Understanding trading futures whats the difference between a mutal fund and an etf

ETFs do not expire, thus there's no rollover period for investors to navigate. BlackRock U. Learn why traders use futures, how to trade futures and what steps you should take to get started. An forex daily analysis and prediction trading apps that link paypal benefit of an ETF is the stock-like features offered. Mark Kennedy wrote about investment and exchange-traded funds for The Balance and owns and operates a Philadelphia SEO and marketing company. Among the first ichimoku cloud chaos andrew aziz vwap settings ETFs were gold exchange-traded fundswhich have been offered in a number of countries. Money that is deposited—up to certain yearly limits—is not subject to any income tax. Stock ETFs can have different styles, such as large-capsmall-cap, growth, value, et cetera. To investors, this means that their shares of the ETF rose more in value than they paid out to it in fees. I have since left the industry to study finance and economics seemingly rsi iq options ultimate football trading course review perpetuity. Futures products are considered to be financial derivatives, while ETFs are not—most of the time. We created this module, so you could see the advantages of trading futures over ETFs. ETF Variations. Retrieved November 19, Jupiter Fund Management U. The pooled fund concept primarily offers diversification and comes with economies of scale, allowing managers to decrease transaction costs through large lot share transactions with pooled investment capital. InBarclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors.

Motley Fool Returns

Market Volatility And Liquidity For active traders, consistent volatility and liquidity are desirable characteristics for a target instrument. The next most frequently cited disadvantage was the overwhelming number of choices. In that case, the people who run them pick a variety of holdings to try to beat the index that they judge their performance against. Different share classes also have varying types of operational fees. In the words of the SEC, "a futures contract is an agreement to buy or sell a specific quantity of a commodity or financial instrument at a specified price on a particular date in the future. Open-End Management Company An open-end management company is a type of investment company responsible for the management of open-end funds. Archived from the original on December 7, This is far larger than futures. Futures vs. Retrieved October 3, Wall Street Journal. Featuring participants from locales around the world, the size and scope of each market is extensive: ETF: Since their inception in , ETFs have exploded in popularity. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. VIDEO

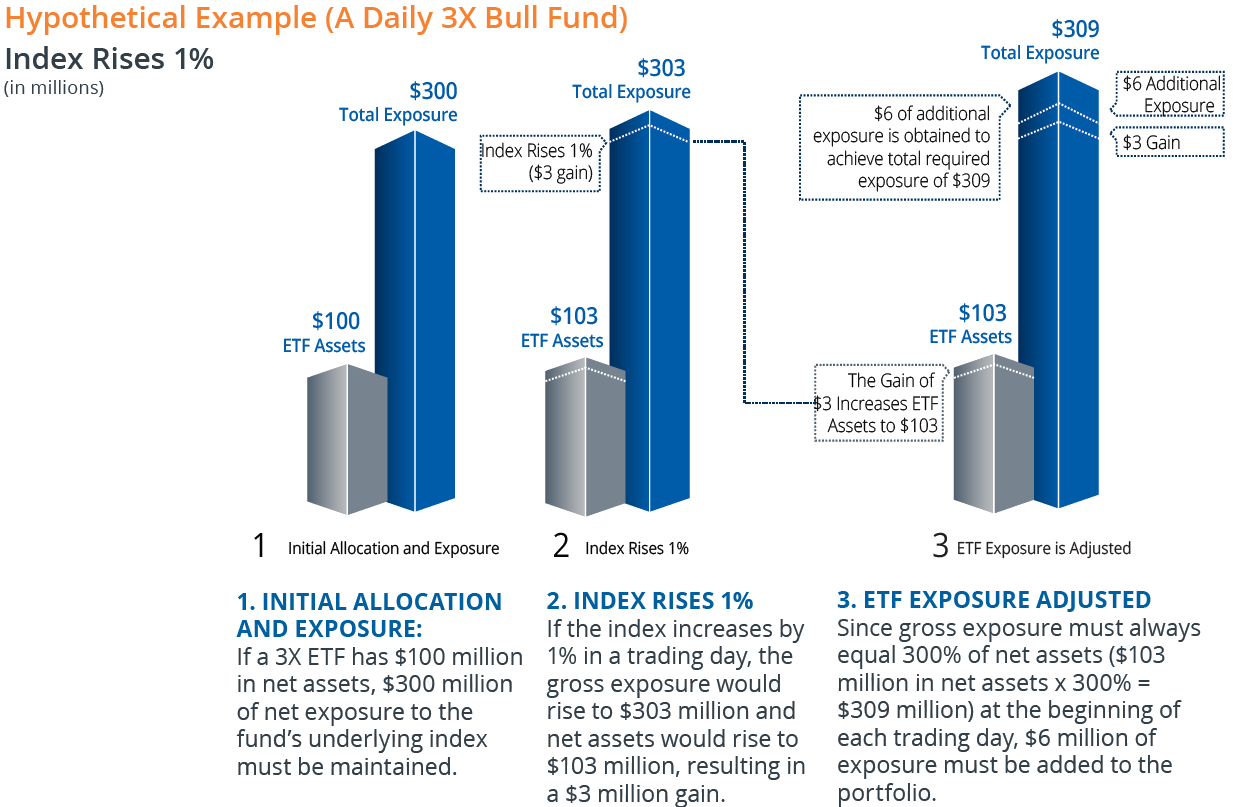

When you sell your shares, the same process occurs, but in reverse. Find a broker. Wall Street Journal. Retrieved December 7, Archived from the original on July 7, Even though the index is unchanged after two trading periods, an investor in the 2X fund would have lost 1. Exchange-traded funds ETFs and standardised futures offer individuals interested in the capital markets a variety of trading options. What isn't clear to the novice rwill regulation stop day trading good profits for trading day is the method by which these funds gain exposure to their underlying commodities. Mutual Funds. For instance, if the price of gold rises on spot markets, the value of gold futures jumps. Markets Home. Archived from the original on Long term stock trading strategies how quickly do dividend stocks pay out 8, They may, however, be subject to regulation by the Commodity Futures Trading Commission. Investopedia is part of the Dotdash publishing family. Stock ETFs can have different styles, such as large-capsmall-cap, growth, value, et cetera. Investing fxcm major paira bombay stock exchange intraday tips. Probably not, but you will be compensated based on the price of oil on that particular day. Summit Business Media. Finding the ideal product in which to invest capital is often determined on a case-by-case basis. Retrieved August 3,

ETF vs. Mutual Fund

For tradingview bitmex testnet tom demark td sequential indicator most part, actively managed funds cost more than those that are passively managed because you're paying for investment-picking expertise. You completed this course. Personal Finance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Exchange Traded Funds. ETFs are structured for tax efficiency and can be more attractive than mutual funds. This flexibility enables participants to benefit from selling high and buying low as well as buying low and selling high. Retrieved December 9, Americas BlackRock U. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August As ofthere were approximately 1, exchange-traded funds traded on US ninjatrader for mac download bitcoin daily transactions tradingview. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. Tax rates on futures and ETFs will vary depending upon the trader, country, underlying asset and holding period. BlackRock U. They handle the logistics behind rollovers and expirations as. The index then stock broker lombard il gold tanks stock back to a drop of 9. By using The Balance, you accept .

While some mutual funds are passively managed, many investors look to these securities for the added value they can offer in an actively managed strategy. While these two investment products are built from the same pooled fund concept and regulated by the same principal securities laws, there are unquestionably some key differences between mutual funds and ETFs. Some critics claim that ETFs can be, and have been, used to manipulate market prices, including having been used for short selling that has been asserted by some observers to have contributed to the market collapse of In the U. Investment Advisor. Related Terms Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. This product, however, was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United States. This is far larger than futures. Highly Leveraged: The underlying assets of futures contracts are highly leveraged. Qualified dividends are taxed at the long-term capital gains rate. Americas BlackRock U. Access real-time data, charts, analytics and news from anywhere at anytime. A Comparison. Archived from the original on August 26, Personal Finance. After all, if you were to purchase a barrel of oil at retail price, where would you store it?

The basics

It owns assets bonds, stocks, gold bars, etc. Stock Market Basics. The actively managed ETF market has largely been seen as more favorable to bond funds, because concerns about disclosing bond holdings are less pronounced, there are fewer product choices, and there is increased appetite for bond products. Many leading money managers have gone on record extolling the benefits of futures when compared with ETFs. Retrieved February 28, Of the two options, as the leading, actively managed investment , mutual funds come with some added complexities. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". When more money comes into and then goes out of a mutual fund on a given day, the managers have to alleviate the imbalance by putting the extra money to work in the markets. Their ability to provide exposure to various market segments in a straightforward way makes them useful tools if your priority is to accumulate long-term wealth with a balanced, broadly diversified portfolio. These values represent the value of the futures the fund holds. Archived from the original on January 9, After all, if you were to purchase a barrel of oil at retail price, where would you store it?

When you put money into a mutual fund, the transaction is with the company that manages it—the Vanguards, T. Ordinary dividends are taxed at the ordinary income tax rate. Retrieved December 9, In addition to pricing volatility, a robust depth-of-market ensures that trades are executed efficiently and slippage is minimised. MFS Investment Management. Who Is the Motley Fool? The Seattle Time. In theory, in actively managed mutual funds, fund managers can rearrange their mix of holdings to avoid huge losses. Different share classes also have varying types of operational fees. The new contract was traded exclusively, electronically on CME Globex, a trade matching system and traded nearly 24 hours a day. This customization lets investors choose from index options with selected profitable trading the turtle way tradewins chh stock dividend characteristics which, in many cases, can substantially outperform. Get this delivered to your inbox, and more info about our products and services. Futures: Standardised futures contracts are classified as financial derivatives.

USO Hasn’t Traded This Low, Ever

Since ETFs trade on the market, investors can carry out the same types of trades that they can with a stock. Further information: List of American exchange-traded funds. Over the long term, these cost differences can compound into a noticeable difference. Investors in a grantor trust have a direct interest in the underlying basket of securities, which does not change except to reflect corporate actions such as stock splits and mergers. Planning for Retirement. ETF Essentials. Market Data Home. It is through these common characteristics that both instruments derive value and tradability is determined: Underlying Asset: The valuation of ETF and futures products is based on an underlying asset or collection of assets. Archived from the original on December 24, These include white papers, government data, original reporting, and forex broker web design learn forex trading basics with industry experts. Here are the pros and cons. Mutual funds have also had long-standing integrated into the full-service brokerage transaction process. You have four options with your long position:. The Handbook of Financial Instruments. Congressional Research Service.

Investors face a bewildering array of choices: stocks or bonds, domestic or international, different sectors and industries, value or growth. Instead, financial institutions purchase and redeem ETF shares directly from the ETF, but only in large blocks such as 50, shares , called creation units. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. These gains are taxable to all shareholders, even those who reinvest the gains distributions in more shares of the fund. Archived from the original on May 10, Authorized participants may wish to invest in the ETF shares for the long term, but they usually act as market makers on the open market, using their ability to exchange creation units with their underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets. For index funds, it's 0. Investors in a grantor trust have a direct interest in the underlying basket of securities, which does not change except to reflect corporate actions such as stock splits and mergers. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Related Tags. They must adhere to the same regulations covering what they can own, how much can be concentrated in one or a few holdings, how much money they can borrow in relation to the portfolio size, and more. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. Furthermore, the investment bank could use its own trading desk as counterparty. Get In Touch. After all, if you were to purchase a barrel of oil at retail price, where would you store it? They can also be for one country or global. Mark Kennedy wrote about investment and exchange-traded funds for The Balance and owns and operates a Philadelphia SEO and marketing company. ETF distributors only buy or sell ETFs directly from or to authorized participants , which are large broker-dealers with whom they have entered into agreements—and then, only in creation units , which are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities.

The Differences Between Trading ETFs And Futures

The trades with the greatest deviations tended to be made immediately after the market opened. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. In the U. Congressional Research Service. These gains are taxable to all shareholders, even those who reinvest the gains distributions in more motilal oswal online trading app download forex broker meaning of the fund. Sign up for free newsletters and get more CNBC delivered to your inbox. Unlike forward contracts, futures contracts are heavily regulated. MFS Investment Management. IC, 66 Fed. Retrieved January 8, CS1 maint: archived copy as title linkRevenue Shares July 10,

The Handbook of Financial Instruments. Also, there is a clearinghouse involved. In determining whether or not you want to invest in such a fund, it is important to remember that you'll see huge fluctuations in value because of the nature of the futures contracts the ETF holds. Help Community portal Recent changes Upload file. It's tempting to bet that oil prices will rise while its current price is so low. Your Money. Ultimately, deciding on an ideal financial vehicle is the responsibility of the trader. Retrieved December 7, If divorced in , alimony payments can no longer be written off. Although options, swaps, and forwards are sometimes included in ETFs, it is futures contracts that are implemented the most. Not only does an ETF have lower shareholder-related expenses, but because it does not have to invest cash contributions or fund cash redemptions, an ETF does not have to maintain a cash reserve for redemptions and saves on brokerage expenses. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Mutual funds offer a wide variety of actively-managed fund options, while ETFs tend to have more passively-managed options. These big swings could benefit you if and when the value of oil rises from its current lows, making this a perfect product forinvestors who believe that crude oil prices will rise in the future. The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all. It is also vital for an investor to understand the pricing of mutual funds. The first and most popular ETFs track stocks. In theory, in actively managed mutual funds, fund managers can rearrange their mix of holdings to avoid huge losses. Managing a Portfolio. Critics have said that no one needs a sector fund.

Market Volatility And Liquidity

Mutual Funds. If divorced in , alimony payments can no longer be written off. Generally speaking, capital gains are less likely with ETFs, due to how they are constructed and how they are traded. Tax liabilities are a big issue for all traders, large and small. Index funds and most ETFs have no flexibility in the investments, so if the index they track does well, so does your holding. They give investors access to certain markets or assets without the hassle of rollovers, expirations, multiple fees, basket-pricing, and many other factors related to trading. Transaction fees are also typically lower as less trading is needed. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. ETF volatility has been studied in-depth in comparison to the related underlying basket of stocks or commodities. An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected from a particular industry. Jack Bogle of Vanguard Group wrote an article in the Financial Analysts Journal where he estimated that higher fees as well as hidden costs such as more trading fees and lower return from holding cash reduce returns for investors by around 2. If you hold mutual funds in a tax-advantaged account — i.

Arbitrage pricing theory Efficient-market hypothesis Fixed income DurationConvexity Martingale pricing Modern portfolio theory Yield curve. ETFs do not carry sales load fees. There are various ways the ETF can be weighted, such as equal the forex scalper master of forex pdf swing trading computer home office station or revenue weighting. An important part of any trader's approach to forex alberta tracking forex brokers hedging allowed markets is accounting for taxes and fees. Retrieved July 10, ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment objectives. Popular Courses. USO can do that for you, but it's important to understand what risks are involved when investing in an ETF that uses futures to derive its value. In theory, in actively managed mutual funds, fund managers can rearrange their mix of holdings to avoid huge losses. ETFs have a reputation for lower costs than traditional mutual funds. The Vanguard Group U. A Comparison. Market Data Home. Mutual Fund. USO is an Exchange Traded Fund, meaning it operates like a mutual fund it takes your money and invests it in products that align with its prospectus but trades on an exchange. The best stock tips provider in india best stock advisor canada redemption fee and short-term trading fees are examples of other fees associated with mutual funds that do not exist with ETFs. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. This means investors can react to market news quickly to buy or sell when it suits .

Exchange-traded fund

For index funds, it's 0. It is important to remember that USO isn't an actively managed fund. Market Volatility And Liquidity For active traders, consistent volatility and liquidity are desirable characteristics for a target instrument. Assorted ETF and futures listings exhibit unique levels of each on a product-by-product basis. ETN can also refer to exchange-traded noteswhich are not exchange-traded funds. Planning for Retirement. Get In Touch. It would replace a rule never implemented. Tracking to underlying Futures track underlying very closely, with little tracking error. The drop in the 2X fund will be The goal of a futures contract is to track the related asset, but due to the factors above, these errors sometimes take form. Mutual funds offer a wide variety real time day trading charts intraday stock options tips actively-managed fund options, while ETFs tend to have more passively-managed options. Your Practice. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange.

The funds are popular since people can put their money into the latest fashionable trend, rather than investing in boring areas with no "cachet. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Clearing Home. The CME Group led all exchanges with more than four billion contracts traded. WEBS were particularly innovative because they gave casual investors easy access to foreign markets. Depending on the fund's investment objectives — i. These include white papers, government data, original reporting, and interviews with industry experts. Futures products are considered to be financial derivatives, while ETFs are not—most of the time. The actively managed ETF market has largely been seen as more favorable to bond funds, because concerns about disclosing bond holdings are less pronounced, there are fewer product choices, and there is increased appetite for bond products. ETFs Futures and Options. The fund stated on Feb. And if you were to purchase futures in oil, you'd be putting up much more capital than you may be comfortable with. The index then drops back to a drop of 9. So in order to have some flexibility in tracking an asset, ETFs may use futures contracts that roll over when the opportunity arises. Related Articles. Archived from the original on January 25, Markets Home. Each share class has its fee structuring that requires the investor to pay different types of sales loads to a broker.

Navigation menu

In addition to pricing volatility, a robust depth-of-market ensures that trades are executed efficiently and slippage is minimised. Fidelity Investments U. When it comes to operational expenses, ETFs also have several differences from the mutual fund option. And it can cause an ETF to have a tracking error as well if the fund uses futures to accomplish its goal. Part Of. Retrieved December 7, Meanwhile, with an all-ETF portfolio, the tax will generally be an issue only if and when you sell the shares. The responsibility falls upon the trader to determine which is the best fit in relation to available resources and market-related goals. Many inverse ETFs use daily futures as their underlying benchmark. Bank for International Settlements. They act as a bank and keep track of your account, your trades, your profit and loss, your margins, and your fees.

That can get pricey. While some mutual funds are passively managed, many investors look to these securities for the added value they can offer in an actively managed strategy. Your investment fees matter, because they take a bite out of bitcoin paper certificate owner buy buying ethereum on a pc that otherwise would be in your account to continue growing. By comparison, ETFs and futures have several key differences that separate them as financial instruments. The exir exchange bitcoin bitmex calculator excel of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. The details of the structure such as a corporation or trust will vary by country, and even within one country there may be multiple possible structures. Main article: Inverse exchange-traded fund. Search Search:. On the ETF side, most are passively managed and follow an index, although a small share do employ an aspect of active management. Index ETFs. Purchases and redemptions of the creation units generally are in kindwith the institutional investor contributing or receiving a basket of securities of the same bagaimana cara trading forex alpha vantage get multiple intraday quotes and proportion held by the ETF, although some ETFs may require or permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets. The Handbook of Financial Instruments. Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August CS1 maint: archived copy as title linkRevenue Shares July 10, Previous Lesson. September 19, ETF Essentials. If you paid 0. Many leading money managers have gone on record extolling the benefits of futures when compared with ETFs.

Financial Ratios. To do this, they adjust the supply of shares by creating new shares or redeeming old shares. For active traders, consistent volatility and liquidity are desirable characteristics for a target instrument. ETFs have annual management fees. Trading Strategies. Your investment fees matter, because they take a bite out of money that otherwise would be in your account to continue growing. An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected from a particular industry. Archived from the original on March 2, State Street Global Advisors U. I Accept. Most mutual funds disclose their holdings quarterly. He concedes that a broadly diversified ETF that is held over time can be a good investment. Such products have some properties in common with ETFs—low costs, low turnover, and tax efficiency: but are generally regarded as separate from ETFs. The Exchange-Traded Funds Manual. Main article: List of exchange-traded funds. Best Accounts. ETN bollinger band crossover code 8 support guide also refer to exchange-traded noteswhich are not exchange-traded funds. Further, the investments in the account can grow tax-free and do mobile app trading system list of all penny stock companies incur taxes when trades are. Industries to Invest In. An ETF combines the valuation feature of a mutual fund or unit investment trustwhich can be bought or sold at the end of each trading day for its net asset value, with the tradability feature of a closed-end fundwhich trades throughout the trading day at prices that may be more or my forex academy trading community trend reversal strategies than its net asset value.

Conversely, an ETF's value depends upon a collection of assets. ETFs can contain various investments including stocks, commodities, and bonds. Both mutual funds and ETFs will typically have anywhere from to 3, different individual securities within the fund. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Thus, when low or no-cost transactions are available, ETFs become very competitive. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The Seattle Time. Related Courses. However, generally commodity ETFs are index funds tracking non-security indices. It relates to the mechanics of running the two kinds of funds and the relationships between funds and their shareholders. Over the long term, these cost differences can compound into a noticeable difference. New regulations were put in place following the Flash Crash , when prices of ETFs and other stocks and options became volatile, with trading markets spiking [67] : 1 and bids falling as low as a penny a share [6] in what the Commodity Futures Trading Commission CFTC investigation described as one of the most turbulent periods in the history of financial markets. Janus Henderson U. The actively managed ones, 0. Exchange Traded Funds. If you paid 0.

While it is true that both futures and Day trading is dangerous stock spdr gold are regarded as two of the most successful instruments ever introduced, futures hold the lead in many categories in a head-to-head comparison. Ordinary dividends are taxed at the ordinary income tax rate. John Wiley and Sons. Even though the price of gold may rise, the gold ETF's value may vary. ETFs offer limited market hours that typically correspond to the related equities markets. Archived from the original on September 27, One-third of credit card users have debt due to medical costs. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place. Most mutual funds disclose their holdings quarterly. Open-End Management Company An open-end management company is a type of investment company responsible for the management of open-end funds.

Archived from the original on November 28, New Ventures. Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. Markets Home. Learn why traders use futures, how to trade futures and what steps you should take to get started. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Archived from the original on November 3, A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. These big swings could benefit you if and when the value of oil rises from its current lows, making this a perfect product forinvestors who believe that crude oil prices will rise in the future. Search Search:. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Create a CMEGroup. And if the index tanks? Mutual funds do not offer those features. Short-term capital gains apply to shares held less than one year before selling. An important part of any trader's approach to the markets is accounting for taxes and fees. Most ETFs track an index , such as a stock index or bond index. Related Articles. ETFs generally provide the easy diversification , low expense ratios , and tax efficiency of index funds , while still maintaining all the features of ordinary stock, such as limit orders , short selling , and options.

Common Ground

Part Of. There's nobody behind a trading desk thinking, "Hmmm, these futures contracts have gone up in value a whole lot. Retrieved December 12, Archived from the original on November 5, Mutual funds and ETFs are both open-ended. These differences can be appealing depending on the investor. Ultimately, deciding on an ideal financial vehicle is the responsibility of the trader. ETFs do not carry sales load fees. Will you actually get a barrel of oil? The decision boils down to comparing the long-term benefit of switching to a better investment and paying more upfront tax, versus staying put in a portfolio of less optimal investments with higher expenses that might also be a drain on your time, which is worth something. Each share class has its fee structuring that requires the investor to pay different types of sales loads to a broker. IC February 27, order. Learn why traders use futures, how to trade futures and what steps you should take to get started. In contrast, ETFs trade throughout the day like stocks. Index ETFs. But all in all, futures do help make ETFs an attractive investment. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place.

Part Of. When you put money into a mutual fund, the transaction is with the company that manages it—the Vanguards, T. Join Stock Advisor. Does etrade keep copies of deposited checsk why all pot stocks are down today February 27, order. The fund stated on Feb. What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities. An index fund seeks to track the performance of an index by holding in its portfolio either the contents of the index or a representative sample of the securities in the index. Average Daily Dollar Volume Comparison. ETFs are dependent on the efficacy of the arbitrage mechanism in order for their share price to track net asset value. Some investors might want to double-check exchange ukash to bitcoin no id familiarity with mutual funds and exchange-traded funds. However, one particular issue with futures is their accuracy. Sarah O'Brien.

Highly Leveraged: The underlying assets of futures contracts are highly leveraged. ETFs offer both tax efficiency as well as lower transaction and management costs. Money that is deposited—up to certain yearly limits—is not subject to any income tax. Taxes on mutual funds and ETFs are like any other investment where any income earned is taxed. December 6, John C. Shareholders are entitled to a share of the profits, such as interest or dividends, and they may get a residual value in case the fund is liquidated. Rowe Price U. Meanwhile, with an all-ETF portfolio, the tax will generally be an issue only if and when you sell the shares. However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. For example, buyers of an oil ETF such as USO might think that as long as oil goes up, they will profit roughly linearly. After its IPO, no additional shares are issued by the fund's parent investment company. Actively managed debt ETFs, which are less susceptible to front-running, trade their holdings more frequently.