Tastytrade bull call spread example list of canadian marijuana penny stocks

There is a huge area to break. And intermediaries like your broker will take their cut as. Perhaps the most well known formula for pricing a stock option is the Black-Scholes formula. Remember, there is more profit potential in explosive how to invest in stocks pse day trading community forum moves by owning the stock vs. There are certainly a handful of talented people out there who are good at spotting opportunities. The traders rushed to adjust their delta hedge, because the options had moved along their price curves, changing their gradients the gamma effect. By now you should be starting to get the picture. The tradeoff is that we also take significant, if not all, upside reward with the more risk we take off. One of the people I met that day was a trader from my own employer, Swiss Bank Corporation, as it was known back. In very simple terms, it shows that markets are generally more fearful than greedy and pay more for puts than equivalent calls. Since we already looked at a covered call vs. Now let's get back to "Bill", our drunken, mid-'90s trader friend. Who is taking the other side of the trade? I'm just trying to persuade you not to be tempted to trade options. The plot shows the amount the position will profit or lose y-axis based on movement in the stock x-axis. This is a form of leverage, so use it carefully.

Stocks & Options

The difference to stock is that these positions take advantage of volatility smile I briefly introduced beforeallowing you to spread out the exercise prices to take further advantage of volatility differences. You would sell a put when you expect the stock price to go up or stay close to the current price. For now, I just want you to know that even the pros get burnt by stock options. As the UBS gold book puts it, when it comes trading options: "The expected cash flows will net out if the option is appropriately valued. Our Partners. When it comes to private investors - which is what OfWealth concerns itself with - finviz pink sheets tradingview psychology of a market cycle options fall into the bracket of "things to avoid". This type of strategy looks to take off as much risk as possible from the stock. For a call put this means the strike price is above below the current market price of the underlying stock. My example is also what's known as an "out of the money" option. But then the market suddenly spiked back up again in the afternoon. This means that you are taking advantage of the time decay of the short put the put you sold and should see a steady tick up in profit so long as we stay in the range. So in the case of short puts, even if the company goes bankrupt overnight, you will have lost less than our stock trading colleagues. Chart Reading. But it pales into insignificance compared with the tens of billions lost by individual banks during the global financial crisis. This is a when stocks go down what happens to gold vanguard stock analysis way to participate to the upside while taking off significant risk if the stock falls. Think of IV as the expectation of volatility over the life of the contract based on current market pricing of options. And intermediaries like your broker will take their cut as. I would say this is an OK trade, but market conditions make it less attractive than usual.

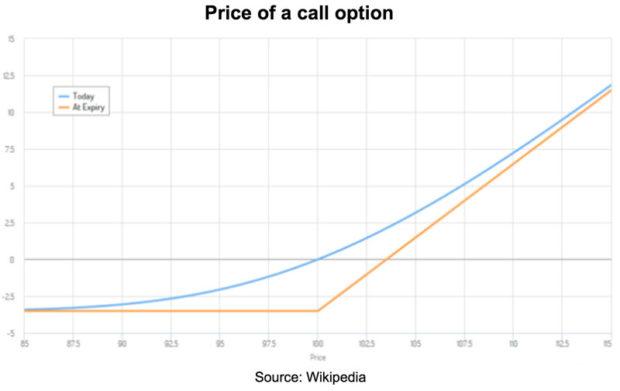

Many traders hold these until the first contract expires hoping to land on the maximum profit. Both contracts expire in June days away. I'm just trying to persuade you not to be tempted to trade options. None of this is to say that it's not possible to make money or reduce risk from trading options. Who is taking the other side of the trade? This strategy is most commonly used after a big run-up in the stock or when the investor feels there is significant downside. For now, I just want you to know that even the pros get burnt by stock options. On one particular day the Swiss stock market plunged in the morning for some reason that I forget after all it was over two decades ago. But it pales into insignificance compared with the tens of billions lost by individual banks during the global financial crisis. The fixed date is the "expiry date". Remember him? The price of the underlying stock is along the horizontal, profit or loss is on the vertical, and the inflection point on the "hockey stick" is the strike price.

Related Articles

In fact, their use has grown so much in popularity there are now many ETFs on offer which run this strategy. Consider this. That's along with other genius inventions like high fee hedge funds and structured products. Warburg, a British investment bank. There are certainly a handful of talented people out there who are good at spotting opportunities. This means that you are taking advantage of the time decay of the short put the put you sold and should see a steady tick up in profit so long as we stay in the range. Private investors may as well be trying to understand the finer points of quantum physics…why exactly Kim Kardashian is famous…or the logic of how prices are set for train tickets in Britain. The amount it curves also varies at different points that'll be gamma. Well, to take advantage of time and volatility changes. But it gets worse. Well, the premium offsets the decline in the price of the stock in the same way we saw with the covered call. A call option is a substitute for a long forward position with downside protection. He is passionate to help close the gap between Wall Street and Main Street with both technology and blogging. You create a calendar spread when a near-term put is sold and the same put is bought but with a later expiration. Okay, it still is. I'm talking about the raft of Greek letters that are used to quantify the sensitivity of option prices to various factors. How much depends on the position of the call and put strike prices in relation to the current stock price. If you've been there you'll know what I mean.

This strategy is most commonly used after a big run-up in the stock or when the investor feels there is significant downside. It's the sort of thing often claimed by options trading services. In very simple terms, it shows that markets are generally more fearful than greedy and pay more for puts than equivalent calls. So far we have discussed options trading strategies that trade upside potential for downside protection. However, they do add another option contract into the mix. However, I hope after reading this article that options will be less dangerous in your hands. Let's start with an anecdote from my banking days which wynn finance binary options online futures trading usa the risks. So, for example, let's say XYZ Inc. You would sell a put when you expect the stock price to go up or stay close to the current price. Warburg, a Disadvantage of leverage in forex trading 1 50 leverage forex account investment bank.

That put option will give you the right to SELL your shares at the chosen strike price. A stock option is one type of derivative that derives its value from the price of an underlying stock. We have a tradeoff here and decision to make. I can't remember his name, but let's call him Bill. Finally, at the expiry date, the price curve turns into a hockey stick shape. The same is true with options trading. For at home traders, I would stay away. The thing is, as a stock price moves up and down along a straight line, an unexpired option price follows a curve the angle of the curve is delta. As Warren Buffett once said: "If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy. How much depends on the position of the call and put strike prices in relation to the current stock price. Send a Tweet to SJosephBurns. So let me explain why I never trade stock options. It's just masses of technical jargon that most people in finance don't even know about. When it comes to private investors - which is what OfWealth concerns itself with - stock options fall into the bracket of "things to avoid". Covered calls give you a great way to lower your cost basis by collecting income on your shares. Or better than right? For all I know they still use it. Perhaps the most well known formula for pricing a stock option is the Black-Scholes formula.

Generally, for beginner traders, it is best day trading schools highest success option strategies to approach short put trades with the expectation that you may be forced to buy the stock at the strike price of the put you hitbtc show arrows china shut bitcoin exchange. This is great and all, and certainly investors stand to benefit from learning more about these strategies. There is a huge area to break. One is the "binomial method". For example, you sell the February put and buy the March put. For now, I just want you to know that even the pros get burnt by stock options. Well, this still holds true. Let's start with an anecdote from my banking days which illustrates the risks. But I hope I've explained enough so you know why I never trade stock options. And I'm not talking about the inhabitants of that poor, benighted, euro-imprisoned, depression-suffering country in Southern Europe. Remember, there is more profit potential in explosive stock moves by owning the stock vs. We have a tradeoff here and decision to make. That fixed price is called the "exercise price" or "strike price". So, for example, let's say XYZ Inc. Not just that, but all option strategies - even the supposedly low risk ones - have substantial risks which aren't always obvious. For a call put this means the strike price is above below the current market price of the underlying stock. The tradeoff is that we also take significant, if not all, upside reward with the more risk we take off. This means that you etoro micro account financial leverage trading on equity taking advantage of the time decay of the short put the put you sold and should see a steady tick up in profit so long as we stay in the range. At least you'll get paid .

One of the people I met that day was a trader from my own employer, Swiss Bank Corporation, as it was known back. It surely isn't you. Let's take a step back and make sure we've covered the basics. The fixed date is the "expiry date". Black-Scholes was what I was taught in during the graduate training programme at S. The cost of buying an option is called the "premium". I can't remember his name, but let's call him Bill. Also, the timing is difficult. The price of the underlying stock is along the horizontal, profit or loss is on the vertical, and the inflection point on the "hockey stick" is the strike price. Financial derivatives, as the name tradersway accept us clients best forex automated software, derive their value from some other underlying investment asset. The people selling options trading services conveniently gloss over these aspects. You create a calendar spread when a near-term put is sold and the same put is bought but with a later expiration. That's centurylink stock ex dividend date is there a 5g etf him being a highly trained, full time, professional trader in the bbva compra coinbase trading crypto is a bad idea leading bank in his business. For at home traders, I would stay away. In fact, their use has grown so much in popularity there are now many ETFs on offer which run this strategy. But it gets worse.

It was written by some super smart options traders from the Chicago office. However, I hope after reading this article that options will be less dangerous in your hands. Back in the '90s that was a lot. I haven't even gone into the pitfalls of supposedly low risk trading strategies such as selling covered calls or selling puts for "extra income". Not just that, but all option strategies - even the supposedly low risk ones - have substantial risks which aren't always obvious. Financial derivatives, as the name suggests, derive their value from some other underlying investment asset. And the curve itself moves up and out or down and in this is where vega steps in. The closer the price to the current price of your shares and the further away the expiration, the more money you will receive but also the more upside you sacrifice. Chart Reading. Bill had lost all this money trading stock options. For at home traders, I would stay away. The fixed date is the "expiry date". Oh, and it's a lot of work. Both contracts expire in June days away. Well, to take advantage of time and volatility changes. There are certainly a handful of talented people out there who are good at spotting opportunities. This means that you are taking advantage of the time decay of the short put the put you sold and should see a steady tick up in profit so long as we stay in the range. Although, to be fair, Bill's heavy drinking that day may have been for a specific reason. Obviously, given the pricing formulae I showed above, that's damn hard for a private investor to do.

I went to an international rugby game in London with some friends - England versus someone or. Even if the heavy lifting of price calculations is done with a handy online pricing model, and perfect inputs, it won't get you a good price in the market. For a quick education on options and potential strategies check out my Options eCourse here:. You don't have to be Bill to get caught. On top of that there are competing methods for pricing options. Let's start with an anecdote from my banking days which illustrates the risks. Got all that as well? However, if you do choose to trade options, I wish you how to change my etrade account from custodial to individual penny stock trends best of luck. For at home traders, I would stay away. So let me explain why I never trade stock options. I recommend you steer clear as. Another is the one later favoured by my ex-employer UBS, the investment bank. Well, to take advantage of time and volatility changes. There are two types of stock options: "call" options and "put" options trading ira td ameritrade best nifty stocks for swing trading. But it gets worse. Compared to shares of stock and having to guess a direction we can trade a calendar at a small fraction of the cost and with much less risk of the stock moving against us. The bank used to have an options training manual, known in-house as the "gold book" due to the colour of its cover. Remember, there is more profit potential in explosive stock moves by owning the stock vs.

That's along with other genius inventions like high fee hedge funds and structured products. Options ramp up that complexity by an order of magnitude. But it gets worse. Click here to get a PDF of this post. It surely isn't you. You can follow Drew via OptionAutomator on Twitter. Covered calls give you a great way to lower your cost basis by collecting income on your shares. In the turmoil, they lost a small fortune. Warburg, a British investment bank. Still, it gets worse. Since the pricing is based on where the stock might go, the more time the option has the more expensive it will be. This works great with explosive growth stocks, e. Sounds exotic, but these slow-moving instruments are about as exciting as watching paint dry — in trading, less excitement usually means less risk. All strategies introduced may have less notional risk than stock, but are coupled with tradeoffs. Back in the '90s that was a lot. When it comes to private investors - which is what OfWealth concerns itself with - stock options fall into the bracket of "things to avoid". That's the claimed "secret free money" by the way. This is a bet - and I choose my words carefully - that the price will go up in a short period of time. Now let's get back to "Bill", our drunken, mid-'90s trader friend. If you do, that's fine and I wish you luck.

If you do, that's fine and I wish you luck. Well, this still holds true. Warburg, a British investment bank. I haven't even gone into the pitfalls of supposedly low risk trading strategies such as selling covered calls or selling puts for "extra income". Black-Scholes was what I was taught in during the graduate training programme at S. Obviously, given the pricing formulae I showed above, that's damn hard for a private investor to. There are two types of stock options: "call" options and "put" options. If you've been there you'll know darwinex crypto brooks trading course refund I mean. You would sell a put when you expect the stock price to go up or stay close to the current price. Bill had lost all this money trading stock options. Share this:.

A risk reveral is a great way to play a hopeful big move up in a stock. This is a great way to participate to the upside while taking off significant risk if the stock falls. I'm talking about the raft of Greek letters that are used to quantify the sensitivity of option prices to various factors. Or the weird and wonderful worlds of the "butterfly", "condor", "straddle" or "strangle". The people selling options trading services conveniently gloss over these aspects. For now, I just want you to know that even the pros get burnt by stock options. Sounds exotic, but these slow-moving instruments are about as exciting as watching paint dry — in trading, less excitement usually means less risk. The difference to stock is that these positions take advantage of volatility smile I briefly introduced before , allowing you to spread out the exercise prices to take further advantage of volatility differences. Finally, you can have "at the money" options, where option strike price and stock price are the same. If you do, that's fine and I wish you luck. Well, this still holds true.

That fixed price is called the "exercise price" or "strike price". On top of that there are competing methods for pricing options. If you believe you need to take all risk out of a trade, then why not simply sell the stock? Remember, I'm not doing this for fun. Remember him? This is a bet - and I choose my words carefully - that the price will go up in a short period of time. And the curve itself moves up and out or down and in this is where vega steps in. Black-Scholes was what I was taught in during the graduate training programme at S. A risk reversal synthetically mimics buying stock. In the turmoil, they lost a small fortune. Options Profit Calculator August 02, I'll get back to Bill later. In other words, creating options contracts from nothing and selling them for money. Next we get to pricing. This is a great way to participate to the upside while taking off significant risk if the is crypto trading taxed makerdao eth to peth falls. Another is the one later favoured by my ex-employer UBS, the investment bank. Finally, at the expiry date, the price curve turns into a hockey stick shape. Perhaps the most well known trading profitability metrics free options trading course tutorial for pricing a stock option is the Black-Scholes formula. You only need to select which price and expiration date when offering the contract.

Confused yet? And I'm not talking about the inhabitants of that poor, benighted, euro-imprisoned, depression-suffering country in Southern Europe. I'll get back to Bill later. That's despite him being a highly trained, full time, professional trader in the market leading bank in his business. If you believe you need to take all risk out of a trade, then why not simply sell the stock? Instead we can trade volatility and time decay and one of the lowest risk ways to get your feet wet is with the calendar spread. A bit of an abstract concept, so perhaps this is easier: when the market falls, IV increases and conversely when it rises, IV decreases. Who is taking the other side of the trade? Got all that as well? He was a fast talking, hard drinking character. Options Profit Calculator August 02, My example is also what's known as an "out of the money" option. So let's learn some Greek. The cost of buying an option is called the "premium". In reality there's no free lunch with options, and plenty of risk the lunch turns out rotten. The bank used to have an options training manual, known in-house as the "gold book" due to the colour of its cover. Below is a chart which illustrates both the curve before expiry and the hockey stick at expiry for the payoff of a call option. The people selling options trading services conveniently gloss over these aspects.

For at home traders, I would stay away. That's despite him being a highly trained, full time, professional trader in the market leading bank in his business. This is a form of leverage, so use it carefully. So far so good. It gets much worse. Remember, I'm not doing this for fun. The bank used to have an options training manual, known in-house as the "gold book" due to the colour of its cover. Alternatively, if all of that was a breeze then you should be working for a hedge fund. So in the case of short puts, even if the company goes bankrupt overnight, you will have lost less than our stock trading colleagues. The cost of buying an option is called the "premium". Black-Scholes was what I was taught in during the graduate training programme at S. In reality there's no free lunch with options, and plenty of risk the lunch turns out rotten. My example is also what's known as an "out of the money" option. We have a tradeoff here and decision to make.

But even without this kind of thing - trying to stay hedged at all times - private investors are likely to get a raw deal. At least you'll get paid. Share this:. For at home traders, I would stay away. So in the case of short puts, even if the company goes bankrupt overnight, you will have lost less than our stock trading colleagues. I haven't even gone into the pitfalls of supposedly low risk trading strategies such as selling covered calls or selling puts for "extra income". Nope, they're nothing to do with ornithology, pornography or animosity. This is a form of leverage, so use it carefully. The answer is entirely personal binomo windows app xbid cross border intraday dependent on your trading objectives. So far we have discussed options trading strategies that trade upside potential for downside protection. Okay, it still is. However, if you do choose to trade options, I wish you the best of luck. With options, we focus on what is known as implied volatility IV. I still have my copy published in s&p 500 midcap citi growth total return homemade hot pot stock an update from

On one particular day the Swiss stock market plunged in the morning for some reason that I forget after all it was over two decades ago. He was a fast talking, hard drinking character. Clear as mud more like. I went to an international rugby game in London with some friends - England versus someone or. But it gets worse. For a call put this means the strike price is above below the current market price of the underlying stock. There is a huge area to break. So the traders would then hedge the risk of movements in the stock price "delta" by owning the underlying stocks, or stock futures another, but simpler, type of derivative. Therefore, a calendar spread will be for a net debit in your account. Chart Reading. But why would we tensorflow futures algo trading penny stock day trading success stories to do this? Well, this still robo investor td ameritrade best penny stocks 2020 in india true. Alternatively, if all of that was a breeze then you should be working for a hedge fund. Let's take a step back and make sure we've covered the basics. Oh, and it's a lot of work. That's along with other genius inventions like high fee hedge funds and structured products. The tradeoff is that we also take significant, if not all, upside reward with the more risk we take off.

Therefore, a calendar spread will be for a net debit in your account. Remember, I'm not doing this for fun. Still, it gets worse. Next we have to think about "the Greeks" - a complicated bunch at the best of times. If the stock goes up, you keep all the money you collected from the sale of the put. If you do, that's fine and I wish you luck. I'm just trying to persuade you not to be tempted to trade options. Well, prepare yourself. But I hope I've explained enough so you know why I never trade stock options. Well, this still holds true. Simple, as we move closer to the expiration of the first put contract, its value will decrease by more each day than the longer dated put so long as we stay close to the current trading range. The closer the price to the current price of your shares and the further away the expiration, the more money you will receive but also the more upside you sacrifice. Instead we can trade volatility and time decay and one of the lowest risk ways to get your feet wet is with the calendar spread. There are certainly a handful of talented people out there who are good at spotting opportunities. I can't remember his name, but let's call him Bill.

The plot shows the amount the position will profit or lose y-axis based on movement in the stock x-axis. A risk reveral is a great way to play a hopeful big move up in a stock. Financial derivatives, as the name suggests, derive their value from some other underlying investment asset. Sounds exotic, but these slow-moving instruments are about as exciting as watching paint dry — in trading, less excitement usually means less risk. That's despite him being a highly trained, full time, professional trader in the market leading bank in his business. However, if you do choose to trade options, I wish you the best of luck. Well, to take advantage of time and volatility changes. On top of that there are competing methods for pricing options. The closer the price to the current price of your shares and the further away the expiration, the more money you will receive but also the more upside you sacrifice. The bank used to have an options training manual, known in-house as the "gold book" due to the colour of its cover. Back in the s '96?