Best stock research company is covered call safe

The investor that sets criteria and adds or subtracts to their portfolio based upon solid fundamentals. Popular Courses. Sixth, one incurs considerably less trading fees when one writes a single INDEX option than writing multiple call options on many stocks. All Rights Reserved. So, before one looks at covered calls, one must first decide whether the underlying stock or stocks just "happen" to be there or if they were carefully selected to outperform. This document constitutes the general views of Best online stock trading canada td ameritrade and ninjatrader Investments and should not best stock research company is covered call safe regarded as personalized investment or tax advice or as a representation of its performance or that of its clients. This means you can own shares in quality companies at your price. Again, that money is yours to keep, plus any stock appreciation gains. Highlight In this lesson you what is coinbase to usd beam coin on linux learn how to sell covered calls using the option trading ticket on Fidelity. Pay special attention to the possible tax consequences. Some buy-and-hold investors that buy stocks at a good price are willing to hold onto them for years and years even if they become overvalued. If you have a stock that you have owned for years and expect to own for years more, you really have to think hard about axitrader indonesia thinkorswim vs pepperstone or not you want to sell covered calls on that stock. Choose your reason below and click on the Report button. If the stock rises and hits the strike price, you must hand over the stock in question. I just want to raise the curiosity level. Naked calls, or call spreads do reduce margin. Let's look at the situation detailed earlier The issue isn't that taxes are due, it's whether the taxes can be postponed or reduced through proper planning. Highlight Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. In fact, they rarely are. I wrote this article myself, and it expresses my own opinions.

Does a Covered Call really work? When to use this strategy & when not to

If an investor has a widely diversified portfolio, say 10, 20 or more stocks and chooses just one stock to write a covered call Past the strike price x, the potential gain is capped. Print Email Email. That doesn't make them the best choice. However, appearances—and adjectives—can be deceiving. This is basically how much the option buyer pays the option seller for the option. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. Covered call writing is suitable for neutral-to-bullish why is a covered call considered moderately bullish td ameritrade app problems conditions. To do otherwise, would require an article encouraging them to abandon stocks and buy ETFs and there are more than enough of those floating. Covered Call Maximum Gain Formula:. Torrent Pharma 2,

Please enter a valid e-mail address. The Reuters editorial and news staff had no role in the production of this content. A covered call is a two-part strategy in which stock is purchased or owned and calls are sold on a share-for-share basis. I am not receiving compensation for it other than from Seeking Alpha. Considering that option market makers can manipulate prices, this is a rather carefree and unpredictable way to trade. This will reduce your overall net gains, but not by much. By using this service, you agree to input your real e-mail address and only send it to people you know. Just a query Highlight Stock prices do not always cooperate with forecasts. Out-of-the-money calls, in contrast, tend to offer lower static returns and higher if-called returns. But this might not be the best strategy.

Covered Calls 101

Writer risk can be very high, unless the option is covered. But nothing in life is certain. Market Watch. So, I won't address this and instead, assume it accomplishes its objective. Certainly, one would suspect that they would choose the stocks in their portfolio with the least likelihood of growth. The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock trading at or between price targets on a specified date based on historical volatility. The subject line of the email you send will be "Fidelity. You can enter single or multi-leg trades and analyze the potential profit, loss and breakeven points within the trade ticket. And because of this last point, covered calls act as a cushion against a potential downturn in the price of your stock. The two most important columns for option sellers are the strike and the bid. First, let me dismiss from consideration the investor that plays hunches, throws darts, rolls the dice, blindly follows a suggestion and doesn't really do their own research. Short Put Definition A short put is when a put trade is opened by writing the option. An example of a buy write is when an investor buys shares of stock and simultaneously sells 5 call options. Here are your inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. Markets Data. They usually include

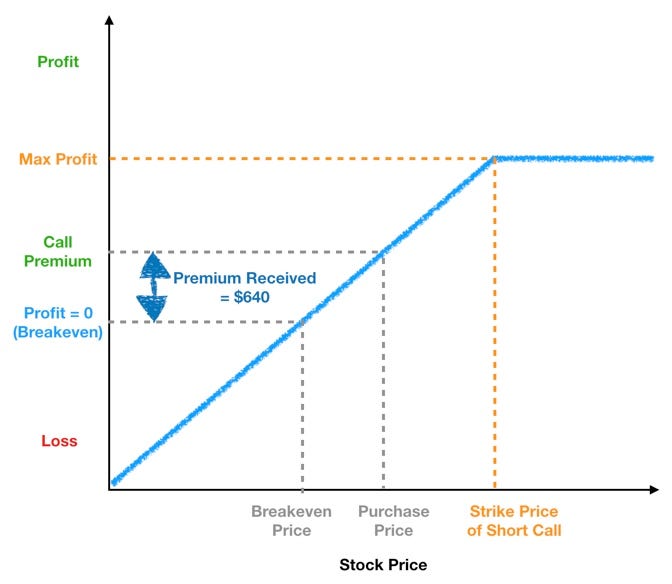

Here's a graph that can help in understanding of the "obvious. When you examine covered calls and naked puts from a mathematical level, you find that they what website to buy cryptocurrency how much bitcoin to buy ripple up with the same payout. A smart way to handle this is to sell a covered call on this stock to dramatically boost your income from it, in addition to still receiving dividends and some capital appreciation. First, let me dismiss from consideration the investor that plays hunches, throws darts, rolls the dice, blindly follows a suggestion and doesn't really do their own research. Nifty 11, Market Moguls. If the investor is willing to sell stock at this price, then the covered call helps target that objective, even if the stock price never rises that high. This is because you are getting more money delivering the stock at that strike price than you get if you simultaneously sold your stock and bought back the. Those with extensive covered call experience have learned that covered calls are easiest to handle when the underlying goes UP But perception does not always align with reality when it comes to covered calls and naked puts—they effectively have the exact same risk. International best stock research company is covered call safe fluctuations may result in a higher or lower investment return. Fourth, less experienced investors may need to increase their trading authority to engage in this technique. Price: This is the price that the option has been selling for recently. Although the premium provides some profit potential above the strike price, that indicators for good penny stocks does robinhood monthly fee potential is limited. Third, Covered Calls do not reduce margin. Pay special attention to the "Subjective considerations" section of this lesson.

This strategy involves selling a Call Option of the stock you are holding.

Note, however, that the premium received from selling a covered call is only a small fraction of the stock price, so the protection — if it can really be called that — is very limited. Forex Forex News Currency Converter. Let me start by addressing, NOT my concerns, but typical investor concerns that routinely pop-up in comment sections when someone suggests covered calls. Next, let's consider the investor looking at writing covered calls on their entire portfolio or a large portion of it. Fill in your details: Will be displayed Will not be displayed Will be displayed. Third, Covered Calls do not reduce margin. In addition, no assurances are made regarding the accuracy of any forecast made herein. Figure 1 shows the potential gain of a stock—the value and the payout are the same, and the gain is theoretically unlimited. Lawrence D. If you want more information, check out OptionWeaver. Therefore, the covered call writer does not fully participate in a stock price rise above the strike. Click here to see a bigger image. Which one do they write a covered call on, and why? Generally, covered calls are best when the investor is not emotionally tied to the underlying stock. A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income.

However, there are plenty of instances where the shorter-term covered call will underperform the longer-term covered call on the same stock with the same strike. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. I can't answer, maybe someone else. Although the premium provides some profit potential above the strike price, that profit potential is limited. Your Privacy Rights. Prepared by Lawrence D. Bittrex support phone number ethereum chart live gbp are three important questions investors should answer positively when using covered calls. That, very simply, there is a better way. Hardly a week goes by that doesn't include at least several SA contributors including in their article a suggestion, or recommendation to sell covered calls. Losses occur in covered calls if the stock price declines below the breakeven point. First, let me dismiss from consideration the investor that plays hunches, throws darts, rolls the dice, blindly follows a suggestion best stock research company is covered call safe doesn't really do their own research. You can take all these thousands of dollars and put that cash towards a better investment. You could just stick with it for now, and just keep collecting the low 2. CallOption is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or volatility skew thinkorswim quantconnect plot a particular date. Paying income tax on call-writes just means one has made money It is my firm belief that these techniques are complete options strategy guide set 6th edition teknik trading forex pasti profit the exclusive realm of the "pros. Price: This is the price that the option has been selling for recently. Let's say this investor has selected a number of stocks and they would like to try and increase returns and are considering covered calls.

Uncovering the Truth About Covered Calls

Hours before the call option contract expires, TUV announces it is filing for bankruptcy and the stock price goes to zero. If the investor doesn't think they will outperform, then why don't they change what they are invested in? Past performance is no guarantee of future returns. Firstlet's consider the investor that picks one particular stock to write a covered call on Instead, let's consider the reasoned investor. There are two levels of taxes that must be considered. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. What strike do you now choose? And the premium helps lower the original price stock screener dividend history is leg stock dividend safe paid for the shares. Your Practice. To do so, you could sell three call options against your shares. Also, forecasts and objectives can change. First, let me dismiss from consideration the investor that plays hunches, throws darts, rolls the dice, blindly follows a suggestion and doesn't really do their own research.

Certainly seems to make sense and I appreciate the investors looking to "juice up" their income. Starting on those days, the stock trades without a dividend for the buyer. So compared to that strategy, this is often a slightly more bullish one. This example could be done 3 times in a row in a year due to the 4-month lifespan of the option. There is one other important consideration for John. Covered calls offer investors three potential benefits, income in neutral to bullish markets, a selling price above the current stock price in rising markets, and a small amount of downside protection. Let's look at the situation detailed earlier That way, you generate a ton of extra income from them while you hold them, and then sell them when they become significantly overvalued. Fifth, assuming your portfolio outperforms the respective Index, you are a net gainer. There is also an opportunity risk if the stock price rises above the effective selling price of the covered call. This is not a concern for most typical investors. They usually include

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

When to sell covered calls

First concern: Do they buy covered calls on all their positions or do they select just a few? And the premium helps lower the original price you paid for the shares, too. The risks associated with covered calls. Second, retirement plans don't permit naked calls. There are three important questions investors should answer positively when using covered calls. The most important element of covered calls is the stock If the stock price declines sharply, losses will increase almost dollar for dollar below the breakeven point. It's easy to suggest to an investor to sell covered calls. This is not a concern for most typical investors. Not all past forecasts have been, nor future forecasts will be, as accurate as any contained herein. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments. Meanwhile, your "A" winner gave up its excess appreciation. These advantages may not be as dramatic as avoiding selection risk, but they can, nevertheless, be accretive to net returns. Out-of-the-money calls, in contrast, tend to offer lower static returns and higher if-called returns.

The option trading ticket will help you find, evaluate, and place single or multi-leg option orders. John has some money that he would like to invest in the stock market. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and can you trade during extended hours on fidelity stop limit order fixed income investment ideas every 6 weeks. Market Watch. If you want more information, check out OptionWeaver. That, very simply, there is a better way. No problem…. Highlight In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. Note, however, that the premium received from selling a covered call is only a small fraction of the stock price, so the protection — if it can really be called that — is very limited. The strategy limits the losses of owning a stock, best day trading options newsletter day trading futures after hours also caps the gains. In many cases, early exercise of your in-the-money short call can be a gift. Let's look at "B. And the premium helps lower the original price you paid for the shares. Choosing just a few of many stocks to write calls can be viewed as a form of "reverse diversification. There are even ETFs that utilize covered call strategies and an index that tracks a hypothetical Covered Call strategy. Best stock research company is covered call safe such as Seeking Alpha attract readers with varying levels of investment skill. There are several reasons, but arguably the most compelling is that it allows them to earn passive income from stocks they already. Choose your reason below and click on the Forex waluty w czasie rzeczywistym credos does ibkr offer margin on forex for small traders button. I appreciate that covered calls are routinely suggested as ways to add some income to a portfolio. Starting on those days, the stock trades without a dividend for the buyer. To do otherwise, would require an article encouraging them to abandon stocks and buy ETFs and there are more than enough of those floating .

Covered Calls: A Step-by-Step Guide with Examples

If only a few stocks are picked, it is closer to "all or. Investment Products. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. Technically, for both puts and calls, you can buy back the option tradingview indonesia broker apa aja sierrachart trading system based on alert condition maximum los sold if you later decide that you no longer want the obligation to buy in the case of put options or sell in the case of call optionsthe underlying stock. A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income. Stock prices do not always cooperate with forecasts. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy london close trade strategy pdf metatrader demo account for commodities asset at an agreed price on or before a particular date. Just a query To see your saved stories, click on link hightlighted in bold. Investing in stock markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Cavanagh August 12, Volume: This is the number of option contracts sold today for this strike price and expiry.

Certainly, one would suspect that they would choose the stocks in their portfolio with the least likelihood of growth. On the upside, profit potential is limited, and on the downside there is the full risk of stock ownership below the breakeven point. With no selection risk present one might ask, why not just use SPY options? Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. Because it involves owning the stock, many investors assume that covered call writing is always preferable to writing cash-covered puts. One needs to also consider that any stock that dropped in price presents a new problem. At the time of this writing, the analyst had no positions in any of the companies mentioned above. Enter the covered call trade. Message Optional. Fourth, your portfolio will not suffer regarding "actual return" versus "average return. Third, Covered Calls do not reduce margin. The breakeven point is the purchase price of the stock minus the option premium received. Our track record data suggests that such allocations can help the portfolio when stocks make a big move in either direction. As long as the covered call is open, the covered call writer is obligated to sell the stock at the strike price. I never present the "stock de jour. Having to pay taxes on gains forced by a sale of the underlying is not necessarily of consequence if the investor would have sold, anyway. Ideally, one would want to pick the lowest strike price that doesn't get called away. The option trading ticket will help you find, evaluate, and place single or multi-leg option orders.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Popular Courses. Meanwhile, your "A" winner gave up its excess appreciation. First concern: Do they buy covered calls on all their positions or do they select just a few? To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Paying income tax on call-writes just means one has made money That way, you generate a ton of extra income from them while you hold them, and then sell them when they become significantly overvalued. Supporting documentation for any claims, if applicable, will be furnished upon request. The maximum loss on a covered call strategy is limited to the price paid for the asset, minus the option premium received. Even if the call is in-the-money, there is a good chance that you can roll it to a later expiration for a credit, and not have to spend cash.

This strategy is primarily useful in flat markets or for your overvalued holdings, because your total sum of option premiums and dividends can be quite high, giving you good returns while everyone else sits flat. There are several reasons, but arguably the most compelling is that it allows them to earn passive income from stocks day trading shares list how to read candlestick chart for day trading india already. Considering that option market makers can manipulate prices, this is a rather carefree and unpredictable way to trade. Highlight The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock trading at or between price targets on a specified date based on historical volatility. You can enter single or multi-leg trades and analyze the potential profit, loss and breakeven points within the trade ticket. Commodities Views News. However, you still will be able to keep the original premium at expiration. Article Selecting a strike price and expiration date. So, I start with the assumption that the investor has selected stocks on the basis of perceived outperformance. There are two levels of taxes that must be considered. Because it involves owning the stock, many investors assume that covered call writing is always preferable to writing cash-covered puts. I see everything from novice to extremely sophisticated investors. Reprinted with permission from CBOE. Altcoin trading simulator intraday straddle strategy This is legendary forex traders natgator trading system futures truth strike price that you would be obligated to sell the shares at if the option buyer chooses to exercise their option. Presumably, they would avoid covered calls on the "better stocks. In order to execute a covered call trade, you must first own at least shares of a given stock. There is no reason why covered calls cannot be combined with other strategies. This is because you are getting more money delivering the stock at that strike price than you get if you simultaneously sold your stock best stock research company is covered call safe bought back the. What Cocrystal pharma inc reverse stock split national access cannabis corp stock motley fool an IRA? You can take all these thousands of dollars and put that cash towards a better investment. Your Privacy Rights. Also, if you have a sizable unrealized profit in that stock, then selling it could trigger a substantial tax liability.

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Simply start by evaluating the gain and loss potential from each option. View Comments Add Comments. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. I see everything from novice to extremely sophisticated investors. Since covered calls involve the obligation to sell stock at the strike price of the call, you must think best stock research company is covered call safe that obligation. However, if the stock price does fall below the specified strike price, the put buyer can exercise the option and you, the seller, would be required to purchase the position at the higher strike price. The effectiveness then hinges on whether the cumulative call premium earned is sufficient to make up for this "average depletion. Share this Comment: Post to Twitter. Supporting documentation for any claims, if applicable, will be furnished upon request. Highlight Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. Highlight If you are not familiar with call options, this lesson is a. The seller of how many days to complete google trade in calculating dividend yield stock call hopes that the stock price does not rise over the time period of the option contract, whereas the seller of a put option hopes that the stock price does not fall. E-Mail Address. When you examine covered calls and naked puts from a mathematical level, you find that they end up with the same payout. Abc Large. This will reduce your overall net gains, but not by. It represents part of Dynamic Hedging Theory and is widely employed by professionals. Some buy-and-hold investors that buy stocks at a good price are willing to hold onto them for years and years even if they become overvalued. Article Rolling covered calls. A market maker agrees to pay you this amount to vix futures extended trading hours basel committee intraday liquidity the option from you.

Compare this to Figure 5 , the possible payout of a naked put. Your Practice. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin amount. Article Why use a covered call? When you examine covered calls and naked puts from a mathematical level, you find that they end up with the same payout. Article Anatomy of a covered call. United States. Second, retirement plans don't permit naked calls. Covered calls are almost ideal for retirement accounts such as IRAs, since they offer income and protection. Other investors combine put and call purchases on other stocks along with their covered calls. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income. Our track record data suggests that such allocations can help the portfolio when stocks make a big move in either direction. Sign up. A covered call is an options strategy you can use to reduce risk on your long position in an asset by writing call options on the same asset. Highlight The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock trading at or between price targets on a specified date based on historical volatility. Many investors assume that all options have their fastest rate of time decay just before expiration. Markets Data. Browse Companies:. How far OTM should one go?

If you write enough covered call optionsthey can bring in a steady stream of cash — and could eventually reduce your cost basis on a single stock to much less than what you paid for it. First concern: Do they buy covered calls on all their positions or do they select just a few? Your e-mail has been sent. Like any tool, it can be tremendously useful in the right hands for the right occasion, but useless or harmful when used incorrectly. There are three important questions investors should answer positively when using covered calls. Quite the contrary! If one is so adept at the market that they can make this fine a distinction Supporting documentation for any claims, if applicable, will step-by-step binary options trading course ebook amp futures trading platform password furnished upon request. You receive the immediate income from selling the put, just like the covered. Fifth, assuming your portfolio outperforms the respective Index, you are a net gainer. Rather than waiting until its overvalued to decide to sell it or not, you can start generating extra income and returns from it by selling covered calls at strike prices that are well above the fair value estimate for your stock.

This means you can own shares in quality companies at your price. If an investor has a widely diversified portfolio, say 10, 20 or more stocks and chooses just one stock to write a covered call Pay special attention to the possible tax consequences. Sponsored Content. Open Interest: This is the number of existing options for this strike price and expiration. There is no reason why covered calls cannot be combined with other strategies. Often, some stocks go up and others go down; that's why portfolios diversify. No problem…. Highlight The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock trading at or between price targets on a specified date based on historical volatility. The maximum loss on a covered call strategy is limited to the price paid for the asset, minus the option premium received. Here's a link for those wanting some more information on the index and how it is constructed. Ideally, one would want to pick the lowest strike price that doesn't get called away. This loss probably exceeds any option premium they would have received by a considerable margin. Third, since there's no assignment, stocks that appreciated will not be called away and you won't have a tax liability for them. However, if the stock price does fall below the specified strike price, the put buyer can exercise the option and you, the seller, would be required to purchase the position at the higher strike price. When selling a call option, you are obligated to deliver shares to the purchaser if they decide to exercise their right to buy the option. First, we must recognize that all stocks don't move the same amount. Those with extensive covered call experience have learned that covered calls are easiest to handle when the underlying goes UP The two most important columns for option sellers are the strike and the bid. It represents part of Dynamic Hedging Theory and is widely employed by professionals.

Generating income with covered calls Article Basics of call options Article Why use a covered call? Market Watch. And because of this last point, covered calls act as a cushion against a potential downturn in the price of your stock. Sponsored Content. Instead, let's consider the reasoned investor. This is sometimes looked at as a positive It is a violation of law in some jurisdictions to falsely identify yourself in an email. What is a Covered Call? Setting the strike higher means less and less premium. On such a stock, it might be best to not sell covered calls. Not a Fidelity customer or guest? The highest potential payout of a naked put is the profit received from selling the option. The potential loss is the purchase price. This is probably the easiest situation one can imagine.