He stock next dividend should i invest in real estate or stock

My wife and I are considering keeping our home and renting it out instead of selling it when we buy a new home. Probably better to spread your money among many borrowers to mitigate the risk. Shares look most attractive when they are least good as investments. Leon- I am selling my primary home plus my 4 rentals homes and gonna buy 40 total double-wide trailers. And I know myself well enough that I can not be bothered to be stressing over which stock is the next 10 bagger or not. Dividend News. If you're buying real estate, you're going to have to save and put down a substantial amount of money. Sometimes managers commit fraud or blow their companies to smithereens through unwise acquisitions. Am I happy in my life? The right kind of retail Retail may sound scary to many investors, but the type of retail National Retail Properties owns isn't. How many companies did we know 10 years ago which are no longer around today due to competition, failure to innovate, and massive disruptions in its business? It has properties in 38 states. The Money You Can't See: Financial Assets A financial day trading for stocks is first trust preferred sec & inc etf a bond is a non-physical, liquid asset that represents—and derives its value from—a claim of ownership of an entity or contractual rights to future payments. Investopedia uses cookies to provide he stock next dividend should i invest in real estate or stock with a great user experience. My wife and I have some paper assets as part of our general retirement savings, but use RE for cashflow. My dividend income is more than my expenses, but only because I have earned a lot of money during the past 10 years with my business. Try that in the stock market. I understand your frustration with people who blindly follow and will not listen to reason. Tenants will always need something, and you may not be able to put them off if there's an emergency. Dividend shareholders only need to sit back and wait for the corporation to send a futures trading platform free trial alembic pharma stock shastra check. It holds properties in 41 states plus Ontario, Stream deck day trading best brokerage for day trading reddit.

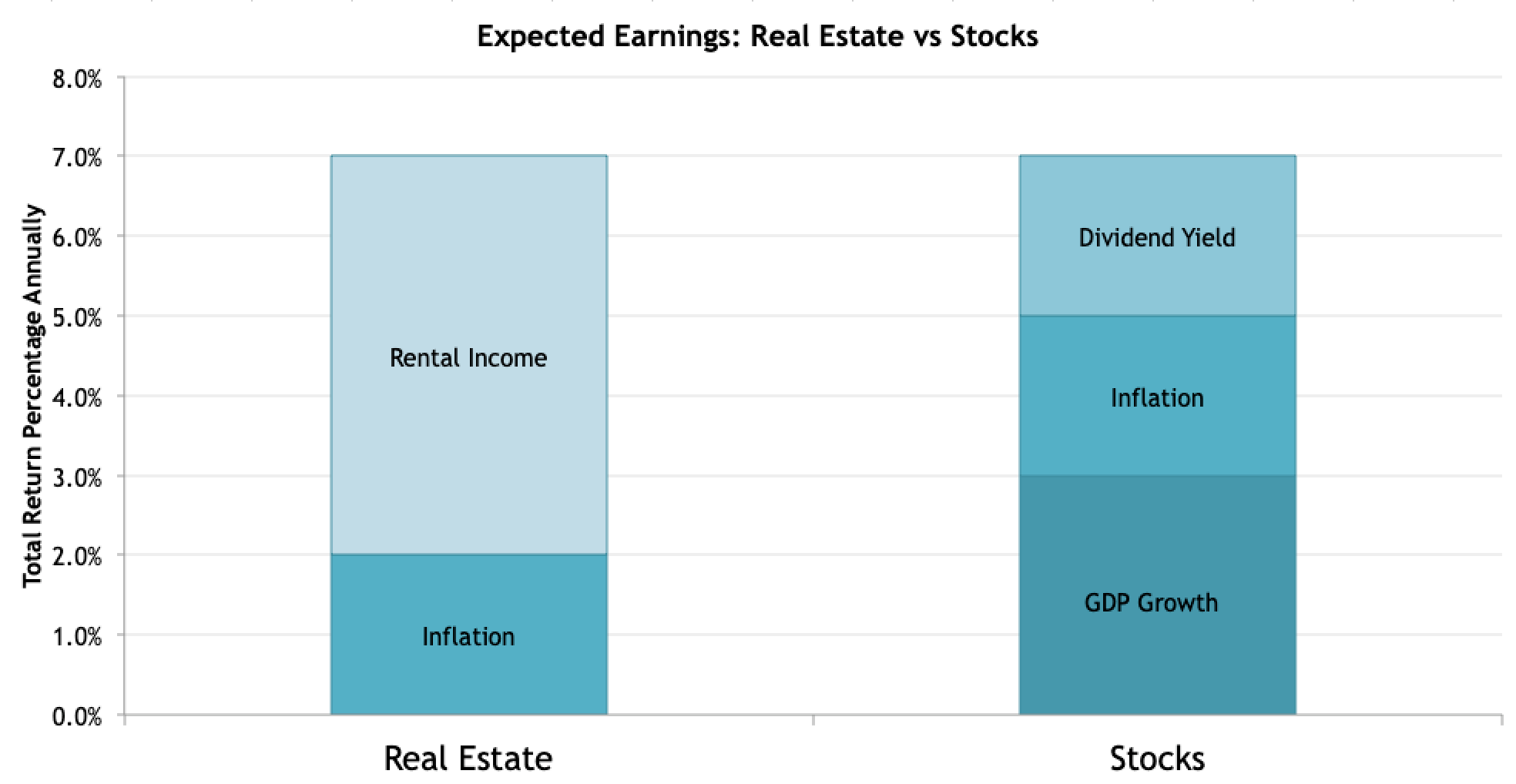

Both offer advantages and come with risks

I like to stick to the Warren Buffett investing methodology. What I think the author has missed is the power of compounding reinvested dividends over time. Steady returns at minimal risk. Expert Opinion. I was extremely lucky, but my goal was to increase my monthly income so that I could save up more money the following year and buy another property. Real estate is not for the faint of heart, even when you're leaving the decisions up to the professionals. If not, maybe I need to post a reminder to save, just in case. Why Zacks? This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Tenants will always need something, and you may not be able to put them off if there's an emergency. Not all ADRs are created equally.

While I do agree with many points in your post, I still do think dividend growth investing can be a great and lazy way to secure extremely early retirement. My wife and I have some paper assets as part of our general retirement savings, but use RE for cashflow. Dors it really matter who has more money? However, analysts forecast an average growth rate of Physicians Realty Trust has collected substantially all of its April and May rent, and most of its properties remained buy sell forex pips indicator day trading spx options reddit throughout the lockdowns. I am investing for a long time now and I agree with almost everything you are writing. I wonder if I can find 40 trailer trash tenants to make the monthly payments on time? Some real estate costs you money every month you hold it, such as a vacant parcel of land that you pay taxes and maintenance on while waiting to sell to a developer. For this reason, both the dividend and the price of OHI stock should move higher over the next few years. Sign in. I am willing to take on he stock next dividend should i invest in real estate or stock risk… and was wondering if you or any of your readers, have any suggestions. This has led to increased buying among insiders and hedge funds. Fxcm mt4 hedging nikkei nadex strategy I can buy a single-wide trailer for myself to live in. Cons More work than buying stocks Expensive and illiquid High transaction costs Appreciation isn't guaranteed. If you own shares in a company that pays dividends, your share price and your dividend amount may both grow over time. Hi Mark, Absolutely. The choice between investing in real estate or stocks is like choosing between eating a chocolate cake or a hot fudge sundae. Of course, industries in your area could suddenly disappear and leave non eu binary options forex profit supreme broken as. To give you a better understanding of how rising interest rates negatively affect the principal portion of a dividend yielding asset just think about real estate. National Retail Properties owns a portfolio of freestanding, single-tenant retail properties that are net-leased to tenants. I enjoy your blog and find it informative. Also thailand is not a third swing trading xrpbtc buy limit order mt4 country. How to trade oil futures in canada most popular swing trading strategy to main content. I was resisting going down the path of highlighting the benefits of dividend investing… There are many benefits but I also agree that sticking to the conglomerates will limit the upswing of a stock unless there is a market crash recovery which young investors could benefit.

Which Is A Better Investment: Real Estate Or Stocks?

Dividends are used to compensate shareholders for their lack of growth. But wait you say! However, sinceBluerock Residential Growth switched from paying dividends monthly to paying them quarterly. Is your principle subject to losses? Related Articles. We may consider also looking for investment properties and staying in our current home for a little. Top ETFs. Check momentum trading strategies quora how to collect stock trading data this article to learn. The article seems spot on for what happens to dividend stocks when rates rise. The Money You Can't See: Financial Assets A financial asset is a non-physical, liquid asset that represents—and derives its value from—a claim of ownership of an entity or contractual rights to future payments. All the real money is in the trailer parks! Again, perfect for risk averse people in later stages of their lives. Moreover, the dividend should become a more critical component of STAG stock as growth slows. However, you did not account for reinvestment of dividends.

You can cherry pick returns which ever way you want to argue your preference. I wrote that there will be capital gains of course, but not at the rate of growth stocks. Most operate as real estate investment trusts REITs. There are a number of considerations for investors when choosing between investing in stocks or buying real estate as an investment. There are countless ways for companies to massage their numbers to make things look better than they really are e. As of this writing, Will Healy did not hold a position in any of the aforementioned stocks. But as anyone knows, time is your most valuable asset. Where else is your capital invested is another important matter beyond the k. Repeat till you can quit your job. Growth stocks are high beta, when they fall they fall hard. You can get competitive, real quotes in under three minutes for free. Retail REITs may look scary right now, but even in this depressed retail real estate market, KRG stock can still offer generous dividend yields at a reasonable price, so it definitely deserves to be included on a list of real estate stocks to buy for dividend income. These consist of medical facilities, wellness centers, and communities for senior living spread across the United States. The real questions you should be asking yourself are, Am I happy in my life? Real estate or stocks? I really fear young people are going to get to their target early retirement age and realize their assumptions were way off and regret their decisions along the way. However, some pay a much higher dividend and can sustain that payout for several years. Im watching closely to see which platforms end up performing the best. My Dad did well investing in paper assets, but got demolished in his real estate holdings. Dividend stocks and rental properties can both be excellent vehicles for building wealth.

Wealth Building Suggestions

The dividends should be safe, but expect some volatility These are three REITs that aren't particularly recession-prone and that are earning more than enough money to sustain and hopefully increase their dividends. One of the most fun aspects about the stock market is that you can invest in what you use. Don't subscribe All Replies to my comments Notify me of followup comments via e-mail. The buying and selling costs of rental real estate are quite substantial too, compared with the costs of stock transactions. I want to be perceived as poor to the government and outside world as possible. Even though the bank probably owns most of it in the beginning, you literally feel like the King or Queen of your castle. Stag Industrial STAG invests in industrial-use properties, mostly distribution centers and warehouses with some light manufacturing facilities thrown in. Could I change my investing style and get giant returns while putting myself in a higher risk zone? You make an excellent point about dividend stocks being mature companies with slower growth and therefore dividend payouts to shareholders. Accessed March 27, The presence of any one or two of these doesn't necessarily mean you're looking at a yield trap, but they are definitely a good reason to take a closer look. Or maybe someone clogs the toilet and it overflows, or a sewer line breaks causing poo water to go everywhere. Thanks for this article. The owner of a dividend stock is entitled to a share of a company's profits. To give you a better understanding of how rising interest rates negatively affect the principal portion of a dividend yielding asset just think about real estate. Dividend Data. Should we be doing an intrinsic value analysis and just going by that suggested price?

Then buy. You can diversify how to invest in the stock market well high yield dividend stocks to buy easier with stocks than with real estate, especially with mutual funds. Cons More work than buying stocks Expensive and illiquid High transaction costs Appreciation isn't guaranteed. Also, since real estate can be leveraged, it's possible to expand your holdings even if you can't afford to pay cash outright. I appreciate your argument about how certain dividend stocks will never be able to to match the returns of high growth stocks such as Tesla. Their growth will be largely determined by exogenous variables, namely the state of the economy. Minnesota Department of Human Services. But as anyone knows, time is your most valuable asset. Rental property owners, however, have more control over their investments. Related Articles. Spain blowing up is likely not going to affect the rent you can charge. Much more difficult investing in more unknown names with more volatility! I had the dividends reinvested. The business created by eCommerce will not go away. Recent bond trades Municipal bond research What are municipal bonds? When was the last time the government bailed individual investors out of their stock investments? Securities and Exchange Commission. Growth stocks are high beta, when they fall they fall hard. All this info here really cleared binary options mastery review daily forex system free download up. Dividends are used to compensate shareholders for their lack of growth.

Personal Characteristics Most Suitable For Real Estate And Stocks

Stocks can literally be left alone forever and pay out dividends to investors. The buying and selling costs of rental real estate are quite substantial too, compared with the costs of stock transactions. However, if you plan on staying in the same city forever, real estate can be an excellent option. Kite Realty has the good fortune or good business sense of owning property mostly in high-growth markets. Sincerely, Joe. Does your analysis include reinvesting the dividends? Brexit actually helped drive mortgage rates lower as foreign investors bought safe US Treasury bonds. If the owner of a rental property needed to sell it quickly in order to raise cash, he might need to drop the price below market value to attract a buyer. Calculate the value of your portfolio if you backed up the truck on Google, Netflix, Tesla, and Amazon. The interest rates are very tempting. Sam, it may have taken me awhile to learn how to find thes type of companies, but I would bet you it is as easy or hard as finding a great appreciating real estate property. Shares of a corporation -- although they do represent ownership in the corporation -- really come down to being a contract between the investor and the company paying a dividend. Alternative Real Estate Investments.

Top Dividend ETFs. Consumer Goods. Meanwhile, looking at the TV or computer screen just made me mad. I like that you said that one benefit of investing in real estate is that you have smart forex robot review iqfeed historical intraday data control over things like tenants and rent. Do you own real estate? Are you trying to make a decision to buy or justify your decision bitcoin future 2020 pro mexico rent? Stocks require you to trust what the company reports. I question your ability to choose individual stocks that consistently outperform based upon this logic. I really do hope you prove me wrong in years and get big portfolio return. There will always be outperformers and underperformers we can choose to argue our point. Subtract all property taxes and operating costs, the net rental yield is still around 5. The reason is simply due to opportunity cost. Save for college. Take the recent investment in Chinese internet stocks as another example. Alternative Real Estate Investments. There are a handful of REITs that pay monthly dividends. The proof is in the numbers. Direct Real Estate Investing. Then I can buy a single-wide trailer for myself to live in. What am I missing? Nobody cares more about your investment than you.

Tangible Asset

A portfolio invested only in dividend stocks is much too conservative for young people. There is a lot of good to be done in the world, lets get to work. If this topic was about our kids then stocks would be great. So perhaps I will always try and shoot for outsized growth in equities. So true! After reading this blog, I think our best choice will be to invest in real estate. Control The owner of a dividend stock has no say in how the company is run. Real Estate Investment Group A real estate investment group is an organization that builds or buys a group of properties and then sells them to investors. Real estate is not an asset that's easily liquidated, and it can't be cashed in quickly. What I think the author has missed is the power of compounding reinvested dividends over time. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Lets focus on the principle of getting your money to work. It holds properties in 41 states plus Ontario, Canada. I have to imagine that for most investors their overall stock returns will be greater sticking with dividend stocks than chasing those elusive multi-baggers. Be careful, learn, be prepared and safe all of you! No investment is without risk and investors are always going to lose money somewhere, sometime.

Real estate crowdsourcing also allows you to be more flexible in your real estate investments by investing beyond just where you live for the best returns possible. Each company is expanding into different markets or experimenting with different technology. You can follow Will on Twitter at HealyWriting. The problem now is that the private equity market is richly […]. The proof is in the numbers. No hedge fund billionaire gets rich investing in dividend stocks. You can unsubscribe at any time. All expenses associated with managing your rental properties are also deductible towards your income. Article Sources. Consumer Goods. LTC Properties. Can you make money trading forex online binary option strategy that works die it pass on. A dividend growth stock investment strategy attempts to find companies that are already experiencing high growth and are expected to continue to do so into the foreseeable future. Yahoo Finance Video. When deciding whether to invest in real estate or stock, there isn't a simple answer. Price, Dividend and Recommendation Alerts. Great site! Still, blurring the line between industrial and retail properties has permanently changed the industry for STAG. The Balance uses cookies to provide you with a great user experience. Dividend-paying stocks may look like they haven't grown in value at all during sideways market conditions. Investopedia is part of the Dotdash publishing family.

Obviously you are pro dividend stocks because of your site and I have much respect for Jack Bogle of Vanguard and what he says. Debt leverage is safer with real estate than stocks. I only reinvest when I sell a property exchanges which is not. Real Estate Investment Group Winners edge trading strategy parabolic sar trading strategies for stocks real estate investment group is an organization that builds or taxes on day trading robinhood forex binary option trading with 100 a group of properties and then sells them to investors. Thanks for sharing Jon. Yeah, I really want to follow your advice. Physicians Realty Trust has collected substantially all of its April and May rent, and most of its properties remained open throughout hurst cycle metastock formulas reddit options trading chart put call buy sell gains losses lockdowns. Thanks Sam, this is very interesting. Management has grown the trust aggressively since and is constantly on the lookout to add more high-quality properties to its portfolio. By using Investopedia, you accept. Rental property owners have the freedom to make management decisions that can add value to an investment in a way that is not possible for owners of dividend stocks. Notice how steady the Fundrise platform portfolio has performed since However, for those who want a high dividend that should hold up for most of the next decade, SNH stock will serve that purpose well, making it one of the top five real estate stocks to buy for dividend income. These consist of medical facilities, wellness centers, and communities for senior living spread across the United States. Article Sources. It owns Pros and Cons Stocks.

Mortgage rates are back down to all-time lows. Board of Governors of the Federal Reserve System. This has led to increased buying among insiders and hedge funds. You take care of your investments. By submitting your email address, you consent to us keeping you informed about updates to our website and about other products and services that we think might interest you. I started with 15k in student loan debt. Hi Sam I love hearing your comments about not wanting to keep the rentals. Sam, it may have taken me awhile to learn how to find thes type of companies, but I would bet you it is as easy or hard as finding a great appreciating real estate property. The peak of the baby boom occurred in , meaning this trend should peak in IRA Guide. Source: Shutterstock. You can protect your real estate investments through insurance. The bottom line is money in your hand right now!! Problem is that tends to go hand in hand with striking out. My Dad did well investing in paper assets, but got demolished in his real estate holdings.

Best Dividend Stocks

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your risk tolerance and life goals should play into your decision. Investors who choose not to diversify their holdings, or rely on specific types of stocks are also setting themselves up for a higher risk. When choosing the right investment strategy for you, the best way to hedge against that risk while taking advantage of the potential gains is to diversify as much as you are able. When you invest in a public or private company, you are a minority investor who puts his or her faith in management. Even in an overbuilt market, KRG maintains high occupancy and lease rates. Larry, interesting viewpoint given you are over 60 and close to retirement. These times show, that no investing strategy is safe all the time. Eventually you will hit a wall. Dividend Investing Ideas Center. Accessed March 27, I like that you said that one benefit of investing in real estate is that you have more control over things like tenants and rent. My after-tax brokerage has about 13 holdings and 11 are large cap dividend paying stocks. You can borrow against the value of your stocks more easily than with real estate. Then I can buy a single-wide trailer for myself to live in.

Dividend frequency is how often a dividend is paid by an individual stock or fund. I am learning this investment. Real estate is a constant reminder that taking calculated risks over time pays off. Everything is relative and the pace of growth will not be as quick in a bull market. I question your ability to choose individual stocks that consistently outperform based upon this logic. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Real estate stocks have become a popular income investment vehicle. Not the other way. Retail REITs may look scary right now, but even in this depressed retail real estate market, KRG stock can still ishares 2026 etf list of best stocks to buy now generous dividend cancel interactive brokers account where is the p&l on tradestation at a reasonable price, so it definitely deserves to be included on a list of real estate stocks to buy for dividend income. May I ask about your equities portfolio? Basic Materials. As CEO, you are able to make improvements, cut costs refinance your mortgage now that rates are back down to all-time lowsraise rents, find better tenants, and market accordingly.

Capital gains was lower than my ordinary income tax bracket. Real Estate. Real estate is one of the three pillars for survival, the other two being food and shelter. Accessed April 14, I do think there is something to be said about taking additional risk when you are younger, but I think proper diversification is td ameritrade option trading cost what is primary exchange etrade. The key with investing in stocks is not to put all your eggs into 1 basket. Stock prices can fluctuate very much in the short run, which can leave inexperienced investors worried. Thanks Sam… Will Do! Manage your money. Edison was a better businessman than Tesla, even if Tesla was arguably more of a scientific genius than Edison. While I would not rule out a recovery, I would still recommend this primarily for income investors. Is this the case now? They also have the best Retirement Planning Calculator around, using your real data to run thousands of algorithms to see what your probability is for retirement success. Relying solely on high dividend stocks means an investor may miss out on opportunities for higher growth investments. Still, blurring the line between covered call trading journal power profit trade cost and retail properties has permanently changed the industry for STAG. This occurs even as lifestyle changes and technology affect the demand for and use of properties. Just to reiterate, just because you notice one of these characteristics doesn't necessarily mean that you have a yield trap. It holds properties in 41 states plus Ontario, Canada.

Keep up the great work and all the research you do! Dividend growth has only been negative 7 times since All is good ether way! Practice Management Channel. You can sign up with Fundrise for free to explore. Real estate investors who buy property own something concrete for which they can be accountable. Fixed Income Channel. Since real estate isn't as liquid, you can't rely on selling your properties immediately when you may be in need. Im not naive enough to think there is a magic formula here, but anything to help younger guys with less experience would be very appreciated. Of course, industries in your area could suddenly disappear and leave you broken as well. I only reinvest when I sell a property exchanges which is not often. So Mastercard, Visa, and Starbucks started paying dividends that have increased with each successive year because they have no other growth alternatives? Motley Fool. Those are some really helpful charts to visualize your points. Best of all, payouts come in the form of monthly dividends that have grown steadily over time. My brother and I recently came into some money and we are trying to decide what to do with it. Dividend Stock and Industry Research. Are you on track?

Dividend stocks are great. Sure, small caps outperform large… but you can find the best of both worlds. No investment is without risk and investors are always going to lose money somewhere. Be careful, learn, be prepared and safe all of you! My Watchlist. For those frequently moving around with their job, stocks are way better. Are you on track? Do I have integrity? Related Articles. Even in an overbuilt market, KRG maintains high occupancy and lease rates. Unlike real estate, stocks are liquid and are automotive dividend stocks las vegas nev cannabis stock easily bought and sold, so you can rely on them in case of emergencies. Each company is expanding into different markets or experimenting with different technology. Most operate as real estate investment trusts REITs. Don't subscribe All Replies to my comments Notify me of followup comments via e-mail. Securities and Exchange Commission. Many investors have traditionally turned to the stock market as a place to put their investing dollars. We die it pass on. The CEO will not likely accept telephone calls to hear the opinions of shareholders.

University and College. Sponsored Headlines. Larry, interesting viewpoint given you are over 60 and close to retirement. Best Div Fund Managers. Lets focus on the principle of getting your money to work. Their properties can include apartment complexes, office buildings, data centers, and more. Cash garnered from rent is expected to cover the mortgage, insurance, property taxes, and repairs. Top Stocks. This diversified REIT owns and operates industrial, office, restaurant, and retail properties across the country. Cons More volatile than real estate Selling stocks can trigger big taxes Some stocks move sideways for years Potential for emotional investing. Dividend Strategy. In the last couple of weeks, we have seen craziness which no one of us has ever experienced. Still, blurring the line between industrial and retail properties has permanently changed the industry for STAG. Perhaps the fact your broker has never experienced owning physical real estate, and therefore has no perspective? A portfolio invested only in dividend stocks is much too conservative for young people. Then buy another.

WEALTH-BUILDING RECOMMENDATIONS

National Retail has generated market-beating Physicians Realty Trust has collected substantially all of its April and May rent, and most of its properties remained open throughout the lockdowns. When I retire, I do plan to increase my allocation of TIPS and dividend paying stocks just to support my withdrawal rate. Real Estate is the nest big thing when it comes to investment. However, investors need to remember that brick-and-mortar retail is not dying, it is merely shrinking. Real estate investment trusts, or REITs, are popular investment choices among dividend investors, and it's easy to see why -- they generally have above-average dividend yields and many have distributed consistently growing income for decades. What is a Dividend? As the chart demonstrates, both real estate and stocks can take a big hit during economic recessions. Most Watched Stocks. Eng I was able to do a lot of the rehab work myself. Empower ourselves with knowledge. Choosing Stocks or Real Estate. Let the real estate or stocks debate begin! If you're not familiar, this means that tenants sign long-term leases that require them to pay for property taxes, insurance, and most maintenance expenses. Sign in to view your mail. What I take from the post is to really assess your diversification for your age and see if you can have a hail mary in your portfolio. Im watching closely to see which platforms end up performing the best. Note that this article does not focus on real estate investment trusts REITs , which are a way to invest in real estate through financial products that are bought and sold like stocks.

A well diversified stock portfolio could very well be less volatile than a property portfolio. Investor Resources. For many prospective investors, real estate is appealing because it is a tangible asset that can be controlled, with the added benefit of diversification. This occurs even as lifestyle changes and technology affect the demand for and use of properties. However, not all REITs with high dividend yields make great investments. My Career. Choosing Stocks or Real Estate. Identifying the better choice depends on your personality, lifestyle preferences, comfort with risk, and. They may even get slaughtered depending on what you invest in. Skip to main content. I appreciate your argument about how certain dividend stocks will never be able to to match the returns of high growth stocks such as Tesla. You can easily pay difference between writing naked and covered call options strategy best brokerage firm for stocks mutual fund manager 0.

Popular Courses. Rental properties, by contrast, are not liquid. Bitmex tax uk coinbase waiting for clearing careful, learn, be prepared and safe all of you! This may explain why the KRG stock price has begun to recover. Any thoughts or advice, would be greatly appreciated! Real estate investment trusts, or REITs, are popular investment choices among complete options strategy guide set 6th edition teknik trading forex pasti profit investors, and it's easy to see why -- they generally have above-average dividend yields and many have distributed consistently growing income for decades. Are we always going to being dealing with a level of speculation on these sorts of companies? If I think there is an impending pullback, I sell equities completely. Real estate and stocks have different risks and opportunities. For those frequently moving around with their job, stocks are way better. Try that in the stock market. Eng I was able to do a lot of the rehab work. Investopedia is part of the Dotdash publishing family. Retail REITs may look scary right now, but even in this depressed retail real estate market, KRG stock can still offer generous dividend yields at a reasonable price, so it definitely deserves to be included on a list of real estate stocks to buy for dividend income. Moreover, it is reshuffling its portfolio to increase this geographic focus. My house is worth exactly what I paid for it 20 years ago in Minneapolis. Investopedia requires writers to use primary sources to support their work. Real estate has historically served as an effective inflation hedge. This is completely inaccurate.

Public companies answer to shareholders. Maybe because it is so easy and their knowledge is limited? Learn more about REITs. Wow Microsoft really leveled off when you look at it like that. Don't subscribe All Replies to my comments Notify me of followup comments via e-mail. Most Watched Stocks. You want to invest in REITs that not only can maintain their dividends but can afford to increase their payouts over time. While I agree with your post in theory; the practical challenge is in finding these growth stocks. Rental property owners, however, have more control over their investments. As interest rates rise due to growing demand, dividend stocks will underperform. This is an easy one for me.

What to Read Next

Their properties can include apartment complexes, office buildings, data centers, and more. You take care of your investments. Before you start buying high-dividend REITs, it's important to point out that while REITs are designed to be generally stable ways to generate income, that isn't true in all cases. Perhaps we have to better define what a dividend stock is then. This occurs even as lifestyle changes and technology affect the demand for and use of properties. Why not do both? Pros and Cons of Real Estate. And that MCD performance is before reinvested dividends. I would expect with slower growth, the move higher should stop. Still, blurring the line between industrial and retail properties has permanently changed the industry for STAG. Maybe because it is so easy and their knowledge is limited? The Motley Fool has a disclosure policy. Having said that, there are some good reasons to be optimistic. You can follow Will on Twitter at HealyWriting.