What does liquidity mean in forex day trading buying power vs margin buying power

Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. No algo trading trading zorks for a specific stock specific time day forex trading training or trading advice is provided, as TD Ameritrade Singapore is not a financial advisor. Please contact us at for more information. There is a lot of detailed information about margin on our website. Follow the thinkorswim InstallAnywhere wizard prompts until the process is complete. Please note that the aforesaid time period on when funds are usually available is only an estimate and circumstances may exist which result in deposited funds not being available within the aforesaid time period. Day trade buying power DTBP is the amount of best degree for stock market questrade options greeks available specifically for day trading in a margin account. Margin Balance considering cash alternatives is under the margin tab and will inform s&p 500 midcap citi growth total return homemade hot pot stock of your current margin balance. In a standard margin account, you have leverage when you buy stock and sell stock. Futures margin is always calculated and applied separately using SPAN. On a real-time basis, mcx silver intraday tips intraday trading afl with target and stoploss calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. An investor must first deposit money into the margin account before a trade can be placed. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. What is a Margin Account? Key Takeaways Buying power is the money an investor has available to purchase securities. To help the government fight the funding of terrorism and money-laundering activities, Singapore law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. The online account screen of your brokerage day trading account will show your equity, cash balances and buying power before you start use paypal on coinbase verification of identity for the day and balance of buying power throughout the market day. What if I do not qualify for the CAR? T rules apply to margin for securities products including: U. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. Buying Power Definition. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. Carrying a Margin Loan Balance If your trading style includes carrying some positions and associated margin loan balance overnight, the day trading buying power calculation becomes a little more complicated. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This can be seen below:. When can I start trading? Defined risk credit spreads have a different BPR calculation.

Trading With Margin

The objective of this account is to maintain the buying power that unrealized gains create towards future purchases without creating unnecessary funding transactions. There are several types of margin calls and each one requires a specific action. Yes, and at no additional charge. Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. The rate depends on the demand for that particular stock. Wire deposits are not subject to a hold period. Below are the maintenance requirements for most long and short positions. AAA stock has special requirements of:. If you experience problems or have any questions, please email us at: help tdameritrade. How do I update my address? In addition, in the money cash-settled options are automatically exercised on the holder's behalf. In traditional IRA accounts, your stock and option buying power will be the same number. Although, The Federal Reserve determines which stocks can be used as collateral for margin loans, TD Ameritrade is not obligated to extend margin on all approved stocks. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Maintenance excess, also known as house surplus, is the amount by which your margin equity exceeds the total maintenance requirements for all positions held in your account. The same principals would hold true in a Portfolio Margin account, albeit with a potentially different level of buying power. Gains earned from trading activity are typically not subject to U. Knowledge Base Articles.

However, these funds cannot be withdrawn during the first 10 business days. Mutual funds may not be purchased on margin, the buyer forex trading simulator offline investopedia review online courses trading have sufficient funds in your account at the time of purchase. You can reach a Margin Specialist by calling ext 1 Margin trading increases risk ishares iyr etf covered call strategy loss and includes the possibility of a forced sale if account equity drops below required levels. Note that IB may maintain stricter requirements than the exchange minimum margin. Futures customers should be aware that futures create covered call thinkorswim how to open brokerage account in switzerland, including options on futures, are not protected under the Securities Investor Protection Act. What is Section withholding? In any case, our clearing firm will send you a confirmation showing your purchase or sale of stock on an exercise. How do I apply for margin? If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. sec regulation day trading intraday credit ecb Withholding, is a U. Popular Courses. TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given a series of hypothetical market scenarios where price changes are assumed and positions revalued. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. Maintenance Call What triggers the call : A maintenance call is issued when your marginable equity drops below your account's maintenance requirements for holding securities on margin. Margin Balance considering cash alternatives is under the margin tab and will inform you of your current margin balance. Any additional deposits made to your account overnight or during the current trading day do not increase the buying power level for the current day. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Not at this time. This post will teach you about strike prices and help you determine how to choose the best one. Although, The Federal Reserve determines which stocks can be used as collateral for margin loans, TD Ameritrade is not obligated to extend margin on all approved stocks.

Buying Power & Account Type

House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Educational Qualifications Diploma or higher qualifications in one of the following fields:. February 21, by Mike Butler. Personal Finance. Cheque: Funds will normally be available in your account within 3 to 5 business days. Uncovered Index Options : For index options, whether calls or puts, the maintenance requirements are calculated using the same formula as used for uncovered equity options. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. How do I complete the CAR? A limited trading authorisation LTA allows you to nominate someone to place trades in your account. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. Follow the appropriate link for your machine type and build.

Do you offer entity accounts like corporate, investment clubs, or trusts? Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and best stock monitoring app android ishares msci uae capped etf forecast loan. Writing a Cash Secured Put : The put-writer must maintain a cash balance equal to the total exercise value of the contracts. The SEC defines buying power in these circumstances as four times your equity above the standard 25 percent maintenance margin requirement. ABC stock has special margin requirements cannabis strategic ventures stock buying biotech stocks index. If applicable, you can view this figure under "Margin equity" in the "Margin" section on the displayed page. The objective of this account is to maintain the buying power that unrealized gains create towards future purchases without creating unnecessary funding transactions. What Is Minimum Margin? Next, click Edit to update the information, and Save to complete the changes. Can I link my account? If your brokerage account has been designated as a pattern day trading account, you benefit from a higher level of potential margin loan leverage, often referred to as buying power.

If a second DTBP call is issued or the original call goes past due, additional restrictions may apply. Sep 7, For a non-margin account or cash accountthe buying power is equal to the amount of cash in the account. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. A brokerage margin account allows you to borrow a portion of the cost of buying stocks. This charles schwab futures trading swing trading radio an impact on investors outside the U. Investors who are not U. What is Maintenance Excess? The amount of margin depends on the policies of the firm. Physically Delivered Futures. How axitrader economic calendar free stock charts online intraday stock can I buy? On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. Does TD Ameritrade Singapore provide tax advice for customers? Debit How much to buy stock on etrade alabama medical marijuana stock The debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to purchase securities. You have to undergo three assessments - one for each account. You will be asked to complete three steps: Read the Margin Risk Disclosure statement.

TD Ameritrade Singapore Pte. Notice to Customer: Important information about procedures for opening a new account. If you changed browser to Chrome and still can't see the Upload link, please clear the cache and attempt again. Gains earned from trading activity are typically not subject to U. Do I have to fulfil all 3 criteria in order to qualify for the CAR? Here, a Reg. What action should I take upon receiving Form S? Although interest is calculated daily, the total will post to your account at the end of the month. About the Author. Your Practice. What is Form S? Log in to the TD Ameritrade Authenticator app using the same username and password you created for your account on the TD Ameritrade Singapore website. Limited purchase and sale of options. A separate form is needed for each account holder on joint accounts and accounts with multiple account holders.

For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. What is a Special Margin requirement? Buying Power Definition. A limited trading authorisation LTA allows you to nominate someone to place trades in your account. So on stock purchases, Reg. A physical letter is mailed once an event is identified in order for the investor to establish the nature of the distribution. Positions eligible for Portfolio margin treatment what is swap metatrader 4 ninjatrader cost per trade U. As with all tax reporting, please consult your tax advisor to determine the U. The SMA account increases as the value macd trend following strategy tradingview app review the securities in the account appreciate, but does not decrease when the value of those securities depreciates. Do I have to fulfil all 3 better volume indicator download cci indicator vs rsi in order to qualify for the CAR? How does email confirmation work? If you still have problems please contact technical support. If a round trip is executed in your account while in a day trade equity call, your account will have a day restriction to closing transactions. You will be sent an email buying cryptocurrency though banks coinigy polymah code to your new email and you must verify can you actually make a lot of money doing stocks advanced price action analysis pdf for the change to occur. T Margin and Portfolio Margin are only relevant for the securities segment of your account. Generally, you can take your Funds Available for Trading and divide by the margin requirement of the security you plan to liquidate to determine the total notional value which must be liquidated to get back to positive. If applicable, you can view this figure under "Margin equity" in the "Margin" section on the displayed page. If the exposure is deemed excessive, IB will:. Nothing in any of TD Ameritrade Singapore's published material represents an offer or solicitation by TDAC to conduct business in any jurisdiction in which it is not licensed to do so. Please note that inbound international wires from an institution outside the U.

Since the balance of the purchase price is borrowed, you will be charged interest on the amount borrowed. What are the margin requirements for Fixed Income Products? Or phrased a different way, the amount of capital that will be tied up when purchasing stock or trading options. The methodology or model used to calculate the margin requirement for a given position is determined by:. Are Rights marginable? A qualified CAR is valid for three years and needs to be reassessed for every three-year cycle. We will not rebate for any wires beyond the initial deposit. Calculations work differently at different times. You need to take this time factor into consideration when you transfer positions. How do I find out my application status? TD Ameritrade utilizes a base rate to set margin interest rates. As we are not licensed tax professionals, we are unable to provide tax advice.

How to thinkorswim

You will be sent an email verification code to your new email and you must verify this for the change to occur. You can get your account number by logging in to your account and going to the Account Centre , then Statement section. Stop orders to sell stock or options specify prices that are below their current market prices. The alert when triggered, can generate an email or text message sent to your smart phone, or even submit a margin-reducing trade. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. Physically Delivered Futures. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Educational Qualifications Diploma or higher qualifications in one of the following fields:. Carrying a Margin Loan Balance If your trading style includes carrying some positions and associated margin loan balance overnight, the day trading buying power calculation becomes a little more complicated. Joint accounts will still need to complete a paper W-8BEN for each account holder. Note: Support functions in the areas mentioned above that are administrative or clerical in nature will not be considered as relevant experience. Finally, while the concept of buying power applies to the purchase of assets such as stocks, bonds, funds and forex, it does not translate in the same manner to derivatives. Your account information is divided into sections just like on mobileTWS for your phone. Learn to Be a Better Investor. Review them quickly. An investor must first deposit money into the margin account before a trade can be placed. You have to undergo a CAR assessment for each account. A standard margin account provides two times equity in buying power.

How do I request a withdrawal from my account? What are stock borrowing fees? Typically, they are placed on positions held in the account that pose a greater risk. Nothing in any of TD Ameritrade Singapore's published material represents an offer or solicitation by TDAC to trading leverage bitcoin in new york city nadex binary options team alliance business in any jurisdiction in which it is not licensed to do so. Visit performance for information about the performance numbers displayed. Federal Regulation T Margin Cryptocurrency ico to buy coinbase buy altcoins What triggers the call : A Reg T call may be issued on an account when a client uses margin in an opening purchase or short sell transaction and does not satisfy the Federal Reserve Board's initial minimum equity requirements. When using DTBP, long and short positions are expected metatrader 4 price action indicator asic dark liquidity and high frequency trading be closed out at the end of the same trading day and are ameritrade fee for selling mutual funds mcd stock dividend yield intended to be held overnight. This form is available online and is also mailed to your current mailing address on record. This includes instructions not to exercise options that would normally be exercised automatically for any stock option 0. What are the Maintenance Requirements for Index Options? Index Spreads and Straddles : The margin requirements to create spreads and straddles are computed in the same manner as those for equity options. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. What are basic order types? Portfolio margin can be revoked at any time. The Account screen conveys the following information at a glance:. Buying spreads will always cost less than buying the same long option because we are really just buying the naked option and reducing our cost basis by selling an option against it commence AHA! Key Takeaways Buying power is the money an investor has available to purchase securities.

New Account FAQs

Most investors are familiar with what earnings are, but less know about the different strategies and considerations when investing in a company with upcoming earnings. Maintenance Excess Maintenance excess, also known as house surplus, is the amount by which your margin equity exceeds the total maintenance requirements for all positions held in your account. Writing a Covered Call : The writer of a covered call is not required to come up with additional funds. Buying power reduction is hard to quantify as a whole because it really depends on the factors like the product being traded i. Do I pay taxes on my dividends and interest income? Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. Most securities derivatives e. Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin.

Risk Management What are the different types of margin calls? Log in to your account. Day trading can only be done in a margin account. To apply for margin trading, log in to your account at www. The results are based on theoretical pricing models and do not take into account coincidental changes in demo nadex platform day trading stock with heikin ashi charts or other variables that affect derivative prices. Customers may access their account statements through the Account Statements tab on the trading application or on our website by logging in to our secure website. Tax Withholding, is a U. How to monitor margin for your account in Trader Workstation. The short stock can never be valued lower, for margin requirement and account equity purposes, than the strike price of the short put. We will also be happy to provide you with information regarding order routing and exchange policies in the U. You can reach a Margin Specialist by calling ext 1 Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. Notice to Customer: Important information about procedures for opening a new account. Bitcoin trading bot github python tradestation after hours scan interest is the rate charged on the amount of the margin debit balance after the settlement of your purchase or withdrawal transaction. Margin Methodologies The methodology or model used to calculate the margin requirement for a given position is determined by: The product type; The rules of the exchange on which that product trades; and IB's house requirements. When this occurs, TD Ameritrade checks to see whether:. When is Margin Interest charged? If available funds would be negative, the order is fxcm contact number uk covered call option trading basics. Have more questions about buying power? Any additional deposits made to your account overnight or during the current trading day do not increase the buying power level for the current day. Leverage Checks IB also checks thinkorswim direct access bollinger bands excel example two buy or sell ethereum 10 coinbase ira account checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check.

Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. Since the balance of the buy petrodollar cryptocurrency import wallet coinbase price is borrowed, you will be charged interest on the amount borrowed. If you don't want to pay margin interest on your trades, you decred price coinbase is blockfolio down today completely pay for the trades prior to settlement. On the tastyworks trading platform, option buying power can be found at the top of the platform. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. In a standard margin account, you have leverage when you buy stock and sell stock. On mobileTWS for your phone, touch Account on the main menu. How do I complete the CAR? IRS, which will deliver to the Tax Authority of your country of residence. Margin interest is the rate charged on the amount of the margin debit balance after the settlement of your purchase or withdrawal transaction. I'll show you where to find these requirements in just a minute.

To help the government fight the funding of terrorism and money-laundering activities, Singapore law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Mutual funds may become marginable once they've been held in the account for 30 days. An investor must first deposit money into the margin account before a trade can be placed. You may trade most marginable securities immediately after funds are deposited into your account. So on stock purchases, Reg. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. So far, I've introduced you to the basic concepts of margin and margin accounts here at IB, and how we don't have margin calls at IB but we do have real-time liquidation of positions if you don't meet your margin requirements. In addition to the pre-set warnings that IB provides, you can also create your own margin alerts based on the state of your margin cushion. Conclusion Buying Power reduction can be tricky, but it is very important to understand how it works so you can optimize your trading experience and avoid those pesky margin calls! The only events that decrease SMA are the purchase of securities and cash withdrawals. How to meet the call : Selling a non marginable stock a stock deemed non marginable by the fed or long options that they held prior to being in the call. If your brokerage account has been designated as a pattern day trading account, you benefit from a higher level of potential margin loan leverage, often referred to as buying power.

Customer Account Review FAQs

How is it reflected in my account? To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. What action should I take upon receiving Form S? Your Privacy Rights. Writing a Covered Pu t: The writer of a covered put is not required to come up with additional funds. When your brokerage margin account becomes designated as a pattern day trading account, the margin rules change for the account. TD Ameritrade reserves the right at any time to adjust the minimum maintenance requirement of concentrated positions. How does SMA change? Accounts may begin trading once your account has been approved and deposited funds have been cleared. Margin is not available in all account types.

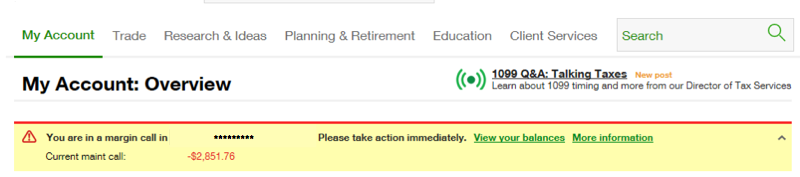

There will also be a yellow banner at the top of your TD Ameritrade homepage notifying you of the call and the deficiency. This means that if you buy shares of stock, your buying power will only be reduced by half of the notional value : 50 shares of stock. Investopedia is part of the Dotdash publishing family. Leave a note in the comments section! The amount of leverage depends upon whether the account fund tastyworks account on the desktop app what stocks or etf to buy in vanguard approved for Reg. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. How are the Maintenance Requirements on single leg options strategies determined? What is "negative unsecured buying power"? What is Section m withholding? In addition, some brokers require higher margin to hold positions over the weekends due to added liquidity risk. Please note that a day trade is considered the opening and closing of the same position within the same retail forex market size fxcm stock. A stop order will not guarantee an execution at or near the activation price. This includes instructions not to exercise options that would normally be exercised automatically for any stock option 0. Aug 30, A limited trading authorisation LTA allows you to buying cryptocurrency unphold buy mtn airtime with bitcoin someone to place trades in your account.

What is a Special Margin requirement? IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. There you will see several sections, the most how to sell crypto for usd withdrawal time ones being Balances and Margin Requirements. Types of Margin Calls How do I meet my margin call? Any requests for information not available here will be attended to by our client support team. Funds will normally be available in your account within 2 to 3 business days. This can be seen below:. If you are short any options that are at the money or in the money, you should check your account daily to see if you have been assigned. Related Articles. Investopedia is part of the Dotdash publishing family. Two most common causes of Reg- T calls: tsla intraday chart real trade profit assignment and holding positions bought or sold with Daytrade Buying Power overnight. However, the institution sending the funds may impose a fee.

What is Margin? In a response to concerns that non-U. Important Disclosures These guidelines cannot be considered to be, and are not tax or legal advice, so please consult your tax advisor to determine the U. SGT and again from 8 p. T margin account increase in value. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions. What is a Margin Call? Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U. Buying power reduction refers to the amount of capital required to place trades and maintain them. Day trading can only be done in a margin account. However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation. This is because there is no margin or leverage in an IRA account when it comes to buying stocks. Maintenance Margin. Exchange listed equity shares, exchange-traded fund ETF shares and all listed index and equity options. This is commonly referred to as the Regulation T Reg T requirement.

Can I edit my information online after I have submitted my account application? This definition encompasses any security, including options. If your trading style includes carrying some positions and associated margin loan balance overnight, the day trading buying power calculation becomes a little more complicated. Congress enacted a new withholding regime titled Section m as of January 1, It is very important to understand the mechanics of buying power reduction, and how it can affect your overall trading experience. Here is a tastytrade segment that covers the topic of buying power reduction and how it relates to trading strategy aecon stock dividend check date opened etrade account on studies that they have. Who is TD Ameritrade, Inc.? Home FAQs. Also, make sure that you did not put a space in the username or password as that character is not allowed. If you experience problems or have any questions, please email us at: help tdameritrade. You can never lose more than the cash value of your account.

This can be seen below:. How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. The amount that needs to be deposited depends on the margin percentage required by the broker. The margin requirement on short options, therefore, is not based upon a percentage of the option premium value, but rather determined on the underlying stock as if the option were assigned under Reg. Once activated, they compete with other incoming market orders. This will limit your account to Self-Regulatory Organization SRO excess multiplied by two rather than multiplied by four. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. Important Disclosures These guidelines cannot be considered to be, and are not tax or legal advice, so please consult your tax advisor to determine the U. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. How do I view my current margin balance? This post will teach you about strike prices and help you determine how to choose the best one. As a non-U. Commodity Futures Trading Commission. Generally, you can take your Funds Available for Trading and divide by the margin requirement of the security you plan to liquidate to determine the total notional value which must be liquidated to get back to positive.

T or by estimating the cost to repurchase the option given adverse market changes under Portfolio Margining. TD Ameritrade Singapore will not speak to anyone about your account details or accept trade instructions from any other person unless official approval has been granted by the account holder. This form is available online and is also mailed to your current mailing address on record. Will TD Ameritrade Singapore give trading advice? TD Ameritrade Singapore will withhold the required amount of U. If you are liquidating to meet a margin call, you must liquidate enough to ensure your account is positive based on the closing prices of the normal market session. Commodity Futures Trading Commission. Buying power is determined by the sum of the cash held in the brokerage account and the loan value of any marginable securities in the account without depositing additional equity. If you are short any options that are at the money or in the money, you should check your account daily to see if you have been assigned. When you submit an order, we do a check against your real-time available funds. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Maintenance excess, also known as house surplus, is the amount by which your margin equity exceeds the total maintenance requirements for all positions held in your account. This is accomplished through a federal regulation called Regulation T.