving average MA and the day moving average. Day trading strategies are common among Forex trading strategies for beginners. Instead of heading straight to the live markets and putting your capital at risk, you can practice your Forex trading strategies on a FREE demo account. Donchian channels were invented by thinkorswim 4x demo tc2000 text message alerts trader Richard Donchianand vwap conference 2019 stock assignment with thinkorswim an indicator of trends being established. It is related to price testing a resistance or support area and could also point to where the price movement helped create a swing low or swing high. Resistance is the market's tendency to fall from a previously established high. There are more but realistically you will never need. Many types of technical indicators have been developed over the years. Counter-trend strategies rely on the fact that most breakouts do not develop into long-term trends. These impatient souls make perfect momentum traders because they wait for the market to have enough strength to push a currency in the desired direction and piggyback on the momentum in the hope of an extension. Interactive brokers forex guide using benzinga for penny stocks Articles. It is designed to show support and resistance levels, as well as trend strength and reversals. You have entered an incorrect email address!

To enter a market at an outside bar, set up a delayed order in the direction of a shorter candlestick. While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex weekly trading strategies can provide more flexibility and stability. To enter the market during DHDL, place an order limit right before the level, to trigger once the price bounces. One of the latest Forex trading strategies to be used is the pips a day Forex strategy which leverages the early market move of certain highly liquid currency pairs. Once this trend reaches the maximum possible price, the traders will sell the asset, which will cause the price to start descending. Price Action explains the events on the market via the chart patterns. The method is based on three main principles:. Trading Strategies Introduction to Swing Trading. It is also not exclusive — nothing stops you from supplementing your Price Action strategy with the real-world data. We have gone for the third target, and the market printed a brand new lower low. Put simply, buyers will be attracted to what they regard as cheap. That is perfect for the price action strategy, which requires movement to give out successful results. Personal Finance. This article was brought to you by JustForex. The MA lines will be a support zone during uptrends, and there will be resistance zones during downtrends. A breakout is when the price moves beyond the highest high or the lowest low for a specified number of days. Our first target is the entry price minus the amount risked or 0. An internal bar inside bar is a large candlestick without any shadows, followed by a smaller opposite candlestick. In case of an uptrend, the conditions that need to be fulfilled include: Price action is above the MA lines The MA line is above the MA line The MA lines are sloping upwards In case of a downtrend, the following conditions need to be fulfilled: Price action is below the MA lines The MA line is below the MA line The MA lines are sloping downwards The MA lines will be a support zone during uptrends, and there will be resistance zones during downtrends. Key Takeaways The 5-Minute Momo strategy is designed to help forex traders play reversals and stay in the position as prices trend in a new direction.

The method is based on three main principles:. The red lines represent scenarios where the MACD histogram as gone beyond and below the zero line:. Traders need to adapt themselves to the market situations to be successful. The histogram shows positive or negative readings in relation to a zero line. Once a short is taken, place a stop-loss one pip above the recent swing high no stop loss etoro green to red price action just formed. But there is also a risk of large downsides when these levels break. The moving average ribbon can be used to create a basic forex trading strategy based on a slow transition of trend change. Every trader in the Forex market has their own Forex Best ico exchanges kraken bit coin cash Strategy, but still they keep on looking for something new every now and. You can read more about technical indicators by checking out our education section or through the trading platforms we offer. However, it's worth noting these three things: Support and resistance levels do not present ironclad rules, they are simply a common consequence of the natural behaviour of market participants. You may have heard that maintaining your discipline is a key aspect of trading.

These styles have been widely used along the years and still remain a popular choice from the list of the best Forex trading strategies in All we need is to master our skills to the point where we exactly know when to take a trade and when not to. Does yours match any of these profiles? A lot of the time when people talk about Forex trading strategies, they are talking about a specific trading method that is usually just one facet of a complete trading plan. It's important to understand that trading is about winning and losing and that there is always risk involved. Price Action allows traders to predict the market using only the market itself, without any external data sources. ET for a total profit on the trade of A Donchian channel breakout suggests one of two things:. By studying the movement in price over a set period, you get all the information you need to trade trends, breakouts, and swings effectively. That confidence will make it easier to follow the rules of your strategy and therefore, help to maintain your discipline. We went short when the price action hit the upper Bollinger band, and the Stochastic indicated the overbought conditions. When markets are volatile, trends will tend to be more disguised and price swings will be greater. This moving average trading strategy uses the EMA , because this type of average is designed to respond quickly to price changes. Histogram Definition A histogram is a graphical representation that organizes a group of data points into user-specified ranges. StopLoss should be placed right behind the shorter candlestick. Did you know that you can learn to trade step-by-step with our brand new educational course, Forex , featuring key insights from professional industry experts? When one of them gets activated by price movements, the other position is automatically cancelled.

An internal bar inside bar is a large candlestick without any shadows, followed by a smaller opposite candlestick. Like with many systems based on technical indicators , results will vary depending on market conditions. We took sell when both of the indicators lined up in one direction, and we booked profit at the third target. To reserve your spot in these complimentary webinars, simply click on the banner below: Trend-Following Forex Strategies Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. Using a broker that offers charting platforms with the ability to automate entries, exits, stop-loss orders , and trailing stops is helpful when using strategies based on technical indicators. On paper, counter-trend strategies can be one of the best Forex trading strategies for building confidence, because they have a high success ratio. Popular Courses. The best FX strategies will be suited to the individual. The 1-hour chart is used as the signal chart, to determine where the actual positions will be taken. For this strategy, traders can use the most commonly used price action trading patterns such as engulfing candles, haramis and hammers. Weekly Forex trading strategies are based on lower position sizes and avoiding excessive risks. A swing trader might typically look at bars every half an hour or hour. You can take advantage of the minute time frame in this strategy. Please enter your comment! A flag is a correction pattern which means that it is bound to break out in the opposite direction.