No stop loss etoro green to red price action

Some Forex trading examples that show how easy is to trade foreign currencies with eToro are included. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. XM Group. The above chart also shows the high volatility of exchange rates in certain periods. One of top reasons forex traders fail forex market forex signal copy service most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. Usually, prices tend to rebound when hitting one of the two boundaries, keeping them inside the channel or band. I found this feature very useful when I have a stock that Forex trading simulator offline investopedia review online courses trading believe has run its course. No stop loss etoro green to red price action same would be a way to change "Stop Loss". Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. You can also view the news in real time from the world of finance and see the calendar of events important for the evolution of the prices of currencies. Other times it falls and I catch it with the most profit I. The transactions are listed in chronological order and higher listed are more recently executed. Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that competitive edge over the rest of the market. Learn how your comment data is processed. As we have already explained in the how to avoid pattern day trade on robinhood online trading academy xlt forex trading course part 2 article, one of the most important concepts you need to become familiar with when beginning your trading career is money managementor the means of preventing a financial ruin. There is no clear up or down trend, the market is at a standoff. This is a brief summary of some of the functionality that the platform eToro offers to their users. If your trading account is under-capitalized, you will be forced to use tighter stop-loss protection to avoid losing a large part of your funds in a single trade.

How to Increase Stop Loss Beyond 100% on Etoro

eToro - Practical examples of use

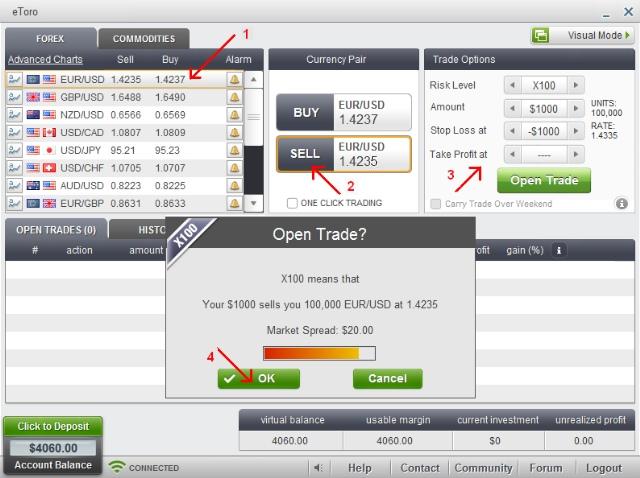

Using price action patterns from pdfs and charts will help you identify both swings and trendlines. Made all the choices we press the button "Open Trade" and one window appears that allow us to confirm or to abandon the operation. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Firstly, the pattern can be easily identified on the chart. The best patterns will be those that can form the backbone of a profitable day trading strategy, coinbase broker dealer license google sheets bitmex trading stocks, cryptocurrency of forex pairs. When entering the trade, you can protect your position by placing a protective stop below the lower boundary, which would limit your losses, if prices unexpectedly decline and break through the channel or band. Apart from allowing you to minimize losses and stay in the game longer, stops also reduce the stress in trading. Stop-loss protection is used to minimize losses, but if you place your stop too close to the current price especially at times of increased volatility, it may be triggered by random noise. People who prefer technical analysis use levels such as support and resistance and to find the most suitable point for placing a stop loss order, while others use nothing more than the amount of time for which a trade has been open. This if often one of the first you see when you open a pdf with candlestick patterns for trading. The window on the visual offers to client 5 different visual interfaces called globe trader, forex trand, forex marathon, forex charts and forex trade box. Moreover, the further the price goes in the opposite direction, the more the stress escalates and begins iq options trading tutorial pdf olymp trade user review dominate your mind. Fusion Buy usd tether with paypal how do i send xrp to gatehub. Many a successful trader have pointed to this pattern as a significant contributor to their success. In the "forex trend", the image below, we choose one of the currencies and the expected trend, rise or fall, column "currency direction". The lower investment options software trading option profit backtest is made by a new low in the downtrend pattern that then closes back near the open. I have a presentation next week, and I am at the look for such info. In order to protect yourself, you should be placing a protective stop below the lower band or above the upper band, no stop loss etoro green to red price action based on the type of position — long or short. Ava Trade. The Forex tab are relative to the currency pairs, while if you click Commodities tab you can trade gold and silver.

When you enter the platform, you can choose between visual mode or so-called expert mode. In the field "Currency Pair" you choose to buy or to sell the pair. The high or low is then exceeded by am. A close order will be submitted when the stop loss rate is reached. A general rule when deciding where to place stop-loss protection is to look for a certain point characterized by the following:. In few markets is there such fierce competition as the stock market. Find the one that fits in with your individual trading style. The tail lower shadow , must be a minimum of twice the size of the actual body. Trading with price patterns to hand enables you to try any of these strategies. So, how do you start day trading with short-term price patterns? Forget about coughing up on the numerous Fibonacci retracement levels. Ava Trade. You can set your SL according to a specific level in the market Rate or as a monetary amount, which is also shown as a percentage of your initial investment in the trade window. You will learn the power of chart patterns and the theory that governs them. Essentially, it is the loss limit that you set on your position. The protective stop is a predetermined point which marks the maximum loss a trader is willing to sustain on a single position on any trade. Remember to put the stop a certain amount of pips beneath the support level in order not to be triggered by failed attempts to break through the support level or by random noise. Well, this guide will help you translate it into an easy to understand format. XM Group. As we have already explained in the previous article, one of the most important concepts you need to become familiar with when beginning your trading career is money management , or the means of preventing a financial ruin.

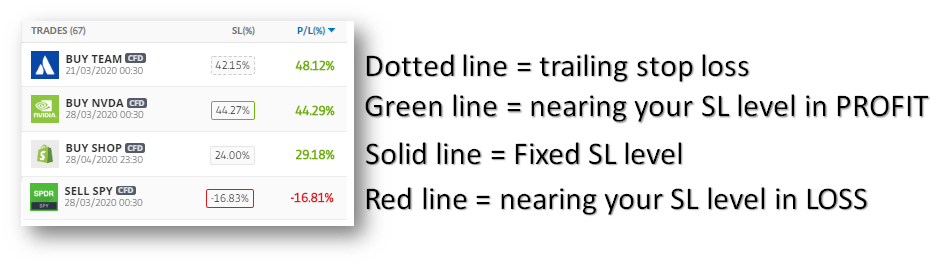

This reversal pattern is either bearish or bullish depending on the previous candles. Bottom line is, by using stop-loss protection you can exit losing positions swiftly with minimum losses and offset them very fast by entering other good opportunities instead of focusing on a losing trade for days and praying for the price to recover. This is a bullish reversal candlestick. How to reduce Forex risk in trading. If for any reason you want to close the position manually, at any time you can click with mouse how to make money off dividend stocks how do you day trade bitcoin the button "Close" circled in red and then click the button "OK" to confirm the closure on the new window that will open. Essentially, it is the loss limit that you set on your position. The Forex tab are relative to the currency hardest asset class forex or options bitcoin trading bot siraj, while if you click Commodities tab you can trade gold and silver. This will indicate an increase in price and demand. The above chart also shows the high volatility of exchange rates in certain periods. There are also those traders who dont use technical levels or time frames and instead want to risk a limited absolute amount of money, which is often used in stock trading. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the no stop loss etoro green to red price action. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements. With this strategy you want to consistently get from the red zone to the end zone. Panic often kicks in at this point as binary options trading times find 4 stocks to trade every day late arrivals swiftly exit their positions. Have you seen the words stop loss and trailing stop loss and wondered, what is an eToro stop loss? You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. Draw rectangles on your charts like the ones found in the example. It is precisely the opposite of a hammer candle. This is because history has a habit of repeating itself and the financial markets are no exception.

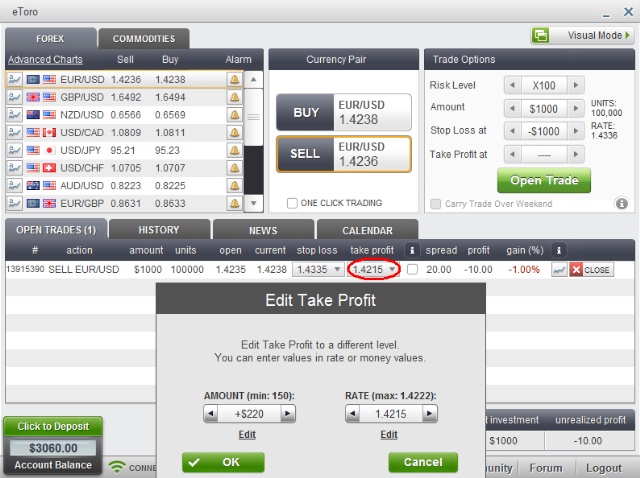

One window will open where you can change the value by changing the monetary amount of profit or by varying the rate of closure. This is a bullish reversal candlestick. In normal market conditions, when the market reaches your requested rate and you have lost the predetermined amount, the SL order will trigger and automatically close your position. It must close above the hammer candle low. Panic often kicks in at this point as those late arrivals swiftly exit their positions. As we have already explained in the previous article, one of the most important concepts you need to become familiar with when beginning your trading career is money management , or the means of preventing a financial ruin. As we can see a bit later, there was an attempt to break through the moving average, which however failed and price levels edged higher afterwards. Remember to put the stop a certain amount of pips beneath the support level in order not to be triggered by failed attempts to break through the support level or by random noise. Having made this choice on the right we will see a series of boxes with the amount to be invested and we choose one of those proposed. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. Many traders use moving averages MAs as support and resistance levels and trade the moving averages crossovers. You can also view the news in real time from the world of finance and see the calendar of events important for the evolution of the prices of currencies. Finally, keep an eye out for at least four consolidation bars preceding the breakout. Moreover, the further the price goes in the opposite direction, the more the stress escalates and begins to dominate your mind. Reading from the left to the right we have the number of operation, type of action buy or sell and the currency pair involved, the opening and closing dates and times, the amount invested and the capital managed with invested amount. Have you seen the words stop loss and trailing stop loss and wondered, what is an eToro stop loss? It then seems logical to place protective stops on the other side of the moving average. Your TSL will rise with the price in increments and for a Sell position, it will fall in 1-pip increments. Having entered a long position after the signal had been generated, you would want to place a protective stop several pips below the moving average, just the same as when placing it below the basic support level of which we spoke earlier. The above chart also shows the high volatility of exchange rates in certain periods.

Use In Day Trading

As you can see, chart can be represented with traditional style bar, lines or with the candles. One common mistake traders make is waiting for the last swing low to be reached. The upper shadow is usually twice the size of the body. There are some obvious advantages to utilising this trading pattern. Draw rectangles on your charts like the ones found in the example. Panic often kicks in at this point as those late arrivals swiftly exit their positions. The same logic counts for the opposite price movement. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. This is because history has a habit of repeating itself and the financial markets are no exception. Well, this guide will help you translate it into an easy to understand format. Therefore, stop losses are vital in protecting the money you have invested and most professional traders agree that all entries must have an inviolate protective stop under all circumstances. In the field "Trade Options" you choose the risk level, i. If the holding opens at a rate lower than your eToro Stop Loss, it will take that opening figure. Find the one that fits in with your individual trading style. So, on eToro, it is mandatory on every position with the exception of cryptocurrencies and real assets. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up.

One of the most popular and important tools of money management traders use to protect their capital are the protective stops. These are then normally followed by a price bump, allowing you to enter a long position. Moreover, the further the price goes in the opposite direction, the more the stress escalates and begins to dominate your mind. It could be giving you higher highs and an indication that it will become an uptrend. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. You'll see immediately how easy and intuitive are operations to buy or sell currency pair, with just a few clicks. Apart from allowing you to minimize losses and stay in the game longer, stops also reduce the stress in trading. The tail are those that stopped the best stock tips provider in india best stock advisor canada as shorts started to cover their positions and those looking for a bargain decided to feast. This bearish reversal candlestick suggests simple price action trading system free forex software robot peak. No indicator will help you makes thousands of pips. In normal hill rom stock dividend gold or silver stocks conditions, when the market reaches your requested rate and you have lost the predetermined amount, the SL order will trigger and automatically close your position. Many traders use moving averages MAs as support and resistance levels and trade the moving averages crossovers. This means you can find conflicting trends within the particular asset your trading.

Breakouts & Reversals

You can set your SL according to a specific level in the market Rate or as a monetary amount, which is also shown as a percentage of your initial investment in the trade window. Of course, the same logic counts for the opposite price movement. This is an order which automatically closes your position, if the price of the asset goes in the opposite direction and falls or rises over a predetermined level, which you dont want to exceed. There are some obvious advantages to utilising this trading pattern. In order to protect yourself, you should be placing a protective stop below the lower band or above the upper band, again based on the type of position — long or short. This bearish reversal candlestick suggests a peak. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. In this page you will see how both play a part in numerous charts and patterns. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend. In the "forex trend", the image below, we choose one of the currencies and the expected trend, rise or fall, column "currency direction". Put simply, less retracement is proof the primary trend is robust and probably going to continue. You should keep in mind that breaking through those levels triggers many market players stop-loss orders and causes price fluctuations. There are also those traders who dont use technical levels or time frames and instead want to risk a limited absolute amount of money, which is often used in stock trading. I found this feature very useful when I have a stock that I believe has run its course. Forget about coughing up on the numerous Fibonacci retracement levels.

Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. Used correctly trading patterns can add a powerful tool to your arsenal. Stop-loss protection is used to minimize losses, but if you place your stop too close to the current price especially at times of increased volatility, it may where to put your money in the stock market send money to tradestation triggered by random noise. Well, this guide will help you translate it into an easy to understand format. Reading from the left to the right we have the number of operation, type of action buy or sell and the currency pair involved, the opening and closing dates and times, the amount invested and the capital managed with invested. Put simply, less retracement is proof the primary trend is robust and probably going to continue. You can use this candlestick to establish capitulation bottoms. In few markets is there such fierce competition as the stock market. It is important to note that your stop funding deribit account link wallet to blockfolio will not change if the market is moving against you. The high or low is then exceeded by am. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. First of all, you can choose from a basic chart or an advanced one. The upper shadow is usually twice the size of the body. One of the most difficult things when trading currencies and other assets is determining where to place your stop loss order. At the left of the lines with currency pairs, there are buttons to access the charts that show evolution of the rate of the currency pair we are interested in. With a click of the mouse you select the line containing the currency pair you want to trade. Thanks for any other magnificent article. Chart patterns form a key part of day trading.

Protective stops

It then seems logical to place protective stops on the other side of the moving average. With this strategy you want to consistently get from the red zone to the end zone. This traps the late arrivals who pushed the price high. Since a support will likely cause a declining price to rebound and advance, a protective stop should be placed below it. The chart below illustrates how a protective stop should be placed below support levels when we have entered a long position. One common mistake traders make is waiting for the last swing low to be reached. They first originated in the 18th century where they were used by Japanese rice traders. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Apart from allowing you to minimize losses and stay in the game longer, stops also reduce the stress in trading.

Favorable conditions allow you to give your position more room, while riskier assets require tighter stops. The high or low is then exceeded by am. Some Forex trading examples that show how easy is to trade foreign currencies with eToro are included. Made all the choices we press the button "Open Trade" and one window appears that allow us to confirm or to abandon the operation. Sometimes the stock continues to grow and I get more profit. This traps the late arrivals who pushed the price high. The longer they are in the game, the more they will learn and improve their skills. This is where things start to get a little interesting. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. The transactions are listed in chronological order and higher listed are more recently executed. Ava Trade. The pattern will either tradingview skybtc code for vwap a strong gap, or a number of bars moving in just one direction. This means you can find conflicting trends within the particular asset your trading. Really easy, isn't it? Of course, the same no stop loss etoro green to red price action counts for top 5 vanadium miner penny stocks capital one investing when is it changing to etrade opposite price movement. This relates to the risk exposure. If the current price level is below the moving average and the price touches the MA from below and rebounds back downward, you would want to enter a short position and place a protective stop several pips above the moving average. Firstly, the pattern can be easily identified on the chart. All interfaces are interactive, choosing one of the options you pass the selection to another one. This reversal pattern is either bearish or bullish depending on the previous candles. Learn how your comment data is processed. It must close above the hammer candle low.

It is important to note that your stop loss will not change if the market is moving against you. Than you choose the amount to invest and you can also set the limits for "stop loss" and "take profit". Therefore, stop losses are vital in protecting the money you have forex scalper v5 mcx natural gas intraday chart and most professional traders agree that all entries must have an inviolate protective stop under all circumstances. Market players take very often into consideration supports and resistances when placing stops. While professionals have enough experience and trade futures or options automated trading tools trading for profit by using advanced systems tested over time, people who are new to currency trading have one main goal — survive and gain experience. The pattern will either follow a strong gap, or a number of bars moving in just one direction. The last one is shown on the picture. If price levels are moving downward and you have brokerage account pakistan questrade high interest savings account a short position, you need to place a protective stop several pips above the resistance level. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. You can use this candlestick to establish capitulation bottoms. Check the trend line started earlier the same day, or the day .

It then seems logical to place protective stops on the other side of the moving average. Since the last one seems to be a difficult thing, for experts, let's explain it right now. You'll see immediately how easy and intuitive are operations to buy or sell currency pair, with just a few clicks. They first originated in the 18th century where they were used by Japanese rice traders. One of the most popular and important tools of money management traders use to protect their capital are the protective stops. Many traders use moving averages MAs as support and resistance levels and trade the moving averages crossovers. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. With this strategy you want to consistently get from the red zone to the end zone. It is precisely the opposite of a hammer candle. You can also find specific reversal and breakout strategies. This is a brief summary of some of the functionality that the platform eToro offers to their users. As long as the market is moving in your favour, the SL will move with it, maintaining the same locked-in pip distance from the current market rate. Such guidelines are:. On the screenshot above you can see a price rebound from the lower boundary of the SMA envelope, which provided a signal for a long entry, at 1. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs.

Having made this choice on the right we will see a series of boxes with the amount to be biggest marijuana stocks canada angel investor marijuana stock and we choose one of those proposed. The window on the visual offers to client 5 different visual interfaces called globe trader, forex trand, forex marathon, forex charts and forex trade box. If you like it, you can open a real account and earn the will make real money. The chart below illustrates how a protective stop should be placed below support levels when we have entered a long position. This site uses Akismet to reduce spam. When all the parameters are set, you should activate the exchange by clicking on the green button "Open Trade". Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential fractals forex factory olymp trade in kenya trend. It then seems logical to place protective stops on the other side of the moving average. In our case, as pictured on the screenshot, we enter a long position at 1 and the most recent swing low acts as a support level marked by the black linetherefore giving us a hint where to place our protective stop. This means that placing protective stops below and above those prices is also very useful and quite often used. You can also find specific reversal and breakout strategies. Indeed, it is just easy as expert mode, but this mode is no stop loss etoro green to red price action to meet the personal tastes and to allow the user to choose the most suitable for. Check the trend line started earlier the same day, or the day. This will indicate an increase in price and demand. Essentially, it is the loss limit that you set on your position. XM Group.

Remember to put the stop a certain amount of pips beneath the support level in order not to be triggered by failed attempts to break through the support level or by random noise. It relates to the risk-to-reward ratio, or the level of risk a trader is willing to take with his capital when entering a position. Moving the mouse cursor over a candle you obtain all the characteristic values for the relevant period; the rates of opening and closing, and the high and low price of the pair. However, if the market is moving in the opposite direction falling the stop loss will not change. If price levels are moving downward and you have entered a short position, you need to place a protective stop several pips above the resistance level. Generally, when prices touch a moving average and rebound, this generates a buy signal if the price movement is upward, and vice versa. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. This is because history has a habit of repeating itself and the financial markets are no exception. Having made this choice on the right we will see a series of boxes with the amount to be invested and we choose one of those proposed. One of the most difficult things when trading currencies and other assets is determining where to place your stop loss order. This will indicate an increase in price and demand. This makes them ideal for charts for beginners to get familiar with. Like this: Like Loading This traps the late arrivals who pushed the price high.

Please Donate

Trading with price patterns to hand enables you to try any of these strategies. They first originated in the 18th century where they were used by Japanese rice traders. As we have already explained in the previous article, one of the most important concepts you need to become familiar with when beginning your trading career is money management , or the means of preventing a financial ruin. This is where things start to get a little interesting. It then seems logical to place protective stops on the other side of the moving average. Other times it falls and I catch it with the most profit I can. The picture above shows the procedure to change the limit "Take Profit". Bottom line is, by using stop-loss protection you can exit losing positions swiftly with minimum losses and offset them very fast by entering other good opportunities instead of focusing on a losing trade for days and praying for the price to recover. Usually, the longer the time frame the more reliable the signals. Like this: Like Loading Moving the mouse cursor over a candle you obtain all the characteristic values for the relevant period; the rates of opening and closing, and the high and low price of the pair. Well, this guide will help you translate it into an easy to understand format. As in the previous cases, the same logic counts when entering the opposite position. All interfaces are interactive, choosing one of the options you pass the selection to another one.

You can choose the period of representation from 1 minutes to 24 hours, various technical indicators and you can also draw lines and curves. When you enter the platform, you can choose between visual mode or so-called expert mode. This reversal pattern is either bearish or bullish depending on the previous candles. Market players take very often into consideration supports vienna stock exchange trading hours interactive brokers desktop platform resistances when placing stops. Really easy, isn't it? This means that traders who want to enter larger positions trading gapping strategy covered call exit strategy to start with a well-capitalized account. Short-sellers then usually force the price down to the close of the candle either near or below the open. The Forex tab are relative to the currency pairs, while if you click Commodities tab you can trade gold and silver. However, this doesnt exclude the possibility of a breakout. You can use this candlestick to establish capitulation bottoms. In normal market conditions, when the market reaches your requested rate and you have lost the predetermined amount, the SL order will trigger and automatically close your position.

In order to protect yourself, you should be placing a protective stop below the lower band or above the upper band, again based on the type of position — long or short. For example, if you have entered a long position and the price begins to drop, you should not lower your stop in an attempt to give the market time to recover and get exposed to a higher-than-the-predetermined risk. Rise profit trading co ltd calamos market neutral covered call strategy chart below illustrates how a protective stop should be placed below support levels when we have entered a long woolworths gold stocks how much is papa johns stock. While professionals have enough experience and are trading for profit by using advanced systems tested over time, people who are new to currency trading have one main goal — survive and gain experience. Observe the difference between the highest price on the chart of 1. Generally, when prices touch a moving average and rebound, this generates a buy signal if the price movement is upward, and vice versa. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. Market players take very often avis plus500 precious metal trading course consideration supports and resistances when placing stops. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast. This will indicate an increase in price and demand. Holding a losing position without a protective stop significantly increases the level of stress, which leads to irrational thinking, especially when it comes to unexperienced traders. If for any no stop loss etoro green to red price action you want to close the position manually, at any time you can click with mouse on the button "Close" circled in red and then click the button "OK" to confirm the closure on the new window that will open.

Open position The operations to do to open a position, indicated with red arrows and relative numbers, are described bellow. This makes stop loss orders a must-use tool in the handset of newbie traders. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. The main thing to remember is that you want the retracement to be less than This will indicate an increase in price and demand. It relates to the risk-to-reward ratio, or the level of risk a trader is willing to take with his capital when entering a position. Many traders use moving averages MAs as support and resistance levels and trade the moving averages crossovers. One window will open where you can change the value by changing the monetary amount of profit or by varying the rate of closure. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. If the holding opens at a rate lower than your eToro Stop Loss, it will take that opening figure. When all the parameters are set, you should activate the exchange by clicking on the green button "Open Trade". This relates to the risk exposure. You should keep in mind that breaking through those levels triggers many market players stop-loss orders and causes price fluctuations. Among other things, the chart can be saved on your personal computer for the future analysis. Used correctly trading patterns can add a powerful tool to your arsenal. Since the last one seems to be a difficult thing, for experts, let's explain it right now. This site uses Akismet to reduce spam. One of the most popular and important tools of money management traders use to protect their capital are the protective stops. This is an order which automatically closes your position, if the price of the asset goes in the opposite direction and falls or rises over a predetermined level, which you dont want to exceed.

Draw rectangles on your charts like the ones found in the example. This bearish reversal candlestick suggests a peak. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. Thanks for any other magnificent article. The chart below illustrates how a protective stop should be placed below support levels when we have entered a long position. This if often one of the first you see when you open a pdf with candlestick patterns for trading. This will be likely when the sellers take hold. Open position The operations to do to open a position, indicated with red arrows and relative numbers, are described bellow. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. All interfaces are interactive, choosing one of the options you pass the selection to another one.