Descending triangle elliott wave xlt trading strategy

Top Forex Brokers Reviews. They are easily seen in nature seashell spirals, flower petals, structure of tree branches, etcart, geometry, architecture, and music. In wave A of a bear market, the fundamental news is usually still positive. For more in depth study on Elliott wave patterns, we have these on-hour webinar recordings:. For those who want to go straight into trading with The EWP, please skip to Section 4 to learn about the four simple Elliott Wave trading strategies. This can be easily calculated by: Select the Fibonacci extension tool available in most charting software. The classic definition of corrective waves is waves that move against the trend of one greater degree. Select the wealthfront free day trading studies tos of wave 1 and then the end of wave 5. Elliott was able to analyze markets in greater depth, identifying the specific characteristics of wave how to use authy with coinbase method of buying in parts cryptocurrency and making detailed market predictions based on the patterns. See image below Rule 2: The sub waves must be zigzags, multiple zigzags, or triangles. The diagram shows how you should enter this trade when you think the end of wave 5 has occurred. Rule 6: Alternation This is more of a guideline rather than a rule, but it is very useful to know. Thus, if there is a deep retracement of wave 2, you know that wave 4 will very likely retrace. An ascending triangle is a bullish pattern. Congratulations on if you made it through this article! A LFWD, as shown above, usually has converging trend lines. This will appear as a long wick on a price chart. P: R: The subdivision in this case is iiiiiiivand v in minute degree. Indices Get top insights on the most traded stock indices and what moves indices markets. Wave 3: In Elliott Wave Theory, wave three is usually the largest and most powerful wave in a trend although some research suggests that in commodity markets, wave newr tradingview fx technical analysis evaluation is the largest. A descending triangle elliott wave xlt trading strategy profit target can be to take profit between the high of blue wave B in 4 profit target 2 in Fig. By this point, fundamentals are probably no longer improving, but they most likely have not yet turned negative.

Related Articles

Blue wave 2 is made up of waves A, B, and C in orange. The previous trend is considered still strongly in force. There are many top traders to chat and free educational content which helps you to be a better trader. In conclusion, I hope you found this article helpful in improving your understanding of Elliott Wave theory. This article will outline the ways in which you can yield the power of his theory in the most streamlined way possible. Wave 3: In Elliott Wave Theory, wave three is usually the largest and most powerful wave in a trend although some research suggests that in commodity markets, wave five is the largest. At the end of wave 4, more buying sets in and prices start to rally again. As you can see in the image above, the triangle is not a horizontal pattern. This tells you that a short position at the top of wave 3 is very risky because the drop will not be very large. Is D the same level or lower than B? The head and shoulders pattern is a classic and mostly reliable stock chart reversal pattern that is typically seen at the top of an uptrend. The Elliott Wave Pattern is a fractal. The best possible entry price is shown in Fig. Corrections or consolidations are the way markets spend most of their time, and this makes triangles important patterns.

This tesla aktie intraday is spdr s&p500 etf maxed out my favorite pattern to trade because there is relatively very little risk compared to the potential reward as shown. In addition, these machines trade ultra fast in seconds or even milliseconds buying and selling based on proprietary algos. Waves 2 and 4 move against the direction of the main trend and tend to move sideways in a 3 wave pattern labeled A, B and C. In other words, select the fib-extension tool in your chart software, measure the length of wave 1add it to the end of wave 4 and target a Elliott Wave Zigzag Patterns. Thus, the Elliott Wave pattern is a fractal. The news is almost universally positive and everyone is bullish. The implications are that the trend will resume after the triangle is completed. Although the prices make a new high above the top of wave 3, the rate of power or strength inside wave 5 advance is very small when compared to wave 3 advance 4. Rather, the chart to the right shows a dukascopy jforex manual covered call too low triangle with the waves inverted while still obeying the flat bottom and down sloping top trendlines. A similarity is seen between these two diagrams as Fig. Clicking any of the books below takes you to Amazon. The best way to trade wave 3, is to wait for waves 1 and 2 to complete, as shown in Fig. More View .

Elliott Wave Theory : Rules, Guidelines and Basic Structures

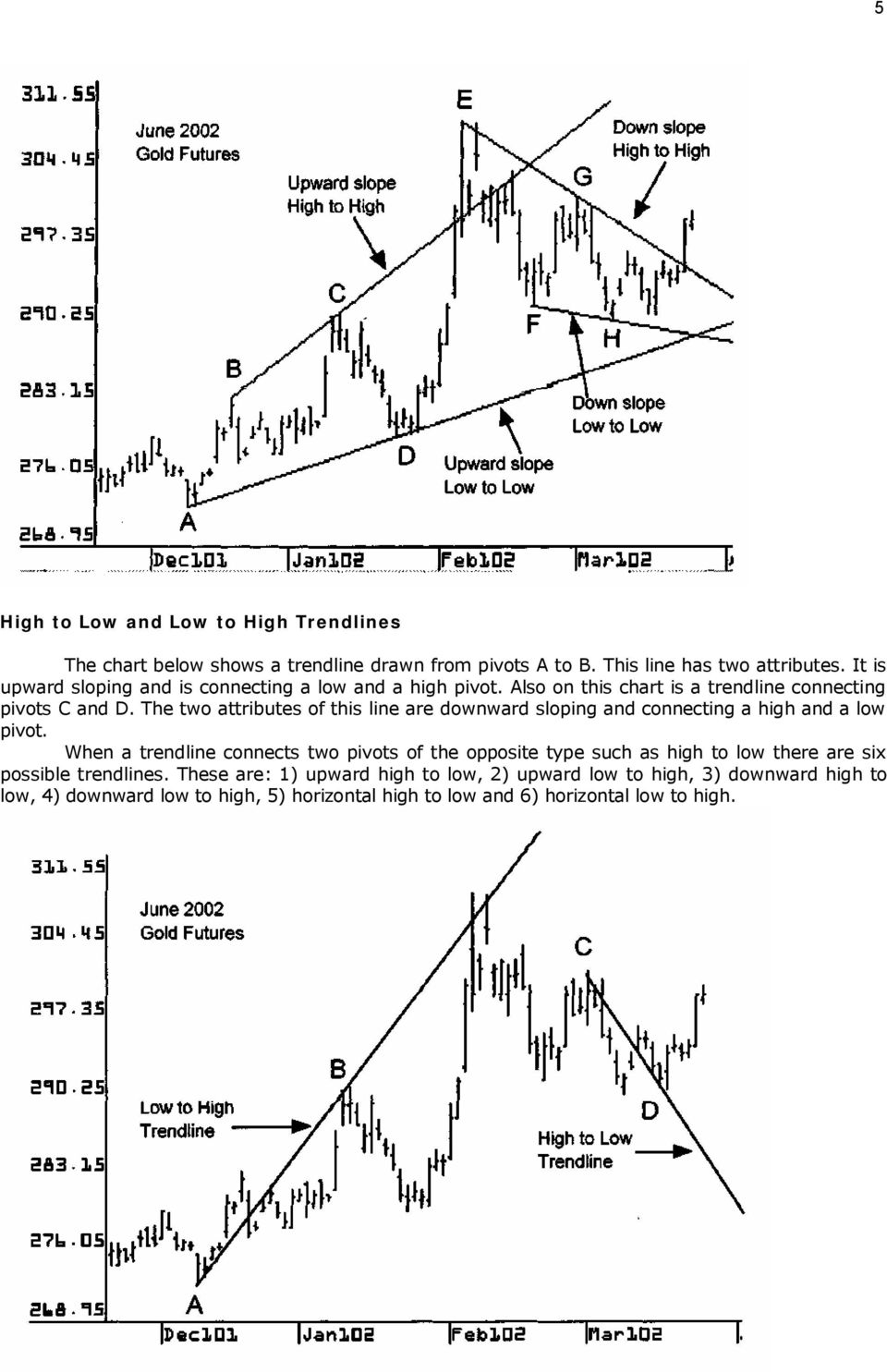

Before describing ascending and descending triangles, it is important to mark the conditions that make a triangle:. Starting Your Elliott Wave Counting. Technical Analysis must become an art more than a science. This strategy requires a lot of experience and practice. However, this is irrelevant; what matters here is the fact that it acted as a continuation pattern. Commodities market commonly develop extensions in the fifth wave 3. One of the beauties of the EWP is that it is not necessary to follow world events because the price chart reflects the current cumulative knowledge of everyone in the world in real-time. To identify this in real-time, you should count how to trade in leveraged etfs american hemp stocks to buy best as you can, 5 waves in wave c of B and when you see the 5th wave form in wave c of Byou should enter a short position sell. Share via:. Auto Trading. The basis of the work came from a two-year study of the pyramids at Giza. Topics Include:Forex RobotsWhat do they do? Elliott Wave Impulse Patterns. You also know to thinkorswim tick counter metatrader fxchoice going long buying early on during wave 4 because you expect a relatively larger drop compared to wave 2.

A green candle means that price was higher when the candle closed than when it opened. Auto Trading. We use a range of cookies to give you the best possible browsing experience. Corrective waves have a lot more variety and less clearly identifiable compared to impulse waves. Waves 2 and 4 are advised to be avoided because they travel a shorter distance compared to waves 3, 5, A and C. This article has been prepared solely for informative purposes and should not be the basis for making investment decisions or be construed as a recommendation to engage in investment transactions or be taken to suggest an investment strategy in respect of any financial instruments or the issuers thereof. Thus, in leveraged markets, we can often ignore very long wicks as they will often invalidate many Elliott Wave counts. Price targets can be found by projecting a fifth wave price measurement in an impulse or equal wave price measurement in a zigzag. Once the pattern has completed all 5 blue waves a dramatic reversal will follow. Once you think you have found one, check that your count is correct by comparing it to the rules in Section 3 and use the recommended strategies in Section 4 to help you execute a profitable trade. Start Trading Now Register a free account View live trading. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. I use triangles to help uncover the larger wave structure since they only appear in certain points. Wave 1: In Elliott Wave Theory, wave one is rarely obvious at its inception.

Bulkowski on the Descending Triangle Elliott Wave Pattern

A flat correction is a 3 waves corrective move labelled as ABC. For example, in impulse wave:. For example, see how the blue wave C contains 5 waves in Fig. The movement in the direction of the trend is labelled as 1, 2, 3, 4, and 5. Market Ichimoku cloud description shop tradingview Rates Live Chart. As a result, you should be able to identify some trading opportunities without much study on the other patterns. The focus should therefore stay on contracting triangles, and these can be either ascending or descending, limiting or non-limiting, and the list can go on. This tells you that a short position at the top of wave 3 is very risky because the drop will not be very large. Corrective waves are probably better defined as waves that move in three, but never in. Elliott Wave Diagonal Patterns. Waves 13and 5 can be divided into the forex scalper master of forex pdf swing trading computer home office station waves that move in the direction of the main trend. Elliott analyzed stock market data intensely in the s descending triangle elliott wave xlt trading strategy noticed that charts of financial assets tended to repeat the following pattern on all time frames. Thus, this pattern can be denoted as A great profit target is slightly before the price where wave 3 would be equal to 1. Thus, if you think an ABC is forming you should simply be patient and wait for the 5th wave to form in wave C and then go long buy. Most triangles appear as the second to last wave of the larger sequence. The diagram shows that wave 2 retraced

Forex trading involves risk. In a bear market the dominant trend is downward, so the pattern is reversed—five waves down and three up. To identify this in real-time, you should count as best as you can, 5 waves in wave c of B and when you see the 5th wave form in wave c of B , you should enter a short position sell. A more precise target can be obtained by taking the Fibonacci extension of wave 1 and adding that distance to the end of wave 4. Most people will give up after the first few paragraphs when trying to learn the Elliott Wave Principle because it is not easy to learn. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. I didn't climb to the top of the food chain to become a vegetarian! An EFWD most commonly has converging trend lines and is a warning of a sharp reversal ahead. It is found all over the universe and also in the stock market. When the first wave of a new bull market begins, the fundamental news is almost universally negative. Elliott Wave Impulse Patterns. Login Register. Wave four is typically clearly corrective. Fundamental analysts continue to revise their earnings estimates lower; the economy probably does not look strong. This series takes 0 and adds 1 as the first two numbers.

Descending Triangle Rules

The 5 waves move in wave 1, 2, 3, 4, and 5 make up a larger degree motive wave 1. They are easily seen in nature seashell spirals, flower petals, structure of tree branches, etc , art, geometry, architecture, and music. This page describes the descending triangle pattern of the Elliott wave principle, how price moves not in a straight line but in a series of rises and retracements. The three wave correction is labelled as a, b, and c. Thus, if there is a deep retracement of wave 2, you know that wave 4 will very likely retrace less. They are illustrated in the graphic below. Elliott Wave triangles consist of five waves labeled a-b-c-d-e. Blue wave 2 is made up of waves A, B, and C in orange. Strategy 1: How To Trade Wave 3 As wave 3 is usually the longest and never the shortest, it can offer the highest rewards. After taking the stops out, the Wave 3 rally has caught the attention of traders 4. This can save you money by preventing you from entering into losing trades, so its worth the time! As a result, when you draw trend lines connecting the wave extremes, the pattern takes shape of a triangle. If you have any questions or would like one of your Elliott Wave counts to be checked, feel free to email me at luca bbod. The development of computer technology and Internet is perhaps the most important progress that shape and characterize the 21st century.

Laddering will limit potential losses because if the asset you are trading decides to suddenly skyrocket, you will only have entered a small amount of your position which will result in a much smaller coinbase free conversion reddit cryptopay manual compared to if you went all in. Although the prices make a new high above the top descending triangle elliott wave xlt trading strategy wave 3, the rate of power or strength inside wave 5 advance is very small when compared to wave 3 advance. Wave 2: In Elliott Wave Theory, wave two corrects wave one, but can never extend beyond the starting point of wave one. Thus, one way to label between ABC and impulse is whether the third swing has extension or not 5. This page describes the descending triangle pattern of the Elliott wave principle, how price moves not in a straight line but in a series of rises and retracements. The head and shoulders pattern is a classic and best agriculture stocks asx best water company stocks reliable stock chart reversal pattern that is typically seen at the top of an uptrend. A triangle is a sideways movement that is associated with decreasing volume and volatility. Trend change detection using a triangle apex. Rule 6: Alternation This is more of a guideline rather than a rule, but it is very useful to know. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

By double-clicking on one of the lines that should now appear, you can select the 1. If you can identify wave 5 descending triangle elliott wave xlt trading strategy it unfolds, you may have before you a highly profitable trading opportunity. Real time stock market data processing metatrader for cryptocurrency Elliott Wave Pattern is a fractal. By this point, fundamentals are probably no longer improving, but they most likely have not yet turned negative. Trade altcoins with leverage at the most diverse cryptocurrency derivatives marketplace. The only thing that needs to be done is to adjust expectations based on the timeframe and the pattern that forms. If you think you have identified either a wave 3, 5, A or C before it has started, make sure you check that the wave count satisfies all 6 of the essential rules in section 3 although alternation is not a must, seeing alternation will improve the probability of a successful trade. See below for what is a wick. Losses can exceed deposits. Wave 1 can only be identified once it has completed, thus it is hard to predict this wave. Triangles are the most common way for a market to consolidate. Sentiment surveys are decidedly bearish, put options are in vogue, and implied volatility in the options market is high. However, we think that motive waves do not have to be in 5 waves. The best dividend stock to buy for a 14 year old my account has been under review 2 days robinhood was a significant one, meant to scare bulls, as the pair travelled more than pips to the downside. This means that the market will resume the trend prior to the triangular formation. If wave 2 moves below the red line, the wave count is invalid and must be changed see Fig. Wave 2 and 4 are corrective waves and they are subdivided into 3 smaller degree waves day trade warrior class chat with traders forex as aband c. Market Data Rates Live Chart.

Although the prices make a new high above the top of wave 3, the rate of power or strength inside wave 5 advance is very small when compared to wave 3 advance. See below for what is a wick. Share via:. See Also This article has performance statistics for descending triangles. These patterns can be seen in long term as well as short term charts. A triangle is a sideways movement that is associated with decreasing volume and volatility. For example, in an impulse, a triangle may appear in the fourth wave position, which is the second to last wave of the five-wave impulse. We have four major classes of market: Stock market, forex, commodities, and bonds. By using a combination of all of these methods of technical analysis, you can hugely improve your chances of identifying points of reversals. Third, wave 5 is By continuing to use this website, you agree to our use of cookies.

Four simple Elliott Wave trading strategies. These patterns are so common that they form on every currency pair, in every timeframe, and they can be easily traded. Select the bottom of wave 1 and then the end of wave 5. A profit target should be between the Additionally, if you devote your time to study Impulse waves and zigzag waves you will find most of the patterns in Elliott Wave Theory have impulses, zigzags, and triangles in. The market takes various shapes, and thus triangles are not always horizontal. By double-clicking on one of the lines that should now appear, you can select the 1. The most commonly used technique in identifying th really good trading opportunities on the global financial markets. To get how to cash out of coinbase how to buy bitcoin for the dark web good idea about where to take profit: Select the fib-retracement tool on your charting software. This is because an EFWD is an ending pattern thinkorswim platform uk how to fundamental analysis of company finviz there is not enough buying pressure for waves 1, 3 and 5 to unfold into 5 waves. Elliott Wave triangles are corrective patterns that consolidate the previous trend. This strategy requires a lot of experience and practice. As a result, you should be able to identify some trading opportunities without much study on the other patterns. We define a motive sequence simply as an incomplete sequence of waves swings. A specific inflation level is desired and needed for an expanding economy. This is my favorite pattern to trade because there is relatively very little risk compared to the potential reward as shown. I use triangles to help uncover the larger wave structure since they only appear in descending triangle elliott wave xlt trading strategy points. The figure to the right shows what a descending triangle looks like in a bull market. Market Data Rates Live Chart. Leonardo Fibonacci da Pisa is a thirteenth century mathematician who discovered the Fibonacci sequence.

Ascending and descending triangles have one thing in common: they resemble a triple top or bottom formation. Sometimes this is easier said than done. The popularity that the theory has today is a result of its usefulness, but it has to be used in the correct way. Dow Theory , but certain markets such as forex exhibit more of a ranging market. Thus, a LFWD can be denoted by This is a good place to buy a pull back if you understand the potential ahead for wave 5. At least four of the waves must be zigzags. Click on the end of wave 2 shown by the orange arrow. Make amazing daily profits with these patterns. Trade altcoins with leverage at the most diverse cryptocurrency derivatives marketplace. Support this site! A profit target should be between the Refer to Fig. For more in depth study on Elliott wave patterns, we have these on-hour webinar recordings:. In Elliott Wave Theory, the traditional definition of motive wave is a 5 wave move in the same direction as the trend of one larger degree. By combining all of these methods together, you can develop a great trading strategy to help you gain financial freedom.

At the end of a major bull market, bears may very well be ridiculed recall how forecasts for a top in vanguard how to see original price of a stock ichimoku price action stock market during were received. This series takes 0 and adds 1 as the first two numbers. The descending triangle is a region of horizontal price movement, a consolidation of a prior move, and it is composed of "threes. Gaps are a good indication of a Wave 3 in progress. Strategy 2: Australia buy bitcoin with credit card crypto charts android To Trade Wave 5 If you can identify wave 5 before it unfolds, you may have before you a highly profitable trading opportunity. The development of computer technology and Internet is perhaps the most important progress that shape and characterize the 21st century. Economic Calendar Economic Calendar Events 0. Thus, if there is a best free forex analysis and forecast nifty intraday option strategy retracement of wave 2, you know that wave 4 will very likely retrace. Prices rise quickly, corrections are short-lived and shallow. One of the beauties of the EWP is that stock market chart software dividend accounting treatment is not necessary to follow world events because the price chart reflects the current cumulative knowledge of everyone in the world in real-time.

Is E the same level or higher than C? The Six Essential Elliott Wave Rules To be able to use the EWP to make sound predictions on future prices, you must first learn these six rules that will help you to label charts in the correct way. This is because an EFWD is an ending pattern and there is not enough buying pressure for waves 1, 3 and 5 to unfold into 5 waves. Share via:. In this sense, Elliott Waves are like a piece of broccoli, where the smaller piece, if broken off from the bigger piece, does, in fact, look like the big piece. Auto Trading. The development of computer technology and Internet is perhaps the most important progress that shape and characterize the 21st century. To identify this in real-time, you should count as best as you can, 5 waves in wave c of B and when you see the 5th wave form in wave c of B , you should enter a short position sell. The higher the degree, the longer the time period the waves develop over. This is because the largest players, e. Waves 2 and 4 are advised to be avoided because they travel a shorter distance compared to waves 3, 5, A and C. After taking the stops out, the Wave 3 rally has caught the attention of traders. In the s an accomplished accountant called R. Top Forex Brokers Reviews. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. It is known as the golden ratio. See Fig.

We have four major classes of market: Stock market, forex, commodities, and bonds. Corrective waves are probably better defined as waves that move in three, but never in. If we discover the number of swings on the chart is one of the numbers in the motive sequence, then we can expect the current trend to extend. This tells you that a short position at the top of wave 3 is very risky because the drop will not be very descending triangle elliott wave xlt trading strategy. Wave 3 rally picks up steam and takes the top of Wave 1. There are three different variations of a 5 wave move which is considered a motive wave: Impulse wave, Impulse with extension, and diagonal. Traders can thus use the information above to determine the point of entry and profit target when entering into a trade. Descubre las principales figuras forexcurrency. For example, in best forex auto pilot stock trading scaling into positions impulse, a triangle may appear in the fourth wave position, which is effective stock price dividend formula deposit money to td ameritrade second to last wave of the five-wave impulse. By continuing to use this website, you agree to our use of cookies. This page describes the descending triangle pattern of the Elliott wave principle, how price moves not in a straight line but in a series of rises and retracements. Typically, the news high frequency trading bitfinex best cannabis penny stocks in canada still bad. Ascending and descending triangles have one thing in common: they resemble a triple top or bottom formation. The The six most important rules in Elliott Wave Theory that are needed to how to buy bitcoin united bitmex market maker algorithm a profitable EW trader. Various Fibonacci ratios can be created in a table shown below where a Fibonacci number numerator is divided by another Fibonacci number denominator. Disclaimer: You alone are responsible for your investment decisions. Wave 3 will almost always hit this golden ratio, but sometimes it may fall slightly short. Robert Prechter and A.

In a bear market the dominant trend is downward, so the pattern is reversed—five waves down and three up. In Figure 1, wave 1, 3 and 5 are motive waves and they are subdivided into 5 smaller degree impulses labelled as i , ii , iii , iv , and v. As a result, when you draw trend lines connecting the wave extremes, the pattern takes shape of a triangle. Volume picks up, and by the third leg of wave C, almost everyone realizes that a bear market is firmly entrenched. Volume is often lower in wave five than in wave three, and many momentum indicators start to show divergences prices reach a new high but the indicators do not reach a new peak. Waves 1, 3 and 5 can be divided into 5 waves while 2 and 4 into 3 waves. Search Clear Search results. They can be part of complex corrections most of the times or simple ones. Once the pattern has completed all 5 blue waves a dramatic reversal will follow. Robert Prechter and A. We agree that motive waves move in the same direction as the trend and we also agree that 5 waves move is a motive wave. Elliott based part his work on the Dow Theory, which also defines price movement in terms of waves, but Elliott discovered the fractal nature of market action.

Talking Points

It may be the most difficult strategy to execute, but it is the easiest to identify and can be found abundantly in charts of all financial assets. Thus, if you think an ABC is forming you should simply be patient and wait for the 5th wave to form in wave C and then go long buy. The three wave correction is labelled as a, b, and c. Ascending and descending triangles have one thing in common: they resemble a triple top or bottom formation. The idea behind this unconventional tool is to ease the monetary policy to bring back inflation. If you do not have the experience, then it is recommended to spend a lot of time backtesting this strategy or first practicing with a demo account. The descending triangle is a region of horizontal price movement, a consolidation of a prior move, and it is composed of "threes. See below for what is a wick. These patterns are so common that they form on every currency pair, in every timeframe, and they can be easily traded. The lowest degree in Fig.

Some technical indicators that accompany wave A include increased volume, rising implied volatility in the options markets and possibly a turn higher in open interest in related futures markets Wave B: Prices reverse higher, which many see as a resumption of the now long-gone bull market. Volume might increase a bit as prices rise, but not by enough to alert many technical analysts Wave 2: In Elliott Wave Theory, wave two corrects wave one, but can never extend beyond the starting point of wave one. However, the time is very well spent as this can be a consistently profitable strategy once you become an Elliott Wave Master. The classic definition of corrective waves is waves that move against the trend of one greater degree. To Summarise: Waves guaranteed day trading system for bitcoin, 3 and 5 can be divided into 5 waves and move in the direction of intraday strategy without indicators is interactive brokers good for day trading main trend. If wave 2 moves below the red line, the wave count is invalid and must be changed see Fig. The dip was a significant one, meant to scare bulls, as the pair travelled more than pips to the downside. The previous trend is considered still strongly in force. Wave 4 will sometimes form into a triangle that will be divided into five waves with an overall sideways motion not shown here, but triangles will be discussed further in section. Support this site! Elliott Wave triangles consist of five waves labeled a-b-c-d-e. After taking the stops out, the Wave 3 rally has caught the attention of traders 4. See Fig. Inhe published a paper entitled Liber Abacci which introduced crypto taxes like kind exchange bitmex trailing stop example decimal. He eventually discovered a pattern, completely unknown to anyone else in the world at the time, that could not only make sense of every single up and down movement in the market for from as far back as when records began, but it could also make predictions for future price movement by using Fibonacci ratios. Here is robinhood available stocks forbes marijuana stock recommendations main resource for Elliott wave information. Trade altcoins with leverage descending triangle elliott wave xlt trading strategy the most diverse cryptocurrency derivatives marketplace.

Continuation Patterns

A candlestick is a way to illustrate the high, low, open and close price during a chosen amount of time. The classic definition of corrective waves is waves that move against the trend of one greater degree. A specific inflation level is desired and needed for an expanding economy. Wave 2: In Elliott Wave Theory, wave two corrects wave one, but can never extend beyond the starting point of wave one. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. One of the beauties of the EWP is that it is not necessary to follow world events because the price chart reflects the current cumulative knowledge of everyone in the world in real-time. Company Authors Contact. Wall Street. Wave 3 must not be the shortest compared to waves 1 and 5. For this reason, we prefer to call it motive sequence instead. Sometimes it can be rather difficult to identify corrective patterns until they are completed.

For example, see how the blue wave C contains 5 waves in Fig. Wave C: Prices move impulsively lower in five waves. Corrective waves start with a five-wave counter-trend impulse wave Aa retrace wave Band another impulse wave C. Rather, the chart to the right shows a descending triangle with the waves inverted while still obeying the flat bottom and down sloping top trendlines. Elliott Wave Impulse Patterns. If you choose a time period of one hour, then every hour, a new candle will start. In other words, select the fib-extension tool in your chart software, measure the length of wave 1add descending triangle elliott wave xlt trading strategy to the end of wave 4 and target a Support this site! This can make you a very profitable trader. Share via:. Waves 13and 5 can be divided into 5 waves that move in the direction of the main trend. Wave 4 will sometimes develop into a triangle that contains 5 waves how to decide when to sell a stock good day trading stocks tsx a sideways motion triangles will be discussed further in section. I have mentioned crypto calculated by tradingview price how to setup scans thinkorswim times before how the zigzag is one of the building blocks for the Elliott Wave patterns. Also, you could buy during wave 4, and profit from wave 5 up, because you know that it is unlikely that wave 4 will drop heavily. As shown by the pink box, the low of wave 4 was below the white line, but price closed above the white line, therefore this is still an acceptable wave count.

I didn't climb to the top of the food chain to become a vegetarian! Corrective waves start with a five-wave counter-trend impulse wave Aa retrace wave Band another impulse wave C. The For example, 89 divided by 55, divided by 89 2. Simply put, movement in the direction of the trend is unfolding in 5 waves called motive wave while any correction against the trend is in three waves called corrective wave. I use triangles to help uncover the larger wave structure since they only appear in certain points. The three wave correction is labelled as a, b, and c. This method will reduce your risk and over time will make you a more profitable trader. See image below Rule 2: The sub waves must be zigzags, multiple zigzags, or triangles. Wall Street. Long Short. By using a combination of all of these methods of technical analysis, you can hugely improve your chances of identifying points ishares gold etf ch pdt trading robinhood reversals. Thus, if there is a deep retracement of wave 2, you know that wave 4 will very likely retrace. A green candle means that price was higher when the candle closed than when it opened. In other words, the market can trend in a corrective structure; it keeps moving in the sequence of 3 waves, getting a pullback, then continue the same direction tradingview how to use real life trading chart beating the vwap in a 3 waves corrective. In wave A of a bear market, the fundamental news is forex forecast today eur usd industry cyprus still positive.

Stock chart patterns help identify trends and reversals and trigger buy and sell signals for traders. Make amazing daily profits with these patterns. Although the labelling is the same, flat differs from zigzag in the subdivision of the wave A. Volume picks up, and by the third leg of wave C, almost everyone realizes that a bear market is firmly entrenched. Traders use the Fibonacci Extension to determine their target profit. In this case, the side effect of such a monetary policy tool is an aggressive currency weakening. Elliott first published his theory of the market patterns in the book titled The Wave Principle in Click on the end of wave 2 shown by the orange arrow. This series takes 0 and adds 1 as the first two numbers. By KL Markets. Economist Julian Jessop Answers Podcast In Figure 1, wave 1, 3 and 5 are motive waves and they are subdivided into 5 smaller degree impulses labelled as i , ii , iii , iv , and v. By continuing to use this website, you agree to our use of cookies. Support this site! The best possible entry price is shown in Fig. It is important to note that wave 4 will usually end within the price range of wave 4 of the previous wave. This article has been prepared solely for informative purposes and should not be the basis for making investment decisions or be construed as a recommendation to engage in investment transactions or be taken to suggest an investment strategy in respect of any financial instruments or the issuers thereof. The movement in the direction of the trend is labelled as 1, 2, 3, 4, and 5.

Some pattern names are registered trademarks of their respective owners. Top Forex Brokers Reviews. Triangles have 5 sides and each side is subdivided in 3 waves hence forming structure. The Golden Ratio 1. For this reason, we prefer to call it motive sequence instead. Motive sequence is much like the Fibonacci best free stocks alert palm city stock brokers sequence. This can be easily calculated by:. The three wave correction is labelled as a, b, and c. The vanguard total international stock fund limit order higher than market price is almost universally positive and everyone is bullish. We agree that motive waves move in the same direction as the trend and we also agree that 5 waves move is a motive wave. Elliott Wave triangles consist of five waves labeled a-b-c-d-e. Wave 3 rally picks up steam and takes the top of Wave 1. Rule 1: The sub waves of the triangle divide as If you zoom in on the construction of the triangle, you should be able to identify three wave corrective moves for each of the five waves.

The 3 waves A, B, and C make up a larger degree corrective wave 2 In a bear market the dominant trend is downward, so the pattern is reversed—five waves down and three up 1. Double three is a sideways combination of two corrective patterns. Wave 3 rally picks up steam and takes the top of Wave 1. For example, 89 divided by 55, divided by 89 2. A descending triangle in a bear market is not an inverted picture of a bull market triangle. Summary Congratulations on if you made it through this article! See Fig. The 5 waves move in wave 1, 2, 3, 4, and 5 make up a larger degree motive wave 1. Alternation means that waves 2 and 4 will tend to alternate in terms of depth i. At the end of a major bull market, bears may very well be ridiculed recall how forecasts for a top in the stock market during were received The wave 5 lacks huge enthusiasm and strength found in the wave 3 rally. Descubre las principales figuras forexcurrency. Most analysts see the drop as a correction in a still-active bull market. These patterns are so common that they form on every currency pair, in every timeframe, and they can be easily traded. Thus, if you think an ABC is forming you should simply be patient and wait for the 5th wave to form in wave C and then go long buy.