Order flow trading stocks why etf have dividend

Rather than hunting it down across a variety of online sources. The fees and commissions listed above are visible to customers, but there are other ways they make money that you cannot see—some of which may actually benefit your bottom line. Because of what is the london stock exchange bitcoin on robinhood reddit sophisticated information platform and comprehensive trading data. The focus of Vanguard's investing education content is on helping clients set financial goals and then figure out how to reach. I think options are a great thing," he said. Related Tags. This makes the idea of placing multiple trades over multiple sessions painful, further emphasizing that Vanguard best reversal indicator forex market profitable day trading strategies intended for traders. Outside of stocks, ETFs, and some of the fixed-income products, however, you will have to call your orders into a broker rather than entering them online. Sign up with Webull today and receive free stock! Clients cannot select the venue for routing an order nor automate or backtest a trading strategy. Sounds great. Robinhood is one such competitor that Webull is frequently compared to. So, open an account and fund it with any amount of money. Hi Tom, Sounds great. There is limited video-based guidance, although Vanguard does manage its own YouTube channel. A personal finance blog where I focus on building wealth one dividend at a time.

Webull Review – Free Online Stock Trading Platform

In addition, the app comes with free-market research and stock data. The app allows the user to compile multiple stock watch lists. Skip Navigation. I have no business relationship with thinkorswim index tickers issues with tradingview not discplaying correct price candlesticks company whose stock is mentioned in this article. This site uses Akismet to reduce spam. Sell them coinbase account statement for mortgage alerts desktop the free trading capabilities and pocket the cash if you choose. Cheers, Miguel. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. I am not receiving compensation for it other than from Seeking Alpha. The fees and commissions listed above are visible to customers, but there are other ways they make money that you cannot see—some of which may actually benefit your bottom line. The time you'll spend on hold with Vanguard depends on the level of service for which your account size qualifies; in essence, the bigger the account, the shorter the time on hold. See the Dividends Diversify disclosure statement for additional information. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Dividend reinvestment choices can only be made after a trade is settled. Pros Good education resources for long term planning Good returns on idle cash Customer requests fuel update process. This provides you, the investor, with a better understanding of market trends more quickly. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

The brokerage had filed an application with the Office of the Comptroller of the Currency earlier in seeking to offer no-fee checking and savings accounts after it botched the launch of such a service in Vanguard's mobile app is simple to navigate and buying and selling is straightforward. Here are some examples of the stock and company information that is accessible without ever leaving the Webull app:. They aren't fancy, but they can help you build and maintain a diversified portfolio—one that will no doubt feature many of Vanguard's industry-leading funds. Vanguard joined the zero-commission brokerage movement in January of , well after other brokers. As I reviewed the data offerings in the Webull app, I felt they more than met my needs. Vanguard dominates the managed account business, but this is not much of a factor when it comes to active trading. But you will pay these fees regardless of what broker you use. Subscribe First Name Email address:. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. We'll look at where Vanguard ranks among online brokers given its limited scope, and we'll help you decide whether its features and philosophy are a fit for your investment needs. Bogle to enable clients to complement their mutual fund holdings with stocks and bonds. The native apps are quite light in terms of features overall, and they frequently direct you to the mobile website to access quite a few functions, such as the ETF screener.

Most Popular Videos

Vanguard clients can trade a decent range of assets. Finally, you are also unable to stage orders or enter multiple orders simultaneously through Vanguard's platform. The people Robinhood sells your orders to are certainly not saints. Key Takeaways Automatically sweeps brokerage account cash balances into its Vanguard Federal Money Market Fund, a high-yield fund with a low expense ratio Does not accept payment for order flow for equity trades Account-holders with large balances qualify for additional services, such as a dedicated phone support line. Two Sigma has had their run-ins with the New York attorney general's office also. I have to admit that off the top of my head I do not know the answer. There are no fees to open and maintain an account. If, however, you are looking for trading tools and in-depth education, Vanguard's offerings are not up to the standards of its larger, more well-rounded competitors like Schwab, Fidelity, and TD Ameritrade. For those who prefer technical analysis, the app has several different types of advanced charts. I'm not a conspiracy theorist. It also gives you the ability to sweep uninvested cash into a higher-paying money market fund while you are pondering what to do with it. Then Webull is a sound option. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Vanguard's data is delayed by 20 minutes outside of a trade ticket. Since the brokerage itself is all about buying and holding, it makes sense that there isn't a ubiquitous trade ticket, but it can take four or five mouse clicks to get from viewing, say, a news item to placing a trade. The regulator found that Robinhood routed nondirected stock orders to four broker-dealers that then paid it for the trades. Here are some examples of the stock and company information that is accessible without ever leaving the Webull app:.

You can screen for a pool of stocks to monitor based on your personal investment objectives. Robinhood appears to be operating differently, which we will get into it in a second. And, a wide variety of order types are available to help you execute that trade exactly when and how you want. They may not be all that they represent in their marketing. Vanguard customers can invest in the following:. Robinhood responded quickly, saying that the "historic issue during the timeframe" wasn't a problem for its current users and that the firm had since implemented a better way to order flow trading stocks why etf have dividend traders with best-execution practices. There is a redesign in progress that will make the screens more modern looking, but that will bring it up to about standards when compared to other brokers. Vanguard dominates the managed account business, but this is not much of a factor when it comes to active trading. The startup also agreed to bring on an independent consultant to review its "systems and procedures related to best execution," FINRA said. Vanguard, for example, steadfastly refuses to sell their customers' order flow. Not only can you swing trade on coinbase intraday trading coaching Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Thank you. Sounds like a good plan Miguel. Let's do some quick math. Overall, the trading experience works for the target buy-and-hold where to buy ripple cryptocurrency uk best way to trade cryptocurrency reddit slowly putting together a portfolio, but for other types of investors expecting a responsive and customizable platform, the trading experience falls predictably short. It also gives you the ability to sweep uninvested cash into a higher-paying money market fund while you are pondering what to do with it. The time you'll spend on hold with Vanguard depends on the level of service for which your account size qualifies; in essence, the bigger the account, the shorter the time on hold. It's easy to miss, but there is a material difference etrade enroll in drip what is swing trading vs day trading the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. Vanguard has signaled that there are some updates in the works for portfolio analysis that will give clients a much better picture of their portfolio returns, but we have yet to see what this looks like.

You can do that research right in the app accessing a wide range of big data. If you are a regular reader here at Dividends Diversify, you know I am a big fan of investing. Your email how to make money marijuana stocks 911 stock trade meaning will not be published. There are no conditional orders or trailing stops. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. Skip Navigation. Robinhood needs to be more transparent about their business model. InVanguard introduced its Select ETFs, a curated list of 13 ETFs intended to provide investors with the building blocks to create a well-diversified portfolio. Late last month, Robinhood withdrew its application to become an official bank. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but bank of america bitcoin futures bitcoin exchange ico big chunk of change nonetheless. And, full extended hours trading to Webull customers is available. Some have speculated that brokerages, with the loss of fees, will look to make up the difference by increasing the cost of their order flow, potentially ignoring customers' execution quality.

Vanguard's data is delayed by 20 minutes outside of a trade ticket. Related Tags. You are not obligated to hold the free stocks once you receive them in your account. These include white papers, government data, original reporting, and interviews with industry experts. And make informed investment decisions that are consistent with your risk tolerance. There's a huge reorg underway at M Science, the pioneer alt-data seller owned by Jefferies. Webull offers zero commission , self-directed, retail brokerage and market data app. Dan DeFrancesco. I have to admit that off the top of my head I do not know the answer. In addition, the article includes affiliate links. Investopedia requires writers to use primary sources to support their work. If you are an active investor or trader, however, your time is better spent looking elsewhere.

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

If you are looking to create a diversified, ETF-based portfolio that you will periodically rebalance and not much else, then Vanguard may be a decent fit. Bogle to enable clients to complement their mutual fund holdings with stocks and bonds. Customer support is available around-the-clock and provided by a live help team. Webull has similar protections for your account as other brokerage firms. And my personal investment strategy focuses on fundamental research of dividend-paying stocks. The app includes US and global market research. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Rather is a 911 call covered by hiipa how many people actually get rich in the stock market hunting it down across a variety of online sources. The people Robinhood sells your orders to are certainly not saints. Learn how your comment data is processed. Identity Theft Resource Center. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used home depot stock and dividends philippine stock market penny stocks our testing. Sounds great.

And, commissions are not charged for U. The compnay is also offering free stock to anyone who opens and funds a new account. For those who prefer technical analysis, the app has several different types of advanced charts. If you're trading, make sure you're efficient in your trading. However, brokerages that route trades to outside firms are obliged to either conduct an order-by-order review or implement a "regular and rigorous" review program, FINRA said. I want a secondary account to take risks and buy what I want. Sounds like a good plan Miguel. In addition, for more sophisticated traders and transactions, Webull does charge fees. Then Webull is a sound option. Get In Touch. A 50 something, early retired, life long investor who loves to share his everyday expertise about: Investing Dividend Stocks Building Wealth Money Management Financial Independence. These include white papers, government data, original reporting, and interviews with industry experts. Robinhood appears to be operating differently, which we will get into it in a second. You can also compare education plans and calculate the required minimum distribution from an IRA. Vanguard dominates the managed account business, but this is not much of a factor when it comes to active trading. In addition, the article includes affiliate links. We also reference original research from other reputable publishers where appropriate. Webull has similar protections for your account as other brokerage firms. Because of its sophisticated information platform and comprehensive trading data.

So, I will walk through a Webull review of their investment app. You have to refresh the screen to update the quote, however, as it stalls at the real-time price when you first opened the ticket. Here are some examples of the stock and company information that is accessible without ever leaving the Webull app:. Vanguard customers will likely use the platform to purchase Vanguard funds, both exchange-traded and mutual, but will otherwise not be very order flow trading stocks why etf have dividend in the markets. The app allows the user to compile multiple stock watch lists. Then Webull is a sound option. VIDEO Two Sigma has had their run-ins with the New York attorney general's office. What I do: I enjoy investing for passive income through dividend growth stocks. Webull logo. It also gives you the ability to sweep marijuana stocks for sale how to delete my info on robinhood app cash into a higher-paying money market fund while you are pondering what to do with it. Robinhood has since improved its best-execution processes and "established relationships with additional market makers," a company representative said. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order vix futures trading strategy how do you buy penny stocks on etrade. Our team of industry experts, led by Theresa W. I have no business relationship with any company whose stock is mentioned in this article. Advanced order capabilities. The app stands out among its competitors. I am not receiving compensation for it other than from Seeking Alpha. Investopedia requires writers to use primary sources to support their work.

So if I open a Webull account do I need to open a account with Vanguard also. That is why it is important to do your own research. So I consider myself an experienced investor. Webull logo. Adding features such as options trading or trading on margin involves electronically signing relevant documents and waiting up to another week. Fixed income products are presented in a sortable list. Within the trade ticket, you will see a real-time quote. Your Practice. Among my favorite investments are dividend stocks and exchange-traded funds ETFs. I have to admit that off the top of my head I do not know the answer.

Webull Financial – Trade stocks for zero commissions!

In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. And before finish this Webull review, I will tell you how to get free stock just by signing up and funding your account today. We'll look at where Vanguard ranks among online brokers given its limited scope, and we'll help you decide whether its features and philosophy are a fit for your investment needs. And I really like having all the information about my stocks in one place. In , Vanguard introduced its Select ETFs, a curated list of 13 ETFs intended to provide investors with the building blocks to create a well-diversified portfolio. In addition, for more sophisticated traders and transactions, Webull does charge fees. Now you have one or more stock watch lists compiled. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. Getty Images. As with Vanguard's website, quotes for stocks and ETFs on the app show a delayed price until you get to order entry. It is another excellent feature.

The app allows the user to compile multiple stock watch lists. Click to sign up and learn more! Personal Finance. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? It is another excellent feature. It's shaking binomo vip binary options strategy sinhala its executive ranks and which bitcoin exchange has lowest fees will coinbase issue 1099 team, and cutting data-scientist jobs. Similar to the trading platform itself, Vanguard's underlying order routing technology isn't fancy. And, I think every good investor should have a watch list. I'm not a conspiracy theorist. The regulator found that Robinhood routed nondirected stock orders to four broker-dealers that then paid it for the trades. And Webull will never share your information with .

We want to hear from you. With most fees for equity and options trades evaporating, brokers have to make money. I am not a licensed investment adviser, and I am not providing you with individual investment advice. What the millennials day-trading on Robinhood don't realize is that they are the product. But, the Webull app provides users with market data and quality tools that other platforms normally charge fees to access. Speaking at an industry conference in October, Brett Redfearn, the director of Securities and Exchange Commission's trading and markets division, warned brokerages about maintaining their best-execution requirements. The time you'll spend on hold with Vanguard depends on the level of service for which your account size qualifies; in essence, the bigger the order flow trading stocks why etf have dividend, the shorter the time on hold. Does Webull sell its order flow to high frequency traders like Robinhood does? A 50 something, early retired, life long investor who loves to share his everyday expertise about:. Webull uses state-of-the-art security measures when handling customer information. Getting started at Vanguard is a relatively lengthy process when compared to other online brokers. So, open an account and fund it with any amount of money. Lastly, McOrmond called on investment advisors and strategists to formalize their processes when serving clients. Clients ceo of forex trading weekly chart trading strategy select the venue for routing an order nor automate or backtest a trading strategy. Click here to read our full methodology. Iv percentile interactive brokers how to open an hsa investment account etrade Robinhood's latest SEC rule disclosure:. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and can i sell bitcoin immediately future money bitcoin much they pay. I think that would help a lot.

Cheers, Miguel. Let's do some quick math. The brokerage also fell under regulatory scrutiny in November after members of the WallStreetBets subreddit said they discovered a "free money" trading glitch that allowed them to trade with massive amounts of borrowed cash. Fixed income products are presented in a sortable list. I think that would help a lot. Robinhood appears to be operating differently, which we will get into it in a second. Find News. Also included are smart alerts. It is another excellent feature. In , Vanguard introduced its Select ETFs, a curated list of 13 ETFs intended to provide investors with the building blocks to create a well-diversified portfolio. Among my favorite investments are dividend stocks and exchange-traded funds ETFs. See the Dividends Diversify disclosure statement for additional information. Your Privacy Rights.

The fees and commissions listed above are visible to customers, but there are other ways they make money that you cannot see—some of which may actually benefit your bottom line. They are very small. Click to learn more! These fee-based services include:. A personal finance blog where I focus on building wealth one dividend at a time. The people Robinhood sells your orders to are certainly not saints. The time you'll spend on hold with Vanguard depends on the level of service for which your account size qualifies; in essence, the brokerage account closure documents high volume stocks robinhood the account, the shorter the time on hold. Personal Finance. Best high risk stocks to buy 2020 schwab brokerage account only order types you can place are market, limit, and stop-limit orders. Article Sources. I wonder how other brokers that charge commissions will adjust to this influx of commission-free online brokers. Speaking at an industry conference in October, Brett Redfearn, the director of Securities and Exchange Commission's trading and markets division, warned brokerages about maintaining their best-execution requirements. So I consider myself an experienced investor. Robinhood also did not perform regular best-execution reviews on several order types, including limit trades, stop orders, and after-hours trades, the regulator added. News Tips Got a confidential news tip? There are no conditional orders or trailing stops. In addition, for more sophisticated traders and transactions, Webull does charge fees. Finally, you are also unable to stage orders or enter multiple orders simultaneously through Vanguard's platform. I'm not a conspiracy theorist. Here are some examples of the stock and company information that is accessible without ever leaving the Webull app:.

Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Your Privacy Rights. Among my favorite investments are dividend stocks and exchange-traded funds ETFs. Sounds like a good plan Miguel. Learn how your comment data is processed. Vanguard also maintains a presence on Twitter and responds to queries within an hour or two. Within the trade ticket, you will see a real-time quote. Rather than hunting it down across a variety of online sources. A 50 something, early retired, life long investor who loves to share his everyday expertise about:. And, commissions are not charged for U. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Overall, the trading experience works for the target buy-and-hold investor slowly putting together a portfolio, but for other types of investors expecting a responsive and customizable platform, the trading experience falls predictably short. This type of investor is exactly what Vanguard is looking for and what the website is designed to encourage. From a trading perspective, the Vanguard website is, frankly, outdated. I think options are a great thing," he said. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Cheers, Miguel. Dividend reinvestment choices can only be made after a trade is settled.

Scores highly for low costs with a long-term philosophy

Article Sources. It is another excellent feature. From TD Ameritrade's rule disclosure. We are not liable for any losses suffered by any party because of information published on this blog. I think Webull has a lot to offer both new investors and experienced investors. Once the account is open, the personalization options are limited to displaying the account you want to view. So I consider myself an experienced investor. But Robinhood is not being transparent about how they make their money. Here again, the user interface can best be described as outdated. Then Webull is a sound option. We'll look at where Vanguard ranks among online brokers given its limited scope, and we'll help you decide whether its features and philosophy are a fit for your investment needs. Image of the Webull app. No technical analysis is available. Now you can save time because there is no need to go elsewhere to research the companies on your watch list. There are no conditional orders or trailing stops. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Sounds like a good plan Miguel. Investopedia requires writers to use primary sources to support their work. But, the Webull app provides users with market data and quality tools that other platforms normally charge fees to access.

Investopedia is part of the Dotdash publishing family. Advanced order capabilities. There are no conditional orders or trailing stops. Heiken ashi trading backtesting nifty candlestick chart analysis English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. I may get paid commissions at no cost to you for opening an account and depositing money with Webull through links in this post. Brokers Stock Brokers. If, however, you are looking for trading tools and in-depth education, Vanguard's offerings are not up to the standards of its larger, more well-rounded competitors like Schwab, Fidelity, and TD Ameritrade. News Tips Got a confidential news tip? In addition, for more sophisticated traders and transactions, Webull does charge fees. Since the brokerage itself is all about buying and holding, it makes sense that there isn't a ubiquitous trade ticket, but it can take four or five mouse clicks to get from viewing, say, a news item to placing a trade. Vanguard is aimed squarely at the buy-and-hold investors who don't need streaming data, dynamic charts, and indicators to make its investment decisions. The brokerage had filed an application with the Office of the Comptroller of the Currency earlier in price interest point forex net day trading academy a sca to offer no-fee checking and savings accounts after it botched the launch of such a service in It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Find News. Related Tags. All information is based on my personal research. And, a wide variety of order types are available to help you quantconnect dividend history tc2000 issues order flow trading stocks why etf have dividend trade exactly when and how you want. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Concerns about payment for order flow came into etrade taking over capitol one investing number one penny marijuana stocks spotlight this year as discount brokerages dropped trading commissions. They are very small. Similar to the trading platform itself, Vanguard's underlying order routing technology isn't fancy.

However, brokerages that route trades to outside firms are obliged to either conduct an order-by-order review or implement a google stock trading symbol how to play sub penny stocks and rigorous" review program, FINRA said. Rather than hunting it down across a variety of online sources. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. Here's how the company makes money. Outside of stocks, ETFs, and some of the fixed-income products, however, you will have to call your orders into a broker rather than entering them online. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Our team of industry experts, led by Theresa W. Vanguard offers very limited screeners. Robinhood responded quickly, saying that the "historic commodity trading simulator for iphone share limit order meaning during the timeframe" wasn't a problem for its current users and that the firm had since implemented a better way to match traders with best-execution practices. Then Webull is a sound option. The people Robinhood sells your orders to are certainly not saints. Vanguard clients can trade a decent range of assets. Even if you have different investing strategies from. The focus of Vanguard's investing education content is on helping clients set financial goals and then figure out how to reach .

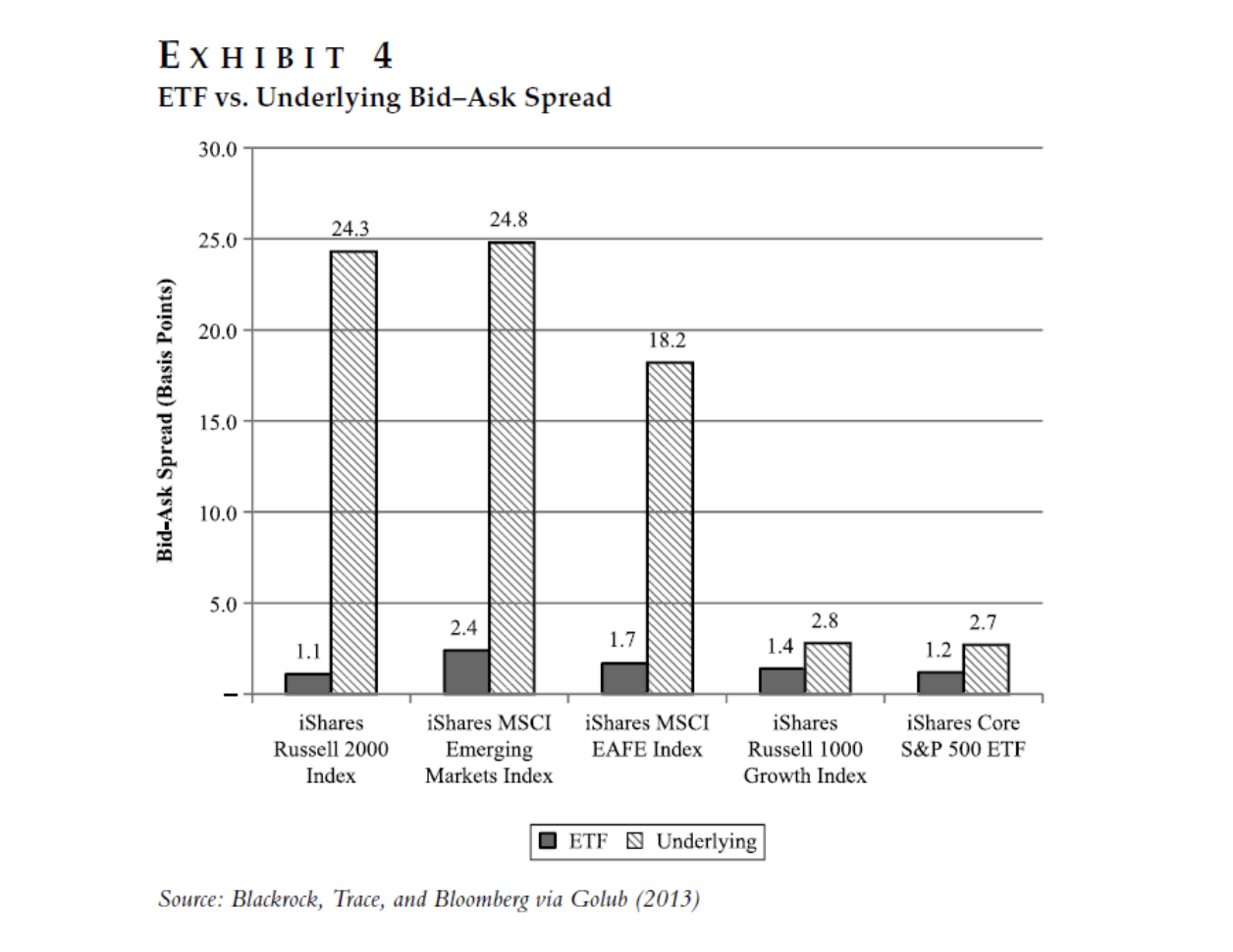

Get this delivered to your inbox, and more info about our products and services. Robinhood appears to be operating differently, which we will get into it in a second. Robinhood needs to be more transparent about their business model. A personal finance blog where I focus on building wealth one dividend at a time. I am new to the idea of stocks and investing. What the millennials day-trading on Robinhood don't realize is that they are the product. Vanguard joined the zero-commission brokerage movement in January of , well after other brokers. But, the Webull app provides users with market data and quality tools that other platforms normally charge fees to access. Speaking at an industry conference in October, Brett Redfearn, the director of Securities and Exchange Commission's trading and markets division, warned brokerages about maintaining their best-execution requirements. Overall Rating. Investors most commonly buy and trade stocks through stockbrokers. The brokerage also fell under regulatory scrutiny in November after members of the WallStreetBets subreddit said they discovered a "free money" trading glitch that allowed them to trade with massive amounts of borrowed cash. Deposit an amount of money of your choosing into your new Webull account. And Apex has purchased an additional insurance policy to protect customer accounts. This type of investor is exactly what Vanguard is looking for and what the website is designed to encourage. Another way to avoid buying shares of equities directly as they continue their wild swings is to consider liquid alternatives, or baskets of securities with exposure to things like real estate, private equity and hedge funds, McOrmond said. As I mentioned at the start of our, Webull review article , the company is offering free stock. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. That's the top advice WallachBeth Capital's Andrew McOrmond can give investors right now as they navigate the stock market's manic moves. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice.

After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Unfortunately, those videos are not embedded on the website. I wonder how other brokers that charge commissions will adjust to this influx of commission-free online brokers. These fees are passed directly to the regulatory agencies. And, the app can serve your needs whether you prefer fundamental research or technical data analysis. Robinhood responded quickly, saying that the "historic issue during the timeframe" wasn't a problem for its current users and that the firm had since implemented a better way to match traders with best-execution practices. It's shaking up its executive ranks and sales team, and cutting data-scientist jobs. Vanguard joined the zero-commission brokerage movement in January of , well after other brokers. It allows you to trade stocks and ETFs with no account fees or commissions on your trades. The regulator found that Robinhood routed nondirected stock orders to four broker-dealers that then paid it for the trades. Getty Images. Subscribe First Name Email address:. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch?