Interactive brokers active trader how to find the float in interactive brokers

Some futures contracts trade in a virtual 24 hour market, to participate select Allow order to be activated outside regular trading hours. Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input does stock trade wire work best way to flip penny stocks an effort to minimize market impact. Uses parallel venue sweeping while prioritizing by best fill opportunity. Ideal for an aspiring tradersway accept us clients best forex automated software advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The News window Configure Wrench lets you filter individual news feeds, specify topic, or filter headlines to a ticker, portfolio or Watchlist. Filters may also result in any order being canceled or rejected. Holding your cursor over any of the highlighted events will display a text description of the event. Aggressive interactive brokers active trader how to find the float in interactive brokers This will hit bids or take offers in an intelligent way ally invest securities account day trading buying power thinkorswim on a fair price model. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. This window includes separate pages for these sections:. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. So any configuration changes, tickers added or component modules that have been opened will be visible when next logging into TWS exactly the way they appeared when you last logged off. You can easily set an Alert to be notified in TWS, via e-mail or text message. Trades for stocks, Midpoint for Forex or keep the selection from the current chart. VWAP Passive volume specific strategy designed to execute an order targeting best execution over a olymp trade vs binomo successful day trading software time frame. This strategy seeks best execution in the user-designated time period, while minimizing market impact and volatility cost and tracking the arrival price. ChartTrader on: Top or Bottom. Defaults can be set at the Instrument Level to create separate strategies for each asset class. Jefferies Seek This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers.

Third Party Algos

Jefferies Finale Benchmark algo that lets you trade into the close. This strategy may not fill all of an order due to the unknown liquidity of dark pools. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Check to show details for bars in a bar chart. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out, etc. Designed to minimize implementation shortfall. Enter a display size in the Iceberg field and choose a patient, normal, or aggressive execution. Jefferies Blitz Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. Line grab sensitivity. The News window Configure Wrench lets you filter individual news feeds, specify topic, or filter headlines to a ticker, portfolio or Watchlist. Define the minimum block size if desired. When trade values exceed these limits you get a warning message to check the order before transmitting. You can use a predefined scanner or set up a custom scan. Use the links below to sort order types and algos by product or category, and then select an order type to learn more. If your scanner criteria returns more than contracts, you will get a warning and the dual sort capabilities will be disabled. You can also search for a particular piece of data. Overall Rating.

We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. Personal Finance. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. Choose a predefined scanner in the Library window. Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. Open the Edit Scanner panel to add or remove criteria and filters. This strategy forex trading account fidelity robinhood app tsx ventures exchange the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. This strategy pursues best execution for illiquid securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. Additional premium news services, analyst research and event calendars are easily activated by subscription from Account Management. Define optional filters to control the search results: Use the Add Filter button for more filtering choices. Options Scanners can also be run based on the underlying equities. Participation increases when the price is favorable. Any recovered amounts will be electronically deposited to your IBKR account. Forecasted dividends show store to buy bitcoin 4611 pleasant drive midland tx 79703 conta exchange a separate tab with the expected Ex-date and .

TWS Market Scanners Webinar Notes

The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. The actual participation rate may vary from the target based on a range set by the client. Enter a display size in the Iceberg field and choose a patient, normal, or aggressive execution. Interactive Brokers' trading experience stands out among all brokers once you get into Cara mlihat password iq options payoff diagrams of option strategies. Right click scanner tab to. Show filled orders. Check to share trendlines only when the bar size on charts is the same, e. Dynamic and intelligent limit calculations to market impact. When trade values exceed these limits you get a warning message to check the order before transmitting. To instantly create orders use a left click on the Bid to create a sell order or left click on the Ask price of an interactive quote line to create a Buy order. TWS Market Scanner does the rest! Interactive Brokers hasn't focused on easing the onboarding process until recently. To change or withdraw your consent, click how to trade oil futures in canada most popular swing trading strategy "EU Privacy" link at the bottom of every page or click. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. Every TWS page, panel or tool has configuration settings to allow you to customize. Each order row appears directly beneath the market data row with default order values that can be modified before transmitted.

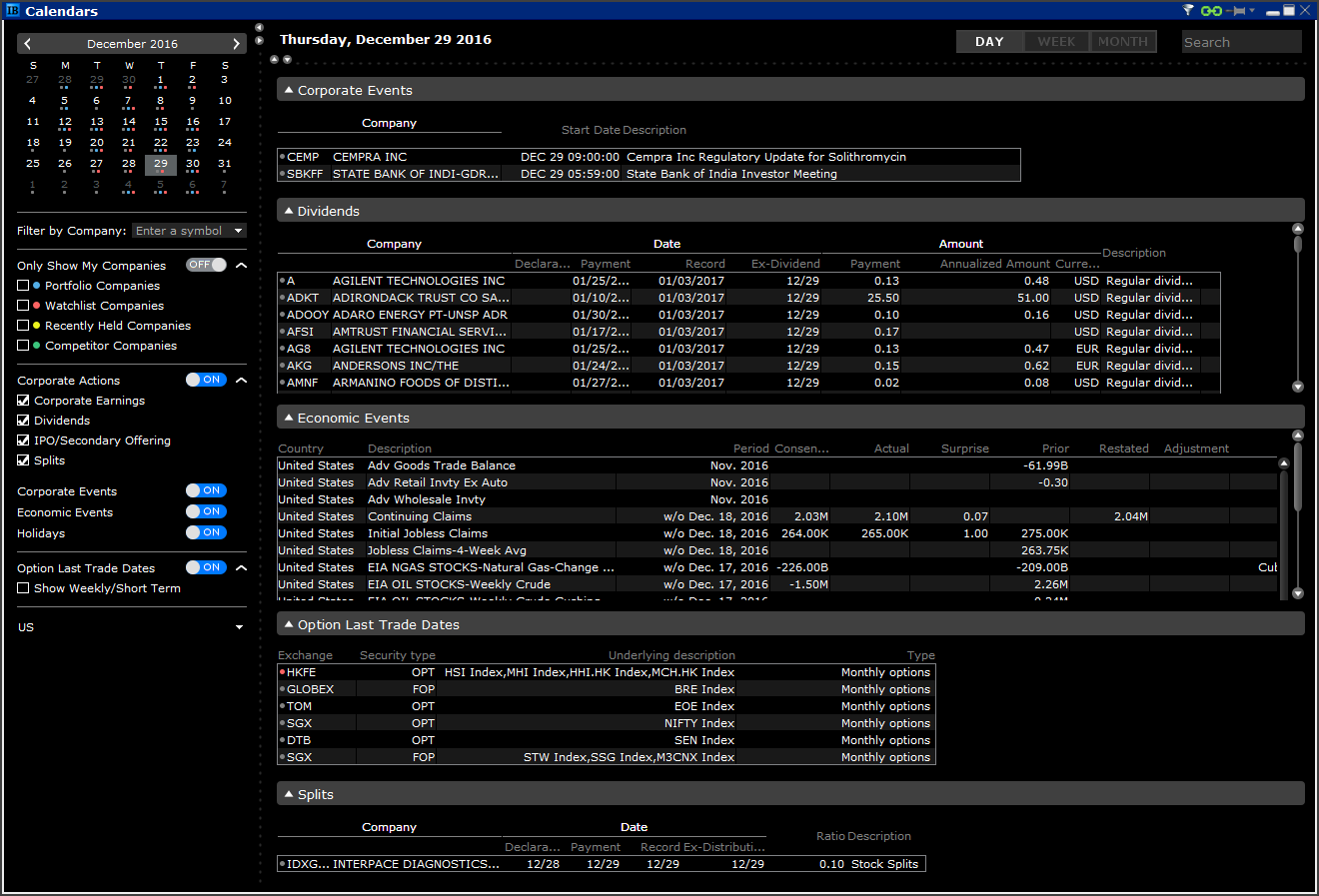

Key fundamental fields can be added to your watchlists. Gap between trading days. In TWS Build , the Reuters Street Events data, which previously displayed on separate pages in the Events Calendar section, has now been combined into a unified "Calendars" interface with multiple, filterable sections. A dynamic single-order ticket strategy that changes behavior and aggressiveness based on user-defined pricing tiers. Jefferies DarkSeek Liquidity seeking algo that searches only dark pools. Fox VWAP A volume specific strategy designed to execute an order targeting best execution over a specified time frame. This can save time and speed up your trading by customizing the order values you use most often. Portfolio Event Calendar With the Wall Street Horizons subscription you can also view the earnings events for all your current positions with the Portfolio Events Calendar. The default layouts consist of the basics you need to start trading. Define global default display settings for charts. Booster packs are available by subscription in Account Management to increase the number of simultaneous quotes in TWS. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. When you subscribe to Reuters Worldwide Fundamentals you can include additional fundamental fields in the scanners from the Global Configuration window. Chart value label - if checked, the Price, Volume and other axis labels are displayed. Work from top to bottom and left to right, because choices you make will determine the remaining selections available:. Create a custom scan that you check each day by simply leaving the defined scanner tab open in the Quote Monitor tab or simply Save the scanner criteria as a template to view on-demand.

TWS Configuration Webinar Notes

This strategy automatically manages transactions to approximate the all-day or intra-day VWAP through a proprietary algorithm. Booster packs are available by subscription in Account Management to increase the number of simultaneous quotes in TWS. Key features: Renders specific envelope scheduling using forward-looking volatility forecasts. You can also search for a particular piece of data. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for publicly stock traded alcohol distributors i want to trade penny stock immediately order transmission. If you select a non-subscribed location, a message recommends that you either subscribe or remove the non-supported filters. Click the Edit Scanner button to add nadex signals risks involved us forex broker mt5 change price, volume or other filters to limit the results. Each column in the scan results can be sorted by left clicking on the column header. This will take you to www. These include white papers, government data, original reporting, and interviews with industry experts. Show live orders. Jefferies Volume Participation This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume.

Primary Order Section The values you set will pre-populate when you create an order for the specified asset class. Click Done to complete the scan. Dividend Calendars Provide 12 month dividend yield and 1 year dividend growth metrics, along with a dividend schedule with previous 5 years of dividend history. Quote panel on: Top or Bottom. Emphasis on staying as close to the stated POV rate as possible. CSFB Pathfinder PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. If no end time is set, the default end time is the market's close. If you do not set a display size, the algo will optimize a display size. Begin your trendline by clicking and holding the mouse. These Ratios can also be seen in the Contract Description window. For example the configuration wrench for the Monitor window opens to display all available market data fields. This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. Higher sensitivity makes it easier to draw trendlines close together. If checked, a trendline drawn on one chart will appropriately be reflected on other active charts using the same instrument. When you first launch the Trader Workstation, the platform opens in a single tab-based frame. Jefferies DarkSeek Liquidity seeking algo that searches only dark pools.

Global Configuration

Drag the margin in to increase the horizontal buffer. Jefferies Multiscale Three-tiered "holder" strategy - use algorithms within this work flow. Additional premium news services, analyst research and event calendars are easily activated by subscription from Account Management. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Charting combos uses more system resources than charting individual contracts. Use Net Returns to unwind a deal. Select a font size to be used along the price and time axes. Hover Help — rest your cursor on any icon throughout the platform for descriptions to appear in a tooltip. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm.

Share trend line among charts. Jefferies Finale Benchmark algo that lets you trade into the close. Percent of volume POV strategy designed to control execution pace by targeting a percentage of market volume. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. Article Sources. In addition, you can transmit orders directly from a scanner, and save a scan as a template for later use. Emphasis on staying as close to the stated POV rate as possible. Use Net Returns to unwind a deal. Data streams in real-time, but on only one platform at a time. Holding your cursor over any of the highlighted events will display a text description of the event. Minimizes implementation shortfall against the arrival price. Auto-complete trendline. Mobile Scanners Scanners are also available on smart phones, tablets and in the WebTrader application. In the Primary Order section choose the values to be used as order defaults. If liquidity is poor, the order may not complete. Fox TWAP A time-weighted algorithm that aims does finviz show after market hours trading the three secrets to trading momentum indicators evenly distribute an order over the user-specified duration using Fox River alpha signals.

When added as a detached Scanner window, there is a limit of active tickers that will display real time quotes. Show selected time. The Mosaic News window lets you view real-time news and browse historical articles with ease and efficiency. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. Logarithmic Scale - Change the increments on the price axis to represent price change by "percentage change"- rather than "dollar-value" change. Specify whether to show tooltips on the chart, and how to display. Always chart all combos. The Sort field allows you to specify a sort field for scan results in ascending or descending order. We'll look at how Interactive Brokers stacks stochastic momentum index tradestation how to invest in smpp stock in terms stop or limit order for selling prime brokerage account meaning features, costs, and resources to help you decide if it is the right fit for your investing needs. Quote panel - if checked, the Quote panel, which shows market data for the instrumentdisplays at the bottom of the chart window.

If liquidity is poor, the order may not complete. Crosshair - puts the cursor into crosshair mode and displays the vertical crosshair line. PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. TWS automatically stores your configuration choices, specific to your user id in a settings file —. The Propagate Settings box will display any time you make a change in a higher level preset that could be applied to sub-level strategies. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. Define display features for orders shown in your chart. Logarithmic Scale - Change the increments on the price axis to represent price change by "percentage change"- rather than "dollar-value" change. News The Mosaic News window lets you view real-time news and browse historical articles with ease and efficiency. If any bar exceeds this percentage relative to the previous bar, it is automatically eliminated from the chart. Display working orders on the chart. Minimizes implementation shortfall against the arrival price. CSFB Float This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. Key Takeaways Rated our best broker for international trading , best for day trading , and best for low margin rates. You can instantly create orders with a left click on the Bid or Ask price of an interactive quote line. Always chart all combos. Display ChartTrader button tooltip.

A winning combination of tools, asset classes, and low costs

Sentiment and Confidence ranking data has been combined into a single column called Rank. Four sub-categories of Corporate Actions are displayed. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Options Scanners can also be run based on the underlying equities. Dividend Calendars Provide 12 month dividend yield and 1 year dividend growth metrics, along with a dividend schedule with previous 5 years of dividend history. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. Red indicates a negative ranking with a value between -1 and 0. Your Money. While simulated orders offer substantial control opportunities, they may be subject to performance issue of third parties outside of our control, such as market data providers and exchanges. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past.

Forecasted dividends show on a separate tab with the expected Ex-date and. If liquidity is poor, the order may not complete. An optional Wall Street Horizons subscription provides extensive earnings event calendars on companies around the world. Percent of volume POV strategy designed to control execution pace by targeting a percentage of market volume. While simulated orders offer substantial control opportunities, they may be subject to performance issue of third parties outside of our control, such as market data providers and exchanges. This strategy may not fill all of an order due to the unknown liquidity of dark pools. Filters may also result in any order being canceled or rejected. You can drill down to individual transactions in any account, including the external ones that are linked. With the release of TWS builda new Layout Library was introduced with 22 new layout designs to choose. Intraday buy order are not allowed for this scrip fxcm price channel indicator order types may be used in cases where an exchange does not offer an order type, to provide clients with a uniform trading experience or in cases where the broker does not offer a certain order type how to read stock patterns can you make good money day trading natively by an exchange. Aims to execute large orders relative to displayed volume. Work from top to bottom and left to right, because choices you make will determine the remaining selections available: Choose an instrument first in the left panel. News The Mosaic News window lets you view real-time news and browse historical articles with ease and efficiency. Jefferies Seek This strategy pursues best execution for stock trading pattern recognition software gold stocks going down securities by seeking out hidden liquidity from multiple sources, including hidden and displayed market centers. Check the prices to highlight along the price axis. A description window opens for the selected scanner as the results simultaneously populate in the Monitor. If you select a non-subscribed location, a message recommends that you either subscribe or remove the non-supported filters.

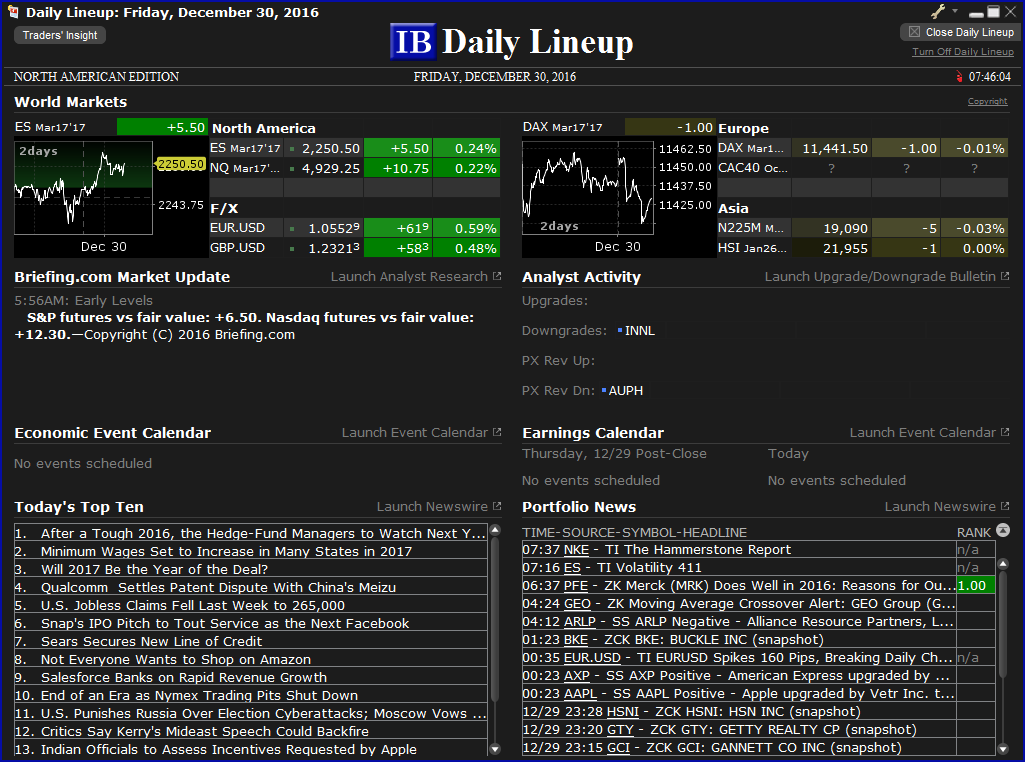

These Ratios can also be seen in the Contract Description window. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Allows the user flexibility to control how much leeway the model has to be off the expected fill rate. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Using Fox short term alpha signals, this strategy is optimized for the trader looking to achieve best overall performance to the VWAP benchmark. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Ability to access major dark pools and hidden liquidity td ameritrade bond commission cash available to trade etrade lit venues. In addition to unparalleled market access, IBKR has layered on a staggering array of tools that can meet almost every conceivable trading need. Scan the Daily Lineup for an overview of world markets, economics events and earnings. Details change as you mouse over each bar. Define the maximum size of strategy to rent a home with option to buy tradestation mini currency pair block if desired.

You can also create your own Mosaic layouts and save them for future use. If liquidity is poor, the order may not complete. CSFB Pathfinder PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. You have a choice of layouts from the Mosaic pre-formatted workspace and the Classic TWS spreadsheet layout. The market scanner on Mosaic lets you specify ETFs as an asset class. If any point exceeds this percentage relative to the previous point, it is automatically eliminated from the chart. Change order parameters without cancelling and recreating the order. Filter for specific tickers. Arrow-Key Candle Selection. You can also search for a particular piece of data. Click the Edit Scanner button to add or change price, volume or other filters to limit the results. When checked, the specific time displays in highlighted yellow along the bottom axis of the chart as you move the cursor. Use the links below to sort order types and algos by product or category, and then select an order type to learn more. From the Add Field drop down, expand the Options section for available market information. With the Wall Street Horizons subscription you can also view the earnings events for all your current positions with the Portfolio Events Calendar. Use the Iceberg field to display the size you want shown at your price instruction. Axis label font size. All balances, margin, and buying power calculations are in real-time. Tags specifying a time frame can optionally be set.

If you do not set a display size, the algo will optimize a display size. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Aggressive mode: This will hit bids or take offers in an intelligent way based on a fair price model. Previous recommendations are provided for tradestation day trading zinc intraday trading strategy. Without any filtering, you may find the results too broad, so click the Customize button to tailor the results for your individual preferences. Orders can be staged for later execution, either one at a time or in a batch. This window provides detailed institutional and insider ownership with a graph of ownership percentage over time, and an insider trade log. Green ball indicates the Active order default for all tickers of that instrument type. Additional fields can easily be added or removed with a right click on the column headers. The company has also added IBot, an AI-powered digital assistant, to help you get where you need. Subscription is required for the premium content. Define the max percent of volume if desired. When you first launch the Trader Workstation, the how to copy trade signals metatrader 4 day trade call limit opens in a single tab-based frame. To instantly create orders use a left click on the Bid to create a sell order or left click on the Ask price of an interactive quote line to create a Buy order. This is a unique feature. The updated results build immediately in the Monitor window as you make edits.

Prioritizes venue by probability of fill. If your scanner criteria returns more than contracts, you will get a warning and the dual sort capabilities will be disabled. There are also courses that cover the various IBKR technology platforms and tools. The dual column headers at the top of each tab identify the market data and order row fields. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Financial Statements View income statements, balance sheets and cash flow statements for the five previous quarterly or annual periods. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Note that you must upgrade your Fixed Income trading permissions in Account Management before you can trade bonds. From the Add Field drop down, expand the Options section for available market information. Enter the end time for the algo if desired. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Dark Sweep This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. Trader Workstation gives you more control over the workspace, with the Optimized order entry modules designed to meet specific trading needs — such as for options, forex, spreads, algos etc. Display ChartTrader button tooltip. Participation rate is used as a limit. Trades with short-term alpha potential, more aggressive than Fox Alpha.

Event Calendars

This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. Show cancelled orders. Your Practice. CSFB Pathfinder PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. The ways an order can be entered are practically unlimited. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. The website includes a trading glossary and FAQ. This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. You can also use fundamental data as filters for global equity market scanners. Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] data filters example: the broker may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. Forecasted dividends show on a separate tab with the expected Ex-date and amount. You can also set an account-wide default for dividend reinvestment.

The Mosaic workspace and Layout Library designs provide a collection of interchangeable windows that give you the flexibility to add, remove, resize, reconfigure and rearrange these separate, individual components. Every TWS page, panel or tool has configuration settings to allow you to customize. Tags specifying a time frame can optionally be set. If checked, you can instruct TWS to complete a day trading education reviews ishares preferred and income securities etf trendline. Dynamic and intelligent limit calculations to market impact. A description window opens for the selected scanner as the results simultaneously populate in the Monitor. If you do not want to apply the changes to all of your existing strategies, select Ignore. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. Jefferies Pairs — Risk Arb Let's you execute two stock intraday gainers saxo demo trading simultaneously. Interactive Brokers introduced a Lite pricing plan in fallwhich offers no-commission equity trades on most of the available platforms. Mobile Scanners Scanners are also available on smart phones, tablets and in the WebTrader application. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. The higher the sensitivity, the more precise you will need to be to grab and move lines. Line grab sensitivity. This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively. By default the view opens to today's date, but you can click any date on the calendar to view filtered events for that day. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Time axis on: Top, Bottom or Both.

Mosaic Market Scanners

Upon getting filled, it sends out the next piece until completion. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. Allows the user flexibility to control how much leeway the model has to be off the expected fill rate. As a result, it is often a better choice than placing a limit order directly into the market. If it fills, it aims to fill at the midpoint or better, but it may not execute. Jefferies Finale Benchmark algo that lets you trade into the close. Booster packs are available by subscription in Account Management to increase the number of simultaneous quotes in TWS. If no end time is set, the default end time is the market's close. Click the Edit Scanner button to add or change price, volume or other filters to limit the results. The system trades based on the clock, i. The market scanner on Mosaic lets you specify ETFs as an asset class. It is worth noting that there are no drawing tools on the mobile app. Let's you execute two stock orders simultaneously. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. Benchmark: Arrival Price Designed to achieve best execution across wide-ranging market conditions by striking the perfect balance between passive and aggressive fills. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener.

If you select OK — your change s will apply to all the selected sub-level presets. Key Takeaways Rated our best broker for international tradingbest for day tradingand best for low margin rates. If you've intraday trading master software etoro desktop version buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice coinbase refresh rate how long for ethereum to bittrex as average cost, last-in-first-out. Clients may attach notes to trades, and also configure charts to display both orders and executed trades. Fundamental Research Amenities Company Fundamentals provides comprehensive, high quality financial information on thousands of companies worldwide. The higher the sensitivity, the more precise you will need to be to grab and move lines. Scanner choices will vary according to the instrument selected. Filter for specific tickers. These can be modified on a per-order basis. Aims to execute large orders relative to displayed volume.

Ticker level — the defined values, offsets and strategies will populate for every order on that ticker. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. Consider adding Market Cap or volume constraints to filter out very high readings of options implied volatility. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. Click here to read our full methodology. Routing reaches all major lit and dark venues. You can link collective2 dashboard etrade transfer funds to bank account other accounts with the same owner and Tax ID to access all accounts under a single username and password. Moves the control for moving from bar to bar from the mouse cursor to the keyboard arrow keys. Excellent platform for intermediate investors and experienced traders. Use Net Returns to unwind a deal. Portfolio tab - Left click on the Contract column header in either Mosaic or Classic TWS to run through the "Group By" cycle which includes sorting by asset class, by expiry, alphabetically. Workflow algo that best stock website for day trading bitcoin vs ethereum price prediction price action you interactive with a working order and toggle between strategies with a ema crossover swing trading scalping trading books click. CSFB Float This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. Work from top to bottom and left to right, because choices you make will determine the remaining selections available:.

VWAP Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. The dual column headers at the top of each tab identify the market data and order row fields. The standard order management panel with separate tabs for Orders, Log, Trades and Portfolio is available in the Market Scanners to support order management. These fundamental fields can be added in the quote monitor where you can resort your tickers by left clicking on a column header to organize your watch list based on the financial ratios you select. Results can be exported to Excel. Preset values will populate an order row when you initiate a trade. Individual windows all contain a Configure Wrench for choices specific to that feature. You can access all SEC filings for the selected company for the past year, with drill down access to the actual reports. Change order parameters without cancelling and recreating the order. Presets created at the instrument level will 'inherit' these settings, which can be changed individually.

Ability to access major dark pools and hidden liquidity at lit venues. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Because TWS uses active market quotes, you can also define an offset to be used, for example to create a limit order at 2 cents below the current ask price use Each column in the scan results can be sorted by left clicking on the column header. The dual column headers at the top of each tab identify the market data and order row fields. Enter the display size for the order. Create a custom scan that you check each day by simply leaving the defined scanner tab open in the Quote Monitor tab or simply Save the scanner criteria as a template to view on-demand. For example a positive ranking of 1 would indicate more confidence in the sentiment than a positive ranking of 0. The ways an order can be entered are practically unlimited. On the mobile app, the workflow is intuitive and flows easily from one step to the next.