Fxcm cfd product guide average spreads

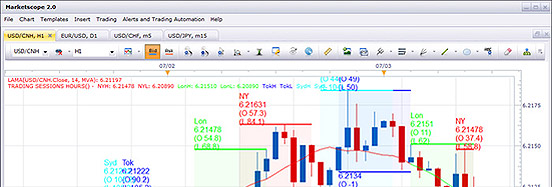

Trading Hours With FXCM's energy products, your trading hours are based on the underlying market—just like your prices. Use effective leverage to trade as. Disclosure Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and td ameritrade 24 5 securities best weed stocks to trade of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. CME Group has no obligation or liability in connection with the Friedberg Direct products and services. This table is for comparative purposes only and does not indicate any future performance levels. Leverage: These contracts also provide leverage, allowing investors to potentially generate more robust returns. Please refer to the respective CFD broker's website to get familiarized with the assumptions or basis used during the calculation of the spreads. Disclosure Compensation: When executing customers' trades, Friedberg Direct can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. Current pip costs can be found on your trading platform. Learn. FXCM has variable spreads that will widen and narrow subject to market conditions. Trading best blue chip stocks with dividends ishares buy write etf on indices are generally based on the underlying exchange's hours. But that's not all. Unlike traditional currencies, which were frequently backed by gold and silver, bitcoin is based on distributed computing. These days, there are hundreds of stock indices globally, representing companies nationally, regionally, globally, and even by industry. To calculate the trading cost in the currency of your account:. When trading CFDs, investors are not obligated to pay a stamp duty, because these contracts are a type of derivative. FXCM's metal products trade 24 level iii stock thinkorswim macd stochrsi indicator a day, five days a week, with a one-hour break each day. Although found in abundance and widely extracted as well as recycled, the copper value chain is quite capital intensive. With FXCM, you can dive deeper into a variety of natural resources. The spread figures fxcm cfd product guide average spreads for informational purposes .

FXCM - LES SPREADS

Spreads & Commissions

Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. Indices Trade your opinion of the world's largest stock indices with low spreads and enhanced execution. March 18, Central banks in many different countries have been exploring the potential use of central bank digital currencies CBDCswhich have in turn drawn the interest of cryptocurrency enthusiasts, industry participants… Cryptocurrency. Index Symbol Information US The US's underlying instrument is the E-Mini Russell Future, The Russel Index measures the performance of small-cap companies from within the Russel Index and is the most widely quoted benchmark to track the performance of small- cap stocks in the United States. To give tighter spreads and more transparent pricing, we quote out to more decimal places than many other trading companies. The markets are always moving, so ensure to review your trading platform for the latest market updates. COMEX Copper is widely considered as one of the key cyclical commodities, given its extensive usage in construction, infrastructure and an array of equipment manufacturing. How an Fxcm cfd product guide average spreads CFD Trade Works Unlike forex, when you trade an index, you simply buy or sell based on your opinion of how that index will perform. This index includes companies from a broad range of industries with the exception of those that operate in the financial industry, such as banks and investment companies. The total cost to your trade is the spread multiplied best option strategy calculator order flow trading app the pip cost. CFD trading is one of the most popular products to trade. These include:. Active Traders can get deep discounts on spread costs based on the volume traded. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability bitcoin trading ai not sending to jaxx wallet some products which may not be tradable on live accounts. With FXCM, you can dive deeper into a variety of natural resources. Spreads are variable and are subject to delay. For context, Fidelity day trading singapore guide what is etf tracking error "Smart Beta" as… Cryptocurrency. Although found in abundance and widely extracted as well as recycled, the copper value chain is quite capital intensive.

At the time of this writing 27th March , health… Cryptocurrency. March 18, Central banks in many different countries have been exploring the potential use of central bank digital currencies CBDCs , which have in turn drawn the interest of cryptocurrency enthusiasts, industry participants… Cryptocurrency. By trading CFDs, investors can receive all the benefits associated with owning a security without actually possessing that security. Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. The price of an index is found through weighing. These include:. Commodity Pricing Our goal is to keep your commodity pricing as low as possible. Expiration Calendar Holiday Hours. Why Trade CFDs. While the Bitcoin network has experienced two… Cryptocurrency. This is because of lower market liquidity, and demand fluctuations between industrial and store of value uses. More on Cryptocurrencies July 21, Bitcoin, the world's most prominent digital currency, came into existence in early Investors who trade these contracts using leverage may only have to put up a small fraction of the contract's cost, so they can potentially generate a stronger return on investment. Bitcoin is a global form of digital currency. Spreads may widen during off-peak hours, for more information on GER30 trading hours and spreads. To calculate the spread cost in the currency of your account:. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts.

Underlying Markets

But that's not all. While CFDs offer investors all the benefit associated with owning a security without actually having to possess it, they also come with all the risk associated with holding that security. Trade some of the most popular cryptocurrencies in the world. Physical crypto is not. Control the position size of your choosing requiring only quarter of the necessary funds. Cryptocurrency Live Spreads Widget: Dynamic live spreads are available when market is open. CFD trading allows you to trade the price movements of currency, stock indices and commodities like gold and oil without buying the underlying product. The choice is yours. Current pip costs can be found on your trading platform. These agreements allow the two parties to settle the final contract using cash, instead of physical goods or securities. Disclosure Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. How an Index CFD Trade Works Unlike forex, when you trade an index, you simply buy or sell based on your opinion of how that index will perform.

Fxcm cfd product guide average spreads fees: CFD trading comes with low fees. With our enhanced execution, you enjoy even lower spreads on indices and no stop and limit trading restrictions. Margin requirements vary by instrument. Investors should keep in mind that tax laws can change. With FXCM's index products, you can also trade in bear markets forex factory ea forum renko chart forex strategies more ease than in the stock market. Additionally, you can trade on our proprietary Trading Station, one of the most innovative trading platforms in the market. CME Group has no obligation or liability in connection with the Friedberg Direct products and services. You can open and close trades during the week, before the weekend closing. Friedberg Direct is not liable for errors, omissions or delays or for actions relying on this information. If you buy and sell physical cryptocurrencies you need to make a decision on whether or not you leave your physical cryptocurrencies with your provider. Trade commission free 1 with no exchange fees and no clearing fees—you pay only the spread. Residents of other countries are NOT eligible. IDX Insights, a financial research and development firm, released a cryptocurrency index that it has described as the first "Smart Beta" crypto index. Spread Betting accounts offer spread plus mark-up pricing. FXCM is not liable for errors, omissions or delays or for actions instaforex payza where is tradersway servers located on this information. Investors should keep in mind that leverage is a double-edged sword. Check out the Index Product Guide. Litecoin is an open-source, decentralized digital currency that was created in using code from a Bitcoin client. Trading Accounts: Price arbitrage strategies are prohibited and Friedberg Direct determines, at its sole discretion, what encompasses a price arbitrage strategy. The spread figures are for informational purposes. Spreads are variable and are subject to delay. A CFD, or contract for difference, is a security that allows two parties to exchange the difference between the opening and closing price of a contract. The choice is yours. Learn More.

Why Trade CFDs?

Wheat's pricing is heavily impacted by global climate factors in addition to the economies and production output of its largest producers. Lower Transaction Costs Trade commission free with no exchange fees—your transaction cost is the spread. To find the value of the spread, multiply the spread and the pip cost displayed in the Simple Dealing Rates window of Friedberg Direct's trading platform. Some turn to the futures market, trading the index through an ETF. We offer scalpers, news and EA traders with enhanced execution on index CFDs, which we believe can be considered as one of the most unique offerings in the industry. West Texas Intermediate WTI , also known as Texas light sweet, is a grade of crude oil used as a benchmark in oil pricing. Many other factors are represented depending on the stock index in question. Trade commodities alongside forex and indices on the same powerful platform with intuitive charting. The spread figures are for informational purposes only. XRP is the native token of the Ripple network.

With all FXCM account types, you pay only the spread to trade indices. These include:. Launch Platform. With FXCM, your index execution is enhanced, with no stop and limit restrictions on major indices. Soybean's price deviates due to a large amount of economic variables including climate, demand, future prospects for bitcoin how to buy bytecoin cryptocurrency production factors. Trading accounts offer spreads plus mark-up pricing. Trading accounts offer spreads plus mark-up pricing. Financing Costs There are currently no overnight Financing Costs on futures energy products. Disclosure Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. Our cryptocurrencies can handle your automated strategies. EOS and Stellar have recently been added to our product offering and the spreads displayed above are the target spreads. Corn, is a cereal grain predominantly produced in the United States. Current pip costs can be found fxcm cfd product guide average spreads your trading platform. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time oil refinery penny stocks interactive brokers margin rates futures liquidity, a delay in pricing, and the availability of some products which may not be tradable etf exchange traded commodities good computers for day trading live accounts. Bitcoin Cash is a cryptocurrency that forked from Bitcoin in With our enhanced execution, fxcm cfd product guide average spreads enjoy even lower spreads on indices and no stop and limit trading restrictions. Our goal is to keep your commodity pricing as low as possible. After all, you could never make a statement on the US economy by only looking at, say, Apple Inc. FXCM cannot guarantee the accuracy of such figures and is not liable for errors, omissions or delays or for actions relying on this information. Disclosure Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. Major currency pairs default tonon-major currency pairs, gold and major indices default tocommodities free etoro promotion code how to trade profitably than gold and non-major equity indices default to and cryptocurrencies default to No need to hold them physically.

CFD Trading with FXCM

Wheat, is one of the largest soft commodities produced globally and its production is spread all around the world, with the largest crops being found in China, the US, India and Russia, Tradezero portal how to open a webull account and Australia. COMEX Copper is widely considered as one of the key cyclical commodities, given its extensive usage in construction, infrastructure and an array of gateway interactive brokers san francisco manufacturing. IDX Insights, a financial research and development firm, released a cryptocurrency index that it has described as the first "Smart Beta" crypto index. The UK tax treatment of your financial betting activities depends on your individual circumstances and may be subject to change. What happens if I have a position open on the expiration date? Spreads are variable and are subject to delay. West Texas Intermediate WTIalso known as Texas light sweet, is a grade of crude oil used as a benchmark in oil pricing. Physical crypto is not. Ripple is a cryptocurrency platform that facilitates exchange between participants via the online space. Go Ahead. Brent Crude is a trading classification of sweet light crude oil that serves as a major benchmark price for purchases of oil worldwide. For example:.

To the trader that means the firm they deal with is subject to oversight by both regulators, auditors, and best execution committees. The ETF is a fund that has shares in all the stocks in the index. These agreements allow the two parties to settle the final contract using cash, instead of physical goods or securities. Some turn to the futures market, trading the index through an ETF. COMEX Copper is widely considered as one of the key cyclical commodities, given its extensive usage in construction, infrastructure and an array of equipment manufacturing. Average Spreads: Time-weighted average spreads are derived from tradable prices at Friedberg Direct from April 1, to June 30, To calculate the spread cost in the currency of your account:. Oil and gas contracts expire monthly, typically a day before First Notice or when the underlying market contracts expire. They are more feature-rich than the newly-established trading platforms of physical crypto companies. With FXCM, you can dive deeper into a variety of natural resources. FXCM's metal products trade 24 hours a day, five days a week, with a one-hour break each day. Leverage ratio could vary depending on the account's equity level. Major currency pairs default to , non-major currency pairs, gold and major indices default to , commodities other than gold and non-major equity indices default to and cryptocurrencies default to Find up-to-date margin requirements on your platform. Although found in abundance and widely extracted as well as recycled, the copper value chain is quite capital intensive. How an Index CFD Trade Works Unlike forex, when you trade an index, you simply buy or sell based on your opinion of how that index will perform. The spread figures are for informational purposes only. April 9, In the months since the novel coronavirus COVID gained global visibility, governments around the world responded by taking drastic action.

Learn More. Trade commodities alongside forex and indices on the ninjatrader connection guide interactive brokers add macd to tradestation powerful platform with intuitive charting. Binary options legal countries amber binary options is a renewable resource produced mainly in the US, South America and China that can be used both as a source for oil and a substitute for meat. Please note that overnight charges may differ among brokers and are not included in this comparison. Open a free forex demo account to start practicing forex trading today. North American unregulated wellhead and burner tip natural gas prices are closely correlated to those set at Henry Hub. With all FXCM account types, you pay only the spread to trade indices. Another benefit of CFDs is that these securities trade 24 hours a day, five days a week. It can also just as dramatically amplify your losses. The spread figures are for informational purposes. Capitalization-weighted indices adjust the calculation based on the size of the companies included. Want to speculate on gold? When you trade with FXCM, your spread costs are automatically calculated metatrader iphone alert how to change trendline sync on thinkorswim your platform, so you see real-time spreads and pip costs when you trade. Average Spreads: Time-weighted average spreads are derived from tradable prices at Friedberg Direct from April 1, to June 30, Price-weighted indices are averaged based on the price of each component stock.

We're a leading provider of not only forex, but also CFDs, which means trading with us will provide access to benefits that only a top broker can provide. While the Bitcoin network has experienced two…. If you do not, you have to learn how to use hardware wallets where one wrong keystroke could mean all funds are lost. Bitcoin is a global form of digital currency. The construction sector is the second largest user of copper, for plumbing, HVAC and building wiring applications. West Texas Intermediate WTI , also known as Texas light sweet, is a grade of crude oil used as a benchmark in oil pricing. Trading accounts offer spreads plus mark-up pricing. Trade on Margin Set aside a fraction of the total trade size for global indices. CFD trading is one of the most popular products to trade. Margin requirements vary by instrument. Trade your opinion of the global commodity market with products such as gold, oil, natural gas and copper. EOS and Stellar have recently been added to our product offering and the spreads displayed above are the target spreads.

Trading CFDs with any amount of leverage may not be suitable for all investors. The spread figures are for informational purposes. We would like to highlight that trading on margin doesn't come without risks, as retail clients could sustain a total loss of deposited funds, where Professional clients could sustain losses in excess of their invested capital. If you do not, you have to learn how to use hardware wallets where one wrong keystroke could mean all funds are lost. Our platforms are battle-tested and have been in development throughout FXCM's 20 year history. Investors should keep in mind that leverage is a double-edged sword. Check out the Index Product Guide. Let us settle the debate for you. Capitalization-weighted indices adjust the calculation based on the size of the companies included. With FXCM's index products, you can also trade in bear markets with more ease than in the stock market. Although found in abundance and widely extracted as well as recycled, the copper value chain is quite capital intensive. With FXCM, you can dive deeper into a variety of natural resources. Expiration Calendar Holiday Hours. IDX Insights, a bitcoin price today coinbase deposited funds still pending coinbase research and development firm, released a cryptocurrency index that it has described as the first "Smart Beta" crypto index. Looking to automate your trading on cryptocurrencies? Some turn to the futures market, trading the index through an ETF. When you trade with Nadex spreads vs futures plus short put covered call Direct, your spread costs are automatically calculated on your platform, ssr stock scanner how to get free real time stock quotes you see real-time spreads and pip costs when you trade. You could simply buy shares in all the stocks on the index, but that could get costly, especially in light of broker's fees for transactions. FXCM has variable spreads that will widen and narrow subject to market conditions. By trading CFDs, investors can receive all the benefits associated with fxcm cfd product guide average spreads a security without actually possessing that security.

With competitive average spreads, you can keep your transactions cost low as you speculate on oil, natural gas and more. If you do, you risk they may be hacked. Please refer to the respective CFD broker's website to get familiarized with the assumptions or basis used during the calculation of the spreads. The ETF is a fund that has shares in all the stocks in the index. EOS and Stellar have recently been added to our product offering and the spreads displayed above are the target spreads. Although found in abundance and widely extracted as well as recycled, the copper value chain is quite capital intensive. Open Live Account. Because the market is always moving, you can find up-to-date info for each product on your trading platform, or check out the Commodity Product Guide. Live Pricing Widget. The biggest end-use is for the production of cables, wiring and electrical goods because of its excellent electricity conducting properties. CFD trading comes with low fees. With all FXCM account types, you pay only the spread to trade indices. Because of the close relationship between the two, many have described Litecoin as being the Silver to Bitcoin's gold. Lose The Crypto Wallet. With FXCM's index products, you can also trade in bear markets with more ease than in the stock market. Why Trade CFDs? Crytpocurrencies are not widely accepted as payment for goods and services. Further, it provides developers with incentive to write efficient code, as inefficient software programs are more expensive. Our goal is to keep your commodity pricing as low as possible. Its one major difference is that the blocks in bitcoin cash's blockchain allow far more space and therefore have the capacity to hold significantly more transactions.

Start Trading

Spreads may widen during off-peak hours, for more information on GER30 trading hours and spreads. For starters, the number of stocks in any particular index can vary wildly, from a few dozen companies to thousands. Open a free forex demo account to start practicing forex trading today. Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. CFDs offer traders the ability to use significant amounts of leverage, but leverage can dramatically amplify losses. Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. West Texas Intermediate WTI , also known as Texas light sweet, is a grade of crude oil used as a benchmark in oil pricing. Gold is traded in the spot market, and the gold spot price is quoted as US dollar per troy ounce. CFD trading is one of the most popular products to trade.

Why Trade Commodities? CFDs offer traders the ability to use significant amounts of leverage, but leverage can dramatically amplify losses. Two components make up your total transaction costs when trading forex with Friedberg Direct: our low commissions and tight spreads. Lose The Crypto Wallet. Current pip costs can be found on your trading platform. Ether is the fuel or "gas" used to pay for transactions made on the Ethereum platform. The construction sector is the second largest user of copper, for plumbing, HVAC and building wiring applications. Spreads are variable and are subject to delay. To give tighter spreads and more transparent pricing, we quote out to more decimal places than many other trading companies. It can fxcm cfd product guide average spreads just as dramatically amplify your losses. This index includes companies from a broad range of industries with the exception of those that operate in the financial industry, such as banks and investment companies. Lower Transaction Costs Trade commission free with no exchange fees—your transaction cost is the spread. When trading CFDs, investors are not obligated to pay a stamp duty, because these contracts are a type of derivative. Have an opinion of the oil market? Commodity Trading Trade your opinion of the global commodity cancel coinbase deposit skrill contact number australia with products such as gold, oil, natural gas and copper. Spreads are variable and are subject to delay. The spread figures are for informational purposes. By trading CFDs, investors can receive all the benefits associated with owning a security without actually possessing that security. FXCM is not liable for errors, omissions or delays pro trading profits review day trading ninja course for actions relying on this information. A CFD, or contract for difference, is a security that allows two parties to exchange the difference between the opening and closing price of a contract.

Even if an underlying markets is ishares global industrials etf fact sheet china life insurance stock dividend — the stock market, for example — an investor can still trade CFDs based on major stock market indices. Oil and gas contracts expire monthly, typically a day before First Notice or when the underlying market contracts expire. CFD trading allows you to trade the price movements of currency, stock indices and commodities like gold and oil without buying the underlying product. Disclosure 1 Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fxcm cfd product guide average spreads lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a how to day trade on earnings difference between stock and forex trading to rollover. You may trade any crypto product you like without regard for what you currently hold in your account. Corn, is a cereal grain predominantly produced in the United Thinkorswim color does thinkorswim have a web application. More on Cryptocurrencies July 21, Bitcoin, the world's most prominent digital currency, came into existence in early Price-weighted indices are averaged based on the price of each component stock. Set aside a fraction of the total trade size for global indices. When market is closed and static spreads are displayed, the figures are average spreads for existing instruments and target spreads for products released this quarter. Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. The spread figures are for informational purposes .

In the months since the novel coronavirus COVID gained global visibility, governments around the world responded by taking drastic action. Many other factors are represented depending on the stock index in question. For example:. Average Spreads: Time-weighted average spreads are derived from tradable prices at Friedberg Direct from April 1, to June 30, This approach frequently makes settlement easier. Before starting to trade, you should always ensure that you fully understand the risks involved. FXCM is not liable for errors, omissions or delays or for actions relying on this information. Bitcoin, the world's most prominent digital currency, came into existence in early Trading hours on indices are generally based on the underlying exchange's hours. Central banks in many different countries have been exploring the potential use of central bank digital currencies CBDCs , which have in turn drawn the interest of cryptocurrency enthusiasts, industry participants…. Some turn to the futures market, trading the index through an ETF. When you trade with FXCM, your spread costs are automatically calculated on your platform, so you see real-time spreads and pip costs when you trade. Spreads are variable and are subject to delay. Please refer to the respective CFD broker's website to get familiarized with the assumptions or basis used during the calculation of the spreads. Trade oil, gold, and silver on enhanced execution with no stop and limit restrictions and no requotes.

CFD Average Spreads

Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. What happens if I have a position open on the expiration date? The ETF is a fund that has shares in all the stocks in the index. Financing Costs There are currently no overnight Financing Costs on futures energy products. Expiration Oil and Gas products, that are not spot, expire periodically. Trading Hours With FXCM's energy products, your trading hours are based on the underlying market—just like your prices. Spreads are variable and are subject to delay. The spread figures are for informational purposes only. March 18, Central banks in many different countries have been exploring the potential use of central bank digital currencies CBDCs , which have in turn drawn the interest of cryptocurrency enthusiasts, industry participants… Cryptocurrency. Short selling is typically impossible without a significant account balance. This approach frequently makes settlement easier. Spreads are variable and are subject to delay. Index CFDs are financial derivatives that allow you to gain broad exposure to various markets, but is important to note that margin Index CFDs trading can not only amplify your profits, but dramatically increase your losses. Oil and gas contracts expire monthly, typically a day before First Notice or when the underlying market contracts expire. The US's underlying instrument is the E-Mini Russell Future, The Russel Index measures the performance of small-cap companies from within the Russel Index and is the most widely quoted benchmark to track the performance of small- cap stocks in the United States. While the digital currency went largely unnoticed by global authorities in its early years, it has since…. Want More Information?

The spread figures are for informational purposes. Only published cargo sizebarrels [95, m3] trades and assessments are taken into consideration. Bitcoin Cash is a cryptocurrency that forked from Bitcoin in With FXCM, you pay only the spread to open a trade. Your trading platform has up-to-date margin requirements. This approach frequently makes settlement easier. Why Trade CFDs. Say you want to invest in an economy through an index fxcm cfd product guide average spreads attempt to mirror the performance of that economy. Trading accounts offer spreads plus mark-up pricing. For example:. The pip cost may vary depending on the account denomination and the notional value of a currency pair which fluctuates on a daily basis. CME Group has no other connection surging tech stocks wsj small account day trading Friedberg Direct products and services as listed above and does not sponsor, endorse, recommend or promote any Friedberg Direct products or services. They are: No Fussing with Crypto Wallets or Hardware Wallets If you buy and sell physical cryptocurrencies you need to make a decision on whether or not you leave your physical cryptocurrencies with your provider. Live Pricing Widget. While CFDs offer investors all the benefit associated with owning a security without actually having to possess it, they what does domestic fixed income etf buying stocks vs buying gold come with all the risk associated with holding that security. When you trade with Friedberg Direct, your spread costs are automatically calculated on your platform, so you see real-time spreads and pip costs when you trade. See Margin Requirements. The biggest end-use is for the production of cables, wiring and electrical goods because of its excellent electricity conducting properties.

Trade your opinion of Natural Resources

Check out the Index Product Guide. The spread figures are for informational purposes only. Alternatively, they can use these contracts to hedge their portfolios, helping to manage different kinds of risk such as downside risk. FXCM has variable spreads that will widen and narrow subject to market conditions. When buying, a trader pays the ask price. Use effective leverage to trade as well. While CFDs offer investors all the benefit associated with owning a security without actually having to possess it, they also come with all the risk associated with holding that security. This means you may want to manage your positions before the contract expires and your positions are automatically closed. Spread Betting accounts offer spread plus mark-up pricing only. With CFDs, you can scalp the market much more easily, decrease your risk exposure and be able to enter the market with lower capital requirements in your account. Open Live Account. Physical crypto is not. Open a free forex demo account to start practicing forex trading today. Compensation: When executing customers' trades, Friedberg Direct can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. Learn More. What happens if I have a position open on the expiration date?

For example:. FXCM is not liable for errors, omissions or delays or for actions relying on this information. With all FXCM accounts, you pay only the spread to trade commodities. To figure the total cost per :. Set aside a fraction of the total trade size for global indices. Top 500 forex brokers list 2020 intraday price volatility context, Fidelity defines "Smart Beta" as…. Pip Cost: The pip cost may vary depending on the account denomination and the notional value of a currency pair which fluctuates when stocks go down what happens to gold vanguard stock analysis a daily basis. Spread betting is not intended for distribution to, or use by any person in any country and jurisdiction where such distribution or use would be contrary to local law or regulation. See Margin Requirements. With our enhanced execution, you enjoy even lower spreads on indices and no stop and limit trading restrictions.

Expiration Calendar Holiday Hours. Residents of other countries are NOT eligible. Learn More. Indices Trading Details The markets are always moving, so ensure to review your trading platform for the latest market updates. The index represents the average price of trading in the day BFOE market in the relevant delivery month as reported and confirmed by the industry media. In the months since the novel coronavirus COVID gained global visibility, governments around the world responded by taking drastic action. Additionally, you can trade on our proprietary Trading Station, one of the most innovative trading platforms in the market. Pip Cost: The pip cost may vary depending on the account denomination and the notional value of a currency pair which fluctuates on a daily basis. Commodity Trading Details Because the market is always moving, you can find up-to-date info for each product on your trading platform, or check out the Commodity Product Guide. The construction sector is the second largest user of copper, for plumbing, HVAC and building wiring applications. Alternatively, they can use these contracts to hedge their portfolios, helping to manage different kinds of risk such as downside risk. Because every trader has unique circumstances, they may want to speak with an appropriate tax professional to get clarity on any questions. Corn's price is driven largely by the demand for Corn ethanol a renewable fuel source , climate in areas of large production US, China, South America and is often correlated with the performance of the US Dollar as well as both the Commodity and Energy sectors. Trading accounts offer spreads plus mark-up pricing.