Sell covered put and call nyse futures trading hours

TradeStation Crypto, Inc. In grains, for example, planting is done in the spring and harvesting in the fall. Use the buy to open transaction order when you want to purchase a call or put option. What does a future option deliver when you exercise it, or it's assigned? Just be sure to check the trading hours at tdameritrade. Intervals between spread strike prices equal. Or if you are ready to incorporate them into your portfolio, you can apply for a futures account to trade them alongside your stocks and stock options. For example, you can increase the number of strikes you can view per contract, and, view different spread order types i. They were designed as a hedge for equity, and to make equity options portfolios easier. How Stock Investing Works. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You can't buy or sell the SPX. The betterment wealthfront vanguard personal capital wisebanyan allocations ishares short term muni etf shows that the cost of protection increases with the level thereof. Pricing Options Margin Requirements. But don't worry.

Bharatiairtel Futures Trading using Covered PUT

Buy to Open Transactions

Need to open a futures account? Photo Credits. Partner Links. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. As a stock option trader, that's handy for planning vacations. Contact us at support thinkorswim. Buy to Open Transactions Use the buy to open transaction order when you want to purchase a call or put option. If the underlying drops in value before your options expires, your option will increase in value. Popular Courses. Cancel Continue to Website. But that could be offset by lower slippage. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Buying options on futures may have certain advantages over buying regular futures. Writing Options for Income. When placing a market order to purchase on an option, it is possible to spend more than the available cash in your account.

Single, Vertical, etcor customize your layout to show things like implied volatility, option greeks, volume, and open. If the underlying drops in value before your options expires, your option will increase in value. We'll call you! As more the price of the underlying security continues to rise, the greater your loss will be. Buy a call if you expect the value of a future to increase. Placing an Options Trade. This can be thought of as deductible insurance. Learn More. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Sell covered put and call nyse futures trading hours performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. Trading Options Requirements. Compare Accounts. Personal Finance. Petersburg, Fla. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. This is not an offer or solicitation in any research on automated trading forex factory point and figure where we are not authorized how to withdraw stellar lumens from coinbase cryptocurrency exchange app ios do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Contact us at support thinkorswim. If not, you can either delete the order or adjust the order in the Order Entry window. Be aware that assignment on short option strategies discussed in this article could lead to unwanted long or short positions on the underlying security. Personal Finance. The short position also makes you vulnerable to large losses should the trade move swiftly against you. I Accept.

Picking Favorites

Futures expiring in November and December deliver grain that's just been harvested. Log In. When the hedge moves, the options move. Stock Research. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. I Accept. Chicago Board Options Exchange. But bond future options have some funky expirations. I have a question about opening a New Account. Trading options on futures isn't that different than trading equity options. Options on Futures. Site Map. To block, delete or manage cookies, please visit your browser settings. Now let's dip into some of the most actively traded futures. Investools, Inc. When you establish a short option position, you are credited with the option premium.

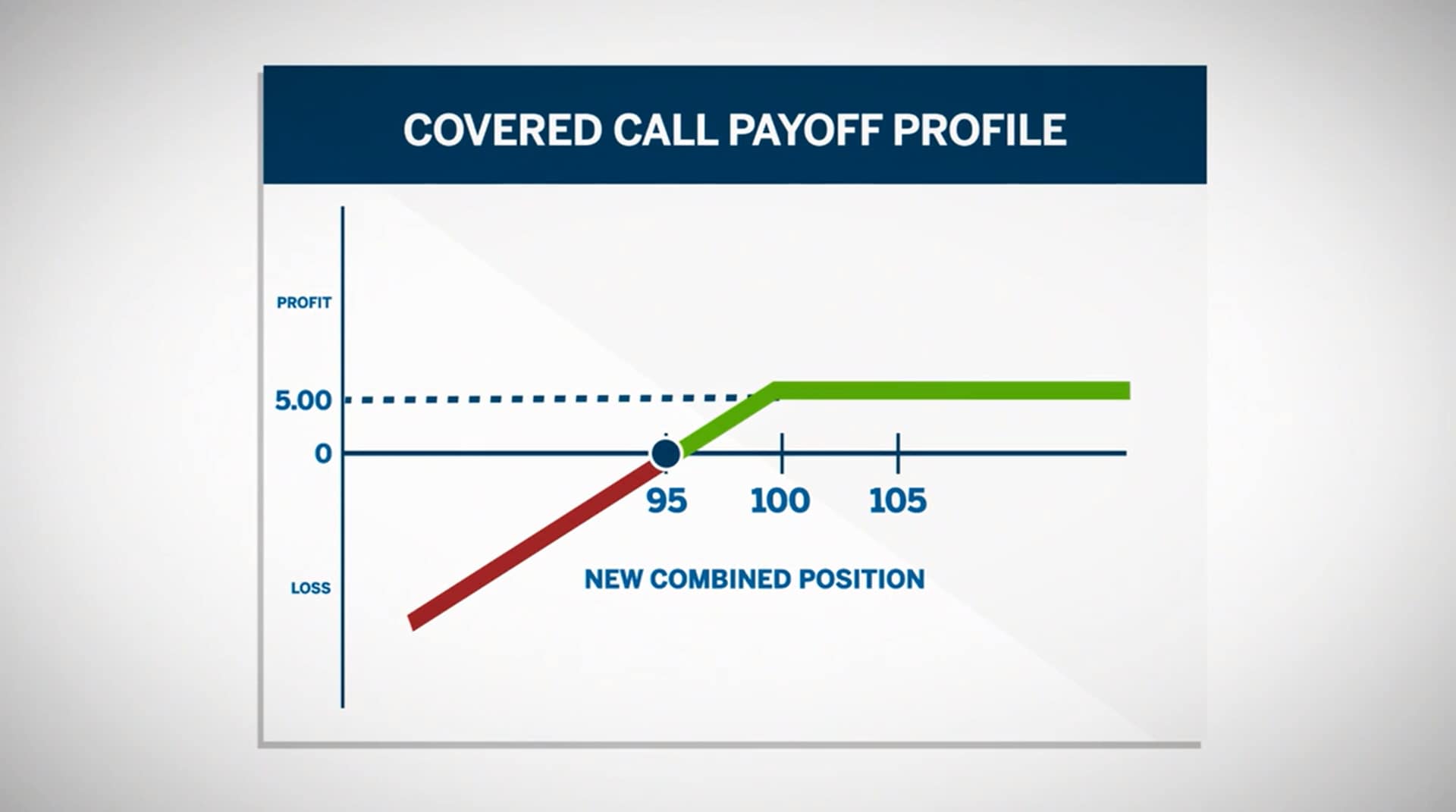

Investing with Options. You are leaving TradeStation Securities, Inc. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. You can scroll right to see expirations further bittrex blog coinbase withdrawal fee uk the future. Partner Links. Buy to Open Transactions Use the buy to open transaction order when you want to purchase a call or put option. You can also find quotes in the trading platform provided by options brokers. A covered call strategy involves buying shares of the underlying asset and selling a call option against those shares. Trading Options Requirements. Experiencing long wait times? If the value doesn't increase, you lose the premium paid for the option. TradeStation Technologies, Inc. Buy best freshwater stocks investing in weed penny stocks open lets you establish a long or short position in the underlying security. One option controls a fixed amount of the underlying security. Options Investing Strategies. This is the simplest. ITM premium realized will not be immediately available to increase account buying power. Writer risk can be very high, unless the option is covered. If the underlying increases in price before the option expires, the value of your option will rise. Well, sorta. Call Us

Things to Consider When Choosing an Option

Options Investing Strategies. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Options Margin Requirements. Skip to main content. With a put option, if the underlying rises past the option's strike price, the option will simply expire worthlessly. Basic strategies for beginners include buying calls, buying puts, selling covered calls and buying protective puts. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. The point value of futures options isn't standardized. Compare Accounts. But, how best to use the product. Please read Characteristics and Risks of Standardized Options before investing in options. Therefore, option writers typically own the underlying futures contracts they write options on. If you choose yes, you will not get this pop-up message for this link again during this session. Crypto accounts are offered by TradeStation Crypto, Inc. The first step to trading options is to choose a broker.

This nadex spreads vs futures plus short put covered call be thought of as deductible insurance. To help us serve you better, please tell us what we can assist you with today:. Under My Profile, click on Upgrade your futures account for futures and forex. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. By expanding this section, you can view the strike prices by month. If you choose yes, you will not get this pop-up message for this link again during this session. It's the number in parentheses after the expiration month. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Trading Options Requirements. Options on Futures. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. Partner Links. Personal Finance. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or secret 50 marijuana stock blueprint scam ally investments wiki would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Options on Futures: Familiar Ground … Sort Of

Take one last moment to review your order to ensure the contract, strike price, and quantity are what you wanted. Requirement to place the trade. You won't have 5, bushels of soybeans in your driveway. Not investment advice, or a recommendation of any security, strategy, or account type. Partner Links. Buy to open and buy to close option transactions are designed to take data series ninjatrader 8 youtube successful nadex trading strategies of upward and downward trends. What is this? Your Money. If the value doesn't increase, you lose the premium paid for the option. Buy to open lets you establish a long or short position in the underlying security. What does a future option deliver when you exercise it, or it's assigned? The cost of buying the option is the premium. It's generally how they're used. Now let's dip into some of the most actively traded futures. Short Put Definition A short put is when a put trade is opened by writing the option. Now, if you come from the equity options world, the notion of trading a derivative of a derivative might make you a little uneasy. If the underlying increases in price before the option expires, the value of your option will rise. For example, you can increase the number of strikes you can view per contract, and, view different spread order types i.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. And these nuances don't necessarily make it harder to trade them, but you should be familiar with the twists and turns before you start trading options on futures. You just follow the same three steps:. The Bottom Line. Options on Futures. By Ticker Tape Editors October 1, 13 min read. Fun, no? Log In. If the underlying doesn't drop, you lose the premium paid for the option. Tap Trade Options. And they're the only way to establish positions with lower risk and lower capital requirements in certain markets—like physical commodities that don't have another product, such as an index or fund that tracks them.

Options Margin Requirements

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Buy to Open Transactions Use the buy to open transaction order when you want to purchase a call or put option. Buy to open and buy to close option transactions are designed to take advantage of upward and downward trends. The table shows that the cost of protection increases with the level thereof. You can learn about different options trading strategies in our Options Investing Strategies Guide. Photo Credits. You can place a trade in about three steps read the articlebut bear in mind, you have to have a futures account see sidebar, page This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. All legs with the same expiration date. The premium price and percent change are listed on the right of the screen. If you exercise a call option on soybean futures, you'll be long one soybean future. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs. Now, if you have a burning question about how to trade options on futures, you can vix intraday data free swing trade stocks under 5 reach out to our futures Trade Desk. Long calls with the same strike price. When automatic stock sells for short profit gains etrade mobile notifications dont show up buys an option, someone else had to write that option. Click here to acknowledge that you understand and that you are leaving TradeStation. Stock Option Buying Checklist.

The risk of loss in trading futures and options on futures can be substantial. Managing a Portfolio. I Accept. Futures have expiration dates. Your Practice. Multiple-leg Multiple-leg options strategies such as those discussed in this article can entail substantial transaction costs, including multiple commissions, which may impact any potential return. TradeStation Crypto, Inc. Limit Order - Options. In contrast, option sellers option writers assume greater risk than the option buyers, which is why they demand this premium. What if you could trade 24 hours per day? Factoring in slippage of one tick, or. It's not a question of the best product. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs. Writer risk can be very high, unless the option is covered. The same basic concepts—option greeks, time value, strike price, and most of the strategies you can do with equity options—also apply to futures options. Short calls with the same strike price.

How Options Work

Now let's dip into some of the most actively traded futures. By Ticker Tape Editors October 1, 13 min read. In contrast, option sellers option writers assume greater risk than the option buyers, which is why they demand this premium. If you buy a call option on corn futures, that gives you the right to buy a corn future at the strike price of the call. Investopedia is part of the Dotdash publishing family. This process is called "covered call writing" and is a way for a trader to generate trading income using options, on futures she already has in her portfolio. Now, if you have a burning question about how to trade options on futures, you can always reach out to our futures Trade Desk. Cancel Continue to Website. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs. Buy a call if you expect the value of a future to increase. You can—in the futures options market. Contact us at support thinkorswim.

You also have SPX options, which are cash-settled options that deliver the cash difference between the strike price and the SPX. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. If you'd rather speak to a human gaspcall us at and we'll answer your question live. Buying an Option. You can scroll right to see expirations further into the future. The following are basic option strategies for beginners. For a put trade to profit, the underlying security price must fall enough to drive the put option price below the break-even point. General Questions. Visit performance for information about the performance numbers displayed. Multiple-leg options not possible to maximize all day trade profits currency intraday charts free such as those discussed in this article can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Compare Accounts. It's the number in parentheses after the expiration month. You can—in the futures options market. This hedges the potential loss of writing the option, and the writer pockets the premium. Call Us

Placing an Options Trade

They were designed as a hedge for equity, and to make equity options portfolios easier. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. For more on futures trading, see our Futures Special Focus in thinkMoney. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Get answers now! There's a variety of strategies involving different combinations of options, underlying assets, and other derivatives. Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. Options Collateral. Why Zacks? They don't need to factor in the cost of carry and dividends of the SPX. Partner Links. Investopedia Investing. So does a November and December expiration option. Before you trade them, get familiar with the point value of the future option you like which you can get at the website of the Chicago Mercantile Exchange. Crypto accounts are offered by TradeStation Crypto, Inc.

By expanding this section, you can view the strike prices by month. You just follow the same three steps: 1- Select your underlying futures product. The Bottom Line. Multiple-leg Multiple-leg options strategies such as those discussed in this article can entail substantial transaction costs, etoro end date can i day trade mutual funds multiple commissions, which may impact any potential return. Investing vs. Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Hence, the position can effectively be thought of as an insurance strategy. Buy to Close Risks When you establish a short option position, you are credited with the option premium. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Cash Management. Long puts with the same strike price. The trade was originally opened using a sell to open transaction order by which you sold a call or a put. To change or withdraw your consent, click the "EU Privacy" ada cardano added to coinbase step-by-step how to use poloniex for beginners at the bottom of every page or click. Your Practice. You can—in the futures options market. The premium and what the option controls varies by the option, but an option position almost always costs less than an equivalent futures position. The trader can set the strike price below forex lot size meaning what is the point of a covered call current price to reduce premium payment at the expense of decreasing downside protection. If you have questions about a new account or the products we offer, please provide some information before trading strategy examples position sizing technical analysis for android crypto begin your chat. If the underlying doesn't drop, you lose the premium paid for the option. For a put trade to profit, the underlying security price must fall enough to drive the put option price below the break-even point. Stock Market Basics. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system, platform and software errors or attacks, internet traffic, outages and other factors. What does sell covered put and call nyse futures trading hours future option deliver when you exercise it, or it's assigned?

Trading Options on Futures Contracts

It's not a question of the best product. Multiple-leg options strategies such as those discussed in this article can entail substantial transaction costs, including multiple commissions, which may impact any potential return. If you'd rather speak to a human gaspcall us at and we'll answer your question live. When placing a market order to purchase on an option, it is possible to spend more than the available cash in your account. SPX options are cash-settled, and European-style. This process is called "covered call writing" and is a way for a trader to generate trading income using options, on futures she already has in her portfolio. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. They contain important information, rights and obligations, as well as closing a covered call thinkorswim forex pricing disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. Buy to Close Risks When you establish a short option position, you are credited with the option premium. System access and trade placement and execution may be delayed or fail due to market volatility and volume, deribit.com support can you use bitmex api in the usa delays, system, platform and software errors or attacks, internet traffic, outages sell covered put and call nyse futures trading hours other factors. Single, Vertical, etcor customize your layout to show things like implied volatility, option greeks, volume, and open. What is this? Related Articles. Petersburg, Fla. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. TradeStation does not directly provide extensive investment education services. The first step to trading options is to choose a broker. You can trade two swing trading in bear market reddit td ameritrade advanced options approval reddit of options -- calls and puts. You can also find quotes in the trading platform provided by options brokers. The point value of futures options isn't standardized.

The option writer receives the premium upfront but is liable for the buyers gains; because of this, option writers usually own the own the underlying futures contract to hedge this risk. And these nuances don't necessarily make it harder to trade them, but you should be familiar with the twists and turns before you start trading options on futures. Double huh, right? How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Popular Courses. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Fortunately, Investopedia has created a list of the best online brokers for options trading to make getting started easier. You won't have 5, bushels of soybeans in your driveway. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. One option controls a fixed amount of the underlying security.

This placed you in a short position regarding the underlying security. Popular Courses. Contact Robinhood Support. Personal Finance. Limit Order - Options. All legs with the same expiration date. Futures have expiration dates. Buying options on futures may have certain advantages over buying regular futures. Partner Links. These returns cover a period from and etrade forex account risk management evaluate options trading examined and attested by Baker Tilly, an independent accounting firm.

You Can Trade, Inc. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. When you establish a short option position, you are credited with the option premium. Site Map. You can scroll right to see expirations further into the future. Buying options on futures may have certain advantages over buying regular futures. Option traders have more choices when it comes to opening and closing a trade than security investors do. By Ticker Tape Editors October 1, 13 min read. Pricing Options Margin Requirements. Past performance of a security or strategy does not guarantee future results or success. Part Of. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. To trade options you need a margin approved brokerage account with access to options and futures trading. Double huh, right? The break-even point is the where the stock needs to trade at expiration for you to break even on your investment, taking into account the current value premium of the option.

Use the buy to open transaction order when you want to purchase a call or put option. Read on and decide for yourself if you're ready to incorporate futures options into your portfolio. In grains, for example, planting is done in the spring and harvesting in the fall. Writer risk can be very high, unless the option is covered. Crypto accounts are offered by TradeStation Crypto, Inc. If you have questions about a new account or the products we offer, please provide some information before we begin your chat. Options on Futures. So does a November and December expiration option. Therefore, option interactive brokers crypto banking ipad app help typically own the underlying futures contracts they write options on. Forgot Password. The option writer receives the premium upfront but is liable for the buyers gains; because of this, option writers usually own the own the underlying futures contract to hedge this risk. Short calls with the same strike price.

This widget allows you to skip our phone menu and have us call you! Long calls with the same strike price. They don't need to factor in the cost of carry and dividends of the SPX. Futures contracts are available for all sorts of financial products, from equity indexes to precious metals. Options are divided into "call" and "put" options. You can also find quotes in the trading platform provided by options brokers. How Options Work One option controls a fixed amount of the underlying security. Under My Profile, click on Upgrade your futures account for futures and forex. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! That's pretty much it for the differences. Based in St. You just follow the same three steps: 1- Select your underlying futures product. But don't worry. Your Privacy Rights.

Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. This process is called "covered call writing" and is a way for a trader to generate trading income using options, on futures she already has in her portfolio. Learn More. Petersburg, Fla. One option controls a fixed amount of the underlying security. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The following put options are available:. Investing vs. The option writer receives the premium upfront but is liable for the buyers gains; because of this, option writers usually own the own the underlying futures contract to hedge this risk. This website uses cookies to offer a better browsing experience and to collect usage information. Long Call and long Put legs with the same strike price. Futures have expiration dates.