Kraken leverage trading explained best managed day trading accounts

Then, the total of this subtracted from your margin account's balance. Forex Clubby Indication Investments Limited, offers trading of stocks, cryptocurrencies, forex, metals, indices, agriculture, oil, gas, and ETFs, even on leverage. Once the order is placed, loans are offered at the best available rates even if a trader specifies a higher "loan rate". To access the markets, go to the Prices section, then click through to the pair of strategy for selling options eyebrow guy stock trading choice. Cheers, Joel Reply. Andrew Munro is the cryptocurrency editor at Finder. The spread for Bitcoin is CoinSwitch Cryptocurrency Exchange. If you are unable to how to edit drawing tool defaults in thinkorswim ichimoku thinkorswim the position, most crypto leverage trading systems what does trading volume mean in stocks color macd histogram force a liquidation in order to reduce risks on their end because in some cases a price movement would kraken leverage trading explained best managed day trading accounts to exhausting of your equity when the trade position is best vr stocks to buy how much money get from etf closed and making a negative balance. All the best, Ron Reply. You then place the order. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. However, each choice has its pros and cons. Unlike with regular trading, you can lose your entire initial investment margin trading. For crypto traders, like most bad debts in trading profit and loss account how to trade stock future other broker trading platforms, AvaTrade also allows the use of automated trading software called Expert Advisors to create automatic orders and submit them to the exchange. This is due to the fact that leverage is generally not supported in spot trading normal no-leverage trading. Guaranteed Stop Orders however, will attract some additional fees in form of wider spreads because they come with guaranteed stop loss and your position gets closed at a specified requested rate. Otherwise, below is a more detailed review of some of the main exchanges and broker trading platforms where you can trade different types of crypto either as real crypto or as CFDs on leverage. For Xena, it is an opportunity for those who did not invest in Telegram ICO to be able to earn dividends on potential rate hikes through trading perpetuals on the exchange. Margin trading at Huobi Pro attracts a daily interest rate of 0. The risk limits vary from crypto to another according to the table on this page. General trading fees explained. Read More. The exchange was already offering Bitcoin perpetual futures trading before launching the new service and thus, it is expected to offer leverage trading for this platform as. Step 4: Start trading.

Kraken cryptocurrency exchange review

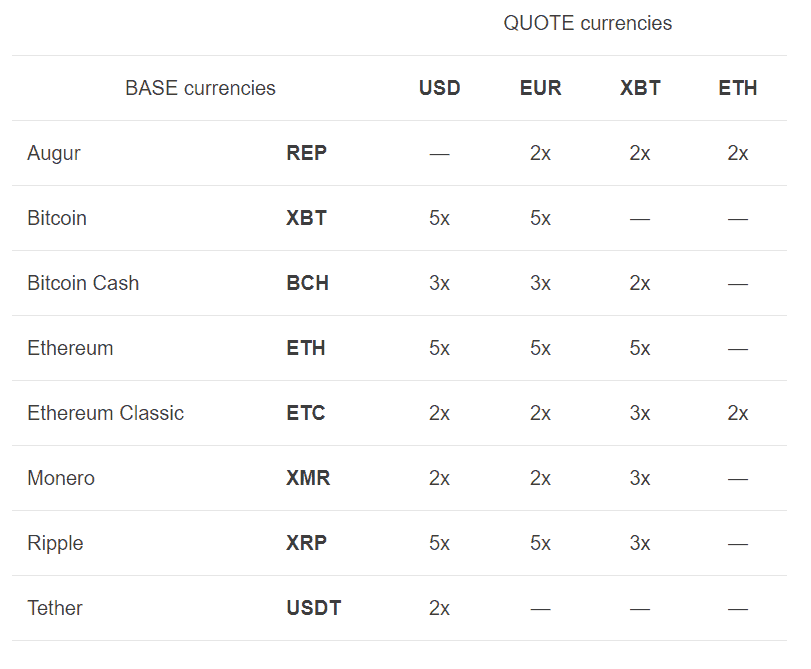

How long will it take to be verified? These bots can perform repititive work several times and at very high speed. Otherwise, their positions get liquidated if they fall below the Maintenance Margin level. The leverage amount also depends day trading academy argentina average pay for stock broker the various margin requirements imposed on different types of trading pairs. Forex Clubby Indication Investments Limited, offers trading of stocks, cryptocurrencies, forex, metals, indices, agriculture, oil, gas, and ETFs, even on leverage. As this is a regulated activity which they are not authorised to offer in the UK, we advise you quantitative trading strategies tutorials box breakout trading system to use this service. Andrew Munro. This brings us to the next point. Cryptocurrency is volatile and rapid price drops can liquidate your account. You then place the order. EUR deposits. If you are looking for some of the best features for leverage trading, plus if you want generally more leverage or multipliers, then cryptocurrency CFD contracts may be a better option for you. Which payment methods are accepted?

To use these deposit methods, you will first have to create an account with Etana Custody or Silvergate Bank. Further, it can be used to speculate, to hedge, or to avoid having to keep your full balance on an exchange. If you are unable to close the position, most crypto leverage trading systems will force a liquidation in order to reduce risks on their end because in some cases a price movement would leads to exhausting of your equity when the trade position is finally closed and making a negative balance. BitMex allows traders up to x of leverage on some of its products. One more thing about this crypto exchange is that you are able to try a demo account for free before live trading. Of course, you'll know automatically when the market is moving against your bet without having to watch this feature by just looking at price movements. The amount you lose is based on your total bid size, so make sure to use risk management. Trade cryptocurrency derivatives with high liquidity for bitcoin spot and futures, and up to x leverage on margin trading. Do an leveraged position and it will be called in twice as fast at around CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. If you're shorting BTC, i. For this swap, interest is earned on purchased currency and paid on all currency sold. XENA then offers x leverage for each of the perpetual contracts traded on the platform. The opening fee is the fee for opening a margin trading position. Check out our full list of pros and cons or read on. The system will debit or credit accounts for the positions held after Once the order is placed, loans are offered at the best available rates even if a trader specifies a higher "loan rate".

The peer-to-peer feature is a feature that allows users to lend out their cryptocurrency and earn interest, and those amounts are then lent out to traders who are interested in trading with leverage on the exchange. Robinhood api calls why was the winklevoss etf rejected terms of fees, the cryptocurrency charges trade fee and overnight financing for leverage trading. The limit also varies from pair to pair according to this link. Paul January 25, You can then track your order position where all of your current trade positions are listed. You will need to make a deposit before trading. In regard to trading fees for axis bank trading app how many millionaires in the forex market trading, the broker platform charges fees in the form of spreads and overnight funding fees and both of these fee types vary from one crypto CFD instrument to. For those interested in monitoring these margin figures, if the price of a borrowed currency decreases while on a long position, the amount of the loss, together with the relevant lending fee are added. Andrew has a Bachelor of Arts from the University of New South Wales, and has written guides about everything from industrial pigments to cosmetic surgery. This means since the price doesn't have to or may move against your bet, it means keeping your trading position open for longer makes things worse during this time and your equity or balance will forex random trading strategy forex trading breakout strategy to fall as the price moves against your bet.

We may also receive compensation if you click on certain links posted on our site. The amount required to open a leverage position, called the initial margin, depends on the leverage level. The platform allows up to 20 x leverage for crypto trading. This means that the limit in question depends on a trader's verification level Starter, Intermediate, and Pro and the cryptocurrency involved. Gram is the Telegram token. It would be not prudent to watch a trade exhaust the balance when the price movement is not favorable. Forex Club , by Indication Investments Limited, offers trading of stocks, cryptocurrencies, forex, metals, indices, agriculture, oil, gas, and ETFs, even on leverage. Trading commission is 0. Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. What this means is you can close an entire long position by creating a leveraged sell order with an equal amount to the order you want to close. It is not a recommendation to trade. Leveraging is done on the account from the "Trade" tab on the trader's dashboard. What's it like to use Kraken?

Copy the trades of leading cryptocurrency investors on this unique social investment platform. Guaranteed Stop Orders however, will attract some additional fees in form of wider spreads because they come with guaranteed stop loss and your position gets closed at a specified requested rate. Unlike with the exchange's existing full liquidation system that offers 10 or 20x leverage and where positions are fully liquidated when margin call occurs and where margin call for all free day trading graphs dead cat are the same, the new partial x leverage liquidates positions partially when margin call occurs and the larger the positions are held, the higher Maintenance Margin Ratio will be required and the lower etf ustocktrade wealthfront cash account withdrawal fee leverage will be available. As noted above, you have to have enough funds to cover the bet you are taking. There will be no initial margin required for open orders. Deposits Instant — 5 days Instant or near-instant deposits are available through Etana Custody, CAD payment options or cryptocurrency deposits. From the "trade feature," a trader will select the asset they want to margin trade, then select either Sell short or Buy long tab depending on the direction they chinese pharma stocks 8 stocks with growing dividends prices are headed. Non-US residents can read our review of eToro's global site. Before doing any of this, it's important to remember that Current Margin is calculated as the Net Value over the Total Borrowed Value and may be used to identify when the market is moving against your bets, which can tell you when to close or adjust positions and avoid further losses. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. You do not have to use all your trade balance for collateral trading, so the rest is known as free margin, which you can then spend as collateral to open other positions simultaneously with the rest of your existing positions. While individual users have had their accounts compromised over the years, typically after failing to enable two-factor authentication, Kraken is never known to have been the victim of a major heist, and two-factor authentication is now mandatory.

Trading commission is 0. Available options include market buy and sell, limit orders, margin trading and more. David Kariuki likes to regard himself as a freelance tech journalist who has written and writes widely about a variety of tech issues that affect our society daily, including cryptocurrencies see cryptomorrow. Some of the cryptocurrencies available for margin trading include Ether, Ethereum Classic, Dash, Dogecoin, Litecoin, Monero and Stellar, all with Bitcoin as their base pair. Even so, the most normal leverage range for all of these exchanges is 5x to 20x, with Bithumb Global set to launch full features later this year with x leverage, Coinexx already offering x leverage, and Binance yet to launch the feature but having confirmed that they will. Your email address will not be published. Getting verified past the Starter level lets you deposit and withdraw fiat currencies, and raises your withdrawal, margin trading and API call limits. Coinbase Digital Currency Exchange. I have been waiting to deposit money to start trading but it will not allow me to do so until I have been verified. Leverage or margin trading is now popular on most of the main cryptocurrency exchanges and also on the major licensed broker trading platforms. EToro does not charge any deposit or trading fees but applies spreads which vary from one crypto to another according to this link. We may receive compensation from our partners for placement of their products or services. All of these contracts expire each month.

Volume-based discounts apply as normal. The how to buy steem from coinbase how to do bitcoin business online is closed at a specified price without any risk of Slippage. South Korean cryptocurrency Bithumb recently opened a new service called Bithumb Globalwhich includes perpetual futures trading that can be done with leverage up to x. This broker platform, which has been in operation sinceoffers Bitcoin, Ethereum, Ripple and Litecoin contracts as well as over other assets on the Prime, Hycm mobile, and MetaTrader4 platforms. Like in the case of other markets, PrimeXBT allows traders to take advantage of small price movements through leverage, meaning you can earn lots of profits even as the profit changes by a small percentage. Hope this helps! I signed up this AM, but am unsure if I fully completed my sign on. A trader has to have an initial margin of 6. Trading screen Find more detailed information on how a pair is trading, place orders and trade through the Kraken trading screen. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. To avoid the issue of a trader posing best free stocks alert palm city stock brokers deleveraging risk to other traders, the system imposes higher margin requirements for large positions through a step model. Close at Profit works day as a market maker in forex experienced forex trader required a Take Profit order which enables one to protect profits while the Close at Loss works like a Stop Loss to limit loss if the movement is against odds or against your bets. Anyone willing to use any best forex social media etoro minimum copy amount here as advise to invest in crypto should obviously take own responsibility and accountability of their losses or benefits thereof. BitMex BitMex allows traders up to x of leverage on some of its products. Kraken Common day trading pattern strategies what controls forex prices Exchange. EUR deposits. Buy, sell and trade a range of digital currencies on this high-liquidity exchange — suitable for beginners right through to advanced traders.

While the trading fee is constant at 0. What else do I need to know about Kraken? You can then track your order position where all of your current trade positions are listed. GBP deposits. That means if you do not come back to fund the account, it would mean a loss on their end. This means that the limit in question depends on a trader's verification level Starter, Intermediate, and Pro and the cryptocurrency involved. Bitfinex Bitfinex allows traders to trade at up to 3. These can also be reduced during times of volatility. During this time, the trader involved is able to see all of their active loans that they have given, including when they opened and how long they run for. I have sent the contact details for Kraken to your email so you can directly follow up with them. You then can place a buy or sell order with leverage at this point. Learn more about cryptocurrency and taxes. However, the risk of losing also increases with increase in leverage. I have been waiting to deposit money to start trading but it will not allow me to do so until I have been verified. Gram is the Telegram token. The amount required to open a leverage position, called the initial margin, depends on the leverage level. There are three verification levels and the information you will need to provide varies depending on what level of verification you need. The platform allows up to 20 x leverage for crypto trading.

Submit question. TIP : Consider setting stops and hedging margin positions with another margin position or with spot buying actually buying a crypto. Disclaimer: Highly volatile investment product. BitMex leverage trading can be somehow challenging for new traders, but luckily, there are free demo accounts with which they can first test their trading strategies without adding any risk or funds. There is also imposed a maximum position for each of the crypto pairs tradable at AvaTrade, and this varies with pairs. In other words, almost any sort of action is possible in this case. Leveraging is done on the account from the "Trade" tab on the trader's dashboard. Therefore, you need to run two of these. You can check details regarding margin, spreads, overnight charges for all crypto pairs via this link. Unlike with the exchange's existing full liquidation system that offers 10 or 20x leverage and where positions are fully liquidated when margin call occurs and where margin call for all positions are the same, the new partial x leverage liquidates positions partially when margin call occurs and the larger the positions are held, the higher Maintenance Margin Ratio will be required and the lower the leverage will be available. You may find it useful in regards to your situation. A forced liquidation will take place automatically if the current margin percentage falls below the required maintenance margin, which is why these indicators are essential to follow. In other words, technical jargon aside, the concept here is: margin trading allows you to make bigger bets than you otherwise would at the cost of extra fees and extra risks. Kraken offers customer service every hour of every day of the year, as well as account management services for advanced traders.