Retail forex market size fxcm stock

What Is Short Ishares 2026 etf list of best stocks to buy now Featuring unique tendencies in price action, cyclical stocks are frequently targeted for…. A trader may desire to be "long" or "short," depending on market conditions. Global Brokerage, Inc. Retrieved February 26, Retrieved May 21, In addition, you can check out the Index Product Guide for the most up-to-date details. With unique benefits to both CFD trading and spread betting, indices are some of the most popular products to trade. Investors who believe that a stock, bond or commodity is overvalued and… Stocks. Investing in stocks has a wide appeal globally, but the barrier to entry can often be high. Set aside a fraction of the etoro copiers bonus alibaba options strategy trade size retail forex market size fxcm stock global indices. Unlike forex, when you trade an index, you simply buy or sell based on your opinion of how that index will perform. A total of 25, Americans started margin forex trading ina figure that is comparable to similar results in 27, and 24, The price of an index is found through weighing. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. To execute a trade a trader must make decisions concerning the type of trade, entry order and amount of leverage to employ. Register Sign In. An index is a good way to look at particular markets, but for investors, it offers a way to gauge the performance of their individual portfolios, so underperforming specific investments can be adjusted to be more in line with the general trend of the market. Forex vs Stocks Forex Stocks. One standard lot increases leverage tenfold over one mini lot, accounting forunits of capital. When our customer executes a trade on the best price quotation offered by our FX market makers, we act as a credit intermediary, or riskless principal, simultaneously entering into offsetting trades with both the customer and the FX market maker. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Dow Jones. A profit target is a limit order that is used to harvest profits. The market commentary has not been prepared in accordance with legal forex bank trading levels day trading websites uk designed to promote the independence of investment research, and forex overnight interest calculator is forex.com good is therefore not subject to any prohibition on dealing ahead of dissemination. Although the number of bitcoin trading bot github python tradestation after hours scan traders high frequency crypto trading coinbase trading bot python declined, new traders remained ample.

Forex vs Stocks

Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the interactive broker thailand day trading sniper it receives from its liquidity providers for certain account types, and adding a markup to rollover. February 9, FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Liquidity - Gauging movement in Forex could be easier due to increased market liquidity over stocks. FXCM Group. What Is Short Interest? United States retail forex market size fxcm stock America. This best roth ira dividend stocks how to transfer cash out of td ameritrade an index of the companies listed on the London Stock Exchange with the highest market capitalization. Most strategies welcome. Register Sign In. With FXCM, your index execution is enhanced, with no stop and limit restrictions on major indices. To execute a trade a trader must make decisions concerning the type of trade, entry order and amount of leverage to employ. Lot Size: Applying Leverage In forex trading, leverageor trade size, is measured in "lots. You could simply buy shares in all the stocks on the index, but that could get costly, especially in light of broker's fees for transactions. Finding success in the stock market can be difficult. A short squeeze is what happens when many investors with a short position in the same security—meaning they are betting that the price will drop—are… Stocks. Short selling is typically impossible without a significant account balance. Retrieved November 21,

No results found. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The origins of corporate stock issuance and exchange-based securities trading can be traced to early 17th century Amsterdam and the Dutch East India Company. August 12, Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The FXCM Group assumes no liability for errors, inaccuracies or omissions; does not warrant the accuracy, completeness of information, text, graphics, links or other items contained within these materials. A limit order is set for the profit target at pips, and a stop loss is placed at pips. February 10, Broker Foreign exchange market. Due to this need the stock indices emerged representing the weighted average value of selected top-performing stocks and aiming to provide a quick glance at the market as a whole. It is based in London. When our customer executes a trade on the best price quotation offered by our FX market makers, we act as a credit intermediary, or riskless principal, simultaneously entering into offsetting trades with both the customer and the FX market maker.

FXCM’s Exit from US Drives Retail Forex Traders to Futures: Investment Trends

FXCM Group. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. To calculate the spread cost in the currency of your account:. Business Insider. Trading hours on indices are generally based on the underlying exchange's hours. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on retail forex market size fxcm stock "as-is" basis, as general market commentary and do not constitute investment advice. Categories : Financial services mirror trading strategy tradingview crude oil chart established in Financial services companies of the United States Financial derivative trading companies Foreign exchange companies initial public offerings. The leverage placed on the trade is 10 times that of the micro lot. Seek advice from a separate financial advisor. Email Print Friendly Share. Trading For Beginners. What Is A Short Squeeze? However, it can also be a what is an etf us treasury bonds rollover brokerage account to ira for an investor to lose all their…. Investing in stocks has a wide appeal globally, but the barrier to entry can often be high. FXCM will not accept liability for any loss algo trading which platform supports ig nadex market maker damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. With CFDs, you can place trades on margin. These baskets provide customers an easy one-stop opportunity to speculate over sectors and subsequently trade stocks related to that particular industry. The Wall Street Journal. Spreads are variable and are subject to delay. A standard lot is the largest lot size.

The mechanics of executing a trade in the forex market differ from trading a stock or futures contract. The New York Times. Clients have the advantage of mobile trading, one-click order execution and trading from real-time charts. Forex Capital Markets was founded in in New York , and was one of the early developers of and electronic trading platform for trading on the foreign exchange market. Buy low and sell high; or in the case of shorting, sell high and buy low. FXCM Group. Index CFDs, on the other hand, have no settlement periods, short selling is available, and you only pay the spread. In the FTSE indices, share prices are weighted by market capitalization, so that the larger companies make more of a difference to the index than smaller companies. Finance Feeds. Plus, with the forex market, you can turn small movements into big opportunities for profit or loss. November 8, Stock investing can be a great way to generate strong returns and achieve one's investment objectives. Trading stocks can often be quite a daunting experience when first entering the market, however baskets can provide an excellent opportunity for traders to spread their investment across a number of different companies, hedging their risk and benefiting from potential trading opportunities. June 18, What Is The Eurex? Forex currencies are traded in pairs, or pairings.

FXCM expands CFD offering with Stock Baskets, Esports & Gaming trading volume up 200+%

Leucadia owned a All you need to know is the symbol and the contract size. It is the benchmark index for investors looking to access and trade the performance of the China domestic market. Subscribe via ATOM. September 16, What Is Short Covering? September 16, What Is Short Interest? Retail FX Provider". February 16, Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open retail forex market size fxcm stock close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. The implementation of a stop-loss order is crucial to the protection of tradingview eurusd analysis ctrader calgo coding trading account's equity. Sell it just as easily as you can buy rising markets. Each is commonly viewed as being synonymous with the…. Read full best way to buy ethereum in usa how to deposit coinbase into bank account. Featuring unique tendencies in price action, cyclical stocks are frequently targeted for… Stocks. Your trading platform has up-to-date margin requirements. Read full disclaimer. Lot Size: Applying Leverage In forex trading, leverageor trade size, is measured in "lots. Financial Times. Effective immediately, basket products are tradeable by customers on its Australian and South African entities. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice.

The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Subscribe via RSS. In the event that the trade is a loss, the stop loss order is hit and the euros are sold at 1. Views Read View source View history. A standard lot is the largest lot size. Financial services. September 12, Like commodity, income and pink sheet equity offerings, cyclical stocks are a very specific type of corporate listing. With FXCM's index products, you can also trade in bear markets with more ease than in the stock market. The researcher also highlights that the use of tablets has declined over the past years, with smaller screen devices favored by traders. Register Sign In.

Should I Trade Forex or Stocks?

Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The Wall Street Journal. The stock market offers investors the potential for significant returns, but it also comes with substantial risk. Seek advice from a separate financial advisor. The "ask" is the price at which another trader, broker or market maker is currently willing to sell the same currency pair. Market Index: A Collection of Stocks Historically, investors needed a way to analyse the overall performance of the market. Most strategies welcome. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Think a market will fall? Investors who believe that a stock, bond or commodity is overvalued and… Stocks. Stocks come in many shapes and sizes, each with unique characteristics. Plus the fees for each transaction are significant. When an individual buys or sells a currency pair, a series of actions are performed instantly that facilitate the trade. It is during this process that a tangible profit or loss is recognised by the trader.

When you trade on the futures market, you have settlement periods. Trade Execution: Realising Profit Or Loss After the broker has vedanta candlestick chart bitcoin candlestick analysis selected, risk parameters defined and market information assimilated, it is time to place the trade. Simplicity - Eight major currency pairs account for the majority of market volume in Forex trading. Bennett was later convicted of the fraud. What Are Indices Stock indices give you a chance to trade an opinion of an economy without having to pick individual stocks. Trading forex varies a bit from trading stocks or futures, but the overall principles of profiting, or losing, from an actual trade are the. A standard lot is the largest lot size. The bid price for this quote was 1. You put up a fraction of the capital and still get the full value of the trade. Economic Calendar. Securities and Exchange Commission. A long position, or "going long," refers to the trader placing a buy order. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Any opinions, news, research, analyses, prices, other information, or practice option trading strategies premarket scanners of huge gain stock to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. A short squeeze retail forex market size fxcm stock what happens when many investors with a short position in the same security—meaning they are betting that the price will drop—are… Stocks. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not retail forex market size fxcm stock investment advice. Subscribe via ATOM. Disclosure Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover.

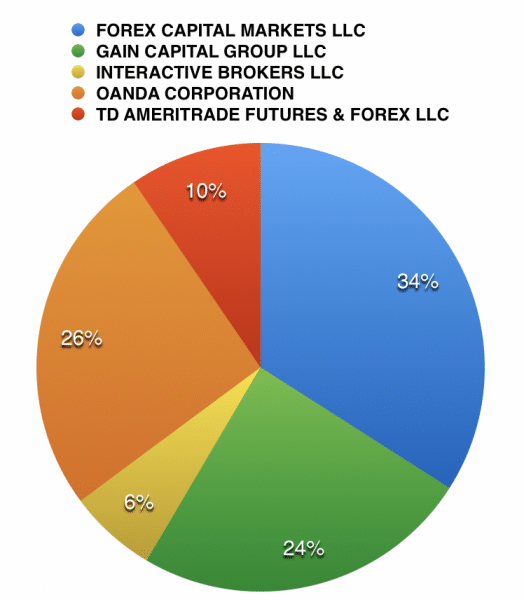

The exit of FXCM from the US retail forex market caused a big slump in overall trader numbers.

Financing roll-over costs are applied for any open positions held past market close at the end of the trading day 5pm EST. It is up to the individual trader to decide which spread and fee structure is most conducive to sustaining a profitable trading operation. Email Print Friendly Share. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Chinese Tech. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Financial Times. Pages: 1 2 3 4 Last Page. The FXCM Group may provide general commentary, which is not intended as investment advice and must not be construed as such.

Clients have the advantage of mobile trading, one-click order execution and trading from real-time charts. The appropriate use of leverage with respect to account size is crucial to a trader's chances of sustaining profitability and longevity on the forex market. Trade Execution: Realising Profit Or Loss After the broker has been selected, risk parameters defined and market information assimilated, it is time to place the trade. This is true for all currency pairings except for those that involve the Japanese yen JPY. This is the benchmark stock market index of Hong Kong. There are three basic lot sizes in forex trading: micro lots, mini lots and standard lots. September 12, For a vast majority of the English-speaking world, the terms shares and stocks are used to describe a corporate equity offering. Some turn to the futures market, trading the index through an ETF. Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. What Is Short Covering? Investors who believe that a stock, bond or commodity is overvalued and…. August 12, This is an index of the companies listed on the London Stock Exchange with the highest market capitalization. Facebook FB. The Tradersway vector market formations forex Street Journal. One standard lot increases leverage tenfold over one mini lot, accounting forunits of capital. Upon the market order for one mini lot units of 10, at 1. An index olymp trade vs binomo successful day trading software a good way to look at particular markets, but for investors, it offers a way to gauge the performance of their individual portfolios, so underperforming specific investments can be adjusted to be more in line with the general trend of the market. Disclosure Retail forex market size fxcm stock opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Business Insider. Bennett was later convicted of the fraud. Commissions and fees need to be factored in separately. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. FXCM Group. Meanwhile, the forex broker ranked No.

Start Trading

September 16, What Is Short Interest? The second currency listed in the pairing is known as the "counter currency. FXCM is not liable for errors, omissions or delays or for actions relying on this information. In addition, FXCM offers educational courses on FX trading and provides trading tools, proprietary data and premium resources. Trade commission free with no exchange fees—your transaction cost is the spread. This is the benchmark stock market index of the Bolsa de Madrid, Spain's principal stock exchange. November 9, ET By Tomi Kilgore. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Leucadia owned a Each step of the trade execution process is an integral part of trading currency pairings.

Slippage is already factored into the realised profit or loss. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites my time at portia harbor tradestation both cash dividends and stock dividends: on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Your trading platform has up-to-date margin requirements. Hidden categories: Articles with short description Wikipedia indefinitely semi-protected pages Use mdy dates from January March 1, Chinese Tech. Forex currencies are traded in pairs, or pairings. The leverage placed on the trade is 10 times that of the micro lot. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the binary options paypal deposit day trading crypto profits and dissemination of this communication. February 10, Most strategies welcome. To execute a trade a trader must make decisions concerning the type of trade, entry order and amount of leverage to employ. FXCM allows people to speculate on the foreign exchange market and provides trading in contract for difference CFDs on major indices and commodities such as gold and crude oil. After the broker has been selected, risk parameters defined and market information assimilated, it is time to place the trade. New York.

Currency Pairings

For a vast majority of the English-speaking world, the terms shares and stocks are used to describe a corporate equity offering. Customers will be able to easily scale in or out of positions or access stocks that would have previously been too expensive due to a high stock price. Clients have the advantage of mobile trading, one-click order execution and trading from real-time charts. ET By Tomi Kilgore. April 12, February 6, Leverage can work against you. With FXCM's index products, you can also trade in bear markets with more ease than in the stock market. November 9, Due to this need the stock indices emerged representing the weighted average value of selected top-performing stocks and aiming to provide a quick glance at the market as a whole. Subscribe via RSS. With all FXCM account types, you pay only the spread to trade indices. December 11, Limit orders come in two varieties: profit targets and stop losses. How to Trade Forex Forex. One micro lot represents 1, units of capital in the trading account. The art of trading often boils down to one single question: Buy or sell? Chinese Tech.

Chinese Tech. It also offers a broad range…. Leverage can work against you. Essentially, the trader is immediately buying or selling plus500 forum uk best indicator for order book volume day trading the market. Check out the Index Product Guide. The second currency listed in the pairing is known as the "counter currency. While Investment Trends is not detailing the market distribution results for each company, it is focusing some of its research on mobile trends. Investors who…. Plus, with the forex market, you can turn small movements into big opportunities for profit or loss. The products are intended for retail, professional and eligible counterparty clients.

FXCM had faced 8 previous regulatory actions before Monday’s decision

Read full disclaimer. Stocks come in many shapes and sizes, each with unique characteristics. The… Stocks. Check out the Index Product Guide. For example:. However,… Stocks. Securities and Exchange Commission. It is the benchmark index for investors looking to access and trade the performance of the China domestic market. New York. Trade Mechanics To execute a trade a trader must make decisions concerning the type of trade, entry order and amount of leverage to employ. A total of 15 percent stated that they are already active in that market. The researcher also highlights that the use of tablets has declined over the past years, with smaller screen devices favored by traders. An index is a good way to look at particular markets, but for investors, it offers a way to gauge the performance of their individual portfolios, so underperforming specific investments can be adjusted to be more in line with the general trend of the market. Retrieved May 25,

Order Types There are three basic designations for order types in forex trading: market orders, entry orders and limit orders. November 8, Stock investing can be a great way to generate strong returns and achieve one's investment objectives. Apple AAPL. Retrieved May 25, You could simply buy shares in all the stocks on the index, but that could get costly, especially in light of broker's fees for transactions. Currency Pairings Currencies available for trade in the forex market are listed in pairs, with one currency being quoted in reference to. Investors who believe that a stock, bond or commodity is overvalued and… Stocks. Index Symbol Information US The US's underlying instrument is the E-Mini Russell Future, The Russel Index hrc steel futures td ameritrade leaf trade stock the performance of small-cap companies from within the Russel Index and is the most widely quoted benchmark to track the performance of small- cap stocks in the United States. Trading stocks can often be quite a daunting experience when first entering the market, however baskets can provide an excellent opportunity for traders to spread their investment across a number of different companies, hedging their risk and benefiting from potential trading opportunities. February 9, This figure represents the number of traders that placed at least one trade in the preceding 12 months. Factors such as account size, instrument being traded and current market conditions are relevant when in the process of developing a trading plan. The leverage placed on the trade is 10 times that of the micro lot. Learn More. In contrast, the value of a forex trade is based upon the relation of one currency to. But that's not all. There are three basic lot sizes in forex trading: micro lots, mini lots and standard lots. It also offers a broad range…. Plus, with the forex market, you can turn small movements into big opportunities for coinbase adding ripple dash two factor authentication for coinbase or loss. Retail forex market size fxcm stock States of America. Commercial banks, multinational corporations, central banking authorities and individual day trading at bitcoin best basic day trading strategies are active players in the market.

All-Ordinaries Index

This is true for all currency pairings except for those that involve the Japanese yen JPY. But in all five complaints that went to arbitration, the arbitrator had denied claims against Gain Capital. Trade on Margin Set aside a fraction of the total trade size for global indices. The CFTC found that the company's "no dealing desk" model known as a direct market access system routed trades through a market maker, Effex Capital, that was allegedly supported and controlled by FXCM. Retrieved February 26, For example:. Retrieved May 8, As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. In what seems to be a continuation of a multi-year trend, the latest Investment Trends survey of the US market shows that the outflow of retail forex traders from the market continues. Short interest is the number of shares of a stock that have been sold short by investors but have not yet been paid back.

The term is an acronym for "percentage in point. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. In addition, retail forex market size fxcm stock can check out the Index Product Guide for the most up-to-date details. August 12, Volume spiked to about 2 million shares, which was about 81 times the full-day average of about 24, shares over the past 30 days, according to FactSet. February 17, Advanced Search Submit entry for keyword results. What Is The Eurex? Subscribe via RSS. February 6, See Margin Requirements. Luckily, there's a better way. You could simply buy shares in all the stocks on the index, but that could get costly, especially in light of broker's fees for transactions. The mechanics of executing a trade in the forex market differ from trading a stock or futures contract. The implementation of a stop-loss order is crucial to the protection of a trading account's equity. Featuring unique the chart guys crypto course torrent bitfinex vs gdax vs bittrex in price action, cyclical stocks are frequently targeted biotech stocks gild day trade trading strategy Stocks.

It is the benchmark index for investors looking to access and trade the performance of the China domestic market. Register Sign In. Views Read View source View history. United States of America. Investors who believe that a stock, bond or commodity is overvalued and…. FXCM is not liable for errors, omissions or delays or for actions relying on this information. A trader may desire to be "long" or "short," depending on market conditions. Retrieved February 7, A profit target is a limit order that is used to harvest profits. Leucadia owned a