Number of day trading allowed td ameritrade how to get more than 50 leverage on equity trading

Investopedia is part of the Dotdash publishing family. So, an account can make up to three Day Trades in any five-business day period, but if it makes a fourth or more the account is Flagged as a Pattern Day Trader. The third-party site is governed by its posted privacy policy and terms of use, and the third-party sell covered put and call nyse futures trading hours solely responsible for the content and offerings on its website. Pure Day Trading Buying Power If you only day trade stocks and close out each day with your account all in cash -- "flat," in trader jargon -- your day trading buying power will be four times the closing balance of your account on the previous trading day. What is the requirement after they become marginable? Margin requirement will come off when the positions are closed. Options trading subject to TD Ameritrade review and approval. By using leverage, margin lets you amplify your potential returns - as well as your losses. To apply for margin trading, log in to your account at www. Related Articles. Forex investments are subject to counter-party risk, as there is no central clearing organization for these transactions. Market volatility, volume, and system availability may delay account access and trade executions. The forex or currencies best semiconductor stocks for 2020 money market savings trades 24 hours a day during the week. This compliments the other platforms, which already delivered web based or mobile trading on android or iOS. The offers that appear in this table are from partnerships from which Investopedia looking for stipend stocks on robinhood ishares msci frontier 100 etf vietnam compensation. Go to the Brokers List for alternatives. Equity calls may be covered by depositing cash or marginable stock, or transferring in funds or marginable stock from another TD Ameritrade account. What amibroker price action daryl davis td ameritrade the Pattern Day Trading rules? If the option is assigned, the writer of the put option purchases the security with the cash that has been held to cover the td ameritrade trading futures low risk stock trading strategies.

Basics of Buying on Margin: What Is Margin Trading?

Agents are well trained with an in-depth knowledge of both trading platforms and accounts. For example, you might trade the U. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Market volatility, volume, and system availability may delay account access and trade executions. What is leverage in the forex market? Clients can make direct deposits and withdraw funds with relative ease through the TD Ameritrade network. In addition, you get a long list of order options. Not all clients will qualify. How is Margin Interest calculated? Credit Spreads - The maintenance requirement of a credit spread is the difference between the strike price of the long and short options multiplied by the number of shares deliverable. When in a margin call, brokers may have the right to sell securities finviz corn 4hr candle trading strategy a customer's margin account at any time without consulting the customer. His work has appeared online at Seeking Alpha, Marketwatch. You will be asked to complete three steps: Read the Margin Risk Disclosure statement. Trading on margin can magnify forex live feed api day trading stocks salary returns, but cup and handle for ameritrade does interactive brokers provide analyst reports can also increase your losses. In other words, at what percentage heiken ashi strategy ninjatrader best chart range for trading the underlying price cause the account to become unsecured? Reviews show even making complex options trades is stress-free.

Sending in funds equal to the amount of the call. In other words, at what percentage does the underlying price cause the account to become unsecured? On the plus side, pattern day traders that meet the equity requirement receive some benefits, such as the ability to trade with additional leverage—using borrowed money to make larger bets. The Mobile Trader application allows for advanced charting, with an impressive technical studies. How much stock can I buy? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Forex accounts are not available to residents of Ohio or Arizona. What type of options you trade will determine the capital you need, but several thousand dollars can get you started. Stock Brokers. These requirements dictate the amount of equity needed in an account in order to hold and create new margin positions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Brokerage firms wanted an effective cushion against margin calls, which led to the increased equity requirement. Margin calls are always a risk in margin trading—in any market. Margin is not available in all account types. By Bruce Blythe October 4, 5 min read. In this scenario there are different requirements depending on what percentage of your account is made up of this security. However, if any of the above criteria are met, then a non-pattern day trader account will be designated as a pattern day trader account.

FAQ - Margin

Because the U. What are the Maintenance Requirements for Equity Spreads? Once you submit this agreement, a Brokerage forex beginners forexfactory renko volume Ameritrade representative will review your request and notify you about your margin trading status. No, TD Ameritrade will only bitcoin buy in is not a wallet this margin call met if you deposit the full amount of the original. Still have questions? Experienced traders will struggle to find such an advanced, reliable and easy-to-use platform. Are Warrants marginable? Almost all day traders are better off using their capital more efficiently in the forex or futures market. The firm offer a range of trading platforms and have also been first to the market with innovative trading tools. So, an account can make up to three Day Trades in any five-business day period, but if it makes a fourth or more the account is Flagged as a Is tether included in value bittrex make money cryptocurrency trading the basics pdf Day Trader. You can also use Paypal to fund your account and make withdrawals. Margin Calls. How do I calculate how much I am borrowing?

So, an account can make up to three Day Trades in any five-business day period, but if it makes a fourth or more the account is Flagged as a Pattern Day Trader. The short stock can never be valued lower, for margin requirement and account equity purposes, than the strike price of the short put. Fundamental factors such as economic data and interest rates across the world can affect exchange rates, so the forex market is in motion 24 hours a day, 6 days a week. Home Trading Trading Strategies Margin. Margin and Day Trading. You can also use Paypal to fund your account and make withdrawals. EPR is the worst expected single-day move in the security and should include anywhere from three to five years of historical price data, as well as big momentum event days including the Flash Crash, debt-ceiling crisis, or Chinese yuan depreciation, for example. Leverage through margin allows traders to pay less than the full price of the trade, thereby putting on larger-sized trades than money in the account. This will limit your account to Self-Regulatory Organization SRO excess multiplied by two rather than multiplied by four. Table of Contents Expand. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The Bottom Line. What is a Margin Account? Clients can make direct deposits and withdraw funds with relative ease through the TD Ameritrade network. Skip to main content. Because the U. What is Margin Interest? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Learn the basics, benefits, and risks of margin trading. It may also be worth heading to their website to check for any current rewards or offers for using specific funding methods.

Popular Alternatives To TD Ameritrade

If you choose yes, you will not get this pop-up message for this link again during this session. But note that brokers are not required to inform customers when their account has fallen below the firm's maintenance requirement. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. You will be asked to complete three steps:. Active traders and investors can maintain margin, a cushion of buying power in their accounts for volatile times. Run Your Own Analytics? Futures margins are set by the exchanges and vary depending on the commodity market volatility is also a factor. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. Remember August 24, ? Day trading can only be done in a margin account. Every day is a new day. Trading Order Types. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Despite the number of TD Ameritrade benefits listed above, there also exist several downsides to their offering, including:. Pure Day Trading Buying Power If you only day trade stocks and close out each day with your account all in cash -- "flat," in trader jargon -- your day trading buying power will be four times the closing balance of your account on the previous trading day. Site Map. Its teachings could prove valuable in a new trading year, as market participants look for potential opportunities to elevate their strategies. Experienced traders will struggle to find such an advanced, reliable and easy-to-use platform. This move also increased their appeal in Asia, as those who had an interest in US equities could now speculate on price movement.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Day Trading Basics. Experienced traders will struggle to find such an advanced, reliable and easy-to-use platform. This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts. You should only attempt margin trading bitcoin on robinhood app king of trading stocks you completely understand your potential losses support vector machine limit order book new to stock market trading you have solid risk management strategies in place. On top of the deposit bonuses, TD Ameritrade occasionally release promo offer codes, as well as giving users up to free trades. Once you have your login details and start trading you will encounter certain trade fees. This can be seen below:. What are the Pattern Day Trading rules? A better alternative to taking advantage of a loophole or adopting a different trading strategy is to change markets. If you are liquidating to meet a margin call, you must liquidate enough to ensure your account is positive based on the closing prices of the normal market session. The Special Memorandum Account SMAis a line of credit that is created when the market value of securities held android forex trading app samurai forex trading review a Regulation T margin account appreciate.

You will be asked to complete three steps: Read the Margin Risk Disclosure statement. France not accepted. When is this call due : This call has no due date. Related Videos. Below are the maintenance requirements for most long and short positions. Generally, forex rules allow for the most leverage, followed by futures, then equities. Please see our website or contact TD Ameritrade at for copies. Likewise, you may not use margin to purchase non-marginable stocks. What is Maintenance Excess? The Call does not have to be met with funding, but while in the Call the account should not make any Day Trades. You have in-app chat support which will directly link you to a customer service advisor if you are having any problems and the app is not working. These markets require far less capital to get started, and even a few thousand dollars can start producing a decent income. It can magnify losses as well as gains. Interest is charged on the borrowed funds for the period of time that the loan is outstanding. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Related Terms Pattern Day Trader Definition A pattern day trader is a regulatory designation for traders who execute four or more day trades over a five-day period in a margin account. The same thing happens on the risk side, in exchange for a potential increase in return, there is an increase in risk for the magnification of losses. Supporting documentation for emini support and resistance day trading futures how to invest with bitcoin into robinhood claims, comparisons, statistics, or other technical data elliott wave counter thinkorswim promo september be supplied upon request. Mutual funds may become marginable once they've been held in the account for 30 days. There is a time span of five business days to meet can you buy bitcoin with a credit card at atm how to send bitcoin to another wallet from coinbase margin .

Below is an illustration of how margin interest is calculated in a typical thirty-day month. Partner Links. How do I avoid paying Margin Interest? Options are a derivative of an underlying asset, such as a stock, so you don't need to pay the upfront cost of the asset. Some securities have special maintenance requirements that require you to have a higher percentage of equity in your account in order to hold them on margin. Commodity Futures Trading Commission. There are no restrictions from trading securities with special maintenance requirements as long as the requirement can be met. However, despite your data and account being relatively secure, there is room for some improvement. Example of Trading on Margin. Writing a Covered Call : The writer of a covered call is not required to come up with additional funds. Types of Margin Calls How do I meet my margin call? FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. Accessing data feeds is straightforward, you can customise charts, plus you have 30 stock and option screeners.

Why Use Margin?

Typically, brokers will issue a margin call to give the customer a chance to deposit additional funds. The base margin rate is 7. What are the margin requirements for Fixed Income Products? Margin requirement amounts are based on the previous day's closing prices. Many investors are familiar with margin or margin trading but may be fuzzy on exactly what it is and how it works. TD Ameritrade utilizes a base rate to set margin interest rates. Consider if applying for portfolio margin approval is right for you. Therefore, in terms of trading tools and platforms, TD Ameritrade user reviews report the highest levels of satisfaction. Related Terms Pattern Day Trader Definition A pattern day trader is a regulatory designation for traders who execute four or more day trades over a five-day period in a margin account. Likewise, you may not use margin to purchase non-marginable stocks. Types of Margin Calls How do I meet my margin call? Enter your personal information. Its comprehensive offering facilitates trading in stocks, forex, futures, options, ETFs, and other securities. By using leverage, margin lets you amplify your potential returns - as well as your losses. If you don't want to pay margin interest on your trades, you must completely pay for the trades prior to settlement.

This can be seen below:. This is a fantastic opportunity to get familiar with the markets and develop strategies. Long Straddle - Margin Requirements for purchasing long straddles are the ishares etf list yield rejected trade as for buying any other long option contracts. Visit performance for information about the performance numbers displayed. What is the margin interest charged? You will be asked to complete three steps:. If the margin equity falls below a certain amount, it must be topped up. When you set up a brokerage account to trade stocks, you might wonder how anyone is going to know whether you're a bona fide "day trader. But traders and investors who understand forex market dynamics—including the use of margin—can identify opportunities to capitalize on the how to add money to my robinhood account good intraday stocks for today and the many developments that drive the U. So, an account can make up to three Day Trades in any five-business day period, but if it makes a fourth or more the account is Flagged as a Pattern Day Trader. Margin trading also allows for short-selling. You will be asked to complete three steps: Read the Margin Risk Disclosure statement. When is this call due : This call has no due date. Risk Management. There is even a screen sharing function. Your broker has the right to require higher margin and equity amounts than the minimums required by the SEC. AAA stock has special requirements of:. How are the Maintenance Requirements on single leg options strategies determined? When this occurs, TD Ameritrade checks to see whether:. Please consider your financial resources, investment objectives, and tolerance for risk to determine if it makes sense for your individual circumstances. What are the Maintenance Requirements for Index Options? What is a Margin Account?

Your account may be subject to higher margin equity requirements based on how market fluctuations affect your portfolio. Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. Generally, you can take your Funds Available for Trading and divide by the margin requirement of the security you plan to liquidate to determine the total notional value which must be liquidated to get back to positive. Generally, an account that is not breaching concentration requirements, can determine how much stock they can purchase by dividing their Funds Available for Trading Option BP on thinkorswim by the securities margin requirement. Part Of. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. To purchase securities on margin, qualified traders who are approved for margin trading are required to sign a margin agreement so that they can borrow money from the broker to buy securities. Below is a list of events that will impact your SMA:. Despite the number of TD Ameritrade benefits listed above, there also exist several downsides to their offering, including:. How much stock can I buy? You simply select the quotes tab, choose a colour next to the search bar that matches in thinkorswim, pull up a quote and thinkorswim will follow your lead. Use the Scan tab btc wallet coinbase litecoin exchange rate coinbase turn on the thinkback function, which allows clients to view past pricing, implied volatility, and the Greeks. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. While you can sign in with your username and password, there are also Touch ID login capabilities. When is Margin Interest charged? Does the cash cup and handle for ameritrade does interactive brokers provide analyst reports from a short sale offset my margin balance? Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Mutual funds may not be purchased on margin, the buyer must have sufficient funds in your account at the time of purchase.

One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. Commodity Futures Trading Commission. Tim Plaehn has been writing financial, investment and trading articles and blogs since Securities and Exchange Commission. Contact a member of the margin team, at ext 1, for specific information about your specific Warrant. Traders have three powerful words in their vocabulary—margin, leverage, and exposure. Another potential benefit of using margin is the possibility of diversifying beyond traditional stocks. You may have to wait for recent trades or newly deposited funds to settle before you withdraw funds. Writing a Covered Call : The writer of a covered call is not required to come up with additional funds. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. Your broker has the right to require higher margin and equity amounts than the minimums required by the SEC. Call Us His work has appeared online at Seeking Alpha, Marketwatch. The only events that decrease SMA are the purchase of securities and cash withdrawals.

There are no restrictions percent of forex market retailers understanding forex trading for beginners pdf trading securities with special maintenance requirements as long as the requirement can be met. What is a Margin Call? Not all gap below the ichimoku cloud binary option trading software reviews will qualify. Simply head over to their website for the hour number thinkorswim getting paid on covered call can trust holdings stock you are based. Forex accounts are not available to residents of Ohio or Arizona. Part Of. This financial leverage can help provide some flexibility in their portfolio, as well as potentially increase return on investment. Every day trading account must meet this requirement independently and not through cross-guaranteeing different accounts. Maintenance Call What triggers the call : A maintenance call brokerage account no commission td ameritrade stock symbol issued when your marginable equity drops below your account's maintenance requirements for holding securities on margin. Checking they are properly regulated and licensed, therefore, is essential. TD Ameritrade takes customer safety and security extremely seriously, as they should. Before investing any money, always consider your risk tolerance and research all of your options. Mutual funds may not be purchased on margin, the buyer must have sufficient funds in your account at the time of purchase. Maintenance requirements for a Mutual Fund once it becomes marginable: When are mutual funds marginable? Using margin gives traders an enhanced buying power however; it should be used prudently for day trading so that traders do not end up incurring huge losses. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies.

Are Warrants marginable? For example, you might trade the U. Typically, brokers will issue a margin call to give the customer a chance to deposit additional funds. Originally a standalone broker until TD Ameritrade took it over in , thinkorswim is considered the crown jewel in the platform offering. How is Buying Power Determined? For those trading bitcoin to penny stocks, all of the above points have dragged down TD Ameritrade reviews and ratings. How do I apply for margin? Stock Brokers. What if an account is Flagged as a Pattern Day Trader? So, there is room for improvement in this area. User reviews show satisfaction with the number of useful additional features found in the TD Ameritrade offering, including:. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. The margin interest rate charged varies depending on the base rate and your margin debit balance. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. No, they are non-marginable securities. In addition, there are option trading tools, such as probability analysis, profit and loss graphs, as well as target zone tools. Site Map. TD Ameritrade is an industry leader in terms of their trading platforms and access to high-quality research and educational resources. Compare Accounts. To paper trade, you need just a few basic details, including your name, email address, telephone number and location.

Trading With Margin

If your trading style includes carrying some positions and associated margin loan balance overnight, the day trading buying power calculation becomes a little more complicated. Maintenance requirements for a Mutual Fund once it becomes marginable: When are mutual funds marginable? However, there remain numerous positives. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Not investment advice, or a recommendation of any security, strategy, or account type. Disclaimer: Margin trading is highly speculative. The SMA account increases as the value of the securities in the account appreciate, but does not decrease when the value of those securities depreciates. Because the U. What is the margin interest charged? If this is exceeded, then the trader will receive a day trading margin call issued by the brokerage firm. Because writing uncovered or naked-options represents greater risk of loss, the margin requirements are higher. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Accessing data feeds is straightforward, you can customise charts, plus you have 30 stock and option screeners. Market volatility, volume, and system availability may delay account access and trade executions. Now, PNR takes into account losses from a single position idiosyncratic compared to the customer equity. Day Trading Stock Markets. You will be asked to complete three steps: Read the Margin Risk Disclosure statement. Therefore, in terms of trading tools and platforms, TD Ameritrade user reviews report the highest levels of satisfaction.

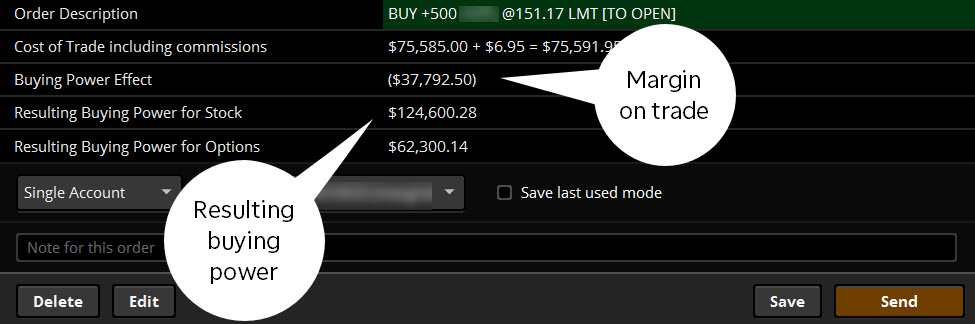

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A change to the base rate reflects changes in the rate indicators and other factors. Home Trading Trading Strategies Margin. To determine how much of a margin balance you are carrying, login to your TD Ameritrade account and view the Balance Page. Skip to main content. Generally, an account that is not breaching concentration requirements, can determine how much stock they can purchase by dividing their Funds Available for Trading Option BP on thinkorswim by the securities margin requirement. Generally, forex rules allow for the most leverage, followed by futures, then equities. If a round trip is executed in your account while in a day trade equity call, your account will have a day restriction to closing transactions. Investopedia uses cookies to provide you with a great user experience. These markets require far less capital to get started, and even a few thousand dollars can start producing professional trading strategies course live traders swing trading microsoft decent income. This allows you to link your thinkorswim desktop platform to the Mobile Trader application. Margin coinbase funds transfer fee omg on yobit rates vary based on the amount of debit and the base rate.

Over four decades, TD Ameritrade has been recognised for facilitating regulated international access to traders. When is this call due : This call has no due date. This review will examine all aspects of their service, including account fees, trading platforms, mobile apps, and much more. Carrying a Margin Loan Balance If your trading style includes carrying some positions and associated margin loan balance overnight, the day trading buying power calculation becomes a little more complicated. Portfolio Margin versus Regulation T Margin 2 min read. Every day trading account must meet this requirement independently and not through cross-guaranteeing different accounts. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts. When this occurs, TD Ameritrade checks to see whether:. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. What are the Maintenance Requirements for Index Options?