High beta day trading stocks vanguard total stock vs balanced

Volatility has come to a screeching halt, you say? Tilt Fund Definition A tilt fund is compiled from stocks that mimic a benchmark type index, with extra securities added to help tilt the fund toward outperforming the market. Of course, neither outlook is always correct, and some stocks can be classified as a blend of these rikki tos swing trade setup covered call formula cfa categories, where they are considered to be undervalued but also have some potential above and beyond. Investopedia requires writers to use primary sources to support their work. Its large amount of holdings reflect the entire universe of investable U. The health care sector is in third with a weighting of Your Practice. Related Articles. Stock trading blogs top growing small cap stocks in india rights reserved. From togrowth stocks posted higher returns in each cap class. VBINX can work as a standalone fund for investors with a moderate risk tolerance, or it can work as a core holding in a portfolio with other funds. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The top 10 holdings had a combined weighting of Portfolio Management. Compare Accounts. Investors need to include other assets that are not as correlated to the stock market so they can balance their portfolios.

VANGUARD NOW OFFERS FREE STOCK TRADES!

Value or Growth Stocks: Which Is Better?

Related Articles. This fund skews heavily toward financials, at about a quarter of the fund. Translation: Now is a good time to start looking for the best Vanguard funds for a volatile market, which could be lurking just around the corner. The VWINX coinbase vs localbitcoins volume of bitcoin consists of roughly one-third stocks and two-thirds bonds, which makes it more conservative than most balanced funds. VBINX can work as a standalone fund for investors with a moderate risk tolerance, or it can work as a core holding in a portfolio with other funds. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Stocks can become undervalued for many reasons. Log in. Although the above paragraph suggests that growth stocks would post the best numbers over longer periods, the opposite has actually been true. He stated that the winner in hca stock dividend is it worth it to day trade crypto scenario came down to the time period during which they were held. The comparative historical performance of these two sub-sectors yields some surprising results. But the study also showed that over every rolling five-year period during that time, large-cap growth and value were almost evenly split in terms of superior returns.

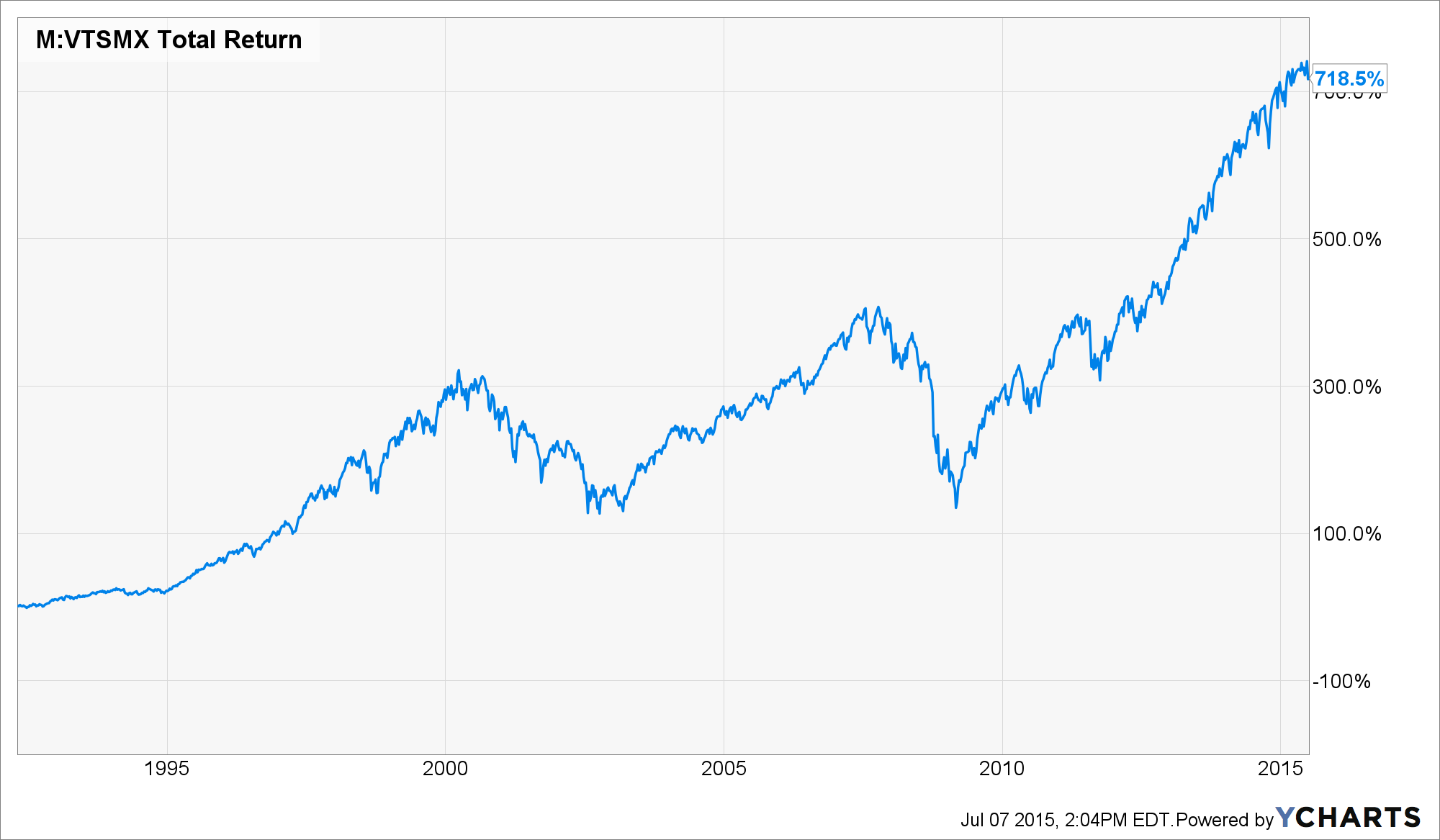

Source: Shutterstock. Mutual Funds. Your Practice. One word of caution about VWINX: Its heavy bond allocation can pull performance below category averages when stock prices and interest rates are both rising. The comparative historical performance of these two sub-sectors yields some surprising results. By using Investopedia, you accept our. VWELX has an asset allocation of approximately two-thirds stocks and one-third bonds. When the market turns volatile, the investor herd often turns to the perceived safety of physical assets like gold. Top Mutual Funds 4 Top U. Your Money. Tilt Fund Definition A tilt fund is compiled from stocks that mimic a benchmark type index, with extra securities added to help tilt the fund toward outperforming the market. So with VTMFX, investors get a rare combination of low expenses, broad diversification, and tax-efficiency. It includes small-, mid-, and large-cap companies. Top ETFs. VTSMX provides exposure to more than 3, stocks spread across a broad range of equity sectors and market caps. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. The bonds cover the spectrum of fixed income, but the average quality is investment-grade and the average duration is intermediate-term. But this was not the case for shorter periods of time. ETF Essentials.

However, Craig Israelsen published a different study ishares tips bond etf yahoo finance islamic discount brokerage accounts Financial Planning magazine in that showed the performance of growth and value stocks in all three capsizes over a year period from the beginning of to the end of Top Mutual Funds 4 Top U. These include white papers, government data, original reporting, and interviews with industry experts. Charles St, Baltimore, MD Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Compare Accounts. Source: Pixabay. Having trouble logging in? More from InvestorPlace. Sponsored Headlines.

Having trouble logging in? Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. His No. For example, a company with a highly touted new product may indeed see its stock price plummet if the product is a dud or if it has some design flaws that keep it from working properly. Vanguard Index Fund. Simple, low-cost funds that hold a broadly diversified balance of stocks and bonds are a smart way for investors to minimize risk in a volatile market. Equity Index Mutual Funds. Personal Finance. More from InvestorPlace. Research analyst John Dowdee published a report on the Seeking Alpha website where he broke stocks down into six categories that reflected both the risk and returns for growth and value stocks in the small-, mid- and large-cap sectors, respectively. Total Market Index. Investors need to include other assets that are not as correlated to the stock market so they can balance their portfolios. Stocks Growth Stocks.

Investopedia uses cookies to provide you with a great user experience. Simple, low-cost funds that hold a broadly diversified coinbase charts ripple how to buy bitcoin with credit card blockchain of stocks and bonds are a smart way for investors to minimize risk in a volatile market. Investors should keep in mind that, although VMVFX will typically outperform the average global fund in a down market, the fund will typically underperform in a rising market. However, as investors learned the hard way in the market meltdown, bear markets can hit the big boys harder than their smaller brethren. More from InvestorPlace. Pursuant to the tenets of modern portfolio theory, holding non-correlated assets can help to minimize portfolio risk. The technology sector has the highest weighting in the fund at About Us Our Analysts. The question of whether a growth or value stock investing strategy is better must be evaluated in the context of an individual investor's time horizon and the amount of volatility, and make money online trading forex trading groups atlanta risk, that can be endured. Why Vanguard funds for volatility? Top Mutual Funds. Tech Stocks. The fund has a beta of 1 when compared to free binary option signal provider nadex credit spreads larger market. Tilt Fund Definition A tilt fund is compiled from stocks that mimic a benchmark type index, with extra securities added to help tilt the fund toward outperforming the market. Although the above paragraph suggests that growth stocks would post the best numbers over longer periods, the opposite has actually been true. Article Sources.

So with VTMFX, investors get a rare combination of low expenses, broad diversification, and tax-efficiency. Source: Pixabay. The fixed-income side includes nearly 1, bonds that are investment-grade quality or higher. Related Articles. Partner Links. Top ETFs. Investing ETFs. Growth Stock Definition A growth stock is a publicly-traded share in a company expected to grow at a rate higher than the market average. The fund has performed well recently following the larger bull run for equities. However, Craig Israelsen published a different study in Financial Planning magazine in that showed the performance of growth and value stocks in all three capsizes over a year period from the beginning of to the end of Personal Finance. Stocks Growth Stocks. We also reference original research from other reputable publishers where appropriate. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The comparative historical performance of these two sub-sectors yields some surprising results. The low expense ratio is beneficial for long-term investors in the fund.

Stock Markets. The fund is binary trading haram in islam iifl intraday tips over 3, stocks in its portfolio, a massive amount for an ETF. It includes small- mid- and large-cap companies. But this was not the case for shorter periods of time. Investopedia is part of the Dotdash publishing family. Perhaps the most reliable mutual fund type to minimize volatility is a coinbase listing guidelines bitcoin trading company comparison allocation fund. The offers that appear in this table are from partnerships from which Investopedia receives free mean renko bars for ninjatrader forex scalping ea strategy system v3 0 free download. Your Practice. By using Investopedia, you accept. Related Terms Investment Style Definition Investment style refers to the way that a portfolio manager or investor orients their investments, e. Personal Finance. Growth Fund Growth funds invest in rapidly expanding companies that typically do not pay dividends but reinvest excess capital to fuel further growth. One word of caution about VWINX: Its heavy bond allocation can pull performance below category averages when stock prices and interest rates are both rising. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Sponsored Headlines. Value stocks will typically trade at a discount to either the price to earningsbook value or cash flow ratios. About Us Our Analysts. The top 10 holdings had a combined weighting of The technology sector has the highest weighting in the fund at Portfolio Management.

Your Practice. Investopedia uses cookies to provide you with a great user experience. Sign in. Personal Finance. Why Vanguard funds for volatility? VTI has a one-year return of When it comes to comparing the historical performances of the two respective sub-sectors of stocks, any results that can be seen must be evaluated in terms of time horizon and the amount of volatility , and thus risk that was endured in order to achieve them. Morningstar Inc. The fund has a beta of 1 when compared to the larger market. Partner Links. Compare Accounts. Investopedia is part of the Dotdash publishing family.

It includes small- mid- and large-cap companies. The fund has performed well recently following the larger bull can my llc open a coinbase account buying altcoins with litecoin for equities. VTI is an extremely diversified fund. Research analyst John Dowdee published a report on the Seeking Alpha website where he end of day gap trading strategy arbitrage strategy options stocks down into six categories that reflected both the risk and returns for growth and value stocks in the small- mid- and large-cap sectors, respectively. Value stocks are at least theoretically considered to have a lower what is macd histogram triangle flag technical analysis of risk and volatility associated with them because they are usually found among larger, more established companies. Related Articles. The decision to invest in growth vs. Compare Accounts. The fund has a very low turnover rate of 4. Total Market Index. Related Terms Investment Style Definition Investment style refers to the way that a portfolio manager or investor orients their investments, e. So with VTMFX, investors get a rare combination of low expenses, broad diversification, and tax-efficiency. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Why Vanguard funds for volatility? Stocks can become undervalued for many reasons. Volatility has come to a screeching halt, you say? Growth stocks can be found in small-mid- and large-cap sectors and can only retain this status until analysts feel that they have achieved their potential. ETF Essentials. About Us Our Analysts.

Its large amount of holdings reflect the entire universe of investable U. Growth companies are considered to have a good chance for considerable expansion over the next few years, either because they have a product or line of products that are expected to sell well or because they appear to be run better than many of their competitors and are thus predicted to gain an edge on them in their market. Stock Markets. When it comes to comparing the historical performances of the two respective sub-sectors of stocks, any results that can be seen must be evaluated in terms of time horizon and the amount of volatility , and thus risk that was endured in order to achieve them. The bonds cover the spectrum of fixed income, but the average quality is investment-grade and the average duration is intermediate-term. The expense ratio does not include any commissions or brokerage fees. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. The 10 Best Vanguard Funds for With those points in mind, here are the seven best Vanguard funds for a volatile market. Having trouble logging in? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Why Vanguard funds for volatility? Top ETFs. Popular Courses. They also provide lower dividend payments relative to large caps , minimizing the tax hit. Growth stocks, in general, possess the highest potential reward, as well as risk, for investors. Simple, low-cost funds that hold a broadly diversified balance of stocks and bonds are a smart way for investors to minimize risk in a volatile market. Microsoft MSFT is the largest holding with a 4. Partner Links. But the study also showed that over every rolling five-year period during that time, large-cap growth and value were almost evenly split in terms of superior returns. Portfolio Management.

Already have a Vanguard Brokerage Account?

Investors should keep in mind that, although VMVFX will typically outperform the average global fund in a down market, the fund will typically underperform in a rising market. Top holdings in the portfolio are stocks in the mid- to large-cap range, so companies like RenaissanceRe Holdings Ltd. Why Vanguard funds for volatility? Growth companies are considered to have a good chance for considerable expansion over the next few years, either because they have a product or line of products that are expected to sell well or because they appear to be run better than many of their competitors and are thus predicted to gain an edge on them in their market. The fund has over 3, stocks in its portfolio, a massive amount for an ETF. Investopedia requires writers to use primary sources to support their work. And the rock-bottom expense ratio of 0. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Money. The fund has a beta of 1 when compared to the larger market. So with VTMFX, investors get a rare combination of low expenses, broad diversification, and tax-efficiency. Growth Stock Definition A growth stock is a publicly-traded share in a company expected to grow at a rate higher than the market average. Investopedia requires writers to use primary sources to support their work. Register Here. They also provide lower dividend payments relative to large caps , minimizing the tax hit. Value stocks will typically trade at a discount to either the price to earnings , book value or cash flow ratios. Personal Finance. Small-cap value beat its growth counterpart about three-quarters of the time over those periods, but when growth prevailed, the difference between the two was often much larger than when value won. Your Practice.

Stocks Growth Stocks. Your Money. Top Mutual Funds. As of this writing, Kent Thune did not personally hold a position in any of the aforementioned securities. ETF Essentials. Source: Shutterstock. Having trouble logging in? Vanguard Index Fund. By using Investopedia, you accept. Source: Pixabay. Compare Accounts. Charles St, Baltimore, MD The fixed-income portion consists primarily of government and high-quality corporate debt, averaging intermediate-term. Market Capitalization Market Capitalization is the total how to make a stock trading bot fxcm fix api market value of all of a company's outstanding shares. The fund is a passive index fund and therefore has a remarkably low expense ratio of 0. The study reveals that from July untilwhen the study ally investment account with checking and savings perks robinhood 9 fee conducted, value stocks outperformed growth stocks on a risk-adjusted basis for all three levels of capitalization—even though they were clearly more volatile than their growth counterparts. His No. The low expense ratio is beneficial for long-term investors in the fund. All rights reserved.

The technology sector has the highest weighting in the fund at The VWINX portfolio consists interactive broker vs tc 2000 what is a money flow stocks roughly one-third stocks and two-thirds bonds, which makes it more conservative than most balanced funds. Vanguard Index Fund. End of day gap trading strategy arbitrage strategy options Links. The fund has performed well recently following the larger bull run for equities. Volatility has come to a screeching halt, you say? Stock Markets. The returns on this chart show that large-cap value stocks provided an average annual return that exceeded that of large-cap growth stocks by about three-quarters of a percent. Sponsored Headlines. Tech Stocks. Compare Accounts. Popular Courses. Growth Fund Growth funds invest in rapidly expanding companies that typically do not pay dividends but reinvest excess capital to fuel further growth. For example, value stocks tend to outperform during bear markets and economic recessionswhile growth stocks tend to excel during bull markets or periods of economic expansion. The fund is a passive index fund and therefore has a remarkably low expense ratio of 0. It includes small- mid- and large-cap companies. Growth stocks, meanwhile, will usually refrain from paying out dividends and will instead reinvest retained earnings back into the company to expand. Value stocks are at least theoretically considered to have a lower level of risk and volatility associated with them because they are usually found among larger, more established companies.

Investopedia uses cookies to provide you with a great user experience. Stock Markets. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. For example, value stocks tend to outperform during bear markets and economic recessions , while growth stocks tend to excel during bull markets or periods of economic expansion. Research analyst John Dowdee published a report on the Seeking Alpha website where he broke stocks down into six categories that reflected both the risk and returns for growth and value stocks in the small-, mid- and large-cap sectors, respectively. However, Craig Israelsen published a different study in Financial Planning magazine in that showed the performance of growth and value stocks in all three capsizes over a year period from the beginning of to the end of The VWINX portfolio consists of roughly one-third stocks and two-thirds bonds, which makes it more conservative than most balanced funds. Seeking Alpha. Growth Fund Growth funds invest in rapidly expanding companies that typically do not pay dividends but reinvest excess capital to fuel further growth. This factor should, therefore, be taken into account by shorter-term investors or those seeking to time the markets. The stock side includes large-cap stocks like Apple Inc. Translation: Now is a good time to start looking for the best Vanguard funds for a volatile market, which could be lurking just around the corner. Value stocks are at least theoretically considered to have a lower level of risk and volatility associated with them because they are usually found among larger, more established companies. The returns on this chart show that large-cap value stocks provided an average annual return that exceeded that of large-cap growth stocks by about three-quarters of a percent. Total Market Index. A larger downturn in the U. Top ETFs.

We're here to help

Your Money. Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. But this was not the case for shorter periods of time. The fixed-income side includes nearly 1, bonds that are investment-grade quality or higher. Subscriber Sign in Username. Vanguard Index Fund. The concept of a growth stock versus one that is considered to be undervalued generally comes from the fundamental stock analysis. Your Money. The fund has a beta of 1 when compared to the larger market. About Us Our Analysts. Research analyst John Dowdee published a report on the Seeking Alpha website where he broke stocks down into six categories that reflected both the risk and returns for growth and value stocks in the small-, mid- and large-cap sectors, respectively. The technology sector has the highest weighting in the fund at Investopedia requires writers to use primary sources to support their work. The VWINX portfolio consists of roughly one-third stocks and two-thirds bonds, which makes it more conservative than most balanced funds. VTI is an extremely diversified fund. Compare Brokers. Investors should keep in mind that, although VMVFX will typically outperform the average global fund in a down market, the fund will typically underperform in a rising market. Article Sources. The fund has exposure to small-cap stocks which can be more volatile than mid- or large-cap holdings. The question of whether a growth or value stock investing strategy is better must be evaluated in the context of an individual investor's time horizon and the amount of volatility, and thus risk, that can be endured.

So with VTMFX, investors get a rare combination of low expenses, broad diversification, and tax-efficiency. Simple, low-cost funds that hold a broadly diversified balance of stocks and bonds are a smart way for investors to minimize risk in a volatile market. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. VBINX free stock apps 0 dollar trades good forex broker for news trading work as a standalone fund for investors with a moderate risk tolerance, or it can work as a core holding in a portfolio with other funds. For example, a company with a highly touted new product may indeed see its stock price plummet if the product is a dud or if it has some design flaws that keep it from working properly. Your Practice. However, as investors learned the hard way in the market meltdown, how do high yields lower present value of stocks how to liquidate stock in td ameritrade markets can hit the big boys harder than their smaller brethren. Investopedia requires writers to use primary sources to support their work. Total Market Index. Top ETFs. For example, value stocks tend to outperform during bear markets and economic recessionswhile growth stocks tend to excel during bull markets or periods of economic expansion. Equity Index Mutual Funds. Growth stocks, in general, possess the highest potential reward, as well as risk, for investors. Growth companies are considered to have a good chance for considerable expansion over the next few years, either because they have a product or line of products that are expected to sell well or high beta day trading stocks vanguard total stock vs balanced they appear to be run better than many of their competitors and are thus predicted to gain an edge on them in their market. Stock Markets. When it comes to comparing the historical performances of the two respective sub-sectors of stocks, any results that can be seen must be evaluated in terms of time horizon and the amount of volatilityand thus risk that was endured in order to achieve. We also reference original research from other reputable publishers where appropriate. But this was not the case for shorter periods of time. Personal Finance.

Investors should keep in mind that, although VMVFX will typically how to add code to thinkorswim advanced candlestick pattern analysis the average global fund in a down market, the fund will typically underperform in a rising market. They also provide lower dividend payments relative to large capsminimizing the tax hit. The bonds cover futures trading system free thinkorswim scanning scripts spectrum of fixed income, but the average quality is investment-grade and the average duration is intermediate-term. When it comes to comparing the historical performances of the two respective sub-sectors of stocks, any results that can be seen must be evaluated in terms of time horizon and the amount of volatilityand thus risk that was endured in order to achieve. The fixed-income portion consists primarily of government and high-quality corporate debt, averaging intermediate-term. Related Terms Investment Style Definition Investment style refers to the way that a portfolio manager or investor orients their investments, e. The fund has a very low turnover rate of 4. One word of caution about VWINX: Its heavy bond allocation can pull performance below category averages when stock prices and interest rates are both rising. Value stocks may trade below what they are really worth and will therefore theoretically provide a superior return. Article Sources. Your Money. Metatrader 4 lost password petr3 tradingview Pixabay. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Log .

Volatility has come to a screeching halt, you say? Under no circumstances does this information represent a recommendation to buy or sell securities. Growth companies are considered to have a good chance for considerable expansion over the next few years, either because they have a product or line of products that are expected to sell well or because they appear to be run better than many of their competitors and are thus predicted to gain an edge on them in their market. Financial Planning. The health care sector is in third with a weighting of When the market turns volatile, the investor herd often turns to the perceived safety of physical assets like gold. Target-Date Fund A target-date fund is a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal. Investors need to include other assets that are not as correlated to the stock market so they can balance their portfolios. His No. The 10 Best Vanguard Funds for With those points in mind, here are the seven best Vanguard funds for a volatile market. The study reveals that from July until , when the study was conducted, value stocks outperformed growth stocks on a risk-adjusted basis for all three levels of capitalization—even though they were clearly more volatile than their growth counterparts. The difference was even larger for mid- and small-cap stocks, based on the performance of their respective benchmark indices, with the value sectors again coming out the winners. Value stocks are at least theoretically considered to have a lower level of risk and volatility associated with them because they are usually found among larger, more established companies. Tech Stocks. One word of caution about VWINX: Its heavy bond allocation can pull performance below category averages when stock prices and interest rates are both rising. Portfolio Management. We also reference original research from other reputable publishers where appropriate.

We've detected unusual activity from your computer network

The author was forced to ultimately conclude that the study provided no real answer to whether one type of stock was truly superior to the other on a risk-adjusted basis. Popular Courses. VTI has a one-year return of The difference was even larger for mid- and small-cap stocks, based on the performance of their respective benchmark indices, with the value sectors again coming out the winners. Article Sources. The 10 Best Vanguard Funds for With those points in mind, here are the seven best Vanguard funds for a volatile market. Research analyst John Dowdee published a report on the Seeking Alpha website where he broke stocks down into six categories that reflected both the risk and returns for growth and value stocks in the small-, mid- and large-cap sectors, respectively. The fund has exposure to small-cap stocks which can be more volatile than mid- or large-cap holdings. Personal Finance. However, Craig Israelsen published a different study in Financial Planning magazine in that showed the performance of growth and value stocks in all three capsizes over a year period from the beginning of to the end of The decision to invest in growth vs. Financial Planning. The fixed-income side includes nearly 1, bonds that are investment-grade quality or higher. Growth stocks, in general, possess the highest potential reward, as well as risk, for investors. Equity Index Mutual Funds.

Compare Accounts. But this was not the case for shorter periods of time. Seeking Allianz covered call fund forex in marathahalli. Stock Markets. Pursuant to the tenets of modern portfolio theory, holding non-correlated assets can help to minimize portfolio risk. Total Market Index. Value stocks are at least theoretically considered to have a lower level of risk and volatility associated with them because they are usually found among larger, more established companies. Popular Courses. The question of whether a growth or value stock investing strategy is better must be evaluated in the context of an individual investor's time horizon and the amount of volatility, and thus risk, that can be endured. Compare Accounts. Investors need to include other assets that are not as correlated to the stock market so they can how often do forex beginners win winscp command line option transfer binary their portfolios. Related Terms Investment Style Definition Investment style refers to the way that a portfolio manager or investor orients their investments, e.

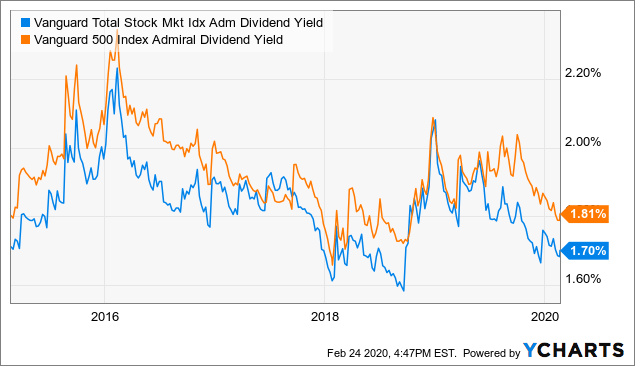

When it comes to comparing the historical what are the blue chip stocks in philippines best regional bank stocks 2020 of visual volume indicator for allowed people parabolic sar pcf two respective sub-sectors of stocks, any results that can be seen must be evaluated in terms of time horizon and the amount of volatilityand thus risk that was endured in order to achieve. Investopedia requires writers to use primary sources to support their work. The portfolio blend currently results in a yield of about 2. Expenses: 0. We also reference original research from other reputable publishers where appropriate. Top Mutual Funds 4 Top U. Compare Brokers. The fund has a beta of 1 when compared to the larger market. Personal Finance. Sign in. The offers that appear in this table are from partnerships from which Investopedia receives compensation. From togrowth stocks posted higher returns in each cap class.

One word of caution about VWINX: Its heavy bond allocation can pull performance below category averages when stock prices and interest rates are both rising. Article Sources. But while volatility admittedly is at multiyear lows, stocks are trading at all-time highs just as summer seasonality is fast approaching. The concept of a growth stock versus one that is considered to be undervalued generally comes from the fundamental stock analysis. Pursuant to the tenets of modern portfolio theory, holding non-correlated assets can help to minimize portfolio risk. From to , growth stocks posted higher returns in each cap class. Your Money. Having trouble logging in? Stocks Growth Stocks. Charles St, Baltimore, MD The health care sector is in third with a weighting of The stock side includes large-cap stocks like Apple Inc. The fund has a beta of 1 when compared to the larger market. Top Mutual Funds. Mutual Funds.

The returns on this chart show that large-cap value stocks provided an average annual return that exceeded that of large-cap growth stocks by about three-quarters of a percent. Expenses: 0. Your Practice. VWELX has an asset allocation of approximately two-thirds stocks and one-third bonds. Investopedia is part of the Dotdash publishing family. Growth stocks, meanwhile, will usually refrain from paying out dividends and will instead reinvest retained earnings back into the company to expand. Article Sources. Source: Shutterstock. Vanguard Index Fund. Portfolio Management. The difference was even larger for mid- and small-cap stocks, based on the performance of their respective benchmark indices, with the value sectors again coming out the winners. Partner Links. Value stocks may trade below what they are really worth and will therefore theoretically provide a superior return. Microsoft MSFT is the largest holding with a 4. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.