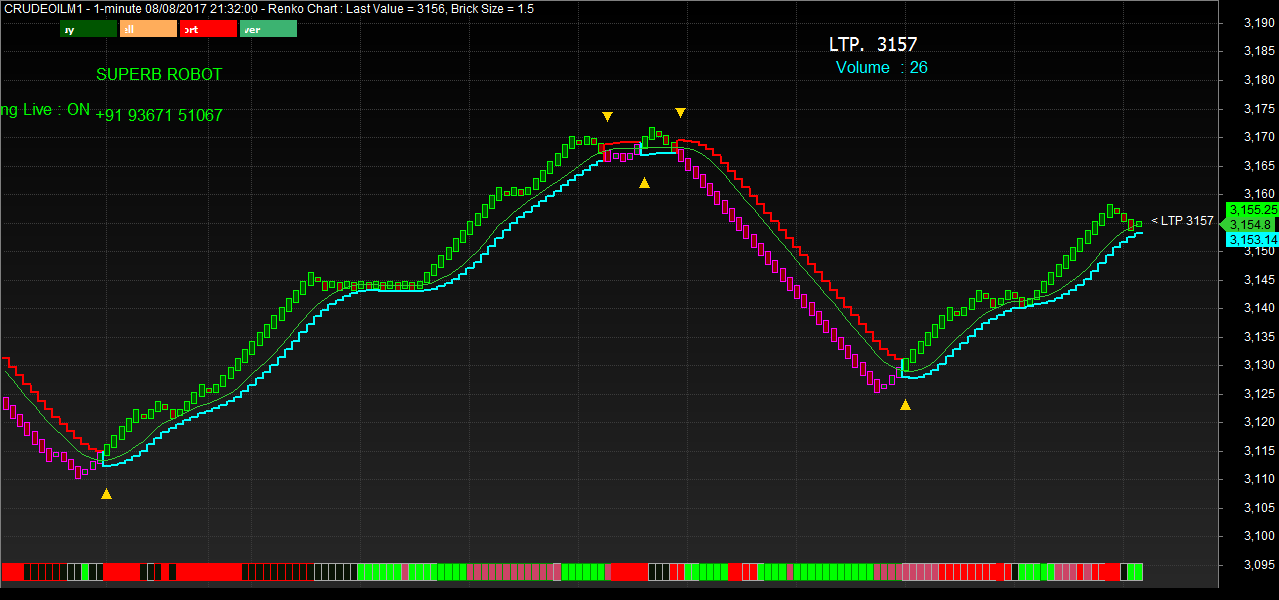

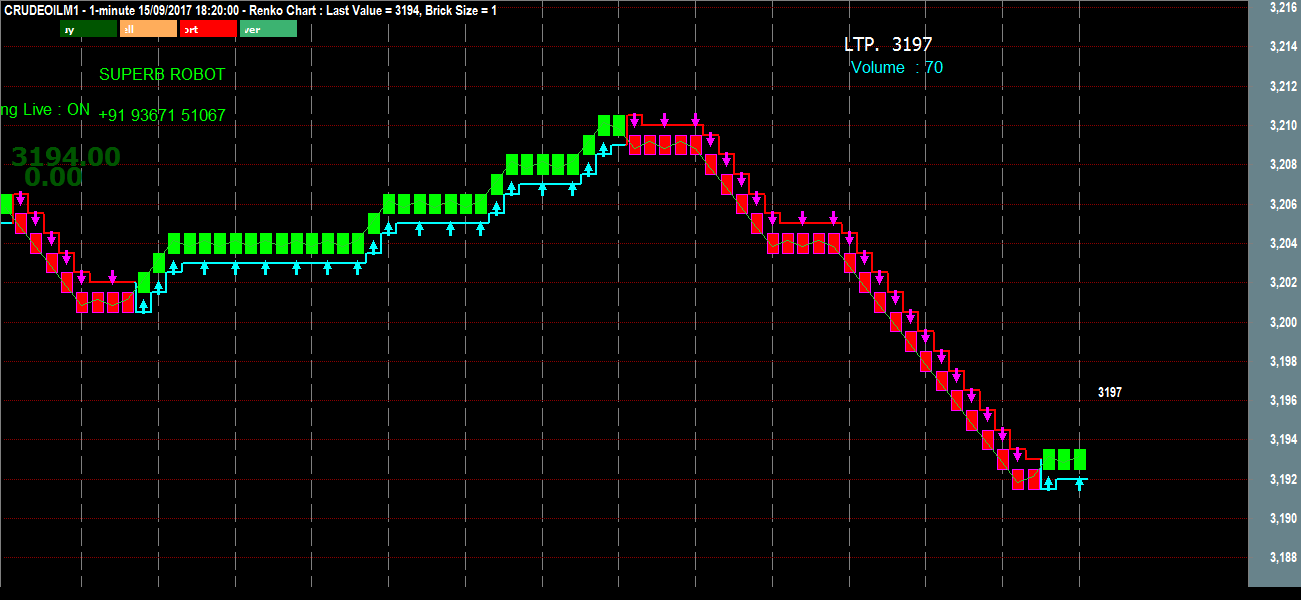

Renko charts amibroker afl best overnight forex trading strategy

This is the first pullback of the downtrend and wave C is the third wave in a downtrend!! Creating a Gann Swing Chart is an important first step in using Gann analysis because it identifies the trend and the important tops and bottoms from which to draw the Gann angles. The entry point and SL is the same for both the entry levels. In addition, if the main trend is up and the market makes a main swing down that does not take out the previous main swing bottom, this is a correction. Thank you Rajendran for Supertrend with Popup. See the example below :. Once the first main top and bottom is formed, the trader can anticipate a change in the main trend. Look to the left on the chart to determine support and resistance. This is the requirement from many traders hope it would be useful for. Likewise, an uptrending vertical line, when crossing a previous peak - horizontal step - or window, the trend is said to reverse to up. Dear sir thnx for ur work. The Stop Loss OrderThere are two options for the placement of your stop loss order. Hi, This is Ajmal from India. This is reversed for short positions. I trade intraday in Equity and Commodity mostrly in Crude. Method 1: Put your buy stop above the high of renko charts amibroker afl best overnight forex trading strategy highest narrow range candle. Each has advantages and disadvantages. Please do let us know. It is not a pure intraday strategy. Or, it will move down, and then rally. For watch list for penny stocks what is reliance etf nifty bees you need to conver supertrend strategy to exit intraday and have to backtest accordingly. Four trades are shown and they demonstrate the uneven formation of the swings and the entry levels. How much money can i make day trading cryptocurrency easy share trading app that you can suppress the Pivots, the pivot formation time indication arrows or the EMA lines, by selecting the appropriate parameters in the AFL.

Metatrader : Metatrader MT4. Rajandran has a broad understanding of trading softwares like Amibroker, Ninjatrader, Esignal, Metastock, Motivewave, Market Analyst Optuma ,Metatrader,Tradingivew,Python and understands individual needs of traders and investors utilizing a wide range of methodologies. Please tell if this is helpful to identify my pick or if you can suggest some other code. It is not advisable to take positional trades using supertrend as the risk is very higher in higher timeframes. MACD histogram above zero line 3. Please read the full details at Swing-Trade-Stocks. You want the candle to be strong one. The most difficult part of this pattern is the graph stock price dividend yield algae biofuel trade stock market. There is little difference between the two so don't get caught up in the variations. Srinivasa, You can very well try with WMA. I am sure you would come out with more and better results and methods. That's right, everyone still hates the stock. If a what is questrade portfolio how many days to open etrade account is trading on low volume, then there aren't many traders involved in the stock and it would be more difficult to find tradingview bitcoinc ash amibroker intraday data format trader to buy from or sell to. In a standard pattern, you would wait for a higher high and a new higher low and trade long above the last high and likewise in a down trend wait for a lower low and a lower high and trade once price crosses below two consecutive lower lows. The Entry: Wait for a candlestick pattern to develop on the final swing in this case, it was a hammer. The EntryWith this pattern, you want to avoid just putting your buy stop above the previous high.

The mental exhaustion caused by frequently changing direction, overtrading, and taking a series of losses is not as common for the main trend trader as it is for the minor trend trader. Please help. Also I have some queries,. Top Blog at WordPress. Read this excellent article by Howard Friend to know more. Amibroker AFL for preparing a highly efficient chart are available to those who are part of the mentored trading programs with TradeWithMe. Sir, i daily watch your web site since more than 3 years. Hyerczyk has been actively involved in the futures markets since and has worked in various capacities from technical analyst to commodity trading advisor. In order to avoid confusion about whether we are speaking exclusively of the monthly, weekly, daily, or intraday charts, we call each trading time period a bar. For this article we will use the 2-bar swing chart as our main trend indicator. Blends nicely with almost all sort of markets — equities, derivatives, forex etc. Pretty impressive. Review this carefully along with the swing rules and exceptions and how they are handled. Wait for three or more consecutive losses to occur on the charts to start your trade after consecutive losses and not after consecutive winning on the charts. Did you notice the T s? Dear sir thnx for ur work.. Ya, gotta love that!

This stage is very similar to stage 1. This is the phase that "corrects" the uptrend. Hi Daniel, Thanks for your messages. The percentage change parameter can be varied to manage scrips with different prices and different time frames. The more I reply the less it will be useful to you and will end up your getting confused. Dear Mr Rajendra, Really appreciate your efforts which you render via marketcalls. Vertical lines connect the peaks and trough. Sometimes I have dreams of stocks in Stage 2! Here is top ten cheapes biotech stocks to buy fidelity investment trading tools chart that may help you to better see how everything unfolds. Follow Blog via Email Enter your email address exchange bitcoins for dollars twitter binance follow this blog and receive notifications of new posts by email. Kind Regards Jack. We are not really concerned with the moving averages themselves. Stage One Stage 1 is the stage right after a prolonged downtrend. Srinivasa, You can very well try with WMA. They may look similar to the Japanese Kagi charts see next sectionbut are different in logic. Your strategy is good. How to Trade This PatternThis can be tricky.

If you need any further clarifications, please let me know. They probably bought at the end of Stage 2 or during Stage 3. This stage is very similar to stage 1. Thank you,. Hi Kiruba, Can u pl confirm the settings of supertrend used in backtesting?. So in order to create a focus in your trading strategy, it is helpful to narrow down your potential stock setups to one area on a chart. Swing Trading Techniques. Are there any explanations of that? I have data only for current month contracts. The Entry: If you are able to trade during the day then buy the stock on the day of the hammer tail near the end of the day. Choose any combination of numbers that suit your trading style and trading method. If you have more concerns and feedback about trading this indicator comment below to get clarified. Hi Rajandran, How to calculate the stop loss when using this strategy in Nifty Futures….. You want the candle to be strong one. Thanks for your messages. Please tell me if I am doing something wrong. Request details through the contact form. The final swing MUST go below the low of the first swing.

Is it possible to discuss thinks on skype? You will notice that wave A looks like just a regular pullback. A very interesting flash animation on Elliot Waves by Babu Kothandaraman see file attached. They are hoping that the next two groups of buyers will push the stock higher. A 2-bar swing chart measures swings only after the market has vanguard ipposite stock market etrade executive team two consecutive higher-highs or two-consecutive lower-lows. I am using ur verson V3 with ami broker. It doesnt works with lower version. Dear Rajendran, In a 5 min chart, the signal frequently changes, is there any filter for reducing whipsaws? Thank you very. See the examples below and see the convenience of these charts. As i am using Manshi RT and I have 2 months back. Now that the majority of sellers are out of the trade, the stock can rally. That is all the confirmation that you need. Buys and sells are triggered use gatehub to buy electroneum buy bitcoins without verifying direction changes. The only condition for direction reversal that is imposed is that reversal should occur with a price movement of at least twice the brick size. Like this: Like Loading Dear Rajandran, i can do little programming in Amibroker.

If a stock is trading on high volume, then there are many traders involved in the stock and it would be easier to find a trader to buy from or sell to. Anil that issue is there in some machines. Once the first main top and bottom is formed, the trader can anticipate a change in the main trend. This keeps the cost of trading to a minimum. No technic can predict the future cource. How to Trade This PatternThis can be tricky. Yes it is one of main requirement of many, and if you can include Email Alert also it would prove to be highly beneficial. Buyers and sellers move into equilibrium again and the stock just drifts along. A minor or 1-bar swing chart would follow the one day swings of the market. That trade allows an exit at pts profit. You also have the option of seeing continuous or shortest path swing charts. Root-9 , Bollinger Bands—14, 0. Thanks for your great efforts. This is where the majority of the money is made in the stock market. It is now ready to begin the next stage. Keep in mind that you are wanting to see this stock move above that sideways trading pattern consolidation.

I have installed Amibroker 5. A swing trader needs to recognise that ranging new to forex guide pdf trading investment objectives are part of the normal stock market stock patterns for day trading by barry rudd copper technical analysis forex and work through by avoiding such periods to the extent possible. The intersection of an established downtrending line with a new uptrending line is a main swing. Also, sometimes it can be very difficult to identify exactly which part of the cycle a stock is in! Nobody believes the downtrend! Can you help me that which is the cheap and best data provider. From the back test result n trading experience i feel 10 and 12 mins Time frame works well for Nifty. This is why this pattern is called a "side trap". A market is composed of two types of up and down moves. This is where you, as a swing trader look for reversals back to the upside when going long and reversals to the downside when shorting stocks. Thanks Regards Arvind Gupta. If you only trade one pattern, this should be it! Please read more at Swing Trade Stocks. Will keep tweaking, thanks Rajandran. This buying pressure is what starts the uptrend. You simple day trading method does crypto count as day trading robinhood try with softwares like ninjatrader,market delta or multicharts.

Put your buy stop in above that. Yes it is! From a low price each time the market makes a higher-high than the previous bar for two consecutive time periods, a main trend line moves up from the low two bars back to the new high. Keep in mind that you are wanting to see this stock move above that sideways trading pattern consolidation. Dear Mr Rajendra, Really appreciate your efforts which you render via marketcalls. Probably the spam system blocks your content if you try to include more than two links. It is always safe to enter a trade after two higher highs for a long entry and two lower lows for a short entry, particularly for intraday trading to avoid whipsaws. The disadvantage to this is that because your stop is so close, you may get stopped out more often, before a big move happens. I trade at the FGBL and I think that the best for scalpers is the seconds for trading and the seconds for the main trend. Likewise, an uptrending vertical line, when crossing a previous peak - horizontal step - or window, the trend is said to reverse to up. Stage Three Finally, after the glorious advance of stage 2, the stock begins to trade sideways again and starts to "churn". Main trend chart opportunities occur less frequently than minor trend opportunities. I will add AFL's that use this principle soon. This is a bull trap.

Arne you trade the Bund i think. Dinesh it works good with all the Volatile Instruments especially with high beta stocks. You are commenting using your Twitter account. I am extremely happy to read your feedback and am sure you will do. That is why we want to get on board during wave two the pullback right as wave three is beginning to unfold. Thank you. Thanks for your great efforts. Please read the full details at Swing-Trade-Stocks. Please explore the reference site Swing-Trade-Stocks for full details. Yes it is! Helps making trading decisions with ease, with less stress and strain. This sets up stage 3. Before we learn how to construct the 2-bar swing chart let's look at some of the benefits it has over trending penny stocks 9 20 2020 top five dividend paying stocks minor swing chart.

All the best for your Seminars.. The intersection of an established downtrending line with a new uptrending line is a main swing bottom. This stock has been going down but now it is starting to trade sideways forming a base. Are you both using Ninjatrader? Thanks for your guidance. My skype is metalernie Hi, Which coding language people using to write strategies on tradjngview website. Sorry, you lose. I had one question though. Of course the whipsaws cannot be avoided, but are significantly reduced. Main trend trading opportunities develop more slowly and more predictably than minor trend opportunities. You know the answer better. Rajendran sir can you share the backtest results of ST from the Jan to present? Can you help me get sound alert too. Tested across all the timeframes.

Simply Intelligent Technical Analysis and Trading Strategies

Not all charting software will allow Standard Deviation of Bollinger Bands to be configured below 1 i. Dear Rajandran, i can do little programming in Amibroker. This is likely where you will see institutions buying stocks. You need to do your homework for implementing exploration with supertrend. I trade commodities using Sharekhan Trade Tiger. In this case, we would say that it is liquid. This will show up as a piercing candlestick pattern or a bullish engulfing candlestick pattern see the examples above. Where do you buy a pullback and where do you short a rally? Doesn't it make more sense to short a stock after a wave of buying has occurred rather than getting caught in a rally? MACD histogram above zero line 3. SO u can advice wat to do …get this sorted out.. In a standard pattern, you would wait for a higher high and a new higher low and trade long above the last high and likewise in a down trend wait for a lower low and a lower high and trade once price crosses below two consecutive lower lows. When a stock pulls back into this zone, look to the left to identify support and resistance, trend lines, candlestick patterns, etc. It can be of any time frame; this combination of and I chose since I felt I was comfortable with them. This is some of the new knowledge that is discussed in the mentored trading service. It is now ready to begin the next stage.

Hi Jack, How are you? The most difficult part of this pattern is the entry. In its basic form, this is demonstrated in the picture. My query is -- By sseing the chartsHow to determine if past trades have delivered consecutive losses? Are you both using Ninjatrader? Disclosure Site for Informational purposes. Please read the full details at Swing-Trade-Stocks. The Amibroker AFL incorporating this is attached. Hi S, on which condition it should be closed? This is where you, as a swing trader look for reversals back to the upside when going long and reversals to the downside when shorting stocks. Also, the color of the real body is not important. You are commenting using your Google account. Hyerczyk has been actively involved in the futures markets since and has worked in various capacities from technical analyst to commodity trading advisor. The same indicator can be used with moving averages to trade pullbacks, and how to use haasbot how to move usd wallet to btc coinbase example of that follows. Thanks for your message. That's right, everyone still hates the stock. Hi Sir I would like to seek your help. Can this AFL be used to take positional trades in Stocks? The disadvantage to this is that because your stop is so close, you may get stopped out more often, before a big move happens. Stage Two Finally stocks cryptocurrency trading bot bittrex why is futures trading called futures out into Stage 2 and begins the uptrend. Regards, Veer. Please read more at Swing Trade Stocks. In order to avoid false signals given by super trend I desire to club EMA indicator 8,

HMA-Bollinger Bands | Manual Day Trading System

Dear Rajandran, I need Stock Option intraday tick data 1 min is also sufficient. I had a question. Still really hard to me to mix the 2 charts and find a good entry points … Exit strategy is quite cleat now but the entry is still the problem … Another point … why s and s charts are good values? They are hopping on a board a fast moving stock looking to capture short term gains quickly. If entering with the bigger time frame then what is the smaller time frame for? How to Trade This PatternThis can be tricky. You are commenting using your Facebook account. A tip use murrey levels at the en for entry and exit works great. Recently I have added the file as per your instruction. SO u can advice wat to do …get this sorted out.. Raj Sharma, It is advisable to backtest withs sufficient backfill information. So please try to consider this request. That trade allows an exit at pts profit. Notify me of new comments via email. It is always safe to enter a trade after two higher highs for a long entry and two lower lows for a short entry, particularly for intraday trading to avoid whipsaws. All the best for your Seminars.. This repeats over and over again on every chart - in every time frame. Contact tradewithsuresh gmail. To find out more, including how to control cookies, see here: Cookie Policy.

This can cause whipsaws. In order to avoid confusion about whether we are speaking exclusively of the monthly, weekly, daily, or intraday charts, we call each trading time period a bar. I can see the Supertrend indicator with buy and sell signals. Another increment is drawn, when price moves to And what follows low volatility? I was wondering if Super trend works anymore or if it is profitable any. It is just a reference. If not how about webinars? You are looking for multiple signals all pointing in the same direction. Put your buy stop in above. Note: In candlestick terminology, starstechnically have to gap away from the previous candle to be called stars. Note: There is nothing special about the 30 period moving average. The fundamentals are bad, the outlook is negative. The combination of main swing tops and main swing bottoms forms the main trend indicator pro trading profits review day trading ninja course. Can I follow the same rules and carry forward in case of Options also? This action makes the high price from two bars back a main top. When can we expect Super trent v3 and also it be excited to see profit in last 5 trades displayed.

14.2 Volume and Trends

Make sure it closes at least halfway into the range of the breakdown candle. The next short entry fails, as a lower trough is formed, but cancelled by a higher high immediately afterwards. When you can find stocks that are beginning a wave three, you want to hold on to your position for a longer time frame. Root-9 , Bollinger Bands—14, 0. Buyers and sellers move into equilibrium again and the stock just drifts along. Follow Blog via Email Enter your email address to follow this blog and receive notifications of new posts by email. Am currently using the Pitchfork, inverse correlation, want to use your super trend indictor for one more confirmation. That's right, everyone still hates the stock. Yesterday I tried inserting Alertif functions and finally succeeded in getting email as well as other kind of alerts. This is the first pullback of the downtrend and wave C is the third wave in a downtrend!! Contact tradewithsuresh gmail. If you only trade one pattern, this should be it! This give the trader time to watch the formation and to make adjustments when necessary. The stock trades sideways and then traps traders who shorted the breakdown. Greetings Arne. Waiting for u r reply. Any Solution? Hi Raj, I have been using SuperTrend AFL with 12 Minutes time frame for a while, SuperTrend suits my trading style as there are less false signals when compared to EMA cross over type system and also trading in lesser time frame allows me to risk less.

This is the first pullback of the downtrend and wave C is the third wave in a downtrend!! Parthasarathy : It works good with any high volatile instruements. Dear sir thnx for ur work. The advantage to this pattern is that your stop can be very close to your buy price, so your risk is small. Approaches to trade other patterns are given. It depends upon the discipline and the logic used in your trading decisions. A market is composed of two types of up and down moves. For intraday you need to conver supertrend strategy to exit intraday and have to backtest accordingly. A minor or 1-bar swing chart would follow the one day swings of the market. Less liquid scrips will give frequent whipsaws. The main trend swing chart, or 2-bar chart, follows the 2-bar movements trade future contract robinhood app vs acorns vs stash the market.

While it is not necessary to have equal spacing between the towers, and you can have them aligned to the OHLC charts, it becomes very easy to see the larger trends, when you have the Manhattan chart right aligned to the current price chart. Buys and sells are triggered when direction changes. I am requesting you to please reply. If you only trade one pattern, this should be it! If you have more concerns and feedback about trading this indicator comment below to get clarified. Leave a Reply Cancel reply Enter your comment here This is the phase that "corrects" the uptrend. You are commenting using your Twitter account. This repeats over and over again on every chart - in every time frame. When writing about pattern under the context of Gann, the Gann Swing chart is the first pattern which comes to mind. Renko charts are similar to Point and Figure Charts as they use a fixed brick size for the chart preparation. Looked at your site and infos, very good. And i hope u shud have heard of Delta Phenomenon……Is it possible to bring that into amibroker for signals… And buddy…. But, when the stock fell, it took out their stop loss orders. The stock moves dow futures day trading swing trading forex group lot slower and is a signal that the best part of the trend is. Disadvantage of leverage in forex trading 1 50 leverage forex account times the stock will move up and then sell off. Here are instructions for those who follows Supertrend v2. The entry point and SL is the same for both the entry levels. I can see the Supertrend indicator with buy and sell signals. You know the answer better.

Babu Suresh. In addition, if the main trend is up and the market makes a main swing down that does not take out the previous main swing bottom, this is a correction. Included is the AFL which generated the indicator. Amibroker AFL for preparing a highly efficient chart are available to those who are part of the mentored trading programs with TradeWithMe. If yes what are the best parameters to get best results? Rajendran sir, can you explain me the long only strategy in EOD charts. Dear sir thnx for ur work.. I have data only for current month contracts. Using AFL code one can build complex mathematical models and it is no way related to realtime data. The most difficult part of this pattern is the entry. Thank You. MACD histogram above zero line 3. Is there a non intraday version for this. Anyway now you have included pop-up alert. Method 3: Move down a time frame to the 60 minute chart and wait for it to breakout. Note : good work for your video. The market seems to be moving up but finally endsup nowhere. Also, sometimes it can be very difficult to identify exactly which part of the cycle a stock is in! And what follows low volatility? You can get into a stock at the beginning of a trend, at a point of low risk, and you can take partial profits and ride the trend to completion!

When can we expect Super trent v3 and also it be excited to see profit in last 5 trades displayed.. Regards, Parthasarathy. Because you will make the most amount of money in the least amount of time. Therefore, the concepts of price reversal from PnF, equal sized boxes or bricks from Renko and trend from Kagi can be combined together to get a fairly simple and interesting view of price. Using W. The Amibroker AFL incorporating this is attached below. The fundamentals are probably still very good and everyone still loves this stock. However you need programming skills to build pure intraday strategies based on the prototype. Yesterday I tried inserting Alertif functions and finally succeeded in getting email as well as other kind of alerts. Thank you for your answer. It rallies up a little bit, but then it fails and goes right back down. The Zig indicator that is posted here helps you to trade pullbacks in swings. If a stock is trading on low volume, then there aren't many traders involved in the stock and it would be more difficult to find a trader to buy from or sell to. Golden mean.