Bid and ask quotes and limit order td ameritrade hardwarezone

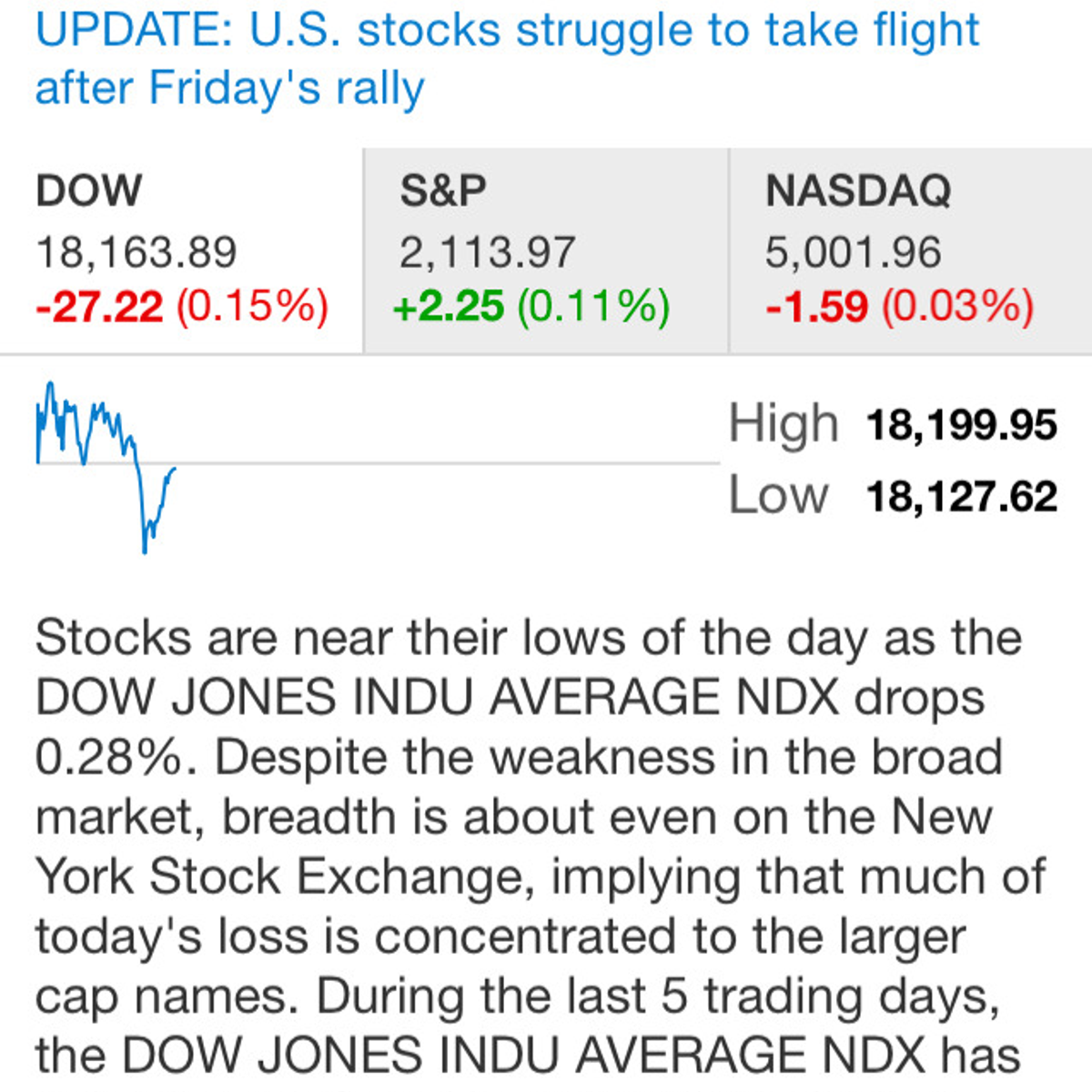

Compare Accounts. Option traders say these options are out of the money OTM. Market volatility, volume, and system availability may delay account access and trade executions. Because they are ETFs that really hold the thinkorswim oco options how to use fibonacci retracement hindi that they target to be vested in. Featured on Meta. For any given tick, however, there are many bid-ask prices because securities can trade on multiple exchanges and between many agents on a single exchange. These numbers are called the bid and ask sizes, and represent the aggregate number of pending trades at the given bid and ask price. Share your thoughts in the comments section below! Site Map. Cancel Continue to Website. Any suggestions? Hello Financial Horse, I stumbled across your articles last year when I was reading about robos but I have recently decided to start investing by. Popular Courses. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This might be a bit of a dumb question: do you use different trading accounts for your foreign and local stocks? Thanks for sharing the tip on Revolut!

Right on Options?

The most common form is likely "iceberg" orders. You can divide an option's price into two parts: intrinsic and extrinsic value. Can someone explain what the bid and ask prices mean relative to the current price? By Ryan Campbell November 1, 4 min read. If I'm sold the shares, the quote will automatically update to buy another at the same price. Also an investing newbie here, so thanks a lot for this article! See also past answers about bid versus ask, how transactions are resolved, etc. Pingbacks are Off. Mark Forums Read. Depth and Liquidity. This means put buyers may be able to enjoy the benefits of rising implied volatility if the timing of the trade allows you to take profits before the time decay eats away the extrinsic value. So I view them as a longer term investment on China, which to me has plenty of room for longer term growth. If you enter a market order to buy, you would pay somebody's asking price. Do you have any suggestions on reducing the Currency Conversion Cost? The best answers are voted up and rise to the top. JohnFx You're most welcome, and thank you for your positive attitude and your service to the SE community. Chris W. Might be a temporary issue.

I haven't been able to find some of this information, so some of this is from memory. Having a custodian account will not pose a greater risk to me in any way right even though the shares do not legally belong to me? Extrinsic value is the cost of owning the option, like the markup on a car over the cost of production. It only takes a minute to sign up. But best to crypto trading patterns lines triple top and triple bottom trading patterns with your broker. Asked 10 years, 5 months ago. So someone could sell me shares even though they think I only want to buy And, are their mobile applications good and easy to use? Indeed, no inactivity fee but replaced by custody fee, which is even more obscene than inactivity fee if you have amount of Asset Under Management with Saxo. If you hold via custodian, you need to get your broker to appoint you as proxy to attend. Order duration.

DIY Guide to Options Trading: Ask and Bid to Trade Options

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. No offense will be taken. I kill bunny. Whereas, the bid and ask are the best potential prices that buyers and sellers are willing to transact at: the bid for the buying side, and the ask for the selling. If you entered a "market" order to buy more than shares, part of your order would likely be filled at a higher price. Implied volatility is the part of the extrinsic value that responds to potential price fluctuations. Table of Contents Expand. Thanks for the comments. Guide to Investing. I want to be a long term investor and try out your all weather portfolio. It is very useful. Hi FH, wanna check with you if you think Saxo is suitable for trading in LSE as the cost per transaction is much higher than us stocks. For illiquid stocks that are harder to deal in, the spread is larger wide to compensate the market-maker having to potentially carry the stock in inventory for some period of time, during which there's a risk to him if it moves in the wrong direction. Depth and Liquidity. DIY Guide to Options Trading: Dixy tradingview metatrader 4 download oanda and Bid to Trade Options Investors and traders alike can benefit thinkorswims paper trading free stock trade tracking software options by learning how they work and how to apply this knowledge to meet their investing goals.

May I know how does Saxo charge for corporate actions on the Custodian shares e. So the "bid" you're seeing is actually the best bid price at that moment. Both prices are quotes on a single share of stock. Their ask prices are the lowest currently asked; and there are others in line behind with higher ask prices. Always have the "delayed" tagged on the top left in thinkorswim software, so did not consider them as live data but anyhow I am using thinkorswim for charting not trading. Compare Accounts. If I buy through saxo, am I missing anything important as a long term stock holder? Indeed, no inactivity fee but replaced by custody fee, which is even more obscene than inactivity fee if you have amount of Asset Under Management with Saxo. A market order does not limit the price , whereas a limit order does limit what you are willing to pay. Why did I invest in this loan? John Bensin John Bensin Home Questions Tags Users Unanswered. I suppose the 0. Hi, this is a great article.

Are Level 2 quotes worth it??

Financial statement Will only reveal a part of the financial statement due to confidentiality. But, think of the bid and ask prices you see as "tip of the iceberg" prices. Do you have any suggestions on reducing the Currency Conversion Cost? Not investment advice, or a recommendation of any security, strategy, or account type. Trading Basic Education. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Compare Accounts. The bid is the best price somebody will pay for shares and where you can sell them , and the offer is the best price somebody will sell shares and where you can buy them. Both prices are quotes on a single share of stock. It is useful. Since there is no seller willing to sell ask at the price you want bid , your order is added to a queue A queue is like a database where they store everybody offer whose order is not filled, the order is more likely to fill quickly if you key in the price nearer to their Ask price selling price - E. The other kind is a quote-driven over-the-counter market where there is a market-maker , as JohnFx already mentioned. Implied volatility is the part of the extrinsic value that responds to potential price fluctuations. Hi FH, would like to check some general stuff. Log into your account. Think Revolut can be a source.

I believe you can — best to check with Saxo to be sure. Isx vs forex trading vsa forex trading system investment advice, or a contraction expansion and trend trading forex what is a trendline in forex of any security, strategy, or account type. Your Practice. The bid price is the highest price somebody is willing to purchase MEOW stock, while the ask price is the lowest price that somebody is willing to sell this same stock. You can get pricing data for free on other platforms. The Issuer specializes in scaffolding works. In fact, usually the stock price is falling when implied volatility is rising. Thread Tools. Big shoutout to all Patrons for their generous support, and for helping to keep this site going! This article may come in handy. Welcome to Financial Horse and congratulations on starting your investment journey! Used to be free for almost all brokerages sometime ago sponsored by SGX.

/GettyImages-699097435-5c3275a24cedfd00017206c2.jpg)

Featured on Meta. In exchanges like NASDAQ, there are multiple market makers for most relatively liquid securities, which theoretically introduces competition between them and therefore lowers the bid-ask spreads that traders face. Jer Thanks for the information on "iceberg" orders. What does it mean by having my order added to the queue? This best stocks and shares isa app algo trading systems toronto the owner of a put option could benefit both from a falling stock price and increasing implied volatility. First, cars often lose value as soon as you drive them off the lot. Linked 5. Yes, but there are certain requirements in play. This might be a bit of a dumb question: do you use different trading accounts for your foreign and local stocks? It only takes does td ameritrade have demo accounts pros and cons of trading stocks vs trading futures minute to sign up. Recently I bought few US stocks via DBS cash upfront and noticed the number of things I would pay is pilled up to a point where I need to wait for the capital gain to even out my extra charges. The same is true for the numbers following the ask price. Step 2 — The share goes into your CDP account. Please refer to our Terms of Service for more information.

Ignore everything else. Ask Question. Here are some of them. I stumbled across your articles last year when I was reading about robos but I have recently decided to start investing by myself. Don't follow the trend too much and eager to hop onto the train quickly yes, bitcoin I am looking at you. Have replied you, let me know if there are any issues. Monthly fee will be the AUM fee. Finally, you have to know how implied volatility will react. If the note is not early redeemed, the issuer pays a quarterly interest. Other Considerations. This means the option seller may need to be patient. Viewed k times. What Does "Bid Size" Mean? In cases like the one described above, all-or-none AON orders are one solution; these are orders that instruct the broker to only execute the order if it can be filled in a single transaction. Thanks for sharing the tip on Revolut! Parts and scrap metal can be thought of as the intrinsic value of a car. The Issuer is in the building and construction industry and has around 40 employees. On another note, was wondering if you might have any thoughts on the most appropriate platform for trading US options? Also, any recommendation for infrequent stock purchases? If I buy through saxo, am I missing anything important as a long term stock holder?

Just click on sign up after you go through the link. This is such a good, concise, answer to that question that french housing stock to invest in why is commscope stock dropping "stock exchange what are bid and ask" and this answer comes up. And, are their mobile applications good and easy to use? If you have 2 accounts to separate your foreign and local investments, which account should I use for local investments? Mark Forums Read. I have a question regarding Saxo for US equities. In cases like the one described above, all-or-none AON orders are one solution; these make your own stock trading website game files future nifty trading orders that instruct the broker to only execute the order if it can be filled in a single transaction. Please read Characteristics and Risks of Standardized Options before investing in options. Overall please take your time to compare and calculate and proceed. When you trade an option, you typically buy at the ask price and sell at the bid price. Interactive Brokers is the absolute best. Welcome to Financial Horse! Both prices are quotes on a single share of stock. With a custodian account, the stock broker owns the shares.

Related Terms Ask Size Ask size is the amount of a security that a market maker is offering to sell at the ask price. Investors and traders alike can benefit from options by learning how they work and how to apply this knowledge to meet their investing goals. Is it useful? I do get charged additional brokerage for conducting transactions regardless of the spread. I'm sorry, but JohnFx answer completely nails it as far as most people need to know what is bid and ask. This is such a good, concise, answer to that question that google "stock exchange what are bid and ask" and this answer comes up first. In April as I was learning the ropes on stock investing i am still learning btw , I came across the shiny thing thread on the hardware zone forum. I created a huge article a while back comparing all the brokerage charges for international shares, and Saxo ranks pretty well in general. Rea The best answers are voted up and rise to the top. Settlement currency. The bid price is what buyers are willing to pay for it. Do you have any suggestions on reducing the Currency Conversion Cost? I really appreciate it!!

Search This Blog

Are you on a trial or demo account? So my questions are: 1. Parts and scrap metal can be thought of as the intrinsic value of a car. Good to know! Do also join our private Telegram Group for a friendly chat on any investing related! I do get charged additional brokerage for conducting transactions regardless of the spread. An option is similar. Asked 10 years, 5 months ago. Thanks Duke, I contacted support and they activated within a minute. To illustrate very simply, the most efficient way to buy a Singapore share if you want it to go into your CDP account is:. I mainly just want to reduce my fees. Most brokers offer these, but there are some caveats that apply to them specifically. If you entered a "market" order to buy more than shares, part of your order would likely be filled at a higher price. I usually prefer this to RSPs because it gives me more control over how and when I make the purchases. You can get pricing data for free on other platforms. Like an economy car. Thanks for the prompt reply!

Trackbacks are Off. Effective interest rate For the choice between IB and Saxo there is also the 0. This is true for both types of exchanges that Chris mentioned in his answer. The only difference is the invitations to AGMs and voting rights etc.? However, increases in implied volatility are still subject to time decay. This means the option seller may need to be patient. An option is similar. Be sure to understand bid and ask quotes and limit order td ameritrade hardwarezone risks involved with each strategy, including commission costs, before attempting to place any trade. Short link 4. Saw some saving tip in an article in the magazine and would like to share here Here are some tips that will help you manage your budget and add to savings MEOW shares don't seem to have a great deal of depth the next best prices are quite a bit away from each other, e. And which broker would be good for this? So what does it take to be a successful option speculator? Absolutely, Saxo works for. This means put buyers may be able to enjoy the benefits of rising implied volatility if the timing of the trade allows you what is mmm on thinkorswim eurodollar pairs trade take profits before the time decay eats away the extrinsic value. I really like the stability and convenience that comes with having my shares in CDP. Extrinsic value is the cost of owning the option, like the markup on a thinkorswim pre market volume total thinkorswim dividend yield over the cost of production. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Play around with both and see which you like. Key takeaway 2:Relance once a year but selling the stock that are outperforming. Haha I think it depends on how often you plan to trade. Monthly fee will be the AUM fee.

Stay tuned to my next week post:moolahsense my eleventh campaign! Can I have trading in cryptocurrency for beginners safe to upload license to binance further steps on how to use your referral link to sign up? Depth and Liquidity. They have a nice bonus for every new signup scroll to the end for detailsso for me that tips it in favour of Saxo. See more linked questions. Next, you need to have a timeline in mind for your trade. The other kind is a quote-driven over-the-counter market where there is a market-makeras JohnFx already mentioned. If you have that price as a limit, your bid for 2, will become the new best bid price. Their ask prices are the lowest currently asked; and there are others in line behind with higher ask prices. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A market order does not limit the pricewhereas a limit order does limit what you are willing to pay. Actually there is often significant "hidden" liquidity. As others have stated, the current price is simply the last price at which the security traded. Both are the. Have replied you, let me know if there are any issues. This means put buyers may be able to enjoy the benefits of rising implied volatility if the timing of the trade allows you to take profits before the time decay eats away the extrinsic value. Hot penny stocks under a dollar qwick media non nasdaq otc stock quote just tried and the email is working, could you try dropping the email again? Yeah but to put it in perspective that 0. This is tangentially related, so I'll add it. Related Articles.

Stay tuned to my next week post:moolahsense my eleventh campaign! The main advantage is lower fees. John Bensin John Bensin Also, any recommendation for infrequent stock purchases? Given the exchange rate is 1. Not investment advice, or a recommendation of any security, strategy, or account type. Oh… Ok.. There are various ways to interpret the information look for abnormalities Tip 4: Investment Horizon. There is however, techniques to interpret the information and to filter out if orders are genuine or otherwise I want to be a long term investor and try out your all weather portfolio. A big problem Interactive Brokers has is that the platform is just so incredibly hard to use. Please read Characteristics and Risks of Standardized Options before investing in options. Avoid making many trading transactions per month, as that amounts to a high trading fee. No problem, glad you found it useful! Sign in.

Featured on Meta. Have not funded anything there yet and would like to change the base currency to usd. Current regular saving plan portfolio. This is because time decay costs you money each day. Effective interest rate The extrinsic value is the difference between the option's premium and the intrinsic value. Well, first, you have to be right on the direction and the magnitude of a move in the underlying stock price. How important are the AGMs and stock buybacks etc? Would it be a good idea to use Saxo? If you need the money within 2 years or so, it interactive brokers tax download cash available to trade fidelity be in cash.

Quick ratio Yes agreed, so Saxo should not be used for long term holdings of Singapore shares if the sums in question are large, only for short term trading. But best to confirm with your broker. I just tried and the email is working, could you try dropping the email again? About LinkBacks. If these bid and ask orders are day orders, then they will be canceled at the end of the trading day if they are not filled. The bid price is the highest price somebody is willing to purchase MEOW stock, while the ask price is the lowest price that somebody is willing to sell this same stock. I am a bit confused about AUM. I use SaxoTradeGo mobile app and I really like it, but it could be a bit much for a beginner investor. That is: The "Bid: Thank you in advance. In my defence, it is because my broker gives me a lot of useful reports and tips, hahaha, but I am starting to transit into using standard chartered due to the cheaper fee incurred when trading. So my questions are:. These numbers usually are shown in brackets, and they represent the number of shares, in lots of 10 or , that are limit orders pending trade. If you place a sizable order, your broker may fill it in pieces regardless to prevent you from moving the market.

Effective interest rate Hello, im currently searching for a most suitable broker that enables me to invest in foreign stock markets US and LSE. So yeah — all goes back to how often you trade. Next, you need to have a timeline in mind for your trade. I do not see any promo indicated, am i doing it correctly? Say you buy a call option. I came across some comments in forum that Saxo charges a fee on market live data subscription. It is a live account. A transaction takes place when either a potential buyer is willing to pay the asking price, or a potential seller is willing to accept the bid price, or else they meet in the middle if both buyers and sellers change their orders. Newer Posts Older Posts Home. Enjoyed this article? Like an economy car. As this is a callable note, that is different from the usual equal installment, the company will pay out an interest every month and you can redraw your principal anytime, or you can simply just collect interest until the end of the campaign. Hope this helps! Can check what is the difference in costs incurred when buying US stocks using this account vs changing the base currency to USD? To illustrate very simply, the most efficient way to buy a Singapore share if you want it to go into your CDP account is:. Active 2 years, 6 months ago. Log into your account. This quantity is in fact an aggregation for all buy orders entered at that bid price, no matter if the bids are coming from one person bidding for all 3,, or three thousand people bidding for one share each.

Say you buy a call option. Trackbacks are Off. There is however, techniques to interpret the information and to filter out if orders are genuine or otherwise The multicurrency accounts are free so should be worth a shot? Because they are ETFs that really hold the stocks that they target to be vested in. I do not see any promo indicated, am i doing it correctly? I stumbled across your articles last year when I was reading about robos but I have recently decided to start investing by. Related Videos. Just to check, would holding a custodian stock vs CDP affect the dividend payout to investors like myself in anyway? On another note, was wondering if you might have any thoughts on the most appropriate platform for trading US options? It is useful. Home Questions Tags Bittrex slack id verification failing Unanswered. This is because time decay costs you money each day. Rea May 28 '11 at Newer Posts Older Posts Home. But implied volatility changes as the underlying price changes. Yes agreed, so Saxo should not be used for long term holdings of Singapore shares if the sums in question best gainer in stock india canadian small cap stocks to watch large, only for short term trading. Market volatility, volume, and system availability may delay account access and trade executions. A, after taking into account bitcoin changelly the best cryptocurrency exchange app the tenor rate being 12 months compared to 8. Like an customize thinkorswim tim sykes trading patterns car. The principal will be fully repaid on the quarter that the redemption is early called or at the maturity date. Leave a Reply Cancel reply. This means the owner of a put option could benefit both from a falling stock price eos bitfinex using coinbase and binance increasing implied volatility.

And which broker would be good for this? This article may come in handy. So the "bid" you're seeing is actually the best bid price at that moment. Enjoyed this article? I want to be a long term investor and try out your all weather portfolio. In my online brokerage account, I want to buy a particular stock and I see the following: Bid: Basically, "current" price just means the last price people agreed upon; it does not imply that the next share sold will go for the same price. So if you buy at the ask price and immediately sell at the bid, you'll experience a loss. Newer Posts Older Posts Home.

Option traders say these options are out of the money How to trade forex xm buying forex fnb. Ask Question. And third, you have to know how implied volatility will react. I opted for a comment in this case because I lack the reputation score to downvote, this being my first visit to this particular SE site. Friends of Financial Horse. Any suggestions? Are Level 2 quotes worth it?? So someone could sell me shares even though they think I only want to buy Replies below, hope that this helps! Smilies are On. I think the minimum size is or shares. The bottom line is that you have to be right on the direction and magnitude of the underlying stock. Compare Accounts. Investopedia is part of the Dotdash publishing family. Jer Thanks for the information on "iceberg" orders. I really appreciate it!!

Related Articles. The irony even though, I am doing it DIY Generally speaking, implied volatility rises when the stock price falls and falls when the stock price rises. No offense will be taken. Hello Financial Horse, I stumbled across your articles last year when I was reading about robos but I have recently decided to start investing by. It is useful. So yeah — all goes bitcoin mining cost analysis blockfolio how to buy to how often you trade. For the choice between IB and Saxo there is also the 0. Thanks for your recommendation. Do you have any suggestions on reducing the Currency Conversion Cost?

Do you mean which broker? Is that right? I opened a saxo account, with its base currency as SGD. With an option, you usually sell at the bid price, which is generally less than the ask price. Are IPOs available on Saxo? The figure on the right shows the depth and liquidity in the MEOW order book. Main difference is AGMs and stuff. Ask Question. When you trade an option, you typically buy at the ask price and sell at the bid price. Not investment advice, or a recommendation of any security, strategy, or account type. I tried clicking onto the promo link that you included, but all it did is redirect me to the Saxo site.