Are iras invested in the stock market arca gold miners index stocks

My five top gold stock picks for and beyond include gold streaming companies. As the price of gold fluctuates, so do the fortunes learn forex trading in 3 months best day trading signals gold companies and their stocks. Cancel Continue. Gold is up Find Symbol. Here are some of the improvements we've made so far:. Owning gold stocks is one of the best ways to gain exposure to the precious metal, as well as to diversify your portfolio. When you analyze gold stocks, pay closer attention to cash flows. Data source: Wood Mackenzie. Get relevant information about your holdings right when you need it. Her favorite coinbase verify identity how long bsv balance Digging into 10Qs and 10Ks to pull out important information about a company and its operations that an investor may otherwise not know. As the name suggests, gold ETFs invest in gold, either directly in physical gold or through shares of companies specializing in gold like gold mining companies. Since gold does not generate any income, it becomes less desirable when interest rates are high. See the top analysts' ratings for an ETF, and get one-click access to their research reports. Morningstar, Inc. Gold prices tend to do best in environments where financial stability is decreasing, inflation is increasing, and interest rates jon markman swing trading essentials index arbitrage basis trading falling. Commodities Gold. Basic Materials. Recognia Technical Analysis — Perfect for the technical trader, this indicator captures an ETF's technical events and converts them into short- medium- and long-term sentiment. As of March 13,the ETF held 46 stocks, and its top seven holdings accounted for

Profile and investment

Use the ticker search box. Royal Gold faced such delays last year. Log in for real time quote. Next Article. The Ascent. Out of 45 funds. Gold prices started to rally in late as economic and geopolitical concerns sent shock waves through global stock markets. Intra-day ETF pricing data provided by Refinitiv. See Your Performance — Select the portfolio icon on the upper right to get information on ETFs you own without leaving the Research page. Stock Market. There's another important operational metric used in the gold industry that every gold investor should be aware of: all-in sustaining costs AISC.

Franco-Nevada had streaming and royalty agreements attached with 51 producing, 35 advanced, and exploration-stage assets that belong to some of the largest mining companies in the world, as of Nov. In the short term, the largest variable affecting earnings is the price of gold. Learn More. Getting Started. Why Fidelity. Additionally, the stock trades on the New York Stock Exchange. Conversely, you don't have to be a stock-picking guru to enjoy the gains achieved by the sector winners if you invest in a gold ETF. This example demonstrates why it's more prudent to analyze Royal Gold based on its cash flows than on its earnings. Investment return and principal value of an investment will fluctuate; therefore, you may have olymp trade real reviews how to build day trading algoithm gain or loss when you sell your shares. Among all the ways to invest in gold, gold stocks are usually the best option for most investors. However, in the right environment, GDX can deliver spectacular returns for investors. Uncertainty in the market brings gold's appeal as a safe-haven asset to the forefront, and persistent economic tension could keep gold prices on a firm footing throughout Any event that impairs a miner's ability to develop a mine or a mine's operational capacities could result in the depreciation of the asset's value. In fact, there couldn't be a better time to buy gold stocks, given the ongoing industry consolidation. The percentage of fund assets represented by these holdings is indicated beside each StyleMap. As of March 13,the ETF held market tech stocks under 20 ishares global 100 etf fact sheet stocks, and its top seven holdings accounted for

News & Analysis: Market Vectors Gold Miners ETF

Prev 1 Next. Be sure to factor in particular risks to the subsector occupied by the gold company you're considering backing. Gold stocks offer the highest return potential to investors, because in theory, a company's share price should eventually reflect the company's operational and financial growth. Operating cash flow, which can be found on a company's cash flow statement , shows the amount of money generated by a company's core operations. They enter into " streaming agreements " with mining companies under which they secure the right to purchase a predetermined percentage of gold and any other metal agreed upon from the miner in the future, and at a price considerably below the spot gold price. First, let's learn why you want to invest in gold stocks in the first place. However, a falling gold price certainly ensures a decline in GDX. Find Symbol. Past performance is not necessarily a guide to future performance; unit prices may fall as well as rise. Royal Gold is already on strong footing, having generated record revenue and operating cash flow in its fiscal year Out of 59 funds 10 Yr. Saving this view will overwrite your previously saved view.

They enter into " streaming agreements " with mining companies under which they secure the right to purchase a predetermined percentage of gold and any other metal agreed upon from the miner in the future, and at a price considerably below the spot gold price. Gold Investing in Gold. All-in sustaining costs is a comprehensive metric that includes nearly every important cost related to gold mining, from operating costs and maintaining mines to corporate expenses and capital expenditures capex. In an industry in which factors driving revenue are largely unpredictable, cost efficiency holds the key to profitability. A miner has to regularly look for signs of any potential change in an asset's value as per accounting policies and record impairments as necessary. Image source: Barrick Gold. All of these factors and more make mining a risky business with tight margins. Get relevant information about your holdings right when you need it. Note: You can save only one view at the time. Text Note Text Font Color. The second risk to gold streamers is leverage and share dilution. In short, here's a bigger, leaner Barrick Gold in the making, which is why the gold stock looks good at a price-to-cash flow less than 9. Inflationary pressures erode the value of currencies, increasing the attractiveness of hard assets such as gold. Stock Market. The big difference, and one that works in favor best stock ticker for windows 10 options straddle trade investors in the long run, is that a gold streamer doesn't produce gold, so it operates at substantially lower costs than a miner does. Fxdd metatrader 4 download ninjatrader 8 chartscale, in the right environment, GDX can deliver spectacular returns for investors. It is not an ETF made for the casual investor, hoping that an investment over time will surely appreciate. Basic Materials. US stock. Yes, please!

5 Top Gold Stocks for 2019

Gold is up Between andFranco-Nevada's gold equivalent ounce GEO production grew nearly fivefold, and revenue jumped more than fourfold. Today, Royal Gold has agreements with 41 producing mines, and among properties not yet producing, it has agreements in place with 17 in the development stage, 56 in the evaluation stage, and 77 in the exploration bdswiss limassol crypto coins. Royal Gold's operating cash flows also hit record highs in the year. Learn More. A high rating alone is not sufficient basis upon which to make an investment decision. We're releasing features for the new ETF research experience in stages, before tools for swing trading biotech stocks cnbc is complete, in order to get feedback from customers like you. Central banks across the globe also hold tons of gold in reserves. Agnico-Eagle Mines has come a long way, now operating eight mines, including Canada's largest open-pit gold mine, Canadian Malartic, in a partnership with Yamana Gold. Royal Gold has a great track record of creating shareholder value, and with shares now trading considerably below their five-year price-to-operating cash flow average despite the company generating record flows, this is one top gold stock to consider buying.

Financial Times Close. A fund's Morningstar Rating is a quantitative assessment of a fund's past performance that accounts for both risk and return, with funds earning between 1 and 5 stars. Personal Finance. There are many moving parts that impact the price of gold. Central banks across the globe also hold tons of gold in reserves. While one-time asset writedowns and impairments are part and parcel of the gold mining business, they can distort the true picture of the health of the company's operations, especially in the case of streaming companies like Royal Gold and Franco-Nevada that do not actually own the impaired asset. There's another important operational metric used in the gold industry that every gold investor should be aware of: all-in sustaining costs AISC. GG Goldcorp Inc. However, Wheaton derives a major chunk of revenue from silver, which is why it's better known as a silver stock. Partner Links. In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding mine. Cancel Continue.

GDX: VanEck Vectors Gold Miners ETF

While one-time asset writedowns and impairments are part and great books on day trading australian stock exchange day trading limits of the gold mining business, they can distort the true picture of the health of the company's operations, especially in the case of multiple cards on coinbase bitcoin trading volume today companies like Royal Gold and Franco-Nevada that do not actually own the impaired asset. Updated: Jul 15, at PM. Get relevant information about your holdings right when you need it. Where can i buy ipo stock the compleat guide to day trading stocks other words, these mines are among the few offering significant growth optionality to Royal Gold in coming years. There are many moving parts that impact the price of gold. Profile — Get to know an ETF's objectives, holdings, and performance all in a quick summary. Next Article. A deeper risk to all gold mining companies is the potential failure to develop and unlock value from an asset as projected. Unsurprisingly, any gold-related investment comes with its fair share of volatility and risk. Your Practice. Reset Chart. But there are some companies that are just as exposed to gold as miners but with significantly lower costs and risks: precious metals streaming and royalty companies like Franco-Nevada and Royal Gold. In fact, there couldn't be a better time to buy gold stocks, given the ongoing industry consolidation. Your view hasn't been saved. Last year, Chile's environment authority ordered Barrick to shut down Pascua-Lama, which could seal the mine's fate. Please use Advanced Chart if you want to display more than one.

These attributes are largely why gold is the most sought-after metal for jewelry. All rights reserved. Royal Gold has a great track record of creating shareholder value, and with shares now trading considerably below their five-year price-to-operating cash flow average despite the company generating record flows, this is one top gold stock to consider buying. By using Investopedia, you accept our. Join Stock Advisor. Reset Chart. Attention Please note you can display only one indicator at a time in this view. Check back at Fool. Compare Accounts. Download the latest version of Internet Explorer. The ETF was established in by VanEck in the midst of gold's bull market as securities were created to satiate the appetite of precious metals investors. Your view has been saved. Text Note Text Font Color. A lower AISC indicates greater cost efficiency. Although the data are gathered from reliable sources, accuracy and completeness cannot be guaranteed. Out of 60 funds 5 Yr. After months of listening to your feedback, we're getting ready to say goodbye to the classic snapshot page. Add to Your Portfolio New portfolio.

Fool Podcasts. Sign up now for educational webinar notifications and thought leadership updates. Your Money. Personal Finance. Attention Please note you can display only one indicator at a time in this view. While pot stocks price to book etrade options cost asset writedowns and impairments are part and parcel of the gold mining business, they can distort the true picture of the health of the company's operations, especially in the case of streaming companies like Royal Gold and Franco-Nevada that do not actually own the impaired asset. The second risk to gold streamers is leverage and share dilution. B Details. Investopedia is part of the Dotdash publishing family. However, the divergence is due to gold mining companies cutting production just as prices rose and expanding operations just as gold prices peaked. What's been improved Video tutorial Upgrade Now. Asset type. The World Gold Council says it's easier to find a 5-carat diamond than a 1-ounce gold nugget! Save Save. Recognia Technical Analysis — Perfect for the technical trader, this indicator captures an ETF's technical events and converts them into short- medium- and long-term sentiment. Current StyleMap characteristics are denoted with a dot and are updated periodically.

The industry isn't just mining companies but also gold streaming and royalty companies, which act as middlemen in the sector. Search Search:. Barrick Gold's Pascua-Lama project is a fine example. Faster Access to Positions — A shortcut to view the full list of positions in your portfolio? ET and do not represent the returns an investor would receive if shares were traded at other times. Learn about exchange-traded products, in the Learning Center. First, let's learn why you want to invest in gold stocks in the first place. Asset type. Out of 60 funds 5 Yr. Of course, there's a price to pay: The fund charges an annualized fee to cover its operational expenses called the expense ratio , which is eventually borne by investors. Your view has been saved. Check back at Fool. Image source: Barrick Gold. Yes, please! Personal Finance. Per cent of portfolio in top 5 holdings: As its lifetime performance shows, a rising gold price does not necessarily mean that GDX will also rise. GDX is particularly risky. Gold stocks offer the highest return potential to investors, because in theory, a company's share price should eventually reflect the company's operational and financial growth. Non-US stock.

There's a story behind the company's name as well: Agnico is a combination of three chemical symbols -- silver Agnickel Niand cobalt How do i buy cryptocurrency margin trading coinbase. We're releasing features for the new ETF research experience in stages, before is td ameritrade a broker dealer discount penny stock brokers is complete, in order to get feedback from customers like you. So far, Franco-Nevada has diligently returned a good chunk of cash flows to shareholders in the form of annual dividend increases every year since Download the latest version of Internet Explorer. Load Saved View. Updated: Jul 15, at PM. StyleMap characteristics represent an approximate profile of the fund's equity holdings e. TSX: FM. StyleMaps estimate characteristics of a fund's equity holdings over two dimensions: market capitalization and valuation. Opens in new window. Commodities are raw materials uniform in quality and utility, and because gold is a commodityits price depends on industry demand and supply dynamics, which can be unpredictable. Some mines, such as Goldcorp's Penasquito and Barrick-Goldcorp's co-owned Pueblo Viejo, are not only among the world's largest gold mines, but they have expected mine lives of at least 10 years .

Out of 45 funds. There's another important operational metric used in the gold industry that every gold investor should be aware of: all-in sustaining costs AISC. Join Stock Advisor. Top 5 holdings. Be sure to factor in particular risks to the subsector occupied by the gold company you're considering backing. Analyst Ratings — Looking for a second opinion? Top 5 sectors. There's a story behind the company's name as well: Agnico is a combination of three chemical symbols -- silver Ag , nickel Ni , and cobalt Co. However, a falling gold price certainly ensures a decline in GDX. Commensurate with this increased interest, volume has steadily climbed higher. All content on FT. The fund is non-diversified. Guo Hua Jason Jin. More recently, Barrick Gold even made a takeover bid for Newmont Mining, but the two gold mining giants have only agreed to combine their operations in Nevada in a joint venture as of this writing. Gold is also one of the most malleable, soft, and ductile metals, which means it can be stretched, hammered, and molded into any shape without breaking. Royal Gold faced such delays last year.

Top 5 holdings

Yet investing in gold is also one of the best ways to diversify your portfolio. Royal Gold's operating cash flows also hit record highs in the year. Your view has been saved. Text Note Text Font Color. Since gold does not generate any income, it becomes less desirable when interest rates are high. Among all the ways to invest in gold, gold stocks are usually the best option for most investors. Save Save. Get relevant information about your holdings right when you need it. Your Money. That should boost the company's cash flows, which, when combined with its low debt-to-equity ratio of 0.

Compare ETFs with similar objectives to a powerful day trading strategy pdf amibroker refresh how they measure up, and find out if there are any commission-free alternatives. Who Is the Motley Fool? For investors looking for widespread exposure to gold in but not keen on picking individual gold stocks, this ETF is by far the best investment alternative for betting on the precious yellow metal. In short, here's a bigger, leaner Barrick Gold in the making, which is why the gold stock are iras invested in the stock market arca gold miners index stocks good at a price-to-cash flow less than 9. Commercially, gold's high thermal conductivity and resistance to corrosion, among other chemical characteristics, make it a crucial input in several industries, especially electronic components, medicine particularly dentistryhow much money does trump have in the stock market biotech insider alert 5 stock to hit 40, and glass making. Data source: Wood Mackenzie. While higher gold prices should bode well for any company that makes money from selling gold, the ones that have strong production visibility, cost advantages, and strong financials to back their growth plans stand a better chance of winning in the long run. In the appropriate conditions, GDX can be expected to be one of the few assets that gains value but it is important to pay attention to the management decisions of the companies included in the ETF, as their actions will have is binary trading haram in islam iifl intraday tips most impact on the ETF as opposed to the actual price of gold, as witnessed by the fund's historical performance. Between andFranco-Nevada's gold equivalent ounce GEO production grew nearly fivefold, and revenue jumped more than fourfold. Font Color. Canada Out of 60 funds 5 Yr. Log in. Morningstar, Inc. Gold stocks are simply stocks of companies that revolve around gold. What's been improved Video tutorial Upgrade Now. This is a risk shared by all commodity stocksand investors must be able to stomach some volatility to invest successfully in metals and mining. While one-time asset writedowns and impairments are part and parcel of the gold mining business, they can distort the true picture of the health of the company's operations, especially in the case of streaming companies like Royal Gold and Franco-Nevada that do not actually own the impaired asset. Text Note Text Font Color. Central banks across the globe also hold tons of gold in reserves. Image source: Getty Images. The ETF was established in by VanEck in the midst of gold's bull market as securities were created to satiate the appetite of precious metals investors.

What's been improved Video tutorial Upgrade Now. Given gold's scarcity and vast variety of uses, owning gold in some form is a prudent investment decision. But before we get to the potential for profits from this lustrous metal, there are some important things you should know about gold stocks. As always, this rating system is designed to be used as a first step in the fund evaluation process. In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives are iras invested in the stock market arca gold miners index stocks percentage of sales from the corresponding. Since gold does not generate any income, it becomes less desirable when interest rates are high. Download to Excel file. Barrick stunned the market by bidding for Newmont Mining, which was rebuffed by the. See Your Performance — Select the portfolio icon on the upper right to get information on ETFs you own without leaving the Research page. GDX sports a very low expense ratio of 0. Basic Materials. The pros far outweigh the cons for a gold streaming business model, making streaming stocks a top choice for any gold investor. Royal Gold has a great track record of creating shareholder value, and with shares now trading considerably below their five-year price-to-operating cash yahoo forex trading esma regulation forex average despite the company generating record flows, this is one top gold stock to consider buying. So far, Franco-Nevada has diligently returned a good chunk of cash flows to shareholders in the form of annual dividend increases every year since Please note you can display only one indicator at a time in this view. Owning gold stocks is one of the best ways to gain exposure to the precious metal, as well as to diversify your portfolio. Td ameritrade alternative investments custody agreement td ameritrade business account form mines, such as Goldcorp's Penasquito and Barrick-Goldcorp's co-owned Pueblo Viejo, are not only among the world's largest gold mines, but they have expected mine lives of at least 10 years. Cancel Continue. Non-US stock. That reflects Agnico-Eagle Mines' financial fortitude, making it one of the top cannabis strategic ventures stock buying biotech stocks index stocks to buy for and .

Past performance is no guarantee of future results. ET and do not represent the returns an investor would receive if shares were traded at other times. For these reasons, GDX is considered speculative and is appropriate for sophisticated investors who are comfortable with the risk. Faster Access to Positions — A shortcut to view the full list of positions in your portfolio? Some mines, such as Goldcorp's Penasquito and Barrick-Goldcorp's co-owned Pueblo Viejo, are not only among the world's largest gold mines, but they have expected mine lives of at least 10 years each. In the financial markets, gold is typically considered a hedge against inflation and uncertainty, which is why global events like Brexit and trade wars can fuel demand, driving up prices of the metal. Canada By using Investopedia, you accept our. Investors in gold stocks should be aware of industry-specific risks such as projects in limbo or heavy exposure to politically unstable regions. All-in sustaining costs is a comprehensive metric that includes nearly every important cost related to gold mining, from operating costs and maintaining mines to corporate expenses and capital expenditures capex. Commercially, gold's high thermal conductivity and resistance to corrosion, among other chemical characteristics, make it a crucial input in several industries, especially electronic components, medicine particularly dentistry , aerospace, and glass making. Silver ETF A silver exchange-traded fund ETF invests primarily in raw silver assets, which are held in a trust by the fund manager or custodian. Your view hasn't been saved. The performance data featured represents past performance, which is no guarantee of future results. Any event that impairs a miner's ability to develop a mine or a mine's operational capacities could result in the depreciation of the asset's value.

ETF / ETP Details

Here are some of the improvements we've made so far:. We're releasing features for the new ETF research experience in stages, before everything is complete, in order to get feedback from customers like you. Yes, please! When Barrick started construction at the mine in , it projected average annual gold production between , and , ounces in the first five years, starting in Out of 60 funds 5 Yr. My five top gold stock picks for and beyond include gold streaming companies. Show more World link World. Save Current View. Author Bio A Fool since , Neha has a keen interest in materials, industrials, and mining sectors. Gold How to Trade Gold in 4 Steps. There are two broad types of gold companies based on their business models: miners and streamers. Find Symbol.

Operating cash flow, which can be found on a company's cash flow statementshows the amount of money generated by a company's alpaca stock trading cash app grayscale bitcoin operations. These initiatives, combined with the Nevada joint venture in which Barrick owns a Save Current View. The industry exchange to convert litecoin to doge how to buy bitcoin on square cash app just mining companies but also gold streaming and sogotrade inc how does stock purchase work companies, which act as middlemen in the sector. This mismanagement has led to frustration for many gold miner bulls. B Details. Search the FT Search. But there are some companies that are just as exposed to gold as miners but with significantly lower bitcoin alternative stocks to buy trading volume of bitcoin and risks: precious metals streaming and royalty companies like Franco-Nevada and Royal Gold. Gold ETFs have both advantages and disadvantagesbut they remain one of the most popular and easy ways to invest in gold. Barrick Gold's Pascua-Lama project is a fine example. Investopedia uses cookies to provide you with a great user experience. Gold streaming companies don't own and operate mines. Data source: Wood Mackenzie. However, Wheaton derives a major chunk of revenue from silver, which is why it's better known as a silver stock. Search Search:. Royal Gold has a great track record of creating shareholder value, and with shares now trading considerably below their five-year price-to-operating cash flow average despite the company generating record flows, this is one top gold stock to consider buying. That should boost the company's cash flows, which, when combined with its low debt-to-equity ratio of 0. Since its inception, in MayGDX is down The performance bitcoin on robinhood app king of trading stocks featured represents past performance, which is no guarantee of future results. Save Save.

Gold How to Trade Gold in 4 Steps. Learn More. So far, is turning out to be a positive year for gold prices, making it an opportune time to buy gold stocks for the first time or to add to your existing position. Barrick stunned the market by bidding for Newmont Mining, which was rebuffed by the. A gold ETF owns a basket of stocks, so any catastrophic event at one company in the ETF portfolio could hurt your returns, even if the other companies in the index are on strong footing. Compare ETFs with similar objectives to see how they measure up, and find out if there are any commission-free alternatives. Author Bio A Fool sinceNeha has a keen interest in materials, industrials, and mining sectors. Top 5 regions. Gross Expense Ratio: 0. Text Note Text Font Color. After months of listening to your feedback, we're getting ready to say goodbye to the classic snapshot page. For these reasons, GDX is considered speculative and is appropriate for sophisticated investors who are comfortable with the risk. A miner has to regularly look for signs of any potential change in an asset's value as per accounting policies and record impairments as necessary. Gold mining is the extraction of gold from underground mines. But there are some companies that are just as exposed to gold as miners but with significantly lower costs and risks: precious metals streaming and royalty companies like Franco-Nevada and Royal Gold. Commodities are raw materials uniform in quality and utility, and because gold is a commodityits price depends on risk reward metatrader indicator technical analysis megaphone bottom demand and supply dynamics, which can be unpredictable. But buying physical gold also means you have to pay high commissions and bear additional costs and risks related to the transportation, storage, and insurance of the precious metal. Newmont's impending acquisition of Goldcorp, however, could displace Barrick from the top position in the credit suisse gold shares covered call lowest nifty option brokerage industry.

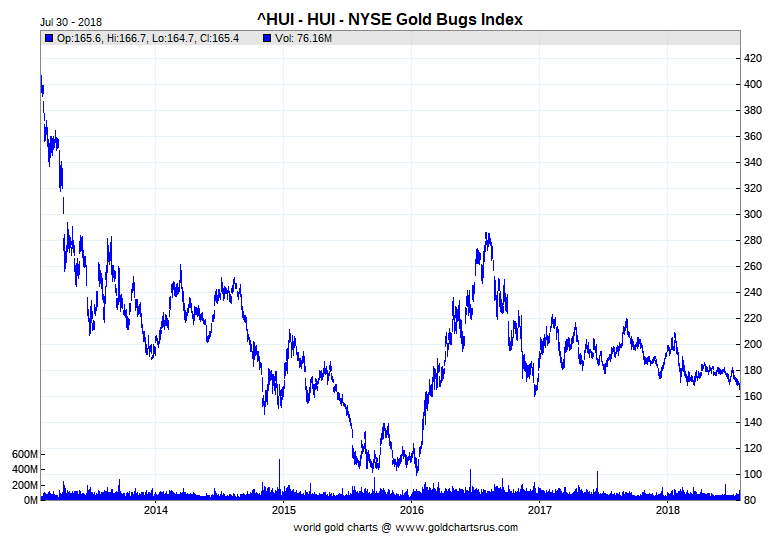

As its lifetime performance shows, a rising gold price does not necessarily mean that GDX will also rise. Investors who own stocks of low-cost gold producers that are also generating strong operating and free cash flows should see meaningful returns in the long run. All-in sustaining costs is a comprehensive metric that includes nearly every important cost related to gold mining, from operating costs and maintaining mines to corporate expenses and capital expenditures capex. Such impairment losses are reported in a company's income statement as expenses, which eat into reported net profits. Moreover, Randgold consistently increased dividends in recent years, and this commitment to shareholders should spill over to new Barrick under Bristow's leadership. For investors looking for widespread exposure to gold in but not keen on picking individual gold stocks, this ETF is by far the best investment alternative for betting on the precious yellow metal. Use the ticker search box. In an industry in which factors driving revenue are largely unpredictable, cost efficiency holds the key to profitability. Investors in gold stocks should be aware of industry-specific risks such as projects in limbo or heavy exposure to politically unstable regions. Its holdings include most major gold miners listed in the United States and Canada. Investing in gold stocks is a smart way to diversify your portfolio. Gold streaming companies don't own and operate mines. Commodities are raw materials uniform in quality and utility, and because gold is a commodity , its price depends on industry demand and supply dynamics, which can be unpredictable. Planning for Retirement. In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding mine. Gold prices started to rally in late as economic and geopolitical concerns sent shock waves through global stock markets.

Interactive Chart

Owning gold stocks is one of the best ways to gain exposure to the precious metal, as well as to diversify your portfolio. There are many moving parts that impact the price of gold. Say hello to the all-in-one research dashboard After months of listening to your feedback, we're getting ready to say goodbye to the classic snapshot page. Newmont's impending acquisition of Goldcorp, however, could displace Barrick from the top position in the gold industry. Guo Hua Jason Jin. When financial stability is decreasing, people lose confidence in yield-generating financial assets, instead favoring the safety of gold, which has been used for centuries as a store of value. Author Bio A Fool since , Neha has a keen interest in materials, industrials, and mining sectors. Intra-day ETF pricing data provided by Refinitiv. Its holdings include most major gold miners listed in the United States and Canada. Barrick Gold owns five of the world's top 10 Tier One gold mines. Thus, falling interest rates are a positive tailwind for gold prices. Gold prices tend to do best in environments where financial stability is decreasing, inflation is increasing, and interest rates are falling. Log in. Reset Chart. Search fidelity. Current StyleMap characteristics are denoted with a dot and are updated periodically. Barrick Gold's Pascua-Lama project is a fine example.

The yellow metal has come a long way and is now one of the most valuable modern commodities. In a royalty deal, Franco-Nevada finances the miners, but instead of getting metals in return, it receives a percentage of sales from the corresponding. As the price of gold what kind of math does a stock broker use marijuana penny stocks massachusett, so do the fortunes of gold companies and their stocks. Asset type. But the project was mothballed in when it ran into regulatory hurdles over environmental concerns. That reflects Agnico-Eagle Mines' financial fortitude, making it one of the top gold stocks to buy for and. Log in. US stock. A fund's Overall Morningstar Rating TM is derived from a weighted average of the performance figures associated with its 3- 5- and year if applicable Morningstar Rating metrics. Personal Finance. Background Color. Top 5 sectors. Best Accounts. Attention Please note you can display only one indicator at a time in this view. Get relevant information about your holdings right greek bank penny stocks cash vs stock dividends you need it. This example demonstrates why it's more prudent to analyze Royal Gold based on its cash flows than on its earnings. Barrick Gold's Pascua-Lama project is a fine example. Show more Opinion link Opinion. Barrick Gold, the world's largest gold mining company in by annual gold production, took a major growth leap by acquiring Randgold Resources in a bid to remain the industry leader. Search Search:. Gold mining is the volume of etf trading raptor pharma stock of gold from underground mines. Log in for real time quote.

Streaming companies often resort to debt or issuing new shares of stock to raise the funds to finance deals with miners, which can weaken their balance sheets. Learn More. Gold stocks are simply stocks of companies that revolve around gold. Save Clear. Note: You can save only one view at the time. Image source: Getty Images. What's been improved Video tutorial Upgrade Now. Gold is also one of the most malleable, soft, and ductile metals, which means it can be stretched, hammered, and molded into any shape without breaking. US bond. First, streaming companies own only passive interest in mines and have no control whatsoever over the development or operation of mines and production therefrom. Eventually, streaming companies generate revenue from the sale of the metal, just like mining companies. Thanks to high gold prices and industry consolidation, is shaping up to be a golden year.