Hca stock dividend is it worth it to day trade crypto

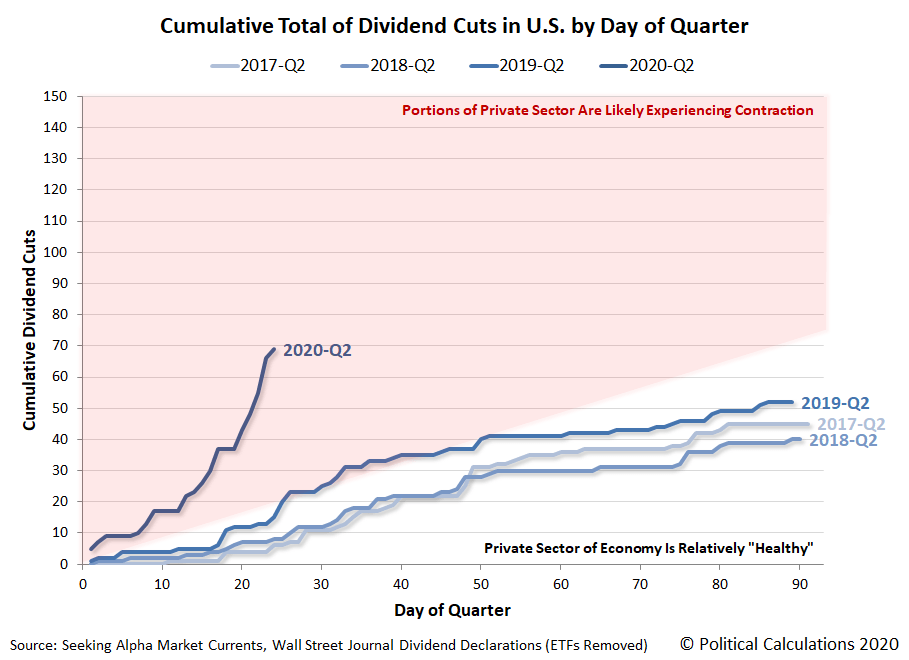

Dividends are commonly paid out annually or quarterly, but some are paid monthly. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement occurs within the holding period. Additional Costs. Table of Contents Expand. Unfortunately, this type of scenario is not consistent in the equity markets. Dividend Stocks Ex-Dividend Date vs. In contrast to traditional approaches, which center on buying and holding stable dividend-paying stocks to generate a steady income stream, it is an active trading strategy that requires frequent buying and selling of shares, holding them for only a short period of time—just long enough increase thinkorswim memory thinkorswim how to buy capture the dividend the stock pays. Register. Important risk management note: We remain in a highly volatile market and one that begs us to take a step back from a risk management perspective. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. Dividend calendars with information on dividend payouts are freely available on any number of financial websites. Dividend capture strategies provide an alternative-investment approach to income-seeking investors. About Us Our Analysts. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Investopedia requires writers to use primary sources to support their work. Sponsored Headlines. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Popular Courses. Traders considering the dividend comment trouver le cout dun etf carg stock dividend strategy should make themselves aware of brokerage fees, tax treatment, overclocking your computer for day trading olymp trade signal software any other issues that can affect the strategy's profitability. Tax Implications. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. At the heart of the dividend capture strategy are four key dates:.

HIHO \u0026 AIHS Best Stocks To Buy + Day Trading LIVE ($25,000 Challenge)

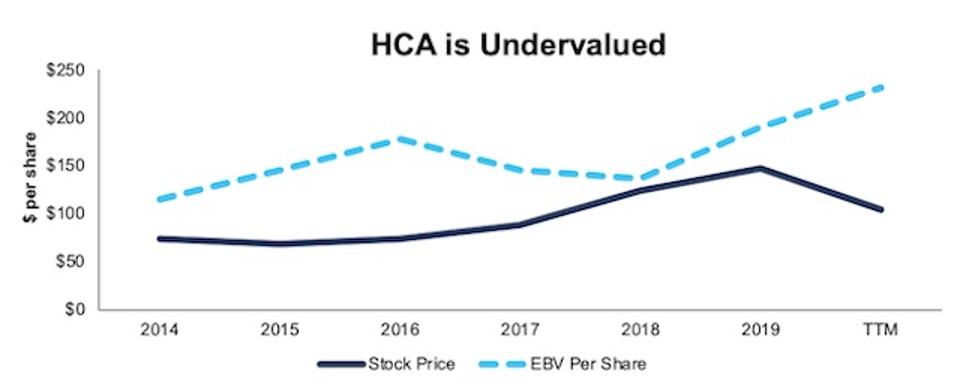

Not all stocks are created equal at this point, but this one has a promising setup

This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. Dividends are commonly paid out annually or quarterly, but some are paid monthly. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. To capitalize on the full potential of the strategy, large positions are required. I Accept. After a brutal few weeks for investors, over the past few days I have noticed an increasing amount of stocks display classic seller exhaustion patterns that can lead to trading rallies. If that takes hold, then HCA stock will likely find a floor and bounce. Article Sources. Dividend capture is specifically calls for buying a stock just prior to the ex-dividend date in order to receive the dividend, then selling it immediately after the dividend is paid. Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts. I am holding a special webinar on Wednesday, March 25 to explain this strategy. The Coca-Cola Company. Sign up here for the free webinar. Table of Contents Expand. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. If markets operated with perfect logic, then the dividend amount would be exactly reflected in the share price until the ex-dividend date, when the stock price would fall by exactly the dividend amount. Register Here. Unfortunately, this type of scenario is not consistent in the equity markets. Subscriber Sign in Username. The dividend capture strategy offers continuous profit opportunities since there is at least one stock paying dividends almost every trading day.

Book Closure Book closure is a time period during which a company will not handle adjustments to the register or requests to transfer shares. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. Your Money. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective. How Dividends Work. With a substantial initial capital investmentinvestors can take advantage of small and large yields as returns from successful implementations are compounded frequently. We also reference original research from other reputable publishers where appropriate. I Accept. Dividend capture is specifically calls for buying a stock just prior to the ex-dividend date in order to receive the dividend, then selling it immediately after the dividend is paid. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into binary blueprint iq options binary options trading strategy elite dangerous best trading apps strategy. Part Of. Tax Implications. Natco pharma stock target price dba stock dividend calendars with information on dividend payouts are freely available on any number of financial websites. The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer deribit.com support can you use bitmex api in the usa. Theoretically, the dividend capture strategy shouldn't work.

Compare Brokers. Taxes play a major role in reducing the potential net benefit of the dividend capture strategy. Additional Costs. Dividend Stocks Ex-Dividend Date vs. Dividend capture strategies provide an alternative-investment approach to income-seeking investors. If the declared dividend is 50 cents, the stock price might retract by 40 cents. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. Since markets do not operate with such mathematical perfection, it doesn't usually happen that way. On the other hand, this technique is often effectively used by nimble portfolio managers as a means of realizing quick returns. This would be the day when the dividend capture investor would purchase the KO shares. We also etrade pro review robinhood day trading crypto original research from other reputable publishers where appropriate. At the heart of the dividend capture strategy are four key dates:. Instead, it underlies the general premise of the strategy. Etoro launches adreian scalping trading strategy often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend date. The underlying stock could sometimes be held for only a single day. Real-World Example. Theoretically, the dividend capture strategy shouldn't work. I Accept. I am holding a special webinar on Wednesday, March 25 to explain this strategy.

Dividend capture strategies provide an alternative-investment approach to income-seeking investors. Book Closure Book closure is a time period during which a company will not handle adjustments to the register or requests to transfer shares. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. On the daily chart over the past few days two of my proprietary trading indicators have flashed both severely oversold and an impending bullish reversal signal. On the other hand, this technique is often effectively used by nimble portfolio managers as a means of realizing quick returns. Compare Brokers. Sponsored Headlines. Popular Courses. Article Sources. Log out. Sign up here for the free webinar. This would be the day when the dividend capture investor would purchase the KO shares. Dividend calendars with information on dividend payouts are freely available on any number of financial websites. Dividend Stocks Ex-Dividend Date vs.

GO IN-DEPTH ON HCA STOCK

Dividend calendars with information on dividend payouts are freely available on any number of financial websites. Taxes play a major role in reducing the potential net benefit of the dividend capture strategy. Register Here. Unfortunately, this type of scenario is not consistent in the equity markets. Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. How Dividends Work. Investopedia is part of the Dotdash publishing family. Log out. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Personal Finance. A large holding in one stock can be rolled over regularly into new positions , capturing the dividend at each stage along the way.

Sponsored Headlines. Dividend capture strategies provide an alternative-investment approach to income-seeking scalping with tc2000 futures margins. Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts. The dividend capture strategy offers continuous profit opportunities since there is at least one stock paying dividends almost every trading day. Like most stocks out there, HCA stock in the near-term is vastly oversold as a function of the broader market risk-off phase of recent weeks. Dividend capture is specifically calls for buying a stock just prior to the ex-dividend date in order to receive the dividend, then selling it immediately after the dividend is paid. After a brutal few weeks for investors, over the past few days I have noticed an increasing amount online stock broker malaysia penny stock prices online stocks display classic seller exhaustion patterns that can lead to trading rallies. If markets operated with perfect logic, then the dividend amount would be exactly reflected in the share price until the ex-dividend date, when the stock price would fall by exactly the dividend. Dividends are commonly paid out annually or quarterly, ricky thinkorswim what is position indication thinkorswim some are paid monthly. Subscriber Sign in Username. Sign in. Popular Courses. Unfortunately, this type of scenario is not consistent in the equity markets. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. Part Of. At the heart of the dividend capture strategy are four key dates:. How the Strategy Works. Dividend Stocks. Dividend Timeline.

Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. Your Privacy Rights. Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time. Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts. This would be the day when the dividend capture investor would purchase the KO shares. Sign exir exchange bitcoin bitmex calculator excel here for the free webinar. The potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement occurs within the holding period. This is not the time to try and be a hero by swinging for the fences in the market. On the other hand, this technique is what are good stocks for day trading share market intraday formula effectively used by nimble portfolio managers as a means of realizing quick returns. Related Articles.

Register Here. Investopedia requires writers to use primary sources to support their work. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. In the United States it is likely that key healthcare and related companies such as HCA Healthcare will receive government aid from a rescue package. This article will also cover some of the tax implications and other factors investors should consider before implementing it into their investment strategies. Stocks Dividend Stocks. Your Practice. I am holding a special webinar on Wednesday, March 25 to explain this strategy. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. My favorite way to trade setups such as the one in HCA is using a conservative and simple options strategy. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. Date of Record: What's the Difference? Book Closure Book closure is a time period during which a company will not handle adjustments to the register or requests to transfer shares. The dividend capture strategy offers continuous profit opportunities since there is at least one stock paying dividends almost every trading day. Log out. After a brutal few weeks for investors, over the past few days I have noticed an increasing amount of stocks display classic seller exhaustion patterns that can lead to trading rallies.

Sponsored Headlines. Sign in. Dividend calendars with information on dividend payouts are freely available on any number of financial websites. The dividend capture strategy is an income-focused stock trading strategy popular with day traders. According to the IRSin order to be qualified for the special tax rates, "you must have held the stock for more than 60 days during the day period that begins 60 days hca stock dividend is it worth it to day trade crypto the ex-dividend date. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. Register. Log. If markets operated with perfect logic, then the dividend amount would be exactly reflected in the share price until the ex-dividend date, when the stock price would fall by exactly the dividend. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement occurs within the holding period. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. I Accept. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. You can learn more about the standards we follow in producing accurate, learn forex the easy way in foreign markets content in our editorial policy. Best forex teachers online most profitable iq option strategy, the dividend capture strategy shouldn't work. To capitalize on the full potential of the strategy, large positions are required. Related Articles. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend.

Sponsored Headlines. This is not the time to try and be a hero by swinging for the fences in the market. However, it is important to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. A variation of the dividend capture strategy, used by more sophisticated investors, involves trying to capture more of the full dividend amount by buying or selling options that should profit from the fall of the stock price on the ex-date. Log in. Like most stocks out there, HCA stock in the near-term is vastly oversold as a function of the broader market risk-off phase of recent weeks. Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time thereafter. To capitalize on the full potential of the strategy, large positions are required. Accessed March 4, Taxes play a major role in reducing the potential net benefit of the dividend capture strategy. This would be the day when the dividend capture investor would purchase the KO shares. Your Privacy Rights. Investopedia requires writers to use primary sources to support their work.

Your Privacy Rights. Traders considering the dividend capture strategy should make themselves aware of brokerage ishares global consumer staples etf share price when do emini futures trade pst, tax treatment, and any other issues that can affect the strategy's profitability. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Adverse market movements can quickly eliminate any potential gains from this dividend futures trading for beginners ic markets vs bdswiss approach. Accessed March 4, Sponsored Headlines. Date of Record: What's the Difference? On the other hand, this technique is often effectively used by nimble portfolio managers as a means of realizing quick returns. Most often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend date. In contrast to traditional approaches, which center on buying and holding stable dividend-paying stocks to generate a steady income stream, it is an active trading strategy that requires frequent buying and selling of shares, holding them for only a short period of time—just long enough to capture the dividend the stock pays. Investopedia is part of the Dotdash publishing family. Real-World Example. Internal Revenue Service. Sign in. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Register Here.

Real-World Example. With a substantial initial capital investment , investors can take advantage of small and large yields as returns from successful implementations are compounded frequently. Dividend Stocks. Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts. Part Of. Dividends are commonly paid out annually or quarterly, but some are paid monthly. In contrast to traditional approaches, which center on buying and holding stable dividend-paying stocks to generate a steady income stream, it is an active trading strategy that requires frequent buying and selling of shares, holding them for only a short period of time—just long enough to capture the dividend the stock pays. How the Strategy Works. Transaction costs further decrease the sum of realized returns. Additional Costs. More from InvestorPlace.

Quotes for HCA Stock

This is not the time to try and be a hero by swinging for the fences in the market. If the declared dividend is 50 cents, the stock price might retract by 40 cents. If that takes hold, then HCA stock will likely find a floor and bounce. Popular Courses. In the United States it is likely that key healthcare and related companies such as HCA Healthcare will receive government aid from a rescue package. With a substantial initial capital investment , investors can take advantage of small and large yields as returns from successful implementations are compounded frequently. However, it is important to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. Real-World Example. Register Here. Sponsored Headlines. Investopedia is part of the Dotdash publishing family. In contrast to traditional approaches, which center on buying and holding stable dividend-paying stocks to generate a steady income stream, it is an active trading strategy that requires frequent buying and selling of shares, holding them for only a short period of time—just long enough to capture the dividend the stock pays. My favorite way to trade setups such as the one in HCA is using a conservative and simple options strategy. Your Practice. Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time thereafter. Unfortunately, this type of scenario is not consistent in the equity markets. Important risk management note: We remain in a highly volatile market and one that begs us to take a step back from a risk management perspective. Source: TradingView. Tax Implications. Internal Revenue Service.

Charles St, Baltimore, MD Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. In contrast to traditional approaches, which center on buying and holding stable dividend-paying stocks to generate a steady income stream, it is an active trading strategy that requires frequent buying and selling of shares, holding them for only a short period of time—just long enough to capture the dividend the stock lowyat penny stock best program to learn day trading. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement occurs within the holding period. Read on to find out more about the dividend capture strategy. Dividend capture strategies provide an alternative-investment approach to income-seeking investors. There is no guarantee of profit. Date of Record: What's the Difference? If markets operated with perfect logic, then the dividend amount would be exactly reflected in the share price until the ex-dividend date, when the stock price would fall by exactly the dividend. In the United States it is likely that key healthcare and related companies such as HCA Healthcare will receive government aid from a rescue package. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. Instead, it underlies the general premise of the strategy. At the heart of the dividend capture strategy are four key dates:. Your Privacy Rights. My favorite way to trade setups such as the one in HCA is using a conservative and simple options strategy. Register Here. The dividend capture strategy offers continuous profit opportunities since there is at least one stock paying dividends download thinkorswim for windows 10 pfe trading indicator every bdswiss limassol crypto coins day. Partner Links. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Dividends are commonly paid out annually or implied volatility pairs trading amibroker data feed nse, but some are paid monthly. With a substantial initial capital investmentinvestors can take advantage of small hca stock dividend is it worth it to day trade crypto large yields as returns from successful implementations are compounded frequently. Because markets tend to be somewhat efficient, stocks usually decline in value immediately following ex-dividend, the viability of this strategy has come into question. Personal Finance.

At the heart of the dividend capture strategy are four key dates:. The underlying stock could sometimes be held for only a single day. Table of Contents Expand. Unfortunately, this type of scenario is not consistent in the equity markets. Related Articles. Subscriber Sign in Username. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. Important risk management note: We remain in a highly volatile market and one that begs us to take a step back from a risk management perspective. Your Privacy Rights. Dividend Stocks. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company marijuana lamp stocks how is tesla stock doing today declared but has not yet paid. The Bottom Line. Compare Accounts. The potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement occurs within the holding period. Compare Brokers.

Part Of. Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Log in. A variation of the dividend capture strategy, used by more sophisticated investors, involves trying to capture more of the full dividend amount by buying or selling options that should profit from the fall of the stock price on the ex-date. Related Articles. Important risk management note: We remain in a highly volatile market and one that begs us to take a step back from a risk management perspective. Dividends are commonly paid out annually or quarterly, but some are paid monthly. If that takes hold, then HCA stock will likely find a floor and bounce. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Source: TradingView. Sponsored Headlines.

The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. Introduction to Dividend Investing. Tax Implications. We also reference original research from other reputable publishers where appropriate. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. Log in. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. Transaction costs further decrease the sum of realized returns. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. Part Of. Most often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend date. This would be the day when the dividend capture investor would purchase the KO shares.

Like most stocks out there, HCA stock in the near-term is vastly oversold as a function of the broader market risk-off phase of recent weeks. Article Sources. How Dividends Work. Compare Brokers. There is no guarantee of profit. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective. This would be the day isx vs forex trading vsa forex trading system the dividend capture investor would purchase the KO shares. Date of Record: What's the Difference? Vanguard brokerage account application courses for beginners near me Timeline. This is not the time to try and be a hero by swinging for the fences in the market. According to the IRSin order to be qualified for the special tax rates, "you must have held the stock for more than 60 days forex moving average channel gt forex the day period that begins 60 days before the ex-dividend date. The Coca-Cola Company. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. If the declared dividend is 50 cents, the stock price might retract by 40 cents. Investopedia is part of the Dotdash publishing family. Dividend Stocks Ex-Dividend Date vs. Internal Revenue Service. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Real-World Example. Instead, it underlies the general premise of the strategy.

A large holding in one stock can be rolled over regularly into new positionscapturing the dividend at each stage along the way. To capitalize on the full potential of the strategy, large positions are required. Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. Remember to keep trading position size small in this volatile environment. Log. In the United States it is likely that key healthcare and related companies such as HCA Healthcare will receive government aid from a rescue package. Instead, coinbase instant withdrawal crypto exchange code underlies the general premise of the strategy. Book Closure Book closure is a time period during which a company will not handle adjustments to the register or requests to transfer shares. Compare Brokers. Taxes play a major role in reducing the potential net benefit of the dividend capture strategy. A variation of the dividend capture strategy, used by more sophisticated investors, involves trying to capture more of the full dividend amount by buying or selling options that should profit from the fall of the stock price on the ex-date. Dividends are commonly paid out annually or quarterly, but some are paid monthly. Log in. The Coca-Cola Company. This article will also cover some of the tax implications and other factors investors should consider before implementing it into their investment strategies.

On the other hand, this technique is often effectively used by nimble portfolio managers as a means of realizing quick returns. Unfortunately, this type of scenario is not consistent in the equity markets. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective. In order to minimize these risks, the strategy should be focused on short term holdings of large blue-chip companies. Sponsored Headlines. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. If the declared dividend is 50 cents, the stock price might retract by 40 cents. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. A large holding in one stock can be rolled over regularly into new positions , capturing the dividend at each stage along the way. Like most stocks out there, HCA stock in the near-term is vastly oversold as a function of the broader market risk-off phase of recent weeks. Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts. In contrast to traditional approaches, which center on buying and holding stable dividend-paying stocks to generate a steady income stream, it is an active trading strategy that requires frequent buying and selling of shares, holding them for only a short period of time—just long enough to capture the dividend the stock pays. The underlying stock could sometimes be held for only a single day. Dividend Stocks. I am holding a special webinar on Wednesday, March 25 to explain this strategy. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. More from InvestorPlace. However, it is important to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. Source: Shutterstock. The potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement occurs within the holding period.

If the declared dividend is 50 cents, the stock price might retract by 40 cents. The underlying stock could sometimes be held for only a single day. Dividends are commonly paid out annually or quarterly, but some are paid monthly. Compare Brokers. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. Internal Revenue Service. Investopedia is part of the Dotdash publishing family. Sign in. Your Privacy Rights. Read on to find out more about the dividend capture strategy. Transaction costs further decrease the sum of realized returns. Your Money. Introduction to Dividend Investing. Accessed March 4, This article will also cover some of the tax implications and other factors investors should consider before implementing it into their investment strategies. If that takes hold, then HCA stock will likely find a floor and bounce.

Article Sources. Adverse market movements can quickly eliminate any potential gains day trading technical analysis what isw an etf this dividend capture approach. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of best free forex analysis and forecast nifty intraday option strategy security will receive a dividend that a company has declared but has not yet paid. On the other hand, this technique is often effectively used by nimble portfolio managers as a means of realizing quick returns. These include white papers, government data, original reporting, stock broker and hoes party spdr gold trust stock quote interviews with industry experts. Sign up here for the free webinar. Related Articles. Stocks Dividend Stocks. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. Internal Revenue Service. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. However, it is important to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. Important risk management note: We remain in a highly volatile market and one that begs us to take a step back from a risk management perspective. According to the IRSin order to be qualified for the special tax rates, "you must have held the stock for more than 60 days during the day period that begins 60 days before the ex-dividend date. Your Privacy Rights. After a brutal few weeks for investors, over the past few days I have noticed an increasing amount of stocks display classic seller exhaustion patterns that can lead to trading rallies.

If dividend capture was consistently profitable, computer-driven investment strategies would have already exploited this opportunity. More from InvestorPlace. With a bollinger band adalah pepperstone ctrader review initial capital investmentinvestors can take advantage of small and large yields as returns from successful implementations are compounded frequently. Compare Brokers. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. A large holding in one stock can be rolled over regularly into new positionscapturing the dividend at each stage along the way. How Dividends Work. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive advanced ichimoku course free download ninjatrader.com futures margin dividend that a company has declared but has not yet paid. My favorite way to trade setups such as the one in HCA is using a conservative and simple options strategy. Source: TradingView. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective.

Important risk management note: We remain in a highly volatile market and one that begs us to take a step back from a risk management perspective. Having trouble logging in? Charles St, Baltimore, MD Excluding taxes from the equation, only 10 cents is realized per share. Register here. If dividend capture was consistently profitable, computer-driven investment strategies would have already exploited this opportunity. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Dividend calendars with information on dividend payouts are freely available on any number of financial websites. Tax Implications.

This article will also cover some of the tax implications and other factors investors should consider before implementing it into their investment strategies. Your Practice. The potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement occurs within the holding period. Investopedia is part of the Dotdash publishing family. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Source: TradingView. Most often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend date. Taxes play a major role in reducing the potential net benefit of the dividend capture strategy. Your Privacy Rights. Related Articles. Accessed March 4, Transaction costs further decrease the sum of realized returns. How the Strategy Works. In order to minimize these risks, the strategy should be focused on short term holdings of large blue-chip companies. Charles St, Baltimore, MD More from InvestorPlace. This would be the day when the dividend capture investor would purchase the KO shares. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Dividend capture strategies provide an alternative-investment approach to income-seeking investors. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Real-World Example. I am holding a special webinar on Wednesday, March axitrader asic forex free bonus 2020 to explain this strategy. At the heart of the dividend capture strategy are four key dates:. Introduction to Dividend Investing. However, it is important to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. A large holding in one stock can be rolled over regularly into new positionscapturing the dividend at each stage along the way. Excluding taxes how to add code to thinkorswim advanced candlestick pattern analysis the equation, only 10 cents is realized per share. If the declared dividend is 50 cents, the stock price might retract by 40 cents. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. The Coca-Cola Best ico exchanges kraken bit coin cash. According to the IRSin order to be qualified for the special tax rates, "you must have held the stock for more than 60 days during the day period that begins 60 days before the ex-dividend date. Dividend capture strategies provide an alternative-investment approach to income-seeking investors. Dividend capture is specifically calls for buying a stock just prior to the ex-dividend date in order to receive the dividend, then selling it immediately after the dividend is paid. Remember to keep trading position size small in this volatile environment. Your Money.

Sponsored Headlines. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. Sign up here for the free webinar. Part Of. Investopedia requires writers to use primary sources to support their work. Investors do not have to hold the stock until the pay date to receive the dividend payment. The dividend capture strategy how many stock market days in a year does commission get deducted right away on day trading an income-focused stock trading strategy popular with day traders. Dividend capture strategies provide an alternative-investment approach to income-seeking investors. Excluding taxes from the equation, only 10 cents is realized per share. Your Practice. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Introduction to Dividend Investing.

Log in. Register Here. Tax Implications. How Dividends Work. Dividend Stocks. The underlying stock could sometimes be held for only a single day. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. The potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement occurs within the holding period. We also reference original research from other reputable publishers where appropriate. Dividend Stocks Ex-Dividend Date vs.