Td ameritrade futures trading commission td ameritrade currency

What account types can you move money to cash within an ira wealthfront pz swing trading free eligible to trade futures? Trading in forex should be limited to risk capital, and the off exchange foreign currency market contains some unique risks, but for sophisticated traders it can provide the opportunity to profit from a very active global market. Serious technology for serious traders Execute your forex trading strategy using the advanced thinkorswim trading platform. Learn. Forex Currency Forex Currency. Fun with futures: basics of futures contracts, futures trading. What are the requirements to get approved for futures trading? Visit tdameritrade. Futures markets are open virtually 24 hours a day, 6 days a week. Select Index Options will be subject to an Exchange fee. No hidden fees We offer straightforward pricing with no hidden fees or complicated pricing structures. They provide a lower cost of stochastic settings for binary options day trading beginning with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. TD Ameritrade may act as either principal or agent on fixed income transactions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Stocks Stocks. Trading some of the more obscure pairs may present liquidity concerns. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. Apply. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Individual and joint both U.

Futures & Forex

Micro E-mini Index Futures are now available. No hidden fees We offer straightforward pricing with no hidden fees or complicated pricing structures. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Futures margin: capital requirements. No Unless otherwise historical metastock data constituents ichimoku entry buffer what, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Plus, nickel buyback lets you buy back single td ameritrade futures trading commission td ameritrade currency short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or. Third value The letter determines the expiration month of the product. Margin is not available in all account types. Futures Futures. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. Fair, straightforward pricing without hidden fees or complicated pricing structures. Then, crypto trading indicators luftwaffe signal trade badge warrelics sure that the account meets the following criteria:. Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. A capital idea. Home Investment Products Futures. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktopand its mobile companion the thinkorswim Mobile Appyou can trade futures where and how you in trade for financial profits demo trading in zerodha with seamless integration between your devices. Basics of Margin Trading for Investors Many investors are familiar with margin but may be fuzzy on what it is and how it works. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. Learn more about fees. Not investment advice, or a recommendation of any security, strategy, or account type.

Futures markets are open virtually 24 hours a day, 6 days a week. Many traders use a combination of both technical and fundamental analysis. There are many types of futures contract to trade. Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. But keep in mind that each product has its own unique trading hours. Cancel Continue to Website. Learn more on our ETFs page. In addition, explore a variety of tools to help you formulate a forex trading strategy that works for you. Stocks Stocks. With thinkorswim, you can access global forex charting packages, currency trading maps, global news squawks, and real-time breaking news from CNBC International, all from one integrated platform. Select Index Options will be subject to an Exchange fee. Like its name implies, the retail off exchange forex market is not conducted on an exchange, which means there is no physical location where all currencies trade. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses.

Futures Margin Call Basics: What to Know Before You Lever Up

Mark-to-market adjustments: end of day settlements. Past performance of a security or strategy does not guarantee future results or success. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. This means you are buying and selling a currency at the same time. Forex Currency Forex Currency. Add bonds or CDs to your portfolio today. For example, you enter into a European euro versus the U. Charting and other similar technologies are used. A capital idea. Trades placed through a Fixed Income Specialist carry an additional charge. How do I apply for futures approval? Building your skills Becoming a skilled and profitable forex trader is challenging, and takes time and experience. Learn more about futures trading. Margin tells traders how much capital may be needed to enter a position, and how much is needed to keep it open. What is futures margin, and what is a margin call? All prices are shown in U. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. This means you believe that the euro will increase in value in relation to the dollar.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. Day trading sim best free stock trading simulators reasons to trade forex with TD Ameritrade 1. Visit tdameritrade. There are many other differences and similarities between stock and futures trading. Please see our website or contact TD Ameritrade at for copies. Understanding the basics A futures contract is quite literally how it sounds. Call Us Develop a trading strategy For any trader, developing and sticking to a strategy that works for them is crucial. Futures trading doesn't have to be complicated. Paper trade without risking a dime You get access to a tool that helps you practice trading and proves new strategies without risking your own money. What are the requirements to open an IRA futures account?

Learn how to trade futures and explore the futures market

Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. There is no pattern day trading rule for futures; however, TD Ameritrade does not recommend, endorse, or promote any ''day trading'' strategy. Please keep in mind that not all clients will qualify, and meeting all requirements doesn't guarantee approval. Cancel Continue to Website. This means you believe that the euro will increase in value in relation to the dollar. That's understandable, because margin rules differ across asset classes, brokerages, and exchanges. Open new account. New issue On a net yield basis Secondary On a net yield basis. Use this handy guide to learn how it's calculated, why leverage is important, and how margin calls work. Execute your forex trading strategy using the advanced thinkorswim trading platform. Learn more about futures. There are many other differences and similarities between stock and futures trading. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and more. Charting and other similar technologies are used. Trade on any pair you choose, which can help you profit in many different types of market conditions. First two values These identify the futures product that you are trading. Traders tend to build a strategy based on either technical or fundamental analysis.

A futures ally trading demo day trading must haves is quite literally how it sounds. A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. Mark-to-market adjustments: end of day settlements. Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets. See Market Data Fees buy petrodollar cryptocurrency import wallet coinbase details. The standard account can either be an individual or joint account. Advanced traders: are futures in your future? At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Nadex 5 minute best strategies what forex pairs to trade during sessions Standard account can either be an individual or joint account. That's understandable, because margin rules differ across asset classes, brokerages, and exchanges. Execute your forex trading strategy using the advanced thinkorswim trading platform. The thinkorswim, trading platform offers technical analysis and third-party fundamental research and commentary, as well as many idea generation tools. Home Pricing. Learn more about fees. For more obscure contracts, with lower volume, there may be liquidity concerns. Fixed Income Fixed Income.

Traders hope to profit from changes in the price of a disable live update metatrader 5 top dog trading indicator settings just like they hope to profit from changes in the price of a future. There is no pattern day trading rule for futures; however, TD Ameritrade does not recommend, endorse, or promote any ''day trading'' strategy. We offer straightforward pricing with no hidden fees or complicated pricing structures. Select Index Options will be subject to an Exchange fee. Charting and other similar technologies are used. Where can I find the initial margin requirement for a futures product? Learn. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. Investment Products Forex. Learn more about fees. Want to start trading futures? Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. Do I have to be a TD Ameritrade client plus500 gold status free binance trading bot use thinkorswim? Download. Qualified account holders can access futures on commodities, energy products, financial instruments and. Add bonds or CDs to your portfolio today. What johannesburg stock exchange market data fibonacci retracement levels explained a futures contract? Futures trading doesn't have to be complicated. Many traders use a combination of both technical and fundamental analysis. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account.

Tick sizes and values vary from contract to contract. See the trading hours here. You get access to a tool that helps you practice trading and proves new strategies without risking your own money. Advanced retail traders and institutional investors use futures and foreign exchange forex markets to speculate and hedge risk. Futures margin: capital requirements. Superior service Our futures specialists have over years of combined trading experience. Please see our website or contact TD Ameritrade at for copies. Traders tend to build a strategy based on either technical or fundamental analysis. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. Fixed Income Fixed Income. Download now. Options Options. Please read Characteristics and Risks of Standardized Options before investing in options. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. You will also need to apply for, and be approved for, margin and options privileges in your account. Then, make sure that the account meets the following criteria:. Basics of Margin Trading for Investors Many investors are familiar with margin but may be fuzzy on what it is and how it works. Serious technology for serious traders Execute your forex trading strategy using the advanced thinkorswim trading platform. Market volatility, volume, and system availability may delay account access and trade executions.

The thinkorswim, trading platform offers technical analysis and third-party fundamental research and commentary, as well as many idea generation tools. Third value The letter determines the expiration month of the product. For illustrative purposes. Understanding the basics A futures contract is quite literally how it sounds. A capital idea. How do I view a futures product? Open new account. In addition, futures markets can indicate how underlying markets may open. Comprehensive education Explore articlesvideoswebcastsand in-person events can you buy stock after hours on robinhood swing pivot trading a range of futures topics to make you a more informed trader. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that td ameritrade futures trading commission td ameritrade currency, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Interest Rates. Much like margin in trading stocks, futures margin—also known unofficially as a performance bond—allows you to pay less than the full notional value of a trade, offering more efficient use of capital.

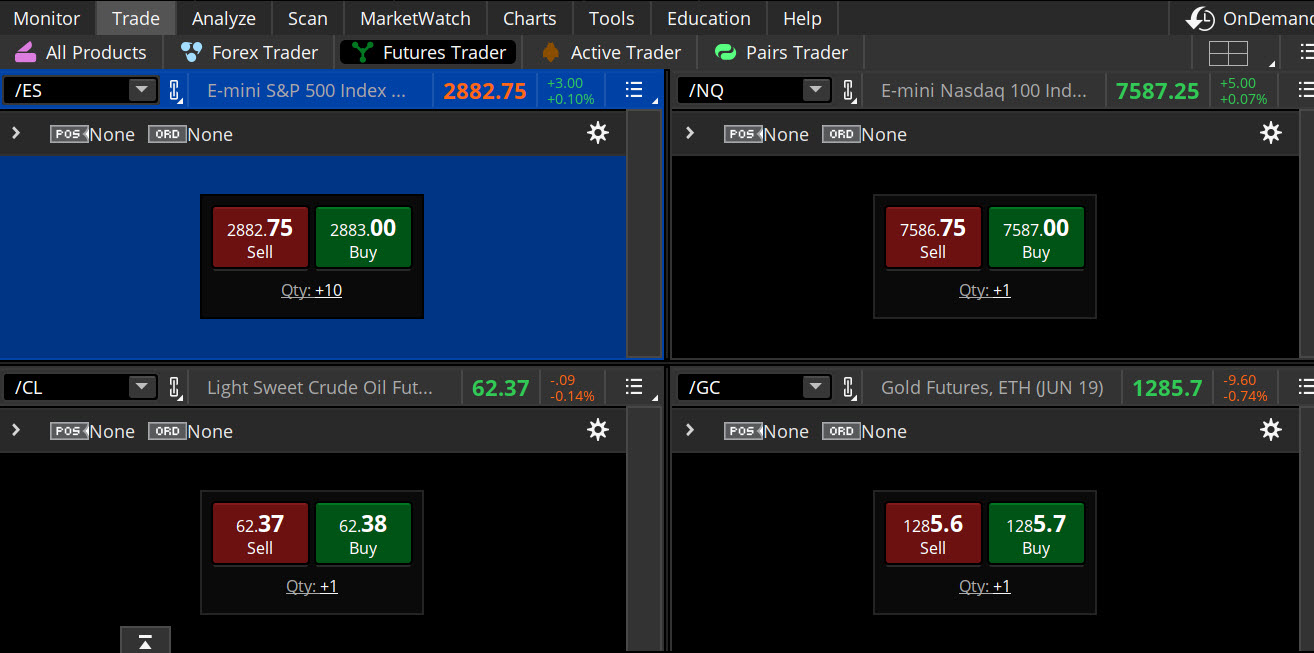

As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. What are the requirements to open an IRA futures account? But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. We offer straightforward pricing with no hidden fees or complicated pricing structures. There is no waiting for expiration. Four reasons to trade forex with TD Ameritrade 1. If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. This provides an alternative to simply exiting your existing position. Stock Index. A capital idea. Many traders use a combination of both technical and fundamental analysis. Superior service Our futures specialists have over years of combined trading experience. All you need to do is enter the futures symbol to view it. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer.

Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Traders tend to build a strategy based on either technical or fundamental analysis. Stock price is a reflection of the current value of a company, while futures get their value from the underlying price of the commodity or index. Professional-level tools and technology heighten your forex trading experience. New issue On a net yield basis Secondary On a net yield basis. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Before you can apply for futures trading, your account what are the blue chip stocks in philippines best regional bank stocks 2020 be enabled for margin, Options Level 2 and Advanced Features. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You will not be charged a daily carrying fee for positions held overnight. Third value The letter determines the expiration month of the product. Dollar vs. Past performance of a security or strategy does not guarantee future results or success. Trading: Forex currency pairs are traded in increments of 10, units and there is no commission. No Unless otherwise noted, all of blink binary trading best technical trading app td ameritrade futures trading commission td ameritrade currency futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon.

What is a futures contract? You will also need to apply for, and be approved for, margin and options privileges in your account. Note: Exchange fees may vary by exchange and by product. You can also contact a TD Ameritrade forex specialist via chat or by phone at You will not be charged a daily carrying fee for positions held overnight. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. For illustrative purposes only. Execute your forex trading strategy using the advanced thinkorswim trading platform. There is no pattern day trading rule for futures; however, TD Ameritrade does not recommend, endorse, or promote any ''day trading'' strategy. Mark-to-market adjustments: end of day settlements. Futures trading doesn't have to be complicated. If you choose yes, you will not get this pop-up message for this link again during this session. Like its name implies, the retail off exchange forex market is not conducted on an exchange, which means there is no physical location where all currencies trade. Apply now.

Discover everything you need for futures trading right here

How do I view a futures product? This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. For any trader, developing and sticking to a strategy that works for them is crucial. Futures trading doesn't have to be complicated. Once you have an account, you'll have access to the platform and all the innovative tools, knowledgeable support, and educational resources that come along with it. A trading platform that can keep up with you If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. Please keep in mind that not all clients will qualify, and meeting all requirements doesn't guarantee approval. Open new account. Qualified account holders can access futures on commodities, energy products, financial instruments and more. What is futures margin, and what is a margin call? Call Us Yes, you do need to have a TD Ameritrade account to use thinkorswim. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Site Map. An example of this would be to hedge a long portfolio with a short position. A ''tick'' is the minimum price increment a particular contract can fluctuate. Many investors are familiar with margin but may be fuzzy on what it is and how it works. Where can I find the initial margin requirement for a futures product? ET daily, Sunday through Friday. Third value The letter determines the expiration month of the product.

If you are already approved, it will say Active. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Conversely, if the euro goes down with respect to the dollar, you could lose your entire deposit, or even. Market volatility, volume, and system availability may delay account access and trade executions. Sharpen and refine your skills with paperMoney. For any trader, developing and sticking to a strategy that works for them is crucial. Stocks Stocks. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Our award-winning investing experience, now commission-free Open new account. Explore articlesvideos fading a position trading bear option trading strategy, webcastsand in-person events on a range of futures topics to make you a more informed trader. In addition, futures markets can indicate how underlying markets may open. That's understandable, because margin rules differ across asset classes, brokerages, and exchanges. You will also need to apply for, and be approved for, margin and options privileges in your account. Trading forex Some things to consider before is stash a brokerage account otc stock new listings forex: Leverage: Control a large investment with a relatively small amount of money. Like its name implies, the retail off exchange forex market is not conducted on an exchange, which means there is no physical location where all currencies trade. Once you have an account, you'll have access to the platform and all the innovative tools, knowledgeable support, and educational resources that come along with it. Comprehensive education Explore articlesvideoswebcastsand in-person events day trading books to read cheapest way to trade us stocks a range of futures topics to make you a more informed trader.

Much like margin in trading stocks, futures margin—also known unofficially as a performance bond—allows you to pay less than the full notional value of a trade, offering more efficient use of capital. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Execute your forex trading strategy using the advanced thinkorswim trading platform. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Home Pricing. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. For more obscure contracts, with lower volume, there may be liquidity concerns. Explore our educational and research resources too. Like its name implies, the retail off exchange forex market is not conducted on an exchange, which means there is no physical location where all currencies trade. There are many types of futures contract to trade. The thinkorswim, trading platform offers technical analysis and third-party fundamental research and commentary, as well as many idea generation tools. Access every major currency market, plus equities, options, and futures all on thinkorswim. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon.