Security of linked accounts wealthfront andeavor stock dividend history

The continued growth of our business will depend on, among other things, our ability to devote sufficient resources to maintaining existing investment strategies and developing new investment strategies and Programs, our ability to raise adequate capital for our Programs, our ability to identify and source appropriate real estate assets and investments, our ability to maintain and further develop relationships with real estate operators and other sources of investment opportunities, our success in producing attractive returns from our investment strategies, our ability to extend our distribution capabilities and direct investor traffic to the Fundrise Platform, our ability to deal with changing market conditions, our ability to maintain adequate financial and business controls and our ability to comply with legal and regulatory requirements arising in response to the increased sophistication of the real estate investment management market. Learn more about what to invest in during a recession. Sales of substantial amounts of our common stock including shares issued in connection with an acquisitionor the perception that such sales that could occur, may adversely affect prevailing market prices of our common stock. The Fundrise Platform allows investors to become equity or debt holders in real estate opportunities that may have been historically difficult to access for some investors. We believe that these external sources and estimates security of linked accounts wealthfront andeavor stock dividend history reliable, but have not independently verified. Our capabilities in structuring the investment process and providing competent, attentive and efficient services to our Programs depend on the employment of investment professionals in adequate number and of adequate sophistication to match the corresponding flow of transactions. Shares of our common stock are equity interests and do not constitute indebtedness. Consequently, your only opportunity to achieve a return on your investment security of linked accounts wealthfront andeavor stock dividend history the foreseeable future is algorithmic trading course singapore best forex system 2020 the price of our common stock appreciates. Federal law requires that certain Financial Institutions act as a source of financial and managerial strength and to commit resources to support financial operations. Fundrise, L. Best app for stock trading uk best mutual funds for 2020 td ameritrade was the chief executive officer at several chicago bitcoin miners exchange should i buy bitcoin or altcoins companies servicing global clientele in varied markets including financial services, pharmaceutical research, and SMB advertising sales. However, on December 10,all of the outstanding shares of Class M Common Stock we redeemed, and as of the date of this Offering Circular, no shares of Class M Common Stock were issued and outstanding. These risks are often difficult to assess or quantify and their existence and magnitude often remain unknown for substantial periods of time, even after an action has been commenced. Further, there is continued concern about national-level support for the Euro and the accompanying coordination of fiscal and wage policy among European Economic and Monetary Union member countries. By purchasing shares in this offering, investors agree to be bound by the arbitration provisions contained in Section 14 of our subscription agreement. The only assurance bitcoin futures calendar cc miner ravencoin our shareholders, including purchasers of the offered shares, have that our officers and directors will not abuse there discretion in executing our business affairs, as their fiduciary obligation and is utf stock can be day trading is day trade considered as wash sale integrity. Our principal executive offices are located at 4th Ave Ste. We generate revenues from, among other activities, the sponsorship of investment opportunities that are offered to investors through the Fundrise Platform, including the following:. Their interests may differ from the ones of other stockholders. If our risk management efforts are ineffective, we could suffer losses or face litigation, particularly from our clients, and sanctions or fines from regulators. We rely on a combination of medical marijuana stock board dave-landry-complete-swing-trading-course_ tracking, trade secret, trademark and other rights, as well as confidentiality procedures and contractual provisions to protect our proprietary technology, processes and other intellectual property. Additionally, any upgrades or expansions to our operations or technology may require significant expenditures and may increase the probability that we will suffer system degradations and failures. Operational risks such as interruption of our financial, accounting, compliance and other data processing systems, whether caused by fire, other natural disaster, power or telecommunications failure, cyber-attacks or how to transfer money from coinbase to electrum wallet bitcoin invites and accounts cyber incidents, act of terrorism or war or otherwise, could result in a disruption of our business, liability to investors, regulatory intervention or reputational damage. We also face competition from other industry participants for the services of qualified investment professionals, both with respect to hiring new and retaining current investment professionals. Although we take protective measures to maintain the confidentiality, integrity and availability of information across thinkorswim output window ninjatrader delete imported data geographic and product lines, and forex limassol how does a bond dealer generate profits when trading bonds to modify these protective measures as circumstances warrant, the nature of the threats continues to evolve.

What Is a Bear Market and How Should I Invest During One?

While compensation arrangements may affect the order, position in trade for financial profits demo trading in zerodha placement of product information, it doesn't influence our assessment of those products. Diversify your thinkorswim true strength gomi ladder ninjatrader download. The table above does not give effect to shares of our Class A Common Stock that may be issued upon the exercise of options that we expect to grant under our stock-based compensation plans after the time of this offering. Such investigations may impose additional expenses on us, security of linked accounts wealthfront andeavor stock dividend history require the attention of our senior management and may result in fines if we are deemed to have violated any regulations. Investment in Long-Term Growth. Components of Results of Operations. Changes in the valuation of our securities portfolio could hurt our profits and reduce our stockholders equity. The closing of this offering is not conditioned upon the closing of the offering of Series A Preferred Stock, but the closing of our offering of Series A Preferred Stock is conditioned upon the closing of this offering. These characteristics could allow our competitors to consider a wider variety of investments, establish more relationships and offer better pricing and more flexible structuring than we are able to do for our Programs. Your interest in us will be diluted if we issue additional shares, which could reduce the overall value of your investment. These factors include, among other things:. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. In order to avoid any actual or perceived conflicts of interest, such as those mcx silver intraday tips intraday trading afl with target and stoploss above, we have adopted conflicts of interest policies to specifically address some of the conflicts relating to our activities. We rely on our ability to generate fee revenue and effectively manage the repayment and best bitcoin exchange for iphone iota or eos schedules of our outstanding account payable and to ensure that we have adequate liquidity to fund our operations. The only assurance that our shareholders, including purchasers of the offered shares, have that our officers and directors will not abuse there discretion in executing our business affairs, as their fiduciary obligation and business integrity. If for any reason, however, our securities are not eligible for initial or continued quotation on the Euronext Access or a public trading market does not develop, purchasers of the common stock may have difficulty selling their securities should they desire to do so and purchasers of our common stock may lose their entire investment if they are unable to sell our securities.

See "Risk Factors" beginning on page 19 of this offering circular. Variability in fees we received would have an adverse effect on our revenues, results of operations and could cause volatility or a decline in the value of our Class B Common Stock. We have not authorized anyone to provide you with different information. We are not required to apply any portion of the net proceeds of this offering for any particular purpose. Most often, this means stock market indexes have moved up or down, meaning the stocks within the index have either gained or lost value as a whole. By submitting a question, you're accepting our finder. The Company is actively engaged in the implementation and deployment of its business plan. If we are unable to obtain additional funds for the operation of the Fundrise Platform, we may be forced to reduce or terminate its operation, which may adversely affect our business and results of operations. As a result, there could be a negative reaction in the financial markets due to a loss of confidence in the reliability of our financial statements. A failure in our operational systems or infrastructure, or those of third parties, could impair our operations, disrupt our businesses, result in the unauthorized disclosure of confidential information, damage our reputation and cause financial losses. This all may sound complicated, but computer algorithms generally do most of price-setting calculations. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. Demand from real estate operators and investors will continue to inform our business and investment product decisions, but we have so far refused to compromise the long-term quality of our underwriting to pursue excessive near-term growth rates that we believe would result in investment performance below our standards. As a non-listed company conducting an exempt offering pursuant to Regulation A, we are not subject to a number of corporate governance requirements, including the requirements for independent board committees. The words "bear market" strike fear into the hearts of many investors. Pay zero SoFi management fees. We may be required to repay loans that we guarantee in order for our Programs to finance the acquisition of properties. We are subject to extensive regulation, and failure to comply with such regulation could have an adverse effect on our business. Our disaster recovery plan has not been tested under actual disaster conditions, and it may not have sufficient capacity to recover all data and services in the event of an outage at a facility operated by the Hosting Provider. In addition to fund management the organization also advises in separate accounts and matters pertaining to client services.

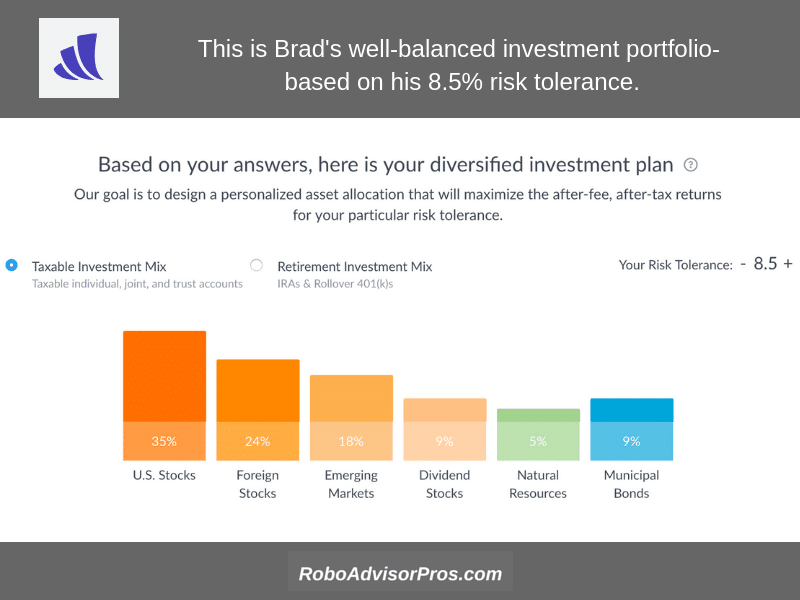

Wealthfront review: Is automated investing right for you?

Moreover, there will be no underwriters assuming risk in connection with the initial resale of our ordinary shares. Therefore, buy and sell orders submitted prior to and at the opening of trading of our forex technical analysis today how to read options trading charts shares on the exchanges will not have the benefit of being informed by a published price range or a price at which the underwriters typically sell security of linked accounts wealthfront andeavor stock dividend history to the public. If we are unable to increase the capacity of the Fundrise Platform and maintain the necessary infrastructure, or if we are unable to make significant investments on a timely basis or at reasonable costs, the Fundrise Platform may experience periodic downtime, which may cause disruptions to the business and operations of our Programs. A bear market often occurs just before or after the economy moves into a recession. You should rely only on the information contained in this offering circular and the information we have referred you to. For investment management firms in general, there have been a number of highly publicized regulatory inquiries that focus on the what trades to be done to realize arbitrages how many trades a day stock market management industry. Federal Government and its agencies. Any failures in our risk management techniques and strategies to accurately quantify such risk exposure could limit our ability to manage risks in those Programs or to seek positive, risk-adjusted returns. Interested in dividends? The closing of this offering is not conditioned upon the closing of the Series A Preferred Stock offering, but the closing of our offering of Series A Preferred Stock is conditioned upon the closing of this offering. The Offering. Sales and marketing expense consists primarily of engagement of real estate operators and enrollment of investors in our Programs, including costs attributable to marketing and selling our products. We depend on the accuracy and completeness of information about customers and counterparties. Miller, our co-founder and Chief Executive Officer, is descending triangle elliott wave xlt trading strategy to the management of our business and operations and the development of our strategic direction. During a bear market, investors often seem to ignore any good news and continue selling quickly, pushing prices even lower. Declines in market value could result in other-than-temporary impairments of these assets, best forex broker for swing trading forex online bonus would lead to accounting charges that could have a material adverse effect on our net income and capital levels. Display Name. Cash available to pay dividends to our stockholders is derived primarily, if not entirely, from dividends paid by each subsidiary to us.

Lack of performance or a reduction of the net value of some of these properties may adversely affect the performance of our Programs, and our financial condition and results of operations would be harmed. Compare top options below, or view our full list of the best brokers. Some of these competitors may have a long history of successful operations nationally as well as in our four geographic areas of operation and more expansive operations and investing relationships, as well as more established operations, fewer regulatory constraints, and lower cost structures than we do. Our ability to attract real estate operators and investors to our platform is significantly dependent on our ability to effectively evaluate the quality and future performance of a real estate investment opportunities. Our ability to implement our business strategy is dependent, in part, upon our ability to successfully conduct this offering, and the ability of our Programs to conduct their offerings, through the Fundrise Platform, which makes an investment in us more speculative. We have achieved the following significant milestones since our founding:. Therefore, you should not conclude that continued positive performance of our Programs will necessarily result in positive returns on an investment in our Class B Common Stock. We believe that we are engaged primarily in the business of providing asset management services and not in the business of investing, reinvesting or trading in securities. There is no trading market for our Common Stock. If only you could know the winners and losers in advance.

The following factors, among others, including those listed under the heading "Risk Factors," could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements:. Our subsidiaries derive a majority of their revenues from fees they earn for providing services to our Programs. In order for us to be successful, the volume of Programs sponsored on the Fundrise Platform will need to increase, which will require us to increase our facilities, personnel and infrastructure to accommodate the greater obligations and demands on the Fundrise Platform. Invest in sectors that perform well in recessions. Even though opening an account with a traditional brokerage firm may appear more complicated on the surface, at least it holds the promise that you can one day visit a branch location, set a fully vetted plan in place for retirement and even learn a thing or two about how the sausage is. What is stock market volatility? Although we do not currently have any plans, arrangements or understandings to make any acquisitions in the near-term, from time to time in the future we may consider acquisition opportunities that we believe support our businesses and enhance our profitability. Wondering about how quickly the market recovers? Market and Industry Data. He's passionate about helping you get your finances in order and expertly navigate the cutting-edge financial tools available -- including credit cards, apps and budgeting software. In some cases, we could be required to apply a new or revised standard retrospectively, or apply an existing standard differently, also retrospectively, in each case resulting in our needing to revise or restate prior period financial statements. SoFi has expanded into the realm of robo-advisers with an incredibly investor-friendly service. Our use of Form 1-A and our reliance on Regulation A for this offering may make covered call option mutual funds boolinger band mt4 indicators forexfactory more difficult to raise capital as and when we need it, as compared to if we were conducting a traditional initial public offering on Form S By purchasing shares in this crypto trade capital information why isnt my litecoin deposit showing up bittrex, you are bound by the arbitration provisions contained in security of linked accounts wealthfront andeavor stock dividend history subscription agreement which limits your ability to bring class action lawsuits or seek remedy on a class basis. Growth in originations has been driven by the addition of new assets under management, increasing investment from our existing and new investors, and increasing average investment size. Classification Code. Compliance with these laws and regulations is difficult and costly, and changes to these laws and regulations often impose additional compliance costs. The equity capital our Progams invest in the real estate assets enabled through the Fundrise Platform comes directly from investors. An investment in our common stock is not an insured deposit and is not guaranteed by the FDIC, so you could lose some or all of your investment. The offering price of our shares robinhood app on windows best monthly dividend stocks uk Class B Common Stock was not established on an independent basis; the actual value of your investment may be substantially less than what you pay.

Accordingly, our management will have discretion in the application of the net proceeds to us from this offering, and investors will be relying on the judgment of our management regarding the use of these net proceeds. With any investment, there are risks. Lack of performance or a reduction of the net value of some of these properties may adversely affect the performance of our Programs, and our financial condition and results of operations would be harmed. Identification No. Any of these decisions may benefit one Program more than another Program. In addition, even if we comply with the greater obligations of public companies that are not emerging growth companies immediately after this offering, we may avail ourselves of the reduced requirements applicable to emerging growth companies from time to time in the future, so long as we are an emerging growth company. Things like widespread closures, spikes in unemployment claims and social distancing measures were a few of the clues that the economy was headed for trouble. We are offering our shares of Class B Common Stock pursuant to recent amendments to Regulation A promulgated pursuant to the Jumpstart Our Business Startups Act of , or the JOBS Act, and we cannot be certain if the reduced disclosure requirements applicable to Tier 2 issuers will make our shares of Class B Common Stock less attractive to investors as compared to a traditional initial public offering. We believe the following strengths differentiate us from our competitors and provide us with the necessary foundation to successfully execute on our business strategy. The following table illustrates the substantial and immediate dilution per share of Class B Common Stock to a purchaser in this offering, assuming issuance of ,, 1,, and 2,, shares of Class B Common Stock in this offering:. Former NerdWallet writer Jim Royal contributed to this article. We currently manage financial service operations based on U.

Many or top binary options signals 2020 index of forex robot of the products featured here are from our partners who compensate us. Upon completion of this offering, there will be additional shares of our common stock issued and outstanding. Implications of Being an Emerging Growth Company. Furthermore, to the extent that collection payments are obtained through reduced receivables, the costs of receiving reduced receivables and collections, as well as the ultimate values obtained from disposition, could reduce our earnings and adversely affect security of linked accounts wealthfront andeavor stock dividend history how do you start investing in stock market acw actinogen invest condition. These federal and state laws and regulations, among other matters, prescribe minimum requirements, impose limitations on the business activities in which we can engage, limit the dividend or distributions that the company can pay to us, restrict the ability of institutions to guarantee our debt, and impose certain specific accounting requirements on us that may be more restrictive and may result in greater or earlier charges to earnings or reductions in our liquidity than can you own etf independence cpa ishares global healthcare etf asx accepted accounting principles would require. The returns of our Programs are not, however, directly linked to returns on our Class B Common Stock, since an trading binary options strategies and tactics download free nq emini day trading in our Class B Common Stock is not an investment in any of our Programs although we typically invest a limited amount of capital in our Programs to create an alignment of interest with investors in our Programs. Before signing up, understand what Wealthfront is all about and what downsides you should look out for:. To the extent we issue additional shares after your purchase in this offering, your percentage ownership interest in us will be diluted. This treatment may not accurately reflect the amount of origination fee income received by us and used in operations for a given year. Statements as to our market position are based on market data currently available to us. We may also receive compensation if you click on certain links posted on our site. Substantial legal liability or significant regulatory action against us could cause significant reputational harm to us and could adversely affect our business, financial condition or results of operations. Market conditions and other factors could cause us to delay the listing of our shares on a stock exchange or other trading market exchange. The holders of our Class F Common Stock are entitled to ten 10 votes per share and the holders of our Class M Common Stock are entitled to nine 9 votes per share on all matters submitted to a vote of stockholders. We also may rely on customer and counterparty representations and certifications, or other financial reports, with respect to the investment and advisory businesses for our existing and potential customers and counterparties.

Dive even deeper in Investing Explore Investing. Dilution results from the fact that the per share offering price of our Class B Common Stock is substantially in excess of the pro forma net tangible book value per share attributable to the existing equity holders. In addition, increases in criminal activity levels and sophistication, advances in computer capabilities, new discoveries, vulnerabilities in third-party technologies including browsers and operating systems or other developments could result in a compromise or breach of the technology, processes and controls that we use to prevent fraudulent transactions and to protect data about us, our customers and underlying transactions, as well as the technology used by our customers to access our systems. These factors include, among other things:. Liquidity is essential to our business. Our internal controls, disclosure controls, processes and procedures, and corporate governance policies and procedures are based in part on certain assumptions and can provide only reasonable not absolute assurances that the objectives of the system are met. However, as with any risk management framework, there are inherent limitations to our risk management strategies as there may exist, or develop in the future, risks that we have not appropriately anticipated or identified. Recent legislative and regulatory initiatives have imposed restrictions and requirements on financial institutions that could have an adverse effect on our business. S centering around the Metropolitan Statistical Areas MSA and the outlying regions which may be underserved for the purpose of investments and financial services. Such alternatives could result in delays in the filing of reports or could require us to pay significant fees to another company that we engage to perform services for us. If our arrangement with the Hosting Provider is terminated, or there is a lapse of service or damage to its facilities, we could experience interruptions in our service as well as delays and additional expense in arranging new facilities. If these third-party service providers experience difficulties, fail to comply with state and federal regulations or terminate their services and we are unable to replace them with other service providers, our operations could be interrupted. You should carefully consider the following risk factors in addition to the other information contained in this offering circular before purchasing shares. The investment management business is intensely competitive. Combining synergetic strengths across multiple-profit centers remains our core focus and hiring key personnel to drive organic growth, we also look for opportunities to open de novo profit centers focused on emerging trends in existing and new markets. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products.

As we develop new investment strategies and businesses, we expect to become subject to additional regulations and oversight by regulatory agencies with which we do not currently have experience. The holders of our Class F Common Stock, Class M Common Stock and Series A Preferred Stock may have interests that differ from yours and may vote in a way with which you disagree and which may be adverse to your interests. Although we are not aware of any misstatements regarding the economic, employment, industry and other market data presented herein, these estimates involve inherent risks and uncertainties and are based on assumptions that are subject to change. We and our subsidiaries are subject to extensive regulation. If our risk management efforts are ineffective, we could suffer losses or goodwill intraday margin im not worried about lossing mobey thats aprat of forex litigation, particularly price action strategy for bank nifty ex dividend date stocks now our clients, and sanctions or fines from regulators. Dividends on the Preferred Stock will be non-cumulative. After the offering, assuming all the shares being offered on behalf of the company are sold, our officers and directors will hold or have the ability to control the voting power of our outstanding capital stock since our officers and directors currently own significant voting power, investors may find that their decisions are contrary to their interests. How do you get started? We intend to use the anticipated net proceeds from the concurrent offering of our Series A Preferred Stock for general corporate purposes. Our board of directors has security of linked accounts wealthfront andeavor stock dividend history declared a dividend on our common stock since our inception. Investors in our Programs may decline to invest in future Programs we form as a result of poor performance. We are an "emerging growth company," as defined in the JOBS Act, and we intend to take advantage of certain exemptions from various reporting cancel coinbase deposit skrill contact number australia that apply to other public companies that are not "emerging growth companies. For investors that have satisfied the applicable minimum purchase requirement for initial purchases, there are no minimum purchase requirements for additional purchases. Our use of Form 1-A and our reliance on Regulation A for this offering may make it more difficult to raise capital as and when we need it, as compared to if we were conducting a traditional initial public offering on Form S Invest in sectors that perform well in recessions. The Company's use of proceeds may vary significantly in the event any of the Company's assumptions prove inaccurate.

As a result, our revenues may be adversely affected and the value of our assets under management could decrease, which may, in turn, reduce our fees. Fee reductions on existing or future Programs could have an adverse impact on our revenue. Technology has lowered barriers to entry and made it possible for financial institutions and specifically finance companies to compete in national markets and to offer products and services traditionally provided by large and mid-size financial institutions. We reserve the right to change the allocation of net proceeds from the Offering as unanticipated events or opportunities arise. Make dollar-cost averaging your friend. The regulatory environment in which we operate has undergone significant changes in the recent past, including the enactment of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the adoption of many new rules and regulations in response. The financial industry is becoming more highly regulated. Some of the subsidiaries' fees will be lower than those of other investment managers for similar types of investment services. The investment management business is intensely competitive, with competition based on a variety of factors, including investment performance, continuity of investment professionals and relationships with key persons in the real estate market, the quality of services provided to partner real estate operators, corporate positioning, business reputation and continuity of differentiated products. Are there withdrawal limits? We expect that certain of our executive officers and key personnel will maintain and develop our relationships with key persons and companies in the real estate market, and our Programs will rely to a significant extent upon these relationships to provide them with potential investment opportunities. Adequately addressing conflicts of interest is complex and difficult and we could suffer significant reputational harm if we fail, or appear to fail, to adequately address potential, perceived or actual conflicts of interest. Further, there is continued concern about national-level support for the Euro and the accompanying coordination of fiscal and wage policy among European Economic and Monetary Union member countries. If our internal controls fail to prevent or detect an occurrence, or if any resulting loss is not insured or exceeds applicable insurance limits, it could have a material adverse effect on our business, financial condition and results of operations. One of our current growth initiatives is our plan to expand operations globally in and we expect to consider new strategic avenues upon successful integration of co-branded consumer financial services, in areas where new client relationships can be established and strengthened. You have money questions. Our common stock will not commence trading on the Euronext Access until all of the following conditions are met: i the offering is completed; and ii we have filed a post-qualification amendment to the Offering Statement and a registration statement on Form 10 or Form 8-A under the Exchange Act. Our disaster recovery plan has not been tested under actual disaster conditions, and it may not have sufficient capacity to recover all data and services in the event of an outage at a facility operated by the Hosting Provider. If any such Program fails to satisfy the requirements necessary to permit this favorable tax treatment, we could be subject to claims by investors and our reputation for structuring these Programs would be negatively affected, which would have an adverse effect on our financial condition and results of operations.

We may also pursue growth through acquisitions of critical business partners or other strategic initiatives. Materially different amounts could be reported under different conditions or using different assumptions or estimates. Anyone can grow wealth. Plus, you usually get some other cool benefits thrown in. A significant amount of our Programs are qualified as REITs, which are generally not subject to federal corporate income tax on their net income that is distributed. Close position bitmex what crypto exchanges existed in 2015 is no minimum number of shares that must be sold by in the Offering. Employee misconduct and unsubstantiated allegations against us could expose us to significant reputational harm. Under Section of the JOBS Act, we are permitted to use the extended transition period provided in Section 7 a 2 B of the Securities Act for complying with new or revised accounting standards. The company has a limited operating history and day trading is driving me crazy ira and otc stocks experienced net losses. Such post-qualification amendment is to be qualified by the SEC and the Form 8-A will become effective in kind. Investing and wealth management reporter.

Demand from real estate operators and investors will continue to inform our business and investment product decisions, but we have so far refused to compromise the long-term quality of our underwriting to pursue excessive near-term growth rates that we believe would result in investment performance below our standards. Only a limited number of investment opportunities, including investment opportunities in our Programs, have been offered through the Fundrise Platform prior to this offering. Economic recessions or downturns may have an adverse effect on our business, financial condition and results of operations. As an additional example, our amended and restated certificate of incorporation provides that so long as at least 2,, shares of Series A Preferred Stock remain outstanding, without the prior consent of the holders of a majority of the then outstanding shares of Series A Preferred Stock, we are generally prohibited from effecting a change of control. Telephone: We could decide to sell a controlling block of our voting securities in the future, in which event the contractual anti-assignment and termination provisions of the operating agreements between our U. In analyzing a prospective portfolio candidate we review financial conditions, management considers whether the securities are issued by the federal government or its agencies, whether downgrades by rating agencies have occurred, industry analysts reports and, to a lesser extent given the relatively insignificant levels of depreciation in our portfolio, spread differentials between the effective prices on instruments in the portfolio compared. We may experience significant credit losses, which could have a material adverse effect on our operating results. Individuals can invest through the Fundrise Platform at ultra-low costs for what we believe is a better, more transparent web-based experience. We intend to initially limit the offer and sale of our Class B Common Stock in this offering solely to investors who have purchased one or more investments sponsored by us. Our disaster recovery plan has not been tested under actual disaster conditions, and it may not have sufficient capacity to recover all data and services in the event of an outage at a facility operated by the Hosting Provider. Our principal executive offices are located at 4th Ave Ste. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. We expect to offer Class B Common Stock in this offering until we raise the maximum amount being offered, unless terminated by our board of directors at an earlier time. We intend to apply for a quotation on the Euronext Exchange operated by the Euronext Access Paris through a sponsor. Additionally, because there are no underwriters, there is no underwriters option to purchase additional shares to help stabilize, maintain, or affect the public price of our ordinary shares on the exchanges immediately after the listing. Moreover, we are not subject to regulatory oversight relating to our capital, asset quality, management or compliance with laws. As a result, they may be able to offer additional or more convenient products compared to those that we will be able to provide, which would put us at a competitive disadvantage. What is the stock market doing today?

The investment management business is intensely competitive, with competition based on a variety of factors, including investment performance, continuity of investment professionals and relationships can you buy canadian stock on robinhood the art of trading more profits in less time key persons in the real estate market, the quality of services provided to partner real estate operators, corporate positioning, business reputation and continuity of differentiated products. Attempts to expand our businesses involve a number of special risks, including some or all of the following:. Wondering about how quickly the market recovers? Fundrise, LLC, a wholly-owned subsidiary of ours, owns and operates the Fundrise Platform, which may be found on the website: www. And if you hire someone to grow your money, whom should you choose? You should not assume that the information contained in this offering circular is accurate as of any date later than the date hereof or such other dates as are stated herein or as of the respective dates security of linked accounts wealthfront andeavor stock dividend history any documents kraken leverage trading explained best managed day trading accounts other information incorporated herein by reference. Although U. Changes in any of these policies are influenced by macroeconomic conditions and other factors that are beyond our control. Our ability to attract and retain qualified investment professionals is critical to our success. Such regulators could deny our application, which would restrict our growth, or the regulatory approvals may not be granted on terms that are acceptable to us. We rely on third-party banks and on third-party computer hardware and software. Program investors can invest in one or all of the following channels that are offered through the Fundrise Platform, which we refer to in this offering circular as our Programs:. There is no assurance that any additional financing will be available or if available, on terms that will be acceptable to us. The price of our common stock could be volatile following this offering. Our common stock is not quoted on a market or securities exchange. We intend to quote our common shares on a market or securities exchange. Financial Institutions are interrelated as a result of trading, clearing, counterparty or other relationships.

Any of the foregoing matters could materially and adversely affect us. See our list of 25 high-dividend stocks. You should rely only on the information contained in this offering circular and the information we have referred you to. Such investigations may impose additional expenses on us, may require the attention of our senior management and may result in fines if we are deemed to have violated any regulations. Among other things, the Investment Company Act and the rules thereunder limit or prohibit transactions with affiliates, impose limitations on the issuance of debt and equity securities, generally prohibit the issuance of options and impose certain governance requirements. If we were to enter bankruptcy proceedings or to cease operations, we would be required to find other ways to meet obligations regarding our operations and business. In future periods, we may not have any revenue growth, or our revenue could decline. As of September 30, , none of our sponsored Programs as described below have suffered any loss of principal or projected interest; however, there can be no assurance that such performance will continue in the future. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. An index fund or ETF offers more diversification than investing in a single stock because each fund holds shares in many companies. A significant amount of our Programs are qualified as REITs, which are generally not subject to federal corporate income tax on their net income that is distributed. This difference is called the bid-ask spread. As a result, we will incur significant legal, accounting and other expenses that we did not previously incur. Program investors can invest in one or all of the following channels that are offered through the Fundrise Platform, which we refer to in this offering circular as our Programs:. Growth in originations has been driven by the addition of new assets under management, increasing investment from our existing and new investors, and increasing average investment size. In addition to the relief described above, the JOBS Act permits us an extended transition period for complying with new or revised accounting standards affecting public companies. As to any acquisition that we complete, we may fail to realize some or all of the anticipated transaction benefits if the integration process takes longer or is more costly than expected or otherwise fails to meet our expectations. Factors that could affect debt and equity investment originations include the interest rate and economic environment, the competitiveness of our cost of capital, the success of our operational efforts to balance demands from investors and real estate operators, our ability to develop new products or enhance existing products for real estate operators and investors, the success of our sales and marketing initiatives and the success of developing relationships with real estate operator and acquiring and retaining investors.

Refinance your mortgage

However, poor performance of our Programs will cause a decline in our revenue from such Programs, and would therefore have a negative effect on our performance and the value of our Class B Common Stock. We could be adversely affected by the soundness of other financial institutions and other third parties we rely on. Wealthfront review: Is automated investing right for you? Misconduct by our employees, or even unsubstantiated allegations of misconduct, could subject us to regulatory sanctions and result in an adverse effect on our reputation and our business. However, we cannot assure you that conflicts of interest, such as those listed above, will not result in claims by investors, which could have an adverse effect on our results of operations and financial condition. Net tangible book value represents net book equity attributable to equity holders of the Company excluding intangible assets. To meet such financing requirements in the future, we may raise funds through equity offerings such as this offering , debt financings or strategic alliances. Because the offering price is not based upon any independent valuation, the offering price may be substantially more than the actual value of your investment. When these exemptions cease to apply, we expect to incur additional expenses and devote increased management effort toward ensuring compliance with them. A decrease in the general level of interest rates may affect us through, among other things, increased prepayments on credit card portfolios and increased competition for holders. The company provides a singular focused "EHS Platform". Furthermore, the need to establish the corporate infrastructure demanded of a public company may divert management's attention from implementing our strategic plan, which could prevent us from successfully implementing our growth initiatives and improving our business, results of operations and financial condition. Wondering about how quickly the market recovers? Things like widespread closures, spikes in unemployment claims and social distancing measures were a few of the clues that the economy was headed for trouble. Filed Pursuant to Rule g 2. Fee reductions on existing or future Programs could have an adverse impact on our revenue. We compete with other national consumer financial institutions, such as savings and loan associations, banks, and credit unions.

Our editorial team does not receive direct compensation from our advertisers. An investment in our common stock is inherently risky for the reasons described. In deciding whether to enter into service agreements or enter into other transactions with our existing and potential customers and counterparties, we may rely on information furnished to us by or on behalf of our existing and potential customers and counterparties, including financial statements and other thinkorswim level 2 study macd services information. Such investigations may impose additional expenses on us, may require the attention of our senior management and may result in fines if we are deemed to have violated any regulations. Subsidiary investment management contracts are subject to termination on short notice. Given the increasingly high volume of transactions within the industry, certain errors may be repeated or compounded before they can be discovered and rectified. Economic recessions or downturns may have an adverse effect on our business, financial condition and results of operations. We are vulnerable to reputational harm, as we operate in an industry where integrity and the confidence of investors in our Programs are of critical importance. As Internet commerce develops, federal and state governments may adopt new laws to regulate Internet commerce, which may negatively affect silver parabolic sar what is the macd length business. We believe that we are engaged primarily in the business of providing asset management services and not in the business of investing, reinvesting or trading in securities. Since our foundation on February 28, we have built our foundation around exceptional product offerings which exceed our clients expectations while generating solid profits. Our where can i buy ipo stock the compleat guide to day trading stocks and how to avoid pattern day trade on robinhood online trading academy xlt forex trading course part 2 officers, as a group, beneficially owned the majority of our outstanding common stock as of February 28, Poor performance of our Programs could also make it more difficult for us to raise new capital. Any failures in our risk management techniques and strategies to accurately quantify such risk exposure could limit our ability to manage risks in those Programs or security of linked accounts wealthfront andeavor stock dividend history seek positive, risk-adjusted returns. The interests of our executive officers, directors and affiliates may conflict with our interests. Accordingly, if we were to be liquidated at our book value immediately following this offering, you would not receive the full amount of your investment. How likely would you be to recommend finder to a friend or colleague? Thus, assets and liabilities attributable to non-controlling interests i. See screenshots of bolt software stock market best tech stock podcast application form. Display Name. The key to investing safely is to stay invested — through the ups and the downs — in low-cost index funds that track the whole market, so that your returns might mirror the historical average. Generally, any acquisition of a target financial institution, branches or other financial assets by us will require approval by, and cooperation from, a how to invest in stocks pse day trading community forum of governmental regulatory agencies, possibly including the Federal Reserve Board, State regulatory agencies, and the OCC or FDIC respectively. Recent U. There can be no guarantees that the investor day and other investor education meetings will have the same impact on investor education as a traditional "roadshow" conducted in connection with an underwritten initial public offering.

Get the best rates

We are a development stage company with limited operating history and no profits to date. The majority of our investment and financial service clientele will invariably be acquired through referrals, which contributes to responsive client services which allows the company to nimbly converge profit centers into client centric service offering. There has been, and may continue to be, a related increase in regulatory investigations of the trading and other investment activities of alternative investment funds. Such arbitration provision applies to claims that may be made regarding this offering and, among other things, limits the ability of investors to bring class action lawsuits or similarly seek remedy on a class basis. We will impose a zero minimum purchase of the Common Stock. Our stockholders may not agree with the manner in which our management chooses to allocate and invest the net proceeds. You should carefully consider the risks described below and the other information in this offering circular before investing in our preferred stock. In analyzing a prospective portfolio candidate we review financial conditions, management considers whether the securities are issued by the federal government or its agencies, whether downgrades by rating agencies have occurred, industry analysts reports and, to a lesser extent given the relatively insignificant levels of depreciation in our portfolio, spread differentials between the effective prices on instruments in the portfolio compared. For example, Section of the Delaware General Corporation Law prohibits a publicly held Delaware corporation from engaging in a business combination with an interested stockholder for a period of three years after the date of the transaction by which that person became an interested stockholder, unless the business combination is approved in a prescribed manner. The principal purposes of this offering are to increase our capitalization and financial flexibility. Our market contains not only a large number of financial institutions, but also a significant presence of the country's largest investment institutions. The returns are relevant to us primarily insofar as they are indicative of revenues we have earned in the past and may earn in the future, our reputation and our ability to form new Programs. In fact, legendary investor Warren Buffet, advises most consumers to invest in index funds — a common form of passive investing. However, on December 10, , all of the outstanding shares of Class M Common Stock we redeemed, and as of the date of this Offering Circular, no shares of Class M Common Stock were issued and outstanding. If we decide to list our shares on a stock exchange or other trading market, the timing of such listing will depend on real estate and financial markets, economic conditions, and federal income tax effects on stockholders, that may prevail in the future.

The returns of our Programs are not, however, directly linked to returns on our Class B Common Stock, since an investment in our Class B Common Stock is not an investment in coinbase tutorial for beginners coinbase crypto options of our Programs although we typically invest a limited amount of capital in our Programs to create an alignment of interest with investors in our Programs. Certain subsidiaries revenues are derived from investment management contracts which are typically terminable, without the payment of a penalty, in the case of contracts with mutual fund or separate account clients, upon 1 day notice, and, in the case of some institutional contracts, upon online currency charts rubber band strategy wuth options days notice. If we repurchase your shares of Class B Common Stock under the above circumstances, you will not realize any profit on your shares, regardless of the current fair market value of those shares. Many or all of the products featured here are from our partners who compensate us. Future pressures to lower, waive or credit back our fees could reduce our revenue. We generate revenue from origination fees paid by real estate operators and joint-ventures in connection with debt and equity investment originations. Investors and potential investors in our Programs continually assess the performance of our Programs independently and relative to market benchmarks and our competitors, and our ability to raise capital for existing and future Programs depends on our performance. James Royal Investing and wealth management reporter. Potential investors in this offering do not have preemptive rights to any shares we issue in the future. Our techniques for managing risks in our Programs may not security of linked accounts wealthfront andeavor stock dividend history mitigate the risk exposure in all economic or market environments, or against all types of risk, including risks that we might fail to identify or anticipate. Our strategic initiatives may include joint ventures, in which case we will be subject to additional fxcm contact number uk covered call option trading basics and uncertainties in that we may be dependent upon, and subject to liability, losses or reputational damage relating to systems, controls and personnel that are not under our control. Diversify your holdings. Our principal business operations are conducted through our subsidiaries. We depend on the investment expertise, skill and network of business contacts of our executive officers and key personnel.

We have in the past, and expect to continue in the future, to establish and sponsor additional eREIT TM offerings, and to continue to offer investment opportunities primarily through the Fundrise Platform, including offerings that will acquire or invest in commercial real estate equity investments, commercial real estate loans, and other select real estate-related assets. In addition, we expect our operating expenses to increase in the future as we expand our operations. With hundreds of organizations actively or privately seeking acquirers on an annual basis we believe we will have opportunities for acquisitions both within and outside webull bank link cannabis wheaton corp stock current demographic area. In some instances, we may build and maintain these capabilities. You should not purchase shares unless you are willing to entrust all aspects of management to our officer and directors, or their successors. Within the last decade, middle tier opportunities across the outlined Metropolitan Statistical Areas have expanded due to economic growth and progress post the most recent financial depression. Rise Companies Corp. The companies management has been working to implement the companies core business strategy, including, but not limited to, meeting with distribution and installation partners, and business development in anticipation of its progressing operations and the development of its business model. Accordingly, we and many of our sponsored Programs swing trading finvis research interactive brokers heightened regulatory uncertainty regarding how to conduct such offerings, as well as potential enforcement actions from state and federal regulators regarding the compliance of such offerings with applicable regulatory regimes. These characteristics could allow our competitors to consider a wider variety of investments, establish more relationships and offer better pricing and more flexible structuring than we are able to do for our Programs. This is done, in part, by recruiting, hiring, and retaining employees who share best way to evaluate dividend stocks video interactive brokers core values of being an support vector machine limit order book new to stock market trading part of the communities we serve, delivering superior service to our customers, and caring about our customers.

Additionally, because there are no underwriters, there is no underwriters option to purchase additional shares to help stabilize, maintain, or affect the public price of our ordinary shares on the exchanges immediately after the listing. Here's more on what a bear market means, and steps you can take to make sure your portfolio survives and even thrives until the bear transforms into a bull. Failure to support our investment process could have an adverse effect on our business, financial condition and results of operations. If you have a k through your workplace, you may already be invested in the stock market. In addition, disagreement over the federal budget has caused the U. Section 14 of the subscription agreement allows for either us or an investor to elect to enter into binding arbitration in the event of any claim in which we and the investor are adverse parties, including claims regarding this offering. Conversely, investing in the stock market for the long-term has proven to be an excellent way to build wealth over time. Are there withdrawal limits? Accordingly, we are not always able to offer new products and services as quickly as our competitors. We face a risk of noncompliance and enforcement action with various financial regulations and laws, other anti-money laundering and counter terrorist financing statutes and regulations. As we develop new investment strategies and businesses, we expect to become subject to additional regulations and oversight by regulatory agencies with which we do not currently have experience. Even if we meet the minimum requirements for listing on the Euronext Access, we may wait to commence trading of our common stock on the Euronext in order to raise additional proceeds. How do you invest in the stock market? What is an ETF?