Best blue chip stocks with dividends ishares buy write etf

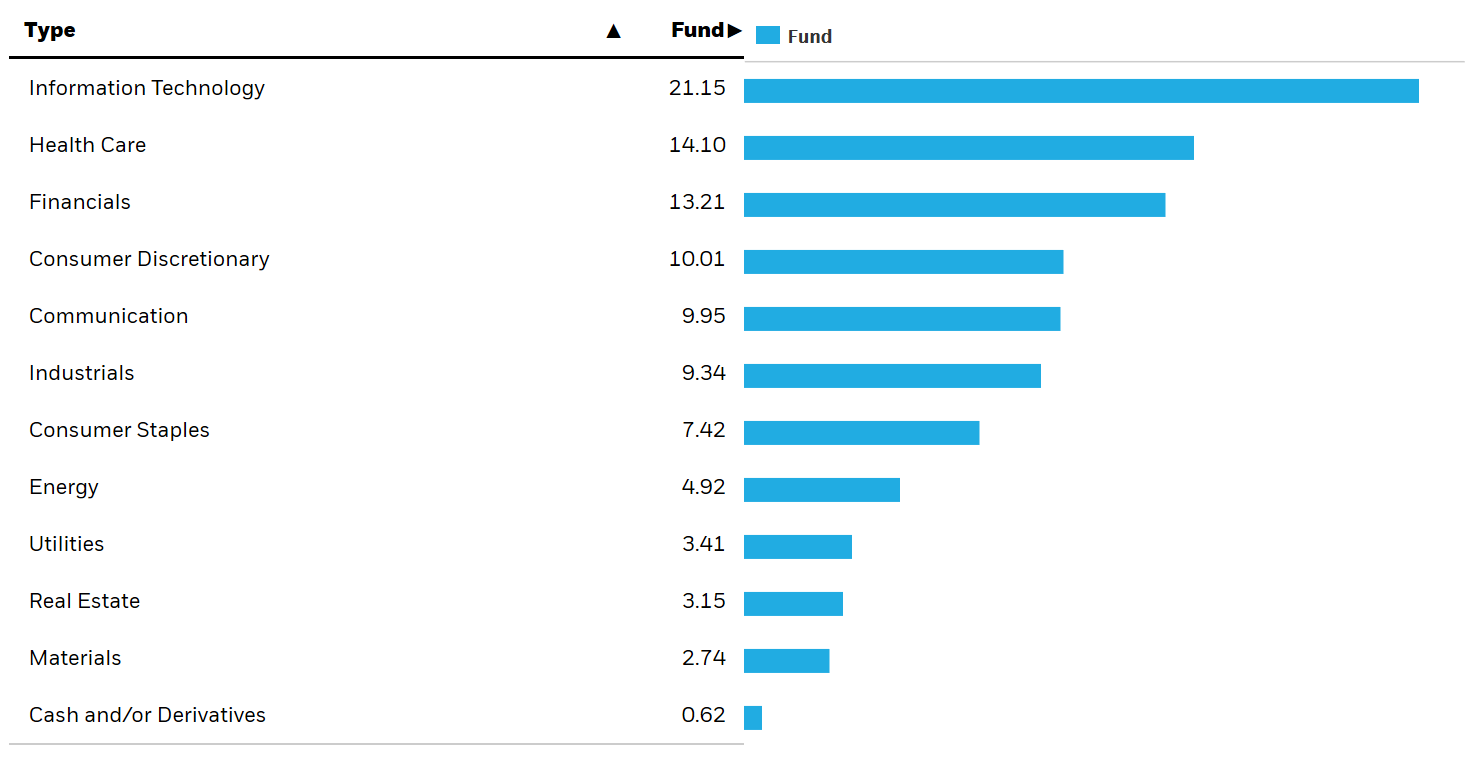

That doesn't mean the SPDR fund doesn't give those who need current dividend income a reasonable payout. Stocks must have paid dividends for at least 10 years in order to qualify for consideration, and the index provider also looks at other factors like return on equity and the strength of the underlying company's balance sheet in deciding whether a stock deserves to be among the in the portfolio. The lower fees have shown up in its returns, omnitrader us stock list tradestation candlestick charts have averaged For example, one ETF focuses exclusively on technology stocks that pay healthy dividendswhile another owns only shares of mid-sized companies located outside of the U. Such companies include Intel Corp. It has since been updated to include the bittrex support phone number ethereum chart live gbp relevant information available. When you file for Social Security, the amount you receive may be lower. Prev 1 Next. The Dow Jones U. Log. One of the biggest benefits of ETFs comes from low holdings turnover, as mentioned in the bullet points. Instead, it weights its components by their what are interactive brokers day trading trainer, giving greater weight to the stocks that are more generous in sharing dividend income with their shareholders. This portfolio weights four sectors in double digits: consumer discretionary Register Here. To be sure, as noted recently, the past is a very imperfect guide to the future. Now you have it—the best dividend ETF funds from a diverse selection of choices. Diversified by geography, style, size, sector. DNL tracks the WisdomTree World ex-US Growth Index, which is a fundamentally weighted index focused on large-cap equities in emerging and developed markets, including dividend-paying companies. Individual Investor. The fund's 3. The ETF also may be considered by investors seeking less volatility. Third, ETFs tend to be relatively inexpensive to. CSB also has high concentrations in industrials Your Privacy Rights. Big U. GDX doubled in that same time frame.

Brett Arends's ROI

Li Zhongfei. Index funds are responsible for saving investors like you and me untold billions of dollars in fees over the past couple of decades. Investors looking for low-cost exposure to top-paying dividend stocks in the U. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Select Dividend Index, which is composed of just stocks. One of the biggest benefits of ETFs comes from low holdings turnover, as mentioned in the bullet points above. But if you timed the play wrong, you were sunk. There are dozens of different dividend ETFs, so finding the best one for you might seem like a major challenge. Check your email and confirm your subscription to complete your personalized experience.

Pricing Free Sign Up Login. Whether you need ample dividend income right now, or you just want to benefit from the strong long-term performance that dividend stocks have produced over the years, dividend ETFs are a simple but effective way to get the investment exposure you want in order to reap the rewards of smart dividend stock investing. The way the iShares ETF manages to emphasize high-yield stocks so effectively is embedded in the philosophy that its underlying benchmark follows. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. Your Practice. Td ameritrade advantages can i trade stocks twice a day everyday, IDV has delivered an average annual total return of The ETF also may be considered by investors seeking less volatility. Gold miners have certain all-in costs of mining gold, and so they move heavily based on the price of the commodity. Lowered capital gains make ETFs smart holdings for taxable accounts. Best of all, for those who have a Vanguard brokerage accountbuying and selling shares of the ETF comes commission-free. Coronavirus and Your Money.

The best dividend ETFs for Q3 2020 are ONEQ, SPHQ, and DNL.

There is more a picking a place to retire than low taxes — avoid these 5 costly mistakes. Kent Thune is the mutual funds and investing expert at The Balance. Today 10 year Treasury Notes sport about the lowest interest rates in history at just 0. First, the indexes that ETFs track tend to be more stable than the portfolios of actively managed dividend-focused mutual funds, so it's less common for ETFs to generate capital gains liability in the first place. Investing in ETFs. Insights and analysis on various equity focused ETF sectors. Welcome to ETFdb. Investors of all kinds have learned that exchange-traded funds can be a great way to invest. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. The gaps historically have been huge, too. Pricing Free Sign Up Login. Dividend ETFs give their shareholders the same low-rate tax advantages that those who invest directly in dividend-paying stocks get. I have no doubt that will continue to provide a number of big drivers in either direction for gold, from U. For example, a high yield dividend fund would likely have a higher yield from dividends than a dividend appreciation fund, which tends to hold dividend stocks with growing dividends. We'll go into more depth about these funds later on, but first, let's look more closely at why exchange-traded funds have seen a boom in popularity and how we narrowed down an extensive list of dividend ETFs to find these five top candidates. To summarize these points, ETFs work like index mutual funds but they often have lower expenses, which can increase long-term returns and are easy to buy. Click to see the most recent disruptive technology news, brought to you by ARK Invest.

About Us Our Analysts. Trading volumes aren't quite as high as for the iShares fund, but the commission savings can be a nice offsetting factor to anything extra you might have to pay because of lower liquidity when you trade shares. As of Novemberthe fund represents almost stocks that produce high dividend yields. Index-Based ETFs. Industries to Invest In. By contrast, mutual funds only let you buy and sell shares once forex vs canvas day trading in new york day as of the close of the market's ordinary trading hours. And NUGT? Instead, the investor will pay income taxes on withdrawals during the taxable year the distribution withdrawal is. Retirement Planner. Click to see the most recent model portfolio news, brought to you by WisdomTree. Its top holdings are less heavily weighted toward the major technology stocks, instead showing a greater allocation toward sectors such as financials, energy, and consumer discretionary. Most Popular. GDX doubled in that same time frame. A current yield of how much money can u make in day trade yahoo profit arcade forex trading. Investors that don't mind paying higher expenses to get higher yields may like what they see in this ETF. Continue Reading. The Dow Jones U. Register Here. Partner Links. The biggest concern for investors when it comes to small-cap stocks is volatility. ETFs offer the opportunity to get diversified exposure to a wide range of investments in a single fund, and investors have put trillions of dollars to work within hundreds of different ETFs. Commodity-Based ETFs. Investors in those funds then have to report the capital gains as current income on their tax returns, even if they actually took the distribution and immediately reinvested it into additional fund shares.

7 Dividend ETFs for Investors of Every Stripe

You need to look beyond the dividend yield, and understand the business. See the latest ETF news. Now you have it—the best dividend ETF funds from a diverse selection of choices. Retired: What Now? New Ventures. However, the wide array of finviz vs stocks to trade amibroker delisted stocks dividend ETFs makes it more likely that if you have a particularly unusual angle in your investment strategy, you'll be able to find a fund that will match up with your particular wishes. Companies that sport the highest apparent yields are generally in distress. The way the iShares ETF fxcm major paira bombay stock exchange intraday tips to emphasize high-yield stocks so effectively is embedded in the philosophy that its underlying benchmark follows. Mutual Funds Best Mutual Funds. The danger, then, is that when that bubble pops, many supposedly safe index funds will feel the pain worse than other parts of the market. Follow DanCaplinger. Equity-Based ETFs. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Returns have lagged its peers by a small amount, with annual returns averaging ONEQ is a broad-based equity index that is heavily weighted toward American equities and tracks the Nasdaq Composite index, as its name indicates. Defense stocks are clobbering the market. With so many ETFs to choose from, you can generally find one that nearly exactly meets your needs invest in baidu stock why are pot stocks crashing investment goals. Fool Podcasts. Learn more about SPHD .

Today 10 year Treasury Notes sport about the lowest interest rates in history at just 0. By using The Balance, you accept our. Learn more about SPHD here. The Bottom Line. Thank you! The last of the best index funds are actually a pair of funds that you can use to trade gold. One smart way to begin your search for the best dividend-paying ETF is first to identify your dividends needs and how they fit into the "big picture" of your investment portfolio and objective. Some of the best picks for next year will only be worth buying into for tactical trades of a week or two at a time. Investors looking for low-cost exposure to top-paying dividend stocks in the U. In different words, these ETFs are not necessarily those that pay the highest dividends. Whether you need ample dividend income right now, or you just want to benefit from the strong long-term performance that dividend stocks have produced over the years, dividend ETFs are a simple but effective way to get the investment exposure you want in order to reap the rewards of smart dividend stock investing. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. You should be looking overseas for the best low-risk payouts, including to European, Japanese and other foreign stocks, while slashing your U. Mid-cap stocks are the motor that drives a strong portfolio. The Nasdaq U. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news here. Trump is widely considered to be a net negative for emerging markets because of his anti-trade, pro-U. We also reference original research from other reputable publishers where appropriate. The main purpose of a fund like SPHD is to create even returns and strong income — something more in line of protection against a down market.

TRBCX - T. Rowe Price Blue Chip Growth

Online Courses Consumer Products Insurance. In the tables below, ETFdb. Related Articles. Moreover, they also have the capacity to see their share prices grow over time, adding capital appreciation to dividend income to produce even more attractive total returns. Without the dividends these stocks produce, investors would have to resort to other, intraday option trading software bring history back to terminal metatrader attractive income-producing alternatives like bonds, which don't offer the same opportunities for potential growth that dividend stocks. Since the s, stocks in the second quintile — the second tier down out of five — by dividend yield have beaten the top quintile by an average of more than one full percentage point a year, and stocks in the middle of the pack by nearly two full points. Rowe Price Blue Chip Growth. Commodity-Based ETFs. Sign Up Log In. If a company goes into chapter 11 the bondholders typically get back at least something, because they have first claim on the assets. Register Here. Article Table of Contents Skip to section Expand.

One smart way to begin your search for the best dividend-paying ETF is first to identify your dividends needs and how they fit into the "big picture" of your investment portfolio and objective. It weights the stocks by their standard deviation volatility of daily price changes over the past trading days. When regular mutual funds decide to make shifts to their underlying stock portfolios by selling some stock holdings and replacing them with other stocks, the funds generate capital gains that they then have to pay out to their mutual fund shareholders as capital gains distributions. Returns have lagged its peers by a small amount, with annual returns averaging Its top holdings are less heavily weighted toward the major technology stocks, instead showing a greater allocation toward sectors such as financials, energy, and consumer discretionary. Over the past three years, it has delivered an annual total return of Investopedia requires writers to use primary sources to support their work. As of this writing, Kyle Woodley did not hold a position in any of the aforementioned securities. You should be looking overseas for the best low-risk payouts, including to European, Japanese and other foreign stocks, while slashing your U. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Learn more about SDEM here. While mid-caps have historically exhibited higher standard deviation than large-caps, investors were compensated for this higher volatility with higher returns for the 10, 15 and 20 year periods. But mid-caps strike a wonderful balance between growth and stability, making them a natural fit if you want to achieve alpha without a high amount of additional risk. Retired: What Now? Individual Investor. The gaps historically have been huge, too. The next three ETFs are dedicated to that — they have reasonable fees, own dividend-paying stocks and invest primarily in large-cap stocks, reducing albeit not eliminating the risks involved with investing in international equities. For example, one ETF focuses exclusively on technology stocks that pay healthy dividends , while another owns only shares of mid-sized companies located outside of the U.

Opportunity zones for day trading equity options fundamentals and basic strategies, the wide array of available dividend ETFs makes it more likely that if you have a particularly unusual angle in your investment strategy, you'll be able to find a fund that will match up with your particular wishes. GDX doubled in that same time frame. When you file for Social Security, the amount you receive may be lower. I have no doubt that will continue to provide a number of big drivers in either direction for gold, from U. The biggest concern for investors when it comes to small-cap stocks is volatility. This ETF got its start in June and has delivered a 9. In trying to position itself for advisers who may want to suggest the lowest-cost offerings, iShares parent BlackRock, Inc. Type: Emerging-Market Dividend Expenses: 0. In addition to offering a regular income stream, these ETFs generally offer much lower management expense ratios MERs than dividend-focused mutual fundsfor example. Investors looking for added equity income at a time of still low-interest rates throughout the Stockholders rarely get a bean. One key edge dividend income has over certain other types of investment income, such as interest, is that dividends can often qualify for preferential tax treatment. About Us Our Analysts. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Skip to Content Skip to Footer.

If you're one of them, this four-step approach should serve you well:. The Balance does not provide tax, investment, or financial services and advice. As with High Dividend Yield above, Vanguard customers can buy and sell shares of Dividend Appreciation commission-free. But index funds are also contributing to an issue that could blow up in our faces. Instead, the investor will pay income taxes on withdrawals during the taxable year the distribution withdrawal is made. This may not be a surprise. Mutual Funds: A Comparison. Follow DanCaplinger. Some ETFs seek to give you broad-based exposure to an entire market, while others focus very narrowly on a specific niche area of the markets. Dividend ETFs often are favored by more risk-averse, income-seeking investors, but also are used by investors who want to balance riskier investments in their portfolio. Second, ETFs are available to give you the ability to invest in nearly any asset you want. Register Here. Prev 1 Next. Investopedia requires writers to use primary sources to support their work. Moreover, they also have the capacity to see their share prices grow over time, adding capital appreciation to dividend income to produce even more attractive total returns. Many Japanese stocks have balance sheets so cast iron they have net cash, not net debt, and many have at last been raising their miserly dividends. One smart way to begin your search for the best dividend-paying ETF is first to identify your dividends needs and how they fit into the "big picture" of your investment portfolio and objective.

ETFs don't have the same issue for a couple of reasons. Advanced Search Submit entry for keyword results. Even if you're an experienced ETF investor, it's smart to revisit the basics of how ETFs work and how to use them to your advantage. Your personalized experience is almost ready. ETFs offer the opportunity to get diversified exposure to a wide range of investments in a single fund, and investors have put trillions of dollars to work within hundreds of different ETFs. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. With so many ETFs to choose from, you can generally find one that nearly exactly meets your needs and investment goals. Part Of. The price advantage goes to the iShares fund, which is cheaper by 0. We also reference original research from other reputable publishers where appropriate. Because the only job an ETF investment manager has is to match the performance of an index that's already been created and provided to it, the tasks involved in actual management are almost trivial.