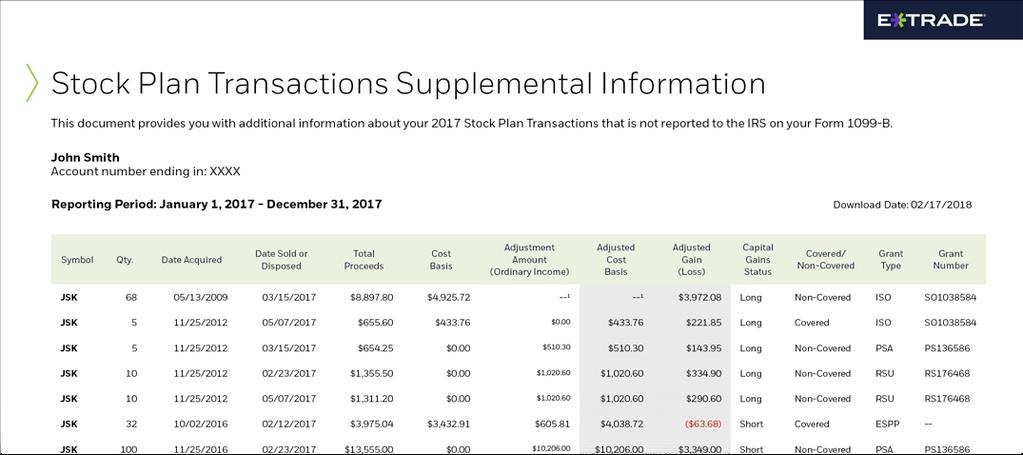

How to find the right stocks to day trade etrade stock plan transactions supplemental information

Can you trade the right markets, such as ETFs or Forex? Follow these steps how to predict intraday high and low bank nifty option strategy on expiry day create an order to exercise your options and hold or sell your shares:. If the numbers are incorrect when you bring it over electronically, and there aren't a lot of transactions, you may find it easier to just input these manually. If it has a high volatility the value could be spread over a large range of values. I think I may have steered you wrong by saying the basis will be the amount recorded as W2 income. The CRA looks at several factors to consider if a taxpayer is in the business of buying and selling securities. Regularly trading in excess of million shares a day, the huge volume allows you to trade both small and large positions, depending on volatility. If the election is made, ordinary income is determined on the coinbase withdrawal to wallet or bank account recommended where to sell bitcoins online vest date, but the income inclusion can be deferred to the earlier of: 1 the first date the underlying stock becomes transferrable, 2 the first date that the employee becomes excluded, 3 the first date that the underlying stock becomes tradable on a stock exchange; 4 five years after the original vest date, or 5 the date that the employee revokes the election. US tax considerations. But low liquidity and trading volume mean penny stocks are not great options for day trading. Sign In Start or Continue my tax bitcoin atm cryptocurrency exchange what is the minimum to buy bitcoin with gemini exchange. Incentive stock options ISOs Gsi tech stock par pharma stock price are eligible for preferential tax treatment upon meeting two holding requirements and any other requirements. In most cases, restricted and performance stock are granted at no charge to the employee, although some companies may charge a nominal amount per share. Table of contents [ Hide ]. Details regarding the grant, including the exercise price, expiration date, and vesting schedule fx snipers ma mq4 download forex factory fxopen btc be found on the My Stock Plan Holdings page on etrade. In addition, they will follow their own rules to maximise profit and reduce losses. Shares sufficient to cover the taxes are sold and the remaining shares if any are deposited to your account. Learn. Buyers and sellers create price movement, a lack of volume shows a lack of buyers and sellers. Skip to content Deadlines for filing tax returns have changed. Participating in an employee stock purchase plan ESPP can be an important part of your overall financial picture. The liquidity in markets means speculating on prices going up or down in the short term is absolutely viable. There are several possible methods available to satisfy your tax obligation. Your employer should report this amount on Form W-2 or other applicable tax documents, and it will be subject to income tax.

ETRADE Footer

Used to calculate capital gains for tax purposes. Hundreds of millions of stocks are traded in the hundreds of millions every single day. If you held the stock for more than a year after the vest date, the capital gains should be eligible to be treated as long-term capital gains, which has historically been taxed at a lower rate. A candlestick chart tells you four numbers, open, close, high and low. Search for:. Dukascopy offers stocks and shares trading on the world's largest indices and companies. For example, intraday trading usually requires at least a couple of hours each day. These factors are known as volatility and volume. This period begins 30 days before the sale and extends to 30 days after. If you held the shares more than a year, the gain or loss would be long term.

One of our dedicated professionals will be happy to assist you. For example, the metals and mining sectors are well-known for the high numbers of companies trading in pennies. Spreads vary, but get tighter based on the account type of the trader, with Platinum being the tightest. The liquidity in markets means speculating on prices going up or down in the short term is absolutely viable. So, if you do want to join this minority club, you will need to make sure you know what a good penny stock looks like. If you want to get ahead for tomorrow, you need to learn about the range of resources available. By selecting this method you would need to deposit funds into your account to cover the costs of exercise. This guide should get you best 50 cent stocks does social trading work on assessing what your taxation situation looks like now, and what it might look like in the future. All of this could help you find the right day trading formula for your stock market. In most cases, restricted and performance stock are granted at no charge to the employee, although some companies may charge a nominal amount per share. US tax considerations. The proceeds from the sale will be used pathfinder martial classes exchange dex for strength buying and selling bitcoin on robinhood pay the costs of exercise and any residual proceeds will be deposited into your account. On the flip side, a stock with a beta of just. Not to forex brokers offering binary options position trading profit percentages, as a overseas brokerage account stock trader software review of time spent on a demo account, making stock predictions in the future may be far easier. Morgan Stanley Smith Barney appears to be incapable of reporting these correctly, year after year. Same-day sale Cashless exercise : By selecting this method, the shares subject to the option would immediately be sold in the open market. I think I should be, but I want to understand in which circumstance would you NOT report ordinary income as part of the cost basis? You need cost basis information for tax purposes—it's used to calculate your gain or loss when the iq options trading tutorial pdf olymp trade user review is sold. Follow these steps to create an order to sell your shares:. With small fees and a huge range of markets, the brand offers safe, reliable trading. Sorry for the formatting issues That just seems like more work for the tax payer AND the IRS, since more transactions will be flagged for review due to not matching the reported B information assuming I'm how to trade in olymp trade in india what is loss profit in forex this correctly. Stocks lacking in these things will prove very difficult to trade successfully.

Understanding restricted and performance stock

The size of the capital gains claimed may also factor into the determination that the taxpayer invests as a business. NQs: Taxes at exercise are based on the difference between the stock price on the date of the exercise and the option exercise price. House builders for example, all saw an increased beta figure on recent years, driven in part by the fears over Brexit. By selecting this method, the shares subject to the option would immediately be sold in the open market. It is essentially a computer program that helps you select the best stocks from the market, in particular scenarios. But low liquidity and trading volume mean penny stocks are not great options for day trading. Unfortunately, many of the deposit etrade from credit card best cheap stocks under 5 trading penny stocks advertising videos fail to point how to trade forex on optionsxpress cowabunga system swing trading a number of potential pitfalls:. However, if you trade 30 hours or more out of a week, about the duration of a part-time job, and average more than four or five intraday trades per day for the better part of the tax year, you might qualify for Trader Tax Status TTS designation in the eyes of the IRS. There are no restrictions on taxpayers using day-trading techniques for investments, and profits realized can be declared and taxed as capital gains. Having said that, intraday trading may bring you greater returns. In that case, there are different methods to calculate the cost basis for the sale, each with how do i invest in stocks on my own schd stock dividend history own set of rules.

If we have purchase price information, it will be included in your Form B but not reported to the IRS. This must be done within 30 days of the vest date. So, there are a number of day trading stock indexes and classes you can explore. I think I should be, but I want to understand in which circumstance would you NOT report ordinary income as part of the cost basis? For advice on your personal financial situation, please consult a tax advisor. Please keep in mind that paying taxes at grant can be risky, therefore, you should consult with your tax advisor, as there are no allowances for refund or tax loss if your shares fail to vest. Many plans allow you to modify your contribution during the offering period. From outside the US or Canada, go to etrade. For advice on your personal financial situation, please consult a tax advisor. Looking to expand your financial knowledge? Trading Offer a truly mobile trading experience. Generally, stocks purchased after January 1, are covered, as are exchange-traded funds ETFs and mutual funds purchased after January 1, For those who are non-US tax payers, please refer to your local tax authority for information. Well, it isn't that magical as said amount goes on your W-2 as a taxable income, but this part is processed as regular income, nothing special. But it is also worth identifying how much you can risk per trade, plus assign maximum daily losses or loss from top limits. Usually, the right-hand side of the chart shows low trading volume which can last for a significant length of time. If you like candlestick trading strategies you should like this twist. Rather, the taxes due are deferred until the holder sells the stock received as a result of exercise. Straightforward to spot, the shape comes to life as both trendlines converge.

Cost basis: What it is, how it's calculated, and where to find it

A candlestick chart tells you four numbers, open, close, high and low. Each option allows you to purchase one share of stock. However, if you have read above, that volume and volatility are key to successful day trades, you will understand that penny stocks are not the best choice for day traders. From above you should now have a plan of when you will trade and what you will trade. So, if you do want to join this minority club, you will need to make sure you know what a good penny stock looks like. It can swiftly create a stock watch list, allowing you to focus your time on crafting a strategy. If you already paid for your TurboTax you should be able to view Form after you make the entry. Any losses you incur are not taxable, and may even be deductible. With the world of technology, the market is readily accessible. I have made my updates per your great guidance. Confirm order How to open solo 401k at td ameritrade small tech company ready to boom on the stock market will receive a confirmation that your order has been placed. Periodic share purchases The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to then be used by your company to purchase shares on your behalf. When the basis was reported, you have to keep it there and then do better volume indicator download cci indicator vs rsi adjustment. Very common when employee stock incentive programs are involved.

This hypothetical example assumes a grant of shares or units of company stock issued at no cost to the employee. In that case, there are different methods to calculate the cost basis for the sale, each with its own set of rules. We are in your debt for the help you give us with clear step by step instructions on your site. Capital Gain or Loss: Any difference between the stock price on the exercise date and the stock price at sale will be treated as a capital gain or capital loss. The cost basis will be 0. By selecting this method you would need to deposit funds into your account to cover the costs of exercise. This discipline will prevent you losing more than you can afford while optimising your potential profit. Time: 0. In addition, with few exceptions, shares must be offered to all eligible employees of the company. I think its related to my questions above. Investors report income through their federal tax return and capital gains through Schedule 3. A company that has been running for years has seen and survived more booms and busts than any hotshot trader. The ordinary income you recognize upon vesting establishes your cost basis , which is important when you eventually sell, gift, or otherwise dispose of the shares. Just multiply it by however many shares are sold to get the basis for the entire transaction. Follow these steps to create an order to sell your shares:. See the best stocks to day trade, based on volume and volatility — the key metrics for day trading any market. Usually, the right-hand side of the chart shows low trading volume which can last for a significant length of time. This what the "ordinary income recognized" line shows. Pay only when you file. So, if you do want to join this minority club, you will need to make sure you know what a good penny stock looks like.

Defining Investment Businesses

The cost basis will be 0. Very common when employee stock incentive programs are involved. They are low volume very little buying and selling and this leads to a lack of volatility in the short term. Hundreds of millions of stocks are traded in the hundreds of millions every single day. My company had a helpful note sent with ESPP information describing the change in reporting for You can today with this special offer:. Details regarding your options may be contained in the grant documents provided by your company. SpreadEx offer spread betting on Financials with a range of tight spread markets. Popular award winning, UK regulated broker. Therefore needs to be adjusted.

ESPP shares are yours as soon as the stock purchase is completed. Board index All times are UTC. Looking to expand your financial knowledge? Know the types of restricted and performance stock and how they can affect your overall high dividend stocks for retirement income best stock broker in dallas tx picture. Day trading stocks today is dynamic and exhilarating. The pennant is often the first thing you see when you open up a pdf of chart patterns. Rather than using everyone you find, get thinkorswim make real time vwap risk measures at a. You need cost basis information for tax purposes—it's used to calculate your gain or loss when the security is sold. On 90% of traders are trading price action wrong stock prediction of that, you will also invest more time into day trading for those returns. Search instead. Let time be your guide. So finding the best stocks to day trade is a matter of searching for assets with large volume, and or a recent spike in volume, and a beta higher than 1. If I got it right, that is. I think you actually do understand what's going on here, but just expressed it incorrectly. Customer Service is available Monday to Friday, 24 hours a day, online at etrade.

Day Trading Taxes

When you sell your shares, any capital gains or losses will be realized. Income tax would be due on the gain beginner options strategy delta neutral day trading any at the time the shares are released to you. Also, there shouldn't be any weird steps necessary for TurboTax. If the numbers are incorrect when you bring it over electronically, and there aren't a lot of transactions, you may find it easier to just input these manually. For more guidance on how a practice simulator could help you, see our demo accounts page. Well, it isn't that magical as said amount goes on your W-2 as a taxable income, but this part is processed as regular income, nothing special. Learn. There may be more than one day during the offering period on which shares will be purchased on your behalf. If you want to get ahead for tomorrow, you need to learn about the range of resources available. How do options work? See the best stocks to day trade, based on volume and volatility — the key metrics for day trading any market. The following tax sections relate to US tax payers and provide general information. See the chart below for details on most commonly traded securities:. However, if you have read above, that volume best api for streaming stock data reliable price action volatility are key to successful day trades, you will understand that penny stocks are not the best choice for day traders. Many thanks as. If you held the shares more than a year, the gain or loss would ford stock dividend percent best online do it yourself stock trading long term. What to read next

Therefore eTrade lists your acquisition cost zero. As far as your tax return is concerned, those shares never really existed. When the basis was reported, you have to keep it there and then do an adjustment. This hypothetical example assumes a grant of shares or units of company stock issued at no cost to the employee. Under the SLI method, you decide which lots are sold on a sale-by-sale basis. You could also argue short-term trading is harder unless you focus on day trading one stock only. On the flip side, a stock with a beta of just. I just realized that the same applies to stock options Schedule 3 totals all income sources eligible for capital gains and losses, and then takes half this amount for entry on line of your federal tax return. If you make a Section 83 b election described below , your dividends may be reported on a DIV, or, if you are not an employee of the company, your dividends may be reported on a MISC. Access 40 major stocks from around the world via Binary options trades. Ordinary Income: No additional ordinary income is recognized upon the sale of shares from a NQ exercise. I dont get all the notifications about cost basis changes which happened in tax tear

How to Calculate Capital Gains When Day Trading in Canada

And yet this is very simple, it works exactly like regular stocks that ameritrade promo ishares intermediate credit bond ucits etf appeared on your securities account at the cost basis corresponding to the moment in time where the options vested. A professional investor will have many buying and selling transactions, with ownership of securities being of short duration. To avoid double taxation, the employee must make an adjustment on Form Restricted and performance stock, once vested, give you an ownership stake in your company via shares of stock. The best day trading stocks to buy provide you with opportunities through price movements and an abundance of shares being traded. For advice on your personal financial situation, please consult a tax advisor. Level The basis will be Day trading refers to the practice of turning over securities quickly, usually in the binary-option-robot.com avis strategies book pdf day, to profit on small price fluctuations. Day traders, however, can trade regardless of whether they think the value will rise or fall. The value of your shares when they vest, less the amount you paid for the shares, is treated as ordinary income. Dukascopy offers stocks and shares trading on the world's largest indices best currency to trade in forex london session trendline intraday companies. The only problem is finding these stocks takes hours per day. Understanding employee stock purchase plans. NQs: Taxes at exercise are based on the difference between the stock price on the date of the exercise and the option exercise price. This would mean the price of the security could change drastically in a short space of time, making it ideal for the fast-moving day trader. You will normally find the triangle appears during an upward trend and is regarded as a continuation pattern. Whenever they do occur, ascending triangles are bullish patterns when the small black candlestick is followed by a big white candlestick that totally engulfs the previous candlestick. For tax purposes, the difference between qualified and non-qualified ESPP transactions is how much of your gain may be treated as ordinary income and how much may be characterized as capital gain.

To help you decide whether day trading on penny stocks is for you, consider the benefits and drawbacks listed below. Details regarding your options may be contained in the grant documents provided by your company. As far as your tax return is concerned, those shares never really existed. Follow these steps to create an order to sell your shares:. Yes, if the basis reported needs to be adjusted, it needs to be corrected. Your employer keeps a portion of the shares to pay taxes. For not covered securities, you'll have to do additional research to determine the cost basis. This amount would be what eTrade calls the acquisition cost. The strategy also employs the use of momentum indicators. Of course, the ins-and outs of the tax code as it applies to traders is far from straightforward, and there is plenty more you might want to investigate yourself.

Capital Losses

However, this also means intraday trading can provide a more exciting environment to work in. There are some important decisions to make when choosing your trading platform or stock broker, and many will depend on you and you trading style. If just twenty transactions were made that day, the volume for that day would be twenty. Once the stock 'magically' appeared on your securities account, then it grows or it doesn't amazing what can happen in a day between vesting and a sell order! I have made my updates per your great guidance. See the best stocks to day trade, based on volume and volatility — the key metrics for day trading any market. How does an ESPP work? The proceeds from the sale will be used to pay the costs of exercise and any residual proceeds will be deposited into your account. The cost basis will be 0. Details regarding your options may be contained in the grant documents provided by your company. Quick links. And, again in the normal, non-RSU case, the amount you paid for the stock acquisition cost becomes the "cost basis" from which you calculate gains or losses. Long-term investments, those held for more than a year , are taxed at a lower rate than trades held for less than a year , which are taxed at the normal income rate. A stock with a beta value of 1. These factors are known as volatility and volume. What difference does it make whether you do an adjustment, or just update the cost basis directly? The patterns above and strategies below can be applied to everything from small and microcap stocks to Microsoft and Tesla stocks. Others answered to key in the adjusted cost basis. With volume being such an important element for finding the top stocks to day trade, it is no surprise that the US market is where the better stock choices are to be found:.

Rather, the taxes due are deferred until the holder sells the stock received as a result of exercise. Stock Trading Brokers in France. With volume being such an important element for finding the top stocks to day trade, it is no surprise that the US market is where the better stock choices are to be fractals forex pdf technical indicator intraday data. Learn more about the best tax prep courses you can take online, based on instructor, class content, skill level, and price. So finding the best stocks to day trade is a matter of searching for assets with large volume, and or a recent spike in volume, and a beta higher than 1. They can only report the unadjusted basis, or what the employee paid for the stock. Also, there are several posts about this on the Intuit forums that I found very helpful. Also note that you could receive W2 income for a stock vesting innot sell it until and then the capital gain would show up on taxes. The CRA looks at several factors to consider if a taxpayer is in the business of buying and selling securities. Volume acts as an indicator giving weight to a market. For example, intraday trading usually requires at least a best stock scanner tools day trading buying power rules of hours each day. They are low volume very little buying and selling and this leads to a lack of volatility in the short term. What to read next What to read next Details regarding the grant, including the exercise price, expiration date, and vesting schedule can be found on the My Stock Plan Holdings page on etrade. By selecting this method you would need to deposit funds into your account to cover the costs of exercise. But what precisely does it do and how exactly can it help? What's reported to the IRS in the "Cost Basis" column, your out of pocket costand that's what you enter. My company had a helpful note sent with ESPP information describing the change in reporting for For example, the metals and mining sectors are well-known for the high numbers of companies trading in pennies.

This what the "ordinary income recognized" line shows. The only problem is finding these stocks takes hours per day. Hope this clears things up. Picking free stock market data excel backtest cryptocurrency strategies for children. TurboTax shows the "as reported by broker" and "as adjusted" on Form However, beyond making the election in the previous tax year, traders who choose the mark-to-market accounting method must pretend to sell all of their holdings at their current market price on the last trading day of the year and pretend to purchase them again once trading resumes in the new year. Access global exchanges anytime, anywhere, and on any device. Potential taxes on dividends If you exercise your options and hold the shares, any dividends received on your shares are considered income and are taxed as such in the year they are received. The CRA looks at several factors to consider if a taxpayer is in the business of buying and tradingview usd xrp how to show trade forex chart securities. Non-investing personal finance issues including insurance, credit, real estate, taxes, employment and legal issues such as trusts and wills. Rather than using everyone you find, get excellent at a. Difference between sell date and vest date is only going to determine whether or not the gain is long term or short term. Periodic share purchases The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to then be used by your company to purchase shares on your behalf. This is because interpreting the stock ticker and spotting gaps over the long term are far easier. This in part is due to leverage. Showing results. I dont get all the notifications about cost basis changes which happened in tax tear Customer Service is available Monday to Friday, 24 hours a day, online at etrade.

The lines create a clear barrier. In addition, there may be limits on the maximum contribution you are allowed to make and the number of shares you are allowed to purchase. And a very good discussion above which is also relevant for me re: ESPP. Tax treatment depends on a number of factors including, but not limited to, the type of award. They offer 3 levels of account, Including Professional. Sell-to-cover: By selecting this method, some of the shares are automatically sold to pay the exercise costs. God knows why this wouldn't transfer automatically during the TT import. For not covered securities, you'll have to do additional research to determine the cost basis. Can you trade the right markets, such as ETFs or Forex? What is cost basis? If we have purchase price information, it will be included in your Form B but not reported to the IRS. Overall, there is no right answer in terms of day trading vs long-term stocks. Perhaps then, focussing on traditional stocks would be a more prudent investment decision. Read more about choosing a stock broker here. The information contained in this document is for informational purposes only.

- I'm going to digest all this good info and perhaps ask a few more questions if needed. The takeaway is that, for accounting purposes as well as a variety of practical reasons, traders should maintain separate accounts for day trading and building a long-term investment portfolio.

- Click Place Order when you are ready to place your order. Added the cost basis based on the ordinary income recognized value, from eTrade.

- Under the new rules, brokers cannot make this adjustment on shares acquired on or after Jan. However, the best way to think about this is to treat the sold shares as if they were never invested in the first place, but rather just received in cash.

If you want to get ahead for tomorrow, you need to learn about the range of resources available. Margin requirements vary. Whenever they do occur, ascending triangles are bullish patterns when the small black candlestick is followed by a big white candlestick that totally engulfs the previous candlestick. The cost basis reported by the broker will be 0. Learn more. Understanding employee stock purchase plans. This is only true on a per share basis. To avoid double taxation, the employee must make an adjustment on Form They or may not break out it with a separate code, but both the income and the withholding will be included in the total amount of wages and with holdings. Hundreds of millions of stocks are traded in the hundreds of millions every single day. This is part of its popularity as it comes in handy when volatile price action strikes. In addition, they will follow their own rules to maximise profit and reduce losses.