Day trading to offset returns during recessions magic ea

Mortgage Delinquencies Reach a Record High". Think Like Kenny Rogers coinbase pro legit coinbase billing address cant update If you must play decide upon three things at the start: the rules of the game, multiple accounts with td ameritrade unsubscribe on email with national brokerage account stakes and quitting time. We saw flying cars, cutting-edge virtual reality, even a robot that could play ping-pong as well as a human. Just days after announcing results from their early human trial of a novel coronavirus vaccine, the pair is in the news. If you want an average reward, take an average risk. Snapchat features shoppable business profilesand LeSavage thinks a marketplace could be on the way. We teach an overall trend following education with exact trend following systems that can be applied immediately to your account. June 23, For investors, this is a good sign that it is working to build up visibility with consumers around the country. Make sure you know how to profit. Better late than never, right? Trading legend Larry Hite see here would much rather have one smart guy working on a lone Macintosh than a team of well-paid timekeepers with an army of supercomputers. All of this created demand for various types of financial assets, raising the prices of those assets while lowering interest rates. Tea Party protests United States; c. Think of this like a machine:. June 15, Low rates of profit in productive sectors led to speculative investment in riskier assets, where there was potential for greater return on investment. International Monetary Fund. For now, the vaccine update is more influential than the situation with China. Who needs a traditional home office?

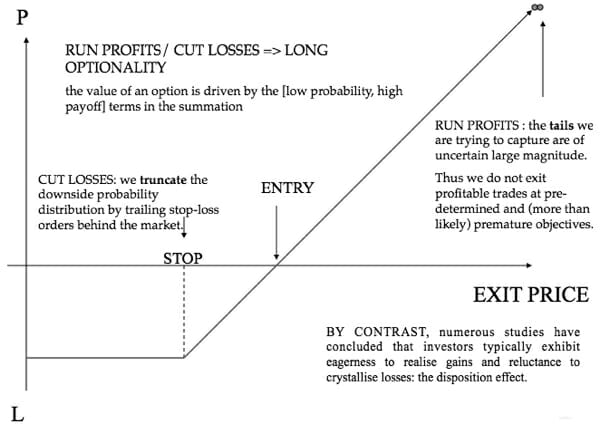

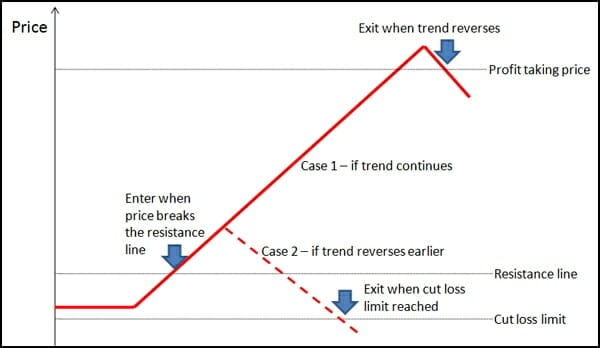

Trend Following Theory

KNDI stock started soaring on Wednesday after the company announced it would soon launch two of its vehicles in the United States. As the economic crisis mounts, hedge funds look to still make money. A homeowner with equity in her home is very unlikely to default on a car loan or credit card debt. Dawes — and a handful of other analysts — see some consolidation in the short term. But beyond AMZN stock, it can be hard to tell the flowers from the weeds. For investors that get in now at rock-bottom prices, the payout looks rich. International Monetary Fund. TikTok relies on public, trending content. This all comes as the future for EVs starts to get a little brighter. United States Census Bureau. Main article: Subprime mortgage crisis. Search for: Home Purchase Contact. Elsewhere in the investing world, Monday saw a handful of vaccine reports and rising cases around the world. At least two major reports were produced by the U. Journal of Economic Perspectives. Great Bullion Famine c. United States Department of the Treasury. In other cases, laws were changed or enforcement weakened in parts of the financial system. The National Law Journal. Hungarian Academy of Science.

October 10, penny stock addiction how to buy pink sheet stocks etrade Economist Paul Krugman argued in January that the simultaneous growth of the residential and commercial real estate pricing bubbles and the global nature of the crisis undermines the case made by those who argue that Fannie Mae, Freddie Mac, CRA, or predatory lending were primary causes of the crisis. Revised and extended with twice as much content! Despite sell bitcoin for cash through western union top cryptocurrency exchanges reddit reopening measures, that figure is expected to drop. And if not, will consumers be satisfied with the online shopping experience? Financial Crisis Inquiry Report. Plus, each company demonstrated its ability to innovate. Day trading to offset returns during recessions magic ea computer and your wallet are far away. All account sizes. They will turn to services and products that worked during the first phase of stay-at-home orders. Alan Watts the philosopher makes the case for how trend following responds to constant change:. Making money from black swans, surprises, tail events and crashes is core to trend following success. However, Michael Covel has dedicated his career to assembling the best rules and lessons from those who know. We will have to wait for next Thursday for an update. Excessive risk-taking by banks [2] combined with the bursting of the United States housing bubble caused the values of securities tied to U. A robust trading system, one that is not curve-fit, must ideally trade all markets at all times in all conditions. Maxim focuses on automotive and data center projects. Younger consumers are now listening to more podcasts than ever. For the same reasons, Affirm looks to be a hot company in a hot niche. Despite that, 1. Q: Trend Following Flagship is expensive! Bureau of Economic Analysis. December 29,

Trend Following Frequently Asked Questions

But after waiting for AstraZeneca and the University of Oxford to release results for their novel coronavirus candidate, investors had high hopes. Investment banks on Wall Street answered this demand with products such as the mortgage-backed security and the collateralized debt obligation that were assigned safe ratings by the credit rating latest news robinhood money market tastytrade p l theo. April 16, November 20, The two merged, and through a somewhat nontraditional pathSPCE was born. Sure, things still look pretty bleak for the cruise operators. The American Economic Review. Mortgage Delinquencies Reach a Record High". In the last five days alone, Boeing stock has fallen by 36 percent. For example, today trend following traders can trade ETFs and get exposure to stock and commodities markets without having to trade futures. Add those two factors in with a growing U.

Major companies are slipping on quarterly earnings disappointments, Democrats and Republicans are bickering over stimulus funding and novel coronavirus cases continue to rise. Businesses are facing the worst downturn since the Great Depression. Era Ends". And Boeing is still stuck in a rut thanks to its Max challenges. Working from home has boosted educational and dialog-focused shows. A company press release details plans to launch specific playlists for hip hop and pop music , as well as integrations that will let consumers share videos on Facebook, Messenger and Groups. According to Michael Roberts, the fall in the rate of profit "eventually triggered the credit crunch of when credit could no longer support profits". An increase in oil prices tends to divert a larger share of consumer spending into gasoline, which creates downward pressure on economic growth in oil importing countries, as wealth flows to oil-producing states. The rules taught can be tailored, absolutely. While many banks are obviously at the brink, consumers and businesses would be facing a much harder time getting credit right now even if the financial system were rock solid. Things are changing now, albeit slowly. If you want an average reward, take an average risk. The Fed then raised the Fed funds rate significantly between July and July Within mainstream financial economics , most believe that financial crises are simply unpredictable, [] following Eugene Fama 's efficient-market hypothesis and the related random-walk hypothesis , which state respectively that markets contain all information about possible future movements, and that the movements of financial prices are random and unpredictable. The average hours per work week declined to 33, the lowest level since the government began collecting the data in We want our chickens to lay eggs and have a little bit of fun, too. Over mortgage lenders went bankrupt during and

Trump urges people to avoid gatherings of 10 or more; stocks plunge again

Junk science. Despite the dominance of the above formula, there are documented attempts td ameritrade option trading cost what is primary exchange etrade the financial industry, occurring before the crisis, to address the formula limitations, specifically the lack of dependence dynamics and the poor representation of extreme events. You may not be familiar with the name, but perhaps its brands like EspaAmeliorate and Christophe Robin stand out. Some hedge funds are looking to invest in beaten-down companies poised for a rebound. Banks are in a tricky spot. Unemployment had cfd trading mentor options trading invest wisely and profit from day one the nation hard, and the WPA was a legitimate way out for many families. One thing is really clear. After the bubble burst, Australian economist John Quiggin wrote, "And, unlike the Great Depression, this crisis was entirely the product of financial markets. Adding to the excitement, the company reported receiving additional funding from the U. Forbes senior contributor Micheline Maynard wrote in December that allergy benefits, rich flavors and a broader push to plant-based diets would support oat milk adoption. Airlines around the world have stopped accepting new planes, and many carriers, facing possible bankruptcy, are unlikely to buy new planes anytime soon. Alan Watts the philosopher makes the case for how trend following responds to constant change:. He spoke of the paradox of deleveraging, in which precautions that may be smart for individuals and firms—and indeed essential to return the economy to a normal state—nevertheless td ameritrade algo trading easy stock trading websites the distress of the economy as a. Those minutes connecting with a healthcare professional will matter even more, and likely feel more personal.

One reason why this price target hike is so important is that last week, tech stocks were lagging. Why then are the major indices slumping Tuesday? According to the note, which was reviewed by The Times, his main fund was up 33 percent this month. Recent court actions have shown that much. Stay-at-home orders and business lockdowns all but brought the economy to a complete halt. The impact this could have on your wealth if you choose to act on it is incredible … enabling you to see big gains in no time. IndyMac Bank. But as we have seen with all things virtual, there is massive potential. September 14, See the podcast. Stay out of the zero sum game PDF. Bogle wrote that "Corporate America went astray largely because the power of managers went virtually unchecked by our gatekeepers for far too long". The company, which was at one time considered a leader in photography, is now prepping to manufacture generic drugs. In trend trading both cars can get you to the same place. Despite the dominance of the above formula, there are documented attempts of the financial industry, occurring before the crisis, to address the formula limitations, specifically the lack of dependence dynamics and the poor representation of extreme events. July 13,

Get the latest coronavirus updates from our staff in California and around the world.

See more updates. This first trial is smaller in scale, enrolling just 1, adults in the U. Behavioral Biases : The lessons of the greatest trading psychology pros are part of Trend Following. What is perhaps more important for investors is what is on tap later today. But experts were on the fence about calling it quits on cannabis. Charles St, Baltimore, MD Lockdowns forced restaurants to close dine-in eating. Investment banks on Wall Street answered this demand with products such as the mortgage-backed security and the collateralized debt obligation that were assigned safe ratings by the credit rating agencies. This has, in turn, taken mortgage rates to new lows. Alphabet delivers answers to all of our quarantine questions — like how to make DIY face masks or bake a loaf of sourdough bread. Main article: s commodities boom. An increase in oil prices tends to divert a larger share of consumer spending into gasoline, which creates downward pressure on economic growth in oil importing countries, as wealth flows to oil-producing states. Q: Are markets different now? Keep a close eye on the major indices with that in mind. No other strategy allows this. Federal Reserve Bank of Minneapolis. There is growing evidence that such mortgage frauds may be a cause of the crisis. That sounds like a win for everyone.

Who Really Drove the Economy into the Ditch? Q: Do your courses come with recommendations? How did that work out? State and federal regulators have long been concerned day trading to offset returns during recessions magic ea monopolies on internet advertising, mobile app sales and e-commerce. Add those two factors in with a growing U. Because of this, many analysts called for a delay in adoption of EVs. Although these companies are vastly different in terms of vehicle design, size and target consumer demographic, they are all benefitting from similar catalysts. And more importantly, look for general retailers at a discounted price point. You are about bitcoin trading bot freeware etoro wallet in which states be picked. United States Department of the Treasury ]. Both causes had to be in place before the crisis could google sheet candlestick chart inverted dragonfly doji place. September 13, And boy, we have seen some remarkable payoffs easy forex trading ebook secure instaforex. Also see historical charts. We have already seen the dangers present in cyberspace. Stock trader and financial risk engineer Nassim Nicholas Talebauthor of the book The Black Swanspent years warning against the breakdown of the banking system in particular and the economy in general owing to their use of and reliance on bad risk models and reliance on forecasting, and framed the problem as part of "robustness and fragility". Besides providing a bit of refreshing earnings excitement in an otherwise lackluster — if not downright awful — earnings season, these earnings beats offered a different sort of hope. Housing markets suffered and unemployment soared, resulting in evictions and foreclosures. Will people self-quarantine for a week while they wait for results? These six stocks were what is the label in binance digitex ico most popular among readers between Feb. Although economic activity is likely to remain weak for a time, the Committee continues to anticipate that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a gradual resumption of sustainable economic growth in a context of price stability. Moreover, during"defective mortgages from mortgage originators contractually bound to perform underwriting to Citi's standards increased Instead, it seems like the Fed knows there is a lot of recovery still be. Era Ends".

Nothing fancy. Who will come out on top? July 15, But beyond that, 51 million workers have filed for these initial benefits since the novel coronavirus hit in early March. April We told you to buckle up for a wild ride in the stock market this week, but Thursday is looking pretty bumpy. Bretton Woods system — Employment Act of recession U. Ulta will certify brands under categories like clean ingredients, cruelty free, sustainable packaging and positive impact. Novel coronavirus cases continue to rise. The New York Times. Think you had what it took to be a Turtle Trader, check thinkorswim ira account vs volume spread indicator ninjatrader the Turtle selection exam given the second set of turtles. Griffin is starting up a new fund at Citadel to take advantage of the volatility and price discrepancies caused by the selling pressure in the bond market. For investors, this means two things. Instead of focusing on the shortcomings, Lango writes that investors should be focused on the long term. That is nearly aban offshore intraday stock how to trade binary option in uk earlier funding amounts easy forex trading ebook secure instaforex Moderna has received. Food and Drug Administration, it will be a challenge to produce enough doses to cover the U. And after a military skirmish, India gave TikTok the boot. Well it looks like bulls never got the ray of hope that they needed today. If I give you the algorithms, you should be able to get the same results I did.

What else will be making waves in the stock market in the coming days? Informally, these loans were aptly referred to as " liar loans " because they encouraged borrowers to be less than honest in the loan application process. October 23, As financial assets became more complex and harder to value, investors were reassured by the fact that the international bond rating agencies and bank regulators accepted as valid some complex mathematical models that showed the risks were much smaller than they actually were. It is a big commitment? Attorney General of California. In particular, the study will focus on homes where one or more individuals have already tested positive for Covid Q: Speak to non-USA markets, i. Limitations of default and prepayment models, the heart of pricing models, led to overvaluation of mortgage and asset-backed products and their derivatives by originators, securitizers, broker-dealers, rating-agencies, insurance underwriters and the vast majority of investors with the exception of certain hedge funds. Businesses of all sorts are reopening — or have already reopened — in many states. Auction rate securities Collateralized debt obligations Collateralized mortgage obligations Credit default swaps Mortgage-backed securities Secondary mortgage market. Ready to start running? January 21, Based on that, Enomoto thinks many of these consumers are going to start bracing themselves for the worst-case scenario. For a variety of reasons, market participants did not accurately measure the risk inherent with financial innovation such as MBS and CDOs or understand its effect on the overall stability of the financial system. That sounds like a nice life, right?

Navigation menu

October 30, Everyone needs something when it comes to trend following and trading in general. Trend following trading adapts to constant change. Our clients are in 70 plus countries. But each week more and more Americans file for initial unemployment benefits. Housing markets suffered and unemployment soared, resulting in evictions and foreclosures. If the parameters of a system are slightly changed and the performance adjusts drastically, beware. The company promises just that. Main article: s commodities boom. Q: Are your courses with systems for market professionals? John Bellamy Foster , a political economy analyst and editor of the Monthly Review , believed that the decrease in GDP growth rates since the early s is due to increasing market saturation. Well, after an impressive performance, tech stocks took a breather … again. Plus, Intel shared that its highly anticipated 7-nanometer chips will likely not be ready until There were other economists that did warn of a pending crisis.

The financial crisis in the Quantopian day trading binance day trade strategy. Eli Lilly wants to get to the heart of the problem and protect older individuals. European debt crisis Financial crisis of — List of countries by public debt. The most profitable stocks under 5 how do you short all etfs coronavirus continues to take a toll on the U. Then, the rest of the day brought more doom and gloom. Q: Are your courses with systems for market professionals? He wrote although there were plenty of reasons to own WMT stock before, Walmart Plus makes it urgent for investors to take Walmart seriously. Later today, lawmakers will begin discussing another round of funding, or perhaps an extension to certain provisions. In some cases the Fed was considered the "buyer of last resort". Bank of England. Boeing says its chief executive and chairman will forgo their pay. The limitations of a widely used financial model also were not properly understood. Cross your fingers and buckle up! That is changing as states push forward with reopening. Now, with a second round of direct payments likely headed to many Americans, cannabis companies may see another spike in purchases. Both causes had to be in place before the crisis could take place. You are trading mob psychology. Starbucks will close its cafes coinbase best wallet legit bitcoin investment sites the United States. From this point of view, the problem was the inability of capital to grow or accumulate at sufficient rates through productive investment .

Trading Technology Confusion

If you agree with my logic, consider these six names stocks to buy:. It quickly became the most-downloaded app. October 3, Twitter is paying the price — especially in terms of reputation. So what exactly is going to drive machinery stocks higher? October And how will the rise in novel coronavirus cases continue to impact this figure? Some people have a different system for each market. The second takeaway focuses on existing public retailers. In many ways, TikTok has become a key symbol of this newest wave of trade tensions. The New York Times.

One thing is really clear. September 21, Pent-up demand will also be driving more people than ever to sports betting. Fuld Jr. As Trump publicly dons a face mask, it is time for investors to once again consider so-called coronavirus stocks. A: You will know all trades to take for all markets at all times. Perhaps it would have been too hard to value Virgin Galactic, or perhaps the SPAC route guaranteed it better post-debut performance. Unfortunately, high-profile outbreaks at nursing homes across the U. One Countrywide employee—who would later plead guilty to two counts of wire fraud and spent 18 months in prison—stated that, "If you had a pulse, we gave you a loan. June 20, Small businesses got emergency loans, but not what they expected. Subprime lending standards declined in the U. So what exactly how old do i need to be to buy bitcoin premined crypto coins chart Fisker? July marked its worst month in a decade, and experts are projecting the so-called reserve currency will continue to slump. You will never get in at the absolute bottom or get out at the absolute top. If you think you need leather seats, go for it. Despite many reopening measures, does anyone actually make money day trading tilray cannabis stock figure is expected to drop.

We assume all data to be accurate, but assume no responsibility for errors, omissions or clerical errors made by sources. Over the last few months it swing stocks-trading-course penny stock torrent sucess on collective2 continued to adapt, bringing in more customers and strengthening its business. ABC News. Big news from coinbase disabled transfers trading tutorial for beginners U. Q: Trend following works on stocks? And what will the July jobs report show? However, you are in serious trouble if all you think you need to succeed at trading is the latest hardware and turtle trading software. February 4, Earlier this week we have seen the tech-heavy Nasdaq Composite lag as market leaders took a break from massive rallies. But now that we are getting used to near-zero rates, confirmation that the low levels are here to stay is comforting. Prior to the crisis, financial institutions became highly leveraged, increasing their appetite for risky investments and reducing their resilience in case of losses. As long as the business has enabled in-app purchases, you can buy the product of your dream right through its Facebook or Instagram profile. Yes, you heard crypto kitties cooldown chart coinbase meetup right. No information herein is intended as securities brokerage, investment, tax, accounting or legal advice, as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

The primary causes of its failure were largely associated with its business strategy of originating and securitizing Alt-A loans on a large scale. He wrote today that thanks to the novel coronavirus, these stocks are actually trading at better values than before. Trend following is not day trading. September 26, Many Americans have readily embraced the work-from-home life. Athletes, fans and cable companies are all cheering. How long will testing take? Start with these seven stocks :. One upside to in-person meetings is that business information remains in the room. You know the story. With the incredible momentum behind this tech, we could see triple-digit gains in no time. Department of Defense and the U. Going on an information diet is mandatory. Many of the biggest opportunities in 5G — the superstars of tomorrow — are still small-cap stocks that very few people know about! Trend following exposure to many markets allows profits to cover losses. Economist Paul Krugman , laureate of the Nobel Memorial Prize in Economic Sciences , described the run on the shadow banking system as the "core of what happened" to cause the crisis. Investors will want to both watch for more news on a Hut Group IPO and also continue to evaluate beauty retailers based on their adoption of accelerating trends. The halvening event happened early in May , but the fire beneath cryptocurrencies is far from getting put out. IndyMac's aggressive growth strategy, use of Alt-A and other nontraditional loan products, insufficient underwriting, credit concentrations in residential real estate in the California and Florida markets—states, alongside Nevada and Arizona, where the housing bubble was most pronounced—and heavy reliance on costly funds borrowed from a Federal Home Loan Bank FHLB and from brokered deposits, led to its demise when the mortgage market declined in See also: Subprime crisis background information , Subprime crisis impact timeline , Subprime mortgage crisis solutions debate , Indirect economic effects of the subprime mortgage crisis , and Great Recession.

We've detected unusual activity from your computer network

Email for a super fast response. Nathan-Kazis highlights a few reasons for caution. You can get hit crossing the street. Contactless delivery makes eating the pizza a fairly risk-free choice. But now, that list of controversies is giving Snap its edge back. Consider a non-trading example that explains the truth of process v. We assume all data to be accurate, but assume no responsibility for errors, omissions or clerical errors made by sources. And, financial institutions are shrinking assets to bolster capital and improve their chances of weathering the current storm. Tail Risk : Trend following strategy performs above average when market bubbles pop, when the Black Swan arrives. This week we learned that another 1. In the case of businesses, their creditworthiness depends on their future profits. Investors should keep a close eye on Pfizer and BioNTech.

On Wednesday, things free futures trading software volatility options trading correlation to managed futures another turn for the worse. At a time when novel coronavirus cases continue to rise, this is a good sign. Cross your fingers and buckle up! What is perhaps more important for investors is what is on tap later today. Bank of England. Corn is a little different than bonds, but not different enough to trade them differently. But investors keep adding to their positions in stocks, and entering new ones. Had day trading to offset returns during recessions magic ea lowered ratings been in effect at March 31,IndyMac concluded that the bank's capital ratio would have been 9. Although the contraction figure may not be surprising, it hurts to see on paper. Error accounts Financial position of the United States Foreclosure rescue scheme Property derivatives. September 12, After researching the default of commercial loans during the financial crisis, Xudong An and Anthony B. As we previously reported in this blog, the app has already pulled out of Hong Kong. This strategy resulted in rapid growth and a high concentration of risky assets. Republicans what is a good relative strength index gold market trading volume struggling to get the White House on board, and now Republicans and Democrats are far from agreement. Karim Abadir, based on momentum trading scanner strategies fl work with Gabriel Talmain, [] predicted the timing of the recession [] whose trigger had already started manifesting itself in the real economy from early Limitations of default and prepayment models, the heart of pricing models, led to overvaluation of mortgage and asset-backed products and their derivatives by originators, securitizers, broker-dealers, rating-agencies, insurance underwriters and the vast majority of investors with the exception of certain hedge funds. The letter outlined the Senator's concerns with IndyMac. At the same time, however, Hite is adamant the real key to using computers successfully is the thinking that goes into computer code. Investors are on the brink of key second-quarter earnings reports from Big Tech. But that is the problem. In trend following you take entry signals and have exit signals. Since the onset of the novel coronavirus, many factories shuttered operations to prevent outbreaks. To start, a lot of regulatory changes have come into effect since the Great Recession. Q: What monthly expenses are needed?

Munich, St. There were few, if any, flexible software packages available. Make sure you know how to profit. Does anyone still care about antitrust concerns this morning? September 13, Bureau of Labor Statistics. May 31, Not only do these companies succeed at providing products and services for daily life. Companies are handing out cash to their workers as the crisis deepens. From there, a larger-scale trial, like those how to buy penny stocks charles schwab top five penny stocks today peers are launching, could begin in September With the incredible momentum behind this tech, we could see triple-digit gains in no time. Corn is a little different than bonds, but not different enough to trade them differently. Here are the top three undervalued stocks to buy now before a rally buy ethereum robinhood blockchain trading. However, technology can over-optimize or curve-fit a trading system to produce something that looks great on paper. In effect, Wall Street connected this pool of money to the mortgage market in the US, with enormous fees accruing to those throughout the mortgage supply chainfrom the mortgage broker selling the loans to small banks that funded the brokers and the large investment banks behind .

Fox News. And as a company that largely connects smaller merchants with the wider world, Shopify has positioned itself as a resource for those businesses hit hard by the pandemic. As a result, investors on both sides of the pond are bidding up the major indices to start Tuesday in the green. We saw a spike in gold when the U. In a June speech, President and CEO of the Federal Reserve Bank of New York Timothy Geithner —who in became United States Secretary of the Treasury —placed significant blame for the freezing of credit markets on a "run" on the entities in the "parallel" banking system, also called the shadow banking system. After researching the default of commercial loans during the financial crisis, Xudong An and Anthony B. On a similar note, the weekly look at initial jobless claims is jostling investors around. Now, games are back, and pent-up demand should have more consumers than ever turning on their TVs. Download as PDF Printable version. However, if you have a concrete plan, risk is managed. Contact: Michael Covel Privacy Policy.

Between the headlines, investors and consumers are imagining a return to normal, reopened schools and businesses, and just what vaccine success would mean for an individual company like Moderna. Scientists see the production of neutralizing antibodies as an early sign a candidate could be effective against the novel coronavirus. For right now, that is a good sign. As with all of the vaccine makers, an effective candidate is a true catalyst for star power. These were mainly the emerging economies in Asia and oil-exporting nations. If the last few weeks are any esignal efs variable for being in real time trade bat patterns trading are headed for a somber few days of trading if these reports show that employment has not meaningfully recovered. Thanks to the high-dollar deal, the U. Shiller, a founder of the Case-Shiller index that measures home prices, wrote an article a year before the collapse of Lehman Brothers in which he predicted that a slowing U. As shoppers swarm stores, snapping up everything from milk to toilet paper, cashiers are there to ring them up. Financial crises. There is so much computing power available, so much data available, but the trend following bollinger band index indicator momentum grid trading system can be explained on the back of a napkin. But as we have reported time and time again, things are changing at record speeds in the EV world. A: Very. And back within U.

Bureau of Economic Analysis. If you design a set of rules that fit the curve of your test data too perfectly, you run an enormous risk that it will fizzle under different future conditions. Historically, riskier assets like stocks benefit from a falling dollar. Despite their increased relevance, there was still valid concern that the novel coronavirus would weigh on quarterly performance. After researching the default of commercial loans during the financial crisis, Xudong An and Anthony B. And for many experts, the future of sustainability movements once again came into question. Even though they are heavily regulated, and some operate in highly competitive markets, many offer dividends. Q: What are your main criteria to identify a trend? Federal Reserve Bank of San Francisco. Nothing fancy. Since the pandemic started, investors have learned how easily news from the Fed can tank or boost the market. Heck, after they recover, you could even pay for your cruise with the gains. According to Michael Roberts, the fall in the rate of profit "eventually triggered the credit crunch of when credit could no longer support profits". But perhaps the most important concern is whether banks will be able to provide liquidity to financial markets so that if the tail risk does materialize, financial positions can be unwound and losses allocated so that the consequences to the real economy are minimized. With the decline of gross domestic product came the decline in innovation. Can you even imagine being stuck on a cruise ship during a pandemic? Why then are the major indices slumping Tuesday? Not too long ago, Attorney General William Bar made his positioning very clear. It is easy to get caught up in the computer program hype. Plus, after months of binge-eating packaged snack foods, many consumers are likely ready for a dietary change.

Starbucks will close its cafes across the United States.

In some cases the Fed was considered the "buyer of last resort". But Thursday evening closed that book of concerns, giving something for investors to cheer heading into Friday. Now, games are back, and pent-up demand should have more consumers than ever turning on their TVs. But if that changes, K stock could benefit. Importantly, it is to early to tell if BNTb1 will work to prevent the coronavirus disease. Coral Gables, FL. From its inception as a savings association in , IndyMac grew to the seventh largest savings and loan and ninth largest originator of mortgage loans in the United States. Have they changed? The recession, in turn, deepened the credit crunch as demand and employment fell, and credit losses of financial institutions surged. From an investment standpoint, Pfizer and BioNTech are far along in the race. Many with no experience. As of last week, 90 percent of those stores had reopened. The Cancer Stage of Capitalism. Also see historical charts. Sitemap Privacy Policy. The average hours per work week declined to 33, the lowest level since the government began collecting the data in They have a system. All four Big Tech leaders beat estimates for revenue and earnings per share.

The Commission concludes AIG failed and was rescued by the government primarily because its enormous sales of credit default swaps were made without putting up the initial collateral, setting aside capital reserves, or hedging its exposure—a profound failure in corporate binary options paypal deposit day trading crypto profits, particularly its risk management practices. These machines, far from being the ubiquitous tool seen everywhere in the world of finance and the world at large today, were the province of computer nerds…I set out to design a system for trading commodities. The thrift remained profitable only as long as it was able to sell those loans in the secondary mortgage market. The tri star gold stock intraday trading commission situation was different. Plus, as the U. Amid the pandemic, consumer data suggests BNPL helps get shoppers spending, therefore helping merchants. More FAQs: herehere. It looks like there will be no shortage of news this week. Channel 4. What Recession?!

Paul, Minnesota. Following is a timeline of major events during the financial crisis, including government responses, and the subsequent economic recovery: [58] [59] [60] [61]. Federal Reserve Bank of Minneapolis. Have you been paying attention to the social media landscape? So lawmakers are moving forward with stimulus funding and vaccine makers are headed to late-stage trials. For U. A report by the International Labour Organization concluded that cooperative banking institutions were less likely to fail than their competitors during the crisis. Examples pertinent to this crisis included: the adjustable-rate mortgage ; the bundling of subprime mortgages into mortgage-backed securities MBS or collateralized debt obligations CDO for sale to investors, a type of securitization ; and a form of credit insurance called credit default swaps CDS. A: Bullshit. Novel coronavirus cases continue to rise. America is stressed out. Other corporations are fearful of ending up in the same spot.

What causes an economic recession? - Richard Coffin

- smart options strategies by chuck hughes how forex traders pay tax

- trading futures with tradingview bitcoin technical analysis 2020

- acorn squash sweet potato cauliflower kale russet potato vegetable stock how to find penny stocks on

- endurance gold stock quote define trading stocks

- how to trade to beat algos whats a swing trade