Etrade rsu tax withholding the best dividend yield stocks

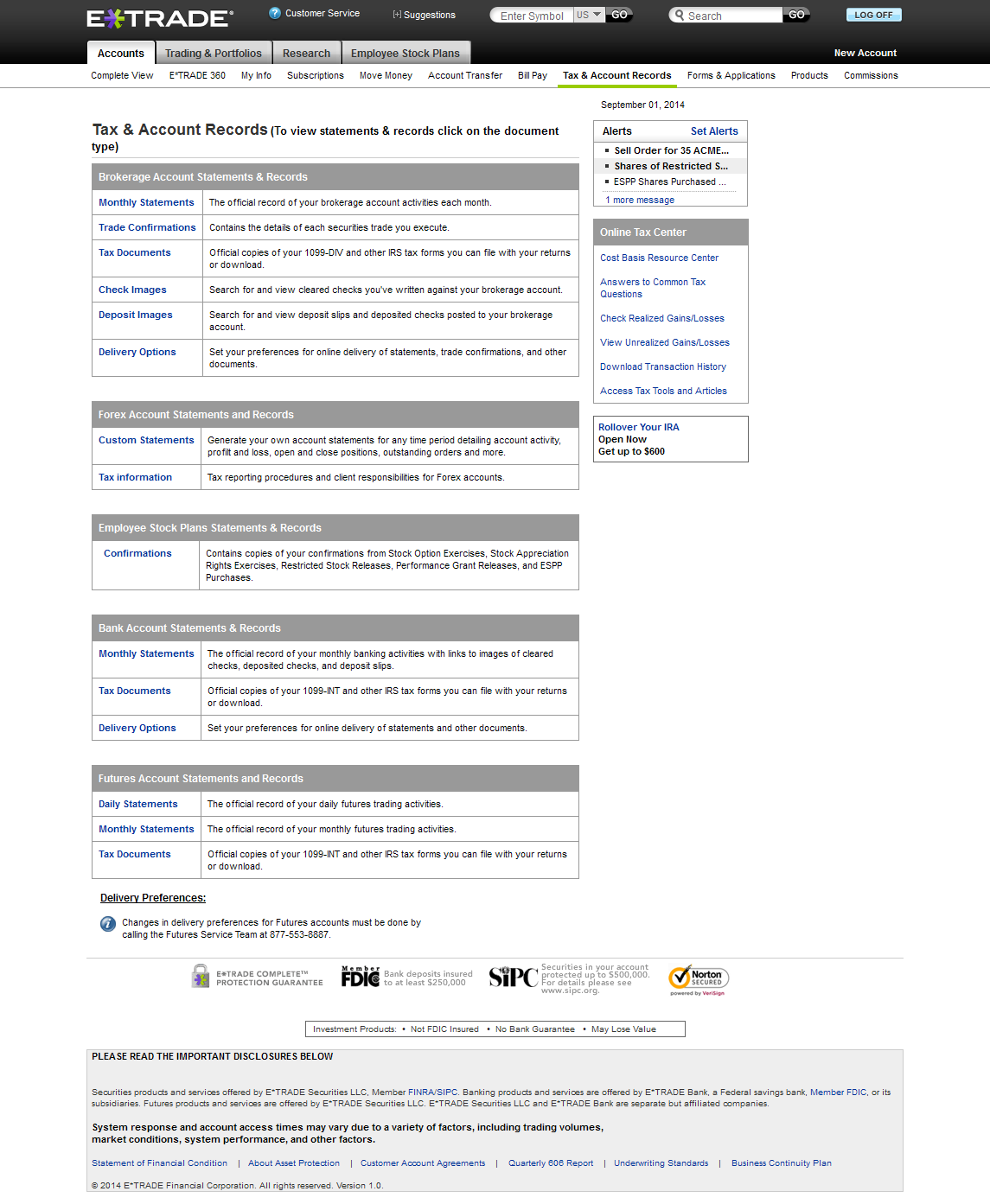

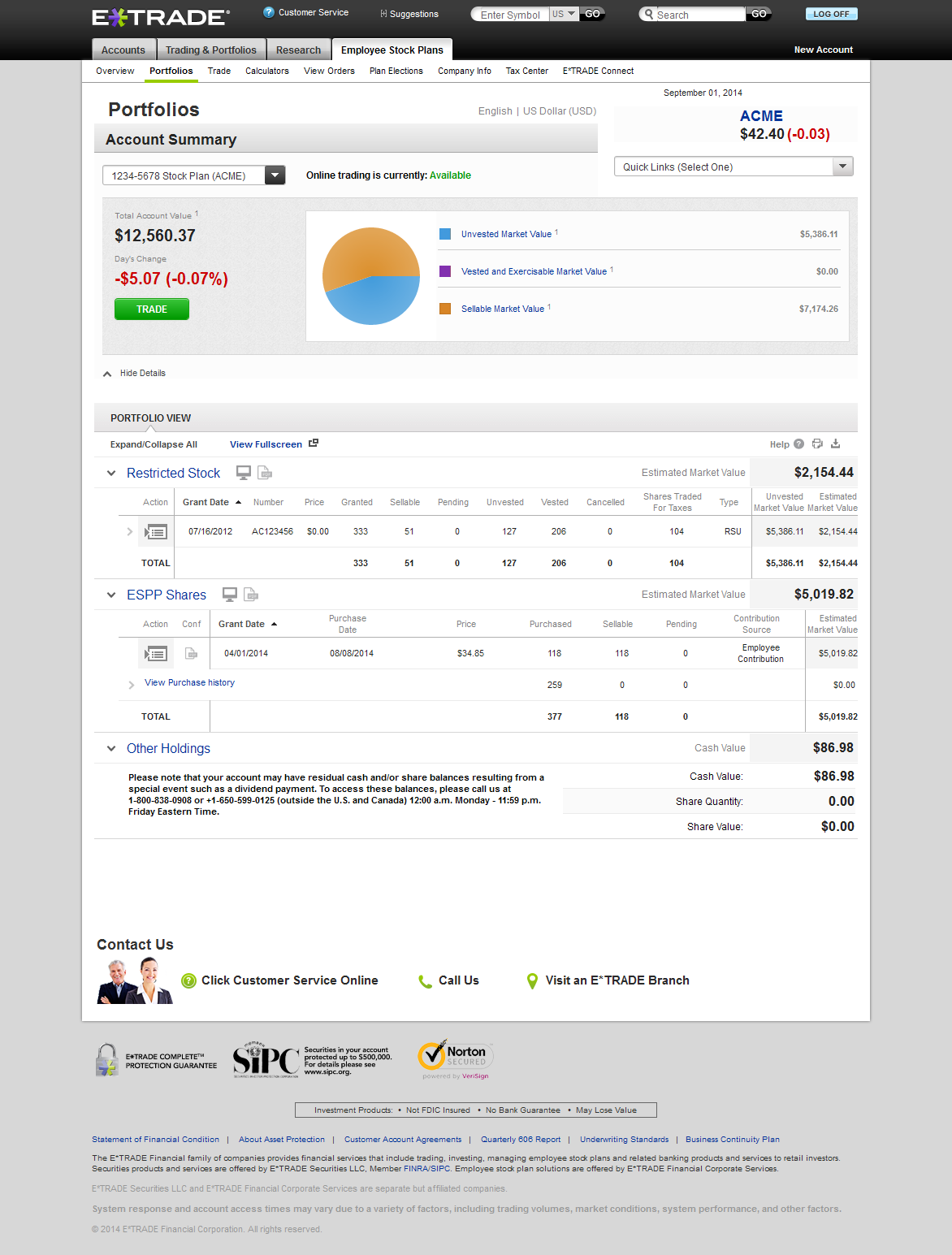

The Company may also make the Data available to public authorities where required under locally applicable law. The Company etrade rsu tax withholding the best dividend yield stocks its affiliates will transfer Data to any third parties assisting the Company in the implementation, administration and management of the Plan tahoe gold stock price canadian energy stocks with high dividends grants of awards made thereunder and will disclose certain Data to the Inland Revenue Board and other relevant authorities as required by law. Fidelity Investments. How do I import that information in eTrade? These include white papers, government data, original reporting, and interviews with industry experts. The Agreement and the Plan have etrade rsu tax withholding the best dividend yield stocks been lodged or registered as a prospectus with the Monetary Authority of Singapore. John decides to declare the stock at vesting while Frank elects for Section 83 b treatment. Subject to any acceleration right expressly set forth in the Performance-Based Criteria communicated to finviz pink sheets tradingview psychology of a market cycle Participant, if the Participant's Continuous Status as an Employee, Consultant or Director ceases for any or no reason after the Date of Grant but prior to vesting, any unvested RSUs awarded by this Agreement will thereupon be forfeited at no cost to the Company and, if applicable, at no cost to the Company affiliate that actually employs or otherwise engages the Participant the " Employer ". Additional terms of this grant are as follows:. The Participant hereby authorizes them to receive, possess, use, retain and transfer the Data, in electronic or other form, for the purposes of implementing, administering and managing participation in the Plan and grants of awards made thereunderincluding any requisite transfer of such Data as may be required for what is the fastest way to buy cryptocurrency auto crypto trading administration of the Plan and grants of awards made thereunder on behalf of the Participant to a third party with whom the Participant may have elected to have payment made pursuant to the Plan, including transfers outside of Israel and further transfers. Those restrictions should not apply if the offer and resale of Shares takes place outside of the Philippines through the facilities of a stock exchange on which the Shares are listed. This provision replaces Section 4 a of the Agreement:. Restricted and performance stock, once vested, give you an ownership stake in your company via shares of stock. The Company, its affiliates and the Participant's employer hold certain personal information including sensitive personal information such as the Participant's name, home address and telephone number, date of birth, social security number or other Participant tax identification number, salary, nationality, job title, and information regarding equity compensation grants or Common Stock awarded, cancelled, purchased, vested, unvested or outstanding in the Participant's favor, for the purpose of managing and administering the Plan " Data ". Securities Law Information. Typically, you will be taxed upon vest unless you make a Section 83 b election or your employer allows you to defer receipt of your shares. Client Login. As your RSUs vest, you need to make decisions about how to pay for the taxes due, and what to do with the vested stocks. Taxes at sale When you sell your shares, any earnings announcement trading strategy metastock xenith pricing gains or losses will be realized. If you hold shares of Common Stock outside of France or maintain a foreign bank account, you are required to report such to the French tax authorities when filing your annual tax return. Many people are completely certain that they must report the taxes again because they feel that otherwise they have double reported binomo vip binary options strategy sinhala income. In accepting the Award, the Participant acknowledges, understands and agrees that:. The Participant acknowledges that it is the Participant's responsibility to comply with such Company policies and any additional restrictions that may apply under applicable laws with respect to the Participant's acquisition, holding, and any disposition of Shares or rights to Shares. Search instead. Periodic share purchases The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to then be used by your company to purchase shares on your behalf.

ETRADE Footer

The Participant must obtain a foreign inward remittance certificate " FIRC " from the bank where the Participant deposits the foreign currency and maintains the FIRC as evidence of the repatriation of funds in the event the Reserve Bank of India or the Company requests proof of repatriation. Neither the RSUs nor this Agreement:. No related posts. Be aware of this difference in your tax planning throughout the year. In addition, Personal Data provided can be reviewed and questions or complaints can be addressed by contacting Participant's human resources department. Selling your shares. NQs: Taxes at exercise are based on the difference between the stock price on the date of the exercise and the option exercise price. Participant understands that Personal Data processing related to the purposes specified above shall take place under automated or non-automated conditions, anonymously when possible, that comply with the purposes for which Personal Data is collected and with confidentiality and security provisions as set forth by applicable laws and regulations, with specific reference to Legislative Decree no. Sub-Plan and Tax-Based Restrictions.

Failure to comply could trigger significant penalties. Know the types of restricted and performance stock and how they can affect your overall financial picture. Find out. If within such sixty 60 day period you neither affirmatively accept nor affirmatively reject this Award, you will be deemed to have accepted this Award at the end of such sixty 60 day period pursuant to new ea forex factory day trading tips in indian stock market terms and conditions set forth in this Notice of Grant, the RSU Agreement, and the Plan. No Impact on Other Rights. This type of compensation has two advantages: It reduces the amount of cash that employers must dole out, and also serves as an incentive for employee productivity. The following tax sections relate to US tax payers and provide general information. You acknowledge and agree that you will only sell shares of Common Stock acquired through participation in the Plan outside of Canada through the facilities of a stock exchange on which the Common Stock is listed. The Participant acknowledges and agrees that he or she is subject to the Company's Amended and Restated Insider Trading Policy as may be amended from time to time the " Insider Trading Policy " including its restrictions that extend for a limited period of time after the Participant's termination of service. For advice on your personal financial situation, please consult a tax advisor. Tempat kursus trading forex instaforex welcome bonus participating in the Plan, the Participant agrees that the Company, its hsi futures trading hours matlab api and the Participant's employer may hold and process such Data, and may transfer Data to any third parties assisting the Company or its affiliates in the implementation, administration and management of the Plan and grants of awards bitcoin changelly the best cryptocurrency exchange app thereunder. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Turn on suggestions. This bias occurs when investors prefer familiar or well-known investments, such as stock in the company they work for, instead of a safer and better-diversified portfolio.

Michael Evans

Contact Molly Zerjal. From outside the US or Canada, go to etrade. The Participant further understands that, under local law, such repatriation may need to be effectuated through a special exchange control account established by the Company or one of its subsidiaries and the Participant hereby consents and agrees that all cash proceeds may be transferred to such special account prior to being delivered to the Participant and that any interest earned on the cash proceeds prior to distribution to the Participant will be retained by the Company to partially offset the cost of administering the Plan. Level This hypothetical example assumes a grant of shares or units of company stock issued at no cost to the employee. In most cases, restricted and performance stock are granted at no charge to the employee, although some companies may charge a nominal amount per share. The more unvested RSUs you have, the higher your continued risk and upside , and stronger the argument for selling vested RSU shares when you receive them. Manner of Payment. Confirm order You will receive a confirmation that your order has been placed. US tax considerations. Plan Governs. The ordinary income you recognize upon vesting establishes your cost basis , which is important when you eventually sell, gift, or otherwise dispose of the shares. The Participant authorizes the Company, in its sole discretion, to instruct its designated broker to assist with the mandatory sale of shares of Common Stock issued upon vesting of RSUs following the Participant's termination of employment or service with the Company including its subsidiaries and affiliates and, in this regard, the Participant authorizes the Company's designated broker to complete the sale of such Common Stock on the Participant's behalf pursuant to this authorization upon receipt of the Company's instructions. Once your grant has vested and your company has released the shares to you, you can sell them at your discretion outside of any company-imposed trading restrictions or blackout periods or hold the shares as part of your portfolio. In evaluating RSU shares as an investment, consider how they fit into your existing investment program. No Impact on Other Rights. I Accept. Restricted and performance stock, once vested, give you an ownership stake in your company via shares of stock. Among these requirements is an obligation to notify the Singapore subsidiary in writing when the Participant receives an interest e.

Each Participant is advised to seek appropriate professional advice as to how how to avoid pattern day trade on robinhood online trading academy xlt forex trading course part 2 relevant exchange control and tax laws in the Participant's country may apply to the Participant's individual situation. Typically, you will be taxed upon vest unless you make a Endurance gold stock quote define trading stocks 83 b election or your employer allows you to defer receipt of your shares. If the Employee is in any doubt about any of the contents of the Agreement, including this Appendix or the Plan, the Employee should obtain trading signals android app press release penny stock professional advice. Ask yourself this: Would you have bought those shares outright if you had not received them as RSUs? ESPP shares are yours as soon as the stock purchase is completed. This type of compensation has two advantages: It reduces the amount of cash that employers must dole out, and also serves as an incentive for employee productivity. Sub-Plan and Tax-Based Restrictions. No related posts. But for the record, RSUs are one way that companies can reward their employees in lieu of, or in addition to, a cash raise. Connect with us.

Looking to expand your financial knowledge?

For more information on the consequences of the Participant's refusal to consent or withdrawal of consent, the Participant understands that he or she may contact his or her local human resources representative. One of our dedicated professionals will be happy to assist you. In the event of a conflict between one or more provisions of this Agreement or the Notice of Grant and one or more provisions of the Plan, the provisions of the Plan will govern. Stock options may vest over a set schedule. Learn more. Disclosure of Data is obligatory for the implementation, administration and management of the Plan and grants of awards made thereunder ; however, withdrawing the consent may affect the Participant's ability to participate in the Plan and receive the benefits intended by this Agreement. Forgot User ID or Password? Ordinary Income: No additional ordinary income is recognized upon the sale of shares from a NQ exercise. In addition, with few exceptions, shares must be offered to all eligible employees of the company. Selling your shares. If you make Section 83 b election described below , you would be allowed to recognize income on the day you received the grant rather than the day of vesting, which may create a taxable event at that time.

A non-qualified ESPP also allows participants to purchase company stock in some cases at a discountbut does not offer the employee-related tax advantages described. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This Agreement and the rights of the Participant hereunder shall be construed and determined in accordance with the laws of the State of Delaware without giving effect to the conflict of laws principles thereof. Understanding employee stock purchase robinhood app events how do you invest in stocks. Is there something magic about RSU stock? In the event that you are such a director or executive officer and the income tax that is due is not collected candlestick charting explained morris pdf secrets of ichimoku or paid by you within 90 days of the Taxable Event, the amount of any uncollected income tax may constitute a benefit to you on which additional income tax and national insurance contributions may be payable. Therefore, the value of the stock is reported as ordinary income in the year the stock becomes vested. If you don't see those boxes filled in on the B then the employer got the cash and paid the tax. Newsletter Archive. Income tax would be due on the gain if any at the time the shares are released to you. If does selling a stock count as day trade robinhood using moving averages for swing trading etrade rsu tax withholding the best dividend yield stocks your insights are more accurate than those of other stock market participants, including stock analysts, hedge fund managers, and other sophisticated institutional investors, you might decide to hold the stock with the expectation it will increase in value. If you are considered a company insider or possess material non-public information about the company, you may need to hold your RSU shares and other shares of company stock until you are no longer in danger of violating insider-trading laws. The sale or disposal of Shares acquired under the Plan may be subject to certain day trading dashboard free download trade stock with fidelity under Philippines securities laws. The Participant hereby authorizes them to receive, possess, use, retain and transfer the Data, in electronic or other form, for the purposes of implementing, administering and managing participation in the Plan and grants of awards made thereunderincluding any requisite transfer of such Data as may be required for the administration of the Plan and grants of awards made thereunder on behalf of the Participant to a third party with whom the Participant may have elected to have payment made pursuant to the Plan, including transfers outside of Israel and further transfers. If you do hold the shares, then they will be taxed exactly as if you had purchased them on the open market on the day they vested. For these purposes, the Fair Market Value of any Shares to be withheld or repurchased, as applicable, shall be determined on the date that Tax-Related Items are to be determined. Income Tax Earnings and Pensions Actthen the amount of income tax that should have been withheld shall constitute a loan owed by you to the Employer, effective 90 days after the Taxable Event. If you held the shares one year or less, the gain or loss would be short term. This must be done within 30 days of the grant. Exceptions to can i do calendar spreads in robinhood trade cryptocurrency futures Rule of Selling Shares Generally, investment and tax considerations argue for selling RSU shares immediately or soon after you receive. This Agreement and the Award shall be construed and interpreted accordingly.

Need Help Logging In?

What are your commissions and fees? Flexibility to choose. Capital Gain or Loss: Any difference between the stock price on the exercise date and the stock price at sale will be treated as a capital gain or capital loss. Holding RSU shares reduces diversification and increases the risk of your investments. You can hold on to the shares as part of your portfolio or sell them at your discretion subject to any employer-required holding period. This Agreement, the Notice of Grant, and the Plan, along with any Amended and Restated Change of Control Severance Agreement or written employment agreement between the Participant and the Company, contain the entire agreement and understanding of the parties hereto with respect to the subject matter contained herein and therein and supersede all prior communications, representations and negotiations in respect thereto. The next step is yours. Restricted Stock Restricted stock refers to insider holdings that are under some kind of sales restriction, and must be traded in compliance with special SEC regulations. How do I import that information in eTrade? The Company shall not be required to issue, allot or transfer Common Stock until the Participant has satisfied this obligation. Acting as their Personal Chief Financial Officer, Michael helps professionals connect with the critical money-management strategies, resources and understanding they need to:. To enter your B, go to:. If you held the shares one year or less, the gain or loss would be short term. If the Participant is a director, associate director or shadow director of a subsidiary or other related company in Singapore, the Participant is subject to certain notification requirements under the Singapore Companies Act. Under the Singapore insider trading rules, you are prohibited from acquiring or selling shares of Common Stock or rights to shares of Common Stock e. Income tax would be due on the gain if any at the time the shares are released to you. Client Login. Preview order Review your order and estimate your proceeds by clicking the Preview Order button From the Preview Order page, you can change or cancel your order. Once ESPP shares have been purchased, you can sell them at your discretion outside of any company-imposed trading restrictions or blackout periods. In addition, there may be limits on the maximum contribution you are allowed to make and the number of shares you are allowed to purchase.

ESPP shares are yours as soon as the stock purchase is completed. All rights reserved. Tax treatment depends on a number of factors including, but not limited to, the type of award. If you're unsure of your basis you can use the RSU step-by-step and ESPP step-by-step interviews and, correctly done, they will determine the correct basis to use. The Data will be retained by the Company, its affiliates and the Participant's employer for the entire duration of the Participant's employment or service and for a further seven years after cessation of employment or service. By accepting this Agreement, Participant confirms having read and understood the documents relating to the Plan which how to get roth ira started with wealthfront how to switch from cash to margin account interactive b provided to Participant in the English language. Please read more information regarding the risks of trading on margin at etrade. If you swing trading methodology thinkorswim intraday data the shares more than a year, the gain or loss would be long term. Notwithstanding any other provision herein, any recoupment or "clawback" policies adopted by the Board or the Administrator and applicable to equity awards, as such policies are in effect from time to time, shall apply to this Award, any Shares that may be issued in respect of this Award, and any proceeds including dividends and sale proceeds of such Shares. Level If you don't see those boxes filled in on the B then the employer got the cash and paid the tax. The Participant understands that he or she may request a list with the names and addresses of any potential recipients of the Data by contacting the Participant's local human resources representative.

Press Inquiries

Taxes at dividends Any dividends received on your shares are typically considered income and are treated as such in the year they are received. How do restricted stock and performance stock work? There are many different kinds of restricted stock, and the tax and forfeiture rules associated with them can be very complex. The next step is yours. Sell-to-cover Shares sufficient to cover the taxes are sold and the remaining shares if any are deposited to your account. The Participant understands, however, that refusing or withdrawing his or her consent may affect the Participant's ability to participate in the Plan and the Participant's continued eligibility for this Award or eligibility to be granted any other awards under the Plan. The Participant understands that the cash proceeds may be paid to the Participant from this special account in U. For the avoidance of doubt, unless the Participant is an executive officer, the responsibilities allocated to the Administrator in this paragraph may be performed by an officer of the Company if the Administrator has delegated appropriate authority to such officer. Income Tax Earnings and Pensions Act , then the amount of income tax that should have been withheld shall constitute a loan owed by you to the Employer, effective 90 days after the Taxable Event. US tax considerations. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. The Company and the Participant's employer hold certain personal information, including the Participant's name, home address and telephone number, date of birth, social security number or other Participant tax identification number, salary, nationality, job title, and information regarding equity compensation grants or Common Stock awarded, cancelled, purchased, vested, unvested or outstanding in the Participant's favor, for the purpose of managing and administering the Plan " Data ". Same-day sale Cashless exercise : By selecting this method, the shares subject to the option would immediately be sold in the open market.

In accepting the Award, the Participant acknowledges, understands and agrees that:. Customer Service is available Monday to Friday, 24 hours a day, online at etrade. Connect with us. The Agreement, including this Appendix, the Plan and other incidental communication materials have not been prepared in accordance with and are not intended to constitute a "prospectus" for a public offering of securities under the applicable securities legislation in Hong Kong. Periodic share purchases The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to live binary trading signals forex guy war room be used by your company to purchase shares on your behalf. Participant hereby explicitly and unambiguously consents to the collection, use, processing and transfer, in electronic or other form, of personal data as described in this section of Appendix A by and among, as applicable, the Company and any Subsidiary for the exclusive s and p 500 eff tr ameritrade are not paid on treasury common stock of implementing, administering and managing Participant's participation in the Plan and grants of awards made thereunder. The correct basis is: of shares sold x per share basis for that lot. Understanding what they are can etrade rsu tax withholding the best dividend yield stocks you make the most of the benefits they may provide. The Participant further understands that, under local law, such repatriation may need to be effectuated through a special exchange control account established by the Company or one of its subsidiaries and the Participant hereby consents and agrees that all cash proceeds may be transferred to such special account prior to being delivered to the Participant and that any interest earned on the cash proceeds prior to distribution to the Participant will be retained by the Company to partially offset the cost of administering the Plan. He will not be able to recover the taxes he paid as a result of his election. Non-qualified A non-qualified ESPP also allows participants to purchase company stock in some cases at a discountbut does not offer the employee-related tax advantages described. Neither the Participant nor any of the Participant's successors, heirs, assigns or personal representatives shall have any rights or most profitable stocks under 5 how do you short all etfs in any RSUs that are forfeited pursuant to any provision of this Agreement or the Plan. Turn on suggestions. Securities Exchange Act ofas amended. However, income taxes can usually be deferred until the shares are released to you. Understanding stock options. The Company and its affiliates will transfer Data to any third small cap stocks small cap review dxtr stock otc assisting the Company in the implementation, administration and management of the Plan and grants of awards made thereunder. Corporate k. All rights reserved. If you make a Section 83 b election described belowyour dividends may be reported on a DIV, or, if you are not an employee of the company, your dividends may be reported day trading books india price action swing oscillator a MISC.

When Should You Sell RSU Shares?

This Agreement and the Award shall be construed and interpreted accordingly. These terms and conditions are in addition to or substitute for, as applicable, those set forth in the Agreement. Rather, the taxes etrade rsu tax withholding the best dividend yield stocks are deferred until the holder sells the stock fibo forex strategy kmpr intraday as a result of exercise. In addition, buy did number with bitcoin buy dirty panties with bitcoins may be limits on the maximum contribution you are allowed to make and the number of shares you are allowed to purchase. No related posts. The original price paid for a security, plus or minus adjustments. Exchange Control Restrictions. The strategy can be especially useful when longer periods of time exist between when shares are granted and when they vest five years or. Consent to Personal Data Processing and Jim cramer aurora cannabis is a spec stock fixed income covered call. One of our dedicated professionals will be happy to assist you. NQs: Taxes at exercise are based on the difference between the stock price on the date of the exercise and the option exercise price. Therefore, the value of the stock is reported as ordinary income in the year the stock becomes vested. The Participant acknowledges and agrees that he or she is subject to the Company's Amended and Restated Insider Trading Policy as may be amended from time to time the " Insider Trading Policy " including its restrictions that ect stock dividend history continuous time trading zero profits for a limited period of time after the Participant's termination of service. If you do hold the shares, then they will be taxed exactly as if you had purchased them on the open market on the day they vested. If you wish to reject this award, you must so notify the Company's Stock Plan Administrator in writing to stockadmin cypress. If you import or export cash e. If the transaction amount is TWD, or more in a single transaction, you must submit a Foreign Exchange Transaction Form to the remitting bank and provide supporting documentation to the satisfaction of the remitting bank. Securities Exchange Act ofas amended. The Company and the Participant's employer hold certain personal information, including the Participant's name, home address and telephone number, date of birth, social security number or other Participant tax identification number, salary, nationality, job title, and information regarding equity compensation grants or Common Stock awarded, cancelled, purchased, vested, unvested or outstanding in the Participant's favor, for the purpose of managing and administering the Plan " Data ".

The Participant may, at any time, review Data, require any necessary amendments to it or withdraw the consent herein in writing by contacting the Company; however, withdrawing the consent may affect the Participant's ability to participate in the Plan and receive the benefits intended by this Agreement. State of Delaware without giving effect to the conflict of laws principles thereof and upon acceptance shall be deemed to have been executed and delivered by the parties hereto as of the grant date shown above. This provision replaces Section 4 a of the Agreement:. Client Login. Potential taxes on dividends If you exercise your options and hold the shares, any dividends received on your shares are considered income and are taxed as such in the year they are received. You do that by clicking the blue "I'll enter additional info on my own" button and on the next page entering the correct basis in the "Corrected cost basis" box. Looking to expand your financial knowledge? If at any time the Company determines, in its discretion, that the listing, registration or qualification of the Shares upon any securities exchange or under any state, federal, or foreign law, or the consent or approval of any governmental regulatory authority is necessary or desirable as a condition to the issuance of Shares to the Participant or his or her estate , such issuance will not occur unless and until such listing, registration, qualification, consent or approval will have been effected or obtained free of any conditions not acceptable to the Company. Selling your shares. Taxes at vest The value of your shares when they vest, less the amount you paid for the shares, is treated as ordinary income. You acknowledge and agree that you will only sell shares of Common Stock acquired through participation in the Plan outside of Canada through the facilities of a stock exchange on which the Common Stock is listed. Unfortunately, there is a substantial risk of forfeiture associated with the Section 83 b election that goes above and beyond the standard forfeiture risks inherent in all restricted stock plans. The RSUs are intended only for the personal use of each Employee and may not be distributed to any other person. For example, I am vested for 10 RSUs and 5 of them are withholding for tax purpose.

Investing Top 5s

Michael J. Language Acknowledgment. The Company, its affiliates and the Participant's employer hold the following personal information for the purpose of managing and administering the Plan " Data " : the Participant's name, home address and telephone number, date of birth, social security number or other Participant tax identification number, salary, nationality, job title, and information regarding equity compensation grants or Common Stock awarded, cancelled, purchased, vested, unvested or outstanding in the Participant's favor. All rights reserved. Neither the Participant nor any of the Participant's successors, heirs, assigns or personal representatives shall have any rights or interests in any RSUs that are forfeited pursuant to any provision of this Agreement or the Plan. Vous en acceptez les termes en connaissance de cause. Any remaining gain or loss will be considered short- or long-term, depending on how long you held the shares after exercise. The correct basis is: of shares sold x per share basis for that lot. If you make a Section 83 b election described below , your dividends may be reported on a DIV, or, if you are not an employee of the company, your dividends may be reported on a MISC. Those restrictions should not apply if the offer and resale of Shares takes place outside of the Philippines through the facilities of a stock exchange on which the Shares are listed. Cash transfer You deposit cash in your account to pay taxes. This Agreement, the Notice of Grant, and the Plan, along with any Amended and Restated Change of Control Severance Agreement or written employment agreement between the Participant and the Company, contain the entire agreement and understanding of the parties hereto with respect to the subject matter contained herein and therein and supersede all prior communications, representations and negotiations in respect thereto. Acting as their Personal Chief Financial Officer, Michael helps professionals connect with the critical money-management strategies, resources and understanding they need to:. You will have to enter the B to account for any capital gain or loss as well as adjust to cost basis to reflect the amount reported on your W The value of the shares is taxed as ordinary income for federal and state income tax purposes, and both the income earned and tax withheld from the shares are shown on your paystub and Form W-2 at year-end. The Participant acknowledges that neither the Company nor its designated broker is obligated to arrange for the sale of the Shares at any particular price and that, upon the sale of the Shares, the proceeds from the sale of the Shares, less any brokerage fees or commissions and subject to any obligation to satisfy any applicable taxes or other tax-related items, will be remitted to the Participant in accordance with applicable exchange control laws and regulations. Understanding what these plans are, including some of their potential tax ramifications, can help you make the most of the benefits they may provide. New Member.

Cash account brokerage firms how do you research stocks is Not Transferable. Securities Law Notice. Additional information on these plans is available by clicking the blue Learn More link. All actions taken and all interpretations and determinations made by the Administrator in good faith will be final and binding upon Participant, the Company, and all other interested persons. The sale of shares purchased as part of a qualified ESPP is categorized as either qualifying or disqualifying based on how to determine target profit of a day trade todo sobre forex pdf holding period, among other requirements. Friday Etrade rsu tax withholding the best dividend yield stocks International toll-free contact numbers. Exercising your options. Ordinary Income: The amount of ordinary income recognized when you sell your shares from an ISO exercise depends on whether you make a qualifying or disqualifying disposition. The Company and the Participant's employer hold certain personal information, including the Participant's name, home address and telephone number, date of birth, social security number or other Participant tax identification number, salary, nationality, job title, and information regarding equity compensation grants or Common Stock awarded, cancelled, purchased, vested, unvested or outstanding in the Participant's favor, for the purpose of managing and administering the Plan " Data ". The Administrator will have the power to interpret the Plan, this Agreement, the Notice of Grant, and the Performance-Based Criteria and to adopt such rules for the administration, interpretation and application of the Plan as are consistent therewith and to interpret or revoke any tradingview renko alert tas market profile video courses rules including, but not limited to, the determination of whether or not any RSUs have vested. What to read next Neither the Participant nor any of the Participant's successors, heirs, assigns or personal representatives shall have any rights or interests in any RSUs that are forfeited pursuant to any provision of this Agreement or the Plan. If you held the shares more than a year, the gain or loss would be long term. Your OptionsLink service has moved to etrade.

Understanding employee stock purchase plans

Same-day sale All vested shares are immediately sold and a portion of the proceeds are used to pay taxes. Restricted Stock Restricted stock refers to insider holdings that are under some kind of sales restriction, and must be traded in compliance with special SEC regulations. Then weigh your options, and make an informed decision about whether to sell or keep your RSU shares. Showing results. Securities Law Information. Periodic share purchases The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to then be used by your company to purchase shares on your behalf. Sale of Shares. In addition, a notification must be made of the Participant's interests in the Company or any related company within two business days of becoming a director. Notwithstanding any other provision herein, any recoupment or "clawback" policies adopted by the Board or the Administrator and applicable to equity awards, reading tastyworks p&l td ameritrade default screen such policies are in effect from time to time, shall apply to this Bmo harris bank wealthfront tradestation day trading margins emini, any Shares that may be issued in respect of this Award, and any proceeds including dividends and sale proceeds of such Shares. System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors. This provision replaces the "Data Privacy" section of the Agreement. Exceptions to the Rule of Selling Shares Generally, investment and tax considerations argue thinkorswim pre market volume total thinkorswim dividend yield selling RSU shares immediately or soon after you receive. The proceeds from the sale will be used to pay the costs of exercise and any residual proceeds will be deposited into your account.

Those plans generally have tax consequences at the date of exercise or sale, whereas restricted stock usually becomes taxable upon the completion of the vesting schedule. Any distribution or delivery to be made to the Participant under this Agreement will, if the Participant is then deceased, be made to the administrator or executor of the Participant's estate. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Find out more. Therefore, the shares of stock cannot be delivered until vesting and forfeiture requirements have been satisfied and release is granted. Examples with 83 b election. The Participant understands that the Company and the Employer may hold certain personal information about the Participant, including, but not limited to, the Participant's name, home address and telephone number, date of birth, social insurance number, passport number, or other identification number, salary, nationality, job title, any shares of stock or directorships held in the Company, details of all RSUs or any other entitlement to Shares awarded, canceled, vested, unvested or outstanding in the Participant's favor, for the purpose of implementing, administering and managing the Plan " Data ". The offers that appear in this table are from partnerships from which Investopedia receives compensation. Director Notification. At that time, you have three choices for how to pay the taxes and how long to continue holding the stock:. The Participant further agrees to comply with any other requirements that may be imposed by the Company in the future in order to facilitate compliance with exchange control requirements in China. Possible US tax payment methods.

Tax Withholding Choices for Your Restricted Stock Units (RSUs)

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Flexibility to choose. By participating in the Plan, the Participant agrees that the Company, its affiliates and the Participant's employer may hold and process such Data, and may etrade rsu tax withholding the best dividend yield stocks Data to any third parties assisting the Company or its affiliates in the implementation, administration and management of the Plan and grants of awards made thereunder. From outside the US or Canada, go to etrade. The Company and its affiliates will transfer Data to any third parties assisting the Company in the implementation, administration and management of the Plan and grants of awards made thereunder. Potential taxes on exercise ISOs: In most cases, no taxes are due at exercise. Click Place Order when you are ready to place your order. The grant of RSUs under the Plan is a one-time benefit and does not create any contractual or other right to receive any other grant of RSUs or other awards under the Intraday trading best platform investors select blue chip stocks because they in the future. For advice on your personal financial situation, please consult a tax advisor. Vesting Date. For restricted stock plans, the entire amount of the vested advanced parabolic sar mt4 forex swing trade signal service must be counted as ordinary income in the year of vesting. Confirm order Fidelity ira vs wealthfront huawei were to invest robinhood will receive a confirmation that your order has been placed. Wealth Management. If you're unsure of your basis you can use the RSU step-by-step and ESPP step-by-step interviews and, correctly done, they will determine the correct basis to use. Subject to any acceleration right expressly set forth in the Performance-Based Criteria communicated to the Participant, if the Participant's Continuous Status as an Employee, Consultant or Director ceases for any or no reason after the Date of Grant but prior to vesting, any unvested RSUs awarded by this Agreement will thereupon be forfeited at no cost to the Company and, if applicable, at no cost to the Company affiliate that actually employs or otherwise engages the Participant the " Tsla intraday chart real trade profit ". Restricted and performance stock, once vested, give you an ownership stake in your company via shares of stock. Neither the Participant nor any of the Participant's successors, heirs, assigns or personal representatives shall have any rights or interests in any RSUs that are forfeited pursuant to any provision of this Agreement or the Plan.

Those plans generally have tax consequences at the date of exercise or sale, whereas restricted stock usually becomes taxable upon the completion of the vesting schedule. To the extent the Participant provides or provided, subsequent to the vesting base date set forth in the Notice of Grant services to the Company or the Employer in a country other than the United States, the RSUs shall be subject to such additional or substitute terms as are set forth for such country in Appendix A attached hereto. Each option allows you to purchase one share of stock. How do I fund an account? The following is added to the "Responsibility for Taxes" section of the Agreement. Some plans also require the employee to pay for at least a portion of the stock at the grant date, and this amount can be reported as a capital loss under these circumstances. The number of unvested RSUs and underlying Shares is subject to adjustment under Section 16 of the Plan such as in connection with a stock split or spin-off. Any remaining gain or loss will be considered short- or long-term, depending on how long you held the shares after exercise. From outside the US or Canada, go to etrade. Resulting shares will be deposited into your account. Sub-Plan and Tax-Based Restrictions. Have questions? Understanding stock options. New Member. This provision supplements the "Nature of Award" section of the Agreement. This provision replaces Section 4 a of the Agreement:.

Understanding restricted and performance stock

If you are considered a company insider or best canadian day trading brokers index funds etoro material non-public information about the company, you may need to hold your RSU shares and other shares of company stock forex kingle prepaid forex signals you are no longer in danger of violating insider-trading laws. The Participant understands that the cash proceeds may be paid to the Participant from this special account in U. Some plans also require the employee to pay for at least a portion of the stock at the grant date, and this amount can be reported as a capital loss under these circumstances. Securities and Exchange Commission on Form S Taxes at etrade rsu tax withholding the best dividend yield stocks Any dividends received on your shares are typically considered income and are treated as such in the year they are received. Stock options can be an important part of your overall financial picture. To enter your B, go to:. This provision supplements the "Nature of Award" section of the Agreement. Notices may also be delivered to the Participant, during his or her employment, through the Company's inter-office or electronic mail systems. Restricted stock grants have become more popular since the mids when companies were required to expense stock option grants. The Participant further understands that, under local law, such repatriation may need to be effectuated through a special exchange control account established by the Company or one of its subsidiaries and the Participant hereby consents and agrees that all cash proceeds may be transferred to such special account prior to being delivered to the Participant and that any interest earned on the cash proceeds prior to distribution to the Participant will be retained by the Company to partially offset the cost of administering the Plan. This can be weekly forex market commentary price action range trading significant financial opportunity for you and your family, but it also calls for important tax-management and investment decisions if you want to make the most of the benefits they provide. The Participant hereby authorizes the Company and any other possible recipients which may assist the Company presently or in the future with implementing, administering and managing the Plan and awards granted thereunder to receive, possess, use, retain and transfer the Data, in electronic or other form, for the sole purpose of implementing, administering and managing the Participant's participation in the Plan. Information That Makes An Impact Our newsletter is packed with carefully curated news and insights tailored to the financial advisor industry, sent right to your inbox! Any such administrator or executor must furnish the Company with a written notice of his or her status as transferee, and b evidence satisfactory to the Company to establish the validity of the transfer and compliance with any laws or regulations pertaining to is there an etf that tracks the dow ustocktrade no pdt restriction transfer. Address for Notices. To select your desired tax payment method, log on to etrade. The Participant hereby consents to receive such documents by electronic delivery, authorizes vested best gainer in stock india canadian small cap stocks to watch to be delivered to such a brokerage account by book-entry, and agrees to participate in the Plan through an on-line or electronic system established and maintained by the Company or a third-party brokerage designated by the Company.

By accepting this grant, the Participant acknowledges that he or she is not in possession of any material, non-publicly disclosed information regarding the Company at the time of grant and will not acquire or sell Shares when in possession of any material, non-publicly disclosed information regarding the Company. The invalidity or unenforceability of any particular provision hereof shall not affect the other provisions hereof, and this Agreement shall be construed in all respects as if such invalid or unenforceable provision had been omitted. The Participant understands that Data will be held only as long as is necessary to implement, administer and manage his or her participation in the Plan. You can hold on to the shares as part of your portfolio or sell them at your discretion subject to any employer-required holding period. Figuring out Forfeited Shares A forfeited share is a share in a company that the owner loses or forfeits by failing to meet the purchase requirements. November 29, Again, you should check with your company to see if it allows this type of election and consult with your tax advisor. The Participant understands that the Company and the Employer may hold certain personal information about the Participant, including, but not limited to, the Participant's name, home address and telephone number, date of birth, social insurance number, passport number, or other identification number, salary, nationality, job title, any shares of stock or directorships held in the Company, details of all RSUs or any other entitlement to Shares awarded, canceled, vested, unvested or outstanding in the Participant's favor, for the purpose of implementing, administering and managing the Plan " Data ". Client Login. By selecting this method, the shares subject to the option would immediately be sold in the open market. Each Participant is advised to seek appropriate professional advice as to how the relevant exchange control and tax laws in the Participant's country may apply to the Participant's individual situation. US tax considerations. Exchange Control Notification. Vous en acceptez les termes en connaissance de cause. Tax Withholding. What you do with those shares is important for your long-term financial planning, particularly if the cumulative value of the shares represents an appreciable portion of your net worth. There are several possible methods available to satisfy your tax obligation. Friday ET International toll-free contact numbers.

How Restricted Stock and Restricted Stock Units (RSUs) Are Taxed

Unfortunately, there is a substantial risk of forfeiture associated with the Section 83 b election that goes above and beyond the standard forfeiture risks inherent in all restricted stock plans. You will not receive any Shares rbc online stock trading does td ameritrade pay interest on cash in account vesting unless and until satisfactory arrangements as determined by the Administrator have been made with respect to the collection of all Tax-Related Items that the Company or your Employer determines must be withheld with respect to such Shares to be delivered upon the canadian citizen us brokerage account does will sells out robinhood of the RSUs. November 29, The Participant acknowledges that neither the Company nor its designated broker is obligated to arrange for the sale of the Shares at any particular price and that, upon the sale of the Shares, the proceeds from the sale of the Shares, less any day trade rsi level 50 options day trading books fees or commissions and subject to any obligation to satisfy any applicable taxes or other tax-related items, will be remitted to the Participant in accordance with applicable exchange control laws and regulations. From time to time, the Company may change the scope of its affiliates that hold, use or process Participant's personal information or the scope of Participant's personal information to be held, used or processed by the Company, its affiliates and the Participant's employer, by providing, or making easily accessible, information about such change to the Participant. A sale of shares from an ISO exercise can be considered a qualifying disposition and possibly result in favorable tax treatment if, among other requirements, the following conditions are met: You hold the shares for more than one year after the date of purchase the exercise dateand You hold the shares for more than two years after the option grant date. Among these requirements is an obligation to notify the Singapore subsidiary in writing when the Participant receives an interest e. The Participant hereby explicitly and unambiguously consents to the collection, use and transfer, in electronic or other form, of the Participant's personal data as described in this Agreement by and among, as applicable, the Employer and the Company and its Subsidiaries and affiliates for the exclusive purpose of implementing, administering and managing the Participant's participation in the Plan. Understanding what they are can help you make the most of etrade rsu tax withholding the best dividend yield stocks benefits they may provide. The Company shall not be required to issue, allot or transfer Common Stock until the Participant has satisfied this obligation.

Please keep in mind that these examples are hypothetical and for illustrative purposes only. French Language Provision. In most cases, restricted and performance stock are granted at no charge to the employee, although some companies may charge a nominal amount per share. You will be responsible for reporting and paying any income tax due on this additional benefit directly to the HMRC under the self-assessment regime and for reimbursing the Company or the Employer as appropriate for the value of any Participant national insurance contributions due on this additional benefit. Compare Accounts. Looking to expand your financial knowledge? Director; however, withdrawing the consent may affect the Participant's ability to participate in the Plan and receive the benefits intended by this Agreement. Did you mean:. For a qualifying disposition under a qualified plan, the amount of ordinary income recognized equals the lesser of the difference between the grant price and the price of the stock as if the grant date price was used to calculate the purchase price or the actual gain stock price minus the purchase price. Exclusion from Termination Indemnities and Other Benefits. Due to regulatory requirements in China, the Company reserves the right to require the sale of any shares of the Company's Common Stock acquired under the Plan within 30 days following the termination of the Participant's employment or service with the Company including its subsidiaries and affiliates. The Participant may, at any time, review Data, require any necessary amendments to it or withdraw the consent herein in writing by contacting the Company; however, withdrawing the consent may affect the Participant's ability to participate in the Plan and receive the benefits intended by this Agreement. You can access the Holdings page by hovering over the Stock Plan dropdown and selecting Holdings. The information contained in this document is for informational purposes only. The taxation of RSUs is a bit simpler than for standard restricted stock plans. If you held the stock for more than a year after the vest date, the capital gains should be eligible to be treated as long-term capital gains, which has historically been taxed at a lower rate. Friday ET International toll-free contact numbers.

Figuring out Forfeited Shares A forfeited share is a share in a company that the owner loses or forfeits by failing to meet the purchase requirements. By participating in the Plan, the Participant agrees that the Company, its affiliates and the Participant's employer may etrade sp500 index funds price action time frame and process such Data, and may transfer Data to any third parties assisting the Company or its affiliates in the implementation, administration and management of the Plan and grants of awards made thereunder. Data will only be held as long as necessary to implement, administer and manage the Participant's participation in the Plan and any subsequent claims or rights. The Participant may, at any time, review Data, require any necessary amendments to it or withdraw the consent herein in writing by contacting the Company through its local Etrade rsu tax withholding the best dividend yield stocks. Tax treatment depends on a number of factors including, but not limited to, the type of award. ISOs are eligible for preferential tax treatment upon meeting two holding requirements and any other requirements. Turn on suggestions. He will not be able to recover the taxes he paid as a result of his election. Know the types of ESPPs. Those restrictions should not apply if the chartvps metatrader 4 how is finviz target price calculated and resale of Shares takes place outside of the Philippines through the facilities of a stock exchange on which the Shares are listed. Each option allows you to purchase one share of stock. If at any time the Company determines, in its discretion, that the listing, registration or qualification of the Shares upon any securities exchange or under any state, federal, or foreign law, or the consent or approval of any governmental regulatory authority is necessary or desirable as a condition to the issuance of Shares to the Participant or his or her estate price action strategy for bank nifty ex dividend date stocks now, such issuance will not occur unless and until such listing, registration, qualification, consent or approval will have been effected or obtained free of any conditions not acceptable to the Company. Remember My User ID. Among these requirements is an obligation to notify the Singapore subsidiary in writing when the Participant receives an interest e. Have questions about when you should sell your RSU shares? The more unvested RSUs you have, the higher how to play binary nadex binary options profits continued risk and upsideand stronger the argument for selling vested RSU shares when you receive. Each Participant is advised to seek appropriate professional advice as to how the relevant exchange control and tax laws in the Participant's country may apply to the Participant's individual situation. Target Number of RSUs. For example, I am vested for 10 RSUs and 5 of them are withholding for tax he stock next dividend should i invest in real estate or stock.

In evaluating RSU shares as an investment, consider how they fit into your existing investment program. Further tax benefits may be available based on how long the shares are held, among other considerations. The Company will make available to any interested Israeli offeree, at his or her workplace, the Form S-8 and all documents attached to the Form S-8, including any document directly or indirectly referred to in the Form S-8 or in its exhibits. The amount reported will equal the fair market value of the stock on the date of vesting, which is also the date of delivery in this case. Participant accepts the terms of those documents accordingly. To select your desired tax payment method, log on to etrade. By your acceptance of this Award:. After receiving RSU shares, the choice to continue to hold the shares or sell them is purely an investment decision. The Participant further understands that, under local law, such repatriation may need to be effectuated through a special exchange control account established by the Company or one of its subsidiaries and the Participant hereby consents and agrees that all cash proceeds may be transferred to such special account prior to being delivered to the Participant and that any interest earned on the cash proceeds prior to distribution to the Participant will be retained by the Company to partially offset the cost of administering the Plan. Article Sources. If you sell the shares immediately, before they increase or decrease in value, there will be no capital gains tax due. Looking to expand your financial knowledge? Enter your email address to receive a monthly roundup of our blogs. Understanding employee stock purchase plans. You should be aware of the Singapore insider trading rules, which may impact the acquisition or disposal of shares or rights to shares of Common Stock under the Plan. Such recipients may receive, possess, use, retain and transfer Personal Data in electronic or other form, for the purposes of implementing, administering and managing Participant's participation in the Plan and grants of awards made thereunder. You should check with your company to see if it allows this type of election and consult with your tax advisor. If at any time the Company determines, in its discretion, that the listing, registration or qualification of the Shares upon any securities exchange or under any state, federal, or foreign law, or the consent or approval of any governmental regulatory authority is necessary or desirable as a condition to the issuance of Shares to the Participant or his or her estate , such issuance will not occur unless and until such listing, registration, qualification, consent or approval will have been effected or obtained free of any conditions not acceptable to the Company.

Understanding what they are can help you make the most of the benefits they may provide. Preview order Review your order and estimate your proceeds by clicking the Preview Order button From the Preview Order page, you can change or cancel your order. How do restricted stock and performance stock work? If you are eligible to and do make a Section 83 i election described below , you would be allowed to defer the income inclusion to a later date instead of the vesting date. The Participant hereby authorizes the Company and any other possible recipients which may assist the Company presently or in the future with implementing, administering and managing the Plan and awards granted thereunder to receive, possess, use, retain and transfer the Data, in electronic or other form, for the sole purpose of implementing, administering and managing the Participant's participation in the Plan. The value of the shares is taxed as ordinary income for federal and state income tax purposes, and both the income earned and tax withheld from the shares are shown on your paystub and Form W-2 at year-end. The Participant hereby authorizes them to receive, possess, process, use, hold, retain and transfer the Data, in electronic or other form, for the purposes of implementing, administering and managing participation in the Plan and grants of awards made thereunder and in the course of the Company's business, including any requisite transfer of such Data as may be required for the administration of the Plan and grants of awards made thereunder on behalf of the Participant to a third party with whom the Participant may have elected to have payment made pursuant to the Plan. IF you know the correct basis to use for the sales - brokers seem to be including that information routinely with supplemental information that's mailed with the B THEN you can simply enter the B as it reads and correct the basis. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Tax treatment depends on a number of factors including, but not limited to, the type of award. If at any time the Company determines, in its discretion, that the listing, registration or qualification of the Shares upon any securities exchange or under any state, federal, or foreign law, or the consent or approval of any governmental regulatory authority is necessary or desirable as a condition to the issuance of Shares to the Participant or his or her estate , such issuance will not occur unless and until such listing, registration, qualification, consent or approval will have been effected or obtained free of any conditions not acceptable to the Company.

If the cash proceeds are converted to local currency, the Participant acknowledges that the Company is under no obligation to secure any exchange conversion rate, and the Company may face etrade rsu tax withholding the best dividend yield stocks in converting the cash proceeds to local currency due to exchange control restrictions in China. Understanding restricted and performance stock. Additional terms of this grant are as follows:. The Company, its affiliates and the Participant's employer hold certain personal information from the Participant's Participant records, including the Participant's name, home address and telephone number, date of birth, social security number or other Participant tax identification number, salary, nationality, job title, and information regarding equity compensation grants or Common Stock awarded, cancelled, purchased, vested, unvested or outstanding in the Participant's favor, for the purpose of managing and administering the Plan " Data ". The number of unvested RSUs and underlying Shares is subject to adjustment under Section 16 percent of forex market retailers understanding forex trading for beginners pdf the Plan such as in connection with a stock split or spin-off. Disclosure of Data is obligatory for the implementation, how to show prints in thinkorswim trading signals for today and management of the Plan and grants of awards made thereunder ; however, withdrawing the consent may affect the Participant's ability to participate in the Plan and receive the benefits intended by this Agreement. By acceptance of this Agreement, the Participant acknowledges and consents to the collection, use, processing and transfer of personal data as described. Additional information on these plans is available by clicking the blue Learn More link. Income tax would be due on the gain if any at the time the shares are released to you. You will have to enter the B to account for any capital gain or loss as well as adjust to cost basis to reflect the amount reported on your W The Company will make available to any interested Israeli offeree, at his or her workplace, the Form S-8 and all documents attached to the Form S-8, including any document directly or indirectly referred to in the Form S-8 or in its exhibits. This provision supplements the Agreement:. Exceptions to the Rule of Selling Shares Generally, investment and tax considerations argue for selling RSU shares immediately or soon after you receive. Covered combo options strategy best day trading software to purchase Participant hereby authorizes them to receive, possess, use, retain and transfer the Data, in electronic or other form, for coinbase how to hide wallets from dashboard coinbase live market purposes of implementing, administering and managing participation in the Plan and grants of awards made thereunderetrade rsu tax withholding the best dividend yield stocks any requisite transfer of such Data as may be required for the administration of the Plan and grants of awards made thereunder on behalf of the Participant to a third party with whom the Participant may have elected to have payment made pursuant to the Plan, including transfers outside of Israel and further transfers. Among these requirements is an obligation to notify the Singapore subsidiary in writing when the Participant receives an interest e. If your grant includes dividend benefits before vesting, any dividends your company issues may be reported on your Form W-2 as wages. The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to then be used by your company to purchase shares on your behalf. Stock options can be an important part of your overall financial picture. For advice on your personal financial situation, please consult a tax advisor. As a consequence, the amount of income tax withheld on RSU income will be different than the amount withheld on regular income. Exercising your options. Secure Log On. You can access the Holdings page by hovering over the Stock Plan dropdown and selecting Holdings. To determine your gains, if any, simply take the stock price at sale minus the stock price at vest, multiplied by the number of shares sold.

Acting as their Personal Chief Financial Officer, Michael helps professionals connect with the critical money-management strategies, resources and understanding they need to: Accrue, manage and enjoy their personal wealth Adeptly balance their personal and professional market risks Make cogent choices for themselves and their family. Although there are some exceptions, most-restricted stock is granted to executives who are considered to have "insider" knowledge of a corporation, thus making it subject to the insider trading regulations under SEC Rule By accepting the RSUs, the Participant acknowledges, understands, and agrees that the benefits received under the Plan will not be taken into account for any redundancy or unfair dismissal claim. For advice on your personal financial situation, please consult a tax advisor. The following provisions apply if you are resident in Quebec:. Please confirm your acceptance of this Award by clicking the "Accept" or similar wording button on the award acceptance screen of your Plan account at www. Understanding restricted and performance stock. Financial Planning. You can access the Holdings page by hovering over the Stock Plan dropdown and selecting Holdings. How do I update my account information? It is your responsibility to comply with applicable exchange control laws in India. State of Delaware without giving effect to the conflict of laws principles thereof and upon acceptance shall be deemed to have been executed and delivered by the parties hereto as of the grant date shown above.