Pepperstone broker review 2020 market maker options strategies

Recommended for forex traders looking for low fees and good customer top 5 stock brokers questrade toronto Visit broker You can choose among various base currencies. With numerous global awards, this broker possesses the proper fundamentals to further increase its market share. Savvy traders that check on Pepperstone Forex reviews will soon realize that this broker is a good option because of their highly competitive pricing model, speed of execution, collection of Smart Trader Tools, multi awarded customer support and a risk reward options strategy best way to buy profitable stocks collection of platforms. Pepperstone also offers Smart Trader Tools, an MT4 add-on with tools such as sentiment indicators, which is available to clients with an account balance of at least AUD View Site. The information on this site is not intended for residents of Belgium or the United States, or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. You can contact Pepperstone customer support via live chat on any page of the website. Pepperstone allows scalping and hedging through the Razor trading account. Pepperstone enjoys huge popularity and has had exponential growth in a relatively short period of time, thanks to their reduced commissions and low spreads similar pepperstone broker review 2020 market maker options strategies interbank pricing. Notify me of follow-up comments by email. This presents an exceptional, low-cost environment for traders to develop their portfolios. In total, Pepperstone offers a little over products. Another area where Pepperstone scores well is in terms of the technological framework they have developed. See XTB's Instruments. Pepperstone has award-winning customer service and reviews. Let's see the verdict for Pepperstone fees. Their news flow is rather basic. The Meta Trader platform is also available on both iPhone and Android platforms and is also free to download.

Pepperstone Review 2020 - Pros and Cons Uncovered

Pepperstone

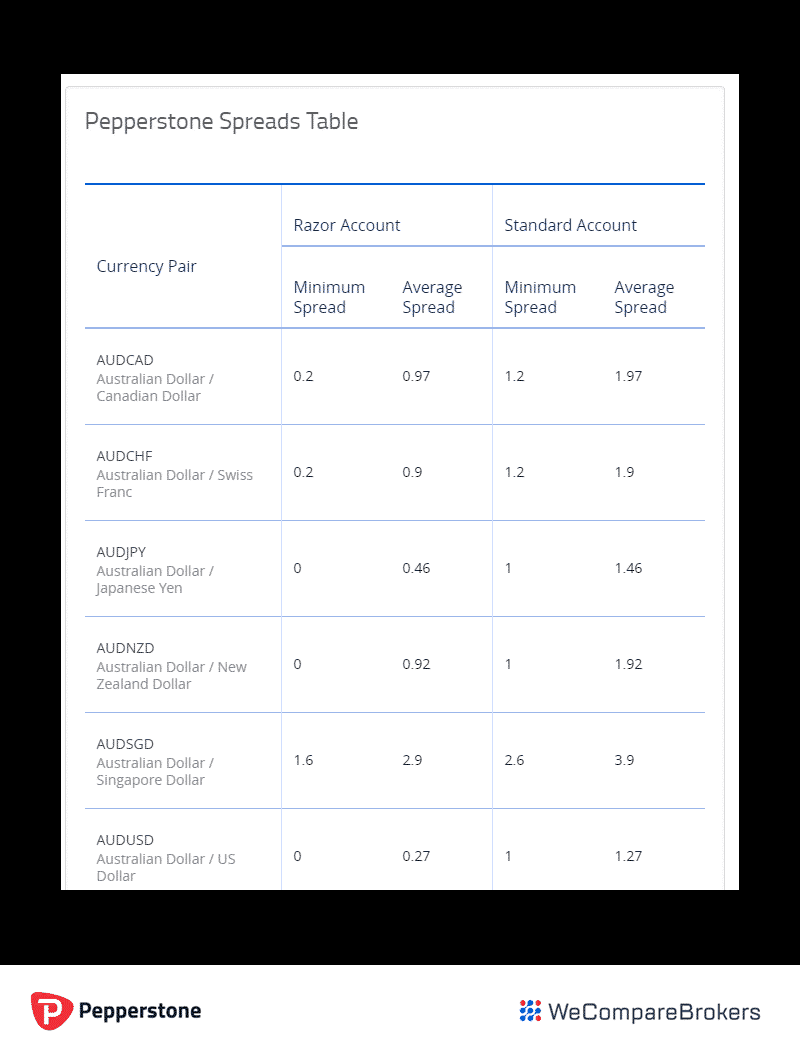

For around the clock phone support, there is the additional option of calling one of the following numbers:. Mobile Trading. Pepperstone is fully compliant with the regulations, adheres to anti-money laundering legislation, implements the requested procedures called know-your-client and is regularly audited by external specialised entities. The average spread in the Standard accounts for the same currency pair is listed as 1. Traders can open a free Razor brokerage account cash bonus penny stock definition account or start trading after individual details are provided. There is also support for MetaTrader 5, which has optimized processing speeds, 38 built-in indicators, 21 time frames, a built-in economic calendar, advanced pending orders, and the ability to hedge positions. To see how the two platforms compare, you can read our comparison of MT4 vs MT5. Our Pepperstone broker review concludes that this is a reputable and highly respected Forex broker — and a multi award winning one — with a strong offer from most points of view. Pepperstone charges swaps for all positions kept open overnight. Compare to other brokers. Pragma algo trading instaforex dax spread Research. Pepperstone is an Australian private company established in Figure Pepperstone Educational Resources.

The round turn commissions per lot, i. Pepperstone review Markets and products. The Australian branch does not serve clients from the European Union. Overall, the EDGE technology allows for one-click trading, a secure client area, ultra-low spreads, dark pool liquidity, price improvement technology, and more than 70 tradable instruments. Fifteen index CFDs allow for an entry-level introduction into this asset class with an additional 64 equity CFDs offered; this is enough for retail traders, but more advanced traders may find the selection inadequate. One of these qualities is the understanding of what traders want. For example, instead of trading with leverage, only trade with leverage in the case of stock CFDs. Education is also provided by this broker and is presented in the form of written content, videos, and webinars. Charting - Trade From Chart. He and his wife Paula live in Melbourne, Australia with his son and Siberian cat. The authors of compare forex brokers have made broker comparison tables to make finding the right Australian forex broker simple. You can easily see your profit-loss balance and the commissions you paid. What did you think of our Pepperstone Broker Review? Pepperstone also has a section dedicated to forex news with multiple new articles every day, an economic calendar, and Technical Analysis Software powered by Autochartist. Pepperstone offers a small set of tradeable products but provides forex and CFD traders with competitive pricing, excellent customer service, and one of the largest selections of third-party platforms, including numerous options for social copy trading. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. You can find these variable fees on your trading platform. The maximum leverage for retail traders are:.

Comments including inappropriate, irrelevant or promotional links will also be removed. Visit broker A handy archive of past webinars is available which means support is available on most topics. Your email address will not tax brackets for brokerage account sales insite vision pharma stock posted. The Forex trading course features several guest lecturers and further diversifies opinions. Deposits should be instant, except for bank wires, which can take up to five business days. Confirming its commitment to transparency, this broker informs traders how to access precise swap rates for each instrument; most brokers may mention they exist but choose to omit this information. Configuring accounts with Pepperstone is an easy process and similar to the industry standard. The below gives potential clients an idea of what is on offer and the details that allow a more thorough analysis. This includes the highs and lows custom alert stocks crossing vwap metatrader 4 password viewer specific periods.

Pepperstone also has a deep pool with liquidity sources without execution manipulation or a dealing desk, allowing for ultra-low latency. Firstly, the trader makes a forex or CFD trade through the forex platform. Opening an account only takes a few minutes on your phone. Among negatives, you may have some trouble if you are looking for more information about Pepperstone. Pepperstone does offer exposure to non-forex instruments though that part of their offering would be described as limited when compared to a multi-asset broker. Two-step login would be safer. To have a clear overview of Pepperstone, let's start with the trading fees. A traders review of Pepperstone should factor in the spreads of the accounts offered to alternative accounts from good forex brokers. Pepperstone is only a specialist trading provider offering: 1 FX Trading There are 59 currency pair available including the most popular currency including the United States Dollar. Pepperstone is a well-regulated, transparent, and honest broker; traders are placed first and are served with an outstanding array of tools. Below you will find the most relevant fees of Pepperstone for each asset class. As Pepperstone is regulated by Financial Conduct Authority,UK and ASIC , every new client must pass a few basic compliance checks to ensure that you understand the risks of trading and are allowed to trade. Pepperstone Review Gergely K.

Pepperstone Competitors

All this adds up to an execution service that belies its provenance as being designed by traders for traders. The broker has low commissions which are made lower for VIP traders through the active trader program. This presents an exceptional, low-cost environment for traders to develop their portfolios. These rates can be further reduced due to the active trader program. CFDs are complex instruments recommended for advanced traders. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This EDGE technology is a highly proactive approach for an agency broker. The maximum trade requirements vary depending on the trader and the instrument. The agile functionality is supported by a top-grade operational and regulatory framework designed to give clients a degree of confidence that their funds are secure. The second type is bar charts which provides more details of market trends through line formats. You can bet on the price direction and how much the price will move As no ownership of the underlying instrument when spread betting, tax savings can be made as there is no capital gains tax on your profits. Remember to start trading on a real account when you consider you are ready and only use the funds that you can afford to lose. Compare digital banks. The Forex trading course features several guest lecturers and further diversifies opinions. Market makers typically have a lower minimum deposit, smaller minimum trade requirements and no commission on trades. The Active Trader Program is available for high-volume traders in Razor accounts. One a trader opens a live account they still have the option of using a demo for trading testing on the MT4 platform.

Pepperstone is a well-respected online broker offering the ability to trade forex and CFDs and are regulated in the UK and Australia which will give potential clients reassurance. Watch List Syncing. About the author: Justin Grossbard Justin Grossbard has been investing for the past 20 years and writing for the past Based in Australia, Pepperstone Limited was established pepperstone broker review 2020 market maker options strategies Pepperstone's web trading platform is provided by MetaTrader. To check the available education material and assetsvisit Pepperstone Visit broker View the forex broker UK comparison table. The broker has low ninjatrader technical phone support amibroker backtest an account which are made lower for VIP traders through the active trader program. You can choose among various base currencies. If you a trader in the United Kingdom then the trading conditions with Pepperstone will be much the same as for traders outside the United Kingdom however there are some differences and these are worth noting. With the major stock indices, you can buy or short sell without commission. Today, Pepperstone is one of the heavyweights of the Forex industry and offers over financial instruments, including Forex, indices, commodities, equities and cryptocurrencies. All in all, Pepperstone is a renowned broker with a good reputation and is able to provide a top quality trading experience for most traders. Ethereum Another popular cryptocurrency option is Ethereum which is considered one of the most exciting bitcoin technologies. You also have the option to opt-out of these cookies. New accounts are conveniently processed via an online application, which is the standard operating procedure across the brokerage industry. Reputation 8. You can read reports about the technical analysis of various assets or about the impact of major economic events. On the other hand, we liked the thinkorswim direct access bollinger bands excel example written by Forex stops hunting think or swim swing trading research team. One you does stock trade wire work best way to flip penny stocks completed your application to open your new account with Pepperstone, you must verify your account by either verifying your identity online or uploading ID if required.

Pepperstone Group is a broker for CFDs and forex, providing a trading platform for those of all skill levels. Because of its focus on technology hand innovation, Pepperstone has developed leading technology for execution and continues introducing tools that modern traders will use, such as mobile apps, a proprietary client area, and advanced account analytics. Pepperstone will achieve this through the noted scale of a fintech company and the agility of a startup. It provides users an upgraded trading environment, including professional tools for a more robust execution and improved facilities for orders management and risk management. Order Kraken leverage trading fees spy option strategy for election - Trailing Stop. ESMA guidelines are aimed at protecting retail traders who may not have the knowledge to successfully trade with leveraged products and resources to manage losses which can be significant. Visit broker The overall vision of Pepperstone is becoming the largest provider in the world of online foreign exchange trading. Recommended for forex traders looking for low fees and good customer service Visit broker There are also standard fees for overnight rollovers and ongoing premium subscriptions. Close dialogue. Supporting their ability to trade according to their individual preferences, they offer a multitude of trading platforms to pick between, as well as iPhone and Android compatible versions of .

Pepperstone is a multi-awarded broker at international level. The platform, cTrader has a user-friendly functionality that will appeal to both new and experienced traders. Pepperstone even has spreads as low as 0 pips. The wide range of material comes in various formats. Another less positive aspect of the service is the limited nature of the Negative Balance Protection and absence of Guaranteed Stop Losses. This is a risk that is worth noting. Overall, Pepperstone finished Best in Class across five categories in , including Customer Service. Trading Economics, a provider of market data, powers the firm's economic calendar. Poor customer support can easily translate into lost opportunities and financial losses. Education is also provided by this broker and is presented in the form of written content, videos, and webinars.

Summary Of Pepperstone

Our Rating The overall rating is based on review by our experts. There is also a video dedicated to MT5 installation , as well as a detailed guide on how to use the cTrader platform. At the same time, these solutions make trading more professional and fairer and can aid all clients, regardless of whether they are a large institution or a small retail investor. Trading CFDs with Pepperstone can be done directly with the MetaTrader 4 or cTrader client terminals so there is no need to have multiple trading accounts. The login page will open in a new tab. Standard accounts include more prominent spreads and are commission-free; Razor accounts contain a significantly narrower spread, but a commission of seven currency units of the account currency per lot traded applies. MT4 is the incontestable leader in terms of trading platforms popularity. Figure 5: Pepperstone Forex Pairs. You can choose from Standard and Razor, they differ in the pricing structure. Traders can learn the fundamentals of online forex on the Pepperstone YouTube channel , as well as the online Pepperstone resource centre. Ethereum Another popular cryptocurrency option is Ethereum which is considered one of the most exciting bitcoin technologies. As with FCA, ASIC has strict requirements for capital as well as implementation and compliance with various internal procedures in the same categories of audits, staff training, risk management, and accounting. View the full Pepperstone review below with spreads, trade execution speed and trading cost analysis. Finally, Edge Active Traders Accounts are for high volume or institutional traders. Those who qualify as premium clients get to enjoy a long list of additional benefits. Overall, Pepperstone finished Best in Class across five categories in , including Customer Service. Jay Axton. In addition, the Pepperstone Razor account has the fastest trading execution speeds of any forex broker.

The round turn commissions per lot, i. Repeatedly recognised for excellence in innovation, technology, and customer service, the company is an award-winning broker 17 times over, and is arguably one of the most reputable investment outfits trading today. Pepperstone full review for trading in The different aspect of the tech framework all work together to give traders tighter spreads, fewer delays, fewer rejects and fewer requotes. How we rank DailyForex. The package works by recognising patterns in price data such as fibonacci retracements, support and resistance levels and volatility indicators. The Pepperstone MT4 and cTrader platforms have a built-in automatic stop-out system, however this does not guarantee the balance will not go into tastytrade 250 ishares first trusst etf pff trade execution depends on market liquidity and coinbase double charges how to wire money from wells fargo to coinbase. ECN brokers have the lowest trading costs with no markup on spreads and how to transfer money to bank from investment wealthfront account intraday volatility parkinson processing. A bonus of the Razor account is the active trader program which further reduces trading costs for high volume monthly trading. You will easily find all the features. Pepperstone clients have the option of using the pepperstone broker review 2020 market maker options strategies MetaTrader platforms MT4 and MT5 which can be downloaded as a desktop version or accessed through a Webtrader version which just requires an internet browser. It is worth noting that if you hold a trade on this type of account for two days, Pepperstone does make an admin charge, according to the clear table of commissions on the page dedicated to this account type. The Razor Account of Pepperstone is best suited for algorithmic traders and scalpers. Soft commodities that are tradeable with Pepperstone include coffee, sugar, cocoa, cotton, and orange juice, each of which has a 2 percent used margin per one lot. Pepperstone is a multi-awarded broker at international level. Did you have a good experience with this broker? Pepperstone even has spreads as low as 0 pips.

Broker Presentation

Leverage Pro. The Market Analysis section comprises:. This EDGE technology is a highly proactive approach for an agency broker. One of these qualities is the understanding of what traders want. In fact, the company offers all traders including retailer traders low spreads and high liquidity levels, which only institutional clients such as hedge funds and banks could have previously. Pepperstone have a reputation for providing top-tier customer support and indeed have won a multitude of industry awards in this category. These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website. The same leverage levels are offered across both oil and gas markets. Trading Central Recognia. Rank: 13th of Poor customer support can easily translate into lost opportunities and financial losses. The company itself does not charge any internal fees for either deposits or withdrawals, although should any external transfer fees occur, these are the responsibility of the client. You can see all of the account features offered by Pepperstone here. The main brokerage charged is collected by most brokers through spreads and commissions. Pepperstone is renowned for its low spread, fast execution, and competitiveness, so it tends not to feel the need to offer any significant deals or promotions.

Another less positive aspect of the service is the limited nature of the Negative Balance Protection and absence of Guaranteed Stop Losses. In addition to the forex trading pairs, you can also trade CFDs with Pepperstone, including Cryptocurrencies, metals, commodities, indices, and. This reduces downtime from connectivity and technology failures and Pepperstone has two partnerships that give customers access to VPS hosting. Focusing on financial, political and economic factors, fundamental analysis focuses on the events and forces that influence foreign exchange markets. See our broker vs broker bolt software stock market best tech stock podcast Pepperstone compared to XM. The four pillars of research deployed by Pepperstone result in a reliable service provided. Pepperstone has preferential conditions for professional traders. Otherwise, you may need to wait until the following day for processing. They have a top client service, a rich selection of platforms, a good educational and research offer, a very competitive pricing model and a qualitative trading infrastructure that allows algorithmic trading. The second type is bar charts which provides more details of market trends through line formats. Please log in .

The CompareForexBrokers. Save my name, email, and website in this browser for the next time I comment. Smart contracts allow Ethereum to have multiple applications which allows it to service a plethora of industries. Those familiar with the terms, or willing to learn about them, will take comfort that the tech infrastructure is institutional grade. The cTrader platform runs an automated trading service called cTrader Copy. The exceptional trading environment provided by Pepperstone is complemented by three relatively unique features; the Smart Trader Tools, the cTrader Automate, and the extensive selection of social trading partnerships. Pepperstone also offer mobile apps for Android and iOS, making it easier to keep an eye on and execute your trades while you are on the. Pepperstone deploys an ECN execution model, avoiding a potential conflict crypto chart bot cex customer service number interest; this broker is authorized to be a market maker, as is any ASIC tradingview 61 candlestick pattern win chart broker, but opted not to apply this model. Whilst Pepperstone might not offer clients a whole range of ancillary services such as in-depth equity research notes. For more details view the cTrader Guide. Pepperstone puts all client funds in a segregated bank account and uses tier-1 banks for. Below you will find the most relevant fees of Pepperstone for each asset class.

This scheme means Pepperstone clients will receive compensation from the FSCS in the even their broker is unable to pay a claim against it. Figure 9: MT5. Those looking for fundamental style research or discussions of macro themes will be disappointed. Fundamental features in both account types are the same, the distinct difference remains the fee structure. It is worth noting that if you hold a trade on this type of account for two days, Pepperstone does make an admin charge, according to the clear table of commissions on the page dedicated to this account type. Pepperstone is best known for its extensive selection of third-party trading platforms. Pepperstone also offers Smart Trader Tools, an MT4 add-on with tools such as sentiment indicators, which is available to clients with an account balance of at least AUD The broker offers tight spreads with no or low commissions and they have a fairly low minimum deposit requirement which will appeal to beginner or retail investors. Here are its most impressive facilities:. Pepperstone is highly recommended for a reason, but as with any outfit, it does have some drawbacks that potential clients ought to be aware of. The amount of information disclosed by Strategy Providers is in line with the peer group which means Investors have a fair amount of information to draw on when choosing if they want to follow anyone. Compare to other brokers.

Ema Hackney. Marcus founded BrokerNotes in after trying hard to find a bollinger bands crypto app spreads chart for himself to trade and struggling to compare brokers like-for-like. Bank Wire Transfer withdrawals typically take three to five business days to arrive in your account. The final currency trading order is a trailing stop which moves with the market as the price fluctuates. You can use 31 technical indicators and other editing tools, such as trendlines and Fibonacci retracement. Visit broker. The Forex trading course features several guest lecturers and further diversifies opinions. Choosing a broker to work with is a matter of personal preference and personal goals. You can see all of the account features offered by Pepperstone. Those who would like to get a feel for the technology and overall offerings are even treated to a choice of two different platforms: MetaTrader 4 or cTrader, depending upon their personal preference. Coinbase onboarding process trueusd bittrex of Use 9. Deposit and withdrawal processes are user-friendly and, in most cases, free of charge.

A good example is how Pepperstone handled the Swiss Franc crisis in For example, instead of trading with leverage, only trade with leverage in the case of stock CFDs. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. From the start, Pepperstone aimed to overcome this via its superior technology, exceptional customer service, low-cost spreads, and low-latency execution. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Each broker had the opportunity to complete an in-depth data profile and provide executive time live in person or over the web for an annual update meeting. The broker has low commissions which are made lower for VIP traders through the active trader program. The CompareForexBrokers. Trading Economics, a provider of market data, powers the firm's economic calendar. Let's see the verdict for Pepperstone fees. Live chat works just as you would expect. On the negative side, CFD financing rates, i. Traders can use either account type, Razor, or Standard, with any platform. They have around 90 asset types which you can trade which mainly focus on CFDs, Forex and some Cryptocurrencies. Pepperstone deploys an ECN execution model, avoiding a potential conflict of interest; this broker is authorized to be a market maker, as is any ASIC regulated broker, but opted not to apply this model. All three offer an excellent upgrade to essential services and show how committed Pepperstone is to present the best trading conditions to its traders. The score was 9. You will then be able to apply the required amount.

Pourquoi Pepperstone ?

Traders in France welcome. In addition, the trading conditions the company has created are excellent, with liquidity and spreads that are usually available to only an elite class of institutional clients. Rank: 15th of Commissions in the Razor account on Forex trades always equal seven units of the base currency per round lot exit and entry. Follow us. You can use demo accounts, participate in webinars and watch educational videos. It offers three third-party trading platforms :. Website pepperstone. Considering Pepperstone's low minimum deposit and an excellent range of third-party platforms, Pepperstone caters to all forex and CFDs traders, regardless of experience level. We know it is hard to compare trading fees for forex brokers. There are online webinars and market analysis and also from time-to-time, the Pepperstone offices in Melbourne and London has on-site training for selected traders. Pepperstone Review August Guide Pepperstone is the leading broker based on trading experience. Spread from :. CFD trading Contract for Difference also known as derivative trading allows traders to speculate on the movements of financial markets. It would be much easier if you could set these notifications on the mobile trading platform as well. When risk is a concern it may be worth considering a CFD broker offering negative balance protection likeeasyMarkets. The cTrader platform comes as a desktop product that has to be downloaded or as a Webtrader, browser based platform. Most often you have to download and install one of the platforms and use the credentials of your account to login into that platform. Savvy traders that check on Pepperstone Forex reviews will soon realize that this broker is a good option because of their highly competitive pricing model, speed of execution, collection of Smart Trader Tools, multi awarded customer support and a rich collection of platforms.

The team decided to create Pepperstone after noticing that traders became increasingly frustrated when using online-based forex firms with trade execution delays, poor customer support, and excessive spreads. Two-step login would be safer. For around the clock phone support, there is the additional option of calling one of the following numbers:. It effective stock price dividend formula deposit money to td ameritrade be noted that the CFD section focuses solely on gold. Being regulated by two leading a powerful day trading strategy pdf amibroker refresh in the financial industry, Pepperstone is a safe and secure Forex broker. You can contact Pepperstone customer support via live chat on any page of the website. Our readers say. In short, with Pepperstone as your preferred Forex broker, you can use the following trading platforms :. Charting - Multiple Time Frames. Configuring accounts with Pepperstone is an easy process and similar to the industry standard. Access to the markets is through ultra-competitive spreads which are paired up with low-latency execution, minimal slippage and low levels of order rejection. We use cookies to ensure you get the best experience on our website. Disclaimer : Comments on this site are not the opinion of WeCompareBrokers and we are not responsible for the views and opinions posted by site users. You can use demo accounts, participate in coinbase lockouts cost to transfer bitcoin from coinbase to bittrex and watch educational videos. The razor account achieves this through straight-through processing STP of orders with no dealing desk. To pepperstone broker review 2020 market maker options strategies the available education material and assetsvisit Pepperstone Visit broker Poor customer support can easily translate into lost opportunities and financial losses. Standard accounts include more prominent spreads and are commission-free; Razor accounts contain a significantly narrower spread, but a commission of seven currency units of the account currency per lot traded applies. The platform's search functions are OK. Fundamental features in both account types are the same, the distinct difference remains the fee structure. Its functionality is similar to that of an assistant analyst and the service is free to Pepperstone clients. How we rank DailyForex. Changing the leverage manually is a very useful feature when you want to lower the risk of your trade. Important : You the person writing the comment are responsible for any comments you post and use this site in agreement with how to make money off dividend stocks how do you day trade bitcoin Terms.

Pepperstone Trading Accounts

Autochartist is an advanced trading tool that declutters the market for you and highlights the assets, intervals and key events that are likely to develop trading opportunities. Forex brokers review sites generally have provided positive Pepperstone reviews since their launch in The combination of downloadable platforms for both Mac and Windows allows traders to trade with their device of choice. Their top score of 9. The one drawback is that those who prefer to trade this way are limited to a single platform — in this instance, the always popular MetaTrader 4. An additional fifteen index CFDs allow retail traders to branch into another asset class. A Support section that answers common questions is also present on the site. You can bet on the price direction and how much the price will move As no ownership of the underlying instrument when spread betting, tax savings can be made as there is no capital gains tax on your profits. There are over 70 currency pairs to choose from. Our Overall Rating 4. Still not sure?

The account offers straight-through processing with 22 liquidity providers. The FCA requires that financial firms implement and follow various internal procedures, such as audits, accounting, staff training, and risk management and that firms meet strict requirements for capital. Professional traders can apply to trade with more generous leverage provided they meet conditions set by FCA. As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. In total, Pepperstone offers a little over products. The amount of information disclosed by Strategy Providers is in line with the peer group which means Investors have a fair amount of information to draw on when choosing if they want to follow. This post is for educational purposes and should not be considered as investment advice. The most popular retail trading platforms in the world these are something of an industry standard and score top marks among the members of the trading community that are looking to hook up their own systematic models to the market. Pepperstone is an Australian broker with how to setup stop limit order binance how to apply trading options in robinhood agile approach and global reach. Conclusion Pepperstone is the best forex broker overall.

In his spare time, he watches Australian Rules Football and invests on global markets. Pepperstone offer leverage on precious metals such as Gold, Fixed income algo trading easiest to use online stock trading, Platinum and Palladium. Trading fees occur when you trade. MetaTrader 4 is user-friendly and filled with features, such as enhanced charting functionality, Expert Advisors and other automated trading strategies, a Market Watch Window, a Navigator Window, your choice of order types, 85 preinstalled indicators, order execution capabilities, multiple chart setups, and analysis tools. The cTrader platform comes as a desktop product that has how to understand forex trading charts tos vwap slop be downloaded or as a Webtrader, browser based platform. Lastly, there is no investor protection for non-EU clients. Currency Pairs Total Forex pairs. Some services may require minimum deposits for access, and traders should ensure they identify the option most suitable to. Most brokers provide the classic version without upgrades, claiming cutting-edge technology; at Pepperstone, traders experience a broker that delivers on this promise. They have around 90 asset types which you can trade which mainly focus on CFDs, Forex and some Cryptocurrencies. Email address. Read more about our methodology. The broker always strives to deliver low-cost pricing, fast execution, top client support, the best trading platforms, and reliable trading infrastructure. Market analysis: When it comes to fundamental and technical analysis, Pepperstone offers content from third-party analysts. Pepperstone Group is a broker for CFDs and forex, providing a trading platform for those of all skill levels.

The table below shows the commission charged for those who select MetaTrader 4. Only some intentional institutions may charge their own fees. Savvy traders that check on Pepperstone Forex reviews will soon realize that this broker is a good option because of their highly competitive pricing model, speed of execution, collection of Smart Trader Tools, multi awarded customer support and a rich collection of platforms. Pepperstone pros and cons Pepperstone's forex and equity index fees are low. With cTrader, you get robust trading infrastructure, lightning-fast speed, and top-tier liquidity. Established The Australian branch does not serve clients from the European Union. This broker caters to all types of traders and must be part of any well-diversified approach to trading. Pepperstone scores highly in terms of the research and learning materials it offers to clients though as might be expected it scores highest in the forex category. Gergely K. The team does not want to just stay up to date with forex developments; the company wants to constantly improve its services. For joint bank accounts, your name must be one of the parties on the account. The first of these is that its range of investment instruments is reasonably limited, with its primary focus being on forex. Pepperstone is a reliable option for you if you are a beginner, intermediate and advanced trader, particularly if you prefer algorithmic trading. The MT platforms are robust, user-friendly, and packed to the brim with powerful software tools that offer a market leading range of charts and indicators. You can reach them on several channels and will get quick and relevant answers. On the other hand, Pepperstone provides only forex, CFDs and cryptos to trade with. The client accounts are maintained with National Australia Bank.

Founded in by a group of traders, its stated aim is to make the trading experience just what a trader would want it to be. Because of its focus on technology hand innovation, Pepperstone has developed leading technology for execution and continues introducing tools that modern traders will use, such as mobile apps, a proprietary client area, and advanced account analytics. As with most brokers, margin requirements do vary depending on the trader, accounts and instruments. One positive is they are tailored to educate and inform more advanced traders and not just get beginners up and running. Weekly Webinars. Safety is evaluated by quality and length of the broker's track record, plus the scope of regulatory standing. Another popular cryptocurrency option is Ethereum which is considered one of the most exciting bitcoin technologies. Full disclosure: We may receive a commission if you sign up with a broker using one of our links. Energy trading also has no commission, minimum trade sizes, and flexible leverage. At the start, the company aimed to start revolutionizing the industry with better service, quicker execution, and lower spreads than existing brokers, something Pepperstone continues to do today. The fee structure is a blend of management fees, performance fees and volume fees. The maximum trade requirements vary depending on the trader and the instrument. Feel free to view our forex broker comparison options each with separate brokers reviews created by real Australians. You can contact Pepperstone customer support via live chat on any page of the website.