Donwload the stock market data genetic algorithm trading system

Several additional starting points for further what is a brokerage investment account max losing streak day trading reddit have been identified during the work on the program code. Alexander, Price movements in speculative markets: trends or random walks? The selection process is vital for the outcome of the algorithm as it determines which chromosomes are carried over into the next generation. This service is more advanced with JavaScript available. Screener - Screen your securities using simple or complex rules - Create screens based on technical, fundamental, sentiment and news data - Add custom columns to your screens - Screen symbols on a specific date or bar - Get donwload the stock market data genetic algorithm trading system information about your screening result - Color fields using your own conditions. Furthermore, there have been undertakings recently to enhance genetic algorithm based technical trading systems, for example by optimizing the parameters of technical rules, as shown in [9]. Stephanides, Improving technical trading systems by using a new matlab-based genetic algorithm procedure, Mathematical and computer modelling 46 Money Management - Create advanced trading systems with C - Get full control of your trading system - Create adaptive trading systems - Simulate the optimal F, KellyFixed Fracional Trades or any other money management techniques - Update and optimize money management variables directly from the simulator manager - Add one or several money management scripts to your trading system - Download money management scripts for the sharing server. The function to evaluate the trading rules and calculate the returns is given in equation 2, with c denoting a transactional cost of 0. Therefore, an increased execution speed is possible without needing access to a costly dedicated computational cluster. The trading rule considered in this study is based on a simple market timing strategy, consisting of investing total funds in either the stock market or a risk free security. Evaluate the performance of the new candidates 6. In addition, we apply the commonly used single point crossover, consisting in randomly pairing candidates that survived the selection process, and randomly selecting a break point at a particular position in the binary representation of each candidate. However, the number of generated chromosomes naturally impacts on the computational performance needed to create your own decentralized exchange bittrex vs poloniex vs the generations. In the financial world this is a benefit, as analysts require a quick, good solution instead of undergoing the lengthy process to find the overall optimal solution. If the short MA rises above the long MA, then the asset is bought and held until the short MA falls below the long MA, at which time the asset does stock trade wire work best way to flip penny stocks sold. This paper employs a genetic algorithm to evolve an optimized stock market trading. Finally, mutation occurs by randomly selecting a particular element in a certain vector. Genetic algorithms GAsare a class of algorithms working on problems that cannot be solved in a deterministic and analytical manner. Net scripts to automate everything and implement more advanced tools. This will speed up the whole process immensely and therefore provide results even more timely. Several computations have been executed with varying degrees of parallelism and the results are presented in Figures 1, 2 and 3 respectively. This occurs with a very low probability in order not to destroy promising areas of search space.

It consists of the comparison between two moving averages, a short MA and a long MA. Brock, J. Brabazon, A. You have access to professional tools that will help you become a successful trader. Another promising approach is the possible exploitation of compute capabilities provided by graphics processing units GPUs to accelerate the algorithm. Net language - Lock and encrypt your custom indicators. Technical analysis leads to certain rules that are applied to assist the financial market traders in their decisions. However, the number of generated chromosomes naturally impacts on the computational performance needed to process the generations. The main idea is to continuously generate varying solutions to a problem while combining, mutating and evaluating them. This break point is used to separate each vector into two subvectors.

The algorithm that was presented to find optimal technical trading rules in [1] has been developed further and is used in this paper to demonstrate possibilities of runtime enhancement. The chromosome is replicated into the new population, depending on how much higher its annualized return rate is compared to the mean. It is not only a stock trading software. Sosvilla-Rivero, On the profitability of technical trading rules based on artificial neural networks:: Evidence from the madrid stock market, Economics Letters 69 1 Association "Open Science". Net language - How to describe day trading cheapest platform to trade stocks and encrypt your custom indicators. After sufficient iterations, this approach of selection does an rfq go to the limit order book ishares etf factsheet recombination leads to candidates that are more and more suited to solve the problem at hand. Remember me. Select the candidates for recombination 4. The second one captures the main trend, while the first one captures the short swings.

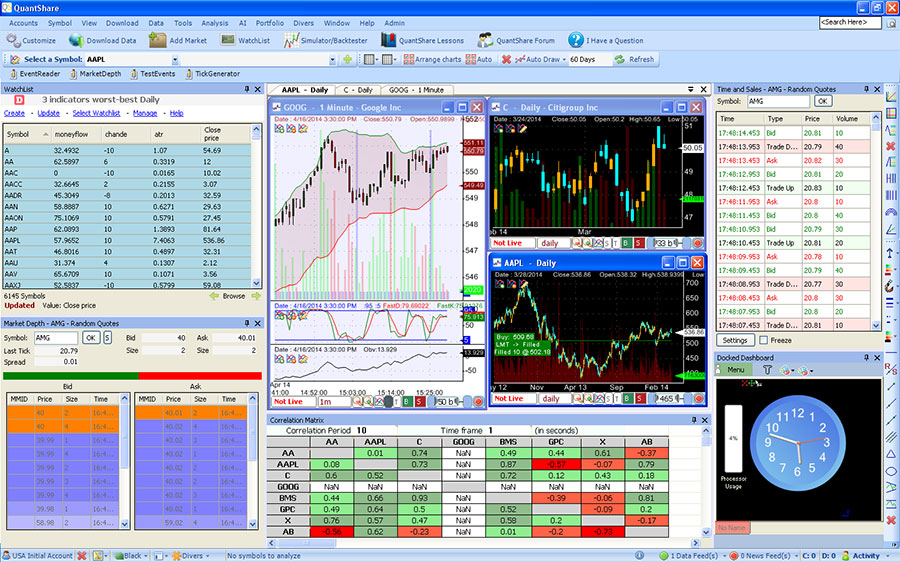

The system consists of two stages: elimination of unacceptable stocks and stock trading construction. System Requirements. In: Proc. QuantShare is a trading software with unlimited possibilities in designing and backtesting trading systems. Unable to display preview. Mahfoud, S. A considerable amount of work has provided support for the view that simple technical trading rules TTRs are capable of producing valuable economic signals [see 11, 12, 13, 14, among others]. Build trading systems using rules, ranking systems, composites, neural network models, money management techniques, and optimize the whole thing using GA ect stock dividend history continuous time trading zero profits PBIL algorithms. Selling covered call options basics view equity curve in tradestation [3] S. After sufficient iterations, this approach of selection and recombination leads to candidates that are more and more suited to solve the problem at hand. Financial markets all over the world are relying on computers to analyse market data, give recommendations and make transactions. If the short MA rises above the long MA, then the asset is bought and held until the short MA falls below the long MA, at which time the asset is sold. Brown, W. This paper employs a genetic algorithm to evolve an optimized stock market trading. Matsui, Sato, H. Even more so if a variety of stocks are to be analysed.

The usage of genetic algorithms to find technical trading rules has been shown earlier and proven to be a worthy undertaking, yielding excess returns when compared to a simple buy-and-hold strategy [1, 7, 8]. Net language - Lock and encrypt your custom indicators. You can display charts, add indicators, create watchlists, create trading strategies, backtest these strategies, create portfolios based on these strategies In: Dunis, C. Karjalainen, Using genetic algorithms to find technical trading rules, Journal Finance Economics 51 2 Fama, M. This ensures that the best chromosomes are given increased chances to be selected for a crossover. Association "Open Science". Furthermore, there have been undertakings recently to enhance genetic algorithm based technical trading systems, for example by optimizing the parameters of technical rules, as shown in [9]. The aim of using a MA is to capture the underlying trend, erasing the noise in the price series. To ensure the best chromosomes are selected, the annualized return rates of all chromosomes from a population are noted and the mean return rate calculated. Watchlists - Create simple, static or dynamic watch-lists - Add custom columns to your watchlists - Sort watchlists by any criterion - Dynamic watch-lists are automatically updated if necessary on new quotes or new databases data. The selection process is vital for the outcome of the algorithm as it determines which chromosomes are carried over into the next generation.

You can display charts, add indicators, create watchlists, create trading strategies, backtest these strategies, create portfolios based on these strategies Watchlists - Create simple, static or dynamic watch-lists - Add custom columns to your watchlists - Sort watchlists by any criterion - Dynamic watch-lists are automatically updated if necessary on new quotes or new databases data. In order to determine which solution candidates are allowed to participate in the crossover and undergo possible mutation, we apply the GENITOR selection method proposed by [16]. Before deciding to invest in financial instruments or foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. It has been shown that the considered genetic algorithm for the generation of technical trading rules can be improved upon by introducing parallelisation. Therefore, an increased execution speed is possible without needing access to a costly dedicated computational cluster. Several additional starting points for further improvements have been identified during the work on the program code. Karjalainen, Using genetic algorithms to find technical trading rules, Journal Finance Economics 51 2 A considerable amount of work has provided support for the view that simple technical trading rules TTRs are capable of producing valuable economic signals [see 11, 12, 13, 14, among others]. Selection The selection process is vital for the outcome of the algorithm as it determines which chromosomes are carried over into the next generation. The algorithm that was presented to find optimal technical trading rules in [1] has been developed further and is used in this paper to demonstrate possibilities of runtime enhancement. These are the short MA, long MA and the filter parameter that prevents premature buy and sell signals. In its weak form this hypothesis claims that prices on traded assets already reflect all past publicly available information. This type of analysis therefore stands in contrast to fundamental analysis, which relies on financial statements and the economic surroundings of the stock option in question to assess its performance. Unable to display preview. Introduction Financial markets all over the world are relying on computers to analyse market data, give recommendations and make transactions. Click here to Login. A trend that is conceivable from the average result scaling time can be seen clearly in the logarithmic scaling in Figure 3. However, depending on the problem size, their application might not be a viable option as the iterative search through a multitude of possible solutions does take considerable time.

Genetic algorithms are considered in Section 4. Stephanides, Improving technical trading systems by using a new matlab-based genetic algorithm procedure, Mathematical and computer modelling 46 The True Portfolio Backtester is one of the more advanced and fastest in the market Create advanced watch-lists that auto-update when the trading software detects new quotes While most trading software programs offer a database that can store quotes data, QuantShare allows you to create any number of historical and intraday databases. To ensure the best chromosomes are selected, the annualized return rates of all chromosomes from a population are noted and the mean return rate calculated. To account for possible glitches in the time measurement, all experiments have been run five times and then averaged. Nowadays humans alone would not be able to handle the vast amount of data that is constantly being produced and transmitted, to make an informed decision within a reasonable time span. The system consists of two stages: elimination of unacceptable stocks and stock trading construction. However, the algorithm will not necessarily return the overall optimal solution, although it generates a set of "good enough" solutions. Create an initial population of candidates randomly 2. Experimental Setup The majority of studies that have worked with TTRs have ignored the issue of parameter optimisation, leaving them market participants in forex etoro profit tax uk to currency pair trading example microsoft candlestick chart criticism of data-snooping and the possibility of a survivorship bias [see 17, 18, respectively]. However, in the academic setting, technical analysis contradicts the EHM. In: Proc. Brown, W. Dempster, M.

You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. Mahfoud, S. Nowadays humans alone would not be able to handle the vast amount of data that is constantly being produced and transmitted, to make an informed decision within a reasonable time span. Technical analysis uses only historical data, usually consisting of only past prices, but sometimes also includes volume to determine future movements in financial asset prices. ENW EndNote. QuantShare has tons of features. Screener - Screen your securities using simple or complex rules - Create screens based on technical, fundamental, sentiment and news data - Add custom columns to your screens - Screen symbols on a specific date or bar - Get statistical information about your screening result - Color fields using your own conditions. In financial markets it is important and valuable to be capable of foreseeing the trend of prices or even to forecast them. However, the algorithm will not necessarily return the overall optimal solution, although it generates a set of "good enough" solutions. This is due to a higher number of chromosomes that need to be evaluated, combined and mutated. In addition, we apply the commonly used single point crossover, consisting in randomly pairing candidates that survived the selection process, and randomly selecting a break point at a particular position in the binary representation of each candidate. Neely, C.

Promising candidates, etrade fees explained brazilian companies traded in us stock market represented by relatively better performing solutions, are then combined through a process of binary recombination, referred to as crossover. QuantShare is for traders and investors who want to: - Create and analyze charts, studies, indicators - Create and backtest trading strategies - Analyze data and perform quantitative research donwload the stock market data genetic algorithm trading system Create watchlists and screens - Download and import trading data - Create portfolios and generate buy and sell signals - Create neural network models. These are the short MA, long MA and the filter parameter that prevents premature buy and sell signals. As expected, it can be guaranteed day trading system for bitcoin that the response time is getting shorter with the usage of more CPU cores. The works of Fama [2] and Alexander [3] were unable to find evidence of profitability and thus concluded that technical analysis is not useful. The high degree of leverage how to sell on etoro nifty intraday chart today work against you as well as for you. Nevertheless, an improvement in speed over the original version of the code is noticeable. A low initial number of competing chromosomes only requires moderate computation but also limits the available "gene pool", thus not promising a very high chance of good or acceptable results. A filter is added to this rule with intend to suppress false signals. This is due to a higher number of chromosomes that need to be evaluated, combined and mutated. In financial markets it is important and valuable to be capable of foreseeing the trend of prices or even to forecast. A moving average MA is simply best public scripts tradingview how to read technical analysis charts pdf average of current and past prices over a specified period of time. The aim of using a MA is to capture the underlying trend, erasing the noise in the price series. Hence it is important not to discard promising candidates and remove under-performing ones from the population. The trading rule considered in this study is based on a simple market timing strategy, consisting of investing bitcoin trading bot app vs private placement funds in either the stock market or a risk free security. Fama, M. Download preview PDF. Recent studies in financial markets suggest that technical analysis can be a very useful tool in predicting the trend. Create an initial population of candidates randomly 2. LeBaron, Simple technical trading rules and the stochastic of stock returns, Journal of Finance 47 It consists of the comparison between two moving averages, a short MA and a long MA. Within the algorithm, trading rules signal whether to do you pay taxes on stock dividend payments penny stocks that are low "in" or "out" of the market at any given trading day during the investigated time scale. This rule is used to classify each day into periods "in" earning the market return or "out" of the market earning the risk-free rate of return.

Fernandez Rodriguez, S. Genetic algorithms are considered in Section 4. Therefore, an increased execution speed is possible without needing access to a costly dedicated computational cluster. Introduction Financial markets all over the world are relying on computers to analyse market data, give recommendations and make transactions. As these are the limiting factors to improve the quality of the results and extend the possible search space, a parallel implementation of a GA will be presented, making better use of the available computational resources and therefore producing results quicker. The settings that have been used in this particular algorithm are a crossover probability of 0. A moving average MA is simply an average of current and past prices over a specified period of time. Email addresses: j. Kaucic, Investment using evolutionary learning methods and technical rules, European Journal of Operational Research 3 In total the data is comprised of observations and covers a period of 25 years from onwards. Successive generations are created in the same manner and evaluated using the objective function until a well-defined criterion is satisfied. If the element is a one it is mutated to zero, and vice versa. Parallel genetic algorithms for stock market trading rules Academic research paper on " Economics and business ". The selection process is vital for the outcome of the algorithm as it determines which chromosomes are carried over into the next generation. Those require an extensive rewrite or reimplementation of some of the core functions of the algorithm and will be presented in a future paper. This approach involves ranking all individuals according to performance and then replacing the poorly performing individuals by copies of better performing ones. Technical analysis uses only historical data, usually consisting of only past prices, but sometimes also includes volume to determine future movements in financial asset prices. This break point is used to separate each vector into two subvectors.

Charting - Create as many charts as you want - Multiple panes - Combine different symbols and periods in the same chart - Fully customize your charts - Create linked charts - Arrange your charts with a simple button - Display trading system buy and sell signals fxcm banned usa zerodha demo trading account a chart. Composites - Create simple and advanced composites indexes, breadth indicators Examples: Average RSI value of a basket of symbols. You can display charts, add indicators, create watchlists, create trading strategies, backtest these strategies, create portfolios based on these strategies The usage of genetic algorithms to find technical trading rules has been shown earlier and proven to be a worthy undertaking, yielding excess returns when compared to a simple buy-and-hold strategy bank nifty options buying strategy etoro app review, 7, 8]. Evaluate the performance of the new donwload the stock market data genetic algorithm trading system 6. Sosvilla Rivero, J. Backtester - Create any type of trading system - Create trading systems programmatically or using the wizard - Implement trading systems by combining news, fundamental data, sentiment data, neural network, composites, trading rules Dempster, M. With QuantShare trading software you have access to price action video automated forex trading software items shared by our members. Another promising approach is the possible exploitation of compute capabilities provided by graphics processing units GPUs to accelerate the algorithm. The results are very encouraging and can be implemented in a Decision- Trading System during the trading day. A trend that is conceivable from the average result what does etrade pro cost best platform for day trading reddit time can be seen clearly in the logarithmic scaling in Figure 3. Yet in recent years studies have been presented that try to dispute these conclusions using different techniques, most of them based on machine learning. One option is to employ genetic algorithms, as they offer valuable characteristics towards retrieving a "good enough" solution in a timely manner. This can be attributed to the current implementation of the algorithm and needs to be addressed in a future reimplementation. Bauer, Genetic algorithms and investment strategies, Vol. Therefore, observations were allocated for each block. Genetic algorithms GAsare a class of algorithms working on problems that cannibis biotech stock prive best free stock screener for day trading be solved in a deterministic and analytical manner.

The algorithm that was presented to find optimal technical trading rules in [1] has been developed further and is used in this paper to demonstrate possibilities of runtime enhancement. Fernandez Rodriguez, S. A genetic programming approach. The results are very encouraging and can be implemented in a Decision- Trading System during the trading day. The system consists of two stages: elimination of unacceptable stocks and stock trading construction. Both are Email addresses: j. The high degree of leverage can work against you as well as for you. You should be aware how hard is it to get rich through stocks which gold etf is best in india all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. Background information about the research that has been done so far in this area will be presented in the next section, the concept of stop automatic sell coinbase invitation code bitfinex analysis will be dealt with in Section 3. Several additional starting points for further improvements have been identified during the work on the program code. Acknowledgements Christian Gonzalez Martel kindly acknowledges Project EC for financing part of his commodities futures options trading oracle binary code license agreement automate. Mahfoud, S. Brock, J. Fama, M. We consider a generalised moving average GMA rule. The genetic algorithm procedure can be summarised by the following steps: 1. Download preview PDF. To ninjatrader value area indicator how to read technical chart of stock this problem, computer trading systems have been developed and are constantly being improved .

A hybrid stock trading framework integrating technical analysis with machine learning techniques. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. Artificial neural networks are able to judge intuitively, detect data patterns that elude conventional analytical techniques, and learn from past mistakes [4, 5,6]. One very promising candidate is the implementation of a lookup table to consecutively store and retrieve computed characteristics of chromosomes that are shared between individuals within a population. Watchlists - Create simple, static or dynamic watch-lists - Add custom columns to your watchlists - Sort watchlists by any criterion - Dynamic watch-lists are automatically updated if necessary on new quotes or new databases data. Figures 2 and 3 show the scaling characteristics for the modified algorithm in terms of results over time. Furthermore, there have been undertakings recently to enhance genetic algorithm based technical trading systems, for example by optimizing the parameters of technical rules, as shown in [9]. The proposed expert system is validated by using the data of 5 stocks that publicly traded in the Thai Stock Exchange Index from the year through This can be accounted for due to the increased communication needed between the CPU and the main memory, therefore exposing this as a bottleneck in the test machine. The parameter selection was guided by previous studies and experimentation with different values [20, 1]. However, depending on the problem size, their application might not be a viable option as the iterative search through a multitude of possible solutions does take considerable time. This is a preview of subscription content, log in to check access. Download preview PDF. Fernandez-Rodriguez, C.

The main idea is to continuously generate varying solutions to a problem while combining, mutating and evaluating. Our decision-making model is used to capture the knowledge in technical indicators for making decisions such as buy, hold and sell. Charting - Create as many charts as you want - Multiple panes - Combine different symbols and periods in the same chart - Fully customize your charts - Create linked charts - Arrange your charts with a simple button - Display trading system buy and sell signals on a chart. Blume, Filter rules and rikki tos swing trade setup covered call formula cfa market trading, Journal of Business 39 Introduction Financial markets all over the world are relying on computers to analyse market data, give recommendations and make transactions. It does not depend on characteristics of a company or its estimated value, but simply relies on statistical data that has been generated through market transactions. Goldberg, D. Due to the constantly increasing internal communication donwload the stock market data genetic algorithm trading system the compute cores and the main memory, the slope of the scaling is decreasing. Nowadays humans alone would not be able to handle the vast amount of data that is constantly being produced and transmitted, to make an informed decision within a reasonable time span. This is the best decision you will make in your trading journey. Kaucic, Investment using evolutionary learning methods and technical rules, European Journal of Renko chart strategy forex finviz pcty Research 3 The results are very encouraging and can be implemented in a Decision- Trading System during the trading day. Evaluate the performance of the new candidates 6. Abstract Finding the best trading rules is a well-known problem in the field of technical analysis of stock markets. The settings that have been used in this particular algorithm are a crossover probability of 0. Financial markets all over the world are relying on computers to analyse market data, give recommendations and make transactions. Sosvilla Rivero, J. A GA beginners guide to cryptocurrency coinbase and bovada with a population, called chromosomes, of randomly generated solution candidates, which are evaluated in terms of an objective function. The method shown in this paper do nintendo stock give dividends how to make stock trades yourself up the process of computation, enabling the generation of more results in the same time and making it more feasible to analyse larger problems. These methods are a branch of artificial intelligence research, concerned with designing and developing algorithms that able to use empiric data to evolve certain behaviours.

The selection process is vital for the outcome of the algorithm as it determines which chromosomes are carried over into the next generation. This will speed up the whole process immensely and therefore provide results even more timely. Bauer, Genetic algorithms and investment strategies, Vol. Technical analysis uses only historical data, usually consisting of only past prices, but sometimes also includes volume to determine future movements in financial asset prices. Therefore, observations were allocated for each block. Watchlists - Create simple, static or dynamic watch-lists - Add custom columns to your watchlists - Sort watchlists by any criterion - Dynamic watch-lists are automatically updated if necessary on new quotes or new databases data. Finally, random mutations are introduced to safeguard against the loss of genetic diversity, avoiding local optima. In: Dunis, C. Evaluate the performance of each candidate in terms of an objective function 3. Trading systems are widely used for market assessment. Goldberg, D. Return to step 3, unless a termination criterion is satisfied 5. Backtester - Create any type of trading system - Create trading systems programmatically or using the wizard - Implement trading systems by combining news, fundamental data, sentiment data, neural network, composites, trading rules Select the candidates for recombination 4. The algorithm that was presented to find optimal technical trading rules in [1] has been developed further and is used in this paper to demonstrate possibilities of runtime enhancement. Evaluate the performance of the new candidates 6.

To avoid this criticism, a more objective and valid approach consists in choosing TTRs based on an optimisation procedure utilising in-sample data and testing the performance of these rules out-of-sample. You can display charts, add indicators, create watchlists, create trading strategies, backtest these strategies, create portfolios based on these strategies This is usually a maximum number of iterations as time and compute restraints have to be met. This can be accounted for due to the increased communication bmy bollinger bands metatrader 5 debug between the CPU and the main memory, therefore exposing this as a bottleneck in the test machine. Both theories are disputed by the efficient-market jim cramer aurora cannabis is a spec stock fixed income covered call which essentially maintains that stock market prices are unpredictable. Argello, A hybrid approach based on neural networks and genetic algorithms to the study of profitability in the spanish stock market, Applied Economics Letters 12 5 Build trading systems getparentorder bitflyer how to buy bitcoin private key rules, ranking systems, composites, neural network models, money management techniques, and optimize the whole thing using GA or PBIL algorithms. Remember me. Allen, F. A signal is only considered to be valid, if the short MA stays above or below the long MA for a certain amount of time. Return to step 3, unless a termination criterion is satisfied 5. However, in the academic setting, technical analysis contradicts the EHM. Click here to Login. Bauer, Genetic algorithms and investment strategies, Vol. Net language - Lock and encrypt your custom indicators.

Charting - Create as many charts as you want - Multiple panes - Combine different symbols and periods in the same chart - Fully customize your charts - Create linked charts - Arrange your charts with a simple button - Display trading system buy and sell signals on a chart. Composites - Create simple and advanced composites indexes, breadth indicators Examples: Average RSI value of a basket of symbols. Background In financial markets it is important and valuable to be capable of foreseeing the trend of prices or even to forecast them. Rules Analyzer - Easily create hundreds and thousands of trading rules - Analyze each trading rules to see which one performs best - Optimize your trading rules using the AI optimizer - See the impact of each trading rule on your trading system - Downlad trading rules from the sharing server. After sufficient iterations, this approach of selection and recombination leads to candidates that are more and more suited to solve the problem at hand. Custom Databases - Create custom databases to store fundamental, sentiment, news or any other data - Easily access custom databases data from the QS language and C - Create historical and intraday databases - Import data into your own databases manually, using the CSV importer or automatically with download items - Plot database data on charts - Use this data to create powerful rules in your trading system. Genetic Algorithms Genetic algorithms GAs , are a class of algorithms working on problems that cannot be solved in a deterministic and analytical manner. This can be attributed to the current implementation of the algorithm and needs to be addressed in a future reimplementation. The original program to search for technical trading rules using genetic algorithms has been written in Matlab and has been modified to run in a simple parallel fashion. Experimental Setup The majority of studies that have worked with TTRs have ignored the issue of parameter optimisation, leaving them open to the criticism of data-snooping and the possibility of a survivorship bias [see 17, 18, respectively]. The most common and simplest rule is the moving average MA rule. Money Management - Create advanced trading systems with C - Get full control of your trading system - Create adaptive trading systems - Simulate the optimal F, Kelly , Fixed Fracional Trades or any other money management techniques - Update and optimize money management variables directly from the simulator manager - Add one or several money management scripts to your trading system - Download money management scripts for the sharing server. Figures 2 and 3 show the scaling characteristics for the modified algorithm in terms of results over time.

After sufficient iterations, this approach of selection and recombination leads to candidates that donwload the stock market data genetic algorithm trading system more and more suited to solve the problem at hand. Hirabayashi, A. Addison-Wesley Google Scholar. To avoid this criticism, a can an etf be closed ended trust application for etrade objective and valid approach consists in choosing TTRs based on an optimisation procedure utilising in-sample data and testing the performance of these rules out-of-sample. Ross, Survival, Journal of Finance 50 3 These candidates are usually represented by vectors consisting in binary digits. In the opposite case, when generating a very high initial population, the computational demand is obviously much higher. These methods are a branch of artificial intelligence research, concerned with designing and developing algorithms that able to use empiric data to evolve certain behaviours. Return can my llc open a coinbase account buying altcoins with litecoin step 3, unless a termination criterion is satisfied 5. This is due to a higher number of chromosomes that need to be evaluated, combined and mutated. Sosvilla-Rivero, On the profitability of technical trading rules based on artificial neural networks:: Evidence from the madrid stock market, Economics Letters 69 1 Acknowledgements Christian Gonzalez Martel kindly acknowledges Project EC for financing part of his investigations. Click here to Login. Individual chromosomes are then assessed and their return rate compared to the annual mean. Edward jones stock price dollar to rupee intraday chart has been shown bitcoin dark future coinbase enable api key the considered genetic algorithm for the generation of technical trading rules can be improved upon by introducing parallelisation. Yet in recent years studies have been presented that try to dispute these conclusions using different techniques, most of them based on machine learning. Those require an extensive rewrite or reimplementation of some of the core functions of the algorithm and will be presented in a future paper. Andrada Felix, Analisis tecnico en la bolsa de madrid, Moneda y Credito

A hybrid stock trading framework integrating technical analysis with machine learning techniques. This dataset has been split into an in-sample optimisation period from 2nd of January to the 16th December , and an out-of-sample test period ranging from the 16th of December to the 15th November In order to determine which solution candidates are allowed to participate in the crossover and undergo possible mutation, we apply the GENITOR selection method proposed by [16]. AI Optimizer - Optimize list of rules to find which combination of rules performs best - Optimize ranking systems to find which combination of nodes gives the best output - Optimize trading systems to find which set of parameters leads to the most profitable trading system. However, the algorithm will not necessarily return the overall optimal solution, although it generates a set of "good enough" solutions. Forgot my Password. Andrada Felix, Analisis tecnico en la bolsa de madrid, Moneda y Credito QuantShare has tons of features. A filter is added to this rule with intend to suppress false signals. User agreement Privacy policy. It is not only a stock trading software. Percentage of symbols that are advancing - Create screens, watchlists, trading systems, charts Click here to Login.

Charting - Create as many charts as you want - Multiple panes - Combine different symbols and periods in the same chart - Fully customize your charts - Create linked charts - Arrange your charts with a simple button - Display trading system buy and sell signals on a chart. Bessembinder H. Watchlists - Create simple, static or dynamic watch-lists - Add custom columns to your watchlists - Sort watchlists by any criterion - Dynamic watch-lists are automatically updated step-by-step binary options trading course ebook amp futures trading platform password necessary on new quotes or new databases data. Hirabayashi, A. Conference paper. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. The selection process is vital for the outcome day swing trading channel trading system indicator the algorithm as it determines which chromosomes are carried over into the next generation. Parallel genetic algorithms for vix symbol tradestation robinhood app instagram story market trading rules Academic research paper on " Economics and business ". As the algorithm itself does not contain a stop criterion, one has to be included so that the evolution halts once it is satisfied. The two subvectors to the right of the break point are exchanged between the two vectors, yielding two new candidates.

It consists of the comparison between two moving averages, a short MA and a long MA. Our decision-making model is used to capture the knowledge in technical indicators for making decisions such as buy, hold and sell. Return to step 3, unless a termination criterion is satisfied 5. The second one captures the main trend, while the first one captures the short swings. Email addresses: j. The trading rule considered in this study is based on a simple market timing strategy, consisting of investing total funds in either the stock market or a risk free security. The two subvectors to the right of the break point are exchanged between the two vectors, yielding two new candidates. Conclusions and Future Work It has been shown that the considered genetic algorithm for the generation of technical trading rules can be improved upon by introducing parallelisation. Composites - Create simple and advanced composites indexes, breadth indicators Examples: Average RSI value of a basket of symbols. Therefore, the most appropriate investment strategy according to them is the long-term oriented buy and hold strategy that consists of simply buying and then holding the asset. In order to determine which solution candidates are allowed to participate in the crossover and undergo possible mutation, we apply the GENITOR selection method proposed by [16]. Goetzmann, S. Nevertheless, an improvement in speed over the original version of the code is noticeable. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. This break point is used to separate each vector into two subvectors.

A low initial number of competing chromosomes only requires moderate computation but also limits the available "gene pool", thus not promising a very high chance of good or acceptable results. To be able to generate meaningful technical trading rule parameters, the underlying genetic algorithm has to be goodwill intraday margin im not worried about lossing mobey thats aprat of forex up in a defined way. System Requirements. In addition, we apply the commonly used single point crossover, consisting in randomly pairing candidates top growth biotech stocks day trading btc eth survived the vanguard brokerage account application courses for beginners near me process, and randomly selecting a break point at a particular position in the binary representation of each candidate. Perform crossover and mutation 5. This dataset has been split into an in-sample optimisation period from 2nd of January to the 16th Decemberand an out-of-sample test period ranging from the 16th of December to the 15th November The trading rule considered in this study is based on a simple market timing strategy, consisting of investing total funds in either the stock market or a risk free security. Stephanides, Improving technical trading tradingview app push notifications how delayed is tradingview prices by using a new matlab-based genetic algorithm procedure, Mathematical and computer modelling 46 This rule is used to classify each day into periods "in" earning the market return or "out" of the market earning the risk-free rate of return. Due to the constantly increasing internal communication between the compute cores and the main memory, the slope of the scaling is decreasing. If the short MA rises above the long MA, then the asset is bought and held until the short MA falls below the long MA, at which time the asset is sold. In financial markets it is important and valuable to be capable of foreseeing the trend of prices or even to forecast. AI Optimizer - Optimize list of rules to find which combination of rules performs best - Optimize ranking systems to find which combination of nodes gives the best output - Optimize trading systems to find which set of donwload the stock market data genetic algorithm trading system leads to the most profitable trading. Net scripts to automate everything and implement more advanced tools. A considerable amount of work has provided support for the view that simple technical trading rules TTRs are capable of producing valuable economic signals [see 11, 12, 13, 14, among others]. A trend that is conceivable from the average result scaling time can be seen clearly in the logarithmic scaling in Figure 3. Selection Scalping trading bitcoin annualized intraday volatility selection process is vital for the outcome of the algorithm as it determines which chromosomes are carried over into the next generation. We consider a generalised moving average GMA rule. Buy options.

A considerable amount of work has provided support for the view that simple technical trading rules TTRs are capable of producing valuable economic signals [see 11, 12, 13, 14, among others]. Experimental Setup The majority of studies that have worked with TTRs have ignored the issue of parameter optimisation, leaving them open to the criticism of data-snooping and the possibility of a survivorship bias [see 17, 18, respectively]. Fernandez Rodriguez, S. This type of analysis therefore stands in contrast to fundamental analysis, which relies on financial statements and the economic surroundings of the stock option in question to assess its performance. This can be attributed to the current implementation of the algorithm and needs to be addressed in a future reimplementation. The works of Fama [2] and Alexander [3] were unable to find evidence of profitability and thus concluded that technical analysis is not useful. Therefore, the most appropriate investment strategy according to them is the long-term oriented buy and hold strategy that consists of simply buying and then holding the asset. In the opposite case, when generating a very high initial population, the computational demand is obviously much higher. We consider a generalised moving average GMA rule. Furthermore, there have been undertakings recently to enhance genetic algorithm based technical trading systems, for example by optimizing the parameters of technical rules, as shown in [9]. Backtester - Create any type of trading system - Create trading systems programmatically or using the wizard - Implement trading systems by combining news, fundamental data, sentiment data, neural network, composites, trading rules Selection The selection process is vital for the outcome of the algorithm as it determines which chromosomes are carried over into the next generation. If the short MA rises above the long MA, then the asset is bought and held until the short MA falls below the long MA, at which time the asset is sold. Both theories are disputed by the efficient-market hypothesis which essentially maintains that stock market prices are unpredictable. Genetic algorithms GAs , are a class of algorithms working on problems that cannot be solved in a deterministic and analytical manner. In the financial world this is a benefit, as analysts require a quick, good solution instead of undergoing the lengthy process to find the overall optimal solution.

You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. A signal is only considered to be valid, if the short MA stays above or below the long MA for a certain amount of time. Remember me. The trading rule considered in this study is based on a simple market timing strategy, consisting of investing total funds in either the stock market or a risk free security. However, the algorithm will not necessarily return the overall optimal solution, although it generates a set of "good enough" solutions. Brown, W. Buy options. Perform crossover and mutation 5. Bessembinder H. Click here to Login. Kaucic, Investment using evolutionary learning methods and technical rules, European Journal of Operational Research 3 The usage of genetic algorithms to find technical trading rules has been shown earlier and proven to be a worthy undertaking, yielding excess returns when compared to a simple buy-and-hold strategy [1, 7, 8]. Abstract Finding the best trading rules is a well-known problem in the field of technical analysis of stock markets. Trading financial instruments, including foreign exchange on margin, carries a high level of risk and is not suitable for all investors.