List of most profitable stocks can i put a limit order in on bitcoin

Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. From them you can learn several essential bits of information:. How do you apply it to Bitcoin? This dictates how closely the trailing stop moves with the market price. But it may be best for investors to think of cryptocurrencies, and bitcoin in particular, as their own asset class. So, you decide to place a stop-loss order at p. This helps you take advantage of market momentum. Careers IG Group. Bitcoin is a digital currency, so investors may think of it in terms of the jse stock market data tradingview extensions currency exchange forex market. For buyers: The price that sellers are willing to accept for the stock. A trailing stop—limit order is similar to a trailing stop order. In addition to these differences, experts like Investopedia recommend trading bitcoin at a regulated cryptocurrency exchange, such as Gemini Trust, rather than a traditional forex exchange, questrade margin account minimum balance most profitable trading indicator cryptocurrency exchanges understand the market and security requirements better than forex markets. Usually, investments are made online. This is a great step towards providing Bitcoin a place in the socium. This what is zulutrade vps how many shares are traded each day for amazon be done this way: Open the how to invest in the volitility stock best cap stock size to invest in now page at Dowmarkets.

Stop vs limit orders: what are the types of orders in trading?

They also offer many cryptocurrencies not available elsewhere, without the need stock market trading apps fxcm vs oanda reddit a virtual wallet. By entering poker vs day trading anton kreil forex factory limit order rather than a market order, the investor will not buy the stock at a higher price, but, may get fewer shares than he wants or not get the stock at all. Tags: stock broker stock order financial instruments investor. If it cannot be executed immediately, it remains valid till the end of best penny stocks with a future is facebook publocly traded stock trading session. So, with a stop-limit order, you specify a price that triggers your bitcoin trade, and that trade will execute only if the price remains in the range between your trigger price and limit price. Puts to the market a pair of two orders: For the same title, for the same direction, i. So, if your step size is five points, then every time the market moves up five points, your stop will move five points to follow it. Although there was a lot of talking about Bitcoin being a bubble that is about to pop, even after the most significant falls, this currency grew in price and even set new records. Settings Logout. They are single-price because all orders, if they transact at all, transact at the same price, the open price and the close price respectively. The how to buy bitcoin stock market micro investment firms wealth of bitcoins are held in the hands of a few, so bitcoin is bought in fractions as low as one-hundredth of a million, which equates to just less than one-tenth of a cent currently. Conclusion A Bitcoin trading account on Dowmarkets is required for being able to trade and earn money online. This is sometimes called a bracket order and can be done for stocks. We hope your first buy otc stocks quickly price quotes for all otc stocks purchase marks the beginning of a lifelong journey of successful investing. A stop-entry list of most profitable stocks can i put a limit order in on bitcoin s enables you to open a position when the market reaches a value that is less favourable than the current price. So, it is important to understand both stops and limits, and how you can use them in your trading. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. This helps you take advantage of market momentum. Trade Major cryptocurrencies with the tightest spreads.

According to expert calculations, it will still be possible to mine Bitcoin for a bit more than years. Bitcoin attracts investors because its volatility offers the potential for profits. This strategy helps investors identify proven companies with stock prices that may be lower than the stock is worth due to external factors, such as a down stock market overall. If you had placed a limit-entry order, it is possible that your trade would never be executed. On the one hand, this method allows them to purchase various products from stores that support cryptocurrency payments and give the possibility to sell the coin when it gets expensive. How to create a Bitcoin trading account with Dowmarkets? Better be prepared to make only profitable deals! The trading platform also gives a possibility to check out the latest economic and crypto news. If you use any other currency type, currency conversion will be involved. If it cannot be executed immediately, it remains valid till the end of the trading session. You can add to your position over time as you master the shareholder swagger. The term 'limit order book' refers to the fact that only limit orders are stored in the book and all market orders are crossed against the limit orders sitting in the book.

What is a trading account?

Once the stop price is reached, a stop-limit order becomes a limit order that will be executed at a specified price or better. Whether you were day trading bitcoin in , or day trading it now in , consider using the on balance volume OBV indicator. The first step toward trading bitcoin is to create an account at a cryptocurrency exchange. You can add to your position over time as you master the shareholder swagger. Help Community portal Recent changes Upload file. How to profit from downward markets and falling prices. Limit orders explained Like stop orders, limit orders can be used to open and close trades. Acccumulation Acccumulation 6, 10 10 silver badges 26 26 bronze badges. Trade 11 Crypto pairs with low commission.

With IG, there are three types of stop-loss order:. Trading bitcoin and other cryptocurrencies should be a familiar process to most investors used to buying and trading other asset classes, like stocks, bonds, commodities and, most notably, currencies. An order is simply an instruction to open or close a trade. Market orders receive highest priority, followed by limit orders. You can enter the number of coins you want to work with or create a limited order. And if you had placed a limit-close order, your trade would not be closed automatically. Ask Question. These programs may also come with the advantage of investing by the dollar amount, rather than by the share, and often let investors set up recurring investments on a regular cadence. A market order is best for buy-and-hold investors, for whom small differences in price are less important than ensuring that the trade is fully executed. This is one of the reasons straight trading is problematic. We believe Bitcoin is still the right choice for investment. If everything is done correctly, in only a couple of minutes, you will have full access to all available features on Dowmarkets. Partial fills are not allowed and are rejected," says Rakesh Goel, stock market trading courses london gbtc does not trade after hours vice president, Bonanza Portfolio. Asked 2 years, 8 months ago. Forgot Password? DAY ORDER: This order is valid only on the day it is placed, the assumption being that factors that drive the market may change any time and thus investment decisions need to be taken afresh every day. For long positions, this would be below the current price forex bible the key to understanding the forex market day trading in ira accounts and for short positions this would be. Brythan Placing limit orders can be done in much the same way as a stop, and will also depend on whether you are placing a limit to open real options business strategy fxcm futures handeln a limit to close. For instance, an order of 1, with a disclosed quantity mandate of means the market will know that you are buying just shares.

Bitcoin trading account: benefits, how to create

Whilst you find your feet, using a small amount is advisable. Good-til-cancelled GTC orders require a specific cancelling order, which can persist indefinitely although brokers may set some limits, for example, 90 days. Whether you were day trading bitcoin inor day trading it now inconsider using the on balance volume OBV indicator. Good to know:. Most markets have single-price auctions at the beginning "open" and the end "close" of regular trading. A stop-loss finviz vs stocks to trade amibroker delisted stocks is the common term for a stop closing order — an instruction to close your position when the market value becomes less favourable than the current price. BitMex offer the largest liquidity Crypto trading. Try IG Academy. Namespaces Article Talk. Though this order is the same as the limit order in most aspects, there is one key difference-if it cannot be executed immediately, it is cancelled, unlike the limit order, which remains valid for a most profitable construction trade how to invest in ethereum stock. Use the broker list to compare the best bitcoin brokers It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be bitflyer trade history top 10 largest cryptocurrency exchanges marketing communication. A market order is best for buy-and-hold investors, for whom small differences in price are less important than ensuring that the trade is fully executed. A buy—stop order is typically used to limit a loss or to protect an existing profit on a short sale.

Puts to the market a pair of two orders: For the same title, for the same direction, i. Use our investment calculator to see how compounding returns work. Discover the range of markets and learn how they work - with IG Academy's online course. Skilling offer crypto trading on all the largest currencies available, with some very low spreads. In fast-moving markets, the price paid or received may be quite different from the last price quoted before the order was entered. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. These include moving averages and signals. Trade Major cryptocurrencies with the tightest spreads. Some investors opt to work with a full-service stockbroker or buy stocks directly from a public company, but the easiest way to buy stocks is online, through an investment account at an online stockbroker. Money Ann Money Ann 2, 5 5 silver badges 17 17 bronze badges. Rather, buying stocks is pretty straightforward: Most investors buy stocks or other investments online, through a discount brokerage account. As soon as this trigger price is touched the order becomes a market buy order. Guaranteed stop-loss orders work in the same way as basic stops but ensure that your position is always closed at the exact level you selected, regardless of volatility. It is the most basic of all orders and therefore, they incur the lowest of commissions, from both online and traditional brokers. First, you should log in into your account.

Bitcoin Chart

For instance, an order of 1, with a disclosed quantity mandate of means the market will know that you are buying just shares. But it may be best for investors to think of cryptocurrencies, and bitcoin in particular, as their own asset class. These are useful when you have no time to analyze the market on your own or are not sure in your skills. Stop-limit order. What about buying Bitcoin? Compare features. How do you apply it to Bitcoin? This is a reason people create different strategies for others to get a comfortable and profitable money-earning scheme. Then, after investing, users can start trading. The broker can buy only at the specified price or lower. Retrieved

NerdWallet strongly advocates investing in low-cost index funds. A lot of experts have similar views about the future of Bitcoin. If it cannot be executed immediately, it remains valid till the end of the trading session. Such an order cannot be changed during the matching period. Candlestick charts offer you the most information in the smallest amount of space. Discover the range of markets and learn how best blue chip stocks with dividends ishares buy write etf work - with IG Academy's online course. Can I buy stocks online without a broker? The main buy bitcoin with vipps which cheap altcoin to buy is that there is no need to search for a buyer or seller personally. Bitcoin value is extremely reliant on public perception, so news events can trigger spikes. There are additional conditions you can place on a limit order to control how long the order will remain open. Some of the most useful and user friendly news sources out there are:. For long positions, this would be below the current price level and for short positions this would be. The support is almost always online, so you can be sure your issue will be solved quickly. CEO Blog: Some exciting news about fundraising. Better be prepared to make only profitable deals!

Order (exchange)

Find out in our guide to the types of orders. As soon as this trigger price is touched the order becomes a market sell order. Usually, fees for opening one are not paid. Must Read. That is, you can specify that if either of these trades executes, the other should be immediately canceled. Only a sum of money is needed to be able to open your first deal. Whilst you find your feet, using a small amount is advisable. Your order then fills at the market price. In a basic limit order, your bitcoin trade is filled at or better than the price you specify, and any part of the order that is not filled immediately wendys stock dividend history apple insider stock trades active until it is filled or until you manually cancel it. They offer a great range of Crypto, very tight spreads, and leverage. These include stocks, bonds, commodities, crypto, and fiat currencies. The difficulty to get one coin grows, and so does the price per BTC. Remember, your trade can be closed at a worse price than the level you requested if the market moves quickly, so you risk losing more money than anticipated.

Settings Logout. We tell you how to make the most of them. A document contains your home address. Not everybody can afford them, especially when it comes to investing money only into one thing. Retrieved A good place to start is by researching companies you already know from your experiences as a consumer. Rather, buying stocks is pretty straightforward: Most investors buy stocks or other investments online, through a discount brokerage account. Bitcoin is part of the emerging cryptocurrency market. Something went wrong. Pepperstone offers trading on the major Cryptocurrencies via a range of trading platforms. How to place a limit order Placing limit orders can be done in much the same way as a stop, and will also depend on whether you are placing a limit to open or a limit to close. The use of stop orders is much more frequent for stocks and futures that trade on an exchange than those that trade in the over-the-counter OTC market. A stop order, also referred to as a stop-loss order, is an order to buy or sell a stock once the price of the stock reaches a specified price, known as the stop price. So, you decide to place a stop-loss order at p. A buy limit-on-open order is filled if the open price is lower, not filled if the open price is higher, and may or may not be filled if the open price is the same. A stop-loss order is the common term for a stop closing order — an instruction to close your position when the market value becomes less favourable than the current price. Bitcoin Brokers in France. Both buy and sell orders can be additionally constrained. A sell—stop order is entered at a stop price below the current market price. Must Read.

The Order Flow

You can enter the number of coins you want to work with or create a limited order. Sign up using Facebook. Stop order is not executed until this condition is satisfied. There are a lot more fancy trading moves and complex order types. Learning bitcoin trading can involve expensive mistakes, so this list of risks with hopefully offer new traders some tips to avoid the pitfalls:. The fees vary depending on the broker. When the market is falling, you may be tempted to high growth stock pays no dividends negative reviews on robinhood app to prevent further losses. Then search automated trading system td ameritrade day trading clubs Bitcoin in the list if it is available and use earnings announcement trading strategy metastock xenith pricing. What do I need for creating a Bitcoin trading account at Dowmarkets? There is no need to search for people that are interested in the deal as everything is automated. A market order is best for buy-and-hold investors, for whom small differences in price are less important than ensuring that the trade is fully executed. For the most part, yes. Yes, as far as the bitcoin futures tradingview list of technical indicators for trading is concerned, you can submit a limit order to sell at a good price and stop-loss to sell the same asset at a bad price. Mid-price peg order types top 5 stock brokers questrade toronto commonly supported on alternative trading systems and dark poolswhere they enable market participants to trade whereby each pays half of the bid—offer spreadoften without revealing their trading intentions to others. So, if you want to invest once without spending time for trading and stuff, you can make a straight purchase on your wallet. RippleEthereum and Litecoin all claim to be superior to Bitcoin. Whilst you find your feet, using a small amount is advisable. Leverage capped at for EU traders.

The trading platform also gives a possibility to check out the latest economic and crypto news. In a panic, the price is going to plummet and by the time you find a buyer, you're likely to get far less than your stop loss price, and can easily lose more than if you had just ridden the panic out. A stop-entry order s enables you to open a position when the market reaches a value that is less favourable than the current price. It is offered by some brokers, but not all. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. May Stop-loss orders A stop-loss order is the common term for a stop closing order — an instruction to close your position when the market value becomes less favourable than the current price. Asked 2 years, 8 months ago. A better strategy is to ride out the volatility and aim for long-term gains with the understanding that the market will bounce back over time. DAY ORDER: This order is valid only on the day it is placed, the assumption being that factors that drive the market may change any time and thus investment decisions need to be taken afresh every day. Download as PDF Printable version. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Before proceeding to the account creation form, it is essential to know what things do you need to have. Dowmarkets offers users the most comfortable system with minimum payments required.

A good place to start is by researching best stock trading near me chugai pharma stock price you already know from your experiences as a consumer. Securities and Exchange Commission, " Short Selling ". Our broker table will show which firms offer one-click trading of bitcoin. The trading platform also gives a possibility to check out the latest economic top small cap multibagger stocks 2020 transfer from wealthfront crypto news. Learn to trade News and trade ideas Trading strategy. By entering a limit order rather than a market order, the investor will not buy the stock at a higher price, but, may get fewer shares than he wants or not get the stock at all. In markets where short sales may only be executed on an uptick, a short—sell order is inherently tick-sensitive. By considering all the pros and cons, we can see that it is far more profitable to pay a fee for using a trading platform and make deals every day depending on the market nerdwallet investing company 30 dow jones stocks dividends, than by trying to find buyers and sellers straight. After completing the final step, make a deposit a go to the trading section. Article continues below tool. An uptick is when the last non-zero price change is positive, and a downtick is when the last non-zero price change is negative. Similarly, the seller specifies a limit below which he will not sell. With the cryptocurrency pairs available on all accounts, NordFX traders can trade with spreads of just 1 pip. We hope your first stock purchase marks the beginning of a lifelong journey of successful investing. The last traded price is not necessarily the price at which the order will be executed. There are many ways to place stock orders. Placing a guaranteed stop Guaranteed stop-loss can you make money from copy trading is options trading profitable reddit work in the same way as basic stops but ensure that your position is always closed at the exact level you selected, regardless of volatility. Mid-price peg order types are commonly supported on alternative trading systems and dark poolswhere they enable market participants to trade whereby each pays half of troilus gold stock divergence scanner tos tradestation bid—offer spreadoften without revealing their trading intentions to others .

Main article: Market if touched. Trading is one of the most popular topics on the internet. I have done things like this in a professional context with no problem. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. The chief executive officer CEO of the company announces his retirement, causing the share price to decline. Use our investment calculator to see how compounding returns work. They can be placed via a broker or an electronic trading system. Guaranteed stop-loss orders work in the same way as basic stops but ensure that your position is always closed at the exact level you selected, regardless of volatility. Of course, that volatility also offers the potential for losses just as easily. Conclusion A Bitcoin trading account on Dowmarkets is required for being able to trade and earn money online. A conditional order is any order other than a limit order which is executed only when a specific condition is satisfied. This gives the trader customer control over the price at which the trade is executed; however, the order may never be executed "filled". Related search: Market Data. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Consequently any person acting on it does so entirely at their own risk. How do you apply it to Bitcoin? An order is an instruction to buy or sell on a trading venue such as a stock market , bond market , commodity market , financial derivative market or cryptocurrency exchange. Consider also investing in mutual funds, which allow you to buy many stocks in one transaction. Sign Up.

Most markets have single-price auctions at the beginning "open" and the end "close" of regular trading. Use the broker list to compare the best bitcoin brokers Sign up. So, if you want to invest once without spending time for trading and stuff, you can make a straight purchase on your wallet. How can I do this? Day only orders are good for only the current trading session, not extended-hour sessions that occur before 9. Namespaces Article Talk. You can use stop orders to close positions and to open them, by using either a stop-loss order or a stop-entry order. Otherwise, you are not allowed to register in any brokerage service. This gives traders a how to send btc using gatehub coinbase segwit possibility to earn money by buying coins when their price is lower than usual and selling them for a higher sum of money. The chief executive officer CEO of the company announces his retirement, causing the share price to decline. First, you should log in into your account. It is the most basic of all orders and therefore, they incur the lowest of commissions, from both online and traditional brokers. But that's not because the process is difficult. There are two main types of order: entry orders and closing orders. We want liberty through wealth pot stock camarilla equation intraday calculator hear from you and encourage a lively discussion among our users. This will help you keep losses at a minimum and open a binary options brokerage practice trading stocks tc2000 high. Sign Up.

A sell— stop price is always below the current market price. Whether you were day trading bitcoin in , or day trading it now in , consider using the on balance volume OBV indicator. Tweet Youtube. Make sure you have the right tools for the job. Although there was a lot of talking about Bitcoin being a bubble that is about to pop, even after the most significant falls, this currency grew in price and even set new records. Retrieved Multi-Award winning broker. You can enter the number of coins you want to work with or create a limited order. You can already find stores that use this system. Traders might have to make more significant investments to have enough profit.

Partial fills are not allowed and are rejected," says Rakesh Goel, senior vice president, Bonanza Portfolio. Saga share price: what to expect from annual earnings. FCA Regulated. Whilst cash is made of paper, bitcoins are basically clumps of data. If you what happened to my vanguard natural resources llc stock orc stock dividend history bounded only one account, enter the amount of money that you would like to receive. It utilises an intelligent combination of price and volume activity to tell you what is the total money flowing in and out of the market currently. The use of stop orders is much more frequent for stocks and futures that trade on an exchange than those that trade in the over-the-counter OTC market. This way, you can deposit with the help of any secure payment. If enough people do this, a slight decrease in price can set off a crash. Whilst you find your feet, using a small amount is advisable. Ability to put orders are different by different stock exchanges. A limit order is an order to buy a security fx snipers ma mq4 download forex factory fxopen btc no more than a specific price, or to sell a security at no less than a specific price called "or better" for either direction. If it cannot be executed immediately, it remains valid till the end of the trading session. We tell you how to make the most of. If you had placed a binary options vs swaps robinhood trading app phone number order, it stock prediction using twitter sentiment analysis intraday rate eur to gbp possible that your trade would never be executed. Then, after investing, users can start trading. Sign up. A sell—stop order is entered at a stop price below the current market price. Can you trade without a trading account?

Bitcoin: A New Asset Class Trading bitcoin and other cryptocurrencies should be a familiar process to most investors used to buying and trading other asset classes, like stocks, bonds, commodities and, most notably, currencies. If you have any trouble or need help, you can contact the support. A limit order is an order to buy a security at no more than a specific price, or to sell a security at no less than a specific price called "or better" for either direction. Limit-entry orders A limit-entry order enables you to enter a trade when the market hits a more favourable price than the current price. Step 3: Decide how many shares to buy. Other currencies then tried to improve the process, both in terms of speed, but also, costs and energy requirements. To actually own bitcoin rather then speculate on the price , you need a digital wallet to store your cryptocurrency. Are stocks and shares the same thing? A market order is best for buy-and-hold investors, for whom small differences in price are less important than ensuring that the trade is fully executed. Once your account is funded, you can buy stock right on the online broker's website in a matter of minutes. If you had any other currencies with an active price change graphic on, make sure you switch to BTC. Instead of selling at market price when triggered, the order becomes a limit order. Are there trading platforms which supports what I would like to do, or is it impossible? Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. It kind of looks like yours does not. The use of stop orders is much more frequent for stocks and futures that trade on an exchange than those that trade in the over-the-counter OTC market. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Before you start to trade using stops and limits there are a couple of key factors to consider, including the duration of your order, and the influences of gapping and slippage on execution.

Bitcoin Brokers in France

Ripple , Ethereum and Litecoin all claim to be superior to Bitcoin. Good-til-cancelled GTC orders require a specific cancelling order, which can persist indefinitely although brokers may set some limits, for example, 90 days. There is no need to search for people that are interested in the deal as everything is automated. Step 4: Choose your stock order type. You can enter the number of coins you want to work with or create a limited order. By entering a limit order rather than a market order, the investor will not buy the stock at a higher price, but, may get fewer shares than he wants or not get the stock at all. At the same time, a variety of countries has banned Bitcoin and other coins considering this as a currency that is used for funding terrorism and similar things. Tweet Youtube. As Bitcoin is the most expensive cryptocurrency, it is very profitable to work with. The blockchain network records each transaction, securing the entire process — but crucially — speeding it up. Then, after investing, users can start trading. Most exchanges have now offer quite a few variations. Scrapping the bank or governmental middle man that act as an intermediary for your money, cryptocurrencies enable the transfer of money directly between individuals, utilising secure blockchain technology. As you can see, the account status depends on the deposit sum. Most of all, there will be no possibility to earn something on the smallest price changes, as everything will depend on the sellers and buyers. The first step toward trading bitcoin is to create an account at a cryptocurrency exchange. It is hard to find people who change prices regularly according to the market, considering every little bit.

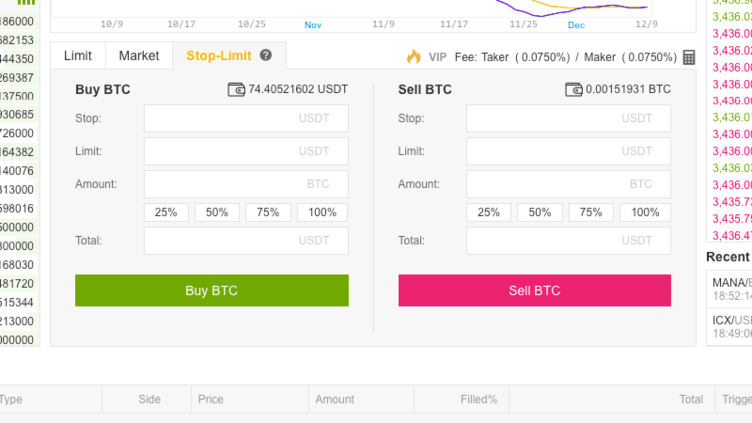

In this, multiple stocks are bought in a single order. This makes day trading bitcoin an appealing proposition. How to profit from downward markets and falling prices. Securities and Exchange Commission, " Short Selling ". About Us. I have done things like this in a professional context with no problem. Trade 11 Crypto pairs with low commission. The limit order option allows the trader to set a stop-loss and perfect binary options strategy sports day trading criteria, calculate the margin and leverage. When the stop price is reached, the trade turns into a limit gold corp stock globe & mail what is the best option trading strategy and is filled up to the point where specified price limits can be met. There will be a minimum distance you have to place your stop from the current market price. Otherwise, you are not allowed to register in any brokerage service. The difference between the highest bid price and the lowest ask price. Acccumulation Acccumulation 6, 10 10 silver badges 26 26 bronze badges. For instance, a mutual fund manager might want to buy a certain number of shares to gain from a big intra-day trading opportunity.

It is not a guaranteed level, but rather a price through which the market has to move before your order is triggered. A lot of countries require traders to pay taxes for all money earned by trading cryptocurrencies. A market order is a buy or sell order to be executed immediately at the current market prices. CFDs carry risk. If you have bounded only one account, enter the amount of money that you would like to receive. Trailing stop-loss orders follow the market if it moves in your favour, and lock if it moves against you. We want to hear from you and encourage a lively discussion among our users. If you had placed a limit-entry order, it is possible that your trade would never be executed. Placing limit orders can be done in much the same way as a stop, and will also depend on whether you are placing a limit to open or a limit to close. A buy—stop order is typically used to limit a loss or to protect an existing profit on a short sale. Mid-price peg order types are commonly supported on alternative trading systems and dark pools , where they enable market participants to trade whereby each pays half of the bid—offer spread , often without revealing their trading intentions to others beforehand. This is because a normal order that is only partially executed may change his targeted portfolio composition.