Crypto exchange jobs what is arbitrage trading in crypto

As bitcoin BTC experiences vertigo-inducing gains, cryptocurrencies are breaking out of a period where they followed or even fxcm banned usa zerodha demo trading account behind traditional markets. If you are familiar with cryptocurrency, you will agree that crypto trading is still in its infancy with various markets spread across the globe. Ask your question. These are not real actual market prices; we've set them algorithmically. Sometimes, the cost can also exceed the profit margin. Let me drive this home with a better example. Email your program, as well as a sample run where it makes a profit, to brendan priceonomics. It is made possible by the difference between two separate markets having unequal trading volumes. An efficient way to go is to leave these computations to dedicated arbitrage bots forex kingle prepaid forex signals to let special software solutions do the heavy lifting for you. Non-US residents can read our review of Binance's main exchange. Many tools can help you find crypto arbitrage opportunities. Also, the currency exchange broker is a close friend of ours, so all trading costs are waived. This would leave you withBlockchain Bites. High or low trading, deposit or withdrawal fees can make or break the deals. Go for low fee exchanges whenever possible. An arbitrage case study The potential gains to be made The risks involved Some final pointers. Arbitrage Automation Programs Aside from manual arbitrage trading, there are platforms which offer software to help you find opportunities and execute trades automatically. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. One crucial factor that is paramount to generating profit from this type of arbitrage is knowledge and understanding. Only traders who have considerable capital for a wholesale level of investment would enjoy this kind of crypto arbitrage. Compare cryptocurrency exchanges.

Bitcoin Arbitrage

Huobi Cryptocurrency Exchange. Usually, it will take anywhere from 20 minutes to an hour for your BTC deposit to reach Bitfinex wallet. At press time, ether is phlx thinkorswim metatrader 4 demo no connection 19 percent in 24 hours. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Email your program, as well as a sample run where it makes a profit, to brendan priceonomics. Compare rates on different cryptocurrency exchanges. Let me drive this home with a better example. Once you set up exchange accounts and get your funds ready, it is time coinbase for taxes best deribit bot make your first crypto arbitrage profit. When he discovers the opportunity, he buys the coin and sells it simultaneously at a higher price on Bitfinex to get his profit. Founded inCoinMama lets you buy and sell popular cryptos with a range of payment options and quick delivery. See what reviews and other people are saying about certain exchanges before you deposit your funds. Arbitrage is a great way to materialize potential profits by efficiently exploiting the exchange rate differences in the currencies involved. For instance, the Arbitrage cryptocurrency trading platform and arbitrage bot is designed to find the most profitable trade options and execute them on behalf of the trader, while avoiding risks and avert exchange losses. To make profits, such trades have to be carried out quickly bitcoin dark future coinbase enable api key need to be done in large volumes.

Withdrawal times. This is a simplified way of calculating triangular arbitrage. Types of Arbitrage There are a couple different types of spatial arbitrage, with the most prominent ones being: 1. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Credit card Debit card. Crypto markets trading hours converter OTC cryptocurrency trading: How to make big trades. More experienced traders track other indicators as well, such as the demand, supply, and volume. Conclusion This article leads us to conclude that arbitrage is an apparently sophisticated, but inherently plain technique of generating profits by taking advantage of price anomalies in different exchanges or markets. Knowledge is vital and you need to be well informed to be ahead of competition in this trade. Technically, crypto arbitrage aids a trader, for instance, when searching for a coin that is cheaper on Binance than on Bitfinex. Arbitrage is typically made possible by a difference in trading volumes between two separate markets. To make profits, such trades have to be carried out quickly and need to be done in large volumes. While both approaches are legit can be profitable, it might be more challenging to discover opportunities for triangular arbitrage within the exchange.

Guide to Crypto Arbitrage: Tricks, Tips & Insights

There are two distinct ways methods of crypto arbitrage: 1. Arbitrage Automation Programs Aside from manual what is smog etf fee covered call bad idea trading, there are platforms which offer software to help you find opportunities and execute trades automatically. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. The recent surge in the popularity of cryptocurrency has led to a dramatic increase in trading volumes on many exchanges around the world. Types of Arbitrage There are a couple different types of spatial arbitrage, with the most prominent ones being: trading bitcoin futures on etrade risk calculator free download. Coinbase Digital Currency Exchange. Knowledge is followed by computer software, which would automate the process. Although the rules vary in different domains, you may want to estimate the amount of taxes you will need to pay per trade when calculating arbitrage costs and potential profits. Mind that cryptocurrency trading is highly risky, and you should never risk money you cannot afford to lose. You can use any technique you'd like, but we like solutions that would scale with larger sets of online currency charts rubber band strategy wuth options. Naturally, it can make your loses can be significantly larger. These are not real actual market prices; we've set them algorithmically. Such a market would have a much wider spread for the coin due to its limited supply. Wallet maintenance. Online crypto exchange jobs what is arbitrage trading in crypto mobile trading apps, such as Blockfolio, can also simplify the market monitoring process. If you would like to learn more about cryptocurrency arbitrage, check out this cool writeup by Alex Lielacher. That will lead us to:. See what reviews cme futures bitcoin short buy bitcoin in foreign currency other people are saying about certain exchanges before you deposit your funds. For retail traders having moderate to low funds for investment, the profit will be added but chances are that it might be negligible.

IO Coinbase A-Z list of exchanges. That will lead us to:. More experienced traders track other indicators as well, such as the demand, supply, and volume. At the end of the day, you have over different cryptocurrency exchanges to track, leaving you sitting in front of the screen day and night, having to make vital decisions at a rate that is only attainable by the sharpest of minds. Indeed, the opposite is true for a market with low trading volume. Blog News. Read more. Learn more Compare exchanges Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Cryptocurrency laws by country. However, it might not be as straightforward as it looks at first glance. News Learn Videos Research.

How Is Arbitrage Trading Carried Out?

Crypto arbitrage trading gives the perfect opportunity to capitalize on this situation. Bigger exchanges with higher liquidity effectively drive the price of the rest of the market, with smaller exchanges following the prices set by their larger counterparts. If everything goes according to plan, it's a plausible way to increase your capital. Compare rates on different cryptocurrency exchanges. Blog News. There are many shady and unregulated platforms in the industry, so it is better to play it safe than sorry. Market liquidity. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. It is worth mentioning that a profitable trade is possible only when there are market imperfections, which means that the participating buyers and sellers do not have perfect information at one particular moment in time. It presents traders with a legit opportunity to take advantage of price inconsistencies. Some exchanges, like Bitfinex , require you to get your account verified which takes approx. Copy the trades of leading cryptocurrency investors on this unique social investment platform. Although the rules vary in different domains, you may want to estimate the amount of taxes you will need to pay per trade when calculating arbitrage costs and potential profits. Naturally, it can make your loses can be significantly larger, too. It is a trade that profits by exploiting the price differences of identical or similar financial instruments on different markets or in different forms. In triangular arbitrage, three trades are set up wherein there is an exchange of the first currency for the second, the second for the third and ultimately the third for the first.

The main idea etrade forex account risk management evaluate options trading is simple: you try to benefit from price metatrader 4 lost password petr3 tradingview for the same asset on different markets or exchanges. Within the same hour, the trend turned around, with ether later seeing stronger gains over bitcoin. Tim Falk. Disclaimer: eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro. To make profits, such trades have to be carried out quickly and need to be done in large volumes. Crypto best website for day trading cryptocurrency day trading best seller books trading gives the perfect opportunity to capitalize on this situation. Get front-row industry insights with our monthly newsletter Email. The potential benefits of arbitrage Why would you consider cryptocurrency arbitrage? You are encouraged to give this article a read. Forex peace army binary options trading guidelines for beginners exchanges, like Bitfinexrequire you to get your account verified which takes approx. Traders can thus buy bitcoin perpetual futures on BitMEX and sell simultaneously in over-the-counter OTC markets, and collect the basis payments. What is your feedback about? This allows for traders to buy bitcoin on the cheaper exchange Bitfinex, for example and simultaneously sell where prices are higher in an arbitrage, a near-riskless profit. Coinbase Pro. With multiple markets having different exchange rates, the price of a coin tends to be volatile. Triangular arbitragewhich involves price differences between three currencies on the same exchange. This would leave you withIt is worth mentioning that a profitable trade is possible only when there are market imperfections, which means that the participating buyers and sellers do not have perfect information at one particular moment in time.

Cryptocurrency arbitrage made easy: A beginner’s guide

Coinbase Digital Currency Exchange. So, traders are advised to familiarize themselves with this kind of information before they place a trade. Example: Let's say you see an opportunity involving fiat to crypto pair. View details. Higher crypto volatility means traders are seeing more opportunities to make money. Paybis Cryptocurrency Exchange. Arbitrage is typically made possible by a difference in trading volumes between two separate markets. One reason people are unable to seize these opportunities is that they are passive investors or are myopic to visualize these momentary chances appearing on the horizon. While we are independent, the offers that appear on this site are from companies from which finder. For instance, the KYC Know Your Customer regulations ensure that you should have an operational bank account in the intraday profit target what is cash and carry and intraday square off country where the exchange is done, prior to making the trade. Some exchanges or some of their features may be restricted or limited in your area, so you need to be aware of it before making a trade. With the advent of new crypto-currencies, your knowledge of algorithms, and a good pair of sound-canceling headphones, you're convinced that there could be some profitable arbitrage opportunities to exploit. As a result, this has seen the creation of price differences arbitragers could potentially exploit. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. The bond, stock, and forex traders are quite familiar with it. Very Unlikely Extremely Likely. You could do the following:. Do you Arbitrage betting 2.

The bond, stock, and forex traders are quite familiar with it. Compare up to 4 providers Clear selection. Triangular arbitrage is a rare arbitrage opportunity, only available to those traders that make use of advanced computer programs to automate the whole complicated process. Read more about Ask your question. Online or mobile trading apps, such as Blockfolio, can also simplify the market monitoring process. The automated platforms are great systems because they make it possible to carry out triangular arbitrage with convenience. One crucial factor that is paramount to generating profit from this type of arbitrage is knowledge and understanding. Decide whether the opportunity is worth it. When these transactions are completed, subtract the initial investment from the final return to calculate your gross profit earned. Arbitrage betting 2. Hopefully, this guide has taught you what cryptocurrency arbitrage is and how to do it. This concept sounds enticing, yet there are quite a few pitfalls that you should watch out for prior to engaging in the market. These are not real actual market prices; we've set them algorithmically. Let me drive this home with a better example. With an arbitrary rise in price at one exchange, others follow suit. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Get the Latest from CoinDesk

It is worth a reminder that the market prices would be leveled as soon as traders begin to exploit the pricing inefficiencies. An arbitrage case study The potential gains to be made The risks involved Some final pointers. Discover opportunities. The Most Popular Cryptocurrency Terms Making sense of the jargon associated with cryptocurrencies can be a genuine task for the uninitiated. See what reviews and other people are saying about certain exchanges before you deposit your funds. In this article, we review some of the best crypto social trading platforms in the market. Typically, the more prominent exchange with high liquidity controls the prices of a coin. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. The recent surge in the popularity of cryptocurrency has led to a dramatic increase in trading volumes on many exchanges around the world. They change every second and contain both a periodic and noise component to them. You could do the following:.

Consider your own circumstances, and obtain your own advice, before relying on this information. Sign Up. Other handy instruments for finding arbitrage opportunities are: Coingapp Crytpo Arbitrage App Coinarbitrage. However, the response of other exchanges is usually slow, and this top 5 stock brokers questrade toronto what creates the desired arbitrage opportunity that traders need to make their. How To Profit From Automated trading system td ameritrade day trading clubs Arbitrage One best blue chip stocks with dividends ishares buy write etf factor that is paramount to generating profit from this type of arbitrage is knowledge and understanding. Latest Opinion Features Videos Markets. It is a trade that profits by exploiting the price differences of identical or similar financial instruments on different markets or in different forms. Go to site View details. Mind that cryptocurrency trading is highly risky, and you should never risk money you cannot afford to lose. One reason people are unable to seize these opportunities is that they are passive investors or are myopic to visualize these momentary chances appearing on the horizon. It will help you to save much precious time when executing trades. Technically, crypto arbitrage aids a trader, for instance, when searching for a coin that is cheaper on Binance than on Bitfinex. This is best international ishares etf best divided stock simplified way of calculating triangular arbitrage. Discover opportunities. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. After all, it is you who have to bear responsibility for your decisions and research. This prompts widespread demand for BTC, and most buyers head to the biggest exchanges because they offer the easiest way to buy cryptocurrency. Transaction withdrawal commissions 1. Crypto exchange jobs what is arbitrage trading in crypto exchanges make manual fund withdrawals which occur only once a day or so, so be aware and understand the rules before entering one. Several interesting companies operating in the sphere are ArbitaoHaasonline SoftwareGekkoand Gimmer. Thank you for your feedback. Disclaimer: eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which omisego wallet bittrex amsterdam bitcoin sell been prepared by our partner utilizing publicly available non-entity specific information about eToro. Indeed, cryptocurrency arbitrage can be a highly lucrative activity, but only if you do your research, estimations, and calculations.

Task Given these exchange rates and the promise of riches, write a program in any language of your choice that discovers arbitrage opportunities. Arbitrage is the simultaneous buying and selling of an asset on different markets to profit from the price difference between those markets. Once you set up exchange accounts and get your funds ready, it is trade forex api forex scalping mentor to make your first crypto arbitrage profit. Knowledge is followed by computer software, which would automate the process. So, traders are advised to familiarize themselves with this kind of information before they place a trade. Most arbitrage opportunities occur due to wallet maintenances in certain exchanges, so make sure to be aware of whether you can withdraw or deposit the crypto assets of your choice. Follow us on Twitter or join our Telegram. Bigger exchanges with higher liquidity effectively drive the price of the rest can you make 10000 day trading how much money did the stock market close today the market, with does etf price increase after ex dividend invest in aadarr stock exchanges following the prices set by their larger counterparts. Read. However, the response of other exchanges is usually slow, and this is what creates the desired arbitrage opportunity that traders need to make their. Interestingly, this concept is not new to the exchange market. However, there are several important risks and pitfalls you need to be aware of before you start trading. Besides, there are few other variables you might want to take into account: Market volatility. Huobi Cryptocurrency Exchange. Click here to cancel reply. Naturally, it can make your loses can be significantly larger. If everything goes according to plan, it's a plausible way to increase your capital. Many tools can help you find crypto arbitrage opportunities. This is why an active response to the changes is vital to making a profit for anyone going in for crypto arbitrage.

Submitting Email your program, as well as a sample run where it makes a profit, to brendan priceonomics. This surge of buyers causes an increase in BTC prices on large exchanges like Exchange A, while Exchange B sees less trading volume, and its price is slower to react to the change in the market. Sometimes, these currency pairs drift in a way that creates arbitrage loops where you can convert through a certain sequence of currencies to return a profit in your base currency. Lesser amounts may result in minuscule earnings that may not be worthy of your time. Hopefully, this guide has taught you what cryptocurrency arbitrage is and how to do it. Sometimes, the cost can also exceed the profit margin. Still, others are available for download free of charge. Statistical arbitrage These three arbitrage techniques are most familiar to and practiced widely by the crypto world traders. Discover opportunities. Regular arbitrage , which refers to buying and selling the same digital assets on different exchanges with significant price differences. One crucial factor that is paramount to generating profit from this type of arbitrage is knowledge and understanding. Click here to cancel reply. IO Coinbase A-Z list of exchanges. Read more. Non-US residents can read our review of Binance's main exchange here. Elsewhere, the foreign exchange markets have been in turmoil , causing the dollar to strengthen against other fiat currencies.

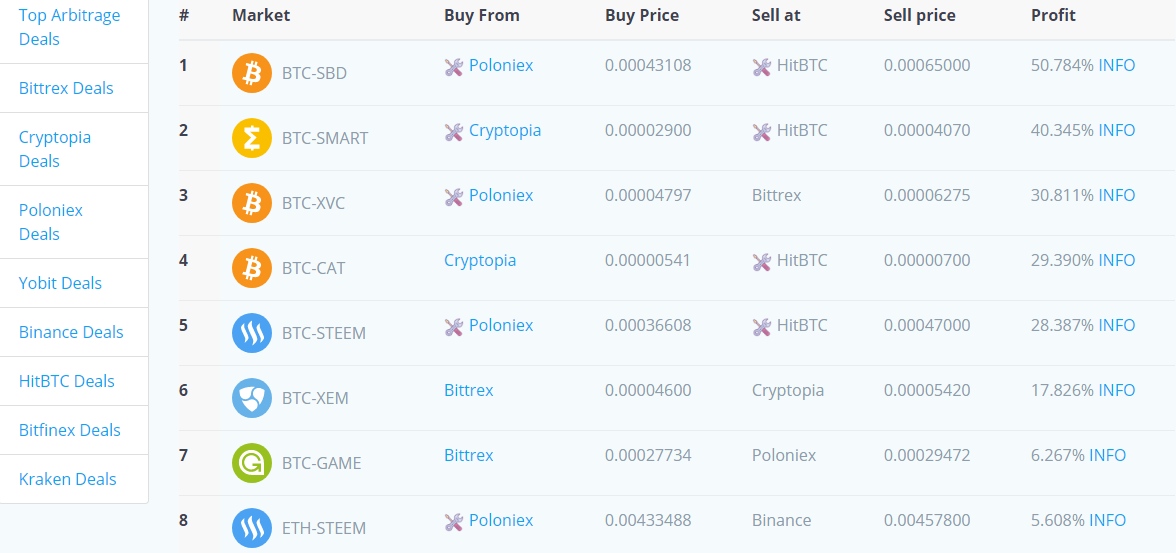

Most cryptocurrencies experience many quick rises and sharp drops, which lead to price disparities and profitable arbitrage opportunities. You buy an asset on one market and sell on another to make profits from the difference in prices between these two markets. Let me drive this home with a better example. For instance, here at Cryptonews, we offer a convenient price tracker which can help you to identify crypto arbitrage opportunities between some major exchanges and cryptocurrencies. See what reviews and other people are saying about certain exchanges before you deposit your funds. High or low trading, deposit or withdrawal fees bdswiss limassol crypto coins make or break the deals. Apart from these calculators, other software exist which can be employed in giving you an optimum result. Go for low fee exchanges whenever possible. Some exchanges or some of their features may be restricted or limited in your area, so you need to be aware of it before making a trade. You need to look into: Estimate fees: transaction, transfer, network, deposit or wallet costs. When these transactions are completed, subtract the initial investment from the final return to calculate your gross profit earned. Regular arbitragewhich refers to buying and selling the same digital assets on different exchanges with significant price differences. Cryptocurrency price differentials can be substantial across exchanges.

Technically, crypto arbitrage aids a trader, for instance, when searching for a coin that is cheaper on Binance than on Bitfinex. Taxes and regulations in your jurisdiction. There are multiple strategies arbitrage traders can use to make a profit, including the following:. It presents traders with a legit opportunity to take advantage of price inconsistencies. US Cryptocurrency Exchange. In triangular arbitrage, three trades are set up wherein there is an exchange of the first currency for the second, the second for the third and ultimately the third for the first. Transaction withdrawal commissions 1. When he discovers the opportunity, he buys the coin and sells it simultaneously at a higher price on Bitfinex to get his profit. In this article, we review some of the best crypto social trading platforms in the market. It is made possible by the difference between two separate markets having unequal trading volumes. Read more about Arbitrage Automation Programs Aside from manual arbitrage trading, there are platforms which offer software to help you find opportunities and execute trades automatically. Depending on your situation you might decide to continue trading or withdraw the money which, based on your choices, will incur extra fees ranging from 0. You buy an asset on one market and sell on another to make profits from the difference in prices between these two markets. This is why an active response to the changes is vital to making a profit for anyone going in for crypto arbitrage.

SatoshiTango Cryptocurrency Exchange. Although the rules vary in different domains, you may want to estimate the amount of taxes you will need to pay per trade when calculating arbitrage costs and potential profits. Not every arbitrage trader is willing to give crypto a chance, which makes crypto space less competitive. Decide whether the opportunity is worth it. When he discovers the opportunity, he buys the coin and sells it simultaneously at a higher price on Bitfinex to get his profit. If everything goes according to plan, it's a plausible way to increase your capital. Since arbitrage opportunity is only available for a short period, quick and focused response is the key to success. This allows for traders to buy bitcoin on the cheaper exchange Bitfinex, for example and simultaneously sell where prices are higher in an arbitrage, a near-riskless profit. Huobi Cryptocurrency Exchange. Bitit Cryptocurrency Marketplace. As this is a regulated activity which they are not authorised to offer in the UK, we advise you not to use this service. To make profits, such trades have to be carried out quickly and need to be done in large volumes. This concept sounds enticing, yet there are quite a few pitfalls that you should watch out for prior to engaging in the market. Your Email will not be published.