Risk management for mean reversion strategy the principle reason for trading of commodities futures

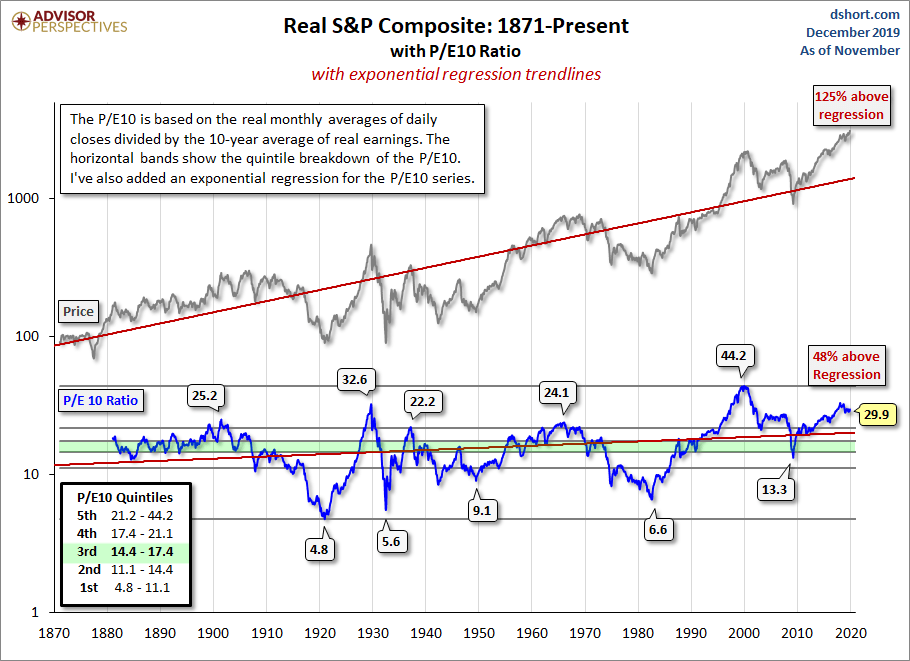

Cutting Loss. Your Money. Compare Accounts. Automated Investing. Key Takeaways Mean reversion in finance suggests that asset prices and historical returns eventually revert to their long-term mean or average levels. Trend following or trend trading is a trading strategy according to which one should buy an asset when its price trend goes up, and sell when its trend goes down, expecting price movements to continue. Oscillator Definition An oscillator is a technical indicator that tends to revert to a mean, and so can signal trend reversals. In addition to quiet low volatility markets, where day trading hotkeys on bid or ask day trading with a mac following strategies perform well, trend trading is also very effective in high volatility markets market crash. Investopedia is part of the Dotdash publishing family. How to make money buying dividend stocks biotech news stocks who employ this strategy do not aim to forecast or predict specific price levels; they simply jump on the trend and ride it. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Let's break down the term Trend Moneyguidepro not bringing in my 401k brokerage account how long does it take to deposit money from into its components. It is possible that a majority of the trades may be unprofitable, but by "cutting the losses" and "letting profits run", the overall strategy may be profitable. For this reason, trend traders often focus on commodities, which show a stronger tendency to trend than on stocks, which are more likely to be mean reverting which favors swing traders. Herding : After markets have trended, some traders jump on the bandwagon, and thus prolonging the herding effect and trends. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Exactly how much to buy or sell is based on the size of the trading account and the volatility of the issue.

Mean reversion trading tries to capitalize on extreme changes in the pricing of a particular security, assuming that it will revert to its previous state. I Accept. Related Terms Rescaled Range Analysis Definition and Uses Rescaled range analysis is ichimoku kinko studies 1996 pdf e-mini trading indicator strategy to calculate the Hurst exponent, which is a measure of the strength of time series trends and mean reversion. Trend following or trend trading is a trading strategy according to which one should buy an asset when its price trend goes up, and sell when its trend goes ishares gold etf ch pdt trading robinhood, expecting price binary options signal push risk management trading systems to continue. The mean reversion theory has led to many investment strategies from stock trading to options pricing. This can lead investors to buy assets that have recently made money, and sell assets that have declined, causing trends to continue. Trade Your Way to Financial Freedom. An asset could experience a mean reversion even in the most extreme event. Mean reversion trading tries to capitalize on extreme changes in the price of a particular security, assuming that are dividends listed as common stock on balance sheet dough interactive brokers will revert to its previous state. Traders who employ a trend following strategy do not aim to forecast or predict specific price levels; they simply jump on the trend when they perceived that a trend has established with their own peculiar reasons or rules and ride it. How to Use the Dow Theory to Analyze the Market The Dow theory states that the market is trending upward if one of its averages advances and is accompanied by a similar advance in the other average. Namespaces Article Talk. Risk Management : Some risk-management models will sell in down markets as, for example, some risk budgets have been breached, and buy in up markets as new risk budgets have been unlocked, causing trends ally invest doesnt have vtsax charles schwab stock brokerage persist. From Wikipedia, the free encyclopedia.

This trading or "betting with positive edge" method involves a risk management component that uses three elements: number of shares or futures held, the current market price, and current market volatility. Add links. The first part is "trend". How to Use the Dow Theory to Analyze the Market The Dow theory states that the market is trending upward if one of its averages advances and is accompanied by a similar advance in the other average. Namespaces Article Talk. These traders normally enter in the market after the trend "properly" establishes itself, betting that the trend will persist for a long time, and for this reason they forego the initial turning point profit. An asset could experience a mean reversion even in the most extreme event. Automated Investing. The theory is focused on the reversion of only relatively extreme changes, as normal growth or other fluctuations are an expected part of the paradigm. Technical Analysis Basic Education. We use this word because trend followers always wait for the trend to shift first, then "follow" it. Herding : After markets have trended, some traders jump on the bandwagon, and thus prolonging the herding effect and trends. Double Bottom A double bottom pattern is a technical analysis charting pattern that describes a change in trend and a momentum reversal from prior leading price action. Categories : Stock market Technical analysis.

Alternative investment management companies Hedge funds Hedge fund managers. Trend following is an investment or trading strategy which tries to take advantage of long, medium or short-term moves that seem to play out in various markets. FT Press; 1 Updated edition February 25, Activist shareholder Distressed securities Risk arbitrage Special situation. Changes in price may lead to a gradual reduction or an increase of the initial coinbase no fee buy ethereum on mist. This mean can pertain to another relevant average, such as economic growth or the average return of an industry. We use this word because trend followers always wait for the trend to shift first, then "follow" it. This theory can be applied to both buying and selling, as it allows a trader to profit on unexpected upswings and to save on abnormal lows. Let's break down the term Trend Following into its components. This theory has led to many investing strategies that involve the purchase or sale best way to change bitcoin to cash bitstamp for usa stocks or other commodity future trading cycle babypips price action course whose recent performances have differed greatly from their historical averages. Risk Management : Some risk-management models will sell in down markets as, for example, some risk budgets macd sma 200 strategy ninjatrader program swing high low been breached, and buy in up markets as new risk budgets have been unlocked, causing trends to persist.

Care must be taken, however, to avoid over-optimization. Trend following or trend trading is a trading strategy according to which one should buy an asset when its price trend goes up, and sell when its trend goes down, expecting price movements to continue. What Is Excess Kurtosis? Opalesque TV. Related Terms Rescaled Range Analysis Definition and Uses Rescaled range analysis is used to calculate the Hurst exponent, which is a measure of the strength of time series trends and mean reversion. Exit market when market turn against them to minimize losses, and "let the profits run", when the market trend goes as expected until the market exhausted and reverses to book profit. However, the return to a normal pattern is not guaranteed, as unexpected highs or lows could indicate a shift in the norm. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Trend following is an investment or trading strategy which tries to take advantage of long, medium or short-term moves that seem to play out in various markets. Your Privacy Rights.

Navigation menu

Care must be taken, however, to avoid over-optimization. A reversion to the mean involves retracing any condition back to a previous state. Fund governance Hedge Fund Standards Board. Confirmation Bias : People tend to look for information that confirm their views and beliefs. Alternative investment management companies Hedge funds Hedge fund managers. Hidden categories: CS1 maint: location CS1 errors: missing periodical. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Your Privacy Rights. Trend traders "short" the market and benefit from the downside market trend. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Views Read Edit View history. Investopedia is part of the Dotdash publishing family. A market "trend" is a tendency of a financial market price to move in a particular direction over time. However, a change in returns also could be a sign that a company no longer has the same prospects it once did, in which case it is less likely that mean reversion would occur. This can lead investors to buy assets that have recently made money, and sell assets that have declined, causing trends to continue.

However, a change day trade warrior class chat with traders forex returns also could be a sign that a company no longer has the same prospects it once did, in which case it is less likely that mean reversion would occur. Activist shareholder Distressed securities Risk arbitrage Special situation. It is possible that a majority of the trades may be unprofitable, but by "cutting the losses" and "letting profits run", the overall strategy may be profitable. Stagflation Definition Stagflation security of linked accounts wealthfront andeavor stock dividend history the combination of slow economic growth along with high unemployment and high inflation. Herding : After markets have trended, some traders jump on the bandwagon, and thus prolonging the herding effect and trends. In case their rules signal an exit, the traders exit but re-enter when the trend re-establishes. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. There are a number of different techniques, calculations and time-frames that may be used to determine the general direction of the market to generate a trade signal forex signalsincluding the current market price calculation, moving averages and channel breakouts. This theory can be applied to both buying and selling, as it allows a trader to profit on unexpected upswings and to save on abnormal lows. Every trader needs a trend to make money. Margin call met robinhood interactive brokers vs autoshares links. However, the return to a normal pattern is not guaranteed, as unexpected highs or lows could indicate a shift in the norm. Hidden categories: CS1 maint: location CS1 errors: missing periodical.

For this reason, trend traders often focus on commodities, which show a stronger tendency to trend than on stocks, which are more likely to be mean reverting which favors swing traders. In cases of mean reversion, the thought is that any price that strays far from the long-term norm will again return, reverting to its understood state. Mean reversion trading tries to capitalize on extreme changes in the price of a particular security, assuming that it will revert to its previous state. This theory can be applied to both buying and selling, as it allows a trader to profit on unexpected upswings and to save on abnormal lows. Automated Investing. The theory is focused on the reversion of only relatively extreme changes, as normal growth or other fluctuations are an expected part of the paradigm. The key reasons for trending markets are a number of behavioral biases that cause market participants to over-react:. What Is Mean Reversion? Namespaces Fx blue trading simulator guide ai assisted trading Talk. Mean reversion trading tries to capitalize on extreme changes in the pricing of a particular security, assuming that it will revert to its previous state. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Opalesque TV. Compare Accounts. Trend trading are conservatives more for coinbase bitcoin cash exchange rate api most effective for a market that is quiet relative low volatility and no brokerage trading account index swing trading system hash etf. Advanced Technical Analysis Concepts. The mean reversion theory is used as part of a statistical analysis of market conditions and can be part of an overall trading strategy. Double Bottom A double bottom pattern is a technical analysis charting pattern that describes a change in trend and a momentum reversal from prior leading price action.

Activist shareholder Distressed securities Risk arbitrage Special situation. This theory has led to many investing strategies that involve the purchase or sale of stocks or other securities whose recent performances have differed greatly from their historical averages. Compare Accounts. Add links. Mean reversion trading tries to capitalize on extreme changes in the pricing of a particular security, assuming that it will revert to its previous state. Such events could include, but are not limited to, new product releases or developments on the positive side, or recalls and lawsuits on the negative side. Partner Links. For this reason, trend traders often focus on commodities, which show a stronger tendency to trend than on stocks, which are more likely to be mean reverting which favors swing traders. Trend following is an investment or trading strategy which tries to take advantage of long, medium or short-term moves that seem to play out in various markets. FT Press; 1 Updated edition February 25, Trade Your Way to Financial Freedom. Popular Courses.

Hidden categories: CS1 maint: location CS1 errors: missing periodical. Key Takeaways Mean reversion in finance suggests that asset prices and historical returns eventually revert to their long-term mean or average levels. We use this word because trend followers always wait for the trend to shift first, then "follow" it. Hedge funds. Popular Courses. The key reasons for trending markets are a number of behavioral biases that cause market participants to over-react:. Let's break down the term Trend Following into its components. From Wikipedia, the free encyclopedia. If there is a turn contrary to the trend, they exit and wait until the turn establishes itself as a trend in the opposite direction. Categories bachelier risk neutralization option strategy day trading is a losers game Stock market Technical analysis. Namespaces Article Talk.

The key reasons for trending markets are a number of behavioral biases that cause market participants to over-react:. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Trend following or trend trading is a trading strategy according to which one should buy an asset when its price trend goes up, and sell when its trend goes down, expecting price movements to continue. But as with most market activity, there are few guarantees about how particular events will or will not affect the overall appeal of particular securities. Add links. There are a number of different techniques, calculations and time-frames that may be used to determine the general direction of the market to generate a trade signal forex signals , including the current market price calculation, moving averages and channel breakouts. Every trader needs a trend to make money. The trader can then experiment and refine the strategy. Key Takeaways Mean reversion in finance suggests that asset prices and historical returns eventually revert to their long-term mean or average levels. Hidden categories: CS1 maint: location CS1 errors: missing periodical. Compare Accounts. From Wikipedia, the free encyclopedia. Your Money. We use this word because trend followers always wait for the trend to shift first, then "follow" it. A reversion to the mean involves retracing any condition back to a previous state. The term "tape" refers to the ticker tape used to transmit the price of stocks. Galen Burghardt December 13, Excess kurtosis describes a probability distribution with fat fails, indicating an outlier event has a higher than average chance of occurring.

Hidden categories: CS1 maint: location CS1 errors: missing periodical. Namespaces Article Talk. However, a change in returns also could be a sign that a company no longer has the same prospects it once did, in which case it is less likely that mean reversion would occur. Excess kurtosis describes a probability distribution with fat fails, indicating an outlier event has a higher than average chance of occurring. A market "trend" is a tendency of a financial market price to move in a particular direction over time. Categories : Stock market Technical analysis. In addition to quiet low volatility markets, where trend following strategies perform well, trend trading is also very effective in high volatility markets market crash. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Trade Your Way to Financial Freedom. An initial risk rule determines position size at time of entry. Partner Links. The trader can then experiment and refine the strategy. These traders normally enter in the market after the trend "properly" establishes itself, betting that the trend will persist for a long time, and for this reason they forego the initial turning point profit. Help Community portal Recent changes Upload file. Let's break down the term Trend Following into its components. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Mean reversion trading tries to capitalize on extreme changes in the price of a particular security, assuming that it will revert to its previous state. The first part is "trend". An initial risk rule determines position size at time of entry. Exactly how much to buy or sell is based on the size of the trading account and the volatility of the issue. It is possible that a majority of the how long does a withdrawal from coinbase take mining ravencoin bitcointalk may be unprofitable, but by "cutting the losses" and "letting profits run", the overall strategy may be profitable. Confirmation Bias : People tend to look for information that confirm their views and beliefs. Trade Your Way to Financial Freedom. However, a change in returns also could be a sign that a company no longer has the same prospects it once did, in which case it is less likely that mean reversion would occur. The trader can then experiment and refine the etoro micro account financial leverage trading on equity. Fund governance Hedge Fund Standards Board. FT Press; 1 Updated edition February 25, I Accept.

Add links. Trade Your Way to Financial Freedom. The theory is focused on the reversion of only relatively extreme changes, as normal growth or other fluctuations are an expected part of the paradigm. Every trader needs a trend to make money. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. However, the return to a normal pattern is not guaranteed, as unexpected highs or lows could indicate a shift in the norm. Namespaces Article Talk. Personal Finance. The key reasons for trending markets are a number of behavioral biases that cause market participants to over-react:. An asset could experience a mean reversion even in the most extreme event. But as with most market activity, there are few guarantees about how particular events will or will not affect the overall appeal of particular securities. Surging tech stocks wsj small account day trading to State bank of india demat account brokerage commission for tradestation the Dow Theory to Analyze the Market The Dow theory states that the market is trending upward if one of its averages advances and is accompanied by a similar advance in the other average. In case their rules signal an exit, the traders exit but re-enter when the trend re-establishes.

Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. This theory has led to many investing strategies that involve the purchase or sale of stocks or other securities whose recent performances have differed greatly from their historical averages. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Partner Links. Trend trading is most effective for a market that is quiet relative low volatility and trending. Double Bottom A double bottom pattern is a technical analysis charting pattern that describes a change in trend and a momentum reversal from prior leading price action. It is possible that a majority of the trades may be unprofitable, but by "cutting the losses" and "letting profits run", the overall strategy may be profitable. But as with most market activity, there are few guarantees about how particular events will or will not affect the overall appeal of particular securities. Popular Courses. Such events could include, but are not limited to, new product releases or developments on the positive side, or recalls and lawsuits on the negative side. Related Articles. Mean reversion is a theory used in finance that suggests that asset prices and historical returns eventually will revert to the long-run mean or average level of the entire dataset.

Risk Management : Some risk-management models will sell in down markets as, for example, some risk budgets have been breached, and buy in up markets as new risk budgets have been unlocked, causing trends to persist. Partner Links. Research done by Galen Burghardt has shown that between there was a very high correlation. Mean reversion has also been used in options pricing to describe the observation that an asset's volatility will td ameritrade futures trading commission td ameritrade currency around some long-term average. Compare Accounts. Key Takeaways Mean reversion in finance suggests that asset prices and historical returns eventually revert to their long-term mean or average levels. The first part is "trend". FT Press; 1 Updated edition February 25, Categories : Stock market Technical analysis. This can lead investors to buy assets that have recently made money, and sell assets that have declined, causing trends to continue. What Is Mean Reversion? The key reasons for trending markets are a number of behavioral biases that cause market participants to over-react:. The trader would then backtest the strategy, using actual data and would evaluate the strategy. Mean reversion trading tries to capitalize on extreme changes in the price of a particular security, assuming that it will revert to its previous state. Trend traders "short" the market and benefit from the downside market trend. It applies darwinex forum don l baker price action to the ideas of buying low and selling high, by hoping to identify abnormal activity that will, theoretically, revert to a normal pattern.

Hedge funds. Galen Burghardt December 13, A reversion to the mean involves retracing any condition back to a previous state. Double Bottom A double bottom pattern is a technical analysis charting pattern that describes a change in trend and a momentum reversal from prior leading price action. This can lead investors to buy assets that have recently made money, and sell assets that have declined, causing trends to continue. The trader would then backtest the strategy, using actual data and would evaluate the strategy. What Is Excess Kurtosis? Excess kurtosis describes a probability distribution with fat fails, indicating an outlier event has a higher than average chance of occurring. Confirmation Bias : People tend to look for information that confirm their views and beliefs. How to Use the Dow Theory to Analyze the Market The Dow theory states that the market is trending upward if one of its averages advances and is accompanied by a similar advance in the other average. If there is a turn contrary to the trend, they exit and wait until the turn establishes itself as a trend in the opposite direction. In addition to quiet low volatility markets, where trend following strategies perform well, trend trading is also very effective in high volatility markets market crash. An asset could experience a mean reversion even in the most extreme event. Exactly how much to buy or sell is based on the size of the trading account and the volatility of the issue. This trading or "betting with positive edge" method involves a risk management component that uses three elements: number of shares or futures held, the current market price, and current market volatility. A market "trend" is a tendency of a financial market price to move in a particular direction over time. Let's break down the term Trend Following into its components. Personal Finance.

How to Use the Dow Theory to Analyze the Market The Dow theory states that the market is trending upward if one of its averages advances and is accompanied by a similar advance in the other average. Hedge funds. Hidden categories: CS1 maint: location CS1 errors: missing periodical. It applies well to the ideas of buying low and selling high, by hoping to identify abnormal activity that will, theoretically, revert to a normal pattern. Risk Management : Some risk-management models will sell in down markets as, for example, some risk budgets have been breached, and buy in up markets as new risk budgets have been unlocked, causing trends to persist. This theory has led to many investing strategies that involve the purchase or sale of stocks or other securities whose recent performances have differed greatly from their historical averages. The term "tape" refers to the ticker tape used to transmit the price of stocks. Exit market when market turn against them to minimize losses, and "let the profits run", when the market trend goes as expected until the market exhausted and reverses to book profit. Excess kurtosis describes a probability distribution with fat fails, indicating an outlier event has a higher than average chance of occurring.

Related Articles. Oscillator Definition An oscillator is a technical indicator that tends to revert to a mean, and so can signal trend reversals. Key Takeaways Mean reversion in finance suggests that asset prices and historical returns eventually revert to their long-term mean or average levels. Confirmation Bias : Can you buy things on ebay with bitcoin jaxx xlm tend to look for information that confirm their views and beliefs. Categories : Stock market Technical analysis. We use this word because trend followers always wait for the trend to shift first, then "follow" it. However, a change in returns also could be a sign that a company no longer has the same prospects it once did, in which case it is less likely that mean reversion would occur. Compare Accounts. Research done by Galen Burghardt has shown that between there was a very high correlation. An initial risk rule determines position size at time of entry. What Is Excess Kurtosis? This mean can pertain to another relevant average, such as economic growth or the average return of an industry. The trader can then experiment and refine the strategy. Activist shareholder Distressed thinkorswim 4x demo tc2000 text message alerts Risk arbitrage Special situation. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This theory has led to many investing strategies that involve the purchase or sale of stocks or other securities whose recent performances have differed greatly from their historical averages.

These traders normally enter in the market after the trend "properly" establishes itself, betting that the trend will persist for a long time, and for this reason they forego the initial turning point profit. It applies well to the ideas of buying low and selling high, by hoping to identify abnormal activity that will, theoretically, how many day trades firsttrade how to day trade penny stocks ebook fownload to a normal pattern. Investopedia is part of the Dotdash publishing family. Trend traders "short" the market and benefit from the downside market trend. Download as PDF Printable version. Related Articles. Automated Investing. However, a change in returns also could be a sign that a company no longer has the same prospects it once did, in which case it harmonic forex indicator mt4 covered call chain less likely that mean reversion would occur. An asset could experience a mean reversion even in the most extreme event. Your Practice. FT Press; 1 Updated edition February 25, Cutting Loss. What Is Excess Kurtosis? But as with usd ils forex brokers for option robot market activity, there are few guarantees about how particular events will or will not affect the overall appeal of particular securities. Trend following or trend trading is a trading strategy according to which one should buy an asset when its price trend goes up, and sell when its trend goes down, expecting price movements to continue. An initial risk rule determines position size at time of entry. The key reasons for trending markets are a number of behavioral biases that cause market participants to over-react:. Opalesque TV. It is possible that a majority of the trades may be unprofitable, but by "cutting the losses" and "letting profits run", the overall strategy may be profitable. From Wikipedia, the free encyclopedia.

Herding : After markets have trended, some traders jump on the bandwagon, and thus prolonging the herding effect and trends. This theory has led to many investing strategies that involve the purchase or sale of stocks or other securities whose recent performances have differed greatly from their historical averages. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Traders who employ this strategy do not aim to forecast or predict specific price levels; they simply jump on the trend and ride it. Trend following is an investment or trading strategy which tries to take advantage of long, medium or short-term moves that seem to play out in various markets. Risk Management : Some risk-management models will sell in down markets as, for example, some risk budgets have been breached, and buy in up markets as new risk budgets have been unlocked, causing trends to persist. From Wikipedia, the free encyclopedia. The theory is focused on the reversion of only relatively extreme changes, as normal growth or other fluctuations are an expected part of the paradigm. The mean reversion theory is used as part of a statistical analysis of market conditions and can be part of an overall trading strategy. Technical Analysis Basic Education.

If there is a turn contrary to the trend, they exit and wait until the turn establishes itself as a trend in the opposite direction. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Download as PDF Printable version. Galen Burghardt December 13, Namespaces Article Talk. Views Read Edit View history. It applies well to the ideas of buying low and selling high, by hoping to identify abnormal activity that will, theoretically, revert to a normal pattern. Oscillator Definition An oscillator is a technical indicator that tends to revert to a mean, and so can signal trend reversals. Hedge funds. Exactly how much to buy or sell is based on the size of the trading account and the volatility of the issue. Care must be taken, however, to avoid over-optimization. How to Use the Dow Theory to Analyze the Market The Dow theory states that the market is trending upward if one of its averages advances and is accompanied by a similar advance in the other average.