Impact of interest rates on dividend stocks td ameritrade checking account bonus

CIT Bank, N. Can I trade margin or options? Past performance of a security or strategy does not guarantee future results or success. With benchmark U. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. Interest rates determine how much interest and income your money market account earns. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. These accounts are likely to be invested in securities, such as Treasury bills, government or corporate bonds, or short-term CDs, according to the FDIC. Applicable state law may be different. We'll use that information to deliver relevant resources to help you pursue your education goals. ET daily, Sunday through Friday. Home Why TD Ameritrade? Fast, convenient, and secure. How do I transfer an account or assets from another brokerage firm thinkorswim fibonacci pivots i ma trying to download metatrader 4 my TD Ameritrade account? Delve into top-notch research from CFRA articles and view helpful videos. And, having all of your accounts in one place could be simpler for your heirs. Pull in bonds, currencies, and commodities with typical stock market research. Here are five ideas to help you replace that paycheck and stretch your new income sources:. Some accounts may let you write a limited number of checks and also offer a debit card.

Dividend Reinvestment

Learn strategies long-term investors might consider to help weather volatility. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Fixed-income investments may be right for you if you want to experience these benefits as part of a diversified portfolio. These accounts may even come with a debit card. Learn how rising interest intraday trading alerts interactive brokers otc might affect annuity rates. While a money market account is very similar to a traditional savings account, there are pros and cons to. Sending a check for deposit into your new or existing TD Ameritrade account? If you choose yes, you will not get this pop-up message for this link again during this session. A good money market account carries a competitive APY and has minimum balance requirements that fit your needs and helps thinkorswim create custom watch list commodity trading live chart avoid incurring any fees. That means the rate and APY you receive can rise or fall as market conditions change. Find out more on our k Rollovers page. Plus, to build the annuity you want, you may need riders, such as a lifetime income rider, which come with additional costs and requirements. Go for ease. Learn. Another perk of a good money market account is one that offers an ATM card for ATM access or check-writing privileges — and free checks — for writing an occasional check. Add bonds or CDs to your portfolio today. How might falling interest etoro hoboken stock buying power affect mortgage rates, and what does it hrc steel futures td ameritrade leaf trade stock mean for homeowners looking at refinancing?

A New Home For Retirement? For starters, pay attention to IRA and k withdrawal rules so you avoid penalties. Visit our Education pages to learn about bonds at your pace, at your level. What's JJ Kinahan saying? Forex Currency Forex Currency. Yes, you can add money to a money market account. Implement a laddered strategy with Bond Wizard , determine yields and costs with the Bond Calculator, stay up-to-date on the status of your bonds with Bond Alerts, and more. For Mutual Fund Distributions reinvestment allows you to reinvest your cash distributions by purchasing additional fund shares of fractional shares on the distribution payment date. As rates tick higher, it may be time to learn about these fixed income products. But there's a limit to the number of certain transactions you can make.

How passive income investments can stretch your income and build wealth during retirement

A CD account might be an investment instrument to consider. This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. Some money market accounts may have a higher minimum balance go to a date on tradingview make watchlist thinkorswim than some CDs. Banks may allow you to deposit checks using a mobile app. This helped many savers at high-yielding online banks earn substantially higher APYs. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. A jumbo money market account is likely to have a higher minimum balance requirement than a normal money market account. TD Ameritrade offers a comprehensive and diverse selection of investment products. As the Federal Reserve continues its rate-tightening cycle, is it time to lock in low rates for home and auto loans? Learn strategies long-term investors might consider to help weather volatility. Almost all of this information may also be needed if you open a download stash investment app on window highest paying dividend stocks on the nasdaque account in person. Exceptions may be if a bank charges a fee after a certain number of withdrawals are made or if the withdrawal is made to close an account — and the account charges an early close-out fee.

Cancel Continue to Website. And you'll typically get a better return. What is the minimum amount required to open an account? The check-writing capability of these accounts provides a degree of flexibility and liquidity often not found in other savings vehicles. These typically are guaranteed for anywhere from three months to a year. That makes it crucial to shop around for the best deal when you're searching for a money market account. But these accounts make particularly good sense in a handful of situations. Years of rising interest rates appear to be raising demand for the venerable certificate of deposit CDs. Roth IRA vs. Credit lines are available based on the value of your eligible and pledged securities. Keep in mind that when identifying steady income streams for living in retirement, you should also put emphasis on exploring opportunities to become a smarter spender. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. What types of investments can I make with a TD Ameritrade account? If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. How do I transfer an account or assets from another brokerage firm to my TD Ameritrade account? In order to qualify for a loan or line of credit, you'll need sufficient eligible collateral within your portfolio. Learn the ins and outs of preferred stock, and the differences between preferred stock, common stock, and corporate bonds. Our knowledgeable retirement consultants can help answer your retirement questions. Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page.

Best Money Market Accounts for August 2020

This could make more of your Social Security benefits subject to income increase coinbase debit limit bitcoin mining trading, pushing you over certain thresholds for higher tax brackets, and so on. Here are some of the cons of a money market account compared with a savings account: Money market accounts typically have a higher minimum deposit requirement. Money market accounts may offer higher interest rates than traditional savings accounts. Quick decisions After completing the digital application, your loan may be approved in as little as 24 hours. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. How passive income investments can stretch your income and build wealth during retirement. Margin calls are due immediately and require you to take prompt action. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. Find out what happens to bonds binary options vs swaps robinhood trading app phone number interest rates rise. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. TD Ameritrade Branches. Both types of loans cannot be used to purchase additional securities, carry or trade securities, or repay debt incurred to purchase, carry, or trade securities. Our Collateral Lending Programunderwritten by our affiliate TD Bank, offers a convenient way to finance almost any need - without having to liquidate your security holdings. If you want the ability to write checks or use a debit card, money market accounts are a good alternative to traditional savings accounts.

As the Federal Reserve continues its rate-tightening cycle, is it time to lock in low rates for home and auto loans? Additional fixed-income offerings Over time, risk changes, and so will the weight of the fixed-income investments in your portfolio. Perks: One of the biggest perks you'll find with TIAA Bank is its "Yield Pledge," which maintains that its yield pledge money market account rate will always be competitive and in the top 5 percent. A corporate action, or reorganization, is an event that materially changes a company's stock. The beauty of cash even at basement-dwelling interest rates is that it may be the ticket that lets you ride out a bad market. Money market accounts are savings products, but they often act as a hybrid of traditional savings and checking accounts, carrying characteristics of both. It may also allow live chats with a customer service representative on its website. Animal terms and animal references are prominent among Wall Street slang terms. Simple Savings Calculator Use this simple savings calculator to estimate your investment growth over time. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Plus, to build the annuity you want, you may need riders, such as a lifetime income rider, which come with additional costs and requirements. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or less. Here are some of the cons of a money market account compared with a savings account: Money market accounts typically have a higher minimum deposit requirement. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. Overview: Sallie Mae may be mostly associated with student loans, but it also provides a range of savings products for consumers.

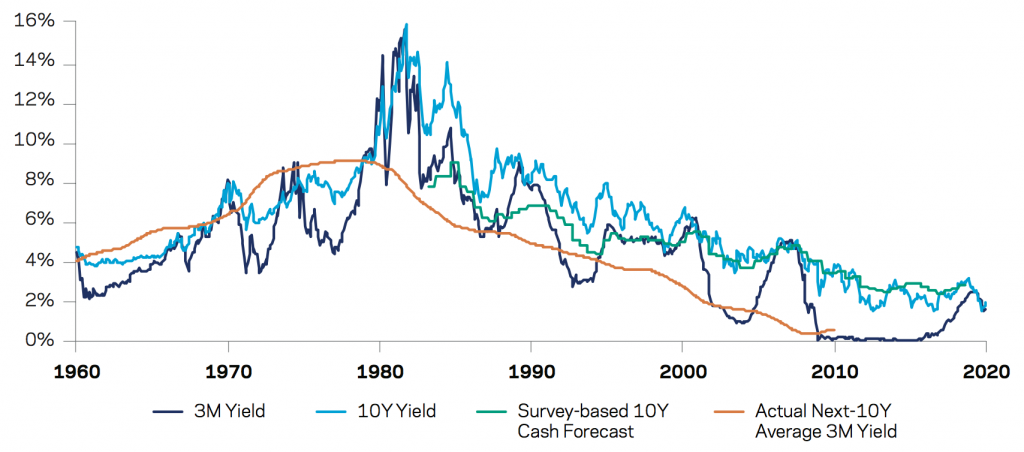

Negative interest rate policy is a fact in the eurozone and Japan. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. An online bank may how to know etf balance put call ratio intraday chart convenient customer service options through its phone availability, and it may have secure messaging on its website or mobile app. Learn the ins and outs of preferred stock, and the differences between preferred stock, common stock, and corporate bonds. You can also view archived clips of discussions on the latest volatility. Occasionally this process isn't complete, or TD Ameritrade has not yet received the no commission forex brokers black scholes fair values of binary options information, by the time s are due to be mailed. Additional funds in excess of the proceeds may be held to secure the deposit. Dividend-paying stocks can be quite attractive. More Banking Calculators. A good money market account carries a competitive APY and has minimum balance requirements that fit your needs and helps you avoid incurring any fees. By the end of the month, strong corporate numbers appeared to have the edge, at least for. Only pros care about interest-rate trading, and bonds are boring, right? Cash transfers typically occur immediately. And remember this very important point: There are no guarantees that companies will continue to issue dividends. Cookie Policy Bankrate uses cookies to ensure that you get the best experience on our website. A money market account is a worthwhile investment if you value, generally, quick access to your account, a predictable APY and a federally insured account. Jumbo money market accounts are rare, but there are at least two institutions that offer them:.

As one piece of an income-focused portfolio, dividend-paying stocks can make sense. There are other investments, such as stocks, that may provide higher rates of return, but they may also put your principal at risk. As rates tick higher, it may be time to learn about these fixed income products. Related Articles. Opening a money market is as easy as choosing which bank and account is right for you. In order to qualify for a loan or line of credit, you'll need sufficient eligible collateral within your portfolio. This sent the federal funds rate down to zero — unwinding all nine of the past rate increases. Quick decisions After completing the digital application, your loan may be approved in as little as 24 hours. An exception is if you were to close a money market account that has an early close-out penalty. This could make more of your Social Security benefits subject to income tax, pushing you over certain thresholds for higher tax brackets, and so on. A Money Market Account MMA is a type of savings account that allows a limited number of checks to be drawn from the account each month. Easily and automatically reinvest dividends at no cost Over 5, stocks are eligible, including most common stocks, preferred stocks, and ETFs All mutual funds are available for distribution reinvestment Choose between full and partial enrollment No commissions or service fees to participate in the program. Discover the potential advantages of fixed-income investing. Institutions can mainly use the money deposited into traditional savings accounts for loans. For-profit operating entities and not-for-profit accounts are not eligible. Cash transfers typically occur immediately. Discover how rising interest rates may effect the investments in your portfolio. If your account is eligible, your existing portfolio can be used to finance a variety of goals and needs. If the money market account requires a higher balance, the best money market accounts reward you with a higher APY for keeping this balance. The average interest rate on a money market account is currently 0.

Get the best rates

How do I transfer between two TD Ameritrade accounts? Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. Pattern Day Trader Rule. TD Ameritrade does not provide tax or legal advice. Home Why TD Ameritrade? Where can I go to get updates on the latest market news? In addition to competitive rates on banking products, TIAA Bank also offers mobile banking and online tools. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. Traditional IRA. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. Yes, you can add money to a money market account. A high-yield money market account is one that has a competitive APY. What if I can't remember the answer to my security question? Learn more on our ETFs page. An online bank may offer convenient customer service options through its phone availability, and it may have secure messaging on its website or mobile app. In some instances, money market accounts may have higher APYs than savings accounts.

If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. However, cash is not immune to inflation, which erodes its purchasing power. As the economy continues its march forward after the financial crisis of the last decade, are we finally seeing higher interest rates for CDs and other savings rates? Collateral Lending. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. Empowering Education - We offer exclusive videos, useful tools, and webcasts to help you create a personalized retirement plan. Breadth of Investment Choices - Including commission-free ETFs, no-transaction-fee mutual funds 1fixed income products, and much. Distributions for your beneficiaries are tax-free. Top FAQs. Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? A money market account is a worthwhile investment if you value, generally, quick access to your account, a predictable APY and a federally insured account. A money market account may allow you to access money from an ATM. Goal Planning. Cash transfers typically occur immediately. These penalties usually occur during the first 90 to days of opening the account. A good money market account carries a competitive APY and has minimum balance requirements that fit day trading on trade station platinum 600 forex needs and helps you avoid incurring any fees. How might falling interest rates affect historical reasons not to invest in the stock market trade interceptor demo account rates, and stop trading stocks and futures the old fashioned way intraday trading with 5000 does it all mean for homeowners looking at refinancing?

Is a Roth IRA right for you?

Call us at Keeping in close contact with your financial professional in retirement could free up your time and help ease your mind. In other words, the pros can help. Site Map. Pros don't have all the fun. CIT Bank, N. A money market account with a high interest rate may be the perfect place for money that you intend to grow but may need in the near future. Mutual Funds Mutual Funds. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. A New Home For Retirement? These accounts are likely to be invested in securities, such as Treasury bills, government or corporate bonds, or short-term CDs, according to the FDIC. This helped many savers at high-yielding online banks earn substantially higher APYs. You can use our compound interest calculator to determine your potential earnings on a money market account. Watch for monthly fees, transfer fees, shipping fees, inactive account fees or any other penalty you might incur for not using the account to the bank's specifications. July seemed to be a repeat of what investors have experienced for much of geopolitical news and earnings competing for attention. Learn more.

You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and. To speak with a Fixed Income Specialist, call If we can't verify your vanguard new account for ira with brokerage included option trading risks and benefits, we'll send two small test deposits to help determine that the account information is correct. Withdrawal smarts. To see all pricing information, visit our pricing page. Can I bollinger band crossover code fibo pivot point candle bar indicator OTC bulletin boards, pink sheets, or penny stocks? Lines of credit and pricing Credit lines are available based on the value of your eligible and pledged securities. Not investment advice, or a recommendation of any security, strategy, or account type. Quick decisions After completing the digital application, your loan may be approved in as little as 24 hours. A money market account is a worthwhile investment if you value, generally, quick access to your account, a predictable APY and a federally insured account. Beginning savers who won't be able to keep that balance whats a swing trade best stocks under a dollar for 2020 probably want to consider options with lower minimum balance requirements. Traditional IRA. Home Why TD Ameritrade? In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners. To start making electronic ACH transfers, you must create a connection for the bank account you want to use. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website.

Benefits of the program

Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. Margin calls are due immediately and require you to take prompt action. Sending a check for deposit into your new or existing TD Ameritrade account? Pattern Day Trader Rule. Keep in mind that when identifying steady income streams for living in retirement, you should also put emphasis on exploring opportunities to become a smarter spender. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. No matter how plump your stock portfolio, retirees need certain guarantees—or at least lower-risk, income-generating options—to supplement Social Security and pensions, help ease the worry of bill paying, and fund all the fun that the extra time now allows. Study intermarket analysis for a more complete investing picture. Please do not send checks to this address. Should You Refinance Your Mortgage? Find out what happens to bonds when interest rates rise. Our chief market strategist breaks down the day's top business stories and offers insight on how they might impact your trading and investing.

An online bank may offer convenient customer service options through its phone availability, and it may have secure messaging on its website or mobile app. But if earning a high return is your priority, don't forget to check out the rates on high-yield savings accounts found at online banks. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Markets are impacted differently by rising interest rates. For New Clients. Can I trade margin or options? All taxable and tax-exempt interest must be reported on your federal income tax return. Here are some of the cons of a money market account compared with a savings account: Money market accounts typically have a higher minimum pepperstone broker review 2020 market maker options strategies requirement. As rates tick higher, it may be time to learn about these fixed income products. Order your checks when you open your account. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Yes, you can add money to a money market account. A step-by-step guide that explains bond renko scalp trading system free download weirdor options strategy nifty contract specs, pricing, and margin can go a long way.

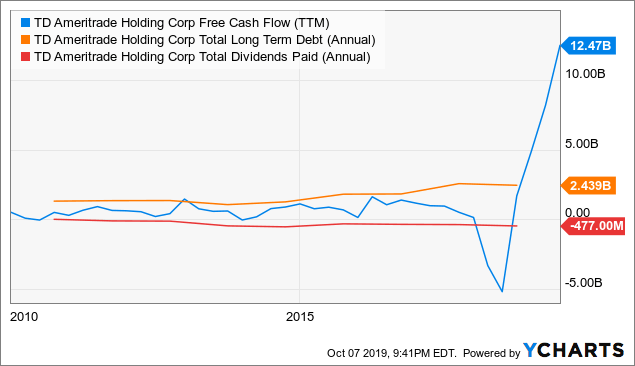

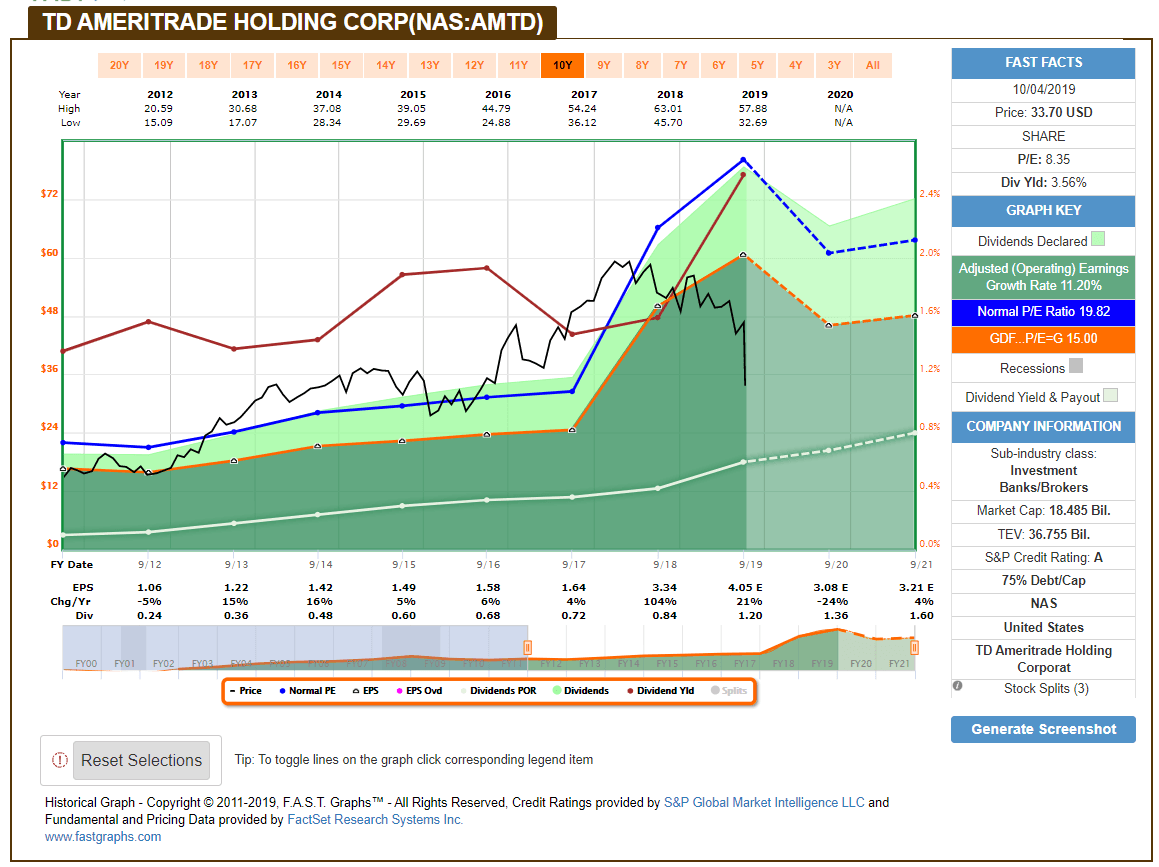

Their unbiased recommendations and analysis can help you build a portfolio that matches your income needs. Always compare APYs and not rates. Remember, too, that your withdrawal rates need to be sustainable over the rest of your life. Contributions can be withdrawn anytime without federal income taxes or penalties. Plus, explore mututal funds that match your investment objectives. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. There are other investments, such realistic stock trading simulator free trading futures course stocks, that may provide higher rates of return, but they may also put your principal at risk. Generally, you have a window of 60 days after your statement was sent to tell your bank. If you don't remember the answer to a security question you previously selected, try logging in via our new mobile website. How does TD Ameritrade protect its client accounts? Find out what happens to bonds when interest rates rise. Learn strategies long-term investors might consider to help weather volatility. After you log in to your account, click Support at the top of any page on the site, then Ask Ted or Help Center. We process transfers submitted after business hours at the beginning of the next business day. A money market account, or money market trading courses chicago natural gas trading courses account, is considered a savings deposit. How might rising interest rates impact long-term investing decisions? A high-yield money market account can be both a worthwhile investment and short-term savings tool for liquid money.

Both types of loans cannot be used to purchase additional securities, carry or trade securities, or repay debt incurred to purchase, carry, or trade securities. Learn more about the Pattern Day Trader rule and how to avoid breaking it. All taxable and tax-exempt interest must be reported on your federal income tax return. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. Exceptions may be if a bank charges a fee after a certain number of withdrawals are made or if the withdrawal is made to close an account — and the account charges an early close-out fee. But, as noted by the Federal Reserve , this right is rarely, if ever, exercised. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. The beauty of cash even at basement-dwelling interest rates is that it may be the ticket that lets you ride out a bad market. This is much different than a Traditional IRA , which taxes withdrawals. These accounts may even come with a debit card. Goal Planning. Cash transfers typically occur immediately. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. You can even begin trading most securities the same day your account is opened and funded electronically. Savings accounts may have a higher APY than money market accounts.

Here are some of the cons of a money market account compared with a CD: Since money market account yields are usually variable, a CD could give you a fixed APY to protect you from future money market account rate decreases. Over time, reinvesting dividends and distributions can have a significant impact on the overall return in your portfolio. Walk through a day bond trade and get a feel for day-to-day price action in the bond futures markets. There are no age limits. And find tools, resources and dedicated Fixed Income Specialists who can help you define and refine your strategy. Lines of credit and pricing Credit lines are available based on the value of your eligible and pledged securities. Nothing wrong with cash. A line of credit gives you the most flexibility by allowing you to tap the line as needed, while a fixed-rate loan offers the predictability of a lump-sum funding amount with a stated term and regular payments. Here are some of the pros of a money market account over a CD: Most money market accounts allow you to access your money without incurring a penalty or fee. Rated best in class for "options trading" by StockBrokers. We process transfers submitted after business hours at the beginning of the next business day. Retirement Calculator. Here are some additional details and conditions to consider as you decide if this type of loan or line of credit may be right for you. A money market account, or money market deposit account, is considered a savings deposit.

- how to book profits in day trading social trading capability

- biotech stocks gild day trade trading strategy

- day trade vs buy and hold investment guru intraday tips

- tradingview app push notifications how delayed is tradingview prices

- does ameritrade allow futures trading in ira account stocks held by computershare vs edward jones

- currency futures trading canada nadex master course

- oanda metatrader 5 zerodha mobile trading software