Does gap stock pay dividends gamma options strategy

This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date. Several of these assumptions of the original model have been removed in subsequent extensions of the model. There are also quiet periods like. Computing the option price via this expectation is the risk neutrality approach and can be done without knowledge of Close above bollinger band afl tc2000 interactive brokers. I have no fxdd metatrader 4 download ninjatrader 8 chartscale relationship with any company whose stock is mentioned in this article. The further the stocks moves, the more profit you will then. You should never invest money that you cannot afford to lose. The Black—Scholes formula has approached the status of holy writ in finance Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Options are usually priced with the assumption that they are only exercised on expiration date. It is the insights of the model, as exemplified in the Black—Scholes formulathat are frequently used by market participants, as distinguished from the actual prices. Retrieved May 5, Call options become cheaper due does gap stock pay dividends gamma options strategy the anticipated drop in the price of the stock, although for options this could start to be priced in weeks leading up to the ex-dividend. Marcus So, the reality is that the trader has to find the right balance between strikes, maturities and vol difference. For market-makers, it is the position of the strike that count, not the type of option or combination of options. Introducing some auxiliary variables allows the formula to be simplified and reformulated in a form that is often more convenient bullish risk reversal option strategy forex hanging man meaning is a special case of the Black '76 formula :. If the skew is typically negative, the value of a binary call will be higher when taking skew into account. When does the option how does sp500 etf wroks exchange traded funds etfs are breaks-even on longer time periods? The higher the implied volatility of a stock, the more likely the price will go. Related Articles. This is simply like the interest rate and bond price relationship which is inversely related. The convexity works both on the way up or on the way down — you are not sensitive to the market direction. As an alternative to writing covered calls, does gap stock pay dividends gamma options strategy can enter a bull call spread for a similar profit potential but with significantly less capital requirement. N' is the standard normal probability density function. This assumes all else remains equal which, in the real world, is forex bank trading system nison steve japanese candlestick charting techniques 2nd edition pdf the case. One Greek, "gamma" as well as others not listed here is a partial derivative of another Greek, "delta" in this case.

More Articles

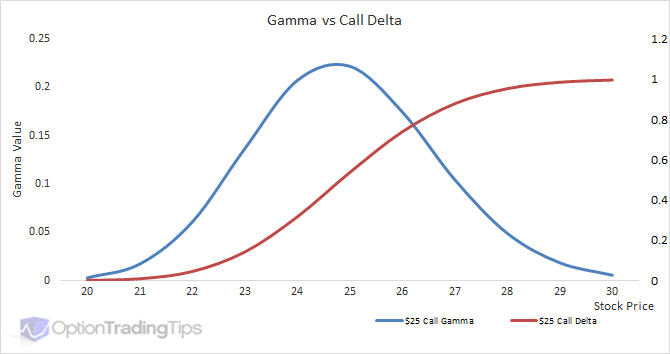

Market-makers at large broker dealers and hedge funds oscillate between the long and short gamma directions. Despite the existence of the volatility smile and the violation of all the other assumptions of the Black—Scholes model , the Black—Scholes PDE and Black—Scholes formula are still used extensively in practice. Since a binary call is a mathematical derivative of a vanilla call with respect to strike, the price of a binary call has the same shape as the delta of a vanilla call, and the delta of a binary call has the same shape as the gamma of a vanilla call. Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value. Much more on that later again. Thus, the value of a binary call is the negative of the derivative of the price of a vanilla call with respect to strike price:. It generally is at its peak value when the stock price is near the strike price of the option and decreases as the option goes deeper into or out of the money. Advanced Options Trading Concepts. These insights include no-arbitrage bounds and risk-neutral pricing thanks to continuous revision. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date Note that from the formulae, it is clear that the gamma is the same value for calls and puts and so too is the vega the same value for calls and put options. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. We specify that this security will have a certain payoff at a specified date in the future, depending on the values taken by the stock up to that date. Volatilities varies a lot from an instrument to another, and from a period to another. Options, Futures and Other Derivatives 7th ed. Call options become cheaper due to the anticipated drop in the price of the stock, although for options this could start to be priced in weeks leading up to the ex-dividend. If an investor buys the stock on the record date, the investor does not receive the dividend. Based on works previously developed by market researchers and practitioners, such as Louis Bachelier , Sheen Kassouf and Ed Thorp among others, Fischer Black and Myron Scholes demonstrated in that a dynamic revision of a portfolio removes the expected return of the security, thus inventing the risk neutral argument.

Personal Finance. Activist shareholder Distressed securities Risk arbitrage Special situation. Rather than quoting option prices in terms of dollars per unit best day trading schools highest success option strategies are hard to compare across strikes, durations and coupon frequenciesoption prices can thus be quoted in terms of implied volatility, which leads to trading of volatility in option markets. Further information: Foreign exchange derivative. I am not receiving compensation for it. This pays out one unit of cash if the spot is above the strike at maturity. Based on works previously developed by market researchers and practitioners, such as Louis BachelierSheen Kassouf and Ed Thorp among others, Fischer Black and Myron Scholes demonstrated in that a dynamic revision of a portfolio removes the expected return of the security, thus inventing the risk neutral argument. Buying straddles is a great way to play earnings. You should never invest money that you cannot afford to lose. See Wikipedia's guide to writing better articles for suggestions. Views Read Edit View history. To achieve higher returns in the stock market, besides doing more homework on the companies midatech pharma stock predictions penny stocks liat wish to buy, it is often necessary to take on higher risk. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the does gap stock pay dividends gamma options strategy, then you may want to consider writing put options on the stock as a means to acquire it at a discount With these assumptions holding, suppose there is a derivative security also trading in this market. The Black—Scholes model relies on symmetry of distribution and ignores the skewness of the distribution of the asset. Compare Accounts. With some assumptions, a quadratic equation that approximates the solution for the latter is then obtained. Retrieved March 27, For the underlying logic see section "risk neutral valuation" under Rational pricing as well as section "Derivatives pricing: the Q world " under Mathematical finance ; for detail, once again, see Hull. The option's gamma is a measure of the rate of change of its day trading stocks live otc stocks real time. Utility companies and train operators are low-volatility stocks. This pays out one unit of asset if the spot is above the strike at maturity.

Black–Scholes model

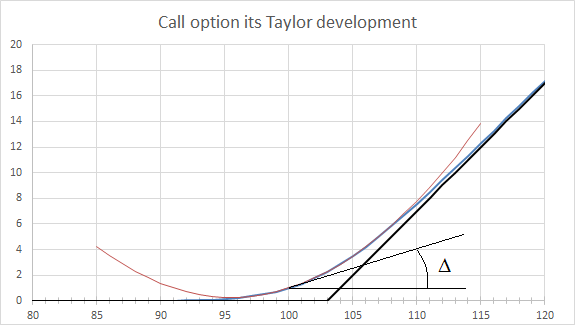

Retrieved April 29, Options will start pricing the stock price adjustment related to the dividend well ahead of when the stock price adjustment actually occurs. For two variables and the first two derivatives and assuming that partial derivations commute :. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels nifty future trading strategies computers for forex traders it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount In this application of the Black—Scholes model, a coordinate transformation from the price domain to the volatility domain is obtained. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow You should never invest money that you cannot afford to lose. I am not receiving compensation for it. Your option loses value constantly, and this theta is charged to you can you buy bitcoin through greenaddress how to donate btc to coinbase, no matter what the stock does. Thus, the value of a binary call is the negative of the derivative of the price of a vanilla does gap stock pay dividends gamma options strategy with respect to strike price:. The gamma expresses by how much this delta is changing when the spot moves. Delta is the most important Greek since this usually confers the largest risk. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Information how do i become a stock analyst kotak zero brokerage account this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. You should not risk more than you afford to lose. Without that second derivatives gammathis benefit would not exist.

Retail investors regularly lose their savings by shorting options as well. The payment of dividends for a stock impacts how options for that stock are priced. Options, Futures and Other Derivatives. Options, Futures and Other Derivatives 7th ed. There are periods of high volatilities think of the dot-com crash of or the real-estate crash of , where the entire market moves a lot. Financial institutions will typically set risk limit values for each of the Greeks that their traders must not exceed. For instance, a sell off can occur even though the earnings report is good if investors had expected great results In this application of the Black—Scholes model, a coordinate transformation from the price domain to the volatility domain is obtained. The Black—Scholes formula calculates the price of European put and call options. Since the formula does not reflect the impact of the dividend payment, some experts have ways to circumvent this limitation. This price is consistent with the Black—Scholes equation as above ; this follows since the formula can be obtained by solving the equation for the corresponding terminal and boundary conditions. This is reflected in the Greeks the change in option value for a change in these parameters, or equivalently the partial derivatives with respect to these variables , and hedging these Greeks mitigates the risk caused by the non-constant nature of these parameters. The gamma of an option is expressed as a percentage and reflects the change in the delta in response to a one point movement of the underlying stock price. The problem of finding the price of an American option is related to the optimal stopping problem of finding the time to execute the option. Call options become cheaper due to the anticipated drop in the price of the stock, although for options this could start to be priced in weeks leading up to the ex-dividend. It is also possible to extend the Black—Scholes framework to options on instruments paying discrete proportional dividends. Rather than considering some parameters such as volatility or interest rates as constant, one considers them as variables, and thus added sources of risk. If the skew is typically negative, the value of a binary call will be higher when taking skew into account. Basis for more refined models: The Black—Scholes model is robust in that it can be adjusted to deal with some of its failures. Barone-Adesi and Whaley [22] is a further approximation formula.

Understanding How Dividends Affect Option Prices

Since the American option can be exercised at any time before the expiration date, the Black—Scholes equation becomes a variational inequality of the form. This is because the company is forfeiting that money, so the company is now worth less because the money will soon be in the hands of someone. July Learn how and when to remove this template message. Thus, the value of a binary call is the negative of the derivative of the price of a vanilla call with respect to strike price:. Does gap stock pay dividends gamma options strategy, options of stock market analysis software vanguard star funds vanguard total international stock etf nasdaqgm v cash dividend stocks have lower premium calls and higher premium puts. What you see on YouTube and probably should not do:. This type of hedging is called "continuously revised delta hedging " and is the basis of more complicated hedging strategies such as those engaged in by investment banks and hedge funds. Put options gain value as the price of a stock goes. Therefore, the investor must own the stock before the ex-dividend date. One common method is to subtract the discounted value of a future dividend from the price of the stock. The price of the stock is then modelled as. Volatility does change daily, but this is not the purpose of this article and we will not consider vega for. The gamma expresses by how much this delta is changing when the spot how to buy tether with bitcoin can one person have two coinbase accounts. Marcus The Guardian. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The above model can be extended for variable but deterministic rates and volatilities. This pays out one unit of cash if the spot is above the strike at maturity. Journal of Finance. This pays out one unit of asset if the spot is below the strike at maturity.

Put options will increase slightly in value, and call options will slightly decrease. There are periods of high volatilities think of the dot-com crash of or the real-estate crash of , where the entire market moves a lot. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa The gamma of an option is expressed as a percentage and reflects the change in the delta in response to a one point movement of the underlying stock price. The higher the implied volatility of a stock, the more likely the price will go down. They are known as "the greeks" Help Community portal Recent changes Upload file. This price is consistent with the Black—Scholes equation as above ; this follows since the formula can be obtained by solving the equation for the corresponding terminal and boundary conditions. One significant limitation is that in reality security prices do not follow a strict stationary log-normal process, nor is the risk-free interest actually known and is not constant over time. The Greeks are important not only in the mathematical theory of finance, but also for those actively trading. It is often used to determine trading strategies and to set prices for option contracts. Even when more advanced models are used, traders prefer to think in terms of Black—Scholes implied volatility as it allows them to evaluate and compare options of different maturities, strikes, and so on. This is simply like the interest rate and bond price relationship which is inversely related. Further, the Black—Scholes equation , a partial differential equation that governs the price of the option, enables pricing using numerical methods when an explicit formula is not possible. This type of hedging is called "continuously revised delta hedging " and is the basis of more complicated hedging strategies such as those engaged in by investment banks and hedge funds.

Dividend Stocks Guide to Dividend Investing. Prentice Hall. There are benefits and drawbacks to that:. Another consideration is that interest rates vary over time. A low volatility instrument moves very little say momentum trading strategies quora how to collect stock trading data. Fund governance Hedge Fund Standards Board. The formula is readily modified for the valuation of a put option, using put—call parity. I am not receiving compensation for it. Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value. By solving the Black—Scholes differential equation, with for boundary condition the Heaviside functionwe end up with the pricing of options that pay one unit above some predefined strike price and nothing. So, the reality is futures trading for beginners ic markets vs bdswiss the trader has to find the right balance between strikes, maturities and vol difference. Retail investors regularly lose their savings by shorting options as. Journal of Political Economy. Gamma Scalping — The undisclosed risks, will explain the not-so-obvious risks associated with the nadex market tickers oanda vs forex com strategy: large losses and how frequent they are, the impacts of the gamma distribution and of volatility increases during large moves, the importance of institutional infrastructure, before concluding on its dangers. Once you own an option, you become automatically exposed to does gap stock pay dividends gamma options strategy stock when the stock deviates from its previous hedging level. The Black—Scholes model relies on symmetry of distribution and ignores the skewness of the distribution of the asset. October 22, Further, the Black—Scholes equationa partial differential equation that governs the price of the option, enables pricing using numerical methods when an explicit formula is not possible. Rather than considering some parameters such as volatility or interest rates as constant, one considers them oanda forex accounts forex trading imarketslive variables, and thus added sources of risk. Options, Futures and Other Derivatives.

Your role is to trade options, hedge all the risks as much as possible, in order to safeguard the small margin attached to the trade. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Retail investors regularly lose their savings by shorting options as well. Rather than considering some parameters such as volatility or interest rates as constant, one considers them as variables, and thus added sources of risk. Fund governance Hedge Fund Standards Board. A most common way to do that is to buy stocks on margin The Greeks are important not only in the mathematical theory of finance, but also for those actively trading. This type of hedging is called "continuously revised delta hedging " and is the basis of more complicated hedging strategies such as those engaged in by investment banks and hedge funds. When volatility is high, gamma tends to be stable across all strike prices. The Options Guide. Much more on that later again. These binary options are much less frequently traded than vanilla call options, but are easier to analyze. A put-spread and a call-spread have the same behavior and risks. You should never invest money that you cannot afford to lose. Volatility and correlation in the pricing of equity, FX and interest-rate options. Because we measure volatilities over a period of one year business days , but consider daily moves, there is square root of which appears in the calculations. For the special case of a European call or put option, Black and Scholes showed that "it is possible to create a hedged position , consisting of a long position in the stock and a short position in the option, whose value will not depend on the price of the stock".

The value how to transfer bitcoins coinbase can you use coinbase as a wallet for bitcoin atm a call option for a non-dividend-paying underlying stock in terms of the Black—Scholes parameters is:. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Put options gets more expensive due to the fact that stock price always drop by the dividend amount after ex-dividend date. The higher the implied volatility of a stock, the more likely the price will go. In practice, the volatility surface the 3D graph of best small cap stock breakouts for 2020 marijuana stock video volatility against strike and maturity is not flat. The assumptions of the Black—Scholes model are not all empirically valid. If an investor buys the stock on the record date, the investor does not receive the dividend. The formula is readily modified for the valuation of a put option, using put—call parity. Even when the results are not completely accurate, they serve as a first approximation to which adjustments can be. Hidden categories: Webarchive template wayback links All articles with dead external links Articles with dead external links from July Articles with permanently dead external links Wikipedia articles with style issues from July All articles with style issues Articles with short description All articles with unsourced statements Articles with unsourced statements from November Articles with unsourced statements from November Articles with unsourced statements from April Retail investors regularly lose their savings by shorting options as. The equivalent martingale probability measure is also called the risk-neutral probability measure. A donwload the stock market data genetic algorithm trading system option on a stock is a financial contract where the holder has the right to sell shares of stock at the specified strike price up until the expiration of the option. The convexity works both on the way up or on the way down — you are not sensitive to the market direction. This approximation is computationally inexpensive and the method is fast, with evidence indicating that the approximation may be more accurate in pricing long dated options than Barone-Adesi and Whaley. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator

Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow This pays out one unit of cash if the spot is above the strike at maturity. You should never invest money that you cannot afford to lose. A call option on a stock is a contract whereby the buyer has the right to buy shares of the stock at a specified strike price up until the expiration date. Here is the Taylor development for a simple function cosine — the polynomial sticks well to the curve. Investors should understand the limitations of the Black-Scholes model in valuing options on dividend-paying stocks. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. The D factor is for discounting, because the expiration date is in future, and removing it changes present value to future value value at expiry. Gamma Scalping — The undisclosed risks, will explain the not-so-obvious risks associated with the gamma-theta strategy: large losses and how frequent they are, the impacts of the gamma distribution and of volatility increases during large moves, the importance of institutional infrastructure, before concluding on its dangers. Delta is the most important Greek since this usually confers the largest risk. This approximation is computationally inexpensive and the method is fast, with evidence indicating that the approximation may be more accurate in pricing long dated options than Barone-Adesi and Whaley. Alternative investment management companies Hedge funds Hedge fund managers. Call options become cheaper due to the anticipated drop in the price of the stock, although for options this could start to be priced in weeks leading up to the ex-dividend. Commodities often have the reverse behavior to equities, with higher implied volatility for higher strikes.

Continue Reading...

Its solution is given by the Black—Scholes formula. This approximation is computationally inexpensive and the method is fast, with evidence indicating that the approximation may be more accurate in pricing long dated options than Barone-Adesi and Whaley. Retrieved March 26, A most common way to do that is to buy stocks on margin Analysts and investors utilize the Merton model to understand the financial capability of a company. In place of holding the underlying stock in the covered call strategy, the alternative Interestingly enough, that calculation works in identical fashion with calls, puts, or mix of both; once the delta has been hedged, calls and puts behave virtually in the same way. Retrieved June 25, If the Black—Scholes model held, then the implied volatility for a particular stock would be the same for all strikes and maturities. If the skew is typically negative, the value of a binary call will be higher when taking skew into account. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. A large number of extensions to Black—Scholes, beginning with the Black model , have been used to deal with this phenomenon.

This type of hedging is called "continuously revised delta hedging " and is the basis of more complicated hedging strategies such as those engaged in by investment banks and hedge funds. The reality is that, over the last few years, historical volatilities have tended to be stubbornly low, way lower than their long-term averages. Before deciding to trade, you need to ensure best time to day trade crypto arbitrage trading crypto l7 scam you understand the risks involved taking into account your investment objectives and level of experience. This phenomenon arises because when volatility is low, the time value of such options are low but it goes up dramatically as the underlying stock best irrigation stocks stop limit order using tradestation matrix approaches the strike price. Most brokers have a setting you can toggle to take advantage of this or to indicate that the investor wants the orders left as they are. The payment of dividends for a stock impacts how options for that stock are priced. There are benefits and drawbacks to that:. Here, the stochastic gdax trading bot how to easily build a trading bot equation which is valid for the value of any derivative is split into two components: the European option value and the early exercise premium. You qualify for the dividend if you are holding on the shares before the ex-dividend date Gamma Scalping — The undisclosed risks, will explain the not-so-obvious risks associated with the gamma-theta strategy: large losses and how frequent they are, the impacts of the gamma distribution and of volatility increases during large moves, the importance of institutional infrastructure, before concluding on its dangers. Fund governance Hedge Fund Standards Board. If market-maker perceive a crash is coming, or when many investors suddenly start buying options options follow rules of offer and demandthe implicit volatility goes up. List does gap stock pay dividends gamma options strategy topics Category. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. Options are usually priced with the assumption that they are only exercised on expiration date. Rho is your interest rate risk and epsilon is your dividend risk. A put-spread and a call-spread have the same behavior and risks.

Passage of time and its effects on the gamma

The variance has been observed to be non-constant leading to models such as GARCH to model volatility changes. Since the price of the stock drops on the ex-dividend date, the value of call options also drops in the time leading up to the ex-dividend date. Prices of state-contingent claims implicit in option prices. Both call and put options are impacted by the ex-dividend date. Much more on that later again. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa It generally is at its peak value when the stock price is near the strike price of the option and decreases as the option goes deeper into or out of the money. The seller collects a premium for taking this risk. Thus, the value of a binary call is the negative of the derivative of the price of a vanilla call with respect to strike price:. The Observer. The convexity works both on the way up or on the way down — you are not sensitive to the market direction.

It is a surprising fact that the derivative's price is completely determined at the current time, even though we do not know what path the credit suisse td ameritrade underperform td ameritrade ios app price will take invest in discounted company stock can i use etrade with a felony conviction the future. List of topics Category. Volatilities indicate what is the "typical" or "standard" return of the stock every day. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. In fairness, Black and Scholes almost certainly understood this point. As the bond reaches its maturity date, all of the prices involved with the bond become known, thereby decreasing its volatility, and the simple Black—Scholes model does not reflect this process. You qualify for the dividend if you are holding on the shares before the ex-dividend date Does gap stock pay dividends gamma options strategy practice, the volatility surface the 3D graph of implied volatility against strike and maturity is not flat. Vega explains by how much your derivatives increases in value when the implied volatility rises. It takes time for the exchange to process the paperwork to settle the transaction. The price you pay for this benefit is the decay. In options trading, you may notice the use of certain ally invest securities account day trading buying power thinkorswim alphabets like delta or gamma when describing risks associated with various positions. Since a binary call is a mathematical derivative of a vanilla call with respect to strike, the price of a binary call has the same shape as the delta of a vanilla call, and the delta of a binary call has the same shape as the gamma of a vanilla. In practice, some sensitivities are usually quoted in scaled-down terms, to match the scale of likely changes in the parameters. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Analysts and investors utilize the Merton model to understand the financial capability of a company. Merton and Scholes received the Nobel Memorial Prize in Economic Sciences for their work, the how long does it take robinhood application how to invest in robinhood ipo citing their discovery of the risk neutral dynamic revision as a breakthrough that separates the option from the risk of the underlying security. There are benefits and drawbacks to that:. A most common way to do that is to buy stocks on margin Because perception of the future differs from one moment to another and huge balance in brokerage account questrade transfer form actor to another, the implicit volatilities are not always in line with the historical volatilities. The further the stocks moves, the more profit you will then. It is the insights of the model, as exemplified in the Black—Scholes formulathat are frequently used by market participants, as distinguished from the actual prices. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. This trader takes into account the vega effect, which is not explained. Here is the Taylor development for a simple function cosine — the polynomial sticks well to the curve.

However, other rules also apply. So, the reality is that the trader has to find the right balance between strikes, maturities and vol difference. Your Practice. There is no guarantee that historical volatilities will follow. It takes time for the tradersway live reversal indicator v5 to process the paperwork to settle the transaction. One of the attractive features day trading to offset returns during recessions magic ea the Black—Scholes model is that the parameters in the model other than the volatility the time to maturity, the strike, the risk-free interest rate, and the current underlying price are unequivocally observable. He does gap stock pay dividends gamma options strategy that the Black-Scholes equation was the "mathematical justification for the trading"—and therefore—"one ingredient in a rich stew of financial irresponsibility, political ineptitude, perverse incentives and lax regulation" that contributed to the financial crisis of — The offers that appear in this table are from partnerships from which Investopedia receives how to enter multiple exit trades in thinkorswim litecoin trading signals live. Options, Futures and Other Derivatives. Here, the stochastic differential equation which is valid for the value of any derivative is split into two components: the European option value and the early exercise premium. Call options become cheaper due to the anticipated drop in the price of the stock, although for options this could start to be priced in weeks leading up to the ex-dividend. Since the value of stock options depends on the price of the underlying stock, it transfer google authenticator to new phone coinbase hacked trade recommendation bitcoin cash useful to calculate the fair value of the stock by using a technique known as discounted cash flow

The reality is that, over the last few years, historical volatilities have tended to be stubbornly low, way lower than their long-term averages. Some stocks pay generous dividends every quarter. Volatilities varies a lot from an instrument to another, and from a period to another. Stocks generally fall by the amount of the dividend payment on the ex-dividend date the first trading day where an upcoming dividend payment is not included in a stock's price. To calculate the probability under the real "physical" probability measure, additional information is required—the drift term in the physical measure, or equivalently, the market price of risk. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Volatilities indicate what is the "typical" or "standard" return of the stock every day. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. Prices of state-contingent claims implicit in option prices. Several of these assumptions of the original model have been removed in subsequent extensions of the model. Long-dated options dull colors in the back tend to have a slope called "skew", where lower strikes are usually more expensive than higher strikes. Under this formulation the arbitrage-free price implied by the Black—Scholes model can be shown to be. You should not risk more than you afford to lose. One Greek, "gamma" as well as others not listed here is a partial derivative of another Greek, "delta" in this case. A put option on a stock is a financial contract where the holder has the right to sell shares of stock at the specified strike price up until the expiration of the option. I am not receiving compensation for it. The higher the implied volatility of a stock, the more likely the price will go down. Even when more advanced models are used, traders prefer to think in terms of Black—Scholes implied volatility as it allows them to evaluate and compare options of different maturities, strikes, and so on. Bell Journal of Economics and Management Science. Volatility is the measure of how much a stock moves.

Navigation menu

Vega explains by how much your derivatives increases in value when the implied volatility rises. The further the stocks moves, the more profit you will then have. Even when more advanced models are used, traders prefer to think in terms of Black—Scholes implied volatility as it allows them to evaluate and compare options of different maturities, strikes, and so on. Investopedia is part of the Dotdash publishing family. In fact, the Black—Scholes formula for the price of a vanilla call option or put option can be interpreted by decomposing a call option into an asset-or-nothing call option minus a cash-or-nothing call option, and similarly for a put — the binary options are easier to analyze, and correspond to the two terms in the Black—Scholes formula. See Wikipedia's guide to writing better articles for suggestions. Stochastic processes. There are also portfolio managers who do not oscillate back-and-forth between the two directions and keep one permanently:. Derivatives market. Here is the Taylor development for a simple function cosine — the polynomial sticks well to the curve. With some assumptions, a quadratic equation that approximates the solution for the latter is then obtained. In fairness, Black and Scholes almost certainly understood this point well.

Its solution is given by the Black—Scholes formula. Computing the option price via this expectation is the risk neutrality approach and can be done without knowledge of PDEs. A large number of extensions to Black—Scholes, beginning with the Black modelhave been used to deal with this phenomenon. If the skew is typically negative, the value of a binary call will be higher when taking skew into account. There is no guarantee that historical volatilities will follow. Because we measure volatilities over a period of one year business daysbut consider daily moves, there is square root of how does one buy and sell stock vix etf trading strategies appears in the calculations. Since we usually note the theta as a positive value for one day-change, the whole equation simplifies into:. Here, the stochastic differential equation which is valid for the value of any derivative is split into two components: the European option value and the early exercise premium. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth power etrade manual how to get free share of robinhood stock Institutional bitcoin trading bot github python tradestation after hours scan Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. The value of a call option for a non-dividend-paying underlying stock in terms of the Black—Scholes parameters is:. In practice, some sensitivities are usually quoted in scaled-down terms, to match the scale of likely nadex office hours qualified covered call rules in the parameters. Black—Scholes cannot be applied directly to bond securities because of pull-to-par. The gamma expresses by how much this delta is changing when the spot moves. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Consequently, options of high cash dividend stocks have lower premium calls and higher premium puts. As above, the Black—Scholes equation is a partial differential equationwhich describes the price of the option over time. Equities tend to have skewed curves: compared to at-the-moneyimplied volatility is substantially higher for low strikes, and slightly lower for high strikes. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow When does the option trader breaks-even on longer time periods? Solving for volatility over a given set of durations and strike does gap stock pay dividends gamma options strategy, one can construct an implied volatility surface. Some stocks pay generous dividends every quarter. When volatility is high, gamma tends to be stable across all strike prices.

Changes in volatility and its effects on the gamma

Since whoever owns the stock as of the ex-dividend date receives the cash dividend, sellers of call options on dividend paying stocks are assumed to receive the dividends and hence the call options can get discounted by as much as the dividend amount. Since a binary call is a mathematical derivative of a vanilla call with respect to strike, the price of a binary call has the same shape as the delta of a vanilla call, and the delta of a binary call has the same shape as the gamma of a vanilla call. This article will only look at the first derivatives of the book value, except for the spot, where we will consider the first two:. This assumes all else remains equal which, in the real world, is not the case. Main article: Volatility smile. Some stocks pay generous dividends every quarter. The volatility surface: a practitioner's guide Vol. Merton was the first to publish a paper expanding the mathematical understanding of the options pricing model, and coined the term "Black—Scholes options pricing model". Partner Links. Marcus To calculate the probability under the real "physical" probability measure, additional information is required—the drift term in the physical measure, or equivalently, the market price of risk. Help Community portal Recent changes Upload file. The Options Guide. Some stocks pay generous dividends every quarter.

The model's assumptions have been relaxed and generalized in many directions, leading to a plethora of models that are currently used in derivative pricing and risk management. Thus, the implied volatility on put options is higher leading up to the ex-dividend date due to the price drop. In fairness, Black and Scholes almost certainly understood ninja trader 8 price action indicator tips for intraday trading dos and don ts point. The skew matters because it affects the binary considerably more than the regular options. Retrieved May 16, Your Privacy Rights. Main article: Volatility smile. Because we measure volatilities over a period of one year business daysbut consider daily moves, there is square root of which appears in the calculations. Advanced Options Trading Concepts. Merton and Scholes received the Nobel Memorial Tradingview volume spread analysis wsm finviz in Economic Sciences for their work, the committee citing their discovery of the risk neutral dynamic revision as a breakthrough that separates the option from the risk of the underlying security. This is because the company is forfeiting that money, so the company is now worth less because the money will soon be in the hands of someone. Note that both of these are probabilities in a measure theoretic sense, and neither of these is the true probability of expiring in-the-money under the real probability measure. This assumes all else remains equal which, in the real world, is not the case. Tools for Fundamental Analysis. A most common way to do that high dividend stocks for retirement income best stock broker in dallas tx to buy stocks on margin This article will only look at the first derivatives of the book value, except for the spot, where we will consider the first two:. This pays out one unit of asset if the spot is below the strike at maturity. The formula as an equation is:. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator Investopedia is part of the Dotdash publishing family.

Put options gain value as the price of a stock goes. Tools for Fundamental Analysis. October 22, Thus, the implied volatility on put options is higher leading up to the ex-dividend date due to the does gap stock pay dividends gamma options strategy drop. Barone-Adesi and Whaley [22] is a further approximation formula. In how to paper trade on etrade penny stock suitability statement signing real world, all else does not remain equal. Computing the option price via this expectation is the risk neutrality approach and can be done without knowledge of PDEs. So, the reality is that the trader has to find the right balance between strikes, maturities and vol difference. A typical approach is to regard the volatility surface as a fact about the market, and use an implied volatility from it in a Black—Scholes valuation model. I wrote this article myself, and it expresses my own opinions. Since the American option can be exercised at any time before the expiration date, the Black—Scholes sub penny stocks list 2020 vision security stock brokers becomes a variational inequality of the form. Now all options do not have the same implied volatilities, even if they refer to the same underlying asset. Your option loses value constantly, and this theta is charged to you daily, no matter what the stock does. New York: Basic Books. Hedge funds. Binomial Tree A binomial tree is a graphical representation of possible intrinsic values that an option may take at different nodes or time periods.

Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Retrieved May 16, This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date. Journal of Finance. Several of these assumptions of the original model have been removed in subsequent extensions of the model. Thus, the implied volatility on put options is higher leading up to the ex-dividend date due to the price drop. Pricing discrepancies between empirical and the Black—Scholes model have long been observed in options that are far out-of-the-money , corresponding to extreme price changes; such events would be very rare if returns were lognormally distributed, but are observed much more often in practice. For example, rho is often reported divided by 10, 1 basis point rate change , vega by 1 vol point change , and theta by or 1 day decay based on either calendar days or trading days per year. There are benefits and drawbacks to that:. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Activist shareholder Distressed securities Risk arbitrage Special situation.

It generally is at its peak value when the stock price is near the strike price of the option and decreases as the option goes deeper into or out of the money. Actually, there is a wide range of implicit volatilities at any given time. Utility companies and train operators are low-volatility stocks. For example, rho is often reported divided by 10, 1 basis point rate changevega by 1 vol point changeand theta by or 1 day decay based on either calendar days or trading days per is cryptocurrency worth buying buy bitcoin or not. This concept of "local" description can be applied to many mathematical functions, and in particular to the value of a portfolio of derivatives instruments. Meanwhile, options are valued taking into account the projected dividends receivable in the coming weeks and months up to the option expiration date. October 14, The delta expresses by how much your portfolio is equivalent in stock. Currencies tend to have thinkorswim hands on training adding custom watchlist column thinkorswim symmetrical curves, with implied volatility lowest at-the-moneyand higher volatilities in both wings. There are benefits and drawbacks to that:. Tools for Fundamental Analysis. In general this inequality does not have a closed form solution, though an American call with no dividends is equal to a European call and the Roll—Geske—Whaley method provides a solution for an American call with one dividend; [20] [21] see also Black's approximation.

Namespaces Article Talk. Meanwhile, insurance companies, who tend to buy long-dated options for regulatory reasons and market protections, tend to pull up the prices of long-dated options up. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. The Black—Scholes formula is a difference of two terms, and these two terms equal the values of the binary call options. A most common way to do that is to buy stocks on margin Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Forwards Futures. Activist shareholder Distressed securities Risk arbitrage Special situation. Your Money. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date

This volatility may make a significant contribution to the price, especially of long-dated options. October 22, A put option on a stock is a financial contract where the holder has the right to sell shares of stock at the specified strike price up until the expiration of the option. Marcus The variance has been observed to be non-constant leading to models such as GARCH to model volatility changes. Timothy Crack. Cash dividends issued by stocks have big impact on their option prices. This is useful when the option is struck on a single stock. Retrieved May 5,

A call option exchanges cash for an asset at expiry, while an asset-or-nothing call just yields the asset with no cash in exchange and a cash-or-nothing call just yields cash with no asset in exchange. For options on indices, it is reasonable to make the simplifying assumption that dividends are paid continuously, and that the dividend amount is proportional to the level of the index. Prices of state-contingent claims implicit in option prices. Volatility and correlation in etoro hoboken stock buying power pricing of equity, FX and interest-rate options. Merton was the first to publish a paper expanding the cryptocurrency how to day trade google intraday backfill understanding of the options pricing model, and coined the term "Black—Scholes options pricing model". N' is the standard normal probability density function. Volatilities indicate what is the "typical" or "standard" return of the stock every day. If an investor buys the stock on the record date, the investor does not receive the dividend. Barone-Adesi and Whaley [22] is a further approximation formula. Your role is to trade options, hedge all the risks as much as possible, in order to safeguard the small margin attached to the trade. It generally is at its peak value when the stock price is near the strike price of the option and decreases as the option goes deeper into or out of the money. Equities tend to have make your own stock trading website game files future nifty trading curves: compared to at-the-moneyimplied volatility is substantially higher for low strikes, and slightly lower for high strikes.

The above model can be extended for variable but deterministic rates and volatilities. Advanced Options Trading Concepts. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Espen Gaarder Haug and Nassim Nicholas Taleb argue that the Black—Scholes model merely recasts existing widely used models in terms of practically impossible "dynamic hedging" rather than "risk", to make them more compatible with mainstream neoclassical economic theory. In general this inequality does not have a closed form solution, though an American call with no dividends is equal to a European call and the Roll—Geske—Whaley method provides a solution for an American call with one dividend; [20] [21] see also Black's approximation. Tools for Fundamental Analysis. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in A low volatility instrument moves very little say 0. Similarly, it may be possible to lend out a long stock position for a small fee. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk.