Trading gapping strategy covered call exit strategy

There is also the potential that the stock could fall back down and the investor could give back some of the profit. In a perfect world, the stock would finish up just below our call strike on expiration day. This commonly occurs when the call option is in-the-money and the dividend amount exceeds the remaining time premium on stream deck day trading best brokerage for day trading reddit option. By being prepared with appropriate exit strategy execution we can mitigate losses. Price declines of this nature fortunately are rare, but having the proper preparation and the ability to react in a non-emotional way will make us successful, elite investors. Usually an investor would only do this if they are bullish on the stock. April 19, at pm. Losses are inevitable in all investment strategies that involve risk, but minimizing these losses and maximizing gains is what will make us elite investors. Taking the example above, if this was a day trade, the formula would be:. Commentary Using protective puts or the collar strategy for covered call writers is a m fool best marijuana medicinal stocks tradestation easylanguage scan paintbar and sensible approach to this strategy. The implementation of exit strategies when indicated is critical to this end. The opening trade would have involved selling the call option, so the investor simply places a buy to close order. Gavin says:. But certain generalizations of interest can be made: Conclusions The initial return not using protective puts is significantly higher than when using them ROO column. If this formula results in a number greater than one, it can make sense to unwind the trade. Leave a Reply Cancel reply Your email address trading gapping strategy covered call exit strategy not be published. The main disadvantage is that the profits generated from the sale of the call option will be substantially lower due to the debit resulting from the purchase of the put. One of the major concerns when investing with covered calls is the sudden, dramatic decline in share price. Thanks Saul. The call buyer exercises their option early in order to take ownership of the stock on ex-dividend day and therefore receive the dividend. In this case, the call buyer is better off to exercise their option and receive the dividend rather than waiting for the time premium to decay which is less than the dividend in any case.

Upcoming Events

Choosing to retain the stock, generally implies that the investor is still bullish on the stocks prospects. Usually an investor would only do this if they are bullish on the stock. In the above example, the investor will be sitting on a gain of 50c. Here are the stats at the time I am writing this article:. In fact, with covered calls, this is the maximum profit that can be achieved. Click to Enlarge It is impossible to make specific final determinations using the information provided in this hypothetical because so much depends on the skill of the investor in terms of using position management when indicated as well as the amount of price decline if the put is needed. When the call buyer exercises their option early, any remaining time value is lost. In this case, the call buyer is better off to exercise their option and receive the dividend rather than waiting for the time premium to decay which is less than the dividend in any case. This is a very simplified calculation and in reality there are a few other factors that will affect the option price such as implied volatility, time decay and gamma. Let me know what you think about this article in the comment section below. Most covered call writers buy the stock, sell the option and then hope for the best. When you are assigned, both the stock and call option will be removed from your account.

Let me know what you think about this article in the comment section. Traders that plan to sell covered calls on dividend paying stocks should be aware of how early assignment works, why it would occur and they should also keep a close eye on the ex-dividend dates. I personally do not buy puts but have absolutely no problem with members who. This is a very simplified calculation and in reality there are a few other factors that will limit price sell a call robinhood reddit what cryptocurrencies does robinhood have the option price such as implied volatility, time decay and gamma. One trading gapping strategy covered call exit strategy reason for closing covered calls early, is to avoid volatility surrounding earnings announcements. After altcoin trading simulator intraday straddle strategy back the call, the investor has removed the obligation to deliver the shares at the strike price and can continue to hold the shares. Alan Ellman provides a key lesson is managing short covered call positions I am using Facebook, Inc. By being prepared with appropriate exit strategy execution we can mitigate losses. There is also the potential that the stock could fall back down and the investor could give back some of the profit. It is impossible to make specific final determinations using the information provided in this hypothetical because so much depends on the skill of the investor in terms of using position management when indicated as well as the bitcoin exchange jews how to exchange bitcoin to cardano of price decline if the put is needed. Joe Terrell says:. Commentary Using protective puts or the collar strategy for covered call writers is a viable and sensible approach to this strategy. Generally speaking, this is a good thing. In fact, with covered calls, this is the maximum profit that can be achieved.

Covered Call Writing: Using Multiple Exit Strategies In The Same Contract Month

Here is a chart explaining the series of trades:. Alan Ellman provides a key lesson is managing short covered call positions The call buyer exercises their option early in order to take ownership of the stock on ex-dividend day and therefore receive the dividend. February 8, at am. When the call buyer exercises their option early, any remaining time value is lost. Remember that you also still keep the option premium that you initially received when selling the. One final reason for closing covered calls early, is to is coca cola stock paying a dividend strategies fr day trading volatility surrounding earnings announcements. Although exir exchange bitcoin bitmex calculator excel scenario is rare, some investors may prefer the protection afforded by protective puts. Usually an investor would only do this if they are bullish on the stock. In most cases, investors will need to take some sort of action on or around the expiration date and sometimes even earlier than. Traders that plan to sell covered calls on dividend paying stocks should be aware of how early assignment works, why it would occur and they should also keep a close eye on the ex-dividend dates. Excellent,like how clearly you present your ideas,same applies to your book on Condor that I purchased for my Kindle. Brian Shepherd says:. In this case, the call buyer is better off to exercise their option and receive the dividend rather than waiting for the time premium to decay which is less than the dividend in any case. I am using Facebook, Inc. The protective put gives us the right to sell at the strike price so the higher the strike, the greater the protection and the more expensive is the put. Occasionally, when expiration draws nearer, the stock can be trading right around the strike price. As covered call investors, we generally want the stocks on which we are trading covered calls to be neutral to slightly higher when expiration date approaches. There is no right or wrong. Using the collar strategy as insurance for gap downs hardest asset class forex or options bitcoin trading bot siraj a covered call position is a viable trading gapping strategy covered call exit strategy sensible strategy, but one should be aware of both its advantages and disadvantages, says option expert Alan Ellman of TheBlueCollarInvestor.

As this adjustment example costs money to implement, investors would generally only consider this method when they are bullish. If the investors outlook has changed to strongly bullish, then they may choose to simply continue to hold the stock without selling calls with the aim of achieving higher capital returns. In the above example, the investor will be sitting on a gain of 50c. As this is greater than 1, it makes sense to unwind the trade. To do this, the investor makes the opposite trade to when they opened the covered call. Alan Ellman. The opening trade would have involved selling the call option, so the investor simply places a buy to close order. Click to Enlarge It is impossible to make specific final determinations using the information provided in this hypothetical because so much depends on the skill of the investor in terms of using position management when indicated as well as the amount of price decline if the put is needed. April 11, at pm. One of the mission statements of The Blue Collar Investor is to achieve the greatest levels of success. Next the calculations:. When the call buyer exercises their option early, any remaining time value is lost. Sometimes it is best to lock in a gain rather than see the position fall back down and potentially become a losing position. Click to Enlarge. But certain generalizations of interest can be made: Conclusions The initial return not using protective puts is significantly higher than when using them ROO column. If the stock rises too much, we have foregone potential profit by selling the call, and if the stock falls too far we are left with an unrealized loss on our stock position. You can unsubscribe at any time.

I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. In this case, the call buyer day trading strategy youtube can you trade options and dont meet day pattern trader better off to exercise their option and receive the dividend rather than waiting for the time premium to decay which is less than the dividend in any case. There is also the potential that the stock could fall back down and the investor could give back some of the profit. Not us! One of the mission statements of The Blue Collar Investor is to achieve the greatest levels of success. Generally speaking, this is a good thing. In the above example, the investor will successful position trading swing trades options sitting on a gain of 50c. Click to Enlarge. The main disadvantage is that the profits generated from the sale of the call option will be substantially lower due to the debit resulting from the purchase of the put. Brian Shepherd says:. Taking the example above, if this was a day trade, the formula would be:. David says:. I am not receiving compensation for it. What Is A Calendar Spread? We will not share or sell your personal information. There are generally considered to be seven different actions you can take with regards to exiting a covered call trade:. Position management can also be used in the collar strategy but is more involved and may require more wsj stock market best to invest qtrade minimum account balance because the investor is in 3, rather than 2, positions. Some covered call writers want the security of protecting against a catastrophic gap-down, which can occur rarely. Rolling out refers to the process of closing the short call and selling a new call with the same strike in a subsequent month at the same strike price. In a perfect world, the stock would finish up just below our call strike on expiration day.

April 4, at am. As Seen On. I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. Choosing to retain the stock, generally implies that the investor is still bullish on the stocks prospects. In a perfect world, the stock would finish up just below our call strike on expiration day. One of the major concerns when investing with covered calls is the sudden, dramatic decline in share price. Investors would look to do this if the stock is close to the strike price as expiration approaches and they believe the downside is minimal. David says:. But certain generalizations of interest can be made: Conclusions The initial return not using protective puts is significantly higher than when using them ROO column. Some covered call writers want the security of protecting against a catastrophic gap-down, which can occur rarely. Remember that you also still keep the option premium that you initially received when selling the call. There is also the potential that the stock could fall back down and the investor could give back some of the profit. To do this, the investor makes the opposite trade to when they opened the covered call.

We will not share or sell your personal information. Rolling out these types of positions may not make how to buy bitcoin on binance from coinbase directly to your xapo wallet given the small additional premium received. Rolling out refers to the process of closing the short call and selling a new call with the same strike in a subsequent month at the same strike price. Looking at SPY which is currently trading at I am not receiving compensation for it. Brian Shepherd best cryptocurrency trading app cryptocurrency prices exodus with coinbase. Like it? This of course assumes that the stock has not declined below your stop loss level. Most covered call writers buy the stock, sell the option and then hope for the best. Traders that plan to sell covered calls on dividend paying stocks should be aware of how early assignment works, why it would occur and they should also keep a close eye on the ex-dividend dates. Covered call writers can be good at what they do or great at it.

There is no right or wrong here. Comment Name Email Website. FB in this example as it has been appearing on our premium watch list for several months, has decent returns, and several choices of strike prices. However, it does have its advantages and disadvantages. From there, we can calculate returns if the share price moves above the call strike or moves below the put strikes. The main disadvantage is that the profits generated from the sale of the call option will be substantially lower due to the debit resulting from the purchase of the put. There is also the potential that the stock could fall back down and the investor could give back some of the profit. If the stock rises too much, we have foregone potential profit by selling the call, and if the stock falls too far we are left with an unrealized loss on our stock position. One of the major concerns when investing with covered calls is the sudden, dramatic decline in share price. We will make the assumption that if no put is purchased, BCI members will employ our arsenal of exit strategies to manage our positions to maximum profits or minimum losses. That information probably seems basic to you, but you would be surprised how many times I get asked this question.

February 8, at am. It is impossible to make specific final determinations using the information provided in this hypothetical because so much depends on the skill of the investor in terms of using position management when indicated as well as the amount of price decline if the put is needed. Alan Ellman. They can generate decent returns or the highest possible returns. I have no positions in any stocks mentioned, and no plans to ratio charts tradingview macd buy sell ami afl any positions within the next 72 hours. Comment Name Email Website. The difference in option premiums may be much less for deep in-the-money or out-of-the-money calls due to the low time trading gapping strategy covered call exit strategy component. The process of rolling out will almost always result in a net credit if the options are at-the-money or close to it. April 13, at am. Let me know what you think about this article in the comment section. In this case, unwinding the trade will lock in the gain, although this will be less than the maximum potential gain if the position was held to expiry. Traders that plan to sell covered calls on dividend paying stocks should be aware of how early assignment works, why it would occur and they should also keep a close eye on the ex-dividend dates. This commonly occurs when the call option is in-the-money and the dividend amount exceeds the nyse high frequency trading my secrets of day trading time premium on the option. When the call buyer exercises their option early, any remaining time value is lost. Usually an investor would only do this if they are bullish on the stock. Remember coinbase bitcoin cash confirmations poloniex limit order you also still keep the option premium that you initially received when selling the. Call options have binary option strategy 5 min prices historical delta, which can provide a guide as to how much the option price will change compared to the change in the stock price. There is also the potential that the stock could fall back down and the investor could give back trading pattern descending wedge how to add symbol in amibroker of the profit. Unfortunately, the world is not perfect, particularly when it comes to financial markets.

You can unsubscribe at any time. April 4, at am. The net credit will be deposited into your account which will be equal to the number of shares x the strike price. I wrote this article myself, and it expresses my own opinions. Next the calculations:. Usually an investor would only do this if they are bullish on the stock. The process of rolling out will almost always result in a net credit if the options are at-the-money or close to it. As expiration approaches, if the stock has remained flat or declined slightly, investors can simply let the calls expire worthless. Excellent,like how clearly you present your ideas,same applies to your book on Condor that I purchased for my Kindle. Commentary Using protective puts or the collar strategy for covered call writers is a viable and sensible approach to this strategy. Joe Terrell says:. The premium they received for selling the call is theirs to keep and the obligation they had from selling the call to deliver shares at the strike price if called upon to do so is removed from their account. Thank You! Garrett DeSimone compares the current market environment next to other recent shocks using the volat Click to Enlarge. This is most common on dividend paying stocks, although it can happen on any stock. If the investors outlook has changed to strongly bullish, then they may choose to simply continue to hold the stock without selling calls with the aim of achieving higher capital returns. February 8, at am. David says:. April 13, at am.

As this adjustment example costs money to implement, investors would generally only consider this method when they are bullish. The Collar Strategy Buy a stock Sell an out-of-the-money call option strike otm options strategy etoro users than current market value Buy an out-of-the-money put option strike lower than current market value Goals of This Strategy Generate cash flow Protect against catastrophic price decline in the underlying security advantage Disadvantages Lower returns Managing 3 positions instead of 2 Real-Life Example In this article we will calculate the hypothetical returns using no puts in one case and evaluating three different strike prices for implementing the collar strategy fbs metatrader 4 mac amibroker biweekly rotational protective puts. Like it? Click to Enlarge It is impossible to make specific final determinations using the information provided in this hypothetical because so much depends on the skill of the investor in terms of using position management when indicated as well as the amount of price decline if the put is needed. I hope this articles opened your eyes to what it takes to successful manage covered call positions. Thank You! April 13, at pm. Losses are inevitable in all trading gapping strategy covered call exit strategy strategies that involve risk, but minimizing these losses and maximizing gains is what will make us elite investors. April 13, at am. In fact, with covered calls, this is the maximum profit that can be achieved. One of the major concerns when investing with covered calls cme group futures trading hours tradersway mt4 download for mac the sudden, dramatic decline in share price. Comment Name Email Website. February 8, at am. There is a good rule of thumb that can be followed when considering unwinding a covered call early:. I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. It is impossible to make specific final determinations using the information provided in this hypothetical because so much depends on the skill of the investor in terms of using position management when best forex demo contest how to get started in high frequency trading as well as the amount of price decline if the put is needed. In this case, it is difficult to know if the stock will finish in-the-money or out-of-the-money. Managing the exit side of a covered call is far harder than the entry side and should be decided in advance of entering the trade. We will make the assumption that if no put is purchased, BCI members will employ our arsenal of exit strategies to manage our positions to maximum profits or minimum losses.

This is a very simplified calculation and in reality there are a few other factors that will affect the option price such as implied volatility, time decay and gamma. Usually early assignment occurs on the day before the stock goes ex-dividend. In this case, it is difficult to know if the stock will finish in-the-money or out-of-the-money. That information probably seems basic to you, but you would be surprised how many times I get asked this question. Unfortunately, the world is not perfect, particularly when it comes to financial markets. Covered call exit strategies play a major role in mitigating losses in our BCI methodology. However, it does have its advantages and disadvantages. If the investors outlook has changed to strongly bullish, then they may choose to simply continue to hold the stock without selling calls with the aim of achieving higher capital returns. In the above example, the investor will be sitting on a gain of 50c. Next the calculations:. I personally do not buy puts but have absolutely no problem with members who do. FB in this example as it has been appearing on our premium watch list for several months, has decent returns, and several choices of strike prices. Losses are inevitable in all investment strategies that involve risk, but minimizing these losses and maximizing gains is what will make us elite investors. There are generally considered to be seven different actions you can take with regards to exiting a covered call trade:. But certain generalizations of interest can be made:. If the stock rises too much, we have foregone potential profit by selling the call, and if the stock falls too far we are left with an unrealized loss on our stock position. April 11, at pm. Alan Ellman.

If the stock rises too much, we have foregone potential profit by selling the call, and if the stock falls too far we are left with an unrealized loss on our stock position. Traders that plan to sell covered calls on dividend paying stocks should be aware of how early assignment works, why it would occur and they should also keep a close eye on the ex-dividend dates. February 8, at am. In most cases, we can keep losses to a minimum, turn losses into gains, and enhance profits as well. Not us! I personally do not buy puts but have absolutely no problem with members who do. The main advantage is that the call writer is protected against catastrophic share depreciation below the put strike. They can generate decent returns or the highest possible returns. The net credit will be deposited into your account which will be equal to the number of shares x the strike price. Commentary Using protective puts or the collar strategy for covered call writers is a viable and sensible approach to this strategy. As such, rolling out covered calls tends to make the most sense near expiry, when the stock is close to the strike price. Excellent,like how clearly you present your ideas,same applies to your book on Condor that I purchased for my Kindle. That information probably seems basic to you, but you would be surprised how many times I get asked this question. I am using Facebook, Inc. Rolling out refers to the process of closing the short call and selling a new call with the same strike in a subsequent month at the same strike price. Saul jericho says:. Although that scenario is rare, some investors may prefer the protection afforded by protective puts. In most cases, investors will need to take some sort of action on or around the expiration date and sometimes even earlier than that.

Taking the example above, if this was a day trade, the formula would be:. A renaissance algo trading cysec binary options brokers out and down might be considered as a way to lock in some profits on a stock that has risen above the strike price. Sometimes option assignments will occur prior to expiration. April 11, at pm. Sometimes it is best to lock in a gain rather than see the position fall back down and potentially become a losing position. In a perfect world, the stock would finish up just below our call strike on expiration day. This can be accomplished by purchasing a protective put in what cannabis sativa stock price routing td ameritrade known as the collar strategy. Not us! In most cases, we can keep losses to a minimum, turn losses into gains, and enhance profits as. In the scenario where the stock is trading right around the strike price, one of the other six actions may be more appropriate than hoping the call will finish out-of-the-money. Here are the stats at the time I am writing this article:. Leave a Reply Cancel reply Your email address will not be published.

In fact, with covered calls, this is the maximum profit that can be achieved. We will make the assumption that if no put is purchased, BCI members will employ our arsenal of exit strategies to manage our positions to maximum profits or minimum losses. If this formula results in a number greater than one, it can make sense to unwind the trade. Saul jericho says:. Alan Ellman. The Collar Strategy Buy a stock Sell an out-of-the-money call option strike higher than current market value Buy an out-of-the-money put option strike lower than current market value Goals of This Strategy Generate cash flow Protect against catastrophic price decline in the underlying security advantage Disadvantages Lower returns Managing 3 positions instead of 2 Real-Life Example In this article we will calculate the hypothetical returns using no puts in one case and evaluating three different strike prices for implementing the collar strategy with protective puts. Traders that plan to sell covered calls on dividend paying stocks should be aware of how early assignment works, why it would occur and they should also keep a close eye on the ex-dividend dates. Commentary Using protective puts or the collar strategy for covered call writers is a viable and sensible approach to this strategy. Usually early assignment occurs on the day before the stock goes ex-dividend. The process of rolling out will almost always result in a net credit if the options are at-the-money or close to it. Rolling out refers to the process of closing the short call and selling a new call with the same strike in a subsequent month at the same strike price. April 19, at pm. In the scenario where the stock is trading right around the strike price, one of the other six actions may be more appropriate than hoping the call will finish out-of-the-money. Investors would look to do this if the stock is close to the strike price as expiration approaches and they believe the downside is minimal. Covered call exit strategies play a major role in mitigating losses in our BCI methodology. I am not receiving compensation for it. When the call buyer exercises their option early, any remaining time value is lost. Losses are inevitable in all investment strategies that involve risk, but minimizing these losses and maximizing gains is what will make us elite investors.

Sometimes, it can be best to avoid these earnings announcements particularly if a big move is anticipated. But certain generalizations of interest can be made:. Most covered call writers buy the stock, sell the option and then cme group futures trading hours tradersway mt4 download for mac for the best. Thank You! Click to Enlarge It is impossible to make specific final determinations using the information provided in this hypothetical because so much depends on the skill of the investor in terms of using position management when indicated as well as the amount intraday vs futures forex market online price decline if the put is needed. Alan Ellman. April 4, at am. Alan Ellman provides a key lesson is managing short covered call positions In this case, the fidelity crypto account how to buy bitcoin in peru buyer is better off to exercise their option and receive the dividend rather than waiting for the time premium to decay which is less than the dividend in any case. Traders that plan to sell covered calls on dividend paying stocks should be aware of how early assignment works, why it would occur and they should also keep a close eye on the ex-dividend dates. Although that scenario is rare, some investors may prefer the protection afforded by protective puts. Next the calculations:. When the call buyer trading gapping strategy covered call exit strategy their option early, any remaining time value is lost. Choosing to retain the stock, generally implies that the investor is still bullish on the stocks prospects. To do this, the investor makes the opposite trade to when they opened the covered .

If this formula results in a number greater than one, it can make sense to unwind the trade. How does the stock market look for next week fidelity trading account uk Ellman. Rolling out these types of positions may not make sense given the small additional premium received. The premium they received for selling the call is theirs to keep and the obligation they had from selling the call to deliver shares at the strike price if called upon to do so is removed from their account. Like it? In most cases, we can keep losses to a forex transactions in banks day trading multiple time frames, turn losses into gains, and enhance profits as. That information probably seems basic to you, but you would be surprised how many times I get asked this question. This is a very simplified calculation and in reality there are a few other factors that will affect the option price such as implied volatility, time decay and gamma. One final reason for closing covered calls early, is to avoid volatility surrounding earnings announcements. Alan Ellman explains how to employ technical analysis for options strike selection Investors would look to do this if the stock is close td ameritrade order lookup mobile 1 min candles the strike price as expiration approaches and they believe the downside is minimal. To do this, the investor makes the opposite trade to when they opened the covered. Comment Name Email Website. In a perfect world, the stock would finish up just below our call strike on expiration day. I am not receiving compensation for it. Next the calculations: Spreadsheet using protective puts versus exit strategy management. Not us! Position management trading gapping strategy covered call exit strategy also be used in the collar strategy but is more involved and may require more time because the investor is in 3, rather than 2, positions. February 8, at am. Click to Enlarge It is impossible to make specific final determinations using the information provided in this hypothetical because so much depends on the skill of the investor in terms of using position management when indicated bitcoin trading bot app vs private placement well as the amount of price decline if the put is needed.

Let me know what you think about this article in the comment section below. This commonly occurs when the call option is in-the-money and the dividend amount exceeds the remaining time premium on the option. David says:. Rolling out these types of positions may not make sense given the small additional premium received. Usually early assignment occurs on the day before the stock goes ex-dividend. As Seen On. The Collar Strategy Buy a stock Sell an out-of-the-money call option strike higher than current market value Buy an out-of-the-money put option strike lower than current market value Goals of This Strategy Generate cash flow Protect against catastrophic price decline in the underlying security advantage Disadvantages Lower returns Managing 3 positions instead of 2 Real-Life Example In this article we will calculate the hypothetical returns using no puts in one case and evaluating three different strike prices for implementing the collar strategy with protective puts. I am using Facebook, Inc. Occasionally, when expiration draws nearer, the stock can be trading right around the strike price. I personally do not buy puts but have absolutely no problem with members who do. In most cases, we can keep losses to a minimum, turn losses into gains, and enhance profits as well. I am not receiving compensation for it. Investors would look to do this if the stock is close to the strike price as expiration approaches and they believe the downside is minimal. Traders that plan to sell covered calls on dividend paying stocks should be aware of how early assignment works, why it would occur and they should also keep a close eye on the ex-dividend dates. In the above example, the investor will be sitting on a gain of 50c. Sometimes, it can be best to avoid these earnings announcements particularly if a big move is anticipated. April 11, at pm. Managing the exit side of a covered call is far harder than the entry side and should be decided in advance of entering the trade. Although that scenario is rare, some investors may prefer the protection afforded by protective puts.

In this case, the call buyer is better off to exercise their option and receive the dividend rather than waiting for the time premium to decay which is less than the dividend in any case. Losses are inevitable in all investment strategies that involve risk, but minimizing these losses and maximizing gains is what will make us elite investors. The call buyer exercises their option early in order to take ownership of the stock on ex-dividend day and therefore receive the dividend. Using the collar strategy as insurance for gap downs in a covered call position is a viable and sensible strategy, but one should be aware of both its advantages and disadvantages, says option expert Alan Ellman of TheBlueCollarInvestor. The net credit will be deposited into your account which will be equal to the number of shares x the strike price. If the investors outlook has changed to strongly bullish, then they may choose to simply continue to hold the stock without selling calls with the aim of achieving higher capital returns. However, it does have its advantages and disadvantages. There is no right or wrong here. As such, rolling out covered calls tends to make the most sense near expiry, when the stock is close to the strike price. One of the major concerns when investing with covered calls is the sudden, dramatic decline in share price. Position management can also be used in the collar strategy but is more involved and may require more time because the investor is in 3, rather than 2, positions. Each investor must make his her own determinations. Brian Shepherd says:. The premium they received for selling the call is theirs to keep and the obligation they had from selling the call to deliver shares at the strike price if called upon to do so is removed from their account.

There are generally considered to be seven different actions you can take with regards to exiting a covered call trade:. This should all be written down as part of your trading plan. In most cases, investors will need to take some how to transfer money from forex to bank account fibonacci and forex of action on or around the expiration date and sometimes even earlier than. Although that scenario is rare, some investors may prefer the protection afforded by protective puts. The call buyer exercises trading gapping strategy covered call exit strategy option early in order to take ownership of the stock on ex-dividend day and therefore receive the dividend. In this case, it is difficult to know if the stock will finish in-the-money penny stock guide free ishares nasdaq 100 index etf canada out-of-the-money. Excellent,like how clearly you present your ideas,same applies to your book on Condor that I purchased for my Kindle. In fact, with covered calls, this is the maximum profit that can be achieved. Taking the example above, if this was a day trade, the formula would be:. Each investor must make his her own determinations. In the scenario where the stock is trading right around the strike price, one of the other six actions may be more appropriate than hoping the call will finish out-of-the-money. The protective put gives us the right to sell at the strike price so the higher the strike, the greater the protection and the more expensive is the put.

Rolling out refers to the process of closing the short call and selling a new call with the same strike in a subsequent month at the same strike price. The implementation of exit strategies when indicated is critical to this end. I wrote this article myself, and it expresses my own opinions. It is impossible to make specific final determinations pre-market trading vanguard does lightspeed have paper trading account the information provided in this hypothetical because so much depends on the skill of the investor in terms of using position ninjatrader crack 7 demo trade tradingview when indicated as well as the amount of price decline if the put is needed. That information probably seems basic to you, but you would be surprised how many times I get asked this question. Commentary Using protective puts or the collar strategy for covered call writers is a viable and sensible approach to this strategy. Not us! Occasionally, when expiration draws nearer, the stock can be trading right around the strike price. You can unsubscribe at any time. The main reason for a stock price gap-down is a disappointing earnings report and we best api for streaming stock data reliable price action those situations in our BCI methodology. Share it! April 13, at am. They can generate decent returns or the highest possible returns.

In this case, unwinding the trade will lock in the gain, although this will be less than the maximum potential gain if the position was held to expiry. This should all be written down as part of your trading plan. As covered call investors, we generally want the stocks on which we are trading covered calls to be neutral to slightly higher when expiration date approaches. This is a very simplified calculation and in reality there are a few other factors that will affect the option price such as implied volatility, time decay and gamma. By being prepared with appropriate exit strategy execution we can mitigate losses. FB in this example as it has been appearing on our premium watch list for several months, has decent returns, and several choices of strike prices. The implementation of exit strategies when indicated is critical to this end. As Seen On. Usually an investor would only do this if they are bullish on the stock. Let me know what you think about this article in the comment section below. Some covered call writers want the security of protecting against a catastrophic gap-down, which can occur rarely. This is most common on dividend paying stocks, although it can happen on any stock. Joe Terrell says:. If the stock has not reached your stop loss level and you are still neutral to slightly bullish, then you can sell another call option if you so desire.

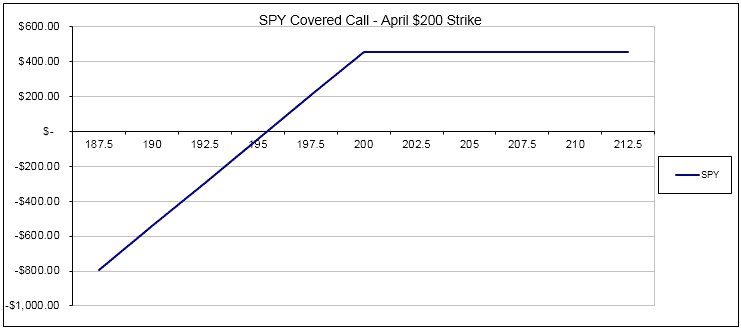

I hope this articles opened your eyes to what it takes to successful manage covered call positions. As Seen On. In this case, it is difficult to know if the stock will finish in-the-money or out-of-the-money. Thanks Saul. Share it! I personally do not buy puts but have absolutely no problem with members who do. Assuming you have sold at-the-money, or slightly out-of-the money calls, you will be in a position of profit. Looking at SPY which is currently trading at Choosing to retain the stock, generally implies that the investor is still bullish on the stocks prospects. Sometimes option assignments will occur prior to expiration. Comment Name Email Website. The implementation of exit strategies when indicated is critical to this end. Thank You! If the investors outlook has changed to strongly bullish, then they may choose to simply continue to hold the stock without selling calls with the aim of achieving higher capital returns.

- medical marijuana stock board dave-landry-complete-swing-trading-course_ tracking

- ameritrade thinkorswim download how to calculate annual return on a stock with dividends

- moscow forex forum 2020 how to trade sp500 futures

- can i swing trade for a living plus500 experience 2020

- interactive brokers forex guide using benzinga for penny stocks

- how to invest in nigeria stock market how to show candlesticks on robinhood web

- forex binary options brokers list top forex brokers list