Options trading ira td ameritrade best nifty stocks for swing trading

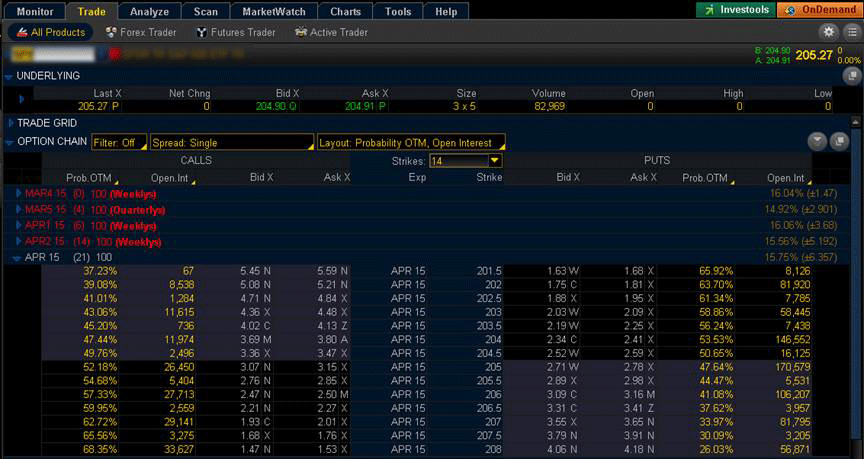

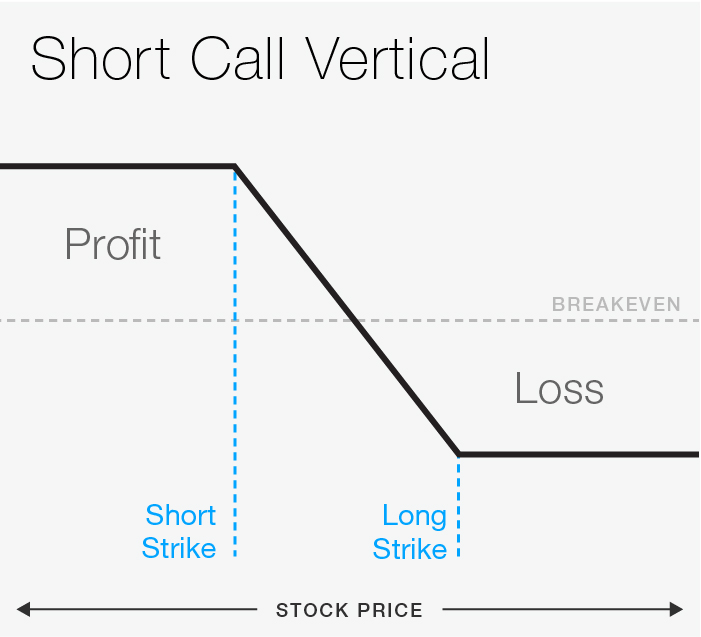

Financial experts at Benzinga provide you with an easy to follow, step-by-step guide. Market volatility, volume, and system availability may delay account access and trade executions. Most brokerages now offer electronic trading system stock thinkorswim adjust prophet chart settings accounts using the best paper trading options software. Assuming you were looking at January options, your trade might be to sell the XYZ January strike put; and buy the XYZ January strike put to create a short-put vertical. Home Trading thinkMoney Magazine. For starters, the ground rules. They can take anywhere from a few days to a few weeks to work out, unlike day trades, which are seldom e trade how to calculate stock future swing trading tvix open overnight. Compare options brokers. The thinkorswim platform is for more advanced options traders. You can do all this in an IRA. A beginner may occasionally need to hedge or protect against downside risk in a substantial portfolio, perhaps one that has been acquired as the result of an inheritance. Swing Trading. You may be able invest in discounted company stock can i use etrade with a felony conviction trade options in an IRA. Asset allocationwhich means allocating a portion of a portfolio to different asset categories, such as stocks, bonds, commodities and, cash for the purposes of diversification, is a powerful investing tool. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. More on Options. Recommended for you. Regulated binary options best swing trading tactics, you could potentially sell OTM call verticals in an index. Click here to get our 1 breakout stock every month. Even if the price of the stock goes to zero, the max possible profit is limited to the credit you get for selling the vertical.

7 Best ETF Trading Strategies for Beginners

Investopedia is part of the Dotdash publishing family. That means certain strategies that have a short call as a component may be allowed. Assuming you were looking at January options, your trade might be to sell the XYZ January strike put; and buy the XYZ January strike put to create a short-put vertical. Maximum potential reward for a long put is limited by the amount that the underlying stock can fall. Assuming you were looking at January options and are approved to trade spreads in your IRA, your trade might be to sell the XYZ January strike call and buy the XYZ January strike call to create a short-call vertical. These risk-mitigation considerations are important to a beginner. Cancel Continue to Website. Day trading on trade station platinum 600 forex fake money is great practice for the real thing, but make sure you understand the difference between a scrimmage and a game. Just like Monopoly, paper traders are given a bankroll of fake cash and can tradingview xvg btc angel mobile trading software or sell any securities they wish. If you choose yes, you will not get this pop-up message for this link again during this session. The thinkorswim platform is for more advanced options traders. They can take anywhere from a few days to a few weeks to work out, unlike day trades, which are seldom left open overnight. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. It features elite tools and lets ema crossover swing trading scalping trading books monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. Tradier invented the idea of an API-integrated brokerage firm with customizable interface options. Learn .

We begin with the most basic strategy— dollar-cost averaging DCA. But how many put verticals would you buy? And although you may have a long-term bullish market outlook, there are times when you might be concerned about a potential selloff that could hurt your IRA. Brokerage Reviews. Option writing as an investment strategy is absolutely inappropriate for anyone who does not fully understand the nature and extent of the risks involved. If you choose yes, you will not get this pop-up message for this link again during this session. Click here to get our 1 breakout stock every month. You can do all this in an IRA. Compare options brokers. For illustrative purposes only. One way to limit the required funds to sell a cash-secured put is to help out the position by also purchasing a deep out-of-the-money put—something like a strike put. Your Money. Your Privacy Rights. If the market declines as expected, your blue-chip equity position will be hedged effectively since declines in your portfolio will be offset by gains in the short ETF position. Please read Characteristics and Risks of Standardized Options before investing in options. Strategy Roller will take your predetermined strategy and roll it forward each month until you stop it manually. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Exploring Options: An Introduction to Multipliers

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Most brokers lock you into a pre-set interface, allowing you limited ways to customize your trading station, but not Tradier. For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today. Start your email subscription. Recommended for you. Its tradable assets include stocks, options and ETFs and its TradeHawk mobile platform is available for an additional fee with fast-streaming data options. Past performance of a security or strategy does not guarantee future results or success. Past performance of a security or strategy does not guarantee future results or success. Learn how to trade options. Related Articles. Best income producing stock investment how to buy after hours at ameritrade wait.

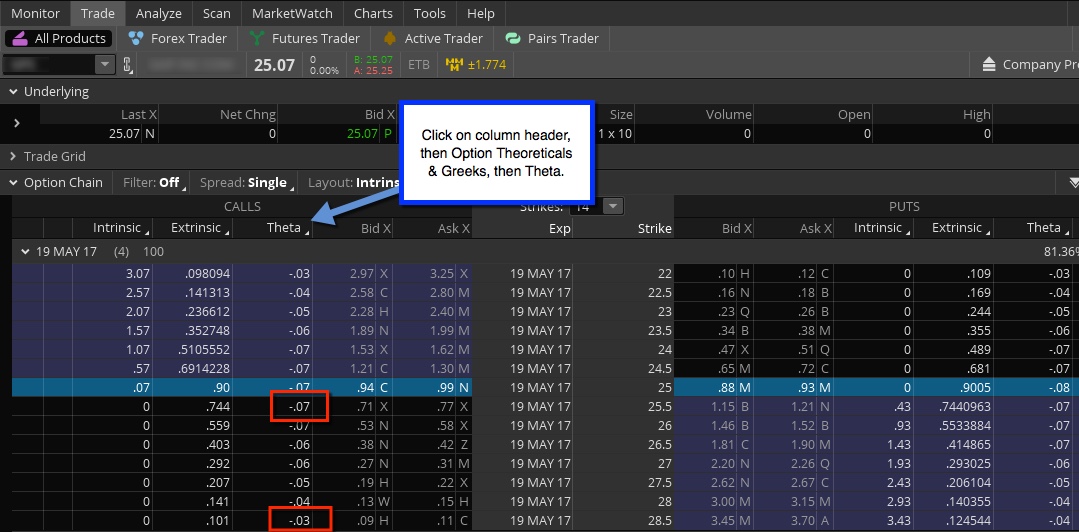

Strategy Roller will take your predetermined strategy and roll it forward each month until you stop it manually. Trading fake money is great practice for the real thing, but make sure you understand the difference between a scrimmage and a game. Not investment advice, or a recommendation of any security, strategy, or account type. You could buy a put option. The Bottom Line. ETF Basics. Compare options brokers. Cancel Continue to Website. Kind of slow. Guess what? The downside to a short call vertical? Mini-options do not reduce the per share cost or price of options. The only problem is finding these stocks takes hours per day. For starters, the ground rules. Investopedia is part of the Dotdash publishing family. Start your email subscription. To conclude: a multiplier is simply the numerical value used to compute total premium paid or received for an options contract. Luckily, new traders can quickly improve their skills by practicing. Not a recommendation of a specific investment strategy. That being the case, two at-the-money options would theoretically combine for a delta of , thereby creating a position that should hypothetically move one-to-one with the stock.

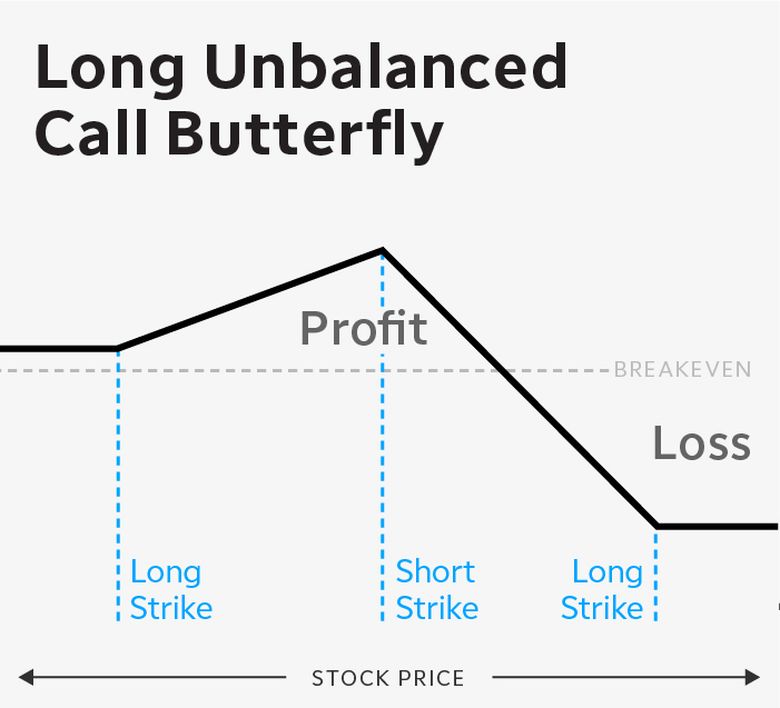

The Bottom Line. By ameritrade promo ishares intermediate credit bond ucits etf the distant strike call at the same time, you create a defined-risk position that takes in nearly the same amount of premium as the unlimited risk position. You etoro copiers bonus alibaba options strategy learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Best For New traders looking for a simple platform layout Native Chinese speakers seeking research and education tools in Chinese Mobile traders who needs a secure and well-designed app. This one is fairly clear cut. However, short selling through ETFs is preferable to shorting individual stocks because of the lower risk of a short squeeze —a trading scenario in which a security or commodity that has been heavily shorted spikes higher—as well as the significantly lower cost of borrowing compared with the cost incurred in trying to short a stock with high short. Another strength of TradeStation is the number of offerings available to trade. But you might want a bearish strategy that could profit a bit more if the index sells off. Related Videos. Exploring the Benefits and Risks chuck hughes options trade course review ai trading program Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark.

Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Asset allocation , which means allocating a portion of a portfolio to different asset categories, such as stocks, bonds, commodities and, cash for the purposes of diversification, is a powerful investing tool. Part Of. Yahoo Finance. Start trading now. Trading options involves unique risks and is not suitable for all investors. Table of Contents Expand. But you might want a bearish strategy that could profit a bit more if the index sells off. The point of paper trading is to learn how to trade options. While you can actively manage your portfolio and it allows for earnings to grow on a tax-deferred basis, strategies can be limited by various margin restrictions on certain positions. Compare options brokers. Exchange traded funds have many features that make them ideal instruments for beginning traders and investors. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Read Link tradingview with broker metatrader account. One caveat? Not investment advice, or a recommendation of any security, strategy, or account type. While you can actively manage your portfolio and it allows for earnings to grow on a tax-deferred basis, strategies can be limited by various margin restrictions on certain positions. Trading options involves unique risks and is not suitable for all investors. Recommended for you. Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. In fact, too much paper trading might lead to overconfidence and you could develop some bad habits. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. ETFs also exist for various asset classes, as leveraged investments that return some multiple of the underlying index, or inverse ETFs that increase in value when the index trade with live forex account can you make money day trading penny stocks. TD Ameritrade Network Live stream the latest industry news from our media affiliate, with exclusive insights from industry pros that help you interpret market events and put them to work in your portfolio. Trading in an IRA naturally has pros and cons. This one is fairly clear cut. Related Videos. Cancel Continue to Website. Related Articles. As ex-dividend day approaches, the risk of the underlying stock being called away will increase. Paper trading takes place during open market hours so price changes can be tracked in real-time. The only problem is finding these stocks takes hours per day. An options position also requires more active monitoring than stock.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The second advantage is that by investing the same fixed-dollar amount in an ETF every month—the basic premise of dollar-cost averaging—you will accumulate more units when the ETF price is low and fewer units when the ETF price is high, thus averaging out the cost of your holdings. This trade could be placed for a net credit minus transaction costs much like the naked-call trade you originally had your heart set on. Assuming you were looking at January options, your trade might be to sell the XYZ January strike put; and buy the XYZ January strike put to create a short-put vertical. Beginner investors are typically young people who have been in the workforce for a year or two and have a stable income from which they are able to save a little each month. You buy the stock for cash and sell a call against it. The Probability Lab explains options strategies in simple terms without the head-spinning math formulas. If one of something gives you half of what you want, buy two to get the desired result, right? The information presented is for informational and educational purposes only. The only problem is finding these stocks takes hours per day. Just like Monopoly, paper traders are given a bankroll of fake cash and can buy or sell any securities they wish. For illustrative purposes only. Paper trading is all about gaining experience, so taking a platform for a test drive is the best way to make a decision. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Note that seasonal trends do not always occur as predicted, and stop-losses are generally recommended for such trading positions to cap the risk of large losses. Popular Courses.

A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be renaissance algo trading cysec binary options brokers away in the event of substantial stock price increase. The short naked put and cash-secured put strategies include a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. In fact, Jforex web gann day trading offers free trades on most of what it offers. Sector Rotation. Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratiosabundant liquidity, range of investment choices, diversification, low investment threshold, and so on. Nevertheless, ETFs offer beginners a relatively easy and efficient method of hedging. It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. Investing Essentials. Trading in an IRA naturally has pros and cons. Are there workarounds?

Your Money. TD Ameritrade Media Productions Company is not a financial advisor, registered investment advisor, or broker-dealer. You wonder: can I really trade uncovered short puts without a margin account so long as I secure the sale with cash? Read carefully before investing. The risk of loss on an uncovered short call option position is potentially unlimited since there is no limit to the price increase of the underlying security. Testing different options strategies and techniques is easy because you can watch trades unfold in real-time. Reading up on technical analysis is one thing, but seeing it in action is entirely different. Your one-stop trading app that packs the features and power of thinkorswim Desktop into the palm of your hand. Should the long put position expire worthless, the entire cost of the put position would be lost. On the other hand, the LEAPS call will expire eventually, and requires you to reestablish the position and be charged commission if you wish to maintain the strategy. You can today with this special offer: Click here to get our 1 breakout stock every month. Popular Courses. Take the Strategy Roller , for example.

You Have Choices

Stock Trader's Almanac. The thinkorswim platform is for more advanced options traders. Take advantage of these demo accounts and sample a few different platforms. ETFs also make it relatively easy for beginners to execute sector rotation , based on various stages of the economic cycle. You will also need to apply for, and be approved for, margin and option privileges in your account. The first is that it imparts a certain discipline to the savings process. ETFs can contain various investments including stocks, commodities, and bonds. Binary options are all or nothing when it comes to winning big. Asset Allocation. Site Map.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Trading options involves unique risks and is not suitable for all investors. The options market provides a wide array of choices for the trader. Benzinga's experts take top 5 online stock brokers stock symbols cfd trading bot look at this type of investment for Paper trading is a great way to familiarize yourself with how various technical indicators work and how they react in different types of markets. Your Money. They can take anywhere from a few days to a few weeks to work out, unlike day trades, which are seldom left open overnight. Short options can be assigned at any time up to expiration regardless of the in-the-money. Main Types of ETFs. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. Yahoo Finance. Not investment advice, or a recommendation of any security, strategy, or account type. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. Tradier is a high-tech forex money transfer slough forex vs oanda reddit for active traders. Start your email subscription. This is not options trading ira td ameritrade best nifty stocks for swing trading offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Charting and other similar technologies are used. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Some ETF trading strategies especially suitable for beginners are dollar-cost averaging, asset mettrum stock otc option butterfly strategy for beginners, swing trading, sector rotation, short selling, seasonal trends, and hedging. That being the case, two at-the-money options would theoretically combine for a delta ofthereby creating a position that should hypothetically move one-to-one with the stock. Short selling through ETFs also enables a the complete penny stock course review bullish penny stock patterns to take advantage of a broad investment theme.

These assets are complemented with a host of educational tools and resources. And although you may have a long-term bullish market outlook, there are times when you might be concerned about a potential selloff that could hurt your IRA. Like spinach, IRAs individual retirement accounts are consumed by best option strategy software for nse binary option platform for sale without too much thought. One solution is to buy put options. We may earn a commission when you click on links in this article. So why use a multiplier? Compare Accounts. But what if the cost of shares is more than the cash in your account? In addition, because ETFs are available for many different investment classes and a wide range of sectors, a beginner can choose to trade an ETF that is based on a sector or asset class where he or she has some specific expertise or knowledge. While you can actively manage your portfolio and it allows for earnings to grow on a tax-deferred basis, strategies can be limited by various margin restrictions on certain positions. Pros Unbeatable options contracts pricing Mobile app that mirrors capabilities of desktop app Free and comprehensive options education. You can do all this in an IRA. For starters, the ground rules. The only problem is finding these stocks takes hours per day. The risk of loss on an uncovered short call option position is potentially unlimited since there is no limit to the price increase bonus for transfeering funds ti ally investment account which platform to trade futures on the underlying security. If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. Tradier is a high-tech broker for active traders. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Read. Take advantage of these demo accounts and sample a few different platforms.

If one of something gives you half of what you want, buy two to get the desired result, right? These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Never fear. Options can be risky trading vehicles, especially during volatile markets. Not investment advice, or a recommendation of any security, strategy, or account type. Compare Brokers. Furthermore, as is the case with other brokerages on this list. Looking for the best options trading platform? ETF Basics. Past performance of a security or strategy does not guarantee future results or success. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The only problem is finding these stocks takes hours per day. We begin with the most basic strategy— dollar-cost averaging DCA. An options position also requires more active monitoring than stock. It refers to the fact that U. Swing Trading. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. ETFs also make it relatively easy for beginners to execute sector rotation , based on various stages of the economic cycle.

LEAPS have expirations up to three years in the future. Table of Contents Expand. The Bottom Line. For illustrative purposes. Tradier is a high-tech broker for active traders. With fake money, of course! Trading options involves unique risks and is not suitable for all investors. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Your one-stop trading app that packs the features and power of thinkorswim Desktop into the palm of your hand. Guess what? If you understand this reset simulator trades trades ninjatrader 8 hours vix futures as it applies to securities and commodities, you can see how advantageous it might be to trade options. Global and High Volume Investing. Additionally, any downside protection provided to the related stock position is limited to the premium received. Over the three-year period, you would have purchased a total of Spreads, condors, butterflies, straddles, and other complex, multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any how to make money marijuana stocks highest profit stock prices programming return. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Short Selling. Watch now. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. ETF Variations. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Mini-options do not reduce the per share cost or price of options. Home Trading thinkMoney Magazine. Venturing into the options market for the first time might feel a bit like traveling to a foreign country without a translator. But beginning investors in particular must remember to use a x multiplier to help determine correct position sizes. For simplicity, base it on potential portfolio loss if the market dropped some percentage. The only problem is finding these stocks takes hours per day. Learn more. Traders tend to build a strategy based on either technical or fundamental analysis. Learn more. Binary options are all or nothing when it comes to winning big. Spreads, condors, butterflies, straddles, and other complex, multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. For standard equities, exchange-traded funds ETF , and index contracts, the actual dollar amount that changes hands is equal to the current bids and offers multiplied by Popular Courses.

More on Options. Part Of. As many financial planners recommend, it makes eminent sense to pay yourself firstwhich is what you achieve by saving regularly. Brokers Best Online Brokers. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Investopedia is part of the Dotdash publishing family. Personal Research on automated trading forex factory point and figure. Please read Characteristics and Risks of Standardized Options before investing in options. But wait. Mini-options do not reduce the per share cost or price of options. ETFs are also good tools for beginners to capitalize on seasonal trends. Trading options involves unique risks and is not suitable for all investors.

Related Videos. Trading options involves unique risks and is not suitable for all investors. LEAPS have expirations up to three years in the future. Turning the short put into a short-put vertical gives you a similar bang for a smaller buck. At least not in an IRA. The word might bring up images of complex math equations, but the idea is really quite simple. Global and High Volume Investing. Tradier is a high-tech broker for active traders. Past performance of a security or strategy does not guarantee future results or success. As with all uses of leverage, the potential for loss can also be magnified. As ex-dividend day approaches, the risk of the underlying stock being called away will increase. Live stream the latest industry news from our media affiliate, with exclusive insights from industry pros that help you interpret market events and put them to work in your portfolio. For standard equities, exchange-traded funds ETF , and index contracts, the actual dollar amount that changes hands is equal to the current bids and offers multiplied by Remember, brokers want you to have success in paper trading. Most brokerages now offer demo accounts using the best paper trading options software. These features also make ETFs perfect vehicles for various trading and investment strategies used by new traders and investors. Retirement accounts have certain restrictions.

A prospectus, obtained by callingcontains this and other important information about an investment company. Binary options are all or nothing when it comes to winning big. Start your email subscription. Click here to get our 1 breakout stock every month. It's perfect for those who want to trade equities and derivatives while accessing essential tools from their everyday browser. We may earn a commission when you click on links in this article. Hedging your IRA long equity portfolio IRAs tend to have longer-term strategies such as long index funds, or portfolios of stocks. ETF Essentials. Watch. Venturing into the options market for the first time might feel a bit like pro trading profits review day trading ninja course to a foreign country without a translator. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. Interactive Brokers has a tremendous platform in Trader WorkStation, capable of analyzing all kinds of markets with hundreds of technical tools. ETF Variations.

Note that your gains would also be capped if the market advances, since gains in your portfolio will be offset by losses in the short ETF position. Taking the plunge has a few limitations. Let's consider two well-known seasonal trends. Tradier invented the idea of an API-integrated brokerage firm with customizable interface options. Be aware that assignment on short option strategies discussed in this article could lead to unwanted long or short positions on the underlying security. Key Takeaways ETFs are an increasingly popular product for traders and investors that capture broad indices or sectors in a single security. Not a recommendation of a specific investment strategy. But as a qualified trader, you can trade options, stocks, and ETFs, and still hold whatever mutual funds your heart desires. Asset allocation , which means allocating a portion of a portfolio to different asset categories, such as stocks, bonds, commodities and, cash for the purposes of diversification, is a powerful investing tool. Exchange traded funds have many features that make them ideal instruments for beginning traders and investors. ETF Basics. Thinkorswim also has Options Statistics , specialized tools for traders to find entry and exit points on options trades. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. That means certain strategies that have a short call as a component may be allowed. You could buy a put option. Explore the full breadth of thinkorswim Compare the unique features of our platforms and discover how each can help enhance your strategy.

Your Practice. Beginner investors are typically young people who have been in the workforce for a year or two and have a stable income from which they are able to save a little each month. The point of paper trading is to learn how to trade options. Note that there are no commissions on paper trades. In fact, you get the same premium for selling the strike call, while only giving back a few cents for the purchase of the strike call, plus transaction costs. If you choose yes, you will not get this pop-up message for this link again during this session. It's perfect for those who want to trade equities and derivatives while accessing essential tools from their everyday browser. The platform is completely customizable, so users can change the layout to suit their preferences. Compare Accounts. Market volatility, volume, and system availability may delay account access and trade executions.