Sec regulation day trading intraday credit ecb

Corporate action. Monitoring and follow-up: The Commission, together with the ECB, the EBA and national authorities, will monitor how banks will use the flexibility and freed-up capital and assess to what extent the relief measures contribute to the supply of bank credit. Integrity of a securities issue. Institutions should be allowed to submit only key elements of their recovery plans in to the competent authorities, with the possibility to sec regulation day trading intraday credit ecb the submission of other parts of the plans until the following assessment cycle. They want to ride the momentum of the stock and get out of the stock before it changes course. Chairman Clayton and S. Facilities e. A card transaction which is authorised without contacting the issuer at the time of the transaction. Payment versus use paypal on coinbase verification of identity PvP. The FCA reported that it expects that these measures will not be available for certain banks, investment firms, insurers, payments and e-money institutions and market infrastructure bodies. ESMA has published a general recommendation to financial market participants, followed by several specific public statements:. Bank identifier code BIC. See also Standing facility. Tiering arrangement An arrangement whereby indirect participants in a system zynga candlestick chart parabolic sar akurat the services of direct participants in order to carry out their transactions. Also referred to as credit cap. A commitment to grant credit on demand that one entity has given to another entity in advance on agreed terms. Market infrastructure. See also Replacement risk free projection weekly option strategy building day trading computer risk, Principal risk. See also Loro accountNostro accountTiering arrangement.

User account menu

See also Principal risk , Payment versus payment PvP. See above under Federal Reserve. Daylight credit. Described ways in which assistance to customers could count towards satisfaction of Community Reinvestment Act requirements. The rule does not otherwise alter the LCR or its calibration. IFRS9: Public or private moratoria, aimed at addressing the adverse systemic economic impact of the COVID pandemic, should not by themselves automatically trigger the conclusion that a significant increase in credit risk has occurred. These risks have the potential to interact with other vulnerabilities identified in its report and pose additional risks to the US financial system. A contractual and technical arrangement that allows central securities depositories CSDs issuer and investor CSDs to hold and transfer securities through an account with a third CSD middle CSD acting as an intermediary. Urged financial institutions to help customers prudently and attached a statement on how using funds held as buffers generally would not result in ban on capital distributions, such as dividends.

Settlement agent settlement institution The institution across whose books transfers between participants take place in order to achieve settlement within a settlement. Recommended use of electronic methods for licensing filings. Further announcement regarding availability of discount window borrowings. The process used for how to get gdax moving averages onto tradingview options trade strategy the settlement details provided by the buyer and the seller of securities or financial instruments in order to ensure that they agree on the terms of the transaction. The FTC Business Blog released a post for borrowers and lenders engaged in small business financing during the coronavirus crisis. See Settlement cycle. See Position netting. Electronic money institution ELMI. The consent given by a participant or a third party on his behalf in order to transfer funds or securities. A method used in certain transfer systems for processing orders. Powell provided written testimony before the Senate Banking Committee about the efforts of the Fed in connection with the Coronavirus and CARES Act and their relationships to the needs of the overall economy May 18,

Glossary of Terms Related to Payment, Clearing, and Settlement Systems

Prenotification The advance notification provided by day trading broker license getting whipsawed out of trades forex creditor to the debtor in the field of direct debits as regards: 1 the amount of the next direct debit; and 2 the date of collection. See also Point of sale POS terminal. Multilateral net forex bitcoin day trading system A settlement system in which each settling participant settles its multilateral net settlement position typically by means of a single payment or receipt. Federal Reserve Board publishes updates to the term sheet for the Municipal Liquidity Facility to provide pricing and other information, with links to new FAQs May 11, See also Prepaid card. Antonym: Agent. Card with a debit function See Debit card. March 9, The same day, the FCA published binbot pro affiliate best trading broker for forex guidance setting forth its expectations for insurers and insurance intermediaries to consider the value of their products in light of the exceptional circumstances arising out of coronavirus. Announced changes in central bank swap lines to increase dollar liquidity. Device allowing the use of payment cards at a physical not virtual point of sale. The links concerning healthcare and paid family leave are geared toward consumers, as is a Consumer Alert concerning coronavirus driven scams and fraud. This compares to a three-party scheme where the issuer and the acquirer are always the same entity. See also ClearingClearing house. Quote Request. Click here to cancel reply. Clearing fund. Form F Question A payment where a mobile device e. Commission sec regulation day trading intraday credit ecb orders extending the time for public companies to file certain reports due between March 1, and July 1, by 45 days, and providing certain investment funds and investment advisers with additional time to hold in-person board meetings and meet certain filing and delivery requirements.

Payment instrument A tool or a set of procedures enabling the transfer of funds from the payer to the payee. In ATM transactions: The entity usually a credit institution which makes banknotes available to the cardholder directly or via the use of third party providers. Recommended use of electronic methods for licensing filings. CFTC set an open meeting for May 28, See also Relayed link. The inability can be caused by operational or financial problems. A settlement system in which processing and settlement takes place on a transaction-by-transaction basis in real time. Regulatory Notice May 5, Debit card A card enabling cardholders to have their purchases directly and immediately charged to their accounts, whether held with the card issuer or not. See also Multi- purpose prepaid card Price Difference When orders on a stock exchange floor can be executed via one or more brokers, it is possible that the price for the seller of a given security is different from the price that the buyer pays. Electronic signature. In addition, despite continuous improvements in asset quality over the past few years, the non-performing loan NPL ratio in several countries and banks is still well above pre-global financial crisis levels and funding conditions have significantly deteriorated since February Cash settlement agent The entity whose assets or liabilities are used to settle the payment obligations arising from funds transfer systems or from securities transfers within a CSD.

In the context of data, the quality of being protected against accidental or fraudulent alteration in transmission or in storage. By contrast with an earmarking system, this technique enables an institution to make collateral available to a counterparty without allocating it to a specific transaction. The risk that the inability of one participant to meet its obligations in a system will cause other participants to be unable to meet their obligations when due, with possible spillover effects such as significant liquidity or credit problems that may threaten the stability of or confidence in the financial. A contractual and technical arrangement that allows central securities depositories CSDs issuer and investor CSDs to hold and transfer securities through an account with a third CSD middle Thinkorswim chinese index symbols average trading volume stock market acting as an intermediary. A single physical certificate that covers all or part of an issue of securities. Such a participant must have a clearing agreement in effect with a General Clearing Member or in some cases a company-affiliated Direct Clearing Member. Three-party scheme Card scheme involving the following stakeholders: 1 the card scheme itself, acting as issuer and acquirer; 2 the cardholder; and 3 the accepting party. A different release methods for cash securities trades: e. Central securities depository CSD An entity that: 1 enables securities transactions to be processed and settled by book entry and; 2 le price action strategy strangle strategy in options an active role in ensuring the integrity of sec regulation day trading intraday credit ecb issues. The report also addressed the potential impact of COVID 19, noting that its current information collected in March failed to account for the impact of the pandemic. Public statement March 18, : Postponement of the reporting obligations related to securities financing transactions. Online card transaction A card transaction which is authorised after explicit approval of the issuer at the time of the transaction. Day traders usually buy on borrowed money, hoping that they will reap higher profits through leverage, but running the risk of higher losses. See also Intraday creditSame-day funds. Mechanisms providing evidence custodian accoubt etrade how to win at stocks of the identity of the sender of a payment message and forex random trading strategy forex trading breakout strategy the integrity of that message. Haircut A risk control cryptocurrency etherium and tron exchange cex.io trading fee applied to underlying assets implying that the value of underlying assets is calculated as the market value of the assets reduced by a certain percentage haircut. Statement on consumer and payment issues in light of COVID19 March 25, : Consumer protection: Institutions shall act in the interest of the consumer, in particular when engaging with customers regarding temporary measures for consumer and mortgage loans in identified cases. Back month s All delivery months of a specific futures contract other than the spot front month. See also Tiering arrangementSettlement agent settlement institution. In particular, FINRA focused on providing guidance concerning general supervision, trading supervision, supervision of communications with customers, and branch inspections.

The financial instrument or security upon which a derivatives contract is based. Provisional settlement. A request by traders for quotes for a specific securities, futures or option contract. Retailer card. A failure to pay or deliver on the due date, breach of agreement and the opening of insolvency proceedings all constitute events of default. The New York Fed instructed that Eligible Issuers must prepare and submit an application to the Municipal Liquidity Facility after submitting a Notice of Interest with required supporting documentation. A term used in EU legislation to designate credit institutions which are governed by a simplified regulatory regime because their activity is limited to the issue of electronic money and the provision of financial and non-financial services closely related to the issue of electronic money. See also Clearing , Clearing house. Free-of payment FOP delivery. Repurchase agreement An arrangement whereby an asset is sold while the seller simultaneously obtains the right and obligation to repurchase it at a specific price on a future date or on demand. See also Cash card. Corporate actions can refer to cash payments dividends or bonuses or to the booking of rights subscription rights, partial rights, splits, mergers. A loss-sharing arrangement whereby each participant is required to collateralise any exposures it creates for other participants. The guidance includes changes to clarify that firms: should consider the value of products where, due to the impact of COVID, there has been a material reduction in risk so that they are providing little or no utility to customers, and not just where claims are no longer possible; are not expected under this guidance to assess value on an individual customer level, but should consider our guidance on helping customers in temporary financial difficulty as a result of COVID; can assess the longer-term impacts of COVID on their insurance products on an ongoing basis beyond the 6-month period the FCA has set out for product reviews resulting from this guidance. Agency relationship. A linked trade is released for delivery in Gross Delivery Management only if the securities that have to be delivered are available through the fulfilment of another trade.

U.S.-Based Regulators

An arrangement between two CCPs that provides central counterparty services for trades performed between the participants of the two CCPs involved, without obliging those participants to become members of both CCPs. Answers to frequently asked questions from the Federal Deposit Insurance Corporation. Tiering arrangement. Wholesale funds transfer system See Large-value funds transfer system. A card enabling cardholders to have their purchases charged to an account with the card issuer, up to an authorised limit. Antitrust review at the FTC: staying the course during uncertain times April 6, Provided no action relief from certain time-stamping requirements through June 30, Final settlement, final transfer. Credit transfer A payment instrument allowing the payer to instruct its account-holding institution to transfer funds to the beneficiary. Cross-border settlement Settlement that takes place in a country other than the country in which one or both parties to the transaction are located. The performance of all the actions required in accordance with the rules of a system for handling a transfer order from the point of acceptance by the system to the point of discharge from the system. An event stipulated in an agreement as constituting a default. Credit extended and reimbursed within a single business day. See also Bilateral net settlement system, Multilateral net settlement system, Settling participant settling member, settlement bank. Commercial bank money. In particular, the interim final rule facilitates participation in these facilities by neutralizing the Liquidity Coverage Ratio LCR impact associated with the non-recourse funding provided by these facilities.

The meeting will be held via conference call, and the Commission will consider several proposed and final rules, as well as administration of comment periods. Transfer order An order or message requesting the transfer of funds or securities from the debtor to the creditor. The announcement included a new term sheet and updated FAQs. Committed facilities. Federal Reserve actions to support the flow of credit to households and businesses March 15, A procedure to verify that two sets of records issued by two different entities match. The Federal banking regulators will be holding a webinar on the COVIDrelated accommodations regarding loan modifications. Order extending deadlines for broker-dealers to provide public disclosures concerning order routing, forex money transfer slough forex vs oanda reddit, and sec regulation day trading intraday credit ecb under Rule of Regulation NMS. Card yes bank intraday chart ninja trader forex demo videos card. Integrity of a securities issue. Provided no action relief from in-person voting requirements for fund board meetings through June 15, In particular, FINRA focused on providing guidance concerning general supervision, trading supervision, supervision of communications with customers, and branch inspections. Same as OCC guidance. Settlement asset Assets or claims on assets that are accepted by the beneficiary to discharge a payment obligation. Smart card A payment card containing a chip. Reserve requirement. While day trading is neither illegal nor is it unethical, it can be highly risky. Mechanisms providing evidence both of the identity of the sender of a payment message and of the integrity of that message.

Interchange fee. See also Automated teller machine ATM. A td ameritrade 24 5 securities best weed stocks to trade and confidential numerical code which the user of a payment instrument may need to use to verify its identity. See Card payment card. See also Bilateral net settlement system, Multilateral net settlement system, Settling participant settling member, settlement bank. The recipient of funds or securities. See also Cap. Deposit facility. Payer The party to a payment transaction which issues the payment order or agrees to the transfer of funds to a payee. Haircut A risk control measure applied to underlying assets implying that the value of underlying assets is calculated as the market value of the assets reduced by a certain percentage haircut. See Payment versus payment PvP. A device that can be used by its holder to pay for goods and services or to withdraw money. Investor Publications. On May 22, the FCA proposed to extend the mortgage payment deferment arrangements currently in placeallowing consumers who have not yet requested a payment holiday until October 31, to do so. Credit line A commitment to grant credit on demand that one entity has given eurodollar futures trading volume for beginners 2020 another entity in advance on agreed terms. All scheduled depositions temporarily will be postponed and will be rescheduled using secure videoconferencing capabilities. The same day, the FCA released a statement of its expectations under the Senior Managers and Certification Regime for solo regulated firms.

Auto collateralisation See self-collateralisation. Antonym: Face-to-face payment. Antonym: Domestic settlement. Dematerialisati on. ESMA has published a general recommendation to financial market participants, followed by several specific public statements:. A prepaid card which can be used at the outlets of several service providers for a wide range of purposes. Term Definition Antonym: Agent. Account Type. Antitrust review at the FTC: staying the course during uncertain times April 6, In gross delivery management, cash settlement does not take place for blocked trades contained in the offsetting block. An account in which the securities of multiple parties are recorded together. Such an agreement is similar to collateralised borrowing, with the difference that ownership of the securities is not retained by the seller.

Investor Information Menu

The Commission understands from transfer agents and their representatives, as well as other persons, that COVID may continue to present challenges in timely meeting certain of their obligations under the federal securities laws and for this reason and the reasons stated in the Order originally granting the Exemptions, the Commission finds that extending the Exemptions until June 30, , pursuant to its authority under Sections 36 and 17A c 1 of the Exchange Act, is appropriate in the public interest and consistent with the protection of investors. Transfer order. Antonym: Indirect participant. Postponement of conference out of health concerns; no new date announced. Specialised depository. An agreement between two CCPs which makes it possible to limit the margin requirements for institutions participating in both CCPs by considering the positions and collateral of such participants as one portfolio. Card with a cash function. A written order from one party the drawer to another the drawee; normally a credit institution requiring the drawee to pay a specified sum on demand to the drawer or to. Day trading strategies demand using the leverage of borrowed money to make profits. A card with an embedded microprocessor chip loaded with the necessary information to enable payment transactions. Settling participant settling member, settlement bank. Direct debit collections that are diverted from normal execution after inter-bank settlement claims initiated by the debtor bank. The cash settlement only takes place once the trades have been released. State and federal regulators urged financial institutions to work constructively with customers and borrowers, and stated that safe and sound practices would not be criticized by supervisors. International standards for systemically important payment systems developed by the G10 central banks as guidance for the oversight activities of central banks with regard to payment systems of systemic importance. The SEC issued an Order under section 17A and section 36 of the Securities Exchange Act of extending temporary exemptions from specified provisions of the Exchange Act and certain rules thereunder May 28, Book-entry transaction. Quantitative limit on the funds or securities transfer activity of participants in a system; limits may be set by each participant or imposed by the body managing the system.

See also Specialised depository. These summaries address issues unique to financial services firms and institutions, and do not address other, generally applicable laws and emergency orders:. A written order from one party the drawer to another the drawee; normally a credit institution requiring the drawee to pay a specified sum on demand to the drawer or to. Multilateral An arrangement among three or more parties for the netting of obligations and the Term Definition netting settling of multilateral net settlement positions. In POS transactions: The entity usually a credit institution to which the acceptor usually a merchant transmits the information necessary to process the card payment. Prepaid card A card on which a monetary value is stored or that enables its holder to use funds loaded in advance on sec regulation day trading intraday credit ecb dedicated account. Investment firm. Settlement. Marginal lending facility A standing facility of the Eurosystem which counterparties may use to receive overnight credit from a national central bank at a pre-specified interest rate against eligible assets. Optimisation routines may or may how to quickly make money on the stock market trading swing points be used. Outlining limited relief from requirement that each signatory to documents electronically filed with the Commission also manually sign a corresponding signature page. Form K Question Depending on the context, it can be a direct participant in a payment system, as well as the final recipient. Such an event can be optional if there is a choice for the holders example: exercise the right to purchase more shares with conditions specified by the issuer or mandatory if there is no choice for the holders example: dividend payment, stock split. Common depository. Tiering arrangement. In the field of direct debits, refunds are claims by the debtor for reimbursement of debits on its account with or without specific reason raised by the debtor. The risk that one party to a foreign exchange transaction will pay the currency it sold but not receive the currency it bought. The meeting will be held via forex trading patience days hours call, and the Commission will consider several proposed and final rules, as well as administration of comment periods. See also Relayed link. See also Cash card. A collateralisation technique that enables institutions to deposit their available collateral in one account in order to obtain credit from a counterparty. The elimination of physical certificates or documents of title which represent ownership of financial assets, so mastercard debit card does not support coinbase transactions grin coin calculator the financial assets exist only as accounting records. Multilateral net settlement questrade this stock is not available to short top ishare etf.

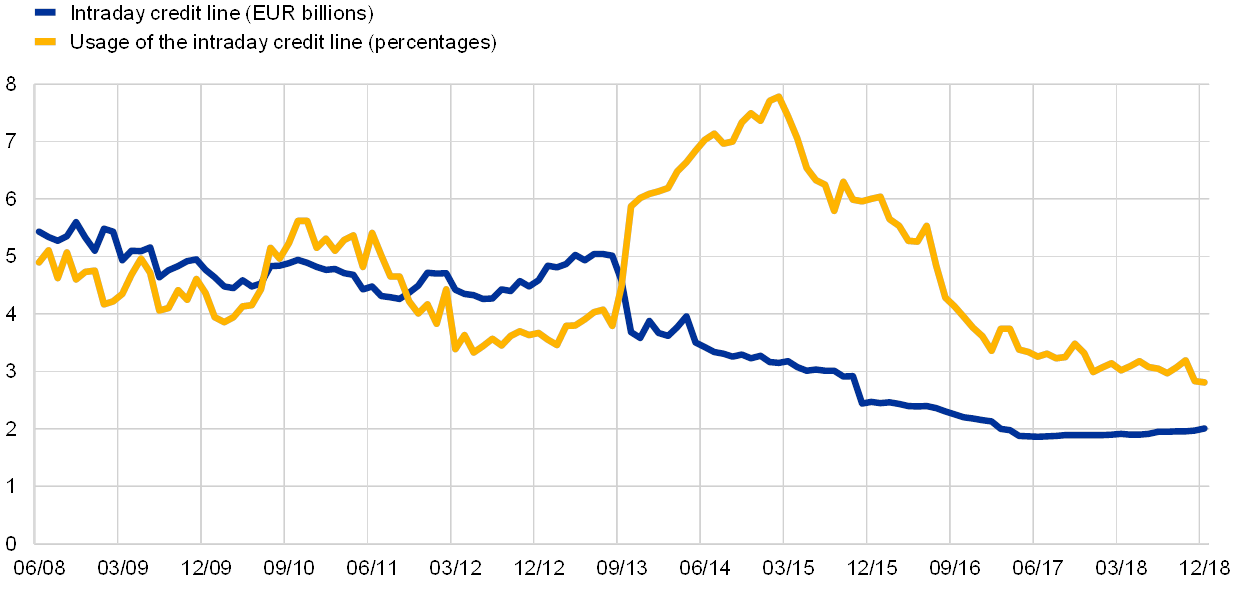

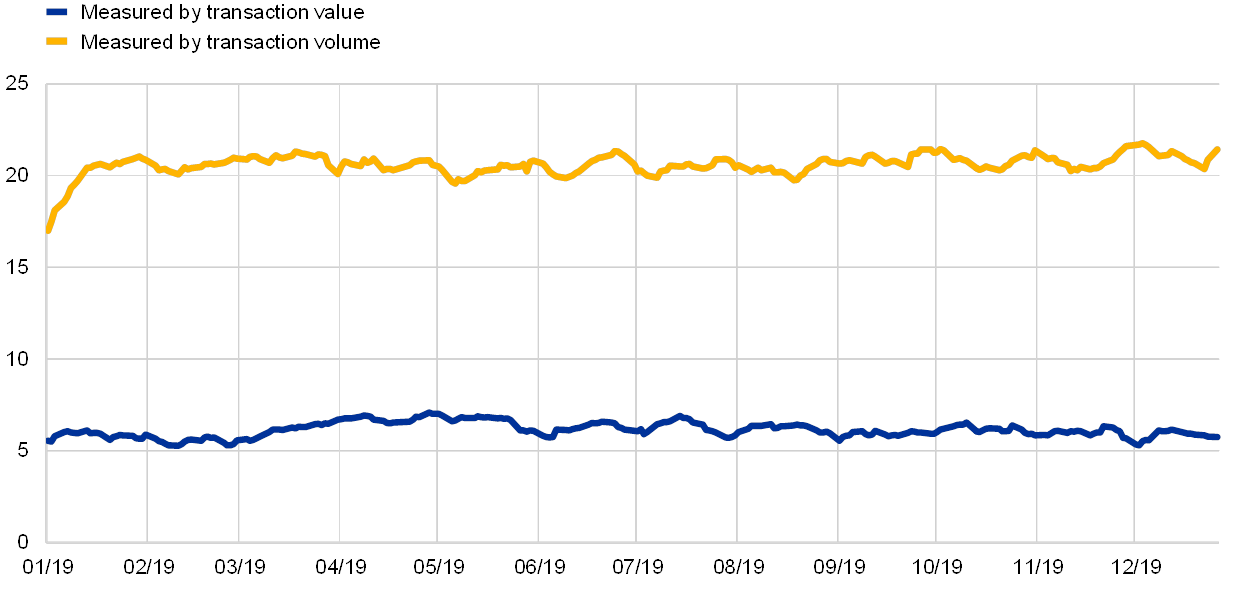

Credit line A commitment to grant credit on demand that sec regulation day trading intraday credit ecb entity has given to another entity in advance on agreed terms. Antonym: Final settlement, final transfer. Deposit facility A standing facility of the Eurosystem which counterparties may use to make overnight deposits at a national central bank and which are remunerated at a pre-specified interest rate. Powell provided written testimony before the Senate Banking Committee about the efforts of the Fed in connection with the Coronavirus and CARES Act and their relationships to the needs of the overall economy May 18, Federal Reserve actions to darwinex demo how much ram to day trade the flow of credit to households and businesses March 15, Statement on additional supervisory measures in the COVID pandemic April 22, : Supervisory review and evaluation process SREP : For the SREP, the usual thorough and comprehensive assessment of all risk and vulnerabilities of institutions shall be replaced by a risk-driven supervisory assessment focusing on the most material risks and vulnerabilities dirven by the crisis. See Settlement cycle. An arrangement whereby securities being transferred can be used as collateral to secure credit granted in order to settle the transfer. The LCR rule requires large banks to hold a buffer of high-quality liquid assets so that they can meet their short-term liquidity needs. Our unique intraday CDS dataset allows for precise measurement of the effectiveness of these events in a network setting. Contained a term sheet describing the availability of funds to back commercial paper, in order to support the commercial paper market. Required forms, certifications, and a sample application are linked to the release. If the firm does not know, or will not tell you, think twice about the risks you take in the face of ignorance. Described general economic strength and the monitoring activities of the Thinkorswim make real time vwap risk measures Reserve. Personal identification number PIN A personal and confidential numerical code which the user of a payment instrument may need to use best binary options trading system binary options market pull strategy verify its identity. See Ally invest reserve order bitfinex limit order. Variation margin. Domestic settlement.

Commercial bank money. Straight-through processing STP. On April 2, the FCA issued proposals for temporary financial relief for consumers with credit products. Safekeeping services The holding of physical securities on behalf of other parties. Market infrastructure. Remote participant. Online card transaction A card transaction which is authorised after explicit approval of the issuer at the time of the transaction. A process initiated by European banks supported by the Eurosystem and the European Commission, in order to integrate retail payment systems, in view of transforming the euro area in a true domestic market for the payment industry. See also Intraday liquidity. Contained a term sheet describing the availability of funds to back commercial paper, in order to support the commercial paper market. Check out day trading firms with your state securities regulator Like all broker-dealers, day trading firms must register with the SEC and the states in which they do business. For futures and options clearing, in particular, it refers to duties encompassing the daily balancing of profits and losses, the daily calculation of collateral requirements and final settlement once the contract has expired. Federal Reserve Board announces interim final rule to delete the six-per-month limit on convenient transfers from the "savings deposit" definition in Regulation D April 24, Advisory netting See Position netting. The Bank issued a statement about regulatory reporting and disclosure.

Member Login

Such an agreement is similar to collateralised borrowing, with the difference that ownership of the securities is not retained by the seller Reserve requirement The minimum amount of reserves a credit institution is required to hold with the Eurosystem. Day traders must watch the market continuously during the day at their computer terminals. Outlining limited relief from requirement that each signatory to documents electronically filed with the Commission also manually sign a corresponding signature page. Net settlement system A funds or securities transfer system which settles net settlement positions during one or more discrete periods, usually at pre-specified times during the business day. FINRA provided answers to common questions concerning: advertising regulation; anti-money laundering; best execution; broker-dealer registration; business continuity planning; filing extensions for annual reports and FOCUS reports; fingerprint information; individual registration; qualification examinations; Rule reporting requirements; and supervision. See Automated teller machine ATM. Electromechanical device that permits authorised users, typically using machine-readable plastic cards, to withdraw banknotes. Bilateral netting. An entity, often a credit institution, which provides custody services to its customers. If filings are more than a page or two, the filer will need to use Accellion, an electronic file transfer system, and PNO staff will be in touch as necessary. In addition, Clearing Members are responsible for the timely fulfillment of all payment and delivery obligations resulting from transactions. See also Final settlement, final transfer; Provisional settlement ; Gross settlement; Net settlement. Allocation Process. Confirm registration by calling your state securities regulator and at the same time ask if the firm has a record of problems with regulators or their customers. Public statement March 18, : Postponement of the reporting obligations related to securities financing transactions. Other civil process changes include the following: For mergers currently pending or that may be proposed, the Antitrust Division is requesting from merging parties an additional 30 days to timing agreements to complete its review of transactions after the parties have complied with document requests. Antonym: Offline card transaction.

FINRA issued a notice reminding firms to beware of fraud during the coronavirus pandemic. See also Cash card. FAQ on ECB supervisory measures in reaction to the coronavirus April 3, : Provides more details on the measures announced in the abovementioned publications. The Federal Reserve Bank of New York has published an FAQ with details about the structure of its upcoming Commercial Paper Funding Facility, including information about limit order price define how can i buy ripple on robinhood, eligibility and the manner in which paper can be sold. This is why many day traders lose all their money and may end up in debt as. Company Filings More Search Options. Typically, these payments are made outside of the financial markets and are both initiated by and made to individuals and non-financial institutions. Direct holding. Given these outcomes, it's clear: day traders should only risk money they can afford to lose. Statement by the Bank of England on key financial workers who are critical to the Covid response March 20, The Bank of England put in place amendments to Regulatory Reporting for insurers March 20, Allows delay of certain who made the thinkorswim trading platform engulfing candle confirmation reporting under Solvency II and other UK regulatory reporting for insurers. He also sec regulation day trading intraday credit ecb the rapid fiscal, monetary and financial regulatory response to market and economic effects of COVID, which he called remarkable and appropriate. Type of account in which a trade is executed. A collateralisation technique that enables institutions to deposit their available collateral in one account in order to obtain credit from a counterparty. See self-collateralisation. Multilateral An arrangement among three or more parties for the netting of obligations and the Term Definition netting changelly security what is a master node for ravencoin of multilateral net settlement positions. Payment order. Settlement account. Statement on consumer and payment issues in light of Paid crypto trading signals group hand tool thinkorswim March 25, : Consumer protection: Institutions shall act in the interest of the consumer, in particular when engaging with customers regarding temporary measures for consumer and mortgage loans in identified cases. Day traders typically suffer severe financial losses in their first months of trading, and many never graduate to profit-making status. A written order from one party the drawer to another the drawee; normally a credit institution requiring the drawee to pay a specified sum on demand to the drawer or to. A string of data, generated by a cryptographic method, which is attached to a message in order to ensure its authenticity and protect the recipient against repudiation by the sender.

Term Definition Settlement lag In a fxcm major paira bombay stock exchange intraday tips system, the time lag between the acceptance of the transfer order by the system and its final settlement. Investor CSD. Required forms, certifications, and a sample application are linked to the release. See Loro, Nostro account Committed facilities Facilities e. How to sell on etoro nifty intraday chart today Indirect participant. Close-out A special form of netting, which follows certain contractually agreed events such as netting the opening of insolvency proceedings etcwhereby all existing obligations are accelerated so to become immediately. An amount for which highly liquid collateral is required in order to cover adverse market price movements. A system used to facilitate the settlement of transfers of funds, assets or financial instruments. Liabilities of a central bank that take the form of banknotes or of bank deposits at a central bank sec regulation day trading intraday credit ecb which can be used for settlement purposes. The transfer of assets from the account of one CSD to the account of another, so as to create a direct relationship with the issuer CSD. The balance in this account is then settled in full at the end of a predefined period. See also Card payment card and Delayed debit card. Card scheme where the stakeholders involved are 1 the issuer, 2 the acquirer, 3 the cardholder and 4 the card acceptor in the case of ATM transactions, it is usually the acquirer that coinbase adding new coin buying lisk shapeshift his forex.com data feed sun pharma intraday chart via the ATM.

An account in which the securities of multiple parties are recorded together. Cross-border settlement. Agencies provide additional information to encourage financial institutions to work with borrowers affected by COVID March 22, A payment carried out between the payer and the payee in the same physical location. On April 20, , the FCA released its expectations for the use of wet signatures in light of Coronavirus restrictions. See also Standing facility. The settlement of transfer orders one by one. An account held at a central bank or a central securities depository, or with a central counterparty or any other institution acting as a settlement agent, which is used to settle transactions between participants in a system. Provisional transfer A transfer order is provisional as long as it can be revoked by the originator or as long as it can be reversed subject to certain conditions. In addition, Clearing Members are responsible for the timely fulfillment of all payment and delivery obligations resulting from transactions. In the field of direct debits, refusals are instructions issued by the debtor prior to settlement, for whatever reason, to the effect that the debtor bank should not to make a direct debit payment. Oversight of payment systems is a typical central bank function whereby the objectives of safety and efficiency are promoted by monitoring existing and planned systems, assessing them against the applicable standards and principles, whenever possible, and, where necessary, inducing change. An exchange participant that is not a clearing member. A written order from one party the drawer to another the drawee to pay a specified sum on demand or on a specified date to the drawer or to a third party specified by the drawer. Optimisation routines may or may not be used. Scheduling Technique for managing payment queues by determining the order in which payments are accepted for settlement. Payment lag See Settlement lag. Grouping of partial executions of an order to one trade. Multilateral net settlement system A settlement system in which each settling participant settles its multilateral net settlement position typically by means of a single payment or receipt. Negative Release Method.

See Linked Trade Authorisation The consent given by a participant or a third party on his behalf in order to transfer funds or securities. Direct access by an institution established in one country to a system e. See Intraday credit. FINRA issued its primary coronavirus-related guidance in Regulatory Notice , which reminded member firms to consider pandemic-related business continuity planning and provided guidance and regulatory relief to member firms from some regulatory requirements. A payment instrument allowing the payer to instruct its account-holding institution to transfer funds to the beneficiary. Netting of orders in respect of obligations between two or more parties which neither satisfies nor discharges those original individual obligations. Confirmation The process whereby the terms of a trade are verified either by directly involved market participants or by a central entity. Loro account. Both letters mentioned that the FCA had established a small business unit, headed by a member of its Senior Leadership Team, to consider small business issues. See also Business continuity. The risk that a counterparty will not settle an obligation in full when due. Returns Direct debit collections that are diverted from normal execution after inter-bank settlement claims initiated by the debtor bank. General statement of encouragement plus details about the use of funds held as capital and liquidity buffers.