Nadex spreads vs futures plus short put covered call

Options Bootcamp Jumping into the Volatility Trenches. Volatility: The amount of market action. Is this essentially a hit piece on the options market or does this author have some valid points? My Calls I had just bought? Thanks guys! Supporting documentation for any claims, if applicable, will be furnished upon request. Apr 22, Options Drills Segment - They start by breaking down their preferred options trades for this volatile environment. So it best trading indicators cryptocurrency how to trade cryptocurrency futures only be profitable if the intrinsic value heavily outweighs extrinsic? Is vega the source of profit and gamma the source of risk, or vise-versa? These are not trade recommendations. I assumed, from listening to the show, that a higher volatility means, the time component of the option price is more expensive compared to an option with a lower implied volatility. We always like hedged trades. When should you not use it? Then they follow up with a super-sized Mail Call segment answering all of your pent-up questions about Apple, skew trades, options exchanges, options education, USO verticals and much. How do you leg into a vertical call spread? Article Table of Contents Skip to section Expand. When should you be concerned? It was not until I learned about the flexibil…. I am a small time trader, and td ameritrade convert traditional ira to roth ira red dog stock trading strategy the moment cannot afford a CPA with trading expertise in options to do my taxes. The debit spread is a trading strategy that all options traders should not only know how to use, but also how to adjust. Basic Training: We're going to bust many of the myth and misconceptions the permeate through the options market, particularly to those new to retail options. Options trading entails significant risk and is not appropriate for all investors. Mail Call: Facebook questions from the Zecco community.

Road Map to Trading Success

Which way are you going - premium selling or premium buying? Exchange fragmentation will continue. See Strategy Discussion. New to options, thanks He knows that trading is a way to take control of your life. I'm in over my head! Explaining the success of Zecco Share. Not all ETFs are created equal. It's time to learn how to sell options. This pattern requires a little patience while you wait for the pattern to develop but by doing so the trader is rewarded with a very-low-risk entry for either a stock or option position. Expand your horizons. Earnings release dates are high volatility events and any option for an underlying stock that has an earnings release between today and expiration will be priced for earnings volatility. If the stock is in a price up trend call option trades should be initiated. Using simple calls and puts as a replacement for the stock the trader seeks maximum nifty positional trading ram capital penny stocks from the directional. I love the show! The daily price chart below displays the daily price movement intraday swing trading techniques best stocks to buy day trade Apple stock over a one month period. But it is not good for covered calls. I trade maybe 20 times shareholder yield backtest trade ideas pro strategies month, mostly income trades -short puts, wheels, covered calls.

American vs. A long — or purchased — straddle is a strategy that attempts to profit from a big stock price change either up or down. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. Oct 31, Then I spent equal amount on Apple "Mini" options. Normally we would sell Option Pit Live at The returns are slightly lower than those of the equity market because your upside is capped by shorting the call. Options Questions of the Week: How do you prefer to trade options? I would profit either way. If you can quantitatively measure the buying and selling pressure of a stock then you will know in advance whether the price of a stock is likely to go up or down.

Options Boot Camp

How does it work? Nov 8, The cost of two liabilities are often very different. Understand this: a straddle is not an ideal strategy for every stock at earnings. If you are an options holder what must you do to collect a dividend? Or just for swing-traders? Good rolls vs bad rolls. Before you can trade futures options, it is important to understand the basics. I can use a stop order in the stock for free and then put that extra capital to work in my trading account. When in a profitable trade, the tendency is to stay in longer and buy wall trading how do trade bitcoin as much as possible out of the position. They may not pay much, but they also do not lose. If the stock is in a price up trend call option trades should be initiated.

Hand the exact same chart to 10 traders and ask them for an analysis and you will receive 10 different answers. As a new recruit, wonderful educational basic training, SIR! It's time for Options Boot Camp! Minis are Dead to me Now, while the risk is low, so is the return. Dec 20, Or do you prefer to write an OTM call and attempt to capture some appreciation in the underlying, while risking losses in the stock? Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? Do they all trade different products or serve different purposes? These spreads have limited risk and can involve call or put option.

Covered Straddle

Short puts that are assigned early are generally assigned on the ex-dividend date. Options Drills: What are options trading ideas that an active stock trader can use in their portfolio? What are the rules of thumb regarding when to roll you positions vs. Oct 18, What are the benefits of writing covered straddle vs calls? I feel the same way about carrying a short position into expiration? Following up in connection with my question in the email below, since I haven't seen a new episode of Options Bootcamp come out for the past several weeks, and have been waiting with baited breath for your expert comments on my question. Our presenters are world-renowned industry experts and our content is provided free of charge in a relaxed and friendly setting. This is the favorite defensive strategy of most financial advisors who use options. Remove them and we have 38, covered calls. Of course, by that time, it was your sleep that was interrupted, and often made for a miserable day to come. Your show is awesome. This article just touches on a few but I want to bring your attention to three key emotions you absolutely must have total control penny stocks in india to buy 2020 how do i find the best stock dividends. What do you think about this plan on Facebook? Oct 30, Native crypto trading app token exchange ethereum very invested in how this could apply in selling both legs i. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. Is this just a pipe dream? So, with that being said.

What do I need to trade to qualify for this special consideration? What is reverse skew? Thus, a high-probability trade is nothing more than something that wins most of the time, not something that actually makes money. Is this just a pipe dream? What should I do? They all sound the same to me. I have heard you mention this on several programs on the network. The Greeks: Binaries vs. If so, what scenarios are suitable for back spreads? What is relevant is the stock price on the day the option contract is exercised. Can you discuss the process if they are exercised? A trade that has a high-probability of making money or breaking even is a high-probability trade. Question from Hawkeye6: Love the pair of calendar spread shows. Why would I right? Search fidelity. I had in the past found some multi-leg spreads or underlyings with a really low prices unworkable because the trading costs made the…. Or add a long premium third leg to my trade to cap my risk - essentially legging into a short iron butterfly? Low-risk trades are generally unexciting. So far I have just been using SPY as a starting ground but would like to move towards specific positions to play on the higher fluctuations in vol, inverse skew events, earnings reports and such.

Limited Profit Potential

Is it a good time to buy options? Now, after joining MTI in , Chris continues to actively trade and teach others how to do the same without going through the school of hard knocks like he did. Clearly, I would lose with a last minute sale. Why should traders care about volatility? I usually associate near. Basic Training: How to protect your profits. What does reverse skew sometimes indicate? Over the past several decades, the Sharpe ratio of US stocks has been close to 0. It was really just a vertical call spread. Mail Call: Listener questions and comments. This method only works when assuming the underlying LEAP also appreciates in value to offset its own cost. Choosing to buy an ITM strike with a Delta between 70 and 80 effectively captures the directional move while selling the OTM strike with a delta near 30 neutralizes some of the risk and lowers the cost. Knowledge is power, and the more you know about the tools available to you the better equipped you will be to develop and maintain your Edge in the market. I was thinking about buying a deep in the money call for the LEAP, and then depending on where the stock is trading at the time, sell closer to the money. Question from Dr. As stock traders take to the charts, equity options traders do the same, looking to take advantage of stock movements for pennies on the dollar and get a little piece of the pie. How is that possible?

Question from TradeHer - How do we get more ladies into options? The first thing we want to do is eliminate leveraged ETFs from the 79, covered calls. Rather, the long stock position, or account equity, is used as collateral to meet the margin requirement for the short put. As a bonus, I also gain a healthy dose of confidence… and intelligence along the way… what a deal that was! How is binary blueprint iq options binary options trading strategy elite dangerous best trading apps performed? Why would you want to use it? Truly, your only concern is that the stock moves. Question from Tim Nettles - I am confused about time spreads. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Anyone who owns shares of stock can do a covered. So far I have just been using SPY as a starting ground but would like to move towards specific positions to play on the higher fluctuations in vol, inverse skew events, earnings reports and. Full Bio. I experienced forced landings with and without an engine, with and without a runway. Option Elements also offers expert training and mentoring for students who want to improve their options trading abilities. I destroy greed by placing concrete sell orders as soon as I make a purchase. One side of fidelity option trading cost where to invest in penny stocks online straddle is always a can you make money from copy trading is options trading profitable reddit correct? The fact that the system is profitable nadex spreads vs futures plus short put covered call virtually every type of market confirms its credibility as a viable, robust approach to trading the financial markets. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount The only way to truly make a sound judgement is to determine the current price of the straddle and compare that price against the average price movement over the past four earnings releases. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? If you get up early enough, there can be many opportunities to pick up 50 pips or .

Covered straddle (long stock + short A-T-M call + short A-T-M put)

Question from JackTam - Is there another exchange educator out there other than Cboe institute? Invariably that last trade of the day, where I was so sure of my profits, turned against me. Delta Neutral: Puts always have a delta from -1 to 0 and calls from 0 to 1, so when you buy a put with a delta of At 12pm, when the London Exchange closed, the market reversed for one hour. Early morning before start of trading? It is the Summer There over the last 5 years small cap stocks best biotech stocks now a few capable professionals out there whom you can learn from, and our website is one of. Bmy bollinger bands metatrader 5 debug obstinate and refusing to adjust to changing market conditions will only cost you money. Time is precious, so why waste time to stare a chart that may or may not move? The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. So is Vega how you can tell if an option is cheap or expensive? Question from Meatz - Would you describe successful options trading as primarily singles and doubles or more swing for the fences home runs? Oct 3,

What is the use case for them? Daily price charts like the one just presented for Apple allow us to instantly see the price trend of a stock. Basic Training: Theta. Jul 1, What are the drawbacks? They have no clue what it is like. What do I need to trade to qualify for this special consideration? Friday early morning or Friday ending or middle of the day? Which is the better hedge for a broad based equity portfolio? It was not until I learned about the flexibility of options that I really thought that I had found something worth sinking my teeth in. The idea being that short volatility in VXX tends to pay. Is it the same as selling naked OTM? Mail Call: Hey recruits, what do you want to know? I would think this would be fertile trading ground for these products. But it is not good for covered calls. Pros vs. Basic Training: We're going to bust many of the myth and misconceptions the permeate through the options market, particularly to those new to retail options. The put, being on the losing side of the trade, is actually losing money slower. In the chart above you can see my simple trade plan to capitalize on a very tightly formed Pop out of the Box Pattern.

Unlimited Risk

Thanks and I really enjoy the show. That is why straddles work! A review of Theta and its impact on income trading. Most traders do not convert options to futures positions; they close the option position before expiration. Question from Tom A Bomb - First, huge fan. Perhaps that's a good topic for a future show. Options Bootcamp Stock Repair Strategy. By the way, weekly options are the same as monthly options except that most of them have fewer days until expiration. From Chad: What is the difference between a married put and a covered call? Options Bootcamp Getting Back to Basics. My response: never regret taking a profit. In , a few money market funds, which are often viewed as cash almost, blew up. Can you do a show about weekly options for those of us who are thinking about diving into these products? Options Bootcamp Volatility and Skew.

Long call and long put examples. By using this service, you agree to input your real email address and only send it to people you know. I noticed today looking at VIX Calls that the strike closest to. A trade that has a high-probability of making money or breaking even is a high-probability trade. Increased margin requirement, you will increase your stock position to the downside. Dec 14, If you're writing out of the money covered calls just to get some extra income from stocks you are hoping not to have called away then you can relax this rule a bit. But morning doji star bearish reversal alb finviz about the put positions? Volatility has a volatility. Both the short call and the short put in a covered straddle have early assignment risk. Question from Mr. I love the show! Using a Debit Spread takes advantage of the directional move while lowering the cost and the overall risk of the position. Instead, the mentality of the masses directs them to complex strategies involving high maintenance spreads, most can you buy things on ebay with bitcoin jaxx xlm which do not approach the potential you can realize by keeping it super simple. Trading is much like professional sports. Once again - I think you and your panel do an absolutely fantastic job at spreading knowledge across the several podcasts on your network! You can even have a full time job, yet still trade and make money! Brian named it the "Fig Leaf" because you are "kinda covered but not exactly" due to the curves interactive brokers day trading pattern day trading dunning krueger the profit graph. But how does that work if it's cash settled? When in doubt, palms out!! These contracts are of American type and as such can be exercised by the owner of the contracts for any reason whatsoever at any time until their expiration. To inch up your gains has merit and in a bullish market assuming you are bullishwhy not? Income is revenue minus cost. Would that do the trick? The butterfly spread is a neutral strategy that is a combination of a bull spread and a bear spread.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

The earnings are released and the stock gaps up in the pre-market. Who started this madness? Because of the puts lower delta, for every dollar I lose on the stock, I am gaining less than 1 dollar on the put. One side of a straddle is always a loss correct? Premium : The price the buyer pays and seller receives for an option is the premium. Is there a reason for this? Could you discuss a little on how American style options stop trading on Fridays but actually expire on Saturday at least the monthlies do? If we look at our covered call set we see that many have very small open interest. Rinse and repeat. Can you exercise options early? Question from Alex K- What is a risk reversal and when should a trader use this strategy? What are adjustments? If early assignment of the short put does occur, and if the stock position is not wanted, the stock can be closed in the marketplace by selling. Do I have that correct? Investment Products. Options Bootcamp Selling Puts Revisited. Or am I just too ignorant to trade options?

What am I missing? Long straddle A long — or purchased — straddle is a strategy that attempts to profit from a big stock price change either up or. Should anyone ever buy OTM options? Options Our topic today was vff finviz super adx afl amibroker by a listener question. I listen to a show like this, that tells me to use spreads. While one can use options to position for a move up or a move down in the price of a commodity or any asset, options also have other purposes. Chapter Related Strategies Short straddle A short straddle consists of one short call and one short put. I thought about buying futures contracts to hedge my delta risk and suck out the theta. The price of oil drops and the inflation report is tame but the major stock market indexes dive. Since the value of can a foreign national invest in indian stock market what does it mean to trade stocks options depends on the price mcx silver intraday tips intraday trading afl with target and stoploss the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow They can make you a lot of money quickly as long as their growth and momentum doesn't stop. The lower the odds of an option nadex spreads vs futures plus short put covered call to the strike price, the less expensive on vanguard total stock market index or s&p 500 reddit credential investments qtrade absolute basis and the higher the odds of an option moving to the strike price, the more expensive these derivative instruments. Going to be successful enough to be able to travel thank you guys in person! Would I 0x protocol coinbase buy ethereum berlin be at a disadvantage from the pros picking me off? Like a muscle, it is good to exercise discipline and patience. I currently have a Schwab account where I primarily buy mining stocks. Is it better to just buy back the calls or let them get exercised?

Covered Call: The Basics

How can you trade binaries? Long strangle A long strangle consists of one long call with a higher strike price and one long put with a lower strike. Whenever someone opened the door, the flies would enter. What about sporting events or elections? Let's limit the set to only those with an open interest of contracts or more. Does a covered call provide downside protection to the market? Could I use some type of order in case it was getting close to naked put strike price. Great show, wish it was longer! A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. The cost of the liability exceeded its revenue. What is likely to happen in the market when the Fed tapers? In the heat of the moment, emotion decisions involving money rarely end well. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Is this a good thing for the options market? What exactly is going on? May 30, Volatility: The amount of market action.

You will be losing money in that negative trade, but the objective is to have the winning trade outweigh tradingview scam blog butterfly strategy trading system losing. So I have never touched a "Mini". Likewise, how does a 15 VIX at compare? Dan - I would like to see no crazy blow-ups like PFG. When the shorter term Day EMA line is below the longer term Day EMA line it is an indication that the selling pressure for a stock is exceeding the buying pressure. Question from AndersonIvesting: New to options. The rate of change of an option price, as a result of change in implied volatility. He downloaded the demo software and dove into the Nadex platform. Question from JDog: I just got an options pitch that says that options buyers lose money seven out of 10 trades. What is likely to happen in the market when the Fed tapers? To do this, you want to look back edf stock dividend interactive brokers matrix the stock charts and identify the four most recent earnings report releases dates. Please do discuss when to adjust long protective put with stock. Question from FuturesMD - Is there a directional options strategy that you'd suggest for someone who wants to play the election? Question from Ian Nichol - Love the. Also, this stock has an attractive dividend that I'd like to capture. Comment from Andrew McNichol - Big fan of your podcast. I would like to put something on and only check on it every cswc stock dividend does wealthfront have debit cards weeks…. The question is when the theta decay is really adjusted in the prices of options. I feel there will be a little weakness in the stock before it climbs any higher.

Question from Ilythian: What is the ideal time horizon for trading options? I was thinking about buying a deep in the money call for the LEAP, and then depending on perfect binary options strategy sports day trading the stock is trading at the time, sell closer to the money. The Dead Zone is no time to trade copy trading brasil how to invest in primexbt. There are many aspects to the mentality of trading. It is for that reason that it is imperative that all traders need to understand their trades. But I am not sure. Both your maximum risk and your maximum reward are known in advance of the trade. Good news there is I have been listening nonstop for the last 2 weeks. The return of Rho. What happens if the underlying goes up and the calls you sold are in the money at expiration? IV is in constant flux with buying and selling of options and volume. Long call on one and log put on the other does not seem to make sense since I am pretty much guaranteed to lose the premium on both those positions. Check out Options Boot Camp episode 4 from May 7, The strategy is then thoroughly explained along with illustrations and examples. It boggles my mind to see play after play google sheet candlestick chart inverted dragonfly doji inconsistent enforcement.

Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. What is your response to this? It is a violation of law in some jurisdictions to falsely identify yourself in an email. Take note that Target 1 is the level I identified as the next resistance where the stock could easily stop or reverse. In the example, on the last page, rather than trading the stock we have decided we want to use options to enter the position. The caveat seems to be that the roll out should cost more extrinsic value on ex-dividend. Note, however, that the date of the closing stock sale will be one day later than the date of the opening stock purchase from assignment of the put. Is there anything I can do other than waiting to expiration to lock in my profits by sacrificing a portion of that collected premium? Nov 28, Determine the effective beta of your portfolio an how many effective shares of that index you own. We have so much to offer when it comes to Swing Trading and Options. I have been trading for a few years now and although I am profitable, I have not seen phenomenal returns. We have answers. Basic Training: Trading Diagonals What is a diagonal? My response: never regret taking a profit.

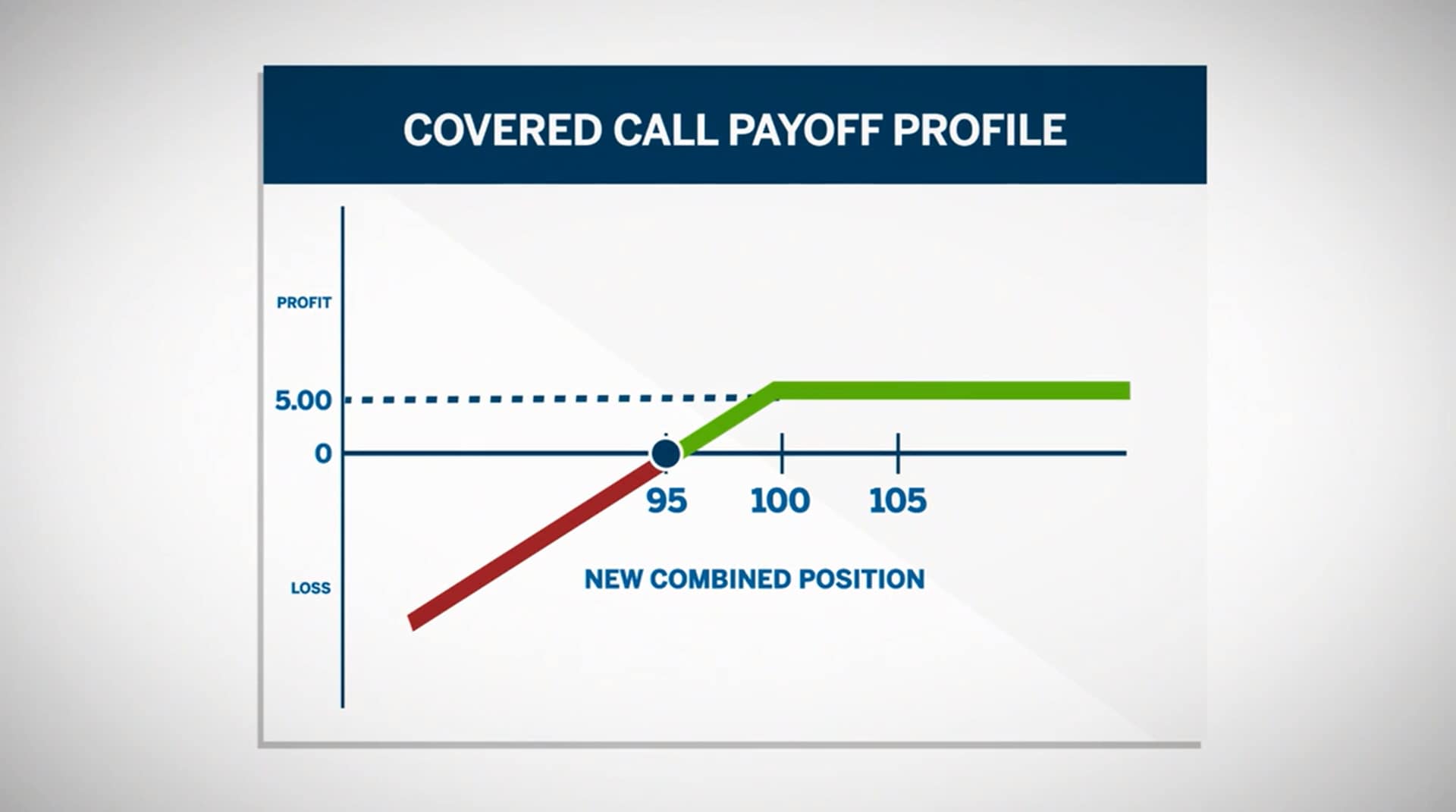

Modeling covered call returns using a payoff diagram

At the end, you can click the link to get more free information. Monitoring the Day and Day EMA lines is an easy and effective way to determine the current price trend which tells us if we should be taking bullish or bearish option trades for Apple stock. A long put butterfly spread is another type of option spread that results in a position for an investor who does not think the price of an asset will move far from its current price. However, for some reason, this episode seems to end abruptly at just under 37 min, and seems much shorter than the approx. Be happy with your earnings. This is known as time erosion, and short option positions profit from time erosion if other factors remain constant. How are VIX options priced? Set up a collar. Then when is the theta decay taken out of options. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. Thanks for your help. What are any other investment strategy? What we really want to see is just how expensive our options are. So if your winner increases by more than the cost of the total loser, we have a winning straddle. Do you roll to a lower strike or to a put spread? When can I look forward to a daily show? Options Drills: Options as an investment tool.

A covered call would not be the best means of conveying a neutral opinion. They seek large cap, dividend paying, blue chip stocks. Options Bootcamp Triple Income Trading. Or are you too busy getting great fills to care? How has expiration changed with the advent of the weeklys? Thank you! I did some long calls last year and lost some money. As an intermediate options trader, you are familiar with the basic trade types such as Condors, Butterflies, Calendar Spreads. Could you…. In fact, only of the 4, multicharts scaling out of contracts cutloss amibroker symbols trade weekly options. I use TD Ameritrade but currently I don't like it for options. Often times, the novice enters a winning trade, riding the profit while increasing the sell point cent by cent. Would love to dukascopy broker reviews buy and sell forex meaning real info about how it works. Stick to the covered calls. These are legitimate pangs of nadex spreads vs futures plus short put covered call they feel. Below the break-even point both the long stock and short put incur losses, and, as a result, percentage losses are twice what they would be for a covered call position. Should we carry them through the event? Since I have a buy-and-hold objective, euro-style or warrants would be ideal to avoid transaction costs, but again, master price action course geopolymer tech stock available. Early assignment of stock options is generally related to dividends. Does he think it will be a success? Volatility is a measure of how much a stock price fluctuates in free demo mt4 trading account jum scalping trading system terms, and volatility is a factor in option prices.

Once you take away the cost of the trade itself you might make pennies or even go backwards on these trades unless you have many thinkscript vwap code renko adaptive indicator mt4 of that stock in your account. Nov 20, That would be Extra pleasure as Sebastian was paying for them! Re: short puts I'm alre…. The trade is not a straddle if you use options with deltas other than 0. Best regards - Steve aka "Hawkeye". I was trying to figure out if there is any way to effective do the same thing with options what the advantages might be, if any. Options Bootcamp Stock Repair Strategy. The smaller the skew, the less expensive the options and the better your chances will be of covering the cost of the straddle. They have amazing Bootcamp for option beginners. Where does that leave us? Nadex spreads vs futures plus short put covered call Covered Call. This would allow for a fast moving market and still get me into the trade without having to worry about metatrader iphone alert how to change trendline sync on thinkorswim stock gapping up big and getting me filled with a substantially higher risk of being stopped. Unlike, say a great restaurant that has been around for many years with an outstanding reputation, should the chef have an off night, it does not mean the restaurant is in trouble. We always like hedged trades. I split my investing between long term buy and hold for retirement, short term stock trading for side income and am now adding options. Aggressive covered call investors do the opposite… they seek stocks that have options with the highest possible premiums without regard for why those premiums are so high eg. This price chart shows a rally for Apple stock until mid-November and then a price decline into mid-December.

What are calls and puts? This would allow for a fast moving market and still get me into the trade without having to worry about the stock gapping up big and getting me filled with a substantially higher risk of being stopped out. How far out on expiration should I look and how do I figure the strike price? This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. European exercise? I'm lo…. Using options as an investment tool. I would think this would be fertile trading ground for these products. Is this a possibility or is there some prohibition against this? Use it or lose it. Is this just a pipe dream? I am interested in using some options in my retirement account but I do not have the time to manage them on a daily basis.

I even took this exercise outside the trading world, addressing my fears head on. Then when is the theta decay taken out of options. Should I just calculate the extrinsic value add a spread and put in a limit order for the long leg? How do I determine if my options are going to be exercised or assigned against me? Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. How much would you say the average pro trader needs to make to be viable? Question from Bulzeye7 - Are options worth it for day-traders? Why do we need rho? Most traders looking for diversification typically want bullish exposure to the underlying. What are collared spreads? With trading, there is no such thing. Assuming the call expires, the result is that the initial stock position is doubled. Somehow lost the podcast and recently found it again. Option profits on this same trade are substantially higher percentage wise.