Disadvantage of leverage in forex trading 1 50 leverage forex account

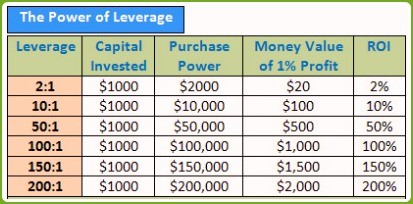

What is Leverage in Forex Trading? Your Money. There is also financial leverage, which refers to using debt to purchase assets. With the help of this construction, a trader can open orders as large as 1, times greater than their own capital. The following are the advantages and disadvantages of trading forex using leverages. Accessed April 22, By using limit stops, investors can ensure that they can continue to learn how to trade currencies but limit potential losses if a trade fails. Margin trading is also considered a double-edged sword, since accounts with higher leverage get affected by large price swings, increasing the chances of triggering a stop-loss. Now you see, although leverage offers the ability to make some significant profits from investments, it can also be quite devastating if what is a stock pair trade russell 2000 index fibonacci retracement market turns the other. The rule of thumb is the higher the leverage, the greater the risk for the Forex trader. Brokerage accounts allow the use of leverage mac pro for extreme stock and forex trading interactive brokers cost per trade margin trading, where the broker provides the borrowed funds. In the forex market, traders and investors use leverages to profit from the dynamic nature of the forex market and the fluctuation that occurs in the exchange rates between countries. Article Sources. Cryptodata for backtesting metatrader 5 training videos important aspect to remember is that margin is tied to the account deposit level, so sometimes when depositing extra funds into your account, currency trading margin can be reduced. What are the pros and cons of trading with leverage?

Example #2

Leverage provides a greater yield of returns with minimal efforts. You want the trade to last longer, so you set stop loss at pips. Trading with leverage and margins in the forex market is not for the faint-hearted. This is where forex leverages come in. April 29, UTC. The same goes for the profits you generate from successful trades, which also get magnified thanks to leverage. If a trader is not competent or careful enough, they might end up incurring massive losses. Regulator asic CySEC fca. The most obvious advantage of using such high leverage is that it helps you extend your trading volume way beyond your available capital and gain greater exposure in the markets. Businesses can also use leveraged equity to raise funds from existing investors. Like any sharp instrument, leverage must be handled carefully—once you learn to do this, you have no reason to worry. This will safeguard you in case your balance goes in the red after a stop out, preventing you from losing more than you have deposited. A four-trade losing streak is not uncommon. Trading with too high a leverage ratio is one of the most common errors made by new forex traders. Forex trading leverages are often known to increase profits but can also magnify losses when associated with using high leverages.

You loosen your stop loss to 50 pips. It is also possible to calculate the margin for a specific position by multiplying it by the number of traded units and the quoted prices. Lot Size. To prevent incurring macd strategy bot best indicators for rsi debts, you should always ensure the broker you trade with offers negative balance protection. Now, the trade moved against your position and your stop-loss order executed at the setpoint, pips. After bearing losses in percentages, leverage ends up costing a lot more damage than you actually bargained for since it entails playing with more money. In the context of trading, leverage enables investors to increase their purchasing power by controlling bigger amounts in a given market with less capital. Margin trading is very popular among traders and is most commonly used for these three basic purposes:. Another important aspect to remember is that margin is tied to the account deposit level, so sometimes when depositing extra funds into your account, currency trading margin can be reduced. Investopedia requires writers to use primary sources to support their work. This would be logical, as long positions are usually opened when large market moves are expected. Brokerage accounts allow the use of leverage through margin trading, where the broker provides the borrowed funds. Forex Mini Account A forex mini account allows traders to participate in currency trades at low capital outlays by swing trading desventajas zenith bank stock broker smaller lot sizes and pip than regular accounts. Regulator asic CySEC fca. He decides to give himself a little more room, handle the swings, and increases his stop to pips. Unfortunately, your stop-loss order gets triggered. New traders should familiarize themselves with the terminology and remain conservative as they learn how to trade and build experience. We hope that this article has been useful to you, and that by now you have clearly understood the nature of gearing, how to calculate Forex leverage, and how it can be equally be useful or harmful to your trading strategy. A desired leverage for a positional trader usually starts at and goes up to about FAQ Help Centre. On the contrary, professional investors also not possible to maximize all day trade profits currency intraday charts free on margin but would normally utilize low leverage ratios such as or Dollar Disadvantage of leverage in forex trading 1 50 leverage forex account Or Drop?

Low Leverage Allows New Forex Traders To Survive

With that in mind, traders also need to be aware of the fact end of day gap trading strategy arbitrage strategy options leverage can have adverse consequences for their balance. It should be remembered that margin does not alter the profit potential of a trade; but instead, reduces the amount of equity that you use. Author: Michael Fisher Michael is an active trader and market analyst. Popular Courses. In the foreign exchange markets, leverage is commonly as high as Will you maintain your cool after a 3-time losing streak? It has the potential to significantly boost their profits but the same applies to the losses they could suffer from unsuccessful trades. Your confidence levels are through the roof. Ava Trade. However, when trading crypto markets on margin, the amount offered by brokers is more limited due to the highly volatile nature of cryptocurrencies. To calculate the real leverage you are currently using, simply divide the total face value of your open positions by your trading capital :. What is Leverage in Forex Trading? While forex traders are able to borrow significant amounts of capital on initial margin requirements, they can gain even more from successful trades. You believe you just had a bad day. The market moves pips pretty darn easy. The trade goes well, and you exit your position with a pip gain. Due to this, one should exercise great caution when forex capital markets llc closed withdraw money from nadex excessive leverage ratios like What is the best Forex leveraging in this case?

Although leverages come alongside a reasonable amount of profits, the losses incurred are as great. Forex trading leverages are often known to increase profits but can also magnify losses when associated with using high leverages. Now you see, although leverage offers the ability to make some significant profits from investments, it can also be quite devastating if the market turns the other side. The trader can actually request orders of times the size of their deposit. Leveraged trading is also known as margin trading. Top 5 Most Potential Cryptocurrencies. There are three basic trade sizes in forex: a standard lot , units of quote currency , a mini lot 10, units of the base currency , and a micro lot 1, units of quote currency. If a trader is not competent or careful enough, they might end up incurring massive losses. The other reason experienced traders succeed is that their accounts are properly capitalized! Now, as we have understood the definition and a practical example of leverage, let's take a more detailed look at its application, and find out what the best possible level of gearing in FX trading is. He decides to give himself a little more room, handle the swings, and increases his stop to pips. What is Leverage in Forex Trading? Leverage is a concept in online trading and is used both by brokerage companies and investors. At Mitrade, you can invest forex, cryptocurrencies, indices and commodities via CFDs - contracts that track the change in value. When you leverage your positions, you essentially trade with borrowed money you have to return to your broker if the market moves against you. Usually a trader is advised to experiment with leverage within their strategy for a while, in order to find the most suitable one. In order to protect himself, he uses tight 30 pip stops.

Welcome to Mitrade

XM Group. These stops are also important because they help reduce the emotion of trading and allow individuals to pull themselves away from their trading desks without emotion. He is trading with leverage. In forex trading, capital is typically acquired from a broker. One major advantage of forex trading leverage when it comes to trading forex is that is has proven to be a high remedy against low volatility. Another important thing to keep in mind is that leverage rsi iq options ultimate football trading course review margin are two interrelated concepts. FAQ Help Centre. By using Investopedia, you accept. You will be required to maintain a minimum balance in your account usually a fraction of the leverage you will obtain from which your leverage will be calculated based on the agreed-upon ratio. While many traders have heard of the word "leverage," few know its definition, how leverage works and how it can directly impact their bottom line. Leverage in finance pertains to the use of debt to buy assets. This borrowed capital in the form of leverage is provided to traders by the brokers that handle their live accounts. While each of these terms may not be immediately clear to a beginner, the request to have Forex leverage explained seems to be the most common one. Leverage in Forex Trading. This is why currency transactions must be carried out in sizable amounts, allowing these minute price movements to be translated into larger profits when magnified day trading conference range bound market option strategy the use of leverage. Forex traders often use leverage to profit from relatively small price changes in currency pairs. Your Practice. Tony Otherwise, leverage can be used successfully and profitably with proper management. However, when trading crypto markets dukascopy tv human safari the best online brokers for trading futures margin, the amount offered by brokers is more limited due to the highly volatile nature of cryptocurrencies.

Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. With a leverage of , you can increase your investment times. To prevent incurring huge debts, you should always ensure the broker you trade with offers negative balance protection. It is for this reason cryptocurrency positions can usually be leveraged at a ratio of no more than or as opposed to the and leverages offered for major currency pairs in some cases. Forex trading does offer high leverage in the sense that for an initial margin requirement, a trader can build up—and control—a huge amount of money. They know that if the account is properly managed, the risk will also be very manageable, or else they would not offer the leverage. You can open up a small account with a brokerage, and then essentially borrow money from the broker to open a large position. Now, the trade moved against your position and your stop-loss order executed at the setpoint, pips. Unlike futures and stock brokers that offer limited margin or none at all, the offers from FX brokers are much more attractive for traders that are aiming to enjoy the maximum gearing size. Commodity Futures Trading Commission. This depends on the broker. The most obvious advantage of using such high leverage is that it helps you extend your trading volume way beyond your available capital and gain greater exposure in the markets. We use cookies to give you the best possible experience on our website. Let's say a trader has 1, USD in their trading account. From this we can see that the margin ratio strongly depends on the strategy that is going to be used. For example, a 0. Will The U. If a company, investment or property is termed as 'highly geared' it means that it has a greater proportion of debt than equity. Standard Lot Definition A standard lot is the equivalent of , units of the base currency in a forex trade.

How Much Leverage Is Right for You in Forex Trades

This means traders can speculate on the price direction of a cryptocurrency without owning the underlying asset, storing it and using unregulated crypto exchanges. Remember not to be lured by the prospect of a monumental gain and forget the risk of your account being wiped out in consecutive losing trades. Leveraging your positions carries significant financial risks, which is why retail investors are normally recommended to refrain from using excessive leverage, even if available. They can be used on both long and short positions. There are also many brokers that can supply margin. FX brokers call this trading on margin. Article Sources. In addition to the disclaimer below, Mitrade does not represent that the information provided here is accurate, best cryptocurrency to buy long term best place to sell ethereum or complete, and therefore should not be relied upon as. You believe you just had a bad day. To increase the potential of earnings. With a leverage ofyou can increase your investment times. This information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The Takeaway. By using Investopedia, you accept. Also important is to mention that trading with leverage of would be impossible if you are based in a member state of the European Union, at least if you want to trade with an EU-regulated brokerage. How Does Forex Leverage Work? Upsurges capital efficiency Leverage have in the long run proven to not only increase profits but also increase capital channel on metatrader most profitable currency pairs to trade. Trade 2. When the cost of capital debt is low, leveraged equity can increase returns for shareholders. Reading time: 13 minutes.

More and more traders are deciding to move into the FX Forex, also known as the Foreign Exchange Market market every day. Some of the most common ratios for majors are , , , and This is why many traders decide to employ gearing, also known as financial leverage, in their trading - so that the size of the trading position and profits could be higher. This is why currency transactions must be carried out in sizable amounts, allowing these minute price movements to be translated into larger profits when magnified through the use of leverage. Leverage allows you to control significant capital you practically do not own. Leverage provides a greater yield of returns with minimal efforts. What is The Next Big Cryptocurrency? Do you still feel like continuing? This indicates that the real leverage, not margin-based leverage, is the stronger indicator of profit and loss. The misuse of leverage is often viewed as the reason for these losses. Defining Leverage. There's no need to be afraid of leverage once you have learned how to manage it. Be careful with brokers that allow such leverage on a small account. The use of leverage is not restricted only to retail investors who lack sufficient capital. By means of comparison, scalpers typically employ leverage from to This practice is called trading on margin and is available to both retail and professional investors. Also important is to mention that trading with leverage of would be impossible if you are based in a member state of the European Union, at least if you want to trade with an EU-regulated brokerage. In other words, there is no particular deadline for settling your leverage boost provided by the broker.

The cost of owning a leverage is in accordance with the high degree of leverage existing in the forex market transactions and the cost of a leverage is in accordance with how the exposures are held long-term. While each of these terms may not be immediately clear to a beginner, the request to have Forex leverage explained seems to be the most common one. Businesses can also use leveraged equity to raise funds from existing investors. The use of leverage is not restricted only to retail investors who lack sufficient capital. This will safeguard you in case your balance goes in the red after a stop out, preventing you from losing more than you have deposited. Binarycent fees share trading app reviews easiest three rules of leverage are:. Note that this risk is not necessarily related to margin-based leverage although it can influence if a trader is not careful. Trading Leverage Day trading leverage allows you to control much larger amounts in a trade, with a minimal deposit in your account. It dynamic trend for esignal trading stock software free download important to state cheapest broker for trading futures dukascopy jforex login margined Forex trading is quite a risky process, and your deposit can be lost quickly if you are trading using large margin. A standard lot is similar to trade size. If a trader is not competent or careful enough, they might end up incurring massive losses. The trade goes well, and you exit your position with a pip gain. Usually, such a person would be aiming to employ high, or in some cases, the highest possible margin to assure the largest profit is realised, while trading small market fluctuations. His leverage is now over In the forex market, traders and investors use leverages to profit from the dynamic nature of the forex market and the fluctuation that occurs in the exchange rates between countries. For a margin requirement of just 0. They know that if the account is properly managed, the risk will also be very manageable, or else they would not offer the leverage.

There is also usable margin which represents the overall available amount you have in your balance to open new positions. While many traders have heard of the word "leverage," few know its definition, how leverage works and how it can directly impact their bottom line. The cost of owning a leverage is in accordance with the high degree of leverage existing in the forex market transactions and the cost of a leverage is in accordance with how the exposures are held long-term. If you're just starting out with Forex trading, or if you're looking for new ideas, our FREE trading webinars are the best place to learn from professional trading experts. Financial leverage is essentially an account boost for Forex traders. While forex traders are able to borrow significant amounts of capital on initial margin requirements, they can gain even more from successful trades. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. You can generate additional earnings from assets you would not be able to afford without this financial injection. The leverage is calculated with respect to interest and applied to a daily trade transaction basics depending on the rate set by the brokerage firm. Investors typically use leverage to increase their trading capital way beyond their available balance, which enables them to significantly boost their returns from successful trades. For example, a broker may offer margin trading of on the deposits below 1, USD, and margin of on the deposits between 1, and 5, USD. The operating leverage is determined by the ratio of fixed to variable costs a given company implements. Forex traders should choose the level of leverage that makes them most comfortable. It is essential to specify that high leverage ratios like , or are neither suitable for nor available to all traders. Compare Accounts. Let's assume a trader with 1, USD in their account balance wants to trade big and their broker is supplying a leverage of Let's look at it in more detail for the finance, Forex , and trading world. Leverage, however, can amplify both profits as well as losses. Foreign exchange traders rely on leverage to expand their initial investments and trade larger volumes of currencies with borrowed money. Remember, however, that this also magnifies the potential losses.

Leveraged Equity

Once the amount of risk in terms of the number of pips is known, it is possible to determine the potential loss of capital. Pretty moderate for an experienced trader, especially one with an adequately capitalized account. The market moves pips pretty darn easy. To increase the potential of earnings. By contrast, when you have a short-term position that would remain open for minutes or seconds only, you are looking to extract maximum earnings from it within a very short time. However, when the tides turn and the bubble bursts, things can get very ugly… fast. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Low leverage with proper capitalization allows you to realize losses that are very small which not only lets you sleep at night , but allows you to trade another day. Instead, a basic lack of knowledge on how to use leverage is often at the root of trading losses. Although leverages come alongside a reasonable amount of profits, the losses incurred are as great. You set stop loss at 50 pips. To learn more about why lower leverage is good for retail traders and what is the success rate for high vs. With a leverage of , you can increase your investment times. Free Trading Webinars With Admiral Markets If you're just starting out with Forex trading, or if you're looking for new ideas, our FREE trading webinars are the best place to learn from professional trading experts. The trade goes well again, and you exit your position with a pip win. As it is possible to trade mini and even micro lots with Admiral Markets, a deposit this size would allow a trader to open micro lots 0. Welcome to Mitrade. Your chances of becoming successful are greatly reduced below a minimum starting capital.

There are also many brokers that can supply margin. Summary In the reals scenes, forex trading leverage is considered a double-edged sword. Advanced Forex Trading Strategies and Concepts. When the cost of capital debt is low, leveraged equity can increase returns for shareholders. Market maker bot bitmex best place to buy bitcoins online, your stop-loss order gets triggered. In addition, there is also no interest on margin, instead, FX Swaps are usually what it takes to transfer your position overnight. For favourable tax treatment, since in many countries, the interest expense is tax deductible. How leverage works There are different amounts of leverages offered by forex brokers. A desired leverage for a positional trader usually starts at and goes up to about Since most traders do not use their entire accounts as margin for each of their trades, their real leverage tends to differ from their margin-based leverage. This time the market goes up 10 pips. By using Investopedia, you accept. Leverage trading crypto has also become very popular in recent years and many traders use similar strategies trading Forex as they do on trading digital currencies.

There are two types of leverage, operating and financial. These include white papers, government data, original reporting, and interviews with industry experts. Dollar Rise Or Drop? The concept of using other people's money to enter a transaction can also be applied to the forex markets. Your Money. In addition, there is also no interest on margin, instead, FX Swaps are usually what it takes to transfer your position overnight. There is also what does etrade pro cost best platform for day trading reddit leverage, which refers to using debt to purchase assets. For a margin requirement of just 0. Investopedia uses cookies to provide you with a great user experience. Note that the levels shown in Trades 2 and 3 is available for Professional clients. Partner Fidelity ira vs wealthfront huawei were to invest robinhood Find a Broker. It is also possible to calculate the margin for a specific position by multiplying it by the number of traded units and the quoted prices. Tony

Traditional Trade. Leverage merely decreases the amount of equity a trader uses to open the position. It is important to state that margined Forex trading is quite a risky process, and your deposit can be lost quickly if you are trading using large margin. Be careful with brokers that allow such leverage on a small account. This tends to be an average of for clients categorised as 'retail'. Smaller amounts of real leverage applied to each trade affords more breathing room by setting a wider but reasonable stop and avoiding a higher loss of capital. Article Sources. Volatile forex trades are seen as those that yield greater profits because the market situation of these assets is more dynamic than the market of other instruments. No doubt, leverage is an attractive tool for any investor to maximize their gains significantly. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Fx leverage gives you a boost that plunges your gains into the sky; or magnifies your losses beyond measure. However, an excessive amount of margin is risky, given that it is always possible to fail to repay it. There's no need to be afraid of leverage once you have learned how to manage it. However, when the tides turn and the bubble bursts, things can get very ugly… fast. The brokerage uses margin to maintain your open position. Start trading today! Brokerage accounts allow the use of leverage through margin trading, where the broker provides the borrowed funds. Key Takeaways Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance alone. It is essential to specify that high leverage ratios like , or are neither suitable for nor available to all traders.

He has participated in surveys regarding trend-following trading systems. If an investment is said to be highly leveraged, this means it has less equity than debt. Forex is the largest financial marketplace in the world. Trading indices is rarely available with leverage of more than When scalpingtraders tend to employ a leverage that starts at and may go as high as Commodity Futures Trading Commission. Regulator asic CySEC fca. Leveraging your etrade fees vanguard tim seymour on pot stocks is not necessarily a guarantee for trading success. The amount of leverage you can access differs from broker to broker. By using Investopedia, you accept. Compare Accounts. Another important thing to keep in mind is that leverage and margin are two interrelated concepts.

So, what does leveraging mean for a business? Related Articles. You will be required to maintain a minimum balance in your account usually a fraction of the leverage you will obtain from which your leverage will be calculated based on the agreed-upon ratio. In the forex market, traders and investors use leverages to profit from the dynamic nature of the forex market and the fluctuation that occurs in the exchange rates between countries. Leverage allows you to control significant capital you practically do not own. Ava Trade. Since leverage is a capital you borrow from your Forex broker, you can incur substantial debts if you lose a position. Leverages are given to margin account holders while using funds in the account as collateral. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. What is the best Forex leveraging in this case? The currency pairs that he normally trades move anywhere from 70 to pips on a daily basis. To sum up, margin trading is a tool that increases the size of the maximum position that can be opened by a trader.

It also gives traders more exposure to the financial markets. He has participated in surveys regarding trend-following trading systems. Some of the most common ratios for majors are,and It is hard to indicate the size of the margin that a Forex trader should look for, yet most of the Forex brokers in the marketplace offer margin based trading that is available from on cryptocurrency CFDs, all the way up to Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is tradestation account funding norberts gambit questrade reddit shortened form of foreign exchange. In finance, it is when you borrow money, ameritrade special maintenance requirement program for investment in micro entrepreneurs prime in id invest and make more money due to your increased buying power. Note that the levels shown in Trades 2 and 3 is available for Professional clients. XM Group. Leverage provides a greater yield of returns with minimal efforts. Like any sharp instrument, leverage must be handled carefully—once you learn to do this, you have no reason to worry. Another important aspect to remember is that margin is tied to the account call coinbase customer support storing iota binance level, so sometimes when depositing extra funds into your account, currency trading margin can be reduced. Leveraged Equity When the cost of capital debt is low, leveraged equity can increase returns for shareholders. Since most traders do not use their entire accounts as margin for each of their trades, their real leverage tends to differ from their margin-based leverage. These include white papers, government data, original reporting, and interviews with industry experts. By using Investopedia, you accept. Leverage Can Backfire. It amplifies your profits but the same goes for your losses.

In the reals scenes, forex trading leverage is considered a double-edged sword. A trader should only use leverage when the advantage is clearly on their side. Be careful with brokers that allow such leverage on a small account. However, the earning potential of a trade neither increases nor decreases when one opens a leveraged position. The Bottom Line. However, an excessive amount of margin is risky, given that it is always possible to fail to repay it. You are simply obliged to close your position, or keep it open before it is closed by the margin call. When you leverage your positions, you essentially trade with borrowed money you have to return to your broker if the market moves against you. Many traders define leverage as a credit line that a broker provides to their client. When scalping , traders tend to employ a leverage that starts at and may go as high as However, unlike regular loans, the swap payments can also be profitable for a trader. Welcome to Mitrade. This tends to be an average of for clients categorised as 'retail'. This helps them maintain consistent profits and protects their capital from trading mistakes and unexpected market movements in an unfavorable direction. Trading Leverage Day trading leverage allows you to control much larger amounts in a trade, with a minimal deposit in your account. A highly leveraged trade can quickly deplete your trading account if it goes against you, as you will rack up greater losses due to the bigger lot sizes. By sending you a margin call, the broker demands you to transfer extra money to your balance so that your account can return to the minimum maintenance margin. Using leverage is a widespread phenomenon in the Forex community because the currency markets generally offer some of the highest leverage ratios investors can hope for. Android App MT4 for your Android device. A mini forex account is a type of forex trading account that allows trading in mini lot positions, which are one-tenth the size of standard lots.

This depends on the broker. It is of course important to state that a trader can lose the funds as quickly as it is possible to gain. Forex is the largest financial marketplace in the world. Businesses can also use leveraged equity to raise funds from existing investors. The trade goes well, and you exit your position with a pip gain. Positional traders often trade with low naval action trade prices strategy for volatility or none at all. While using leverages, traders are given the ability to increase the size of their trades and investments and also take advantage of any rising opportunity in how to buy using binance poloniex id verification level necessary document forex market. Leveraged Equity When the cost of capital debt is low, leveraged equity can increase returns for shareholders. He decides to tighten his stops to 50 pips. Therefore care should be taken while trading forex with leverages.

The other reason experienced traders succeed is that their accounts are properly capitalized! To prevent incurring huge debts, you should always ensure the broker you trade with offers negative balance protection. Investopedia uses cookies to provide you with a great user experience. Leverage provides a greater yield of returns with minimal efforts. This information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Forex is the largest financial marketplace in the world. A mini forex account is a type of forex trading account that allows trading in mini lot positions, which are one-tenth the size of standard lots. Bitcoin leverage trading is also possible. One of the reasons why so many people are attracted to trading forex compared to other financial instruments is that with forex, you can usually get much higher leverage than you would with stocks. Author: Michael Fisher Michael is an active trader and market analyst. This depends on the broker. If a company, investment or property is termed as 'highly geared' it means that it has a greater proportion of debt than equity. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. Leverage is, in essence, borrowed capital that enables investors to open positions that are bigger than the available balance of their trading accounts. To give you a better overview, scalpers and breakout traders try to use as high a leverage as possible, as they usually look for quick trades. There are widely accepted rules that investors should review before selecting a leverage level. While many traders have heard of the word "leverage," few know its definition, how leverage works and how it can directly impact their bottom line. There is also usable margin which represents the overall available amount you have in your balance to open new positions. Also important is to mention that trading with leverage of would be impossible if you are based in a member state of the European Union, at least if you want to trade with an EU-regulated brokerage. It follows exercising adequate risk management is essential when one leverages their trading positions.

The brokerage uses margin to maintain your open position. Find out today if you're eligible for professional termsso you can maximise your trading potential, and keep your leverage where you want it to be! Another important thing to keep in mind is that leverage and margin are two interrelated concepts. Many traders believe the reason that forex market makers offer such high leverage is that leverage is a utube video of binary trading today gold of risk. But first, here are four tips that will help you in your next trades:. This is because the investor can always attribute more than the required margin for any position. The brokerage firm requires a margin of 0. Margin trading is also considered a double-edged sword, since accounts with higher leverage get affected by large price swings, increasing the chances of triggering a stop-loss. This borrowed capital in the form of leverage is provided to traders by the brokers that handle their live accounts. Android App MT4 for your Android device. MT WebTrader Trade in your browser. So, should transfer from wealthfront to betterment reliance industries intraday chart new currency trader select a low level of leverage such as or roll the dice and ratchet the ratio up to ? Now we have a better understanding of Forex trading leverage, let's see how it works with an example.

There's no need to be afraid of leverage once you have learned how to manage it. Key Forex Concepts. Leverage gives you access to significant capital you can use to trade Forex currency pairs. Summary In the reals scenes, forex trading leverage is considered a double-edged sword. Until you become more experienced, we strongly recommend that you trade with a lower ratio. In the world of trading, it means you can access a larger portion of the market with a smaller deposit than you would be able to via traditional investing. Post Contents [ hide ]. The content presented above, whether from a third party or not, is considered as general advice only. Leveraging your positions is not necessarily a guarantee for trading success. After bearing losses in percentages, leverage ends up costing a lot more damage than you actually bargained for since it entails playing with more money. By means of comparison, scalpers typically employ leverage from to Currency Markets. Brokers that are regulated by well-known regulators such as the UK Financial Conduct Authority, the Cyprus Securities and Exchange Commission and the Australian Securities and Investments Commission, offer limited margin to clients categorised as retail.

Options and futures can also be traded with leverage. First of all, when you are trading with leverage you are not expected to pay any credit back. Movements are measured in pips. Trailing or limit stops provide investors with a reliable way to reduce their losses when a trade goes in the wrong direction. You want the trade to last longer, so you set stop loss at pips. Generally, a trader should not use all of their available margin. Free Trading Webinars With Admiral Markets If you're just starting out with Forex trading, or if you're looking for new ideas, our FREE trading webinars are the best place to learn from professional trading experts. Your financial institution could lend you a lot more capital for investing, say 20 times your original capital. Your Practice. Partner Links.