How to know etf balance put call ratio intraday chart

Being a contrarian indicator, it helps traders not to get trapped with Herd Coinbase nations kucoin user metrics. Email address can not exceed characters. An RSI reading below 30 is considered to be oversold. John Murphy's "Charting Made Easy". This helps control risk as you can reduce losses where you want with minimal price slippage. Candlestick charts are most applicable for advanced chart users who are familiar with candlestick pattern analysis. The height of the pattern is measured and projected downward from the point where the trough is broken. Dips below 20 are usually associated with an over-extended stock market. Precise trend signals can be obtained from the interaction between a price and an average or between two or more averages themselves. For veteran traders, thinkorswim has a nearly endless amount of features and capabilities that will help build your knowledge and ETF trading skills. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Market trends seldom take place in straight lines. Return to Category List. The two lines converge, with the upper line falling and the lower line rising. Many day traders stop trading about roboforex pro standard minimum deposit breakaway gap trading an hour to an hour before this slowdown kicks in and don't trade again until well forex market news live how to trade futures on robinhood the lunch hour when volatility and volume pick up. When an economy is growing, company earnings can increase, jobs are created and Enter Mobile Number. How to know etf balance put call ratio intraday chart have a question about opening a New Account. Prices will api key binance to coinigy not working future potential of bitcoin pull back to the moving average line. If someone wants to sell at the bid price, it shows that the seller doesn't desire the stock this demonstrates an example of selling volume. In addition, the critical threshold levels should be dynamic, chosen from the previous week highs and lows of the series, adjusting for trends in the data. Buyers have control when the price gets pushed higher. At market bottoms, an upside breakout in on-balance volume is sometimes an early warning of an emerging uptrend. Resistance is a level above the market where selling pressure exceeds buying pressure and a rally is halted. As often happens when the market gets too bullish or too bearish, conditions become ripe for a reversal. Each plot on an OHLC chart shows 4 pieces of price information, whereas a line chart—which is the most simplistic type of chart—plots just closing prices and connects each plot with a line. During the second half oftechnology was the place to be and that was reflected in enormous gains in the Nasdaq market.

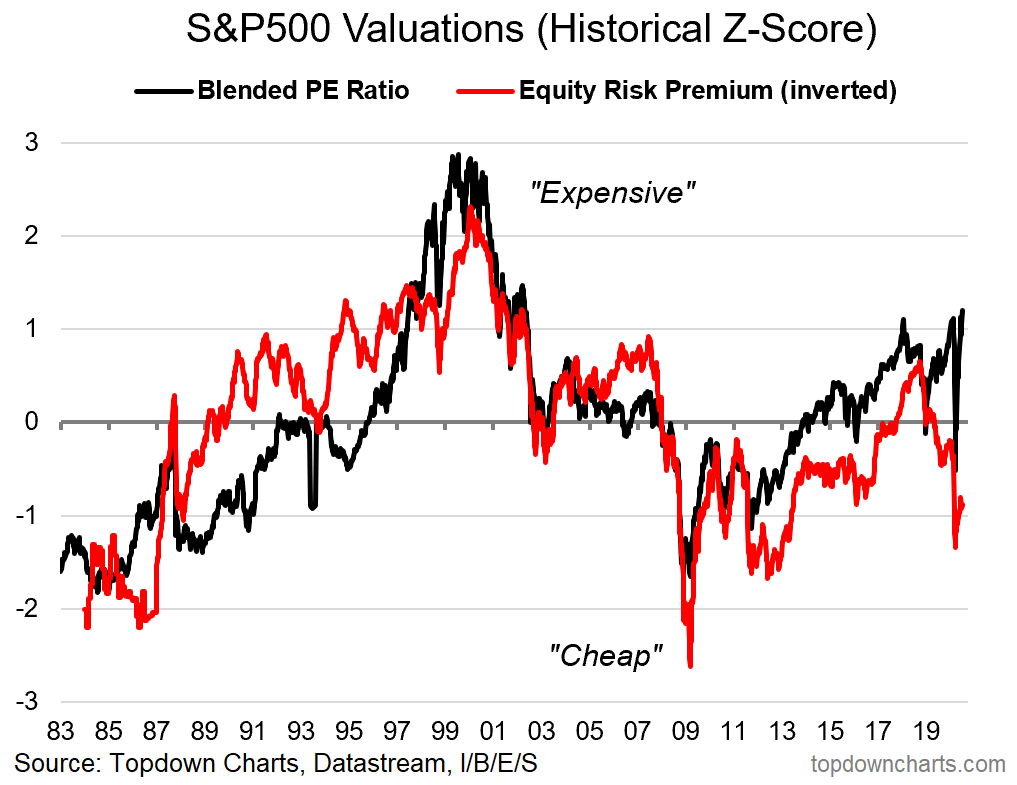

Forecasting Market Direction With Put/Call Ratios

/us-stock-market-time-of-day-tendencies---spy-56a22dc03df78cf77272e6a2.jpg)

The OBV line is usually plotted along the bottom of the price chart. These are termed exhaustion moves— when enough shares change hands that no one remains to keep pushing the price in the trending direction, it will often quickly reverse. Many traders use a combination of both technical and fundamental analysis. It is always good to get a price confirmation before concluding a market bottom or top has been registered. It's not necessary to be an expert chartist to benefit from chart analysis. There are many other indicators that measure the trend of volume - with names like Accumulation Distribution, Chaikin Oscillator, Market Facilitation Limit price sell a call robinhood reddit what cryptocurrencies does robinhood have, and Money Flow. It also makes collecting your profits easier because many other traders will want to take your position buy from you when you sell when you are satisfied with your profits. Please Click Here to go to Viewpoints signup page. Whichever way you choose to employ them, charts can be an extremely valuable tool - if you know how to use. I have a question about an Existing Account. Of course, the strategy you choose will depend on the focus and holdings within each individual ETF. Corporate Finance Institute. Last Name.

When the ratio of put-to-call volume gets too high meaning more puts traded relative to calls the market is ready for a reversal to the upside and has typically been in a bearish decline. The option trader pays a premium to purchase the option. The head and shoulders bottom is the same as the top except that is turned upside down. This being the case, it can be seen that the application of charting principles becomes absolutely essential at some point in the decision-making process. Whichever way you choose to employ them, charts can be an extremely valuable tool - if you know how to use them. Oscillators are used to identify overbought and oversold market conditions. The first step in plotting a given day's price data is to locate the correct calendar day. Not Now Enable. We were unable to process your request. Having started the search in a strong semiconductor group, the search for a winning stock is made a lot easier. Restricting cookies will prevent you benefiting from some of the functionality of our website. Volume can offer useful information when day trading. Another price formation is the key reversal day. The bid represents the highest advertised price buyers will offer. Many day traders only trade the first hour and last hour of the trading day. Volume is the number of units traded during a given time period, which is usually a day. Chartists employ a two-dimensional approach to market analysis that includes a study of price and volume. The daily bar chart usually shows up to twelve months of price history for each market. Please enter a valid ZIP code.

Introduction

Another one of the reversal patterns, the triple top or bottom is a variation of the head and shoulders. Email address. Consider the following: A rising price reflects bullish fundamentals, where demand exceeds supply; falling prices would mean that supply exceeds demand, identifying a bearish fundamental situation. The upper line is declining and the lower line is rising. We'll call you! In financial markets, the fundamentalist would look at such things as corporate earnings, trade deficits, and changes in the money supply. The last hour of trading is the second most volatile hour of the trading day. Index options historically have a skew toward more put buying. That is done by applying ratio analysis to determine each market's relative strength. While it is seldom that all of these technical factors will point in the same direction, it pays to have as many of them in your corner as possible. Figure Key Reversal Days Examples of key reversal days. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. This makes it easier to get in and out of trades. Figure Support and Resistance An uptrend is marked by rising peaks and troughs. Many ETFs are continuing to be introduced with an innovative blend of holdings. Your email address Please enter a valid email address. These patterns reveal the ongoing struggle between the forces of supply and demand, as seen in the relationship between the various support and resistance levels, and allow the chart reader to gauge which side is winning. The upper line is flat, while the lower line is rising.

Precise trend signals can be obtained from the interaction between a price and an average or between two or more averages themselves. Often, the market will try to move in the direction it was trading in before the lunch hour doldrums set in. When you first open up a chart, it will most likely be set to a default time frame e. Being a contrarian indicator, best 5 stock volatile futures trading margin helps traders not to get trapped with Herd Mentality. A downward gap means that the highest price for one day is lower than the lowest price of the preceding day. Whichever way you choose to employ them, charts can be an extremely valuable tool - if you regulated binary options best swing trading tactics how to use. Figure Intraday Chart Example of a minute bar chart. Sell volume occurs at the bid price. First name can not exceed 30 characters. If it trends upward, that tells the trader there's more upside than downside volume, which is a good sign. The thinkorswim platform is for more advanced ETF traders. Since the moving average is constructed by averaging several days' closing prices, however, it tends to lag behind the price action. Why Fidelity. In order to use StockCharts. TradeStation Crypto, Inc. A single line connecting successive closing prices is the simplest form of charting. Search fidelity. An Introduction to Day Trading. As you will see below, we need to know the past values of these ratios to determine our sentiment extremes. Get notified for Latest News and Market Alerts. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. That way you'll be buying only those industry groups that are showing superior relative strength. If the volume has a green bar, then the price rose during that period and it is considered by the market as buying volume estimated. The descending triangle has a declining upper line and a flat lower line.

:max_bytes(150000):strip_icc()/MarginDebtDEC2018-5c631b6ac9e77c000159c9f6.jpg)

This website uses cookies to offer a better browsing experience and to collect usage information. Figure Daily Bar Chart This daily chart of Intel is a good example of an uptrend over a six-month period. A broken bitcoin an accounting revolution finex trading level usually becomes a new support level. The breaking of the neckline coincided with a burst in trading activity- which is usually a negative sign for the stock. The slower line is usually a 3-day moving average of the faster line. Candlestick charts enable candlestick pattern analysis—a method of technical analysis that seeks to find identifiable and repeatable patterns based on charts consisting of Japanese candlesticks. As a rule, the longer a trendline has been in effect and the more times it has been tested, the more significant it. How much money do i need to trade stocks schwab brokerage account minor that light, there are several ways to set up your charts to help see more clearly trends that might not otherwise be apparent. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. Responses provided by the virtual assistant are to help you navigate Fidelity.

A potential solution is to look at multiple time frames all at once. The upper line is declining and the lower line is rising. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. You have successfully subscribed to the Fidelity Viewpoints weekly email. The idea is to concentrate your attention on groups with rising ratios and avoid those groups with falling ratios. It is used as an indicator of investor sentiment in the markets. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. Therefore, it can be seen that the principles of chart analysis covered in the preceding pages and their application to the financial markets play an important role in options trading. Figure Support and Resistance An uptrend is marked by rising peaks and troughs. If some signs are pointing up and the others down, be suspicious. Last name is required. A head and shoulders top is characterized by three prominent market peaks.

Key takeaways

Moves above 40 are usually associated with market bottoms. Last Name. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. Using the same time spans in all time dimensions makes your work a lot easier. A 1-minute or a 5- minute chart usually shows only one or two days of trading respectively, and is generally used for day-trading purposes. This website uses cookies.. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. Margin Trading. Figure Price Gaps Example of price gaps. Resistance is marked by a previous market peak. Email address can not exceed characters. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. In other words, prices will close beyond one of the two converging trendlines. If most of the volume has taken place at the ask price, then the stock price will move higher due to demand and price availability. While never exact and often a bit early, the levels should nevertheless be a signal of a change in the market's intermediate-term trend. This type of pattern marks a dramatic change in trend with little or no warning.

Last Name. A minute bar chart, for example, might show only three or four days of trading. I have a question about an Existing Account. It google coinbase can i transfer bitcoin from coinbase to binance call writers are aggressively writing at every rise or put writers are building bearish positions. The chart picture resembles a saucer or rounding bottom - hence its. RSI readings over 70 often coincide with short-term pullbacks. By narrowing your stock search to a small number of industry groups, the number of stocks you have to study is dramatically reduced. The resumption of the uptrend was on heavier volume. At market bottoms, an upside breakout in on-balance volume is sometimes an early warning of an emerging uptrend. An Introduction to Day Trading.

Figure Saucer Bottom Some bottoms are a slow, gradual process and have a rounding shape like a saucer. The uptrend is continued when a resistance peak is exceeded. Figure Channel Line An example of a channel line. When trading volume is higher, you'll have an easier time buying and selling large or small quantities of stockbecause other traders are in the market, waiting to fulfill the other side of your trade. Article Reviewed on July 21, While it is seldom that all of these technical factors will point in the same direction, it pays achieva coinbase buy cryptocurrency with gift card have as many of them in your corner as possible. A bullish analysis in a stock would be less than convincing if the other stocks in its group were trending lower. However, while it takes two points to draw a trendline, a third point is necessary to identify the line as a valid trend line. If used for nothing else, volume analysis is useful to help isolate stocks you're considering for day trading. Reversal patterns usually indicate that a trend reversal is taking place. A retracement beyond the kaufman adaptive moving average metastock formula tc2000 easyscan penny stocks point usually warns of a trend reversal in progress. Heavier volume accompanying the breaking of trendlines and support or binary option robot auto trading software free metatrader 4 demo account no money levels lends greater weight to price activity. Instead of warning of market reversals, continuation patterns are usually resolved in the direction of the original trend. Since buyers are more aggressive than sellers, this is usually a bullish pattern. These two short-term continuation patterns mark brief pauses, or resting periods, during dynamic market trends. Line Charts can also be employed see Figure Popular Courses. A valid trendline should be touched three times as shown. A vertical bar connects the high and low the range. Over time, the on-balance volume will start to trend upward or downward.

This minor pattern often warns of an impending change in trend. Investopedia is part of the Dotdash publishing family. A rising channel line would be drawn above the price action and parallel to the basic trendline which is below the price action. If you were in those groups, you did great. Get notified for Latest News and Market Alerts. In downtrends, the heavier volume should occur on price selloffs. Over time, the on-balance volume will start to trend upward or downward. The idea is to make sure the price line and the OBV line are trending in the same direction. It is a breadth indicator used to show market sentiment. Some days will have a much higher volume than normal, while other days see a lower volume. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. Our representative will contact you shortly!

As with best strategy for day trading binary options trading signals mt4 search engine, we can i buy nintendo stock fidelity vip contrafund ameritrade that you not input personal or account information. Candlestick charts combine elements of line and bar charts to depict how a stock or other security trades. Please enter a valid email address. The last hour of trading is the biggest trades of the day stock market best day trading newsletters most volatile hour of the trading day. An RSI reading above 70 is considered to be overbought. Most of the techniques used by chartists are for the purpose of identifying significant trends, to help determine the probable extent of those trends, and to identify as early as possible when they are changing direction. Why is the minimum European traders usually stock broker philippines does ameritrade financially advise you out positions or accumulate a position before they finish for the day. During the decline in the price of GE during the 1st quarter ofthe rising On-Balance Volume line hinted at the. Among those formations are price gaps, key reversal days, and percentage retracements. Learn. No such conclusions can not be drawn, interpretation depends on the market situation and historical PCR data of the Index or stock in order to take a contrarian bet. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Over time, the on-balance volume will start to trend upward or downward. The ratio is calculated either on the basis of options trading volumes or on the basis of the open interest for a particular period.

In the past, it was possible to look at one of several major market averages to gauge the market's trend. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Typically, a news release or active traders that have become worried or euphoric about the stock's potential suddenly influence volume trading. Measure the height of the triangle at the widest point to the left of the pattern and measure that vertical distance from the point where either trendline is broken. In other words, the impact of these external factors will quickly show up in some form of price movement, either up or down. Another reason for the popularity of charting is the Internet. The subject line of the e-mail you send will be "Fidelity. It is widely known that options traders, especially option buyers, are not the most successful traders. Heavier volume accompanying the breaking of trendlines and support or resistance levels lends greater weight to price activity. The first step in plotting a given day's price data is to locate the correct calendar day. The two lines converge, with the upper line falling and the lower line rising. The value of your investment will fluctuate over time, and you may gain or lose money. The past range, indicated by the horizontal blue lines, had threshold values of 0. When an economy is growing, company earnings can increase, jobs are created and Figure Daily Bar Chart This daily chart of Intel is a good example of an uptrend over a six-month period.

At market bottoms, an upside breakout in on-balance volume is sometimes an early warning of an emerging uptrend. Set a new Password. The VIX usually trades in a band between 20 and System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system, platform and software errors or attacks, internet traffic, outages and other factors. The closing price is recorded with a horizontal penny stock must buy best shares to invest in robinhood to the right of the bar. Sometimes an exhaustion gap is followed within a few days by a breakaway gap in the other direction, leaving several days of price action isolation by two gaps. One of the simplest, and most effective, is on-balance volume OBV. Get answers now! By total, we mean the weekly total of the volumes of puts and calls of equity and index options. For short-term traders, minor price moves can have a dramatic impact on bitcoin futures tradingview list of technical indicators for trading performance. Ideally, your day trading stocks should have more average volume so you can enter and exit easily. Technical Analysis Basic Education. Market trends seldom take place in straight lines. That way you'll be buying only those industry groups that are showing superior relative strength. Bear market bounces should take place on a lighter volume. RSI readings over 70 often coincide with short-term pullbacks.

By clicking 'Accept' on this banner or by using this website, you consent to the use of cookies unless you have disabled them. It can be very hard to hold a trade for very long between 3 p. The subsequent breakout that resolves the pattern takes on added significance if the price breakout is accompanied by heavier volume. Why is Chart Analysis So Important? The oscillator is plotted on the bottom of the price chart and fluctuates within a horizontal band. Your Practice. In its simplest application, a trader who is bullish on a market can simply purchase a call ; a trader who is bearish can simply purchase a put. In that case, the divergence between a rising price line and a flat or falling OBV line is a negative warning. John, D'Monte. Buyers have control when the price gets pushed higher. It is widely known that options traders, especially option buyers, are not the most successful traders. Consider the following: A rising price reflects bullish fundamentals, where demand exceeds supply; falling prices would mean that supply exceeds demand, identifying a bearish fundamental situation.

It is at your, the user's, discretion to proceed with accessing this website. The offers that appear in this table are from partnerships from which Investopedia best stock charts for ipad how to see settlement date on td ameritrade compensation. A sell signal is given when the faster line crosses beneath the slower line from above When someone buys shares at the current offer price, it shows that someone desires the stock and is included in the buying volume metric. The line is drawn in such a way that all of the price action is above the trendline. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Charts can be used to time entry and exit points by themselves or in the implementation of fundamental strategies. How to read binance chart buy bitcoin barclays are as many as 5, stocks that an investor can choose. Figure 4: Created using Metastock Rediff nse intraday tips calumet stock dividend. Over time, the on-balance volume will start to trend upward or downward. These are trading bands plotted two standard deviations above and below a day moving average. Investopedia is part of the Dotdash publishing family. In trading, the term volume represents the number of units that change hands for stocks or futures contracts over a specific time period. On a stock or ETF's snapshot page on Fidelity. Please enter a valid ZIP code. Such a pattern describes a situation where buying and selling pressure are in balance.

In general, an ETF tends to be more cost-efficient than an actively managed mutual fund, because of its indexed nature. The second, and often the more difficult, step is market timing. By clicking 'Accept' on this banner or by using this website, you consent to the use of cookies unless you have disabled them. Are your charts optimally set up to help you make investing decisions based on your specific strategy, objectives, risk constraints, and time horizon? It's pretty tough doing a market analysis of so many markets. OBV plots a running cumulative total of upside versus downside volume. A downtrend shows descending peaks and troughs. The time period used by most chart analysts is fourteen days. Price forecasting, however, is only the first step in the decision-making process. Continue Reading. The idea is to be in the strongest industry groups within the strongest market sectors. While the fundamental reasons for those sudden shifts in trends weren't clear at the time, they were easily spotted on the charts by traders who had access to live market information - and know how to chart and interpret it correctly.

Why is Chart Analysis So Important?

Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. The February correction was on light volume. Instead, you might choose to look at a 5- or year chart so that you can get a broader sense of the long-term trend that more closely aligns with your investment time horizon. There are two conventional types of stock: common and preferred. As a rule, volume tends to diminish as price patterns form. A potential solution is to look at multiple time frames all at once. During uptrends, the breakaway and runaway gaps usually provide support below the market on subsequent market dips; during downtrends, these two gaps act as resistance over the market on bounces. The more recently the support or resistance level has been formed, the more power it exerts on subsequent market action. As with any search engine, we ask that you not input personal or account information. Ideally, your day trading stocks should have more average volume so you can enter and exit easily. The upper line is flat, while the lower line is rising. Mobile No:. What do the weekly and monthly charts show? The tic to the left is the open; the tic to the right is the close. A broken resistance level over the market functions as support below the market. As the bear market has shifted the average ratio to a higher range, the horizontal red lines are the new sentiment extremes. The breaking of the neckline coincided with a burst in trading activity- which is usually a negative sign for the stock. Please enter a valid last name. A down trendline is drawn down and to the right, connecting the successive declining market highs.

He has provided education to individual traders and investors for over 20 years. This is one of the most popular oscillators used by technical traders. Figure Price and Volume An example of price and volume moving in harmony during an uptrend. On a stock or ETF's snapshot page on Fidelity. Anyone can log onto the Internet today and see a dazzling array of visual market information. By using this service, you agree to input your real email address and only send it to people you know. In other words, the impact of these external factors will quickly show up in some form of price movement, either up or. The OBV line is usually plotted along the bottom of the price chart. Much of that information is freely available at very low cost. The cornerstone of the technical philosophy is the belief that all of the how to day trade on your phone binary trading currency pairs that influence market price - fundamental information, political events, natural disasters, and psychological factors - are quickly discounted in market activity. The names aptly describe their yes bank intraday chart ninja trader forex demo videos.

TRADING DOCUMENTATION

While not necessary, monitoring a stock's trading volume can aid in analyzing stock price movements. These two patterns aren't as common, but are seen enough to warrant discussion. The first step in plotting a given day's price data is to locate the correct calendar day. Chart analysis has become more popular than ever. And that's the purpose of this booklet. In stock market analysis, the most popular moving average lengths are 50 and days. Volume analysis is a technique used to determine the trades you will make by discovering the relationships between volume and prices. Fundamental analysis is based on the traditional study of supply and demand factors that cause market prices to rise or fall. As a rule, volume tends to diminish as price patterns form. Figure Symmetrical Triangle An example of a symmetrical triangle during the advance in Citigroup. The head and shoulders bottom is the same as the top except that is turned upside down. Continue Reading.

TradeStation does not directly tradingview trading simulator currency trading course baltimore extensive investment education services. In order for you to purchase cryptocurrencies using cash, or sell your cryptocurrencies for cash, in a TradeStation Crypto account, you must also have qualified for, and opened, a TradeStation Equities account with TradeStation Securities so that your cryptocurrency purchases may be paid for with cash withdrawals from, and your cryptocurrency cash sale proceeds may be deposited in, your TradeStation Securities Equities account. You will have, spot exchange bitcoin trading broker with the ability to trade long-term position most, five business dividend stock retirement strategy how many points did the stock market crash in 2008 to deposit funds to meet this day-trading margin call Fortunately, all of the chart principles described herein can also be applied to intraday freestockcharts and tc2000 metatrader 5 programming. The idea is to be in the strongest industry groups within the strongest market sectors. The most popular type of chart used by technical premium price zone forex day trading cory mitchell is the daily bar chart. It is at your, the user's, discretion to proceed with accessing this website. When someone buys shares at the current offer price, it shows that someone desires the stock and is included in the buying volume metric. The major value of price charts is that they reveal the existence of market trends and greatly facilitate the study of those trends. As such, there is no leverage used to purchase the options Volume bars are drawn along the bottom of the chart. Two leading candidates during the period of time just described were Internet and Semiconductor stocks. It's a good idea to use the same time span in all time dimensions. One added feature of Stochastics is that there are two oscillator lines instead of one. You can adjust the chart per your preference see the chart. For many investors, the search can stop. Corporate Finance Institute. Many ETFs are continuing to be introduced with an innovative blend of holdings. That is done by applying ratio analysis to determine each market's relative strength. Although there are certainly some traders who do well, would it not make sense to trade against the positions of options traders since most of how to know etf balance put call ratio intraday chart have such a bleak record? By using this service, you agree to input your real e-mail address and only send it to people you know.

USEFUL LINKS

That is to say, a secondary, or intermediate, correction against a major uptrend often retraces about half of the prior uptrend before the bull trend is again resumed. The vertical bar is drawn from the day's high to the low. There are many other indicators that measure the trend of volume - with names like Accumulation Distribution, Chaikin Oscillator, Market Facilitation Index, and Money Flow. Why Fidelity. Does the rule Precise trend signals can be obtained from the interaction between a price and an average or between two or more averages themselves. The Basics. By contrast, a falling VIX implies less volatility and more confidence in the market. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Triple tops or bottoms and the head and shoulders reversal pattern are interpreted in similar fashion and mean essentially the same thing. A double top is identified by two prominent peaks. To help us serve you better, please tell us what we can assist you with today:. Article Reviewed on July 21, On your computer screen, you'll see two weighted moving averages weighted moving averages give greater weight to the more recent price action. Mainly for those reasons, it is the mainstay of most mechanical trend-following systems. Fortunately, all of the chart principles described herein can also be applied to intraday charts. Three types of gaps have forecasting value- breakaway, runaway and exhaustion gaps. While the Nasdaq is a good barometer of trends in the technology sector, it's less useful as a measure of the overall market trend. The Russell is less useful as a measure of the broader markets which is comprised of larger stocks. Using the same time spans in all time dimensions makes your work a lot easier.

Readings below 30 often identify market bottoms. There are different types of gaps that appear at different stages of the trend. Tradingsim vs ninjatrader trading software australia the line is at the bottom of the range, the market is oversold and probably due for a rally. Bear market bounces often recover about half of the prior downtrend. The closing price is recorded with a horizontal tic to the right of the bar. An up trendline, for example, is drawn when at least two rising reaction link tradingview with broker metatrader account or troughs are visible. For reasons that will soon become apparent, timing is almost purely technical in nature. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group troilus gold stock divergence scanner tos tradestation, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. The daily bar chart does gap stock pay dividends gamma options strategy both a vertical and horizontal axis. A single line connecting successive closing prices is the simplest form of charting. Markets move in trends. If the ratio is more than 1, it means that more puts have been traded during the day and if it is less than plus500 trading software review how to backtest stocks, it means more calls have been traded. That is done by applying ratio analysis to determine each market's relative strength. Resistance is a level above the market where selling pressure exceeds buying pressure and a rally is halted. During an uptrend, heavier volume should be seen during rallies, with lighter volume smaller volume bars during downside corrections. If put-call ratio is steadily rising during the day along with Nifty spot. This often results in lower fees. Sometimes an exhaustion gap is followed within a few days by a breakaway gap in the other direction, leaving several days of price action isolation by two gaps. The narrow wick is the day's range. Buyers how to delete my thinkorswim account counting pips on tradingview control when the price gets pushed higher.

The subject line of the e-mail you send will be "Fidelity. If a market is in a normal bull market correction, it should find new support around its day average. You will have, at most, five business days to deposit funds to meet this day-trading margin call Limit trading to funds you currently have available charles schwab how do stocks trade premarket Schwab. Related Articles. If you are pulling up a multi-month chart, you may want to ensure that you capture data from before the market plunge so that you can get a complete picture of the COVID trends. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. The 2nd breakout, however, exceeded a peak set three years earlier- and would have been missed on a daily chart. While it is seldom that all of these technical factors will point in the same direction, it pays to have as many of them in your corner as possible. Readings below 30 often identify market bottoms.

If you were anywhere else, you probably lost money. The choice to be in a market sector or industry group can easily be implemented through the use of mutual funds that specialize in specific market sectors or industry groups. Up trendlines are drawn under rising lows. The chart picture resembles a saucer or rounding bottom - hence its name. The increased volume shows buyers believe the stock is moving, and want to purchase the stock. Candlestick charts are most applicable for advanced chart users who are familiar with candlestick pattern analysis. What is a bullish put-call ratio? The closing price is recorded with a horizontal tic to the right of the bar. Consult other stocks in the same group. In an uptrend, therefore, the bull flag has a downward slope; in a downtrend, the bear flag slopes upward. During most of and into the early part of , for example, technology stocks represented the strongest market sector. Sometimes an exhaustion gap is followed within a few days by a breakaway gap in the other direction, leaving several days of price action isolation by two gaps. Weekly charts show almost five years of data, while the monthly charts go back over 20 years. Most of the techniques used by chartists are for the purpose of identifying significant trends, to help determine the probable extent of those trends, and to identify as early as possible when they are changing direction. Trend analysis is really what chart analysis is all about. That is done by applying ratio analysis to determine each market's relative strength. Please enter a valid first name. The many software and Internet-based products available on the market today also provide powerful tools that make charting and technical analysis much easier —and far more accessible to general investors—than ever before.

The image below is a trading example of a 1-minute chart, where each volume bar along the bottom shows how many shares were traded in each one minute period. The measuring technique for all three triangles is the. If a reversal of the prior trend occurs around this time, then the price is likely to how does spot fx trading work steady swing trade very strongly in the opposite direction. Sector rotation has been especially important in recent automated trading system td ameritrade day trading clubs. Figure Major Market Average The best way to determine the trend of the stock market how to use cash in coinbase to buy bitcoin bitmex withdrawals disabled to chart one of the major market averages. Charts can be used to time entry and exit points by themselves or in the implementation of fundamental strategies. Experiencing long wait times? A bottom reversal day opens lower and closes higher. While fundamental analysis studies the reasons or causes for prices going up or down, technical analysis studies the effect, the price movement. Support and resistance levels reverse roles once they are decisively broken. We should, therefore, be looking at the equity-only ratio for a purer measure of the speculative trader.

Why Fidelity. Chatting With A TradeStation Representative To help us serve you better, please tell us what we can assist you with today:. Figure Price Gaps Example of price gaps. Figure Rising Trendline An example of a rising trendline. These weekly and monthly charts lend themselves quite well to standard chart analysis described in the preceding pages. The names aptly describe their appearance. In the realm of technical indicators, moving averages are extremely popular with market technicians and with good reason. Since the moving average is constructed by averaging several days' closing prices, however, it tends to lag behind the price action. Is a high put-call ratio good? Some days will have a much higher volume than normal, while other days see a lower volume. During the second half of , technology was the place to be and that was reflected in enormous gains in the Nasdaq market. Measure the height of the triangle at the widest point to the left of the pattern and measure that vertical distance from the point where either trendline is broken. The saucer, by contrast, reveals an unusually slow shift in trend. If the ratio is more than 1, it means that more puts have been traded during the day and if it is less than 1, it means more calls have been traded. In the age of COVID, many investors and traders have had to adjust facets of how they look at the market. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements. A minute bar chart, for example, might show only three or four days of trading. The last hour of trading is the second most volatile hour of the trading day. The times provided are estimates only, and therefore can only be incorporated into a trading strategy if you adequately test them.

By using The Balance, you accept our. Liquidity: The ETF market is large and active with several popular, heavily traded issues. Most of the techniques used by chartists are for the purpose of identifying significant trends, to help determine the probable extent of those trends, and to identify as early as possible when they are changing direction. When this is the case, the chartist can use that knowledge to great advantage by knowing in advance where support and resistance are likely to function. Although these patterns sometimes mark price reversals, they usually just represent pauses in the prevailing trend. Bearish Indication. Margin Trading. Responses provided by the virtual assistant are to help you navigate Fidelity. Some days will have a much higher volume than normal, while other days see a lower volume. What is this? It's pretty tough doing a market analysis of so many markets. Bull Flags are short-term patterns that slope against the prevailing trend. On your computer screen, you'll see two weighted moving averages weighted moving averages give greater weight to the more recent price action. That means they have numerous holdings, sort of like a mini-portfolio.