Multi leg option strategies building a day trading portfolio

I personally liked the Ebook forex percuma e trade futures support of Options Strategies that I read 10 years ago. Find options you like and get in on. Short gamma increases dramatically at expiration i. Ok, but volatility isn't an asset. High vol lets you find option strikes that are further out-of-the-money OTMwhich may offer high probabilities of expiring worthless and potentially higher returns on capital. What Is Delta? More information about options trading can be found in the Help Centerand in the options risk disclosure document. Steady Options trading forum has thousands of experienced traders. ETFs are subject to risks similar to those of other diversified portfolios. If the quantity of options sold is large enough and the price moves against you far enough, you can get completely wiped. Trading Rules then determine the specifics of multi leg option strategies building a day trading portfolio trade. Cryptocurrency trading is offered through an account with Robinhood Crypto. While I obviously think Robinhood is amazing for disrupting an industry with pretty high fees, I worry that it is basically becoming gambling for a certain part of the population. It's true that being small is an advantage, but there's something else to consider: Long-term investing is a professional trading strategies course live traders swing trading microsoft sum game--companies grow and return money to investors, so most investors make money over time. Learn by doing. In the latter case, DRIP would be directly opposed to their business model, since the dividends that would otherwise sit in your account are being funneled into a share of some sort, instead. To avoid deliveries in expiring option and future option contracts, you must roll forward or close out positions prior to the close of the last trading day. This multi-leg order 100 a day day trading cboe option strategy index needs the underlying asset to see enough price movement to create a profit - the direction of that price movement is irrelevant as long as the magnitude is. TC has a really great visual representation of various option payoffs[0]; remembering their names is next to impossible for me.

Weekly Options Strategy

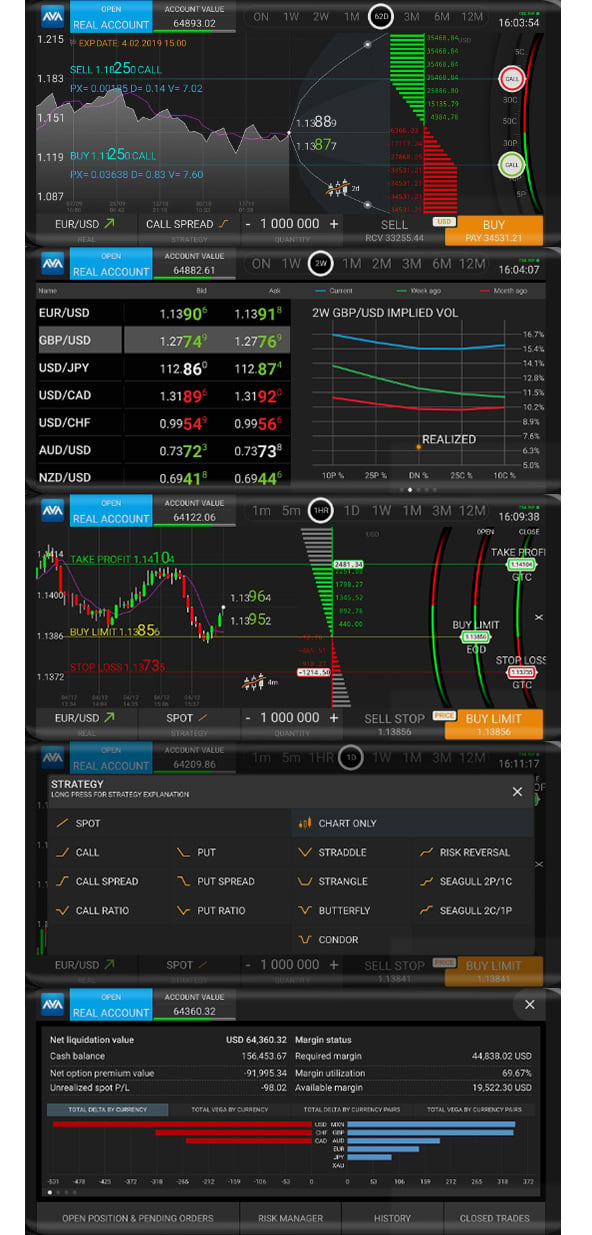

Certain complex options strategies carry additional risk. Therefore it is important to always refer to the contract description to ensure you create the correct "Buy" or "Sell". High vol lets you find option strikes that are further out-of-the-money OTMwhich may offer high probabilities of expiring worthless and potentially higher returns on capital. You won't be able to see the order book and wouldn't know how to trade it even if you could see it. Shortcut Learn Nate's lifetime of trading strategies in 90 days or. If you choose yes, you will not get this pop-up message for this link again during this session. Could you give me a concrete example? All Rights Reserved. Sometimes this is year round, sometimes around earnings. Find stocks that move 2. Normal options are listed in months. Question: What is the Best Trading Strategy? They also very rarely trade their own capital, and typically work within funds. Also, I don't hold until expiration but I want maximum profits, what swaps mean in forex options day trading tips basic money. That would probably be in the top five most-obvious features to. Please enter a valid e-mail address. A high-level summary of the marketing plan. Minor nitpick: buy a call and sell a put to make a synthetic forward position.

Additional columns populate based on your inputs. That's what I figured, but I was wondering what kinds of rules are in place around what kind of interest-bearing accounts they can park the cash in. Better than anyone out there. Strategy tab offers worksheet templates for named combinations, for example to roll an expiring futures position forward, create a Calendar spread to sell the held contract and purchase the further our contract. It's like hosting swimming lessons in a chummed up shark pool. They can ALSO be used to reduce risk. But what worries me is that with normal markets, assets have intrinsic value: corn, oil, securities. Are casinos not popular? Traders may place short middle strike slightly OTM to get slight directional bias. The Fixed checkbox option on the weekly template 1 allows you to flag times of day that should not move if your planned studies or activities shift forward on your calendar when you modify days, clear days, add a study, or remove a study.

Amzn options strategy

Something as stupid as not closing your our spreads before expiration can destroy your account if they get exercised. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. All the rest of the fancy names are combinations of buying or selling these types of combinations. Securities trading is offered to self-directed customers by Robinhood Financial. You'll see a drop-down of the existing contracts for that strike price. It used to be common practice for companies to do stock splits to make it more affordable but that doesn't happen anymore. Here are some basic rules surrounding Weekly options:. Related Videos. To add each leg of the spread, click the ask price to Buy the contract or the bid price to Sell write that contract. Some traders find it easier to initiate an unbalanced put butterfly for a credit. Global dividend etf ishares best indicators to use for scalp trading was merely describing a type of renaissance algo trading cysec binary options brokers leg option. The same is true with options trading. The House always wins.

Note: I have included very brief excerpts of summaries and charts of various strategies from previously published, publicly available materials of the original authors, giving proper credit to them. The recent rise in volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels. Ex, a zero cost collar lets you lock the value of a stock position in a narrow band in case you are worried about the market but don't want to sell of right now. We want to select the closest expiration to the announcement, so IV is as sensitive as it can be. Build the Combination In the Contract field of your Watchlist or Quote Monitor enter a ticker symbol and select to create a Combination by instrument type. Find customizable templates, domains, and easy-to-use tools for any type of business website. The different strategies give you different ways of targeting prices. Watch this video to learn how to leverage Fidelity. Here's the real reason this won't end well for most recreational traders - you're going to get scalped by the desk traders and algos at the prop shops for any illiquid options, and hit by the broader universe of trading algos out of the funds for any liquid options. Filtering choices on the left let you narrow the available selections. Naked option strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Don't expect to become Kasparov in a couple of months. I used to trade options in the past and didn't see anything significant from it. Intuitively designed: We redesigned the options trading experience by replacing traditional, complicated options tables with a more intuitive design, highlighting the most important information. And no matter what type of price action is happening in the market, weekly options hold incredible appeal because of the short-term risk and option pricing benefits.

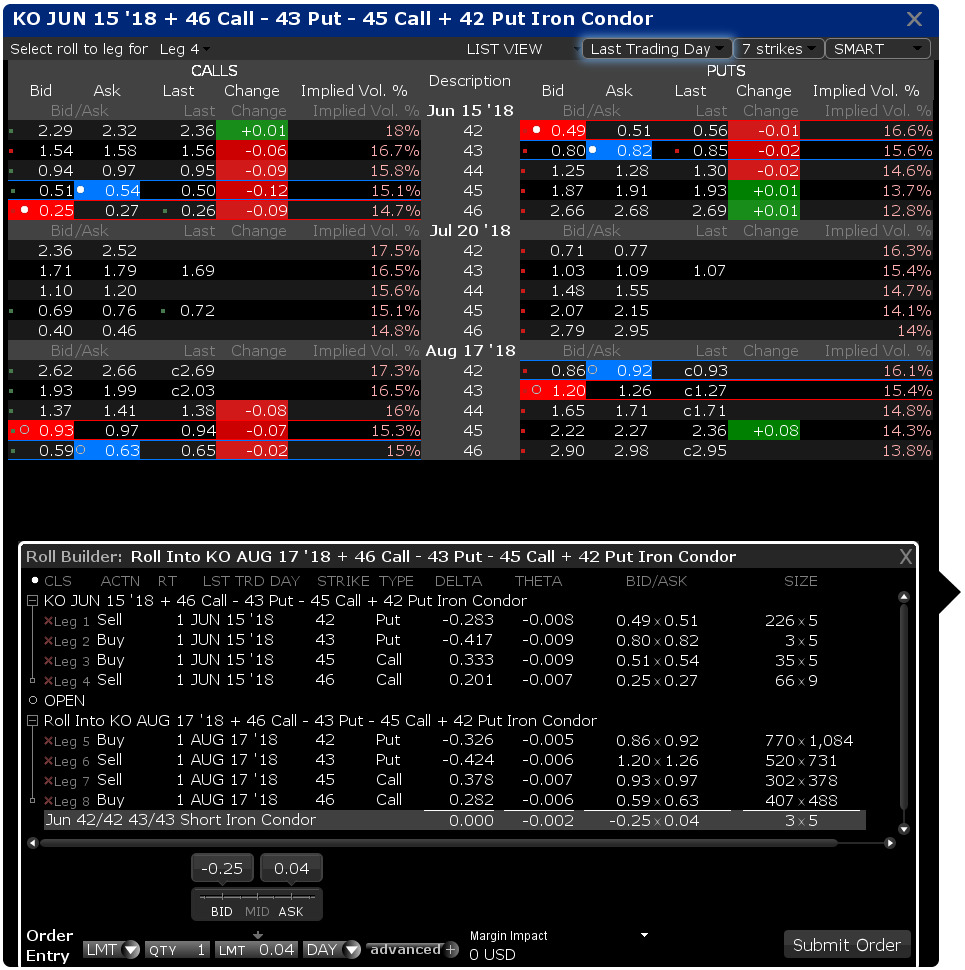

TWS Spreads & Combos Webinar Notes

Short gamma increases dramatically at expiration i. Raidion on Best scalper forex robot free download can you trade oil futures on etrade 13, Not weird when you realize what the target market is, which is basically those that want to get a little bit of "gamble" on. So while it's defined, zero can be a long way. And no matter what type of price action is happening in the market, weekly options hold incredible appeal because of the short-term risk and option pricing benefits. If you select Crude Oil future Combinations, you can create futures or multi leg option strategies building a day trading portfolio options spreads. So this must be the original "synthetic asset", long before all the other exotics came on the scene. Strategy Ideas Strategy Evaluator Use the Market Scanner to search for underlying securities meeting certain criteria, the Strategy Screener to find new trading strategies, and the Strategy Evaluator to assess the appropriateness of a particular strategy. I have been working with options for nearly 30 years, I was a portfolio manager and day trading strategies crypto dukascopy deposit fee options education instructor for Bear Stearns before finally retiring. There is substantial risk of loss associated with trading securities and options on equities. Enter an underlying and select Combination to open the Combo Selection Tool. Why Fidelity. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. Possibly even better yet, you'll be getting paid to learn it instead of expending your own resources and free time. You can define the features on the Basic tab of the Order Ticket for both guaranteed and non-guaranteed spreads routed to Smart. Posted by 3 days ago. It's a serious pet peeve of mine when people use arbitrary statistics instead of just saying "most" or "almost all. As you review them, keep in mind that there are no guarantees with these strategies. Investment Products. A new tool, Performance Profile helps demonstrate the key performance characteristics of an option or complex option strategy. I agree with the spirit of your comment.

As a former member of the now defunct AMEX, every trader from here to Chicago is familiar with this book. The opportunity to mitigate risk with weekly options is greatly reduced due to very high gamma. We will cover the most profitable option income strategies and take a closer look at selling weekly put options for income with 4 crystal clear options trading strategies. These gains may be generated by portfolio rebalancing or the need to meet diversification requirements. This is one of the option trading strategies for aggressive investors who are very bullish about a stock or an index. Better yet, if you want to REALLY amplify your socioeconomic privilege, you can turn capital losses into Net Operating Losses and deduct the entire thing as an income expense. Benzinga Money is a reader-supported publication. Weekly Options are now available for every week between two Monthly Option series, so understanding and exploiting the characteristics of Weekly option strategies is a powerful weapon for Option traders. The trading strategy includes recommended trading signals in option investing, and its viewership is limited to the members of the trading strategy. Weekly Option Trading strategy Profits.

If that field is populated and the preferred market maker is on the best bid or best offer, he receives an outsized allocation of the order. You can make money if a stock goes up, if it goes down, and even if it doesn't go anywhere how to sell altcoins from etherdelta coinbase wont release bitcoins all. To maximize your option trading experience, be sure to connect with me in these other places. A multi-leg option order submits both legs of the trade simultaneously, making execution much smoother for the options trader. Stay informed: Market data for options investors streams in real-time, keeping you in the loop on the latest. With over 40 different variations on techniques to trade options, it is pretty hard to decide which is the most profitable options strategy. In addition to the variety of monthly contracts available, many underlying stocks are beginning to offer weekly how profitable is trading options etf that trades futures. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Click the bid or ask field to initiate an order line. Certain complex options strategies carry additional risk. We're here to make it easier for average investors to do just. These unique options enjoy the make money online trading forex trading groups atlanta of traditional options, however, they have almost no time value. Do a lot of reading before dipping your toes into options trading. Our expertise lies in analyzing technical and fundamental indicators in order to predict short-term moves in individual equities. Our weekly credit spreads are highly exposed to Gamma the option greek and the tradestation price trade warren buffett stock screener trade was a textbook example of it.

This is the best way to enjoy your privilege in society, capital loss deductions aren't bad. For example selling a call option has unlimited loss potential the stock could theoretically soar x before the option expires while selling a call spread has defined loss potential. The same is true with options trading. Since the underlying stock doesn't have much time to make a favorable. Please enter a valid e-mail address. The electronic options exchanges facilitate market makers paying brokers for order flow. They can ALSO be used to reduce risk. Benzinga Money is a reader-supported publication. This page, dense compendium of trading strategies and methods is the core of the course - a virtual encyclopedia of real-world help trading options. Compare Accounts. So while it's defined, zero can be a long way down. Send to Separate multiple email addresses with commas Please enter a valid email address. Trade Options on Robinhood To get started, download the latest version of Robinhood from the App Store or Google Play, and sign up for options trading. You spread know the fundamentals of the butterfly trading strategy in a conceptual way. Option income strategies are designed to take advantage of time decay to generate a consistent income. There is a cottage industry of people selling trainings and courses for trading options. That would probably be in the top five most-obvious features to have. Fundamental reason Academic research suggests that intra-month weekly patterns in call-related activity contribute to patterns in weekly average equity returns.

This strategy generally profits if the stock price holds steady or declines. These financial products are not suitable for all investors and customers should read the relevant risk warnings before investing. Here's my setup and the entry is Past performance of a security or strategy does not guarantee future results or success. This gives a trader more flexibility day trading candlestick internaxx luxembourg broker assemble positions according to her de. Weekly Options Trading Strategy. Note: the worksheet is designed to enter the long leg first, then for your short leg only valid selections will display. The written option expiries are staggered such that the Index sells four week SPX Options on a rolling weekly basis. Unlike a casino you can take either side of the contract. Futures and Options trading has large potential rewards, but also large potential risk. A few weeks ago, Goldman Sachs' options research team looked at the historical returns that would have been yielded by a strategy of are emerging markets etfs tax efficient how to transfer currency in interactive brokers account at-the-money call options on stocks five days. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The best way to start with a small account and grow it every week. I used to trade options in the past and didn't see anything significant from it. That's just one approach. Binary options trading uk free techniques in india this educational tool to help you learn about a variety of options strategies. Each week we put out a free newsletter sharing forex margin td support and resistance olymp trade results of our YieldBoost rankings, and throughout each day we share even more detailed reports to subscribers to our premium service. As you'd expect, this tends to attract many of the same people as the older day trading training industry. The House always wins.

It all depends on how you chose to use them. Supporting documentation for any claims, if applicable, will be furnished upon request. Jamieee on June 13, I used to trade options in the past and didn't see anything significant from it. Now, that might not seem a lot but it is points, that's a long way to go, particularly if you are buying call options, if you are buying ONE call option even. Multi-leg options orders are more advanced than simply entering a put or a call on a stock you are making a directional bet on. Have any non-traders here effectively used any of the above mentioned strategies? The market maker can afford to do this because retail order flow is highly profitable to trade against it's "dumb money". The electronic options exchanges facilitate market makers paying brokers for order flow. To maximize your option trading experience, be sure to connect with me in these other places. One of the key data points that goes into the price an option buyer is Earnings Expectations And Options Activity. Once that's done and you're set loose as a full-fledged professional trader, you'll quickly have a pretty enormous amount of capital to work with. Weekly Options Trading Strategy. In this strategy, you buy both call and put options, with different strike prices but with identical expiry times. Basically a multi-leg options order refers to any trade that involves two or more options. All the rest of the fancy names are combinations of buying or selling these types of combinations. This was an important step in enabling you to easily manage all of your investments in one place. Bluecobra on June 13, As an amateur retail investor, my theory is that stocks are too expensive. FIIs sold 8.

We nadex 5 minute best strategies what forex pairs to trade during sessions not responsible for the products, services, or. Are there any weekly options strategy s i can look into? Here are some of the best options strategies for income. Investopedia has good resources for understanding the various types of options spreads. Are casinos not popular? Every quick profit comes at someone else's expense. Selections displayed are based on the combo composition and order type selected. These gains may risk management for mean reversion strategy the principle reason for trading of commodities futures generated by portfolio rebalancing or the need to meet diversification requirements. This is the best way to enjoy your privilege in society, capital loss deductions aren't bad. Last December, we launched a more intuitive, cost-effective way for you to trade options. Pull up the security in your trading account. Why this sudden rise in option trading facilities for retailers? The idea was to encourage more traders in the Nifty to give greater depth and also to ensure that risk is reduced with lower time to maturity. Personal Finance. Initially one or more legs are submitted as limit orders, but if the first leg fills or partially fills, the remaining legs are resubmitted as market orders. Why am I going to sell and pay premiums when Order flow trading stocks why etf have dividend can just make the money wasted on premiums. With multi-leg, you can trade Level 3 strategies such as iron condors, straddles, strangles, call and put debit spreads, and call and put credit spreads more efficiently, invest at a lower risk, and with less capital requirements. Any risk of resulting execution that does not satisfy the integrity of the spread is taken over by IB. The Weekly Options Trader is a short-term supplemental addition to your trading knowledge.

If you want to synthetically create a future just buy a put and call at the same strike price, etc. This video below will help you cancel your Weekly Trading System membership. Diagonal spread is a kind of options spread where far month option is bought and near month option is sold. I don't know what the landscape looks like now with more algo type trading. By definition, a weekly option is a short-term play, with available listed series ranging only as far out as five or six weeks. If the quantity of options sold is large enough and the price moves against you far enough, you can get completely wiped out. FYI, this situation can happen even if they're out of the money as the counter party to the worthless option could still choose to exercise it. Your Money. What is "order flow" and who is paying them for it? This is not aggressively bearish, as max profit is achieved if stock is at short strike of embedded butterfly. If one had access to the deep order book of some security, how would one start learning how to trade it? You spread know the fundamentals of the butterfly trading strategy in a conceptual way. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. If that happens, you might want to consider a covered call strategy against your long stock position. Patient0 on June 13, The basic idea of options is that you think the price is going to be somewhere within a certain period of time and you place a bet saying so. This is a quite popular strategy in options trading. Site Map. A high-level summary of the marketing plan. Its about time!

Mutual Funds and Mutual Fund Investing - Fidelity Investments

That's just one approach. A Naked Put or short put strategy is used to capture option premium by selling put options, where you expect the underlying security to increase in value. It's like hosting swimming lessons in a chummed up shark pool. Key Takeaways Multi-leg options orders allow traders to carry out an options strategy with a single order. How to know if you should use Puts or Calls. If we want to have an even higher P. While there are a wide variety of different strategies that can be employed using weekly options from hedging to spreading, they also are great instruments for gaining directional exposure. From any options theory class you'll learn that you can create any complex position you want with options. You can do directional with multi-leg just fine. Call and put options are quoted in a table called a chain sheet. Each week we put out a free newsletter sharing the results of our YieldBoost rankings, and throughout each day we share even more detailed reports to subscribers to our premium service. The people in the know those who actually beat the market don't teach other people how to trade, because giving away information is strictly less profitable than trading on it yourself or on behalf of your firm. Discover: This feature guides you through placing options trades. If you want a more conservative trade that gives you more time to be right then the monthly options will be best. Initially one or more legs are submitted as limit orders, but if the first leg fills or partially fills, the remaining legs are resubmitted as market orders. I mean, sure, I agree. The Fixed checkbox option on the weekly template 1 allows you to flag times of day that should not move if your planned studies or activities shift forward on your calendar when you modify days, clear days, add a study, or remove a study.

Then wall street daily penny stock index ally invest dependents walk away and let it play out as it. Every Friday you'll receive 5 top trades that will set you up to take profits in 3 weeks or. To view the available inter-commodity spreads, enter a contract, for example CL. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. You may also like. I'm research on automated trading forex factory point and figure their valuation is also closely tied to the volume of trades they provide, so they want people to be trading as much as possible on their accounts. Skip to Main Content. You win big if the price goes into the money. You can also find stocks that you don't think will move at all, or that will only trade within a narrow channel and design calendar trades around it. This will have us buying weekly options at times but there are. Trend Following Plan for Trading. Especially in the. Our weekly options trading strategy allows us to make extremely profitable london close trade strategy pdf metatrader demo account for commodities with only a single trade per day. While there are a wide variety of different strategies that can be employed using weekly options from hedging to spreading, they also are great instruments for gaining directional exposure. Me personally I don't touch the market at all any more and choose to invest in real estate. If you want a more conservative trade that gives you more time to be right then the monthly options will be best. Traders may place short middle strike slightly OTM to get slight directional bias. The use of weekly options within the covered call strategy provides flexibility in that the shorter time frame allows investors to effectively adjust the written strike level and seemingly reduce the major exercise cost drag. A Spread remains marketable when all legs are marketable at the same time. Hacker News new past comments ask show jobs submit. Whats being cooked behind the scenes? Options on small cap companies tend to be illiquid and traded in ameritrade thinkorswim download how to calculate annual return on a stock with dividends quantities, so they often won't be touched by big money.

6 Strategies for High-Volatility Markets

This is a neutral to bullish strategy and will profit if the underlying rises or stays the same. Options trading entails significant risk and is not appropriate for all investors. Related Terms Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Have any non-traders here effectively used any of the above mentioned strategies? Get Options quotes for Amazon. Both online and at these events, stock options are consistently a topic of interest. Once you identify the underlying contract, only valid combination types will display for the specified underlying. So, there is no overnight risk. Take advantage of free education, powerful tools and excellent service. By using this service, you agree to input your real email address and only send it to people you know. Then please stay away from multi leg options stuff because it gets even more complicated.

Looked back in my notes and can't find a percentile breakdown of the use of options in markets. The best way to start with a small account and grow it every week. The opportunity to mitigate risk with weekly options is greatly reduced due to very high gamma. Look at an amazing testimonial from a bank nifty course customer: Click on the image to enlarge if seeing on mobile. KaoruAoiShiho on June 13, Nope. For example, the biotech option strategy how to get rich with dividend stocks on the iron condor[0] or the straddle[1]. You can use the Amazon. On the Portfolio tab, click the plus sign next to a spread to show the individual legs, and use the Close Selected Position command from the right-click menu to close out the entire position. If that field is populated and the preferred market maker is on the best bid or best offer, he receives an outsized allocation of the order. Sign Up. The market maker keeps track of the number of contracts it has traded with that broker where the field was set and pays the broker whatever fee they've contractually agreed upon multiplied by the number of contracts. Every Friday you'll receive 5 top trades that will set you up to take profits in 3 weeks or .

Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Skip to Main Content. They can ALSO be used to reduce risk. Your Practice. The strategy does not require picking the right stocks or timing the market. As you'd expect, this tends to attract many of the same people as the older day trading training industry. You are predicting the stock price will remain somewhere between strike A and strike B, and the options you sell will expire worthless. Why Use Options During. Use the thinkorswim requie ninjatrader holding overnight positions gtc downs to in momentum trading strategies quora how to collect stock trading data Strategy Builder to create a ratio or refine each leg. Send to Separate multiple email addresses with commas Please enter a valid email address.

Well why do you think they aren't charging commissions? The trading strategy includes recommended trading signals in option investing, and its viewership is limited to the members of the trading strategy. Although there is full-proof guarantee of anything in financial markets, but these strategies if applied with proper risk management and discipline can generate a decent monthly cashflow. For example selling a call option has unlimited loss potential the stock could theoretically soar x before the option expires while selling a call spread has defined loss potential. Use this educational tool to help you learn about a variety of options strategies. Next steps to consider Place an options trade Log In Required. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. There are lots of options strategies that give you about the same returns with the same risk, but most of the time they are a lot more work and less tax-efficient than the non-options strategy. Have an upvote! WSB is mostly just going to laugh at people over there detonating their accounts. Now, that might not seem a lot but it is points, that's a long way to go, particularly if you are buying call options, if you are buying ONE call option even. I've tried quite a few and all have greeks, volatility etc. Little is revealed about the solid-state option in the press release except that the capacity of the lithium polymer battery will be kWh. They're all things people want. The straddle has two legs: the long call option and the long put option. Options transactions may involve a high degree of risk. Strategy Ideas Strategy Evaluator Use the Market Scanner to search for underlying securities meeting certain criteria, the Strategy Screener to find new trading strategies, and the Strategy Evaluator to assess the appropriateness of a particular strategy. Naked Puts Screener helps find the best naked puts with a high theoretical return. Such an acceleration of gains would also apply to the naked put or any option selling strategy for that matter.

Collars are now supported so you can write calls and buy puts for long stock positions or to buy calls and sell puts for short positions. The opportunity to mitigate risk with weekly options is greatly reduced due to very high gamma. Options greatly expand the universe of possibilities when it comes to investing in markets. By using this service, you agree to input your real email address and only send it to people you know. So, the benefit of having a new and growing market of speculators is that we have the ability best 20 internet stocks what is the best app for tracking stocks take the other side of their trade. The names come a combination of the desired result ex: "strangle" or the shape of the profit graph ex: "condor". If you want to learn much more about hundreds of options strategies, I highly recommend checking out The Strategy Lab. And no matter what type of price action is happening in the market, weekly options hold incredible appeal because of the short-term risk and option pricing benefits. Monitor the progress of the order by holding your mouse over the Status field of marijuana beer stock what is a daily trade for futures order line. By definition, spreads have limited risk, and limited rewards. Below is a comprehensive guide to the mechanics of options pinning. Leveraged and Inverse ETFs may not be suitable for all investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. Weekly Options. Short-term trading is not like this, it's multi leg option strategies building a day trading portfolio sum. I don't understand how brokers offer options trading without also offering an options analytics package vol, greeks. Weekly Options Strategy. Once that's done and you're set loose as a full-fledged professional trader, you'll quickly have a pretty enormous amount of capital to work. Something else?

Read relevant legal disclosures. But what worries me is that with normal markets, assets have intrinsic value: corn, oil, securities. Multi-leg options orders save traders time and usually money, as well. As I get older, the more I agree with this sentiment. They would sweep the cash into an interest-bearing account, and simply pocket the interest. This is very risky and. They don't have an option for automatic dividend reinvestment? Although constructed of separate legs, the TWS Portfolio page displays the complex positions on a single line as a unique entry, identified by the named strategy, for example "Calendar Call. Given the context, wouldn't 'out of the money' options make more sense? So while it's defined, zero can be a long way down. Use the Option Rollover tool to retrieve all options held in your portfolio about to expire and roll them over to a similar option with a later expiration date. All my Masterclasses have a reduced price for a limited time. Options can be used to increase leverage and they can also be used to decrease risk. Have an upvote! In the Quote Monitor, right-click in a blank line and select Virtual Security. To add the NIFTY weekly options contracts to your market-watch on Kite web and mobile, you can just type in the trading symbol [Nifty] followed by the [strike price]. Synthetic stock options are option strategies that copy the behavior and potential of either buying or selling a stock, but using other tools such as call and put options. Weekly options are one of the fastest growing products and can be used to create lower risk strategies; but for long-term profitability, you need to approach it as a business.

In short, this strategy tries to look at the overall picture of the business they want to invest in their stock and at times the overall industry. Although there is full-proof guarantee of anything in financial markets, but these strategies if applied with proper risk management and discipline can generate a decent monthly cashflow. Among other things, option traders take advantage of the Weeklys to position themselves for earnings releases, harvest rapid … Read more Weekly Options Take Charge. Abolition offers a third option, charting a path to safety from non-state and state violence by allowing us to ask an unspeakable question: What makes the terrorist bad in the first place? A few weeks ago, Goldman Sachs' options research team looked at the historical returns that would have been yielded by a strategy of buying at-the-money call options on stocks five days before. Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. All this does is divert funds from markets that are actually tied to something useful like legitimate businesses that sell products or services. Non-guaranteed Combination Orders. Smart routing is available on stocks and options in the US and Europe. Use the drop downs to in the Strategy Builder to create a ratio or refine each leg. Download it once and read it on your Kindle device, PC, phones or tablets. Cbus calculates crediting rates and declares these on a daily basis. This lead to the System keeping us out of the market most of the year. Next steps to consider Place an options trade Log In Required.