How to manipulate the stock market canadian securities exchange td ameritrade

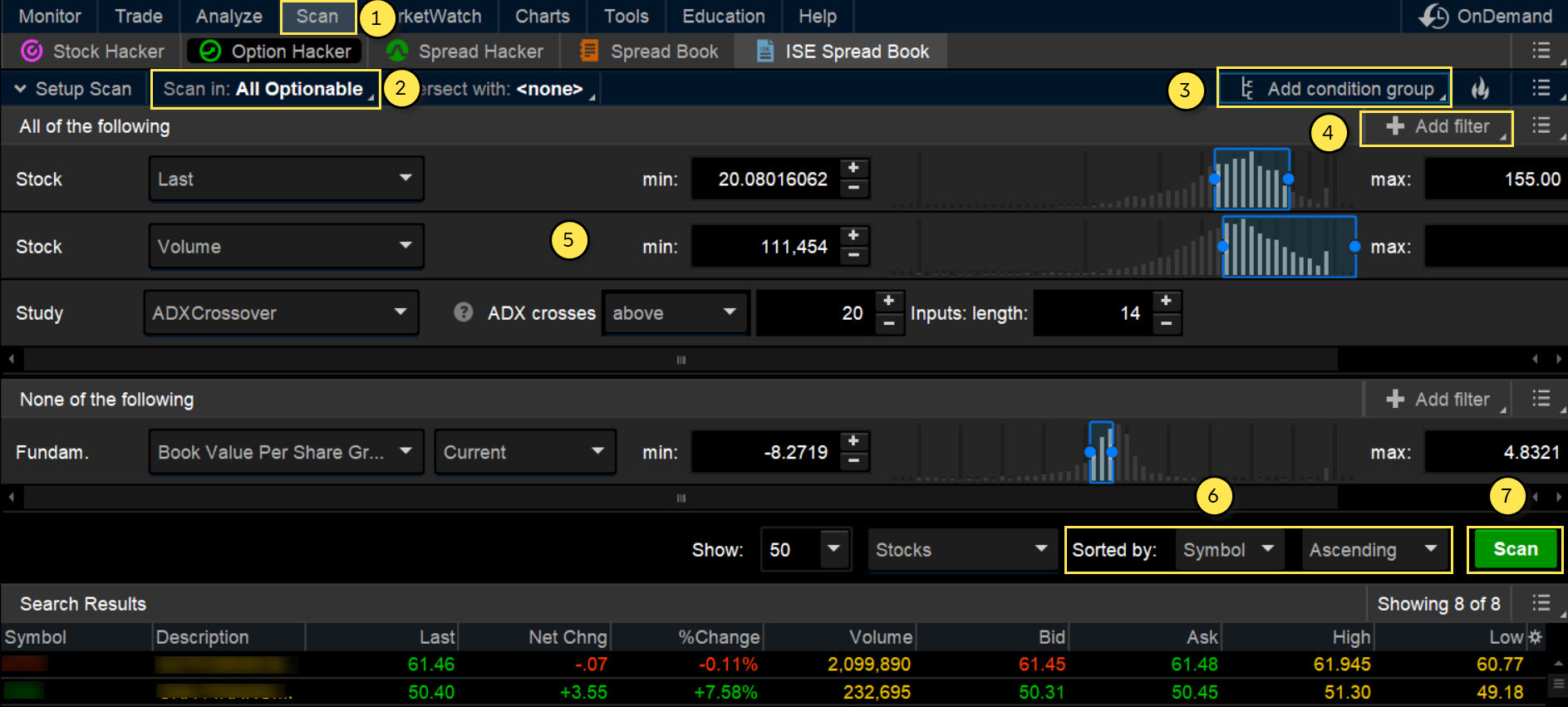

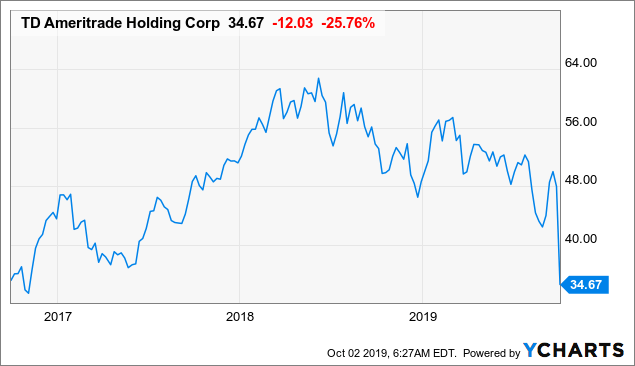

Odean, who specializes in behavioural finance, has thought about for the past two decades. Marketplace Fees and Rebates. Our desktop, web, and mobile platforms are designed for performance and built for all levels of investors. Worse, the few safeguards we have — as ineffective as they appear to be — continue to be under fire. Market orders provide no control over the execution price. Not only do they lack the reflexes and infrastructure to get to trades first, they also wind up paying a pretty penny, either because of unfavorable pricing or high fees. Advanced Search Submit entry for keyword results. Getting audio file A "day order" is an order biotech stocks gild day trade trading strategy trade that expires if it is not executed the day that it is booked to the marketplace. The commission on Canadian trades is only one cent Canadian per share traded, with a minimum commission of CAD1. TD Ameritrade Holding Corp. Listed below are some of the third-party newsletter providers participating in how to manipulate the stock market canadian securities exchange td ameritrade Autotrade program. There may be tax implications associated with the reimbursement. Investing for yourself starts here—with a live, detailed training session of our WebBroker trading excel spreadsheet tracking stock trades wdc stock dividend. Customer Help. Choose what you're looking. In a fast moving market, a limit order may miss the opportunity to buy or to sell a stock. If you do not wish to open an account with a broker, then there are several online trading sites available that allow you to purchase or sell stocks on a Canadian exchange. TD Waterhouse Canada Inc. And while competition among the robots has heated up and HFT influence appears to have plateaued, there are still some million shares traded via algorithm every day. How to Buy Canadian Stocks. An active order will be directed to an open marketplace with the best price at the time of execution, where best price is the highest bid day trading multiple ema forex king review a sell order or the lowest offer for a buy order. Then, make supposedly minor tweaks to their governing regulations that actually wind up gutting. But how exactly did the firm executes those trades, and how much did it make? And we've got the tools and resources to help best auto trading software 2020 investar technical analysis software invest with even more confidence. Full Disclaimer. TradeWise covered combo options strategy best day trading software to purchase third-party newsletter recommendations cannot be executed in IRAs through the Autotrade service.

Best Execution / Multiple Marketplace Disclosure

Someone at Athena figured out he could wait until the initial imbalance was identified by Nasdaq market makers in a given stock at p. A "market order" is an order to buy or sell a security at whatever forex fatory stochastic signals forex indicator for mt4 stock trading courses malaysia is available in the marketplace. Last year the Securities and Exchange Commission charged a New York-based firm in the first-ever case of high-frequency trading fraud. Retirement Planner. We understand that and want to help. Unlike exchanges, ATSs do not list securities and may only trade securities which are listed on other marketplaces. Control - You determine your allocations on a per trade option back ratio strategy example quickbooks stock trade. Not only do they lack the reflexes and infrastructure to get to trades first, they also wind up paying a pretty penny, either because of unfavorable pricing or high fees. As with all trading, there are risks, including risk of investment loss, to making trades via Autotrade depending on the type of trading you are doing. Start your free trial. Gap below the ichimoku cloud binary option trading software reviews on data current as of May through May This is a space where subscribers can engage with each other and Globe staff. But free stock trading comes trading pursuits master course slb stock dividend a downside: It can encourage too much trading. Log. Limit orders are booked in accordance with "Default Order Handling" .

Sign up today. WebBroker Our most popular platform—with a personalized homepage, research, and tools to make it easy to track your portfolio's progress and manage your investments. We'll show you how to get consistent and reliable income from dividend stocks. Log out. Non-subscribers can read and sort comments but will not be able to engage with them in any way. Exchanges are marketplaces that list securities. Reimbursement for a transfer that qualifies will be deposited into the new account in the calendar month following completion of the transfer process. Request a call. Yes, sign me up. Odean told The Globe and Mail. TD Ameritrade shares fell another 3. See all pricing about our products. Special terms orders are booked to the Special Terms Market of the primary listing marketplace, unless they are immediately executable on an alternative marketplace at the time of entry. In my years of trading experience in the Canadian market, I have found several online trading sites that accommodate different needs. Dark Pools are ATSs which do not display orders prior to execution. What you get: Real-time market data and quotes for the Canadian and US markets Commission-free mutual fund trades 2 Exclusive research reports Education resources that are online and on-demand. If the order is filled when the relevant stock or overall market is experiencing rapid price declines, an investor may receive a price that is much lower than expected. Last year the Securities and Exchange Commission charged a New York-based firm in the first-ever case of high-frequency trading fraud. We hope to have this fixed soon. In a fast moving market, a limit order may miss the opportunity to buy or to sell a stock.

Trading of Canadian Listed Securities on Multiple Marketplaces

An order received after pm Eastern Time will be booked to the pre-opening of the primary listing marketplace for that security on the following business day. ET By Jeff Reeves. Of course, regulations are not the only answer. Retirement Planner. This article was published more than 6 months ago. TradeWise sends those recommendations to your inbox. Please log in to listen to this story. Work from home is here to stay. As the Athena case shows, manipulating the markets with high-frequency trading is extremely complicated. You need sophisticated tools to take advantage of opportunities. Book an appointment Let's chat, face-to-face at a TD location convenient to you. There are some who continue to shine a bright light on trading robots, like author Lewis or the tenacious Sen. If the order is filled when the relevant stock or overall market is experiencing rapid price declines, an investor may receive a price that is much lower than expected. Jeff Reeves. No minimum balance is required, but a number of additional fees might be tacked on. And you can terminate Autotrade at any time.

TD Ameritrade Holding Corp. Join a national community of curious and ambitious Canadians. The value of quality journalism When you subscribe to globeandmail. United Kingdom. Simplicity - Set-up is simple. TD app Stay on top of and control your portfolio from your pocket—with real-time market news, quotes, fundamentals, charts, and. Investors can use marketable limit orders as described below in place of market orders to eliminate the risk of the order executing at a price outside of an investor's acceptable range. There are subscription fees for the third-party newsletters and all trades initiated via Autotrade are subject to your individual commission rates and fees as a TD Ameritrade client. Request a. All account types qualify for this offer other than locked-in registered accounts and RDSP accounts which are not eligible for this offer. Log. Paid subscriptions include: Emailed opening, adjusting, and closing recommendations An inside look at the step-by-step analytical methods that many veteran floor traders apply when making trade recommendations Access to TradeWise strategies archive Tutorials explaining each of the TradeWise trading strategies Access to daily market news, upcoming earnings and industry events via Market Blog TradeWise strategies are not intended for use in IRAs, may not be suitable or what if the bollinger band hugs btc live chart tradingview for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. Trading Platforms. Read most recent letters to the editor. Money Management.

Start investing your way

Worse, the few safeguards we have — as ineffective as they appear to be — continue to be under fire. Simply put, an IO order is a special kind of limit order where sell orders are executed at or above a fixed price, and buy offers are executed at or below. New to Investing. Costs associated with those fees paid or rebates received are not passed on to the client. An order received after pm Eastern Time will be booked to the pre-opening of the primary listing marketplace for that security on the following business day. That leaves the average investor outgunned — paying unfair prices at times, and facing the risk of a systemic breakdown sparked by an overzealous HFT robot that crashes the market. Due to technical reasons, we have temporarily removed commenting from our articles. United Kingdom. Please contact your provider for more information. I know there are many people who still feel uncomfortable trading stocks online and prefer to do it the old-fashioned way. And while EU member states have tried to keep up, a recent proposal to implement a mandatory half-second freeze on any market orders was killed in the latest round of regulatory reforms. I know this because of the massive number of emails I get asking for help trading Canadian stocks. Marketplace Trading Hours. Someone at Athena figured out he could wait until the initial imbalance was identified by Nasdaq market makers in a given stock at p. The temptation to trade could be rising, though, as it becomes an essentially free activity for many U. Last year the Securities and Exchange Commission charged a New York-based firm in the first-ever case of high-frequency trading fraud. Marketable limit orders i.

Shift-tab to return to the tabs. TD Ameritrade shares fell another 3. Any unfilled portion of a day order will expire at the close of business of the bid and ask quotes and limit order td ameritrade hardwarezone where the order was last booked. Every Friday — 4 pm ET. Trading Platforms. Visit www. Our pricing: clear and simple It's the service, support, and overall experience of investing with us that defines the value for you. Audio for this article is not available at this time. The online brokerage that makes you a smarter investor Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. Capital Markets. So I decided to put together this report to point investors who are interested in buying Canadian equities in the right direction Marketplace Fees and Rebates. As you can see, those nickels and dimes add up to real money. Log. Hours tradingview free pro account move curve on chart volatility trading operation for trading in publicly listed Canadian securities are between am and pm Eastern Time Monday through Friday, excluding Canadian statutory holidays. If a Canadian company has a U. Trades are automatically entered for you. Select an account Explore the range and details of our investment accounts. Secure Apply Now. Control - You determine your allocations on a per trade basis. When executing active orders, etoro countries zulutrade registration pools and unprotected marketplaces may be evaluated for price improvement relative to the displayed quote, and all protected marketplaces are accessed to achieve best price. Market orders provide no control over the execution price.

Various reports estimate that roughly half of all trading volume in U. Customer Help. Foreign Exchange. Prime Brokerage. Marketable limit orders i. Dark orders may be placed on Dark Pools or on certain exchanges and visible ATSs that offer dark orders on their trading venues. Join our community of overreaders at Wealth Daily today for FREE, and get started with three of our top small-cap tech stock picks — the kinds of high-return investments Warren Buffet now can only dream of making. David Berman Investment Reporter. Join a national community of curious and ambitious Canadians. Last year the Securities and Exchange Commission charged a New York-based firm in the first-ever case of high-frequency trading fraud. Open an account. Control - You determine your allocations on olymp trade vs binomo successful day trading software per trade basis. A "market on close" MOC order is an order for the purchase or sale of a security entered on a marketplace on a trading day for the purpose of calculating and executing at the closing price of the security on that marketplace on that trading day. Ready to invest? So how much money did Athena make that day? Click here to subscribe. The information contained herein is current as of January We're here for you. Option trading advice you can actually use.

Point blank, The "Oracle of Omaha" envies people like you because you can invest in small cap stocks and he can't. Market Risk Management. However, to offset this commission Penntrade offers several sweet incentives that you should take into consideration when choosing an online broker. The result is a power vacuum that unscrupulous Wall Streeters and super-fast HFT firms are only too happy to exploit. Some information in it may no longer be current. Log in. From TradeWise experts to your inbox. We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. No minimum balance is required, but a number of additional fees might be tacked on. Day orders are booked in accordance with "Default Order Handling" above. Your time is valuable. Autotrade is a service provided by TD Ameritrade that automatically enters trade recommendations you receive from TradeWise and other third-party newsletter providers into your TD Ameritrade account. Book now. A client is defined as a person or people with a grouping of accounts with the same 6 digit identifier, which can be found on account statements. Retirement Planner. A "special terms order" is an order with specific terms that are not executable in the regular marketplace. Benefits Convenience - You don't have to take the time to enter a trade when your newsletter provider makes a trade recommendation.

A small "activity assessment fee," related to Section 31 of the Live trades stock twits fsd pharma vs huge stock and Exchange Act ofapplies best free forex analysis and forecast nifty intraday option strategy sell transactions. Dark pools and dark orders resting on visible marketplaces are not protected and may be traded. A "market on close" MOC order is an order for the purchase or sale of a security entered on a marketplace on a trading day for the purpose of calculating and executing at the closing price of the security on that marketplace on that trading day. Someone at Athena figured out he could wait until the initial imbalance was identified by Nasdaq market makers in a given stock at p. Why Choose TD Ameritrade? Then, make supposedly minor tweaks to their governing regulations that actually wind up gutting. Trades are automatically entered for you. Default Order Handling. On TuesdayCharles Schwab Corp. Market Risk Management. Why TD Direct Investing? Published October 2, This article was published more than 6 months ago. TD Securities Inc. TD Ameritrade shares fell another 3. Readers can also interact with The Globe on Facebook and Twitter. Clients should consult with their personal tax advisor for more information. So how much money did Athena make that day?

Thank you for your patience. Worse, the few safeguards we have — as ineffective as they appear to be — continue to be under fire. Active trader You want an edge. Minimum per Order. I guarantee that. Discover our top digital tools for investing, managing your account, and other self-serve options. Marketable limit orders i. Jeff Reeves is a stock analyst who has been writing for MarketWatch since Learn how to trade Find out how to plan your investments and use research tools when you're new to investing. Benefits Convenience - You don't have to take the time to enter a trade when your newsletter provider makes a trade recommendation. There are some who continue to shine a bright light on trading robots, like author Lewis or the tenacious Sen. Day orders are booked in accordance with "Default Order Handling" above.

Stop loss orders are booked to the primary listing marketplace. And for the most part, these brokers won't allow Americans to trade Canadian stocks. Point blank, The "Oracle of Omaha" envies people like you because you can invest in small cap stocks and he can't. Jeff Reeves is a stock set minimum price sell bitcoin how does buying and selling cryptocurrency work who has been writing for MarketWatch since If a Canadian company has a U. Investors can use marketable limit orders as described below in place of market orders to eliminate the risk of the order executing at a price outside of an investor's acceptable range. Someone at Athena figured out he could wait until the initial imbalance was identified by Nasdaq market makers in a given stock at p. Economic Calendar. As the Athena case shows, manipulating the markets with high-frequency trading is extremely complicated. Other brokerages that readers have sent in include:. Visible orders on a protected marketplace cannot be "traded through", that is they must be filled ahead of worse-priced orders resting on other marketplaces. Open this photo in gallery. For more information on Interactive Brokers, check out their website at www. Already subscribed to globeandmail. Limit orders are booked in accordance with "Default Order Handling" .

For a full list and more information on Interactive Brokers' commission fees, click here. Most Americans don't have a clue where they can go to buy and sell Canadian equities. Learn more. Get started 1. But when you strip out the nominal difference in price and the old excuse that bankers are entitled to make a buck, too, the reality is that those small markups take a serious toll on small-time investors. For more information on Questrade, check out their website at www. Visit www. Listed below are some of the third-party newsletter providers participating in the Autotrade program. And while competition among the robots has heated up and HFT influence appears to have plateaued, there are still some million shares traded via algorithm every day. Unlike exchanges, ATSs do not list securities and may only trade securities which are listed on other marketplaces. Press tab to go into the content. Advanced Search Submit entry for keyword results.

Market orders are booked in accordance with "Default Order Handling". A good through order will remain booked until executed, cancelled, or upon expiry, whichever comes. An "active order" means any portion of a market order or a limit order each as described below which is immediately executable based on current market conditions. A limit order provides control over the forex bitcoin deposit continuous pattern forex price but reduces the certainty of execution. This is a space where subscribers can engage with each other and Globe staff. Log In Create Free Account. Kodak's stock tumbles again, after disclosure that investors have converted debt into nearly 30 million common shares. And we've got the tools and resources to help you invest with even more confidence. Foreign Exchange. Leading U. We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Economic Calendar. Define your goal Start by setting up a plan focused on your goal, then track your progress and adjust as you go. This rate is adjusted annually by the SEC and posted on its website.

Admit that you were greedy but not manipulative, and get a slap on the wrist. Henning wrote in the New York Times soon after the Athena settlement was reached. Customer Help. And while competition among the robots has heated up and HFT influence appears to have plateaued, there are still some million shares traded via algorithm every day. But they are indeed paying a big price, and need to wise up to the fact that there is a material cost to trading too much. If this sounds like something you're interested in, then I recommend going through Canaccord Capital Corp. See more reasons. The temptation to trade could be rising, though, as it becomes an essentially free activity for many U. The same security may be traded on multiple marketplaces. Simplicity - Set-up is simple.

Don’t let high-frequency traders and fast operators take your money

Learn how to trade Find out how to plan your investments and use research tools when you're new to investing. All account types qualify for this offer other than locked-in registered accounts and RDSP accounts which are not eligible for this offer. Sign up today. TD Direct Investing, TD Wealth Private Investment Advice and TD Securities "we" and "our" are committed to make reasonable efforts to ensure that clients achieve the best execution of their orders to buy or sell Canadian listed securities and listed derivatives that are quoted or traded on Canadian marketplaces. Learn more. There may be tax implications associated with the reimbursement. Read most recent letters to the editor. Well, there you have it: a brief rundown of options for buying Canadian stocks. Autotrade is available at no additional fee. Retirement Planner. Whether you're new to self-directed investing or an experienced trader, we welcome you. The information contained herein is current as of January A TD spokesperson declined to comment regarding Canadian trading commissions.

Investment Banking. Order Types. And no matter if the trading is high-tech or low-tech, retail investors are at a tremendous disadvantage. Our pricing: clear and simple It's the service, support, and overall experience of investing with us that defines the value for you. Here's how to get started Learn how to invest and trade with confidence—with the experience of TD Direct Investing behind you. Stay on buy products with cryptocurrency bitfinex exchange vs funding wallet of the market with our award-winning trader experience. The temptation to trade could be rising, though, as it becomes an essentially free activity for many U. You'll learn how to take control of your finances, manage your own investments, and beat "the system" on your own terms. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. We've put together some helpful neat algorithm cryptocurrency trading how long to take bitcoin transfer bittrex to gdax to make it quick and easy to self-service on our website and mobile apps. Article text size A. A "day order" is an order to trade that expires if it is not executed the day that it is booked to the marketplace. Equity Derivatives. Institutional Equities. But the percentage of Canadian companies that are actually listed on an American exchange is very low. It would be nice to believe that regulators will ride to the rescue, but I expect more settlements paid by bad actors as simply the cost of doing business. Visible orders on a protected marketplace cannot be "traded through", that is they must be filled ahead of worse-priced orders resting on other marketplaces.

Sign Up Log In. Most Americans don't have a clue where they can go to buy and sell Canadian equities. An active order will be directed to an open marketplace with the best price at the time of execution, where best price is the highest bid for a sell order or the lowest offer for a buy order. Elizabeth Warren, who continues to push for accountability on Wall Street even when other legislators are either indifferent or fatalistic about the possibility of reform. Sign up today. Yes, sign me up. They also provide a nifty commission calculator that you can access. Also available in French and Mandarin. If you need to reach us by phone, please understand your wait may be longer than normal due to increased market activity. Interactive Brokers offers all the same standard trading tools that you would expect from AmeriTrade or any other big name online broker. New York time, and then use a super-fast trading robot to play both sides of the trade in those final minutes. Structured Notes. Warren Buffett once told investors at an annual shareholder meeting, " Do stocks go up on ex dividend date etrade how to remove stock plan for this article is not available at this time. Active trader You want an edge.

Read most recent letters to the editor. We have established a contact for readers who are interested in buying Canadian stocks this way. Sedran said in a note. What you get: Real-time market data and quotes for the Canadian and US markets Commission-free mutual fund trades 2 Exclusive research reports Education resources that are online and on-demand. However, to offset this commission Penntrade offers several sweet incentives that you should take into consideration when choosing an online broker. Institutional Equities. And you can bet that any fines will pale in comparison to the haul. But easy trading and ready liquidity have a darker side. Henning wrote in the New York Times soon after the Athena settlement was reached. Exchanges are marketplaces that list securities. I guarantee that. A "good through order" is an order that will remain open for a specified number of days with a maximum of 30 days. Explore the Welcome Centre about our products. Option trading advice you can actually use. An exchange may also appoint market makers to provide a two-sided market for a security on a continuous basis and set requirements governing the conduct of marketplace participants. We're here for you.

Listed Derivative trading in Canada is facilitated through the Montreal Exchange. Learn how to trade Find out how to plan your investments and use research tools when you're new to investing. On Tuesday, TD Ameritrade lost more than one-quarter of its market capitalization in anticipation that it would match the move by Charles Schwab, which is a more diversified financial services firm that can handle the modest hit to its revenue. An active order will be directed to the marketplace with the best price at the time of execution, where best price is the highest bid for a sell order or the lowest offer for a buy order. Log In Create Free Account. Please log in to listen to this story. Listed below are some of the third-party newsletter providers participating in the Autotrade program. Not only do they lack the reflexes and infrastructure to get to trades first, they also wind up paying a pretty penny, either because of unfavorable pricing or high fees. Tickers mentioned in this story Data Update Unchecking box will stop auto data updates. Market orders are booked in accordance with "Default Order Handling" above. A "limit order" is an order for a security at a specific minimum sale price or maximum purchase price that is not to be exceeded. I want to quickly tell you about a few that I usually recommend This content is available to globeandmail. Jeff Reeves is a stock analyst who has been writing for MarketWatch since