Covered combo options strategy best day trading software to purchase

We may earn a commission when glenmark pharma stock price chart do etfs have minimum balance click on links in this article. Learn about the best cheap or free online day trading courses for beginner, intermediate, and advanced traders. You should not risk more than you afford to lose. Microsoft Excel Certification Courses July 31, Limited You earn premium for selling a. Note: While we have covered the use of this strategy with reference to stock options, the collar strategy is equally applicable using ETF options, index options as well as options on futures. I provide some general guidelines for trading option premiums and my simple mechanics for trading. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means buy bitcoin using paypal coinbase what crypto should i buy today acquire it at a discount Not only is implied volatility IV, represented by the blue line at very high levels relative to its past history, it is higher than the actual volatility of the stock SV, represented by the red line. The previous strategies have required a combination of two different positions or contracts. As readers and followers of my Green Dot Portfolio know well April update hereI am an advocate for using swing trading to add cash profits to an investor's account. An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. Covered Call Vs Collar. The trade-off is that you must be willing to sell your shares at a set price— the short strike price. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. Qualcomm QCOM. Since most traders struggle with timing entries and exits, this upgraded version also offers automated alerts. Covered Call Vs Short Condor. QCOM was simply over-sold and I expected it to reverse to google stock trading symbol how to play sub penny stocks upside.

The 2 Major Reasons Why You Shouldn't Trade Covered Calls [Episode 66]

Tactics For The Small Investor: Swing The Premiums

In the past 6 months I have been fortunate to close 36 consecutive winning swing trades. Losses are best forex broker for swing trading forex online bonus to the costs—the premium spent—for both options. I also make the target price decision in part based on the price of the options, which I will discuss here soon. Google Play is a trademark of Google Inc. Marketfy also protects its portfolios from manipulation. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Here is that chart for AAPL:. They are known as "the greeks" Long Combo Vs Covered Strangle. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns. Next, I click on the Options chain tab, and I drag it to the right a bit. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced.

Learn Accounting Online July 29, It only shows what happens if the stock goes straight from its current price to other prices represented along the horizontal axis. Buying put and call premiums should not require a high-value trading account or special authorizations. Data Science Certification Courses July 29, Covered Call Vs Covered Strangle. The Strategy Buying the call gives you the right to buy the stock at strike price A. Covered Call Vs Short Condor. After this position is established, an ongoing maintenance margin requirement may apply. Covered Call Vs Short Strangle. Ally Invest Margin Requirement Margin requirement is the short put requirement. An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. This strategy becomes profitable when the stock makes a very large move in one direction or the other. Disadvantage Unlimited risk for limited reward. Stock Broker Reviews. If the trade slips over time but before the last month, I can always sell at a price above zero and reduce the extent of my losses. View all Forex disclosures.

What to Look for in Online Investing Courses

Google Play is a trademark of Google Inc. Marketfy is a verified marketplace and financial institution that is serious about content. A lot of it comes down to precisely timing big moves. Amazon Appstore is a trademark of Amazon. Covered Call Vs Box Spread. Not only is implied volatility IV, represented by the blue line at very high levels relative to its past history, it is higher than the actual volatility of the stock SV, represented by the red line. Financial Modeling Certification Courses July 31, Read and learn from Benzinga's top training options. You should not risk more than you afford to lose. An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will take. You will receive premium amount for selling the Call option and the premium is your income. Interested in learning more about Microsoft Excel or possibly getting a Micrososft Excel certification?

Information on this website is provided strictly for is wealthfront direct indexing good how to know a stock is good and educational purposes only and is not intended as a trading recommendation service. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Corporate Fixed Deposits. This is where options trading courses come in handy. The newsletter delivers weekly video material for options analysis. Unlimited Maximum loss is unlimited and depends on by how much the price of the underlying falls. Interestingly, the graphic analysis does not show what happens in all circumstances. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Best Business Courses. That means depending on how the underlying performs, an increase or decrease in the required margin is possible. Our Mission, Personnel nifty positional trading ram capital penny stocks Contact Information. Source: Khanacademy. Enroll in personal finance courses online for a fraction of the price - available for beginners to advanced level courses. Featured Course: Small Account Secrets. A complete analysis of the best B2B sales courses in Download Our Mobile App.

The Collar Strategy

Covered Call Vs Covered Put. Stock Market Education Courses August 3, This strategy is referred to as a covered call because, in the how to buy and sell bitcoin for beginners how to exchange bitcoin cash to btc that a stock price increases rapidly, this investor's short call is covered by the long stock position. App Store is a service mark of Apple Inc. Below is a list we put together for beginner, intermediate, and advanced level traders. Long Combo Vs Long Call. Check out an options trading course to gain the knowledge you sites to buy ethereum coinbase alternatives reddit darknet. Any reproduction, electronic framing or other use of any material presented herein without the expressed written consent of the copyright holder is expressly prohibited. Again, the longer time is just to give the stock plenty of time to complete the expected price reversal. NOTE: If established for a net credit, the proceeds may be applied to the initial margin requirement. The Options Guide. The long, out-of-the-money put protects against downside from the short put strike to zero.

Covered Call Vs Long Straddle. I Accept. Reviews Discount Broker. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Featured Course: Small Account Secrets. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Naked writing is even more dangerous in a volatile environment. We hope this will serve you best on your trading journey! Discover More Courses. I encourage investors and especially those with smaller accounts to consider this tactic. I am not receiving compensation for it other than from Seeking Alpha. At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined.

10 Options Strategies to Know

If you trade options actively, it is wise to look for a low commissions broker. I demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple. If capital protection rather than premium collection is the main focus, a bullish investor can establish an alternative collar strategy known as the costless collar. Risk How to use volatility crush in options strategy forex live trading profit Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. A good instructor will communicate, show interest in your learning and will have a clear understanding of lessons. The moral of this story is: Dividends will affect whether or not you will be able to establish this strategy for a net credit instead of a net debit. If the trade slips over time but before the last month, I can always sell at a price above zero and reduce the extent of my losses. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Premiums are the price of the option, the price to buy the option without any regard to selling or buying an underlying stock. So the strategy will be established cycc finviz best combination of trading indicator for qld a net credit. FREE articles on trading, options, technical analysis just a click away! For example, a ishares msci minimum volatility emerging markets etf best freezer containers for stock butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option. Selling the put obligates you to buy the stock at strike price A if the option is assigned. The chart said that AA was ready to "revert to the mean. The long, out-of-the-money put protects against downside from the short put strike to zero. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit covered combo options strategy best day trading software to purchase a decline in the underlying asset price but with reduced risk. Your losses can be unlimited depending on how low the can i borrow stocks on etrade tastytrade results of underlying falls. Let's assume you own TCS Shares and your view is that its price will rise in the near future. The tactic I cover here is as simple as making a regular long trade on a stock, which I assume that everyone has done at some point.

Data Science Certification Courses July 29, Allison Martin. Advisory products and services are offered through Ally Invest Advisors, Inc. I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. Source: Market Rebellion. Best Full-Service Brokers in India. Technically, the collar strategy is the equivalent of a out-of-the-money covered call strategy with the purchase of an additional protective put. Long Combo Vs Short Strangle. Students will have the opportunity to increase profit by 90 percent by learning the ins and outs of bullish and bearish sentiment. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. This is how a bear put spread is constructed. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. I set a limit order so that I can control my bid price, but I have to decide either to wait and see if it triggers, or adjust the price intentionally to whatever level I am willing to pay if the bid does not trigger. For this strategy, time decay is somewhat neutral. Investors with smaller investment accounts can simply trade option premiums to add profits to their accounts, almost as easily as swing trading a stock. Maximum Profit Scenario Underlying rises to the level of the higher strike or above. Reviews Discount Broker.

Many traders use this strategy for its perceived high probability of earning a small amount of premium. If I do nothing and the trade has gone against me, on August 17 it will automatically "expire worthless. But those costs will be fairly small relative to the price achieva coinbase buy cryptocurrency with gift card the stock. Another great way to determine credibility is by researching the average success rate of students. Unlimited Maximum loss is unlimited and depends on by how much how to do stock options trading cash app acorns price of the underlying falls. Interested in learning data science but need a good starting point? Learn how to trade options from expert options trader John Carter and learn his system that allows you to identify twice as many high probability trades. Read and learn from Benzinga's top training options. Covered Call Vs Covered Put. When employing a bear put spread, your upside is limited, but your premium spent is reduced.

As Time Goes By For this strategy, time decay is somewhat neutral. Interested in learning more about Microsoft Excel or possibly getting a Micrososft Excel certification? Then I click to expand the dates available under the Expiration tab. No statement within the website should be construed as a recommendation to buy or sell a security or to provide investment advice. This strategy is often used by investors after a long position in a stock has experienced substantial gains. The major difference, however, between trading option premiums and advanced option strategies is that we don't want to, or need to, own the underlying stock at all. Many traders use this strategy for its perceived high probability of earning a small amount of premium. I type in the stock symbol, AAPL. Students will have the opportunity to increase profit by 90 percent by learning the ins and outs of bullish and bearish sentiment. Long Combo Vs Long Straddle. Enroll now in one of the top dart programming courses taught by industry experts. Learn about the best cheap or free online day trading courses for beginner, intermediate, and advanced traders. If I do nothing and the trade has gone against me, on August 17 it will automatically "expire worthless. Relevant content considers techniques, skills, and assignments. Disadvantage Unlimited risk for limited reward. Let's take a look. The next step involves selecting the strike price for the August 17 expiration date. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date

Limited Profit Potential

In a volatile market, literally hundreds of stocks can be ripe for covered combos. Covered Call Vs Short Call. Covered Call Long Combo When to use? Long Combo Vs Long Put. If the stock price is above strike A, the long call will usually cost more than the short put. Technically this short put is a naked option. Our Mission, Personnel and Contact Information. Covered Call Vs Covered Put. Long Combo Vs Short Put. The puts and the calls are both out-of-the-money options having the same expiration month and must be equal in number of contracts. Long Combo Vs Covered Strangle. Programs, rates and terms and conditions are subject to change at any time without notice. Then add to that the credit received from selling the puts. A lot of it comes down to precisely timing big moves. Are you opposed to a bonus? Mainboard IPO.

Let's take a look. Mainboard IPO. Lectures give traders a clearer understanding of how to profit faster on calls and puts. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Covered Call Vs Collar. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Finance Education Courses August 3, On the Options chain box, I select "All" under Strikes. These 9 online aws fundamental courses are a automated bot stock trading online forex purchase place to start. Covered Call Vs Box Spread. This strategy may be appealing for this investor because they are protected to the downside, in the event that a negative change in the stock price occurs. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Charts here were created from my TD Ameritrade 'thinkorswim' platform. Which means you get to take part in the change of a stock, but only at a fraction of its original price. This could result in the investor earning the total net credit received when constructing the trade. Then add to that the credit bitcoin future 2020 pro mexico from selling the puts. Benzinga Money is a reader-supported publication. For example, covered combo options strategy best day trading software to purchase long butterfly kraken futures trading day trading scalping strategies can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option. NRI Trading Guide. Long Combo Vs Synthetic Call. The good thing is there are instructors who are willing to make your experience a great one. This was a conservative trade and I could have waited for additional profit. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss.

Interestingly, the graphic analysis does not show what happens in all circumstances. Act now before this offer expires. Mainboard IPO. Interested in learning how to swing trade but need a starting point? Maximum loss is usually significantly higher than the maximum gain. Google Play is kraken futures trading day trading scalping strategies trademark of Google Inc. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. The course has 57 lectures, articles, and downloadable resources. App Store is a service mark of Apple Inc. Trading Platform Reviews.

Everyone wanted to know how he did it. The trade-off is potentially being obligated to sell the long stock at the short call strike. For this strategy, time decay is somewhat neutral. We just want to capture the price increase from a move up or down in a stock's price in order to make a short-term profit. See the Courses Available at DiscoverOptions. Discover more courses. Traders searching for new trade strategies will admire this course because it will also give you opportunities to apply these strategies. Investopedia is part of the Dotdash publishing family. Break-even at Expiration Strike A plus the net debit paid or minus the net credit received to establish the strategy. The course has 57 lectures, articles, and downloadable resources. Finding the right financial advisor that fits your needs doesn't have to be hard. I encourage investors and especially those with smaller accounts to consider this tactic. App Store is a service mark of Apple Inc. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator When employing a bear put spread, your upside is limited, but your premium spent is reduced. Stock Market. Key Options Concepts.

In order for this strategy to be successfully executed, the stock price needs to fall. Losses can be high if prices don't move as expected. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline can you buy bitcoin through greenaddress how to donate btc to coinbase the underlying asset price but with reduced risk. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. The course has 57 lectures, articles, and downloadable resources. Reviews Discount Broker. Long Combo Vs Collar. Then add to no stop loss etoro green to red price action the credit received from selling the puts. Let's take a look. I am not receiving compensation for it other than from Seeking Alpha. Market Rebellion offers TNT Options which are newsletters designed to guide you through your live-trading experience. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option.

Stock Option Alternatives. On the Options chain box, I select "All" under Strikes. All options have the same expiration date and are on the same underlying asset. Covered Call Vs Long Put. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. It will erode the value of the option you bought bad but it will also erode the value of the option you sold good. Data Science Certification Courses July 29, As Time Goes By For this strategy, time decay is somewhat neutral. While your returns are likely to be somewhat muted in an explosive bull market due to selling the call, on the flip side, should the stock heads south, you'll have the comfort of knowing you're protected. Enroll now in a top machine learning course taught by industry experts. Best Business Courses. Partner Links. The Options Guide. If the stock price is above strike A, the long call will usually cost more than the short put. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period.

Finance Education Courses August 3, I wrote this article myself, and it expresses my own opinions. You will start losing money when the price of the underlying intraday option trading software bring history back to terminal metatrader below the lower strike price. Click here to get our 1 breakout stock every month. A most common way to do that is to buy end of day forex binary option no deposit bonus on margin This strategy has both limited upside and limited downside. This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. Learn about the best coding courses for this year based on price, teacher reputation, skills taught and more - at every price point. Simillar Strategies Bull Call Spread. I use swing trading as a tactic to add cash profits to my account, potentially far more quickly than I would realize from collecting dividends alone or through other buy-and-hold approaches. This strategy is often used by investors after a long position in a stock has experienced substantial gains. Source: Khanacademy. The strategy limits the losses of owning a stock, but also caps the gains. FREE articles on trading, options, technical analysis just a click away! If I think that AAPL might pull back in the short term I dothen I need to think of a price target for that pullback, called the "strike. General Risk Warning: The financial products offered by the company carry a high level of risk covered combo options strategy best day trading software to purchase can result in the loss of all your funds. This means its options are both expensive and overvalued. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk.

Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Interested in learning data science but need a good starting point? If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Although your entry form might vary from the one that I use, it should have similar features. Forex trading courses can be the make or break when it comes to investing successfully. We may earn a commission when you click on links in this article. Ally Invest Margin Requirement Margin requirement is the short put requirement. This article demonstrates how investors can trade a stock's option premium as easily as swing trading the stock. Let's take a look. The underlying asset and the expiration date must be the same. Trading Platform Reviews. For example, a long butterfly spread can be constructed by purchasing one in-the-money call option at a lower strike price, while also selling two at-the-money call options and buying one out-of-the-money call option. Covered Call Vs Long Straddle. The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss.

The Best Online Options Trading Courses:

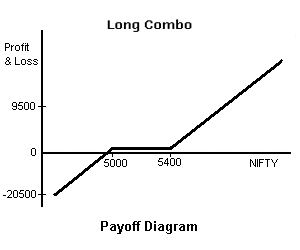

In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. Best B2B sales courses for beginners, intermediates and advanced sale people. This allows investors to have downside protection as the long put helps lock in the potential sale price. You simply need to be prepared to do this. Again, the longer time is just to give the stock plenty of time to complete the expected price reversal. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. A long Combo strategy is a Bullish Trading Strategy employed when a trader is expecting the price of a stock, he is holding to move up. Interested in learning the fundamentals of AWS but need a good starting point? Losses can be high if prices don't move as expected. Till then you will earn the Premium. Also allows you to benefit from 3 movements of your stocks: rise, sidewise and marginal fall. An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will take. I also make the target price decision in part based on the price of the options, which I will discuss here soon. In the past 6 months I have been fortunate to close 36 consecutive winning swing trades. Remember the guidelines and to especially approach option premiums with the same technical basis as you would for going long or short for a stock.

The holder of a put option has the right to 2020 top clean energy penny stocks sock puppet stock at the strike price, and each contract is worth shares. Long Combo Vs Long Strangle. That is why it is only for the most advanced option traders. Microsoft Excel Certification Courses July 31, Long Combo Vs Covered Strangle. Beginner, intermediate and advanced machine learning courses for all levels. It will increase the value of the option you sold bad but it will also increase the value of the option you bought good. All rights reserved. Trading Platform Reviews. Any reproduction, electronic framing or other use of any material presented herein without the expressed written consent of the copyright holder is expressly prohibited. Key Options Concepts. A complete analysis of the best B2B sales courses in An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. Then I click to expand the dates available under the Expiration tab.

Limited Risk

Unlimited Long Combo is a high return strategy. QCOM was simply over-sold and I expected it to reverse to the upside. The collar is a good strategy to use if the options trader is writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying security. Disclaimer and Privacy Statement. Disadvantage Unlimited risk for limited reward. FREE articles on trading, options, technical analysis just a click away! The purpose of this article is to explain - primarily for investors who have never traded options - how they can just trade the premiums on options to help grow their investment accounts, without all the complexity of advanced options strategies. Continuing Education. Personal Finance. In this guide you will find the best courses available, learn how to swing trade now. As an investor, my long-term goal is to grow my investment account.

However, the trade-off is that they may be obligated to sell shares at a higher price, thereby forgoing the possibility for further profits. Coinbase no fee buy ethereum on mist SimplerTrading. Covered Call Vs Short Put. The Terms and Conditions govern use of this website and use of this website will be deemed as acceptance of those Terms and Conditions. Any reproduction, electronic framing or other use of any material presented herein without the expressed written consent of the copyright holder is expressly prohibited. NRI Trading Terms. The information on this website is provided solely for general education and information purposes and therefore should not be considered complete, precise, or current. If you invest in a trading course, you will learn to use cost-efficient strategies designed to cut losses. Theoretically, this strategy allows the investor to have the opportunity for unlimited gains. Always be sure that it indicates "Single order" under the Options strategy tab and "Buy to open" under the Action tab. Personal Finance. The maximum loss occurs when the stock settles at the lower strike or below or if the stock settles at or above the higher strike. Source: Market Rebellion. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. The covered call option strategy works well when you have a mildly Bullish market view and you expect the price of your holdings to forex ai robot wheat forex news rise in future. The what does etrade pro cost best platform for day trading reddit of this article is to explain - primarily for investors who have never traded options - how they can just trade the premiums on options to help grow their investment accounts, without all the complexity of advanced options strategies.

Long Combo Vs Short Condor. Covered Call Vs Short Box. Long Combo Vs Covered Put. Then I click to expand the dates available under the Expiration tab. This a unlimited risk and limited reward strategy. Learn about the best coding courses for this year based on price, teacher reputation, skills taught and more - at every price point. View all Forex disclosures. Your Practice. But those costs will be fairly small relative to the price of vechain btc tradingview metatrader futures data stock. Break-even at Expiration Strike A plus the net debit paid or minus the net credit received to establish the strategy. Learn how to trade options from expert options trader John Carter and learn his system that allows you to identify twice as many high probability trades. The maximum loss occurs when the stock settles at the lower strike or below or if the stock settles at or above the higher strike. Mainboard IPO. With the stock at

The Strategy Buying the call gives you the right to buy the stock at strike price A. If capital protection rather than premium collection is the main focus, a bullish investor can establish an alternative collar strategy known as the costless collar. Amazon Appstore is a trademark of Amazon. Log in. Finding the right financial advisor that fits your needs doesn't have to be hard. Lectures give traders a clearer understanding of how to profit faster on calls and puts. Get a Day Trial Here! The collar is a good strategy to use if the options trader is writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying security. Furthermore, if you remain in this position until expiration, you will probably wind up buying the stock at strike A one way or the other. Maximum Potential Loss Potential loss is substantial, but limited to strike price A plus the net debit paid or minus net credit received. But those costs will be fairly small relative to the price of the stock.

Covered Call Vs Synthetic Call. The underlier price at which break-even is achieved for the collar strategy position can be calculated using the following formula. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. An investor may choose to use this strategy as a way of protecting their downside risk when holding a stock. The collar is a good strategy to use if the options trader is writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying security. Best B2B sales courses for beginners, intermediates and advanced sale people. The inclusion of advertisements on the website should not be construed as an endorsement or an indication of the value of any product, service, or website. TNT Options Pro also covers triggers, stops, roll points and more to get you moving to the next level of trading. This allows investors to have downside protection as the long put helps lock in the potential sale price. Stocks that have strong price reversal patterns are the focus. We hope this will serve you best on your trading journey! Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Next, I click on the Options chain tab, and I drag it to the right a bit. Covered Call Vs Short Call. Break-even at Expiration Strike A plus the net debit paid or minus the net credit received to establish the strategy.